a16z, Silicon Valley's Premier Venture Capital Firm, Releases Latest Report: The Demise of SaaS and the Three Pillars of AI Application Moats

![]() 01/20 2026

01/20 2026

![]() 379

379

Author: Lin Yi

Editor: Key Focus

On January 20, a16z, Silicon Valley's leading venture capital firm, unveiled a comprehensive analysis report on AI applications, focusing on a critical question: What constitutes the true competitive moats for AI applications?

a16z distills three core insights:

1. Software as a Labor Substitute

For two decades, the SaaS industry has thrived on a simple premise: streamline and automate workflows traditionally performed by humans, then charge enterprises on a per-user basis. However, in a16z's view, this paradigm is losing its edge. AI applications are ushering in a new era where software is not just a tool but a direct replacement for labor.

This shift opens up a business opportunity far exceeding the traditional software market. Take a16z's investment in Salient as an illustration. The conventional SaaS approach would involve selling a superior management software suite to collection agencies to help them cut costs. Salient, however, takes a radical step by replacing human collectors with AI. Traditional collectors are not only expensive and prone to high turnover but also susceptible to errors due to emotional biases and limited legal knowledge. In contrast, AI collectors are well-versed in the complex legal frameworks of all 50 U.S. states, fluent in 21 languages, and perpetually emotionally stable. As a result, Salient not only slashes costs but, more importantly, enables clients to recover 50% more overdue payments.

"Saving money is universally appealing, but making more money is even more so," notes the report. When software transcends its role as a mere tool and directly delivers results, clients are willing to pay not a nominal subscription fee but a share based on the outcomes achieved.

2. AI-Driven Transformation of Traditional Software

Despite the onslaught from startups, a16z does not foresee the rapid demise of established software giants. The most formidable companies possess not just customers but "hostages"—deeply entrenched systems and relationships that make them nearly irreplaceable.

Companies like NetSuite and Workday have seamlessly integrated their record-keeping systems into the fabric of enterprises, rendering them extremely difficult to dislodge. For these incumbents, AI serves as a tool to fortify their defenses. Workday, for instance, can effortlessly roll out an AI-powered background check feature and charge $500 per employee, leaving clients with little choice but to comply. Thus, a16z advises entrepreneurs to steer clear of these behemoths and target entirely new, untapped markets.

3. Building Competitive Moats with Proprietary Data

As giants like OpenAI and Google continue to advance the capabilities of large language models, the scarcity of the models themselves diminishes. In today's increasingly commoditized AI landscape, proprietary data has emerged as the sole fortress against competition.

Open Evidence exemplifies this trend. While ChatGPT can provide general medical information, Open Evidence holds exclusive licenses for core medical literature, such as The New England Journal of Medicine. The insights derived from this closed dataset are beyond the reach of general-purpose large models, which rely on publicly available web data. When AI possesses understanding and reasoning capabilities, dormant data transforms into a goldmine.

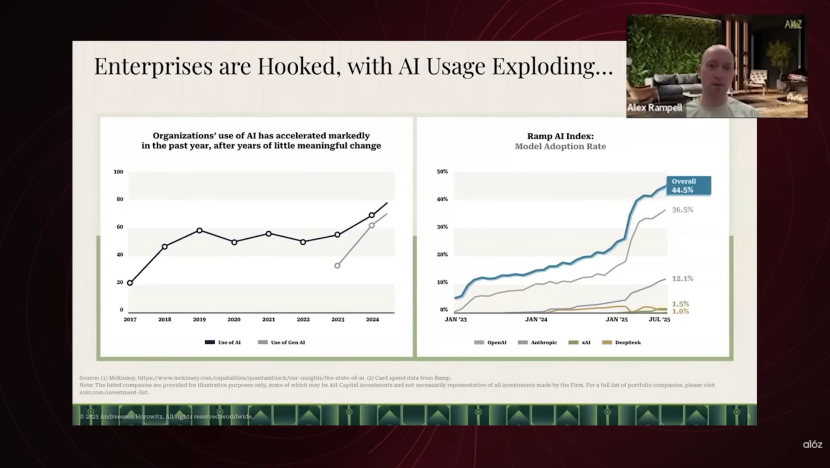

a16z posits that the underlying logic of human nature is straightforward: everyone desires to become wealthier and lazier. For enterprises, adopting AI is not merely about cost reduction (lazier) but also about directly boosting revenue (wealthier). Data from Ramp reveals a significant surge in enterprise spending on AI in January 2025, reflecting tangible productivity gains.

Unlike the mobile internet era, which simply placed computers in our pockets, the AI era builds upon the foundations of the past fifty years of PC, internet, cloud, and mobile technologies. It targets a global audience of 8 billion already connected users, spreading at an unprecedented pace. While concerns about an AI bubble persist, in a16z's investment portfolio, companies that leverage data to build moats and directly deliver results in their business are proving the era's authenticity by achieving the fastest revenue growth from $0 to $100 million. For entrepreneurs, now is not the time to fear incumbents but to identify undigitized sectors and harness AI to transform manual labor into profit-generating machines.

Key Insights from the a16z Report:

1. Software as Labor: The Largest Untapped Opportunity

The SaaS industry's logic is undergoing a fundamental shift, evolving from selling tools to directly delivering work outcomes. Traditionally, enterprises purchased software (such as Office) on a per-user basis to assist employees. In the AI era, software will directly replace labor to complete tasks.

2. Proprietary Data: The Ultimate Competitive Moat

As the capabilities of large models become widespread and commoditized, the scarcity of the models themselves declines. Proprietary data emerges as the true competitive moat. Entrepreneurs should leverage private data to build advantages that general-purpose models cannot replicate.

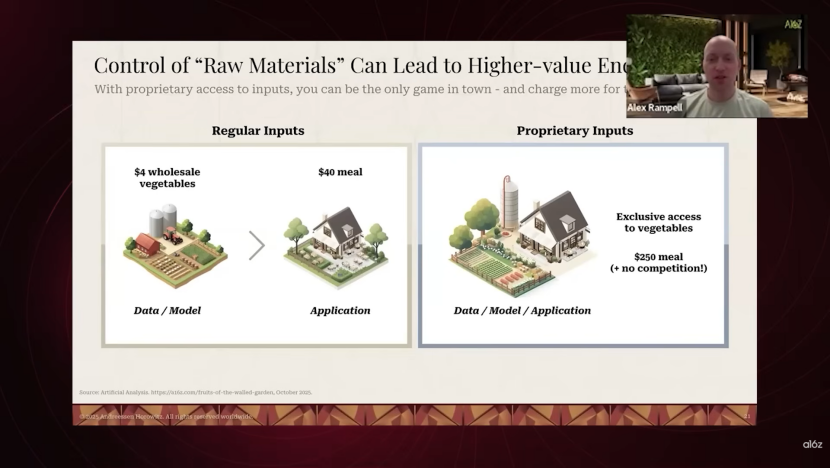

3. Business Model Transformation: From Raw Materials to Finished Products

In the AI era, the value of a simple data subscription model (selling raw materials) is limited. The true value lies in using exclusive data to generate finished products. In the past, companies like PitchBook sold data for analysis. Now, AI should directly generate complete analytical reports or memos based on the data. This shift from selling vegetables to selling gourmet meals can increase product value by 10x or even 100x.

4. Incumbent Defense: Holding Hostages, Not Just Customers

Existing software giants (such as Salesforce and Workday) will not be easily disrupted because they possess deeply entrenched record-keeping systems and customer relationships that are extremely difficult to replace. These customers are more like locked-in "hostages." Giants can leverage their existing monopolistic positions to easily launch AI features and impose mandatory fees. While clients complain, they have no alternative.

5. Vertically Integrated Services: The AI Era's Disruptors

Instead of developing a software tool that is difficult to sell to accountants, why not directly acquire an accounting firm as a testbed and use AI to dramatically boost efficiency? This way, you can serve thousands of new clients at a lower cost, becoming an AI-driven super accounting firm. This model solves the hardest problems in traditional software sales: customer acquisition and delivery.

6. AI Redefines Labor Value: Augmentation, Not Just Replacement

The current AI transformation is more about augmenting labor or addressing talent shortages than causing massive unemployment. The core of business decision-making is balancing cost and value: when AI can work around the clock at extremely low cost and remain emotionally stable, it is essentially performing work that humans are unwilling or unable to do well. The future work landscape will not see humans eliminated but rather shifted toward higher-value domains as AI takes over inefficient labor, just as farmers transitioned to other professions in the past.

7. Consumer AI Opportunities: Aggregation and New Categories

In the consumer application space, beyond creating entirely new native categories (such as the voice market where 11Labs operates), "model aggregators" often hold more value than single models. This is akin to Kayak's role versus airlines. Users need a unified interface to invoke the best capabilities of all models rather than being locked into a single vendor's model. Since large vendors are usually constrained by their proprietary models, this leaves significant room for third-party aggregation platforms.

Below is the original a16z report:

1. Macro Perspective: Product Cycles Drive Market Growth

Reviewing the Nasdaq index from 1977 to the present, despite short-term market fluctuations, the long-term trend has consistently been upward. The core driver of this growth is product cycles. Over the past few decades, we have experienced four major product cycles:

The Personal Computer (PC) Era: This was the starting point.

The Internet Era: Built connections on top of PCs, giving rise to infrastructure companies like Cisco and application-layer giants such as eBay and Amazon.

The Cloud Computing Era: Infrastructure like AWS emerged, supporting the explosion of application-layer companies such as Workday, Shopify, and Veeva.

The Mobile Internet Era: Put computers in everyone's pockets.

Now, we are in the fifth cycle—the AI Era. This is not a completely new phenomenon emerging out of nowhere but is built on top of smartphone penetration and cloud computing infrastructure. If we go back a few decades, with only the ENIAC computer and no cloud or mobile devices, AI would be nothing more than a museum piece. Today, with most of the global population of 8 billion owning smartphones, the adoption rate of new technologies is unprecedented. We observe that the vast majority of new software revenue currently comes from AI, whether at the infrastructure or application layer.

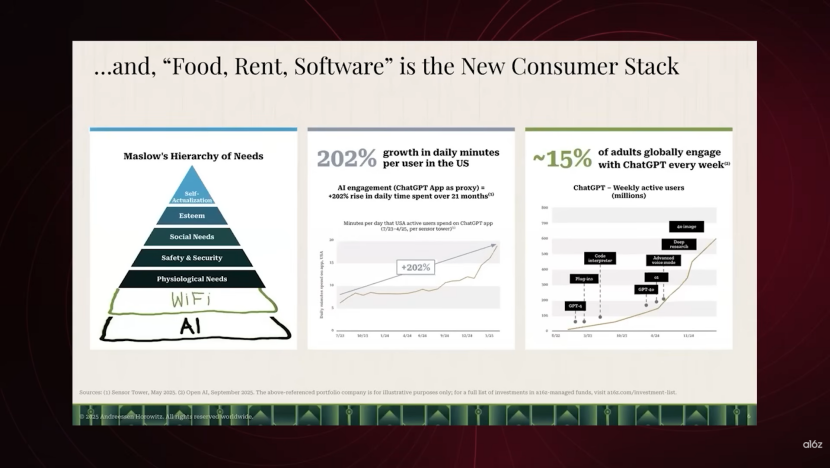

I have a general observation about human behavior: everyone wants to become wealthier and lazier. In other words, people hope to achieve greater economic value with less work. Generative AI is the key to unlocking this demand.

Two years ago, when ChatGPT was first released, everyone saw it as a novel toy capable of writing scripts. But now, it has penetrated enterprises, genuinely saving people time and money. Take Ramp, an enterprise expense management company, as an example. We can see that forward-looking companies (not just startups but also traditional enterprises with thousands of employees) are actively adopting AI technologies. This is not just a steady curve of growth but a sharp inflection point.

Maslow's hierarchy of needs once jokingly had Wi-Fi at the base. Now, the next foundational need is actually AI. Approximately 15% of U.S. adults use ChatGPT weekly, making it a daily tool—ranging from handling life's trivialities (such as my wife using it to look up legal clauses for a school bus complaint) to processing complex business logic.

2. a16z's Three Major AI Investment Themes

We have been contemplating: What is defensible? What will giants like OpenAI not do? Based on this, we have summarized three primary investment themes:

AI-Native Transformation of Traditional Software:

This refers to existing software categories leveraging AI for self-reinvention. Looking back, if you could have invested in cloud-native companies (such as Salesforce and NetSuite) 15-20 years ago, you would have reaped enormous returns because the on-premise software giants of that era could not adapt to the subscription model.

But this time, things are different. Existing software giants like Adobe, Salesforce, and Workday are not sitting idle. They are integrating AI into their existing products and charging for these new features. For example, Workday may leverage its monopolistic position (holding "hostages" rather than just customers) to offer built-in background check features at a high price that clients find difficult to refuse. These giants become even stronger with AI, making direct competition in the existing software landscape extremely challenging.

Software Replacing Labor (Service-as-Software):

This is the area we are most excited about and represents the largest market opportunity. It is a greenfield opportunity.

Previously, software companies sold tools; now, software is beginning to sell work results directly.

Consider an eye clinic that spends $500 annually on a Microsoft Office subscription but $47,000 to hire a receptionist. If there is now software capable of performing 90% of the receptionist's tasks (24/7 availability, multilingual proficiency), the clinic would not be willing to pay just $500 but rather a fraction of the labor cost (e.g., $20,000).

This completely transforms the software market size. We are no longer vying for that $500 software budget but carving out a share of the multi-trillion-dollar labor market. These companies typically have no historical baggage and create value in entirely new domains.

Walled Gardens and Proprietary Data:

This category refers to enterprises that possess proprietary data models and can establish deep moats. The core lies in leveraging private data to build advantages that general-purpose AI models cannot replicate.

In the legal field, you may have heard of Harvey, which serves high-end corporate law firms. However, we have identified another unique market—plaintiff lawyers (e.g., those handling personal injury or labor law cases).

The business model in this market is highly specialized: contingency fees/success-based commissions. Lawyers charge a percentage of the awarded amount rather than billing by the hour.

For corporate lawyers, a 50x increase in AI efficiency might reduce billable hours and thus revenue. However, in plaintiff work, a 5x increase in efficiency means lawyers can handle 5x more cases, directly doubling their income. This aligns perfectly with AI's core value.

Our investment, Eve, is not just a tool but is taking over end-to-end workflows. Eve has introduced voice agents that can automatically contact potential clients, gather evidence, sift through thousands of pages of medical records, and draft demand letters. Eve's defensibility lies not just in its ability to make calls or write summaries (these are differentiators, not defensibility) but in becoming the system of record.

As Eve handles more cases, it accumulates private data on case outcomes. It can advise lawyers: "Based on past data, this case is only worth $5,000 and not worth pursuing; that case could be worth $5 million." This outcome-based judgment is unattainable for OpenAI or other general-purpose models because this data is not publicly available.

In AI investing, we focus not just on differentiation (e.g., conversing in 50 languages) but also on defensibility.

Competing in the existing software landscape means facing incumbents with deep customer relationships, which is difficult. However, if you can:

Carve out greenfield markets and replace expensive, inefficient manual labor with software;

Establish a record-keeping system, gather private data through workflow management, and foster a virtuous cycle of "data-insights-value".

Then, you can construct genuine competitive barriers. Eve's legal practice exemplifies this approach; it not only reduces the marginal cost of case handling but also leverages data advantages to guide business decisions. This stickiness and network effect represent the sustainable growth drivers we pursue.

3. Reflections on Unemployment and Technological Substitution

Regarding the societal impact of large-scale unemployment, I believe this scenario won't materialize rapidly. Looking back to 1789, 98% of Americans were farmers. While tractors undoubtedly replaced some human labor, they also facilitated transitions into other professions. Frankly, most technological advancements we witness today aren't eliminating jobs.

Take the 3.5 million truck drivers in the U.S. as an example. Someday, we'll undoubtedly develop superior alternatives to human-driven trucks—AI-powered vehicles. The core of business decision-making lies in balancing costs and value: when output value falls below costs, human employment becomes irrational. However, if AI can be employed, the equation changes. When costs plummet while value remains constant, companies will adopt AI on a large scale. But this doesn't necessarily mean massive human displacement. Predicting with precision is challenging, but 75 years ago, positions like product managers or software designers didn't exist. For those in the 1800s, many modern jobs would have been inconceivable. Thus, many current changes represent enhancements rather than direct substitutions.

Rather than saying software is consuming the workforce, it's more accurate to say it's augmenting the workforce or addressing talent shortages. For instance, hiring someone to answer calls at 2 a.m. is challenging, but AI can handle this task. It's not merely a cost issue but a reconfiguration of the value-cost equation.

A prime example is the auto loan collection industry. This grueling job involves dealing all day with clients refusing repayment due to anger over accidents or insurance disputes. Employees endure long waits on hold with music, creating an extremely distressing environment that leads to high turnover. In such scenarios, AI's value lies not in cost savings but in its ability to increase repayment rates by 50%.

Companies like Salient have experienced explosive growth by shifting their sales pitch logic. Instead of saying, "I'll help you save money," they say, "I'll help you increase your monthly income by 50% through compliant means while ensuring you won't face legal trouble from employees saying the wrong thing under duress." AI can work around the clock, maintain emotional stability, and strictly adhere to compliance requirements. This is true value creation.

Building a record-keeping system and constructing vertical operating systems through software are crucial for making products highly sticky.

Even in industries like dining, which seemingly don't purchase software and have high failure rates, Toast has demonstrated the enormous potential of vertical software. Initially, many were skeptical of Toast, but they eventually provided not just software but also integrated financial services (payment processing and loans), becoming a one-stop platform for restaurant operations. This deep integration makes it impossible for traditional payment processing companies to replace Toast by simply adding software features.

Similarly, handling complex compliance issues is also a form of competitive moat. For example, in human resources or legal tech, you need to capture every new federal and state law. The requirements in Missouri, California, and Iowa are entirely different. It's challenging for humans to remember all these differences in real-time, but systems like Salient can master 21 languages and all regulatory details, which is why their performance can be 50% higher.

Now, we enter a crucial concept—the Walled Garden.

Currently, companies like OpenAI resemble infrastructure suppliers or, metaphorically, vegetable farms where they grow and sell tokens. Originally, they should have focused solely on infrastructure, allowing downstream companies to build applications. However, OpenAI has also started building its own applications, akin to a farmer opening a restaurant on the farm and directly competing with restaurant owners who buy vegetables.

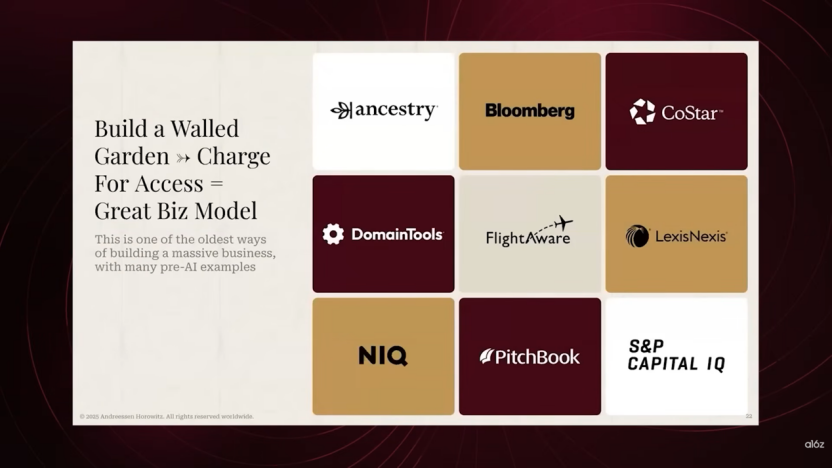

In this environment, the survival blueprint for application-layer companies lies in mastering scarce raw materials—data. This is akin to the world's oldest business model: claim a piece of land, establish physical assets, and then charge for access. In the AI era, you can do the same thing with data.

Some data is publicly available, but when aggregated, it becomes an exclusive asset. For example, FlightAware's data comes from ADS-B transponders, which are technically open and free—you can even buy an antenna on Amazon to receive them. However, FlightAware has built a vast global receiver network, integrating fragmented information into complete flight tracking data. This is information ChatGPT cannot directly answer, but FlightAware knows.

In the past, companies like PitchBook sold financing data in the private market (e.g., a company's Series B valuation in 1992), or CoStar sold real estate data. Previously, their model was to sell data subscriptions (e.g., $200 per month). However, in the AI era, the real value lies in using this exclusive data to generate finished products. Instead of having analysts subscribe to PitchBook and write reports, AI can directly generate a complete memorandum on a company based on exclusive data. This means the business model shifts from selling vegetables (data subscriptions) to selling gourmet meals (complete analytical results), with value potentially increasing from hundreds to thousands of dollars.

Open Evidence is the ChatGPT of the medical field. Its interface resembles ChatGPT's, but the difference is that it holds exclusive licenses from The New England Journal of Medicine and other authoritative medical journals. If you rupture your Achilles tendon and ask ChatGPT, you will only receive mediocre advice; but Open Evidence, based on authoritative evidence-based medical data, can provide far more precise recommendations. This is because it monopolizes the supply of high-quality ingredients.

VLex is a 26-year-old company that acquired all legal archives in Spain. By applying AI to these unique legal datasets, their revenue has grown fivefold. Lawyers don't need generic legal advice but precise memoranda based on specific case law that can be prepared by 7 a.m.

In corporate procurement, Lio demonstrates the power of proprietary data. Corporate procurement departments aim not only to save money but also to navigate complex contractual negotiations. For example, if you're negotiating a contract with Deloitte, the Lio system can access 50 past contracts the enterprise signed with Deloitte, analyze historical terms, and advise you on which clauses to push back on. These private historical contract datasets are treasure troves that ChatGPT can never access, giving Lio's product irreplaceable value.

Much information that seemed free or of little value in the past (e.g., real-time aircraft locations, a YouTuber's historical subscriber counts) has become an extremely valuable training resource and competitive barrier in the AI era. As long as you can collect and aggregate data that others cannot access and build services on top of it, you possess a Walled Garden capable of competing against giants.

I strongly encourage everyone to pay attention to the so-called Walled Garden and its outcomes. This refers not just to creative archives but also to logistics information and even data in county recorder's offices. For example, you can find out who owns which property, but this information typically requires an in-person visit to the offline office. Although this information is essentially free, if you can digitize it, make it easily accessible, and add value through AI on top of it, the product you create will far exceed the value of the data itself.

This isn't merely about adding AI; the core logic is that you possess something others do not. People are scrambling to buy because you're creating an asset that is ultimately more valuable. Now is the prime time to do this. For instance, an entrepreneur found old instruction manuals for all blenders from the 1980s and 1990s. In 1999, you wouldn't have known where to find these, but they could be purchased cheaply on eBay. This demonstrates the potential of leveraging overlooked data to build information silos. If you had done this a decade ago, it might have been an ordinary business, but today, delivering finished products through AI can increase their actual value by 10x or even 100x.

This leads to a classic investment framework: the battle between startups and established giants. The key question is whether startups will secure distribution channels first or whether giants will achieve innovation first.

For areas with Walled Garden data that is difficult to replace, startups have enormous disruptive potential. For example, selling old manuals on eBay used to be about selling raw materials (data) and monetizing through subscriptions, with limited value; but now, leveraging AI, you can deliver finished products worth thousands, making the business model viable. This answers the frequently asked question in the venture capital circle: "Why now?" Just as Uber's emergence required the iPhone and GPS to become ubiquitous, AI technology is now mature enough to allow vertical companies that struggled for years (such as legal tech company VLex) to become unicorns. In contrast, I am pessimistic about projects that merely improve upon existing software.

I don't believe NetSuite or QuickBooks will be easily disrupted because they control a vast goldmine—customer data and payment flows. They can easily introduce AI features to their existing customer base and charge for them. Therefore, I am very bullish on established giants in the SaaS (Software as a Service) sector leveraging AI to further solidify their positions. Why did taxi companies fail to create Uber? Often, it's because incumbents are constrained by existing mindsets, dismiss new models as stupid, or fail to act until it's too late. However, I am very optimistic about new opportunities that can replace human labor or build Walled Gardens based on proprietary data.

If you possess proprietary data, you shouldn't just sell it to AI companies (like Harvey or OpenAI) but use it to build your own products and sell directly to end customers. If VLex sold its data to law firms, they might only charge a subscription fee; but if they use the data to provide high-value legal analysis services, they can significantly increase their pricing power. This is similar to how OpenAI charges meagerly, but applications built on its model can create enormous value.

Smart companies will use AI to transform raw materials into finished products. For example, you don't need to buy raw data from LexisNexis; what you truly need is an analyzed risk assessment report. If a company can leverage AI to complete the entire process—from data cleaning and analysis to outputting conclusions—and directly help clients solve problems (e.g., deciding whether to accept a deal), then it's not just selling software but replacing expensive human services.

This brings us to the transformation in white-collar services. I once referred to it as "AI Barbarians at the Gate." Traditional private equity firms enjoy acquiring accounting firms or dental clinics and cutting costs through layoffs and outsourcing. However, AI now offers a completely new integration path.

Take the accounting industry as an example: the biggest bottleneck is hiring Certified Public Accountants (CPAs). If you develop an AI tool, acquire an accounting firm as a testbed, and use AI to dramatically boost efficiency, you won't need to acquire 100 more firms. You can rely on the license and existing clients of this one firm, leveraging AI processing capabilities to serve thousands of new clients at a lower cost. Rather than creating a software tool to sell to accountants (which is difficult to market), you can directly become an "AI-driven super accounting firm."

Similarly, in debt collection, you can buy an underperforming collection agency with a compliant license, implant AI technology, leverage its existing customer base, and rapidly scale the business. This "vertically integrated software plus services" model is more attractive than simply selling software because it solves customer acquisition and delivery challenges.

4. Three Major Trends in Consumer AI

This logic also applies to the consumer sector. We observe three primary trends:

AI-Native in Traditional Categories: Just as Photoshop is a staple for designers, in the AI era, young designers might opt for other AI-native design tools. These new tools have AI logic built into their foundation, offering a completely different user experience.

Creation of New Categories: For example, the voice and audio model market where 11Labs operates barely existed five years ago or was limited to niche voiceover markets. Through vertical integration and technological breakthroughs, they created and dominated this new category in an extremely short time.

Monetization of Proprietary Data: This is a highly effective playbook. Take Slingshot, an AI therapist we invested in, as an example. They collect data (notes) by providing AI recording tools for human therapists, then use this high-quality professional data to train a foundational model and ultimately develop Ash, a direct-to-consumer psychological counseling product. Although powerful, OpenAI lacks this vertical depth of data, which is Slingshot's competitive moat.

Many people ask why big companies like Google or OpenAI don't dominate everything. The reason is that in consumer applications, being a "model aggregator" is often more valuable than being a single model provider.

This scenario is quite similar to Kayak's position within the airline sector. Just as users prefer to explore all available flight options rather than limiting themselves to United Airlines' website alone, in the realm of video generation or creative tools, different models showcase their strengths in distinct areas. Consequently, users require a consolidated interface that can harness the full range of model capabilities. Large corporations are typically restricted to utilizing only their proprietary models, creating ample opportunities for third-party aggregation platforms to thrive.

At a16z, we are always on the lookout for the most outstanding opportunities, not just satisfactory ones. This approach leads us to adopt a reverse selection strategy—actively seeking out top-tier entrepreneurs who have not yet publicly sought funding, rather than passively reviewing business plans that have been circulating for months.

Our decision-making process is guided by conviction rather than consensus. If a partner holds a strong belief in a project, even in the face of doubts from others, we will back it. In the world of venture capital, the cost of missing an opportunity to make a transformative impact far outweighs the risk of investing in a project that ultimately fails.

Once we commit to an investment, we embark on an all-out effort to secure the deal and rally the entire company to support it. This goes beyond providing financial backing; we also tap into our extensive network of expert resources across diverse fields (be it enterprise services or consumer applications) to empower entrepreneurs to achieve success. Our goal is not to simply write checks but to be the most valuable partners for entrepreneurs in their respective industries.

When it comes to customer retention rates for AI-native companies, we have not encountered significant challenges thus far. Despite the prevalence of experiments and shifts in the market, enterprise clients are increasingly seeking startups that can offer comprehensive ecosystems and holistic solutions. Merely providing an AI feature (such as speech-to-text conversion) is no longer sufficient; it is crucial to construct a complete workflow around the core functionality.

In the realm of sales, we have observed an intriguing trend: the shift away from traditional sales pitches towards a greater emphasis on forward-deployed engineering. Large enterprises are eager to leverage AI to reduce costs and enhance efficiency, yet they often lack a clear understanding of how to implement it effectively. Therefore, startups must delve deeply into client operations, assisting them in comprehending how to refactor (restructure) business processes to align with AI capabilities. This endeavor extends beyond merely selling software; it involves driving cultural transformation within the organization. Startups that can guide enterprises through this transformative journey will unlock vast market opportunities.