Will Porsche's Exclusive Charging Network Go 'Offline' to Survive?

![]() 12/26 2025

12/26 2025

![]() 475

475

Lead | Introduction

Constructing a proprietary supercharging network can deliver a superior charging experience to users, a trend that has spurred numerous automakers to make substantial investments. Nevertheless, Porsche has opted to gradually phase out its exclusive charging services. What's behind this decision?

Published by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Full text: 2,701 characters

Reading time: 4 minutes

Porsche is navigating through stormy waters.

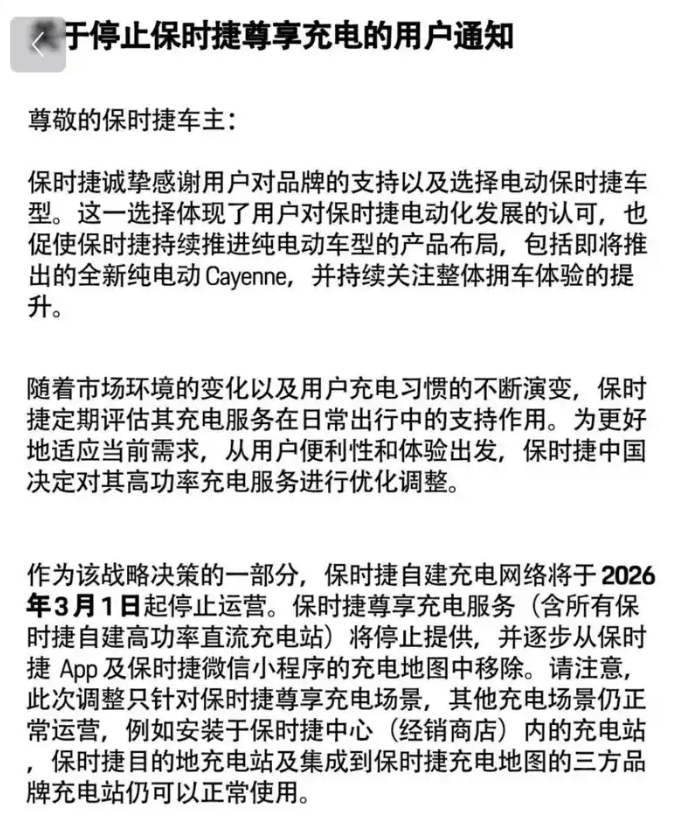

Recent reports reveal that Porsche's self-built exclusive charging network will commence a gradual shutdown starting March 1, 2026.

△ Porsche's self-built exclusive charging network will start winding down operations from March 1, 2026.

This adjustment will impact approximately 200 charging stations nationwide. Following the adjustment, Porsche's exclusive charging services will no longer be listed on the charging maps within the official Porsche App and WeChat Mini Program. Apart from the exclusive charging network, Porsche will continue to offer other charging options for domestic customers, including charging stations at Porsche Centers (dealerships), Porsche destination charging stations, and third-party brand charging stations integrated into the Porsche charging map, all operating as usual.

△ Porsche and NIO will increasingly rely on third-party charging facilities to cater to their users.

Unsustainable Closed Supercharging Network

For automakers' self-operated supercharging networks, insufficient utilization can turn the service into a financial drain for the manufacturer. Currently, Porsche only markets a handful of new energy vehicle models in China, including the all-electric Taycan, Macan, and the hybrid Panamera, with the all-electric Cayenne slated for delivery in late summer 2026. Sales of these models have been relatively lackluster. Data indicates that in the first three quarters of this year, Porsche's electric vehicle (comprising both all-electric and plug-in hybrid) deliveries in China stood at roughly 8,049 units, constituting 25% of total sales. The all-electric Macan, once highly anticipated, has also fallen short of expectations in the domestic market. Consequently, relying solely on these models, along with Audi's all-electric vehicles, which have similarly weak sales in China, it's challenging to sustain Porsche's exclusive charging network spanning over 200 locations across the country.

Even Tesla, with its strong global presence, has opted to open its supercharging network to other brands to boost customer traffic and generate more revenue. Li Bin, the head of NIO, noted in July this year that over 90% of the usage at NIO's charging stations comes from customers of other brands. However, Porsche has not followed suit. Except for Audi, Porsche's self-operated charging stations are not accessible to other brands, leading to very low utilization rates. Considering the costs associated with charging stations, site rentals, power system capacity, and wiring, it's difficult for charging stations to break even, let alone turn a profit. When companies are highly profitable, they can afford to subsidize related businesses with substantial investments. But if a company's profitability diminishes, shutting down related businesses becomes a logical move.

△ Tesla opens its supercharging network to other automakers.

Some Automakers Might Not Need to Build Their Own Supercharging Networks

Currently, numerous domestic automakers have constructed their own charging facilities. Tesla, Li Auto, XPeng, and Zeekr all boast extensive supercharging networks. NIO, in addition to its charging network, has a vast battery swap station network, making it the largest investor in energy replenishment infrastructure in China.

Beyond addressing the initial shortage of charging networks during the early stages of electric vehicle deployment, constructing a proprietary supercharging network is primarily aimed at enhancing the driving experience for customers. One of the major pain points for electric vehicle users is the relatively long charging time. To mitigate this, manufacturers have equipped their models with 800V supercharging capabilities. However, 800V supercharging alone is not enough; it necessitates compatible charging stations to function optimally. The primary goal of manufacturers' self-operated supercharging networks is to enable users to experience the convenience of extreme fast charging, thereby promoting the sales of their electric vehicles and bolstering the image of high-performance brands.

△ Automakers' self-built supercharging networks can offer users a superior supercharging experience.

It's crucial to note that the layout of third-party charging stations in China is already highly developed. Data shows that as of the end of March this year, the total number of charging facilities in the country reached 13.749 million units (including public and private charging stations), with public charging facilities covering 98% of highway service areas and 97.31% of counties. Compared to European and American countries, China, known as the infrastructure powerhouse, has demonstrated remarkable prowess in building charging infrastructure, reducing the necessity for automakers to construct and operate their own charging facilities. Taking Teld and StarCharge, two leading domestic third-party charging companies, as examples, as of March 2024, they operated over 550,000 and 510,000 charging stations in China, respectively, achieving nationwide coverage of major cities. In the future, these third-party charging stations will continue to upgrade, gradually popularizing higher-voltage supercharging stations. Meanwhile, there's also a possibility that Porsche will collaborate with brands like Li Auto, XPeng, and Zeekr, enabling its models to access these companies' supercharging networks.

△ The domestic third-party charging network infrastructure is relatively developed, providing near-complete coverage of major cities and highways in China.

What Lies Ahead for Porsche?

For a luxury brand like Porsche, offering exclusive and prestigious services to users is a vital aspect of building its brand image. The decision to suspend its self-operated exclusive charging services ultimately boils down to cost reduction and efficiency enhancement.

In the third quarter just concluded, Porsche reported an operating loss of €966 million, compared to a profit of €974 million in the same period last year. This was primarily due to a significant increase in strategic restructuring costs. In the first three quarters of 2025, Porsche incurred restructuring expenses ranging from approximately €2.7 billion to €3.1 billion, mainly for laying off nearly 2,000 employees, delaying the development of all-electric models, and canceling plans for independent battery production to alleviate long-term operational burdens.

△ Porsche's operating profit for the first three quarters of this year was a mere €40 million.

Porsche China's performance is far from optimistic. In the first three quarters of this year, Porsche's sales in China plummeted by 26% year-on-year to 32,000 units, while the global market only witnessed a 6% decline during the same period. This follows three consecutive years of decline from 2022 to 2024, with sales halving compared to the 68,700 units sold in the same period of 2022. China has also slipped from Porsche's largest single market globally to the third position, with its internal status within Porsche continuously waning.

For Porsche, shutting down its self-operated supercharging network merely addresses a superficial issue. The top priority for the company's sustainable development is to revitalize sales in China.

On one hand, Porsche needs to actively respond to the fierce competition in the domestic market. In the Chinese automotive market, brands like Li Auto, AITO, NIO, Zeekr, and Xiaomi have siphoned off a significant portion of sales that once belonged to Porsche. These models, whether in terms of design or performance, possess late-mover advantages, making it difficult for Porsche, which has been slow to launch new models, to keep pace. Especially in the electric vehicle segment, since the release of the Taycan in 2019, Porsche's second all-electric model, the Macan EV, only made its debut in 2024. This development pace pales in comparison to the rapid three-generation-per-year model development speed of domestic automakers. Accelerating the launch of new models to continuously capture market attention is a challenge that Porsche's engineering and R&D team needs to tackle.

△ Porsche needs to expedite the pace of new vehicle launches.

On the other hand, Porsche needs to address the deficiency in its technological approach of prioritizing the three electric components (battery, motor, and power electronics) over software. Taking the Taycan as an example, while it has set industry benchmarks in terms of acceleration performance and being the first to adopt an 800V supercharging architecture, its infotainment system lacks integration with popular domestic apps like WeChat CarPlay and Gaode Maps, which Chinese consumers frequently use. Additionally, its voice interaction capabilities are rudimentary, far inferior to the voice interaction functions powered by large language models offered by many domestic brands. These issues ultimately stem from the fact that Porsche's domestic team did not play a significant role in the development of the infotainment system, rendering the Taycan essentially an imported product. Moving forward, if Porsche wants to enhance its sales in China, it must empower its domestic R&D team with greater decision-making authority. In this regard, Volkswagen, Porsche's parent company, has taken a proactive step ahead of many foreign automakers in China by acquiring a stake in domestic automaker XPeng and introducing XPeng's electrical and electronic architecture.

△ Porsche urgently needs to rectify the deficiency in its technological approach of prioritizing the three electric components over software.

Commentary

In recent years, like other multinational automakers, Porsche can no longer relish the easy days it once enjoyed in the Chinese automotive market. Cutting its self-operated supercharging network is just one step, which cannot completely resolve the challenges Porsche faces in China. To compete with domestic new energy vehicle upstarts, Porsche must introduce competitive products. Therefore, Porsche needs to make bold cuts in unnecessary expenditures and concentrate its limited resources on new models and technologies.

(This article is an original work by Heyan Yueche and may not be reproduced without authorization.)