2025 Autonomous Driving Outlook (2): How Does the Autonomous Bus Robobus Stand Out and Become the 'Primary Battleground' for L4 Autonomy?

![]() 12/26 2025

12/26 2025

![]() 370

370

Introduction

The autonomous driving landscape in 2025 is no longer the 'pie in the sky' era of the past.

As Waymo burns through billions without escaping the Robotaxi quagmire, as Cruise is abandoned by General Motors, and as domestic leader Yuanrong Qixing abandons L4 Robotaxi for L2 assisted driving, the industry has reached a collective realization: The deployment of L4 autonomous driving must find the golden intersection of 'scenario-driven demand + commercial viability.'

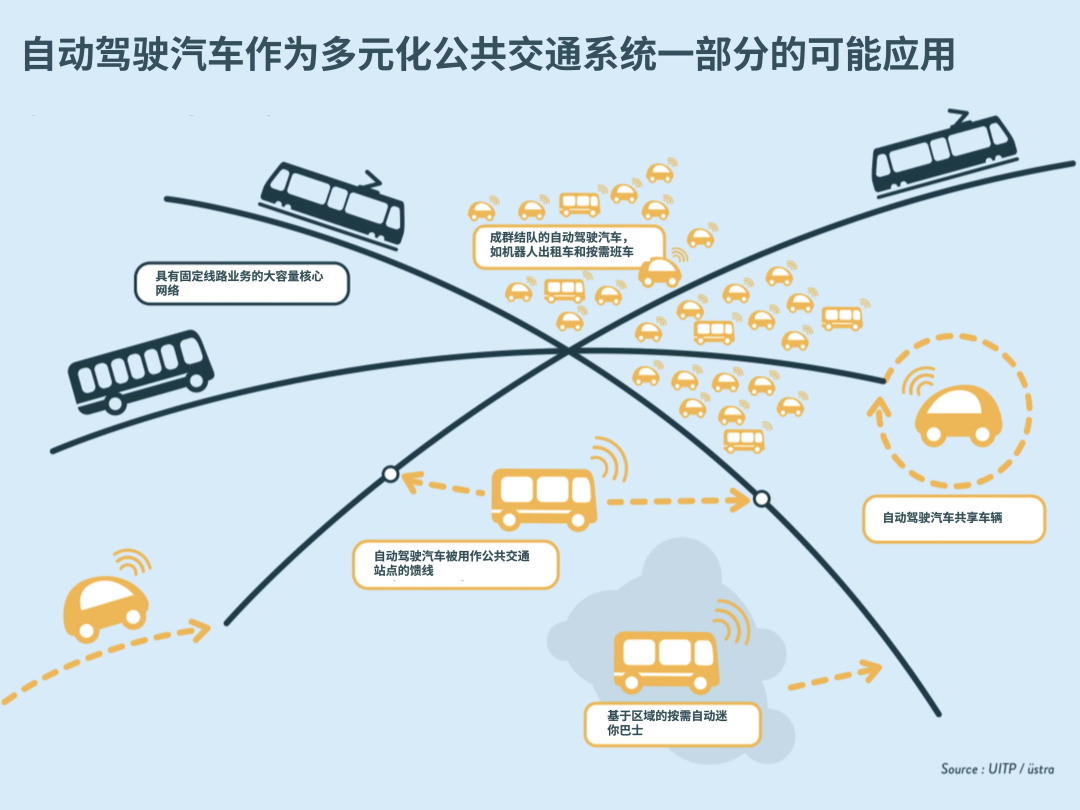

Thus, rapid diversification unfolds—autonomous trucks (Robotrucks) dominate port and mainline logistics, autonomous delivery vans (Robovans) conquer last-mile logistics, while autonomous buses (Robobuses) quietly claim center stage with their 'public transit attributes + high-frequency, essential scenarios.'

Today, 'Autonomous Vehicle Insights' (WeChat: wurenchelaiye) examines: Why is Robobus the 'primary battleground' for L4 autonomy?

(For related reading, click: '2025 Autonomous Driving Outlook (1): The 'Ticket' to L3 Autonomy Has Arrived—Will Your Next Car Drive Itself?')

I. Robotaxi Struggles: The 'Full-Scenario Fantasy' Falls to Reality

Five years ago, the autonomous driving industry was still intoxicated by the promise of 'Robotaxi revolutionizing the world.'

Waymo's valuation soared to $175 billion, Cruise attracted investments from SoftBank, General Motors, and other giants, while domestic players like Baidu and Pony.ai vowed to commercialize fully driverless Robotaxis by 2025.

But reality delivered a harsh blow.

1. Technologically, Robotaxi faces 'hellish' challenges on urban open roads:

Pedestrians darting across streets, food delivery riders 'ghosting' into traffic, sensor failures in rainstorms...

These 'edge cases' demand system reliability exceeding 99.999%, yet current technology struggles to guarantee 99%.

Even if technology meets standards, regulatory liability remains an insurmountable hurdle—who bears responsibility in an accident: the automaker, algorithm provider, or passenger? No clear answer exists.

2. Commercially, Robotaxi's profit model remains a 'castle in the air.'

In the U.S., a single L4 Robotaxi incurs $200,000 in hardware costs (≈1.4 million RMB), plus operations, insurance, and map updates, pushing daily costs per vehicle above $100.

Yet passenger fares cover less than half of these expenses.

Cruise's collapse after burning $10 billion epitomizes this failure.

3. Capital-wise, as the industry enters 'rationality,' investors no longer buy 'tech stories.'

By 2025, financing in autonomous driving flows exclusively to scenarios with rapid deployment and clear profit paths—Robobus, Robotruck, and Robovan.

In recent years, Robobus has quietly surged.

IHS Markit predicts China's shared mobility market will reach 2.25 trillion RMB by 2030, with autonomous buses potentially capturing billions or even tens of billions in market size.

This growth is not hypothetical—Singapore, France, the U.S., and over 30 other countries have deployed Robobus pilots, laying the groundwork for global scalability.

II. Why Robobus Succeeds? Three Advantages Make It a 'Hexagonal Warrior'

While Robotaxi struggles to survive, Robobus operates in multiple cities.

Shenzhen's B888 autonomous bus route, Singapore's official autonomous bus program, Guangzhou's smart transportation upgrade plan... How does Robobus achieve rapid deployment?

(For related reading, click: 'Shenzhen Launches First Four Regularized Autonomous Bus Routes, Serving 41,874 Passengers Safely Over 200 Days')

The answer lies in its three core strengths.

Strength 1: Essential Scenarios, Steady Demand Like an 'Anchor'

Robobus addresses 'pain points within pain points.'

In urban microcirculation, traditional buses suffer from 'uneven capacity and insufficient coverage,' leaving commuters waiting endlessly.

In industrial parks and tourist attractions, short-distance shuttle demand is high, but labor costs are prohibitive.

At airport hubs, travelers lugging luggage across hundreds of meters to reach shuttles complain of poor experiences...

Robobus fills these gaps.

Shenzhen's B888 route, connecting Luohu District's commercial hubs and metro stations, averages over 2,000 daily riders with occupancy rates above 80%.

Critically, such essential scenarios persist regardless of economic cycles, providing the most stable foundation for commercialization.

Strength 2: High Scene Adaptability, Lower Technical Complexity Than Robotaxi

Unlike Robotaxi's open-road scenarios, Robobus operates on fixed routes like bus lanes, park shuttles, and campus commutes.

These routes are predictable, with controlled traffic environments, significantly reducing L4 deployment difficulty.

For example, in campus scenarios, Robobus travels at 20 km/h, avoiding primarily pedestrians and small obstacles.

In urban microcirculation, traffic is denser but routes are fixed, enabling vehicles to plan paths via high-definition maps and respond swiftly to incidents.

In contrast, Robotaxi faces 'infinite possibilities' on open roads, with technical complexity on another level.

Strength 3: Clear Commercialization Path, Dual-Driven by To G and To B

Robobus's commercial model exemplifies 'walking on two legs.'

To G (Government Collaboration):

Integrate with public transit networks, generating revenue through fares + government subsidies.

Singapore's project, with over 300 existing bus routes, could unlock massive market potential if pilots succeed.

Domestically, Guangzhou, Shenzhen, and other cities have included Robobus in smart transportation upgrades, using policy subsidies to reduce early-stage costs.

To B (Enterprise Customization):

Provide tailored shuttle services for parks, tourist sites, and airports, charging service fees.

For instance, Mushroom Autonomous's Robobus solution for a large industrial park saves $70,000 annually in labor costs while boosting the park's image, achieving 95% customer satisfaction.

More critically, Robobus's scaled operations further reduce costs.

As order volumes grow, vehicle production, sensor procurement, and system R&D expenses decline, creating a virtuous cycle of 'tech cost reduction → deeper scenario validation → expanded orders → further cost reduction.'

EqualOcean Intelligence estimates Robobus gross margins could reach 25%, with profitability inevitable once operations scale past critical thresholds.

III. China Leads: From Tech Export to Global Ecosystem Expansion, Robobus's Global Ambitions

In the Robobus race, Chinese autonomous driving firms have quietly seized the 'center stage.'

1. Domestically, leaders like WeRide and Mushroom Autonomous have achieved commercial closure.

WeRide's Shenzhen B888 route, the city's first autonomous minibus operating in a bustling downtown area, covers over 200 km daily, serving over 100,000 passengers.

Mushroom Autonomous partners with 20+ cities, including Beijing and Shanghai, deploying 500+ Robobuses with over 10 million km logged.

(For related reading, click: 'China's Autonomous Bus Boom: Guangzhou, Chengdu, Suzhou, Shaoxing, Hangzhou, Shenzhen, Jinan, Tianjin, Nanjing, Shanghai, Wuhan, Ezhou—Who Leads?')

2. Internationally, Chinese firms shine brighter.

In October 2025, Mushroom Autonomous won Singapore's first L4 autonomous bus tender, integrating into its public transit system—a global first.

Notably, Mushroom adopted a 'smart tech + vehicle manufacturing + localized operations' consortium model, collaborating deeply with Singaporean automakers and operators to resolve localization challenges.

This approach not only safeguards the Singapore project but also lays groundwork for Southeast Asian and European expansion.

In contrast, Western firms lag in Robobus deployment.

Waymo explores autonomous buses but progress is slow; Tesla's Robobus plan remains 'PPT-stage.'

Chinese firms' first-mover advantage is becoming a global competitive 'moat.'

IV. Challenges Remain: Technology, Cost, Operations, Regulations—Four Hurdles to Overcome

Robobus's path to dominance is not smooth. To truly become L4's 'primary battleground,' it must surmount four barriers.

1. Technologically, extreme weather and complex scenarios remain 'hard nuts.'

Rain and snow degrade LiDAR accuracy;

In crowded tourist sites, accurately predicting pedestrian intentions to avoid collisions remains an industry challenge.

Additionally, vehicle-infrastructure coordination maturity directly impacts efficiency—if road facilities fail to communicate with vehicles in real time, Robobus throughput suffers.

2. Cost-wise, initial investments remain steep.

An L4 Robobus typically costs over 1 million RMB. While costs decline with scale, upfront capital pressure is immense.

Although Jishi Intelligence's E6 model reduced prices to $2,800, it targets last-mile Robovans—Robobus cost control is far tougher.

3. Operationally, maintenance systems must shift from 'manual-driven' to 'AI-driven.'

Traditional bus maintenance relies on manual inspections, but Robobus demands real-time monitoring of autonomous systems and swift software fault resolution, requiring higher technical proficiency from maintenance teams.

Ensuring operational safety and handling sudden failures are also critical.

4. Regulatorily, liability and insurance frameworks remain 'blank zones.'

If a Robobus crashes, who is liable—the automaker, algorithm provider, or operator?

No global regulations clarify this.

Insurance products also lag behind tech advancements—existing auto insurance policies cannot cover autonomous risks, necessitating redesigned coverage.

V. The Future Is Here: How Close Are We to Smart Mobility as Robobuses Roam Cities?

Despite challenges, the rise of autonomous buses Robobus is unstoppable.

It not only provides a viable path for L4 deployment but also reshapes the autonomous driving industry—shifting from 'tech races' to 'scenario-driven landings' and from 'solo fights' to 'ecosystem collaborations.'

For society, Robobus's scaled adoption will bring profound changes: enhanced public transit efficiency, reduced congestion, and lower carbon emissions—gradually turning smart city visions into reality.

For individuals, the day we board a smooth-riding Robobus and feel not just convenience but the warmth of technology serving life will mark the true value of autonomous driving.

In 2025's autonomous driving arena, Robobus stands center stage.

Now, it must prove its 'primary battleground' status through technological breakthroughs, innovative models, and scaled operations.

When the Robobus smoothly navigates through parks, scenic areas, and airports, with the elderly swiping their senior citizen cards, children using their student cards, and the rest of us scanning QR codes with our phones to board, all for a fare of just 2 yuan—cheaper than a cup of milk tea—

At this moment, autonomous driving is no longer just a flashy display by tech enthusiasts in first-tier cities; it has become a 'little joy' in the everyday lives of ordinary people.

The most authentic value of technology lies not in replacing humans, but in enabling everyone to travel more conveniently, safely, and with dignity.

In any case, the WeChat official account ' Autonomous vehicles have arrived ' (Autonomous Vehicles Are Here) believes:

While Robotaxi is still waiting for the day of 'city-wide lamp-free' driving, Robobus has already allowed grandmas and grandpas to sit at the bus stop for two extra minutes.

Don't underestimate these two minutes; they represent the first push of the accelerator for L4 autonomous driving as it moves from the 'lab' to the 'real world'. What do you think, dear?

#AutonomousVehiclesAreHere #AutonomousDriving #SelfDriving #AutonomousVehicles