A Boom Year for Social Media Globalization: Success and Failure Hinge on AI | 2025 Globalization Review

![]() 01/14 2026

01/14 2026

![]() 562

562

Editor | Li Xiaotian

The year 2025 was another eventful year for social media globalization.

Early in the year, after Donald Trump returned to the White House, he announced an extension of the deadline for enforcing the TikTok ban, but this failed to stem the tide of American “TikTok refugees” flocking to Xiaohongshu (Little Red Book). In just two days, Xiaohongshu gained over 700,000 new users, initiating a large-scale direct exchange between Chinese and American users.

In July, Grok, an AI chatbot developed by Elon Musk's xAI, launched its “Companion Mode,” introducing virtual girlfriend Ani and a cartoon panda named Rudy.

In August, Chizicheng Technology released its 2025 interim profit forecast, projecting total revenue of RMB 3.135 billion to RMB 3.215 billion and net profit attributable to shareholders of RMB 470 million to RMB 510 million. Subsequently, Chizicheng's stock price surged, with a cumulative year-to-date increase of 200%, drawing significant industry attention.

In mid-December, TikTok CEO Shou Zi Chew announced in an internal memo that ByteDance agreed to transfer majority control of its U.S. operations to a new joint venture, TikTok USDS Joint Venture LLC, responsible for data protection, algorithm security, content moderation, and software assurance. ByteDance would retain full ownership of e-commerce, branded advertising, and global connectivity businesses.

At the end of 2025, U.S. social media giant Meta announced the acquisition of AI agent startup Manus for $1.55 billion, bringing in a Chinese entrepreneurial team. Xiao Hong, the post-90s founder of Manus, was appointed as a Meta vice president.

The fervor of social media globalization has impacted every corner of the industry.

A UI designer told Xiaguang Society that over the past six months, all the orders he received were for designing social media globalization apps.

In the Middle East and Spanish-speaking regions, for social apps focused on live streaming and voice chat, host resources are the most crucial “asset.” Amid the “social media boom,” some globalized apps even offer over 100% revenue sharing to attract hosts—accepting initial losses to secure market share.

Support for high-quality Middle Eastern hosts has gone beyond expectations: “Renting villas and providing sports cars are standard practices,” said the founder of a leading MCN agency focused on the Middle East and North Africa. Leveraging the strong family culture in the region, a “mentor-apprentice” referral model can create tight-knit networks, deeply binding hosts to platforms.

While seemingly “loss-making,” this approach yields long-term benefits: “Once users settle in, some hosts reinvest their earnings into the app's ecosystem instead of cashing out,” the founder explained.

As the new year begins, Xiaguang Society has identified six key trends from the dynamic “boom year” of social media globalization in 2025.

While Indonesia was once the consensus first stop for globalization, the Middle East has emerged as one of the most “lucrative” destinations in recent years.

About five years ago, a common “doubt” about social media globalization in the Middle East was that, despite promising immediate data, the region's relatively small population base seemed to limit sustainable market growth.

The first companies to enter shattered this perception. Financial reports show that in the first quarter of 2025, BIGO's global average monthly active users reached 260.4 million, with Bigo Live averaging 28.9 million monthly active users.

In the Middle Eastern social media landscape, nearly all top players are Chinese companies. As positive news crossed borders, the region remained the hottest destination for social media globalization in 2025.

That year, Saudi Arabia, Qatar, the UAE, and Iraq saw the launch of 74,256 new social apps.

Tens of thousands of new apps entered the market, supported by the migration and reorganization of industry talent.

These new platforms in the Middle East often recruited talent from major social media companies like BIGO and TikTok. Armed with mature operational experience, these individuals adopted a “one-person, one-city” approach, rapidly elevating the industry's overall professionalism in resource competition, platform design, customer service, and revenue-sharing policies.

However, no new app truly broke through in the Middle Eastern market that year.

The market remained dominated by head companies (leading players), with gains and losses shifting among them. After a decade of wild growth, explosive expansion is no longer replicable. Besides the top players, dozens of apps with one to two million monthly active users vie for market share. While countless new apps emerge, many quietly disappear.

Today, the Middle East appears to be a relatively “red ocean” (highly competitive market).

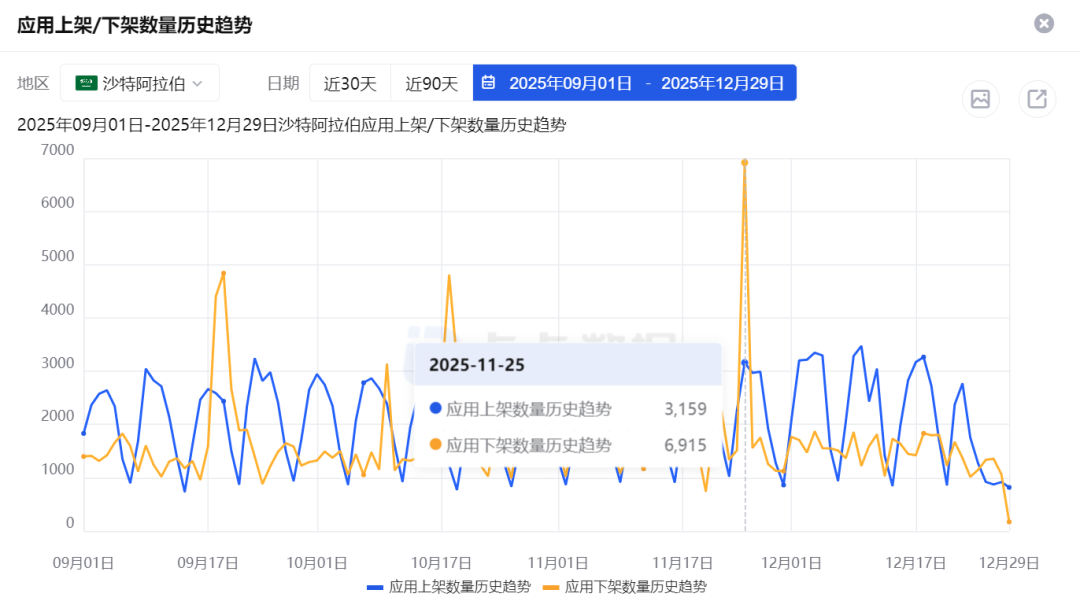

Source: DianDian Data. On November 25, 2025, Saudi Arabia saw 6,915 social apps removed from stores.

Were there any standout markets this year?

Surprisingly, Southeast Asia emerged as a new growth opportunity.

This shift may stem from “regional synergy,” “connected user bases,” and social ecosystems. For example, some apps in Thailand integrated hosts from Laos. Compared to Thailand, Laotian hosts not only bridge language differences but also skew younger and more diverse. This reflects Laos' local ecosystem: while the average monthly income in its capital is just RMB 600–1,000, the culture embraces Southeast Asia's ethos of instant consumption and pleasure, driving young people's eagerness to earn.

Meanwhile, Latin America, particularly Brazil, showed steady growth. Short-video platform Kwai surpassed 60 million monthly active users in Brazil, with a 15% ad conversion rate. Brazilian young users have strong social demands, with over 60% willing to engage in voice games, virtual gifting, and other features—“a gateway for Spanish-speaking social media globalization.”

However, the ultimate goal of social media globalization remains unchanged: entering the North American market.

This year, video social apps Clique and Carol took on the North American market, successfully ranking in Canada's top 100 entertainment social apps within two months.

The allure of the Middle East lies in its high-net-worth users, but North America boasts similarly affluent users with even greater density.

The challenge is that North America's social app landscape is already dominated by incumbents like Facebook, Instagram, Snapchat, and TikTok. Additionally, the U.S. remains the world's riskiest market, making it harder to disrupt the status quo quickly.

The most talked-about trend in 2025 was undoubtedly the integration and innovation of social apps with AI technology.

In 2024, the industry focused on refining models, with most capital flowing into vertical-specific models.

By 2025, the model layer had matured significantly, enabling transformative applications. This sparked an unprecedented surge in consumer-facing (To C) initiatives.

“After all, application development is where Chinese companies excel—current models are still more advanced in the U.S.,” an investor explained to Xiaguang Society.

Except for a few top firms, growth in the social media sector centered on AI. “Traditional businesses saw little change or growth, but AI-driven directions hold nearly limitless potential,” the investor added.

Indeed, 2025 saw commercial successes in AI-powered social media.

The most notable example is Meitu. By November 2025, BeautyCam (Meitu's flagship app) topped app store charts in 119 countries, including the UK, Norway, and Sweden. In October alone, it ranked first on Apple's App Store in 14 countries, including Italy and France.

Its photo-restoration app Wink saw nearly 30 million global downloads in the first half of 2025, generating over $6.46 million in revenue via the App Store.

Meitu is not alone. Xiaguang Society learned that an AI music app had already generated $6 million in revenue sharing.

Reviewing the social media sector in 2025, we identified the top eight growth areas and found that AI accounted for over 75% of the sector. The most prominent performers were emotional chatbots targeting female users ( Yi Nv system ). According to Guoyuan Research, Talkie reached 34.89 million monthly active users in 2025, becoming the world's largest role-playing app.

The combination of AI and metaphysics (e.g., fortune-telling) emerged as one of the fastest-growing verticals.

In 2025, 10 million users engaged with AI spiritual app Hallow, generating $15 million in annual revenue. Another 5 million users interacted with Bible Chat, an AI-powered Bible study assistant, contributing $10 million.

In this space, AI priests and pastors compete for “spiritual” users. While these apps naturally enjoy high daily engagement due to religious adherence, their user bases resist commercialization, making revenue reliant on in-app purchases and subscriptions rather than ads.

An investor in social apps bluntly stated, “These apps earn only modest profits.”

Meanwhile, most failed social startups in 2025 were AI-driven.

For instance, Starla-Call the Universe, a metaphysical AI astrology social app that predicted users' “soulmate appearances,” generated over $2 million in 20 days and $2.4 million monthly at its peak. However, its revenue plummeted after the hype faded, dropping to just $54,000 in November.

Undoubtedly, AI-powered social media remains capital-intensive, characterized by both prosperity and bubbles, opportunities and risks.

Notably, Japan emerged as one of the most receptive markets for AI companion apps.

This may relate to Japan's social environment.

As of September 2025, nearly 30% of Japan's population was elderly. With shrinking household sizes and widespread loneliness, social isolation became a prevalent issue. Japanese social interactions often remain superficial or even hypocritical, with strict boundaries fostering emotional repression and frequent “anxiety” ( unease deisu) among the public. These factors created fertile ground for AI companion apps.

Additionally, while Japan lags in cashless payments, its high acceptance of soft pornography and view of AI social apps as extensions of galgames (Japanese dating simulation games) or “dream girl” economics (monetizing female fantasies) has driven consumer acceptance of AI companions.

Though many AI companion apps focus on soft pornography to tap male spending power, their services remain limited. Currently, their user demographics overlap significantly with those of maiden games (female-oriented dating games).

Photo source: @Love and Deep Space

More importantly, in the social networking sector, the application scenarios for AI remain quite limited. In most cases, AI still serves merely as a technological tool for improving efficiency and product delivery.

Meanwhile, the monetization models of AI-powered social apps have not seen significant changes. Overall, AI social applications still rely on three primary approaches: paid subscriptions, advertising revenue, and in-app purchases. In emerging markets, some apps also incorporate e-commerce and gaming to achieve diversified monetization through scenario-based and customized strategies.

In terms of service models, most AI social applications follow the approach pioneered by Character AI, utilizing core models for content generation. A few cases explore deeper integration of AI Agents with social networking, such as optimizing matching mechanisms to enhance accuracy and reducing effective social interaction losses during the cold start phase.

Jimo, a social networking app targeting overseas markets, stands as a typical representative in exploring AI-powered social interactions. Beyond conventional modules for stranger socializing and community-based interactions, Jimo has introduced an AI virtual conversation feature. Although the app defines it as a channel for “self-communication,” its core function remains as an AI assistant tailored for social scenarios, offering users more interactive and exclusive social Q&A services. For instance, users can select their current state to receive simple social interaction suggestions from the AI.

" "

"

Behind the lack of deep integration between social networking and AI lies a widespread industry consensus: the foremost priority in social interactions remains authenticity. “Most users come here seeking genuine interactions and connections,” and AI struggles to truly replace communication itself.

However, practitioners from no fewer than five companies told Xiaguang Society that the industry is still exploring the possibilities of combining AI and social networking. This implies that while the model layer will become increasingly stable in the coming years, the application layer will grow more diverse.

" "

"

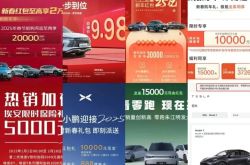

In the past few years, the way social networking apps expand overseas has undoubtedly been through buying traffic to achieve explosive data growth.

From a long-term perspective, the data targets pursued by traffic acquisition, such as deep conversions and user retention rates, do enable companies to clarify their industry positioning and determine development directions. However, the essence remains attracting as many users as possible, believing this will lead to successful operations.

Yet, this dividend was quickly exhausted, and the market, especially in the Middle East, has now entered a phase of Stock period (inventory saturation).

The clearest data point is the doubling of customer acquisition costs. For example, in the Middle East, known for its low costs a few years ago, the current cost has reached approximately $3 per user. In Taiwan, China, this figure has soared to a “sky-high” $10 per user.

The Sea heat (overseas expansion craze) has even spread to “outside the fifth-ring road” regions. It is understood that last year, in Egypt, outside the “Gulf Six,” the customer acquisition cost was a few cents, but this year it has risen to around $2.

At the same time, users are more stringent with their willingness to pay on new platforms. To trigger the same level of consumption as before, traffic acquisition efforts now need to double or triple, leading most products to abandon this path.

According to Guangdada's "2025 Overseas Social APP Marketing Trend Observation," only 4,484 social applications worldwide are running ads, a year-on-year decrease of 12.43%. However, the average monthly content volume per advertiser has surged by 47.37% year-on-year, indicating that advertisers are shifting from “quantity to quality,” reaching more audiences through more precise and high-quality content.

In more mature markets, social networking companies expanding overseas have also recognized the necessity of strategic shifts—from acquiring users through traffic purchases to conveying brand value.

This year, an increasing number of overseas social applications have begun to forge deeper emotional connections with users through online and offline activities.

From a marketing perspective, influencer marketing has become a crucial medium for connecting brands and users.

Wang An, the founder of the social application GiddyGiddy, revealed to the media that after his overseas practical experience, he found that the fission models commonly used for growth by most domestic internet companies are difficult to apply in overseas markets, but influencer marketing is one of the few effective growth strategies.

A key reason behind this is that overseas users are more concerned about the sense of security in stranger socializing, community-based interactions, and anonymous socializing. On most platforms, users do not actively make “sharing” the primary interaction mechanism; instead, they prefer to shape their own social spaces.

" "

"

Lisa shares Labubu on social media.

As a result, the influence of KOLs and KOCs on the general public is remarkably powerful. Endorsements by influencers can reduce communication losses, better adapt to users' social habits, be more persuasive, and foster connections in relatively normalized settings.

Of course, marketing strategies also need to be customized based on the content ecosystems and user demographics of different platforms. For example, on TikTok, entertaining and highly interactive content is easier to spread; on Instagram, content with strong aesthetic and stylistic attributes is more in demand.

The popularity of influencer marketing is further fueling the overseas expansion market. A practitioner in social media marketing told Xiaguang Society that in 2025, the number of Chinese companies doing influencer marketing business in Saudi Arabia has more than tripled compared to last year.

" "

"

In 2025, localization remains the key word for social networking apps expanding overseas.

In markets like the Middle East, where competition for existing users is fierce, localization is almost the core strategy and means of corporate competition.

Currently, localization is primarily implemented from three perspectives: product, operations, and branding.

From the product side, localization mainly focuses on optimizing strategies for recharging, content distribution, long-term incentives, and even seemingly minor details like simplifying the registration process. As competition intensifies in the GCC market, social applications expanding into lower-tier markets (lower-tier markets) like Egypt and Iraq have begun to sub-divide regional user habits. How to quickly convert users and make the app align as closely as possible with local user habits has become the most critical metric.

For example, to break free from one-way payment limitations, Saada integrated a UGC ecosystem into its video rooms—users are no longer just content consumers but can also earn small rewards as amateur streamers. This dual role model of “consumption + income generation” is similar to the logic of Douyin Lite’s “earn coins and cash out,” capturing ordinary users' desire to earn money at a low cost while enhancing community retention and activity.

On the operational side, the focus is on segmenting user experiences. In the Middle East, strategies are more targeted: locking in high-value (R) users for directed maintenance and relying on elite clubs and other top-tier incentive mechanisms to solidify retention.

From a branding perspective, activities and staffing deployments online and offline help users recognize that the company identifies with local culture, values national pride, and is committed to long-term local development. In overseas social networking, especially in “acquaintance societies” like the Middle East, such actions bring lasting trust dividends and encourage deeper connections with the app and brand.

The deeper key to localization lies in reducing the impact of perspective biases caused by temporal and spatial differences on decision-making. Ultimately, it means letting professionals handle professional matters.

“Scholar Lin Xueping mentioned in a conversation with Xiaguang Society, ‘Actually, good overseas managers often appear as mavericks from the headquarters' perspective. They must have significant autonomy. Leaders need to trust their expatriate managers.’ This model of granting high autonomy to local overseas teams greatly fosters a sense of ownership among local employees, continuously enhances team combat effectiveness, and makes localization strategies more efficient.

Today, a newer form of localization has emerged: “invisibility” in overseas expansion.

Simply put, it involves using local companies as “intermediaries” and hiring Chinese employees engaged in overseas social networking as the core driving force.

A typical example is JACO, which surged to become the Top 1 app in Saudi Arabia and the United Arab Emirates in just one month this year.

On the surface, JACO appears to be a local app backed by Middle Eastern funding, but its development team is actually Beijing Baiyitu Information Technology Co., Ltd., an experienced overseas expansion company. Previously, the company's Beeto and Hektar both reached the Top 1 download rankings in the Middle East. Even now, a significant portion of the company's key business leaders are Chinese employees.

This represents a typical collaborative model for Chinese social companies to deeply localize and adapt in the Middle East: Middle Eastern local capital focuses on resource alignment, license applications, and government coordination, while Chinese companies concentrate on technology export, system construction, and operational implementation. A customized equity structure deeply binds the long-term interests of all parties, forming a stable development consortium.

" "

"

The reasons behind this are not hard to understand. The Middle East once allowed Chinese companies with successful experience to dominate the social entertainment sector due to its underdeveloped social and entertainment landscape. However, as localization competition intensifies, many practitioners have realized: once local Middle Eastern players enter the social networking market, their inherent “local filter” will bring natural user recognition and goodwill, becoming an unparalleled advantage in Stock competition (inventory competition).

Regarding how to further enhance localization, a senior operator in overseas social networking believes that building a more comprehensive and comfortable local living environment may be an inevitable investment for companies. “For example, in Saudi Arabia, network infrastructure is relatively underdeveloped, so some companies undertake large-scale renovations of such infrastructure to ensure employee well-being, thereby boosting localization from a humanistic perspective.”

As scholar Lin Xueping said in a conversation with Xiaguang Society, ‘Chinese companies expanding overseas must truly create jobs and value for the local community. Companies need to integrate into the local area and become part of the community to tightly connect with everyone.’

" "

"

In 2025, the global social application market faces stricter regulatory scrutiny.

In December 2024, several social products were massively banned for involving child abuse and child pornography. This serves as a clear warning: the use of materials related to children, lolis, and anime characters requires extreme caution, and subsequent regulatory policies will only continue to tighten.

On January 1, 2025, Florida, USA, restricted minors under 14 from opening social media accounts, while those aged 14-16 can only use social media with parental consent. Australia, Spain, and Denmark enacted similar bills in 2025.

In February, Google updated its advertising policies for dating and companionship services, banning or restricting 11 types of ads, including those “promoting underage dating,” “advertising paid companionship, dating, or sexual behavior,” and “marital affair dating or infidelity services.”

In July, the Apple Store strengthened its age ratings for app content. Building on the existing ratings, it eliminated the 12+ and 17+ age brackets and introduced three new tiers: 13+, 16+, and 18+. It also requires app developers to answer new age rating questions to help the system more accurately identify potentially sensitive content in apps.

Since September, social products have been removed in batches from markets including Turkey, the USA, the UAE, and Saudi Arabia.

At the same time, dating and companionship products must undergo certification at the advertising account level to ensure product descriptions match reality. Even regarding AIGC, Google requires filters, clear feedback and complaint channels, and users must complete at least two steps to view sensitive content.

From a regional perspective, the areas with the most global risks are the USA, Indonesia, Vietnam, India, Japan, and South Korea. Japan and South Korea mainly face issues related to AI deepfakes, while Southeast Asia deals with minors and gambling.

Due to compliance issues, the number of social software removals, especially those related to 1V1 video services, has been increasing in 2025. Since late August, the Information and Communication Technologies Authority (BTK) of Turkey has gradually imposed access bans on nearly 30 social applications, including Azar, LivU, and Tango.

The sudden collapse of platforms has left guilds and streamers dependent on them in a state of displacement. To ensure stable income, they have had to proactively seek newer platforms with stronger compliance and more stable operations, naturally triggering a reallocation of industry resources. Leading overseas social applications, leveraging their stability and compliance advantages, have seized the natural opportunity to absorb high-quality resources, further intensifying the industry’s “80-20 rule” differentiation.

For companies, to mitigate risks and achieve sustainable development, they need to avoid over-reliance on a single market: on the one hand, building a global presence to solidify their business foundation and enable cross-regional flow and resource circulation; on the other hand, deepening local operations and regional cooperation to reduce uncertainties caused by policy changes. Only by pursuing both “globalization” and “localization” can companies adopt a more stable development strategy.

In this year of overseas social networking expansion, some blindly followed trends, but many more embraced opportunities.