"Qianwen" Makes a Comeback in the "Palace": The Initial Hurdle is to Outshine "Cousins"

![]() 11/25 2025

11/25 2025

![]() 679

679

In a mere month, Alibaba has staged a dazzling "welcome back the crown prince" spectacle. In October, Kuake was thrust into the limelight with the so-called "Plan C," launching AI assistant features to serve as Alibaba's consumer-facing (C-end) gateway into the AI realm. Yet, less than a month later, "Plan C" appeared to reach a turning point. On November 17, Qianwen re-emerged as a "group-level gateway." This swift transition resembles a hasty leadership shuffle. The abrupt "return" of Qianwen, a product that has been around for some time, undoubtedly exposes Alibaba's internal uncertainty and anxiety regarding AI entry points.

Strictly speaking, Qianwen is not a brand-new offering. It is a rebranded version of the Tongyi Qianwen App, which has been available to the public for over two years.

Its current prominence stems not from organic user adoption but from Alibaba's latest strategic move to "consolidate resources for major objectives." While the capabilities of the underlying model are crucial, in today's landscape of "model convergence and experience homogenization," an AI assistant's success as a stable entry point hinges not on its technical stack but on its ability to establish user habits and perceptions through a superior product experience.

A more pressing issue is Alibaba's lack of clarity regarding the roles of Qianwen, Kuake, and Lingguang (from Ant Group), which emerged almost simultaneously. Despite the packaging rhetoric, all three are essentially chatbot products built on large models, with their underlying model capabilities drawing from Qianwen's large model. Even when pitted against its own siblings, Qianwen has yet to demonstrate a clear inherent advantage.

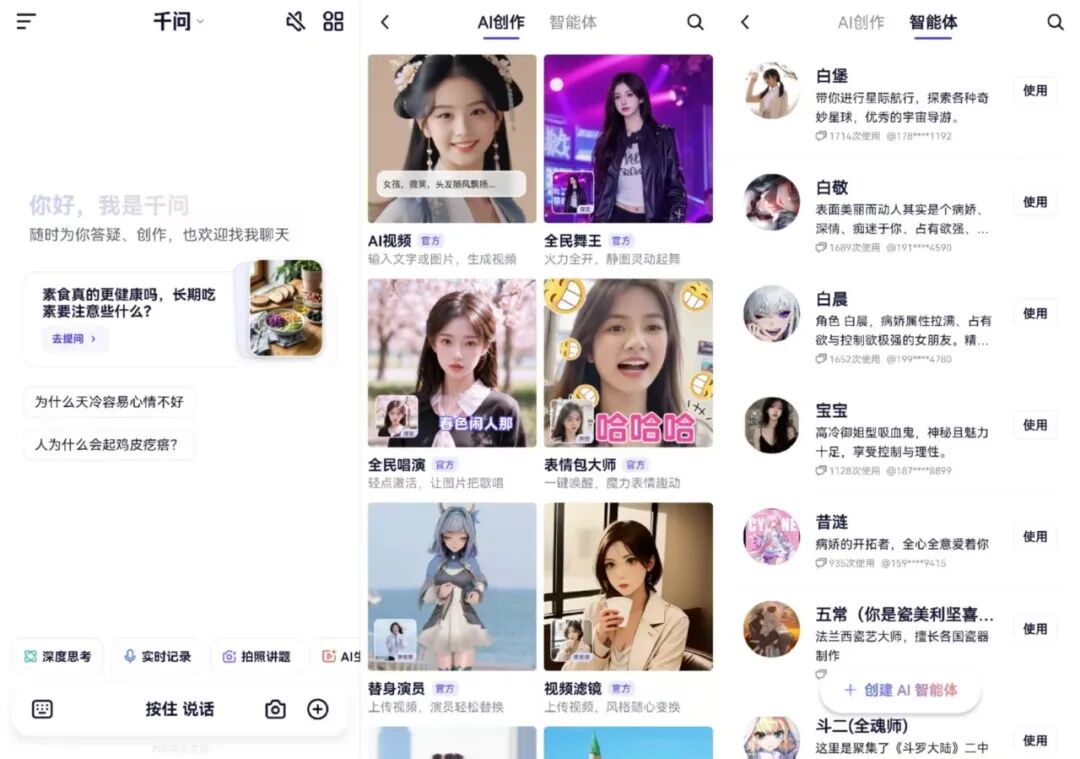

Screenshot of Qianwen APP

Therefore, before venturing into external competition, Qianwen's primary task is not to benchmark against ChatGPT or clash with Doubao and Yuanbao. Instead, it must first establish absolute dominance within Alibaba's internal ecosystem. Only when Qianwen truly surpasses Kuake, outpaces Lingguang, and stabilizes user perception can it legitimately compete on the external stage. Otherwise, all narratives of "returning to the palace" are merely superficial spectacles.

Why Did Qianwen Suddenly "Return to the Palace"?

Qianwen's sudden resurgence does not stem from overnight strength but from an internal decision at Alibaba: a "flagship AI assistant" representing the group must exist. Within a month of Kuake's "Plan C" launch, Qianwen re-emerged with narratives like "free ChatGPT" and "national-level assistant," explicitly positioned within Alibaba's three-tier AI architecture—bottom-layer computing power, middle-layer large models, and top-layer C-end applications represented by Qianwen.

This reorganization appears more top-down than market-driven.

Weibo Screenshot

External reports suggest that Alibaba has wavered internally over the past year: Should it build a dedicated chatbot app or integrate AI capabilities across all products? Previous coverage of Alibaba's AI strategy highlighted its focus on open-sourcing Tongyi models, empowering ecosystems, and prioritizing cloud, models, and business-to-business (B-end) solutions.

The global shift in user perception driven by ChatGPT and the rapid establishment of domestic products like Doubao and Yuanbao as "AI entry points" forced Alibaba to acknowledge a stark reality: Without a proprietary chatbot, it remained absent from the C-end AI landscape. Even with robust foundational models, ordinary consumers felt no tangible impact.

Kuake's past performance is hard to label as disastrous, but it fell short of Alibaba's lofty expectations. Despite its large user base and rapid product iterations, Kuake remained heavily browser- and tool-oriented. Users engaged it for searches, research, document organization, and cloud storage but rarely viewed it as a "daily operating system."

Screenshot of Kuake's Official Website

As analyzed in YiYu Observer's "Kuake's Three Escape Routes," its bloated product attributes make it unclear whether users engage it for AI or purely as an AI-enhanced cloud storage and browser tool. Feedback from readers and netizens suggests the latter dominates.

Realistically, while agile, Kuake could serve as a short-term breakthrough, its strong tool nature makes it ill-suited as "Alibaba Group's AI face."

After betting on multiple product lines, Alibaba ultimately consolidated resources and narratives under a single brand.

In this context, Qianwen's strategic repositioning represents an internal redistribution of power and resources: entry point control shifted from Kuake to a name directly tied to the group's AI strategy.

Screenshot of Qianwen's Official Website

Turning to Qianwen, the earlier Tongyi Qianwen failed to gain significant traction, lagging in retention and visibility compared to the "AI Six Little Dragons." However, it possesses an advantage Kuake lacks—it is a natural extension of the "Tongyi Large Model," making it easier to position as Alibaba's official AI entry point. More importantly, it enables Alibaba to weave its ¥380 billion AI investment, Qwen open-source matrix, and cloud computing power into a cohesive AI narrative.

From its demonstrated capabilities, Qianwen's features—dialogue generation, multimodal understanding, and task orchestration—fall within mainstream large model assistant capabilities, showing no clear "dominant" differentiation.

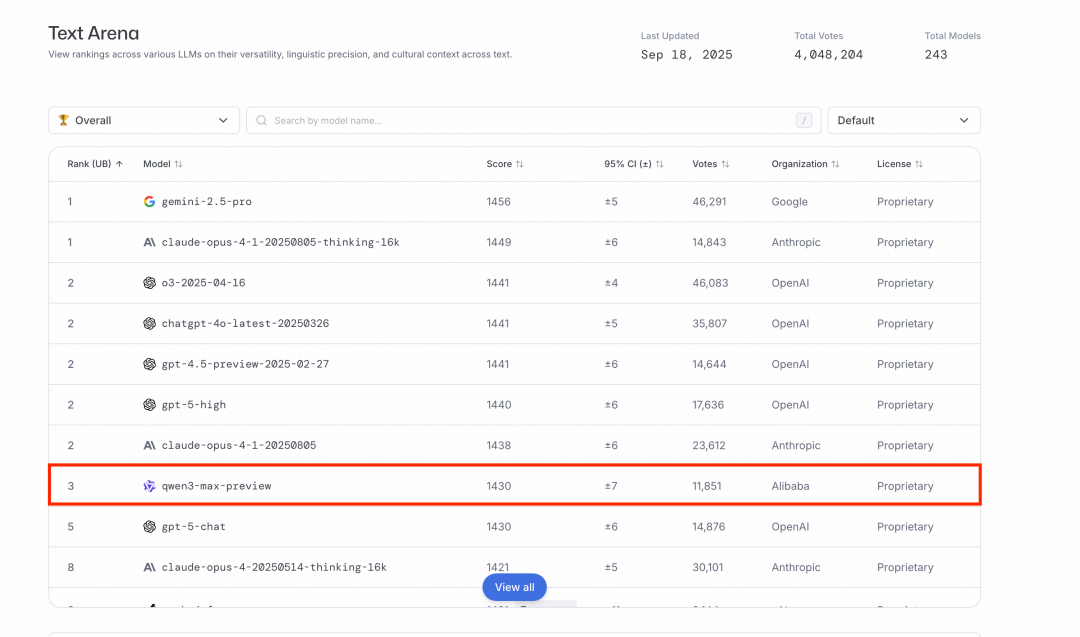

While the Qwen3-Max model may be powerful, the "model as product" vision has not materialized automatically.

Source: LMArena Rankings

Alibaba's repeated failures in social and content-driven C-end ventures prove a simple yet harsh truth: Strong technology does not automatically translate to strong products.

Qianwen's return essentially represents Alibaba's symbolic choice in the entry point battle. However, this does not guarantee victory. Even for those accustomed to palace intrigue dramas, we know the "crown prince's" life is rarely easy.

Qianwen's Real Rivals Are Internal "Cousins"

For Qianwen to truly "return to the palace" at Alibaba, its first challenges are not external competitors but two internal roles it must displace: Kuake and Lingguang.

Internal entry point conflicts at Alibaba are fiercer and more real than external competition.

Kuake is the direct "older brother."

Regardless of whether it qualifies as a true AI product, Kuake boasts hundreds of millions of users, a mature product form, and clear usage scenarios. The issue is not Kuake's poor performance but its lack of purity. For Alibaba, Kuake is too utility-focused and functionally mixed to carry group-level narratives. However, users care only about usability, not narratives.

For Qianwen to truly replace Kuake, it must achieve overwhelming user experience superiority.

Especially given the relative maturity of AI chatbots, the newly launched Qianwen remains in a catch-up phase, let alone establishing clear product advantages over similar internal offerings.

Meanwhile, "Qianwen" appears prominently beside Kuake Search, suggesting Kuake now serves as a "traffic feeder."

Screenshot of Kuake APP

Lingguang is the "younger cousin."

Hailing from Ant Group, Lingguang positions itself as a full-modal mini-app generator, naturally integrated with Alipay's mini-program ecosystem.

This positions Lingguang closer to real-life scenarios in service orchestration and task handling than Qianwen.

Screenshot of Lingguang APP

Alibaba Group now elevates Qianwen, but will ordinary users naturally adopt a pattern of "searching with Kuake, chatting with Qianwen, and getting things done with Lingguang"? If usage scenarios fragment, Qianwen's claimed "entry point status" becomes logically untenable.

Arguably, Qianwen's greatest advantage may lie in resource allocation. Its current slogan of "free and always available" suggests initial generosity. However, as user scale grows and computing resources tighten, that moment may reveal true priorities.

Another aspect is marketing. From Doubao to Kimi and Yuanbao, AI products from both giants and startups rely heavily on paid user acquisition to build awareness and usage. Thus, after product stabilization, Alibaba will likely invest heavily in promoting Qianwen—resources Kuake and Lingguang may lack.

Tencent Yuanbao Ad on Social Media

According to a November 24 report by Kechuangban Daily, Qianwen App's public beta surpassed 10 million downloads in one week, outpacing ChatGPT, Sora, and DeepSeek to become the fastest-growing AI app in history. However, as previously noted, Qianwen is not entirely new, making it unclear whether this figure represents cumulative or new downloads.

Meanwhile, Lingguang claims four million downloads in four days and first-week growth surpassing ChatGPT, indicating ongoing rivalry.

However, for domestic AI apps, the challenge is not initial adoption but long-term retention. Every AI assistant claims to help users get things done, but the question remains: Do enough users truly need AI for those tasks? This, too, is a critical issue.

This cannot mask Alibaba's internal contradiction: It needs a unified AI entry point representing the group, but after over two years of delay and an inherently decentralized ecosystem, achieving this remains elusive.

For Qianwen to truly "return to the palace," it must first resolve Kuake's user perception issues and Lingguang's scenario competition. Otherwise, it remains a "crown prince" propelled by resources, offering little new to ordinary users.

Ultimately, the question is: Why must Qianwen succeed?

The answer lies in whether Qianwen can achieve what Kuake's various attempts failed to do. Alibaba's model capabilities are strong, but model strength does not equal product strength. ChatGPT's ability to outperform Google's Gemini thus far proves this point: Entry points are chosen by users, not declared.

Qianwen's immediate challenge is not benchmarking against ChatGPT but establishing absolute internal dominance at Alibaba. Only by winning internally can it consider external expansion.