The competition in the large model market is heating up, and the top three positions are changing every month.

Written by: Zhou Xiangyue

Edited by: Zhao Yanqiu

2024 is considered the first year of large model applications, and the progress of large model deployments has been attracting much attention. Bidding information for large models is considered an indicator of this trend. Recently, Digital Intelligence Frontline has sorted out the bidding results of large model-related projects between January 1, 2024, and June 15, 2024, through channels such as the Chinese Government Procurement Network, the Chinese Public Bidding Service Platform, Tianyancha, Qichacha, and Xunbiaobao, and has observed some characteristics of the entire large market surrounding large models this year.

What features do over 230 projects present?

In the first half of 2024, large model-related projects are seeing a significant outbreak.

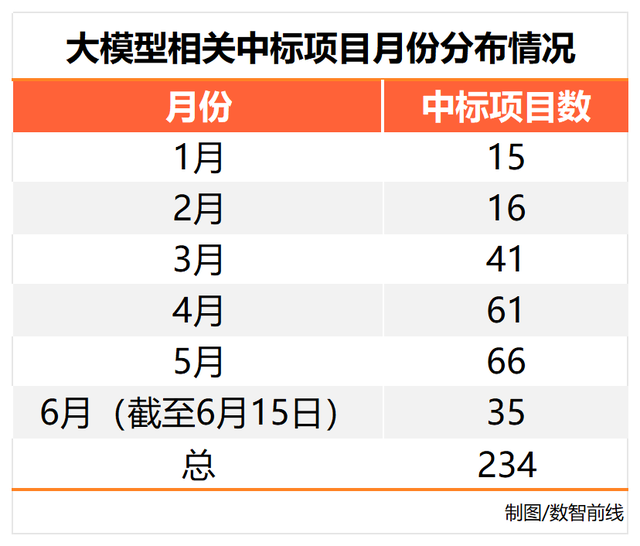

According to incomplete statistics from Digital Intelligence Frontline, in the first five and a half months of 2024 alone, over 230 domestic large model project bidding announcements have been released, far exceeding the level of 2023.

Among these over 230 projects, we have discovered the following characteristics and trends:

First, the number of large model bidding projects is increasing month by month, and related demand is becoming more diversified.

In the first five months of 2024, the number of winning projects in each month has hit a new high for that month, rapidly expanding from 15 in January to 66 in May. And in June, in just the first half of the month, the number of announced large model-related winning projects has already reached 35. It can be foreseen that more large model projects will come flooding in during the second half of the year.

Looking at the procurement needs of winning projects, they are quite diverse, including not only computing power aspects such as GPU chips, training and inference servers, and cloud resources, but also data-level aspects, namely data annotation or data resources related to large models. There are also large model-level aspects, such as large models and related supporting platforms, application-level aspects (integration and deployment of large models in specific scenarios), as well as diverse needs for evaluation, consulting, and training.

However, in terms of proportion, the demand for computing power support for large models still dominates, accounting for about a quarter. Large models and enterprise models related to various scenarized applications, as well as projects that empower existing businesses with large models, also occupy a significant proportion and are increasing day by day.

Second, the regional distribution of purchasers is widespread, and central state-owned enterprises have also become involved. Among the projects we have counted, the regional distribution is quite widespread, with Beijing, Shanghai, Shenzhen, Hangzhou, and other cities being areas with more projects. However, there are also related projects in places such as Baoshan, Yunnan; Nanning, Guangxi; Jiaozuo, Henan; Korla, Xinjiang; and Rikaze, Tibet Autonomous Region.

From the industry distribution of bidding units, a large number of projects have emerged in many fields such as operators, finance, education, energy, government affairs, and automobiles, indicating that large models have begun to penetrate into various industries.

At the same time, large model projects of central state-owned enterprises are increasing rapidly. Among the top ten major large model vendors we counted, over 60% of the projects come from central state-owned enterprises.

Third, large companies have a first-mover advantage in obtaining projects, but there are still many opportunities in the overall market.

Looking at the winning parties, in the first half of this year, the companies that have won the most projects are still mainstream large model vendors. The top ten mainstream large model vendors have collectively won about 84 projects, accounting for over 35% of the total number of projects. Among them, according to incomplete statistics, China Telecom, iFLYTEK, Zhipu AI, Baidu Cloud, and China Mobile have won 16, 14, 12, 11, and 10 projects respectively, ranking in the top five.

Apart from the top ten mainstream large model vendors, over 60% of the remaining projects have been awarded to various solution providers, integrators, and engineering companies, and the number of projects won by these solution providers generally ranges from 1 to 3.

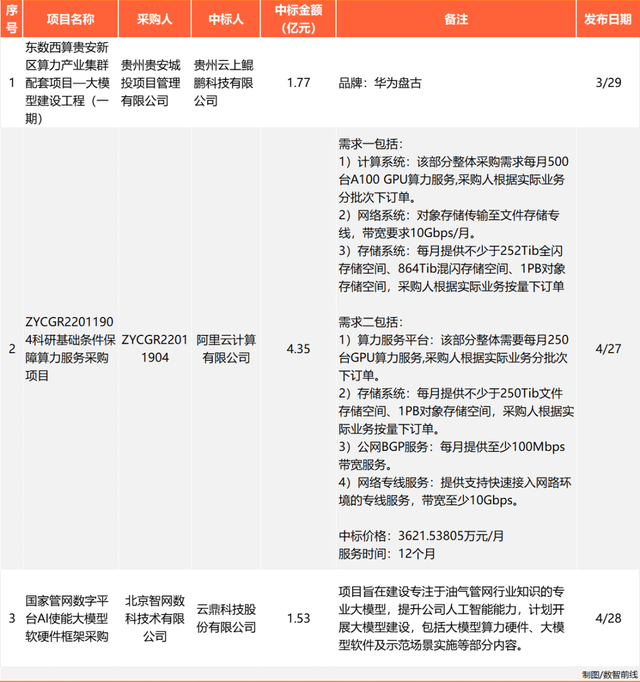

Fourth, multiple billion-level computing power projects have emerged, and there are also projects with zero-yuan bids.

Looking at the winning amounts of 234 large model-related projects, most of them range from several hundred thousand yuan to several million yuan.

However, among them, there have also been multiple large projects, including three projects at the billion-yuan level. The largest single project is a computing power project worth 435 million yuan, won by Alibaba Cloud. The other two billion-level projects were both won by third-party service providers outside of large model vendors. Both of these service providers are partners of Huawei Cloud.

Projects worth tens of millions of yuan have reached 18, such as the "AI Steel Large Model Construction Project" won by China Mobile Xiangtan Branch, worth 24.116 million yuan, and the "City Brain Phase II Project Construction Based on Large Models" won by Beijing Donghua Hechuang Technology Co., Ltd., worth 61.035 million yuan.

It is worth mentioning that many of these projects worth tens of millions and billions of yuan are related to AI computing power. Large projects are increasing, and even in some particularly small places, several billion-level projects can be announced.

In fact, computing power-related projects may continue to emerge in the second half of 2024. Currently, many places have already announced projects related to smart computing centers in advance. For example, the Yan'an AI Large Model Smart Computing Center, with a total investment of 250 million yuan, is expected to start construction in June 2024; the Haikou Comprehensive Bonded Zone Free Trade Port High-end Manufacturing Computing Power Integrated Innovation Center project, with an estimated investment of 465 million yuan, will be tendered in October 2024; and the Xiangyang Dongjin New Area Smart Computing Center and Large Model Construction Project (Phase I), with a total investment of 490 million yuan, is planned to start construction in July 2024...

While large projects frequently emerge, there are also projects with zero-yuan bids. On the one hand, this could be a price war that companies are adopting to compete for projects. On the other hand, it could also be that the bidding projects are of an experimental or testing nature, and customers will pay for the actual value.

For example, the "AI Large Model Scenarios and Application Exploration Services" project of China Unicom Xiong'an Industrial Internet Co., Ltd. was won by iFLYTEK Co., Ltd. for zero yuan. However, this project is mainly aimed at selecting partners and has not yet involved specific project implementation issues.

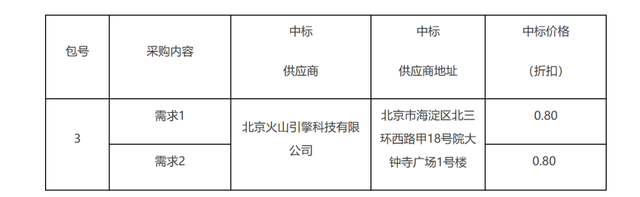

Another example is the "ZYCGR22011904 Scientific Research Basic Condition Guarantee Computing Power Service Procurement Project (Second Time)" won by Volcano Engine, which also shows a winning amount of zero yuan. Although in the specific winning information description, the winning price is presented in the form of a "discount".

After discussing the overall situation, let's take a closer look at the winning situations of the top ten mainstream large model vendors.

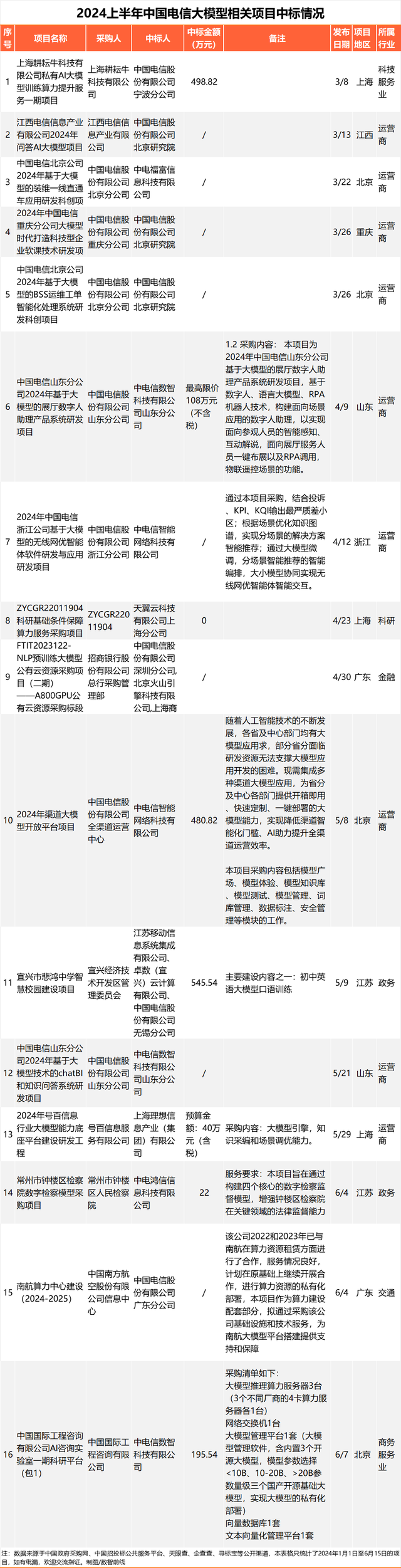

China Telecom: The player with the most projects

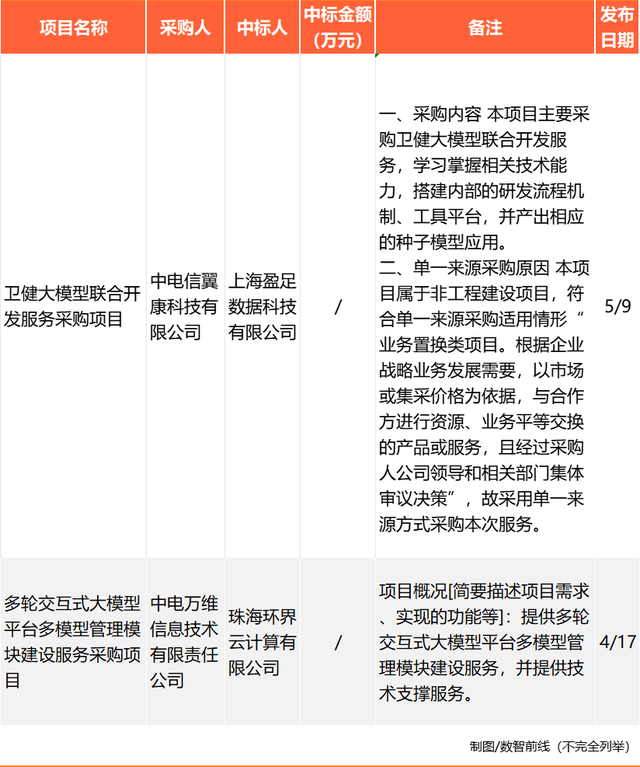

Both expectedly and unexpectedly, in the first half of 2024, China Telecom was the player with the most projects among all large model vendors. As a central state-owned enterprise, China Telecom can obtain quite a few first-hand total integrated projects. According to incomplete statistics, it has won at least 16 large model-related projects, of which 9 belong to "projects within the group's system".

Apart from internal procurement projects, China Telecom has also won many projects from external sources. Among them, there are projects related to the implementation and application of large models, such as the large model procurement project of the Changzhou City Zhonglou District People's Procuratorate, as well as many computing power-related projects, such as the computing power center construction project of China Southern Airlines.

This project distribution also aligns with China Telecom's layout in large models to a certain extent. Since December 2022, it has started the research and development of semantic large models and officially released its first trillion-parameter stellar semantic large model "TeleChat" in November 2023, gradually forming a "1+1+1+M+N" large model layout, including 1 smart computing cloud base, 1 general large model base, 1 data base, M internal large models, and N industry large models. To meet the new demands of large models on the cloud, Tianyi Cloud, a subsidiary of China Telecom, is also accelerating its comprehensive upgrade to smart computing clouds.

In addition, it is worth mentioning that in this statistics, China Telecom has also served as a major bidding party, releasing a number of large model-related bidding projects as a general contractor.

iFLYTEK: Aggressive in winning projects in the past six months

iFLYTEK has been quite aggressive in winning projects in the past six months. From the beginning of the year to now, it has won at least 14 large model-related projects in bidding information released on various platforms. Especially in June, iFLYTEK has won 5 projects in just half a month.

iFLYTEK is also a key choice for central state-owned enterprises. Among the 14 bidding enterprises, at least 11 come from central state-owned enterprises, and one belongs to a public institution.

This is largely due to iFLYTEK's layout in domestic full-stack capabilities. Last October, iFLYTEK and Huawei jointly launched China's first domestic computing power platform with 10,000 cards, "Feixing No. 1," and verified the reliability of "Feixing No. 1" by launching iFLYTEK Spark V3.5 more than three months later.

At the same time, last year, to explore the path of large models for central state-owned enterprises, iFLYTEK integrated iFLYTEK Research Institute, relevant business units, and some front-line forces to establish the company's first-level organization "Spark Corps" to strengthen the exploration of the central state-owned enterprise market.

In addition, it is worth mentioning that iFLYTEK's industry accumulation and customer relationships that have been built up over the years in some vertical industry markets have also helped it quickly win projects. Industries such as justice and operators have been sectors that iFLYTEK has invested in for quite some time.

Zhipu AI: A dark horse

In the first half of 2024, Zhipu AI is undoubtedly a dark horse among mainstream large model vendors.

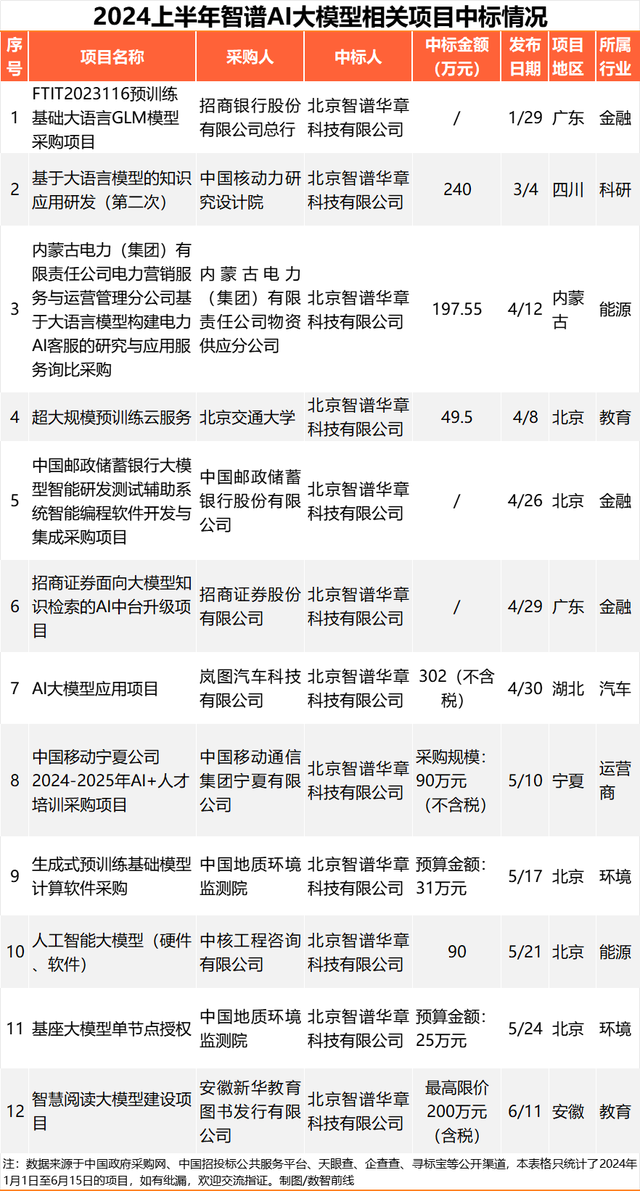

Although it is a "young company" that has only been established for a few years and does not have years of business scenario accumulation like other established companies, from the beginning of the year to now, Zhipu AI has won at least 12 large model-related projects, covering industries such as finance, scientific research, energy, education, automobiles, operators, and geology, becoming one of the artificial intelligence companies with the most winning projects and the widest coverage of industries.

Especially from the perspective of winning projects of central state-owned enterprises, among the 12 winning projects, 8 come from central state-owned enterprises, and 3 are tendered by public institutions.

Why can Zhipu AI, as a "young company," win so many projects?

On the one hand, as early as March 14 last year, on the same day as the release of GPT-4, Zhipu AI also released its dialogue model ChatGLM based on a trillion-parameter base model and open-sourced the bilingual Chinese and English dialogue model ChatGLM-6B, becoming one of the earliest commercially available large models last year, gaining a first-mover advantage.

On the other hand, at the beginning of this year, the Beijing AI Industry Investment Fund invested in Zhipu AI, making it the first AI large model company invested in by the fund since its establishment. The fund is jointly established by the Beijing Municipal Government Investment Guidance Fund and social capital, which has given Zhipu AI a good endorsement effect and attracted the attention of many central state-owned enterprises.

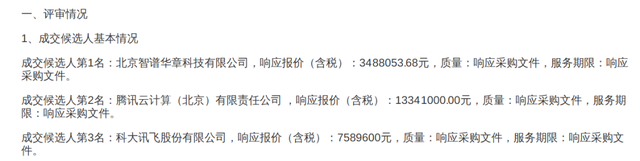

In addition, a lower price is also a key factor for this company to win in some projects. For example, in the large model project tendered by岚图汽车, Zhipu AI quoted a price of 3.4881 million yuan, which is several times lower than Tencent Cloud's quotation of 13.341 million yuan and iFLYTEK's quotation of 7.5896 million yuan.

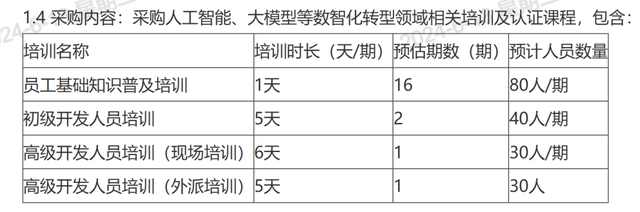

It is worth mentioning that in addition to large models and computing power, training related to large models is also included in the products and services purchased by B-end customers from Zhipu AI. For example, the "China Mobile Ningxia Company 2024-2025 AI + Talent Training Procurement Project" worth about 900,000 yuan.

Baidu Cloud: Serving over half of central state-owned enterprises

Baidu Cloud is one of the earliest vendors to launch large language models in China and has a first-mover advantage in winning large model projects. So far in the first half of this year, Baidu has won at least 11 large model-related projects, covering industries such as finance, operators, automobiles, water utilities, government affairs, energy, and ports, and among them, two are billion-level projects.

Since the beginning of this year, when the State-owned Assets Supervision and Administration Commission held a special promotion meeting on artificial intelligence for central enterprises, the actions of central state-owned enterprises in large models are accelerating. Baidu and Huawei were the only two AI companies that participated in this promotion meeting, which was quite helpful for them to enter the central state-owned enterprise market.

Among the 11 projects counted incompletely, 9 of them come from central state-owned enterprises. For example, China Tower, China Southern Power Grid, and Taiping Financial Services Co., Ltd., a first-tier subsidiary of China Taiping Insurance Group.

Apart from these publicly tendered projects, at the 2024 Smart Economy Forum on May 28, Shen Dou, President of Baidu Intelligent Cloud Business Group, revealed a statistic—more than half of the 98 central enterprises in China use Baidu's large model platform or services.

The project accumulation of cloud vendors in the traditional cloud computing era has also brought them new orders for upgrading to large models to a certain extent. For example, China Tower's "2024 Digital Virtual Customer Service Assistant Procurement Project" was procured from