Prospects for New Energy Vehicles in 2026: The Pivotal Shift from "Quantitative Growth" to "Qualitative Transformation"

![]() 01/14 2026

01/14 2026

![]() 427

427

On the streets of Amsterdam, the Netherlands, a Zeekr vehicle glides past historic buildings, while a NIO Space at the street corner subtly introduces China's automotive lifestyle to European cities.

This scene epitomizes the remarkable progress of China's new energy vehicle (NEV) industry in 2025.

This year, after the industry's retail penetration rate historically exceeded 50% in March, it successfully surged past the 60% milestone by year-end, signifying the complete transition of electrification from a "niche alternative" to a "market mainstream." Domestic brands like BYD and Geely have cemented their leadership with systemic advantages, while emerging forces have accelerated their differentiation amidst fierce "mid-game competition," shaping the industry landscape.

The "scale-driven competition" of electrification in previous years has drawn to a close. The multifaceted competition in 2025, spanning from the deployment speed of intelligent technologies to the depth of global operations, and then to the health of supply chains and profit models, has laid a solid foundation for the next phase.

Standing on the robust foundation of 2025, the industrial landscape for 2026 is gradually taking shape, with core issues shifting from "how to expand market share" to "how to redefine value."

01 Penetration Rate Crosses the Pivotal Threshold

In China's auto market in 2025, NEVs are the undisputed growth driver. In the first 11 months, NEV production and sales both surged by over 30% year-on-year, with sales accounting for 47.5% of total vehicle sales. A full-year penetration rate exceeding 50% is virtually assured.

More notably, the monthly retail penetration rate has climbed rapidly. In December, domestic NEV retail sales are projected to reach 1.38 million units, with the penetration rate potentially breaking through the 60% mark for the first time.

From a market structure perspective, domestic brands have emerged as the dominant force. In November, the retail penetration rate of NEVs for domestic brands soared to 79.6%, far outpacing mainstream joint-venture brands (6.8%).

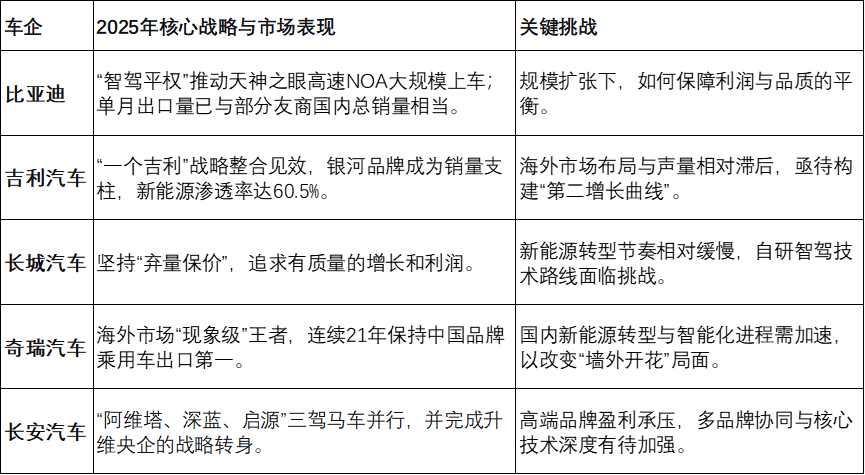

Among the "Five Permanent Members" of domestic brands, 2025 has witnessed vastly different strategic choices and outcomes. The table below summarizes their core characteristics:

Meanwhile, competition among emerging automotive forces has intensified and diversified. Leapmotor, with cumulative annual deliveries exceeding 536,000 units and a year-on-year increase of 113.42%, has emerged as the "champion" among emerging players.

On the other hand, Li Auto is grappling with transformation challenges. Its first all-electric SUV, the i8, launch event sparked controversy due to a collision test that defied physical principles, followed by the recall of the MEGA model. Coupled with the pressure of dual operations in extended-range and all-electric models, its third-quarter performance witnessed a "precipitous decline."

Behind the dramatic shifts in the industry landscape lie two core driving forces: rapid technological advancement and in-depth global expansion.

Technologically, "universal intelligent driving" has become a reality in 2025.

Represented by BYD, its "Divine Eyes" high-level intelligent driving assistance system has been deployed on the Seagull model, priced at just 78,800 yuan. It is anticipated that the hardware cost of highway NOA will plummet to 3,000-5,000 yuan, while the hardware cost of urban NOA is expected to enter the 1,500-3,000 yuan range. This signifies that intelligent driving is rapidly transitioning from a high-end "luxury" feature to an affordable configuration for economy cars.

In more forward-looking technological domains, the nine cutting-edge and nine innovative technologies selected at the 2025 World New Energy Vehicle Congress point the way forward. From Huawei's "megawatt charging technology" to the "all-domain AI large model for new energy batteries," the focus of industrial innovation has transcended electrification itself, delving into underlying areas such as energy, algorithms, and chips.

In terms of globalization, China's automotive exports have undergone a qualitative transformation from "product exports" to "industrial localization." In the first 11 months, NEV exports reached 2.315 million units, doubling year-on-year.

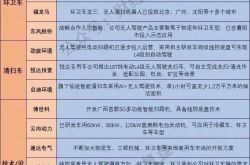

Export models are no longer mere trade transactions. In Thailand and other regions, led by complete vehicle enterprises such as BYD and Great Wall Motors, power battery enterprises like CALB and Guoxuan High-Tech, as well as parts giants such as Ningbo Tuopu, have established factories, forming a collaborative overseas expansion model for the industrial chain of "vehicle enterprises leading, parts enterprises following, and service matching replenishment."

02 Deep Integration and Value Reassessment

In 2025, while the market size of China's NEV industry continues to expand, it is undergoing a profound transformation driven by a shift in capital logic. Industry competition has evolved from the early "financing-driven scale expansion" to a new stage where winning capital favor relies on technological depth, profit models, and ecological value.

Among these, the rationalization shift in the capital market is particularly pronounced. Throughout the year, a wave of IPOs in Hong Kong has been set off among industrial chain enterprises. Chery Automobile concluded its 21-year marathon to go public, with its profound manufacturing system and overseas channel value being re-evaluated; Seres achieved A+H listings with its intelligent vehicle selection model deeply cooperating with Huawei, marking the capital certification of the "technology + manufacturing" integration model; brands like Avatr Technology seeking independent listings have opened up financing channels to cope with high intelligent R&D costs.

The core logic of this wave of IPOs is that the industry is shifting from relying on venture capital "life support" to financing through public markets to "strengthen the core" in order to support long-term technological investment and global expansion. Enterprises must demonstrate their sustainable profit paths and growth potential to more discerning public investors.

Meanwhile, the role of state-owned capital has undergone a strategic upgrade. The restructuring and upgrading of Changan Automobile to become the third central automotive enterprise after FAW and Dongfeng Motor is of landmark significance.

This move signifies that state-owned capital is transforming from past policy supporters and financial investors to active industrial integrators and strategic stabilizers. Its primary objectives are to guide resources towards tackling "bottleneck" technologies such as intelligent chips and operating systems; to curb disorderly price wars and excessive internal competition in the market; and to inject certainty into the industry's basic R&D and supply chain security with a longer-term perspective and greater determination, fostering a healthier and more resilient industrial ecosystem.

A more fundamental change lies in the blurring of industrial boundaries and ecological competition.

The core of the automotive value chain is rapidly shifting from traditional manufacturing to "electrical architecture-software-data-services." Li Auto released AI glasses deeply integrated with its vehicle infotainment system, aiming to upgrade the cockpit into a super terminal for personal AIoT ecosystems; XPENG unveiled its flying car and laid out its robotics business, representing the platform-based extension of its intelligent technologies into multi-dimensional travel scenarios.

The deep involvement of tech giants like Huawei and Xiaomi is not merely about "building cars" but redefining the architecture and experience of automobiles. The automotive industry is evolving into an open ecological platform that integrates energy, semiconductors, artificial intelligence, and mobile services.

03 Hidden Concerns Amid the Celebration and Future Directions

In 2025, while China's NEV industry is making rapid strides, the underlying structural challenges in the industry are becoming key factors affecting its trajectory and sustainability.

The industry's sustainable leadership depends not only on technological innovation and market expansion but also on repairing fragile industrial symbiotic relationships, adhering to the bottom line of business integrity, and building systematic competitiveness for the future.

The primary hidden danger lies in the increasingly strained supply chain relationships. Under the pressure of fierce "price wars," some OEMs have been disorderly transferring cost pressures upstream, leading to excessively extended payment terms for suppliers, especially small and medium-sized enterprises, severely squeezing their survival and R&D space. This not only erodes the foundation of product quality but also shakes the trust basis for industrial collaborative innovation.

Therefore, the state has revised regulations, explicitly mandating that payment terms for large, medium, and small enterprises should not exceed 60 days. This "anti-internal competition" measure aims to reverse zero-sum games and promote the industry to build a healthy ecosystem of risk-sharing and benefit-sharing, recognizing that only with a solid supply chain foundation can vehicle brands continue to thrive.

Another prominent issue is the disconnect between exaggerated marketing and product substance. Under competitive anxiety, some enterprises have resorted to exaggerated propaganda or misleading demonstrations that defy basic principles, attempting to cover up technological or definitional shortcomings. Such behavior severely undermines consumer trust and damages brand credibility in the long run. As a major durable consumer good, the automotive market is built on solid reputation, and any short-sighted "marketing magic" may trigger backlash far exceeding short-term traffic gains.

Looking ahead, the industry needs to undergo profound forging in three dimensions:

First, build a resilient supply chain community. Leading enterprises need to regard the supply chain as strategic partners, constructing flexible networks capable of jointly coping with risks and collaborative innovation through data sharing, joint R&D, and even capital ties, shifting from cost exploitation to value symbiosis.

Second, promote technological innovation from application integration to underlying breakthroughs. Competition is shifting from electrification assembly to original innovation in the era of intelligence. The key to victory lies in continuous investment in underlying technologies such as intelligent chips, vehicle operating systems, vehicle-road-cloud integration, and next-generation batteries, which are crucial for the ultimate competitiveness of China's high-end manufacturing industrial chain.

Third, complete the transformation of globalization from "product output" to "ecological localization." Going overseas needs to upgrade from trade and localized production to "brand and ecological localization." This requires enterprises to deeply integrate into local markets, establishing localized systems covering R&D, services, and recycling, achieving the identity transformation from "Chinese global enterprises" to "truly global enterprises."

04 Conclusion

The capital and ecological changes in 2025 indicate that the competition in China's NEV industry has entered the "second half."

The rationalization of the capital market forces enterprises to prove sustainable profitability; the upgrade of state-owned capital aims to shape a more orderly and resilient industrial landscape; while borderless ecological competition opens up vast imagination space and brings more complex challenges.

In this value reassessment, the ultimate winners will not only be sales champions but also true giants capable of defining next-generation technological standards, controlling core ecological nodes, and achieving commercial closures.