The Trailblazer of Large Models Falls Short of Market Euphoria

![]() 01/12 2026

01/12 2026

![]() 442

442

On January 8, 2026, Zhipu AI, hailed as the "pioneer stock of global large models," made its debut on the Hong Kong Stock Exchange. Its meteoric rise in performance and an astounding subscription rate of over 1,159 times for its public offerings prior to listing had fueled market anticipation to fever pitch.

However, the inaugural trading day did not unfold with the same fervor. Zhipu's stock price briefly dipped below its issue price during the session, eventually closing with a modest 13.17% increase.

The following day, January 9, Minimax, another contender for the title of the inaugural large model stock, commenced trading and closed up 109.09%. In contrast, Zhipu's stock rose by 20.61%. Zhipu's performance on its second trading day may have been somewhat buoyed by Minimax's relatively robust showing.

Nevertheless, when juxtaposed with the "wealth creation phenomenon" witnessed by GPU firms like Moore Threads and MXIC on the A-share Science and Technology Innovation Board, which experienced exponential value growth upon listing, Zhipu's two-day performance appeared rather subdued, particularly when compared to Minimax.

As fellow pioneers in the AI revolution, why did Zhipu's market debut fail to captivate and even appeared somewhat lackluster? How did the capital market assess Zhipu's worth? And how should we perceive Zhipu's long-term potential?

I. Has the AI Wealth Creation Myth Lost Its Luster?

The choice of listing venue is pivotal in understanding the disparities in stock prices.

The investor landscape in the Hong Kong stock market is characterized by international investors constituting roughly 60%, Hong Kong investors 25%, and mainland investors 15%, with professional institutional investors accounting for 85% of the trading volume.

The dominance of institutional investors has shaped the Hong Kong stock market's traits, where "market capitalization and liquidity are concentrated in mature, medium-to-large leading enterprises" and "stocks with stable cash flows and robust fundamentals are favored by funds."

In essence, the Hong Kong stock market places significant emphasis on clear profitability pathways, healthy cash flows, and whether valuations appear excessively inflated compared to international peers.

This valuation characteristic also partly elucidates why Zhipu's performance and valuation trailed Minimax—when gauging the loss rate by adjusted net loss/revenue, Minimax exhibited a clear trend of loss reduction.

Conversely, the A-share Science and Technology Innovation Board offers a vastly different valuation landscape. Here, investors demonstrate greater patience for companies with "hard technology" attributes that address "bottleneck" issues and are willing to pay a substantial "dream premium" for their future potential and national strategic significance.

Similarly, among the "Four Little Dragons" of domestic GPUs, Biren Technology and Illuvation, which listed on the Hong Kong stock market alongside Zhipu, also witnessed far less impressive stock price performances compared to MXIC and Moore Threads.

From a valuation standpoint, based on the midpoint of projected revenue for 2025 and the closing market capitalization on January 8, MXIC and Moore Threads boasted PS ratios of 147 times and 233 times, respectively, while Biren Technology hovered around 109 times. Illuvation lacked a projected value, but even if it had one, it would be significantly lower than the former three.

This underscores that different markets possess varying pricing mechanisms for the same technological narrative.

The second factor lies in the distinct roles of the two companies within the AI industry value chain, which dictates the risks and rewards associated with their respective business models.

GPU companies are quintessential "shovel sellers." In the current AI surge, computing power is undeniably the hard currency and infrastructure. Regardless of which downstream large models and applications ultimately prevail, the demand for computing power remains certain and continuously growing.

The shovel seller's business is intricately linked to the industry's expansion without bearing the risks of specific application successes or failures, lending this business model an inherent defensive and certainty halo.

Large model companies, on the other hand, resemble "gold prospectors." They confront the final application market directly, with vast potential but also high risks: rapid technological iteration, fierce competition from industry giants, and arduous exploration of commercialization...

Simply put, the market perceives "selling shovels" as more reliable and valuable than "predicting where to dig for gold."

Zhipu also incorporates some shovel-selling attributes into its business, such as providing API services, but this constitutes a relatively minor portion, as detailed below. Therefore, Zhipu must demonstrate not only its technological superiority but also its commercial leadership to garner higher market enthusiasm.

Ultimately, all disparities are reflected in specific valuation figures.

Brokerage firms' performance forecasts for Zhipu offer a referable valuation benchmark.

CITIC Securities projects Zhipu's 2026 revenue to be approximately RMB 1.604 billion and assigns it a valuation of around 30 times price-to-sales (PS) for 2026, corresponding to a target market capitalization of approximately HK$ 53.9 billion. Zhipu's closing market capitalization on its inaugural trading day was about HK$ 57.9 billion, largely in line with this benchmark.

A 30 times PS acknowledges its industry standing and growth potential. For reference, a few years ago, a leading AI company received an international bank's valuation of only around 16 times PS shortly after its listing.

Although Zhipu did not experience the Moore Threads or MXIC-style "overnight wealth," it still represents a substantial and solid return, considering its Pre-IPO financing valuation was just over RMB 24 billion, and its market capitalization reached HK$ 69.8 billion (approximately RMB 62.53 billion) two days after listing.

II. Robust Pillars and Fiercely Competitive Growth Engines

The Hong Kong stock market's pricing mechanism necessitates a focus on business fundamentals, i.e., the nature of Zhipu's business.

Zhipu's revenue is bifurcated into two segments.

The first segment comprises localized deployment solutions. Zhipu deploys its hundred-billion-parameter foundational large model, GLM, on clients' private servers or dedicated cloud environments, offering highly customized exclusive model services.

This service is typically billed based on the project and subsequent ongoing computing power consumption. Due to the deep customization and privatization guarantees, it naturally targets large banks, central enterprises, leading internet companies, and other "big B" clients with stringent requirements for data security and model controllability.

Localized deployment is characterized by high unit prices and high gross margins, with the business's gross margin reaching around 60% in the first half of 2025. The "downside" is also apparent: it necessitates deep customization and close service, making it challenging to replicate.

It is not uncommon for "deep collaboration in one year to lead to no orders the next."

In localized deployment, Zhipu's approach is to construct a powerful general-purpose brain and then have it learn and solve professional problems across various industries.

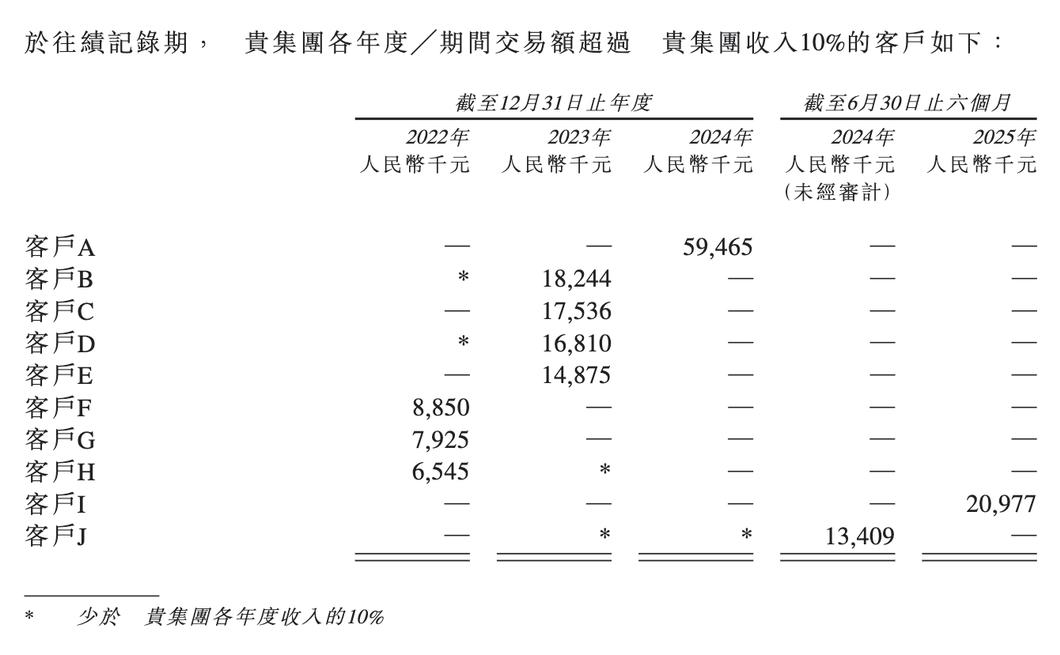

Zhipu has deployed in multiple industries, with revenue generation becoming increasingly diversified. According to the prospectus, it plans to prioritize model deployment and scenario verification in the consumer electronics and IoT industries over the next six months and, in the long term, expand into high-barrier industries such as education and healthcare.

Unlike Zhipu, which views AGI as a belief, some large model companies opt for a focused strategy, abandoning the competition for foundational large models and the AGI narrative, and instead developing industry models or enterprise-level solutions for B2B applications, such as 01.AI and Baichuan Intelligence, which focuses on medical AI.

Clearly, Zhipu's strategy demands more resources, placing a more urgent demand on achieving a closed commercial loop and early self-sufficiency.

The second segment is cloud deployment. Zhipu encapsulates its model capabilities into standard API interfaces, making them accessible to all developers and enterprises like utilities. Clients pay based on usage volume, accessing the services as needed. This represents a more standardized and lightweight service model.

Obviously, cloud deployment is the narrative that resonates more with the capital market and is also Zhipu's long-term strategic focus.

However, the domestic cloud business is highly competitive, with major players offering APIs at rock-bottom prices. Zhipu's gross margin in this area plummeted from 76.1% in 2022 to 3.4% in 2024 and turned negative in the first half of 2025.

Therefore, Zhipu must demonstrate its ability to become a platform company with "network effects" and "extremely low marginal costs."

On its listing day, an internal letter from Tang Jie, Zhipu's founder and chief scientist, mentioned that after the release of GLM-4.7, the MaaS platform's ARR annualized revenue exceeded RMB 500 million (with overseas revenue exceeding RMB 200 million), a 25-fold increase from RMB 20 million in just 10 months.

This letter conveys two narratives: one is internationalization, considering overseas developers' stronger willingness to pay, and the other is the explosive growth of the cloud business.

However, it must be acknowledged that Zhipu remains primarily a B2B solution company deeply serving large clients. Data shows that in the first half of 2025, localized deployment and cloud business revenue accounted for 85% and 15%, respectively.

Localized deployment offers high unit prices and gross margins but is resource-intensive, while the cloud business is fiercely competitive, and computing power remains expensive. In the first half of 2025, computing service fees in operating costs and R&D expenses totaled RMB 1.18 billion, more than six times the revenue for the same period.

Thus, despite rapid revenue growth, Zhipu has been consistently incurring significant losses.

Zhipu's revenue surged from RMB 57.41 million in 2022 to RMB 312 million in 2024 and further to RMB 191 million in the first half of 2025, representing a year-over-year increase of over 300%. However, its adjusted net loss also widened from RMB 97.417 million in 2022 to RMB 1.752 billion in the first half of 2025.

Facing losses exceeding eight times its revenue, Zhipu's stance is: at this stage, it does not pursue short-term profitability but instead focuses on increasing model usage volume, customer base, and ecological penetration.

In other words, today's losses are the "strategic ticket" required to secure tomorrow's industry leadership.

This is a high-stakes gamble for future dominance. Success or failure hinges on two simultaneous races.

One is the technological race, where its model performance must continuously lead, serving as the ultimate trump card to attract all clients. The other is the cost race, where it must leverage technological innovation and scale effects to reduce computing power costs faster than revenue growth.