Why Have Used Cars Remained So Popular Amid a Decade of Growth?

![]() 01/20 2026

01/20 2026

![]() 461

461

The sustained decade-long growth has been propelled by pressures from the new car market.

Amid escalating new car sales, the automotive market has reaped widespread benefits, with the used car sector enjoying its most prosperous year yet. Data from the China Automobile Dealers Association reveals that the national used car transaction volume exceeded 20 million units in 2025, marking a decade of uninterrupted growth.

In a market environment where new car prices continue to decline and product competitiveness steadily improves, the used car market has displayed remarkable resilience, sustaining steady growth.

More significantly, used cars emerged as a focal point of market attention in 2025. Extensive media coverage of 'zero-kilometer used cars' seemed to unveil a darker side of the used car market. For a while, automakers were eager to distance themselves from zero-kilometer used cars, while dealers sought to capitalize on their sale.

The Booming Used Car Market

Unlike the fluctuating sales trends of new cars, the domestic used car market has maintained rapid growth over the past decade. In 2016, the market size surpassed 10 million units. Over the next decade, used car transactions continued to climb, with an average annual growth rate exceeding 10%, far outpacing that of the new car market.

This signifies a crucial shift in domestic automotive consumption patterns, with the market transitioning from a singular focus on new cars to a dual-wheel drive model encompassing both 'new cars and used cars.' Used cars have become a significant option for first-time and additional vehicle purchases, particularly evident in third- and fourth-tier cities as well as county-level markets.

Behind the rapid growth of the used car market lies the influence of multi-dimensional factors, including policies and technological advancements.

The optimization of the policy environment has laid a solid foundation for the expansion of the used car market. Since August 1, 2022, restrictions on the relocation of small non-operating used cars meeting National V emission standards have been lifted nationwide, significantly facilitating the free circulation of used cars.

Simultaneously, convenient measures such as 'cross-provincial handling of used car transactions' have been implemented, reducing transaction costs and time.

Under the multi-dimensional influence of policies, used car transactions have become highly streamlined, greatly facilitating the circulation of used cars. According to statistics, in December 2025, the used car transfer rate rose to 34.9%, an increase of over 15 percentage points compared to 2021.

To illustrate the convenience of buying a used car, Xiaoyuan, a resident of Shanghai, remarked that it was even simpler than purchasing a new car. In early 2025, Xiaoyuan found a used fuel-powered car online in a neighboring province and completed all the necessary procedures in just half a day. Even the license plate could be mailed across provinces, allowing him to drive the car home the same afternoon he bought it.

In contrast, when accompanying a friend to buy a new car previously, it took two days to complete all the procedures, even with the car in stock, and required two trips to the vehicle management office to obtain the license plate.

Besides promoting the circulation of used cars, policies have also expanded the used car market from the source. Driven by the national trade-in policy, the nationwide automotive trade-in scale exceeded 11.5 million units in 2025, with over 6.6 million units being replaced, providing 6.6 million used car sources to the market.

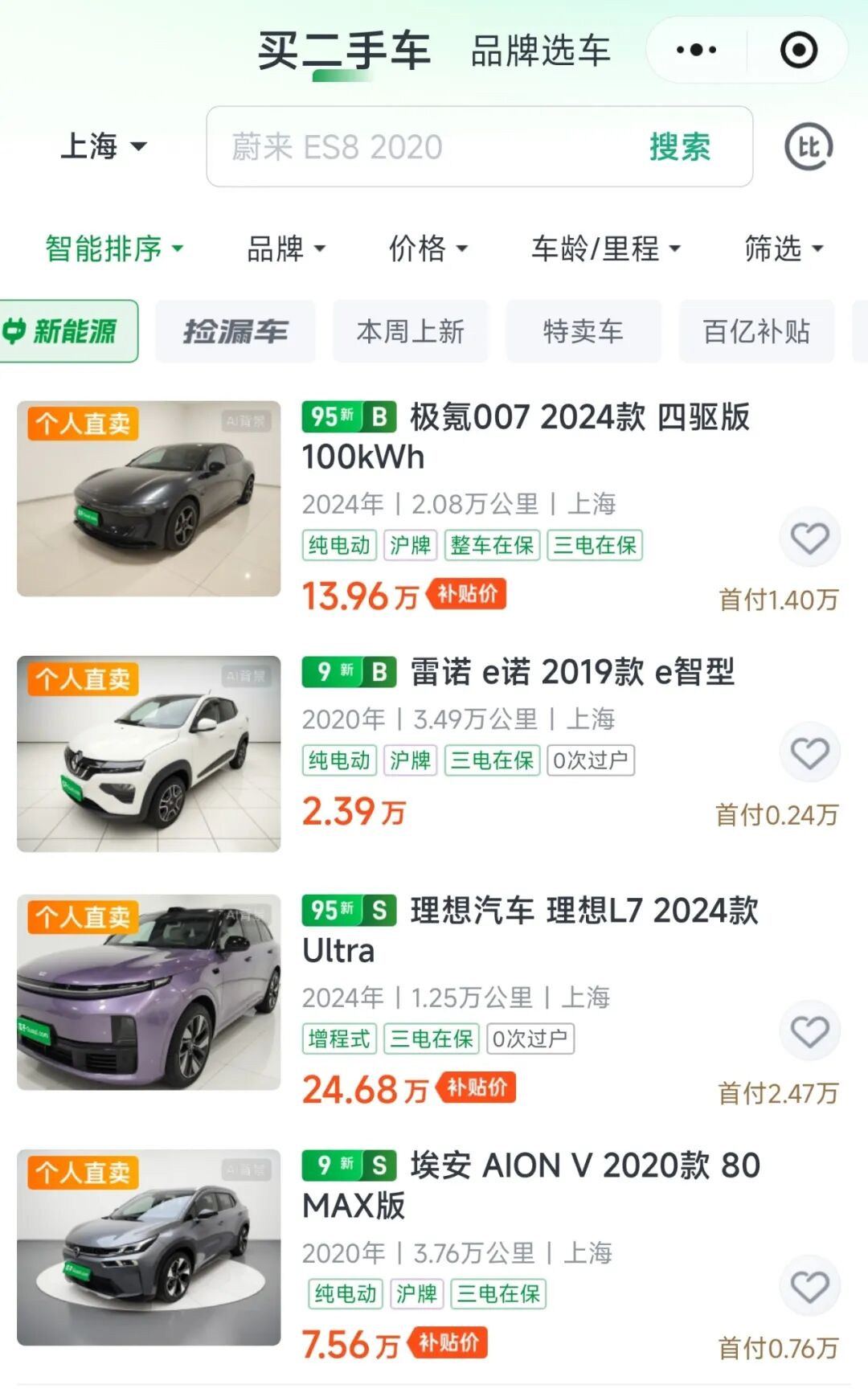

Especially with the continuous development of new energy vehicles (NEVs), used NEVs have also become a viable option for consumers. According to statistics, by the end of 2025, the national NEV ownership exceeded 40 million units, accounting for over 10% of the total vehicle population.

Calculating with an annual replacement rate of 5%, the annual supply of used NEVs exceeds 2 million units. Data from the China Automobile Dealers Association shows that the actual transaction volume of used NEVs reached 1.6 million units in 2025, accounting for 7.9% of the total annual transactions, an increase of 2.2 percentage points compared to 2024.

Under such market conditions, the consumption attitudes of many consumers have shifted, particularly among young consumers who have become the main force in used car consumption. Consumers born in the 1980s, 1990s, and even 2000s account for over 60%, enabling young people to consider used cars as their first vehicle without being limited to new cars.

The primary consumption range for used cars is between 100,000 and 200,000 yuan, which is also the most competitive range between new and used cars. 43.8% of used car consumers have chosen this range.

Under the influence of the expanding passenger car market, the used car market also enjoys the benefits. Driven by policies and technologies, the used car market has flourished.

Amplified Issues

As the scale of used cars surpasses 20 million units and the market structure changes, more issues have come to light.

Firstly, there are issues with used NEVs. Unlike fuel-powered cars, NEV technology has developed rapidly in recent years, with significant differences between annual models, substantially shortening consumers' vehicle replacement cycles. According to statistics, the replacement cycle for NEV users has shortened to 3-4 years, far less than the 5-6 years for fuel-powered cars.

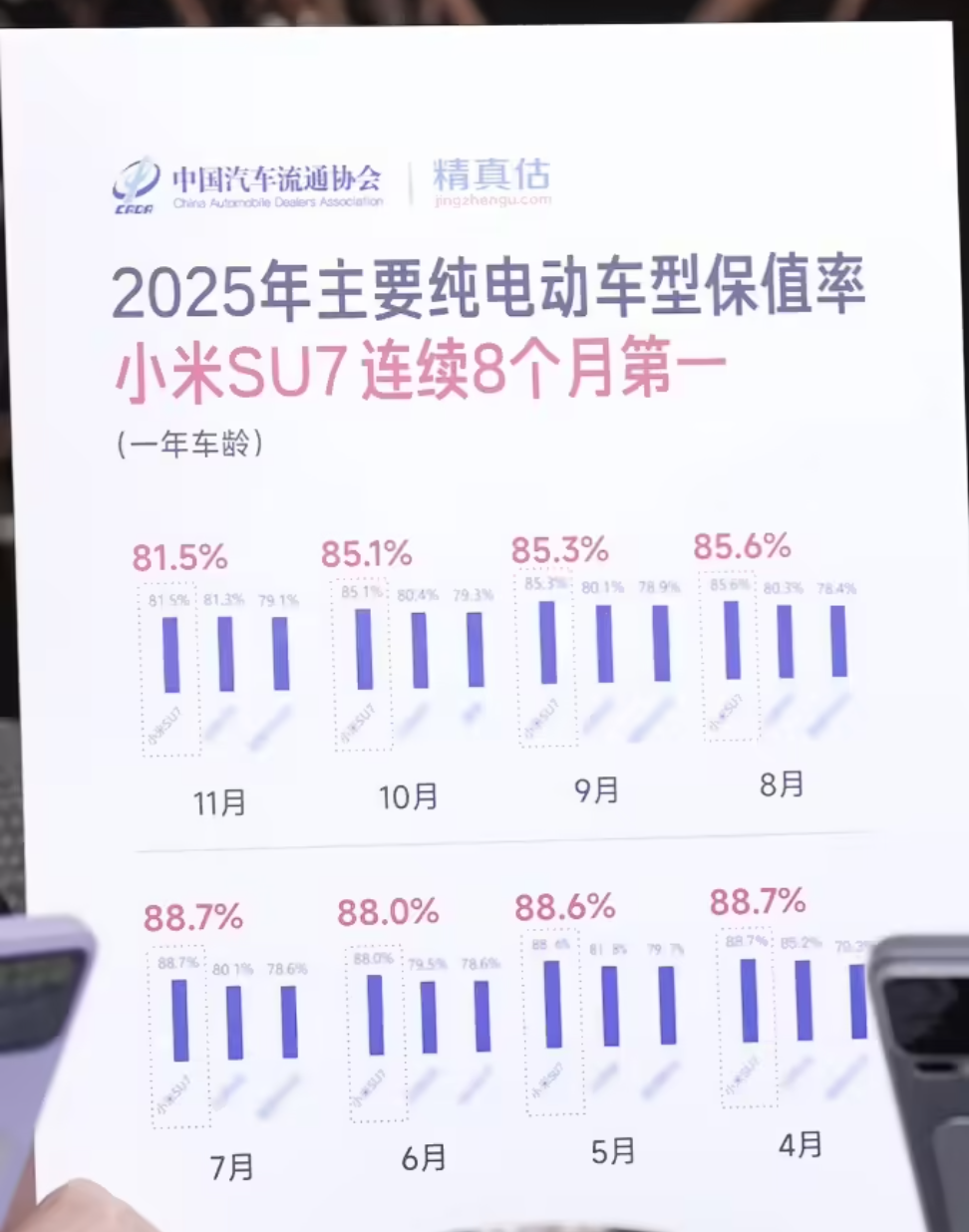

On the other hand, due to the significant differences between annual models, the residual value of NEVs is notably low. Especially with the continuous price wars among new cars, the discount rate for new cars has reached 18.5%, and some NEV models have experienced severe price inversions.

The accelerated depreciation of NEVs has further intensified price competition. Data shows that the one-year residual value rate of the Tesla Model 3 has plummeted from 75% to 62%. Even the Xiaomi SU7, regarded as a national favorite, has seen its one-year residual value rate continuously decline.

Many NEV owners find it disheartening when they discover that the estimated value of their once high-priced used car is below 50% during replacement.

Simultaneously, consumers purchasing used NEVs are also filled with concerns. Unlike the well-established aftermarket for fuel-powered cars, NEV after-sales service faces numerous barriers. Except for a few brands, the lifetime warranty for the three electric systems (battery, motor, and electronic control) of most NEVs only applies to the first owner. Buying a used NEV means forgoing the warranty.

More importantly, much vehicle information for NEVs is not directly accessible. For instance, battery health, a crucial concern for consumers, can only be viewed in terms of usage time and mileage on most platforms. Information such as battery health and cycle count, which can only be viewed by manufacturers, can only be detected by 4S dealerships.

This reflects a disconnect in the construction of relevant systems. The decades of experience in used fuel-powered car transactions have led to the formation of relatively complete standards from automakers to used car trading platforms. However, the development time for NEVs is significantly shorter, and applying fuel-powered car standards to NEVs would lead to numerous issues.

Currently, reliable battery information can only be accessed through official automaker used car platforms. For example, BYD's officially certified used cars provide 21 battery health checks to ensure battery safety. However, most inspection platforms can only provide inspection reports that prove whether the vehicle is an accident car, flood-damaged car, or fire-damaged car, as well as exterior issues.

Unlike third-party platforms, official used cars offer official warranty services that third parties cannot provide. For instance, NIO certified used car users can enjoy the same BaaS battery leasing service and lifetime free roadside assistance as new car users; BYD certified used car users can enjoy a lifetime warranty for the three electric systems and nationwide warranty service.

However, these official services often include the cost in the vehicle price. For similar condition used cars, official prices are usually significantly higher than those on third-party platforms. Official involvement is more about maintaining used car prices.

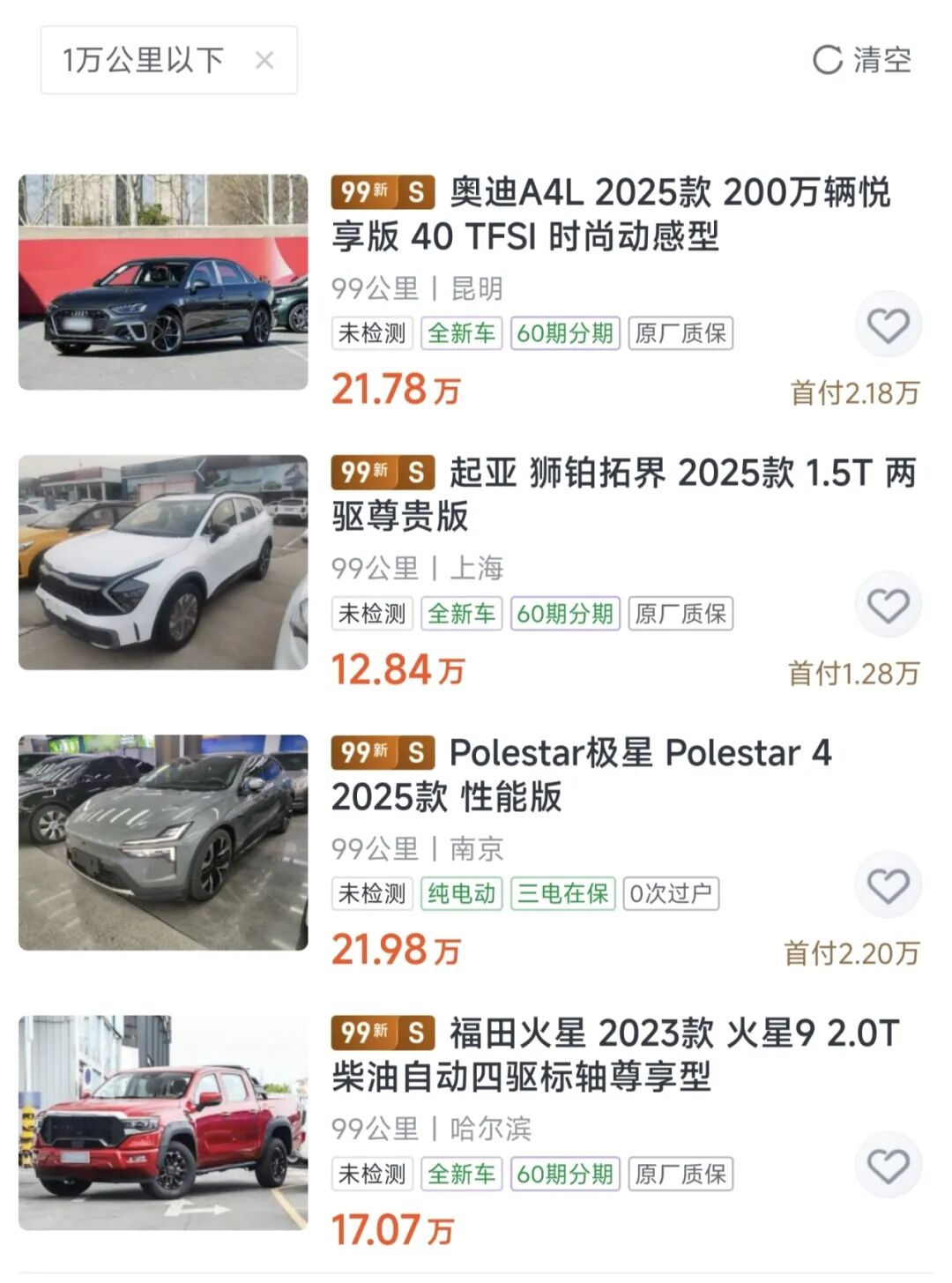

Besides these factors, the highly scrutinized zero-kilometer used cars have also undergone policy adjustments with the arrival of 2026. According to regulations from multiple departments, starting from January 1, 2026, strict controls will be implemented on vehicles applied for export with a registration date of less than 180 days (including 180 days) to prevent new cars from being exported under the guise of used cars.

As the used car transaction volume surpasses 20 million units, it represents not only a leap in market size but also a profound transformation in automotive consumption structures, circulation systems, and business models. Driven by factors such as policy liberalization and NEV popularization, the market continues to grow.

For the new car market, the rise in used car volume has brought about multifaceted impacts, including intensified price competition, diversified consumer choices, reshaped market dynamics, and adjusted product strategies.

These impacts pose both challenges and opportunities, prompting new car manufacturers to rethink their business models and value creation methods.

Simultaneously, with the rapid growth in NEV ownership and shortened replacement cycles, the used NEV market is poised to become the fastest-growing segment.

In Germany, used electric vehicles have been included in the subsidy scope for electric vehicles, with buyers of used electric vehicles also eligible for a €4,000 subsidy.

For the domestic market, perhaps with the continuous expansion of the used car market size, new changes are on the horizon.

Note: The images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-