Will the car prices rise or fall this year?

![]() 01/14 2026

01/14 2026

![]() 510

510

Guide

Introduction

On one hand, raw material prices are rising, while on the other, joint-venture brands are initiating price wars.

The beginning of China's auto market in 2026 unfolds amid complex dynamics, marked by high uncertainty and complexity. At the start of the year, the terminal market encountered a "dismal opening," with passenger car market foot traffic and order volumes significantly declining during the New Year's holiday compared to the same period last year.

For instance, order volumes at multiple leading independent brands and new-energy vehicle stores were halved month-on-month. This widespread sluggishness occurred despite automakers offering various subsidies, yielding minimal results and leading to an unfavorable start.

Behind the market slowdown lies a complex web of intertwined factors. The most direct cause is the decline and poor continuity of policy incentives. Simultaneously, although the new national subsidy policy for the new year has been announced, implementation details in some key cities remain unclear, leading consumers to adopt a wait-and-see attitude due to concerns about missing out on stacked discounts.

A deeper reason may lie in demand being exhausted. Over the past two years, stimulated by strong subsidies, more than 18.6 million vehicles have been traded in, effectively bringing forward future demand, especially for the first half of 2026, creating a current market vacuum. Additionally, weak consumer confidence has made decisions regarding major purchases like automobiles more cautious.

This situation significantly increases future uncertainty. On one hand, there is a survival crisis, while on the other, heavyweight new models are making their debut in the Ministry of Industry and Information Technology's catalog, preparing to spark a new round of product competition. For all participants, 2026 will be a survival test of strategic resilience and operational efficiency, with the industry landscape potentially being reshaped in this complex adjustment.

01 Rising Prices of Upstream Raw Materials

Recently, a notable observation is that while the new energy vehicle market continues to grow rapidly, it is facing price pressures driven by a combination of rising upstream raw material costs and adjustments in industry regulatory policies.

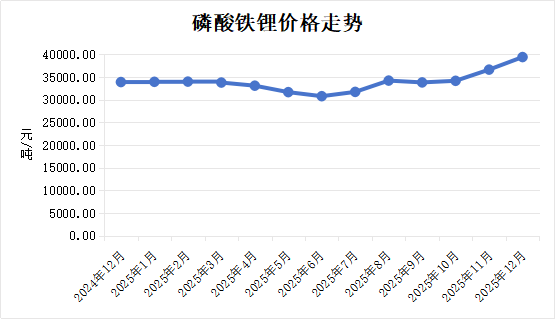

Price increases in core battery materials such as lithium iron phosphate, coupled with a series of symposiums convened by authorities like the Ministry of Industry and Information Technology to curb "cutthroat" competition, indicate that battery costs may enter an upward trajectory, ultimately affecting the terminal prices of complete vehicles.

As the dominant material for power batteries, lithium iron phosphate is experiencing a notable price surge. Since the fourth quarter of 2025, several leading companies, including Hunan Yutong, Wanrun New Energy, and Defang Nanomi, have successively announced production cuts for maintenance and simultaneously raised processing fees. Notably, Hunan Yutong has explicitly increased processing fees for its entire range of lithium iron phosphate products by 3,000 yuan per ton.

The direct driver of this price increase is the across-the-board rise in upstream raw material costs. Lithium carbonate, the most crucial raw material for lithium iron phosphate, accounts for over 40% of its cost, and its price trend directly determines the industry's basic cost structure.

According to SMM Information, on December 17, 2025, the market price of battery-grade lithium carbonate from Fubao had risen to between 97,200 yuan and 100,000 yuan per ton, representing an increase of over 50% from the mid-year low. Furthermore, various chemical raw materials that constitute the precursor of lithium iron phosphate, iron phosphate (such as phosphoric acid, 98% monoammonium phosphate, and ferrous sulfate), have also shown a general upward trend since the fourth quarter of 2025.

A deeper reason lies in the industry's long-term cutthroat competition and losses, forcing companies to seek price recovery. Over the past three years, lithium iron phosphate prices have fallen by more than 80%, with the entire industry suffering continuous losses. This vicious competitive landscape began to show signs of reversal after the China Industrial Association for Power Sources organized a meeting of leading companies in November 2025 and issued an initiative for coordinated action.

Recently, William Li, the founder of NIO, also urged consumers to "buy cars earlier," citing that the biggest cost pressure on the automotive industry in 2026 will come from rising memory prices. However, the current cost pressure has not yet been fully passed on to terminal prices. Once automakers' profit margins are squeezed, they may transfer costs through future price increases.

It is reported that the core reason for the memory price increase is the explosive growth of the AI industry, leading to a surge in demand for memory in servers. A single server's memory usage is tens or even hundreds of times that of an ordinary home computer. Currently, over 70% of the global memory chip production capacity is occupied by AI companies, directly driving up prices.

This price increase has directly affected automotive manufacturing costs. The memory cost required for a vehicle's intelligent cockpit and intelligent driving systems has risen by approximately 5,000-10,000 yuan. For instance, Level 2 assisted driving requires 8-12GB of memory, while Level 3 may require 32-128GB.

While raw material costs are pushing up prices, policy efforts are also actively guiding the industry away from disorderly price wars. In late November 2025, the Ministry of Industry and Information Technology organized a symposium for manufacturing enterprises in the power and energy storage battery industry, explicitly requiring the regulation of irrational competition in the industry in accordance with laws and regulations and firmly resisting related behaviors.

Entering January 2026, regulatory efforts intensified further. The Ministry of Industry and Information Technology, the National Development and Reform Commission, the State Administration for Market Regulation, and the National Energy Administration jointly convened a symposium targeting irrational behaviors such as blind capacity expansion and low-price competition. They explicitly stated that they would focus on strengthening price enforcement, product quality supervision, and combating intellectual property violations, aiming to create a fair competition environment with high quality and reasonable prices.

The combined effects of raw material price increases and policy regulations constitute factors that may lead to price increases in new energy vehicles. After all, battery costs account for a significant proportion, and material price increases directly affect battery prices. Lithium iron phosphate cathode materials account for over 40% of the cost of lithium iron phosphate batteries, and their substantial price increases will inevitably directly drive up the manufacturing costs of battery cells.

However, if cost pressures persist and remain significant, while market demand stays strong, adjusting the terminal prices of vehicle models to share part of the pressure will become an unavoidable choice for most companies. If new energy vehicles generally undergo price adjustments due to the aforementioned dual pressures, it will have a profound impact on the market.

02 Joint Ventures Initiate Price War First

In fact, while everyone is speculating whether new energy vehicles will see price increases, the Chinese auto market in 2026 greeted its first week with intense competition. BMW, a traditional luxury giant, took the lead in announcing official guide price reductions for 31 of its main models, with the maximum reduction exceeding 300,000 yuan.

Following closely, Yueda Kia introduced a nationwide unified fixed-price sales model for its K3 and Yi Run (Yitiao) models, aiming to completely eliminate price fluctuations. Subsequently, Beijing Hyundai also adopted the fixed-price model, and Chang'an Mazda introduced the CX-50 with increased features at the same price.

Meanwhile, BYD, the market leader, did not directly reduce prices but instead played a more damaging card: fully equipping its Qin, Dolphin, and other plug-in hybrid models with larger batteries, increasing the pure electric range to 210 kilometers while maintaining the starting price at 89,800 yuan.

If BMW's official price reduction is more symbolic than substantial in terms of the actual amount, then Kia and Hyundai's adoption of SAIC General Motors' fixed-price model represents a more sophisticated pricing strategy. Without an absolute advantage in brand strength, joint-venture brands are attempting to stabilize their market share through ultimate cost-effectiveness.

However, whether it's BMW or Kia and Hyundai's price reductions, they both face significant pressure in the face of BYD's value reconstruction strategy. Instead of simply adjusting price figures, BYD chose to enhance core technological parameters, increasing the pure electric range of plug-in hybrids from the universal (common) 100 kilometers or so to 210 kilometers while keeping the price unchanged.

This means that for most users, plug-in hybrids can truly serve as pure electric vehicles for daily commuting, significantly reducing usage costs, while eliminating range anxiety for long-distance travel. This is not just a leap in product strength but also a redefinition of the market value of plug-in hybrid models.

This forces all competitors to face a dilemma: whether to follow BYD in making similar technological upgrades and thus become embroiled in the arms race it dominates, or to adhere to the original technological specifications but make more significant price concessions to compensate for the product generation gap? BYD's move effectively elevates market competition from price to technological value, setting a higher entry threshold.

Of course, this series of collective actions, seemingly strategically diverse but ultimately aligned in their objectives, reflects the complex dynamics of China's auto market in the deep waters of electrification and intelligent transformation. They collectively herald a harsh reality: market competition in 2026 will not only not ease but will also continue in more diverse and profound forms. A comprehensive war surrounding price, value, and survival rights has already begun.

In fact, the root cause lies in profound changes in the deep structure of China's auto market. The market has shifted from incremental to stock competition, with consumers becoming increasingly rational and pragmatic, comprehensively weighing price, technology, and brand. Moreover, the penetration rate of new energy vehicles continues to rise, with independent brands establishing significant leading advantages in electrification and intelligentization, delivering a dimensionality reduction strike against traditional fuel vehicles and even joint-venture brands.

Therefore, price wars are no longer short-term promotional tools but have evolved into a normalization (normalized) market cleansing mechanism. BMW's price reduction is to secure survival space, Kia and Hyundai's pricing innovation is to attract customers who value transparency, and BYD's value upgrade is to consolidate and expand its dominant position.

It can be said that for the entire industry, sustained fierce competition will undoubtedly accelerate the reshuffling process. Companies lacking core technologies, with ambiguous brand positioning, and weak cost control capabilities will be eliminated. For consumers, this is undoubtedly a boon, as they will obtain more valuable products and services at lower prices.

Undoubtedly, a broader and deeper-level comprehensive competition is inevitable. This competition will ultimately prompt the automotive industry to abandon inflated premiums and flashy gimmicks and return to a trajectory driven by technological innovation. Whether for automakers or consumers, a more transparent, efficient, and also harsher new era of the automotive industry has arrived.

Editor-in-Chief: Shi Jie Editor: He Zengrong

THE END