Who received the 5.7 billion yuan worth of orders for humanoid robots in 2025?

![]() 01/29 2026

01/29 2026

![]() 347

347

The most exciting aspect of the humanoid robot sector in early 2026 centers on the competition over 'shipments.'

First, Zhiyuan Robotics shipped 5,168 units throughout the year, earning the top spot for global humanoid robot shipments in 2025 as rated by the authoritative market research firm Omdia.

Later, Unitree Technology officially announced that its 2025 shipments exceeded 5,500 units, with over 6,000 units rolling off the production line, reclaiming the 'first place' throne.

Behind the competition for mass production lies the continuous rise in demand for orders in 2025.

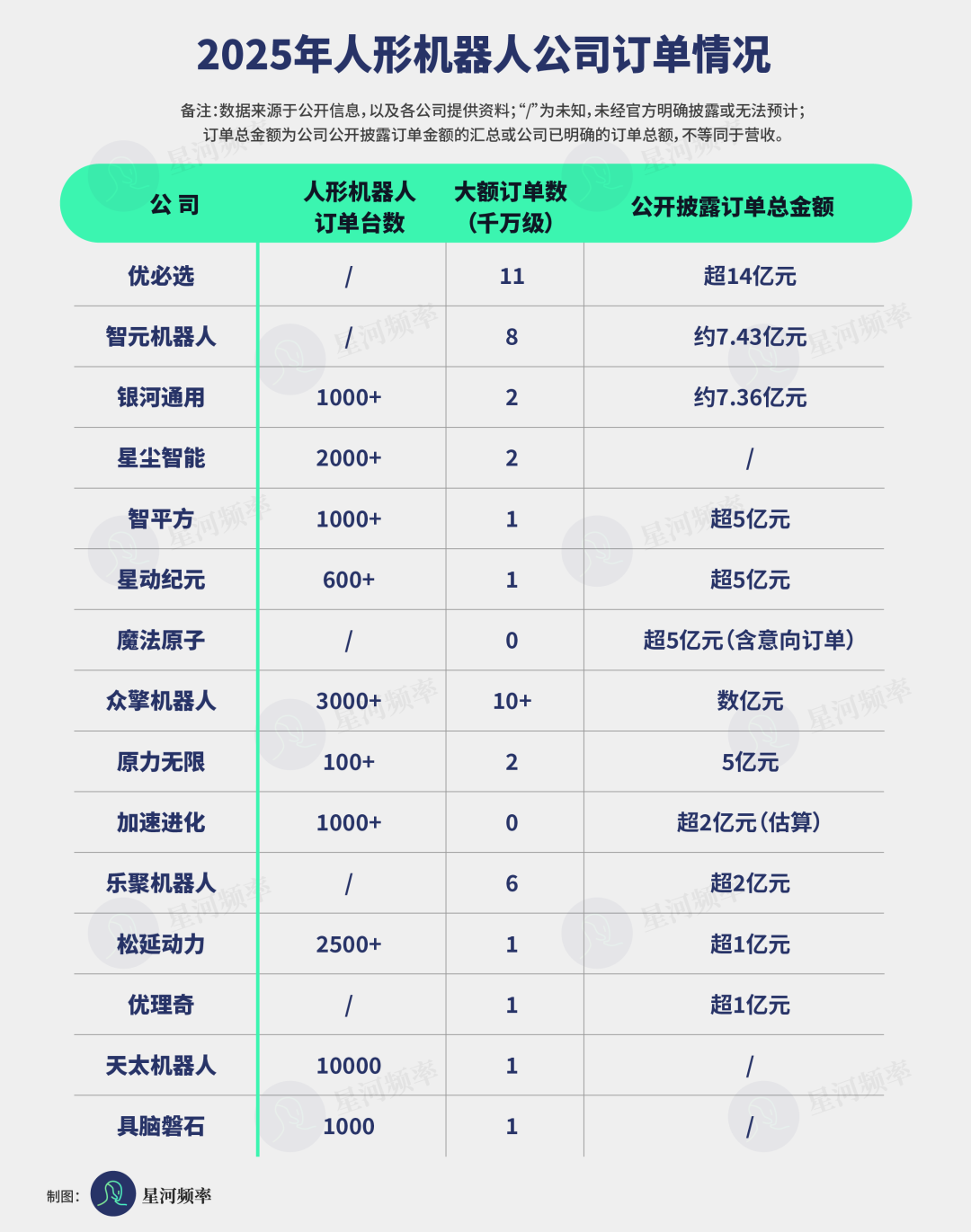

Based on publicly disclosed information and supplemented confirmations from some companies, we found that the number of orders in the humanoid robot sector reached 51 in 2025, with 48 being large orders (amounting to tens of millions of yuan or more), totaling over 5.7 billion yuan.

The capital market's enthusiasm also rose simultaneously. IT Juzi data shows that in 2025, there were 370 financing events in the embodied intelligence sector, with a total financing amount reaching 41.929 billion yuan.

Orders, mass production, and capital all erupted in the same year, making 2025 a critical turning point in the commercialization process of humanoid robots.

Focusing on the 48 large orders as our main sample, we attempt to reconstruct the true trajectory of humanoid robot commercialization over the past year and the underlying logic behind it, starting with order structure and delivery progress.

B-side + G-side Contribute 5.7 Billion Yuan in Orders

In 2025, large orders in the humanoid robot sector exhibited an active and diverse landscape, with a concentrated outbreak (use 'surge' or 'spike' if a more natural English term is preferred) in the second half of the year.

Throughout the year, 16 companies publicly disclosed their order progress, with 14 of them possessing large orders worth tens of millions of yuan.

Based on the disclosed total order amounts, UBTECH, Zhiyuan, and Galaxy General ranked in the top three.

It should be noted that the above statistics are based solely on publicly available information or data provided by the companies. In reality, the scale of undisclosed 'underwater orders' is likely to be even larger.

For example, Zhongqing Robotics disclosed only one large order last year, but its co-founder, Yao Aiwen, revealed that the company actually secured over 10 large orders worth tens of millions of yuan in 2025, with the total number of humanoid robot orders exceeding 3,000 units.

Although Unitree Technology does not have an advantage in the number of publicly disclosed large orders, its annual shipments exceeded 5,500 units, indicating that the total number of orders it actually received is also substantial, albeit with more dispersed demand.

Considering both order size and shipment volume, Unitree Technology, UBTECH, Zhiyuan Robotics, and Galaxy General jointly constitute the first tier in terms of order size for humanoid robots in 2025.

From the perspective of order composition, several leading companies exhibit vastly different commercial focuses, dividing into two order models: 'large-scale and centralized' and 'high-frequency and decentralized.'

UBTECH, Zhiyuan Robotics, and Galaxy General fall into the 'large-scale and centralized' category. Their large orders all originate from the B-side (industrial sector) and the G-side (government/local state-owned enterprises).

UBTECH's large orders primarily come from automotive industry clients as well as government and local state-owned enterprises.

Among its automotive clients are Dongfeng Liuzhou Motor, Miyi (Shanghai) Automotive Technology, and Tianqi Automation; government orders are concentrated in Liuzhou, Zigong, Guangxi, and Jiangxi, mainly for the construction of local data collection centers and demonstration projects.

Zhiyuan Robotics' order characteristics bear a distinct 'Huawei flavor,' primarily concentrated among Huawei supply chain enterprises and local government projects.

Among Zhiyuan Robotics' clients, companies such as Universal Robots, Fulin Precision, China Mobile, Longcheer Technology, and Joyson Electronic are all Huawei partners; government orders also focus on data collection center projects, with implementations in Zhuhai and Shaoxing.

This order characteristic is directly related to Zhiyuan's team background.

Among Zhiyuan's seven partners, four have previously worked at Huawei, including founder and CEO Deng Taihua (former Huawei vice president), CTO Peng Zhihui (former 'Huawei Genius Teen'), Vice President of Marketing Jiang Qingsong, and Chief Human Resources Officer Niu Jia. Their strong Huawei heritage makes it easier for them to tap into large-scale projects focused on industry and government affairs.

Galaxy General follows a similar path. In 2025, its two large orders came from automotive component manufacturer Baida Precision and the Taizhou Bay Embodied Intelligence Robot Concept Verification Center project, both pointing to industrial and government-led systemic demands.

Unitree Technology's order model is 'high-frequency and decentralized.' Tianyancha data shows that Unitree Technology secured a total of 62 projects (including quadruped robots) in 2025, far exceeding Zhiyuan (23) and Galaxy General (10), with order amounts ranging from tens of thousands to several million yuan.

Additionally, Unitree Technology has secured numerous orders from C-side customers as well as universities, research institutions, and industrial clients overseas.

Overall, the large orders from UBTECH, Zhiyuan Robotics, and Galaxy General generally feature high amounts, long cycles, and concentrated clients, primarily focusing on the industrial and government sectors.

In contrast, Unitree Technology's order model leans more toward small amounts, high frequency, and decentralization.

This difference fundamentally stems from varying product positioning.

Unitree Technology's humanoid robots are priced relatively low, do not emphasize 'brain capabilities,' and do not offer deeply customized solutions, making them more suitable for scenarios with dispersed budgets and high purchase frequencies, such as university teaching, scientific research experiments, and small-scale inspections.

This positioning also determines that Unitree Technology currently struggles to cover industrial-grade application scenarios that demand higher stability and systemic capabilities.

Scientific research demands primarily focus on teaching, experimental, and exploratory applications, with limited scale for individual orders but widespread and sustained overall demand. These clients are more concerned with price transparency, delivery efficiency, and product versatility rather than systemic integration capabilities.

In terms of cost structure, Unitree Technology maintains stable gross profit margins per robot. Although decentralized orders have low individual amounts, they offer quick payment cycles, enabling cash flow closure for each product without relying on large projects to amortize costs.

In contrast, UBTECH, Zhiyuan Robotics, and Galaxy General focus on customized and systematic solutions, better meeting the complex demands of the industrial sector and large-scale government scenarios.

In this model, humanoid robots require higher intelligence ceilings and systemic integration capabilities, with unit prices generally exceeding 500,000 yuan. Research, development, and delivery costs are higher, typically necessitating orders worth tens to hundreds of millions of yuan, with minimum orders of several hundred units, to cover upfront investments and provide long-term operation and maintenance services.

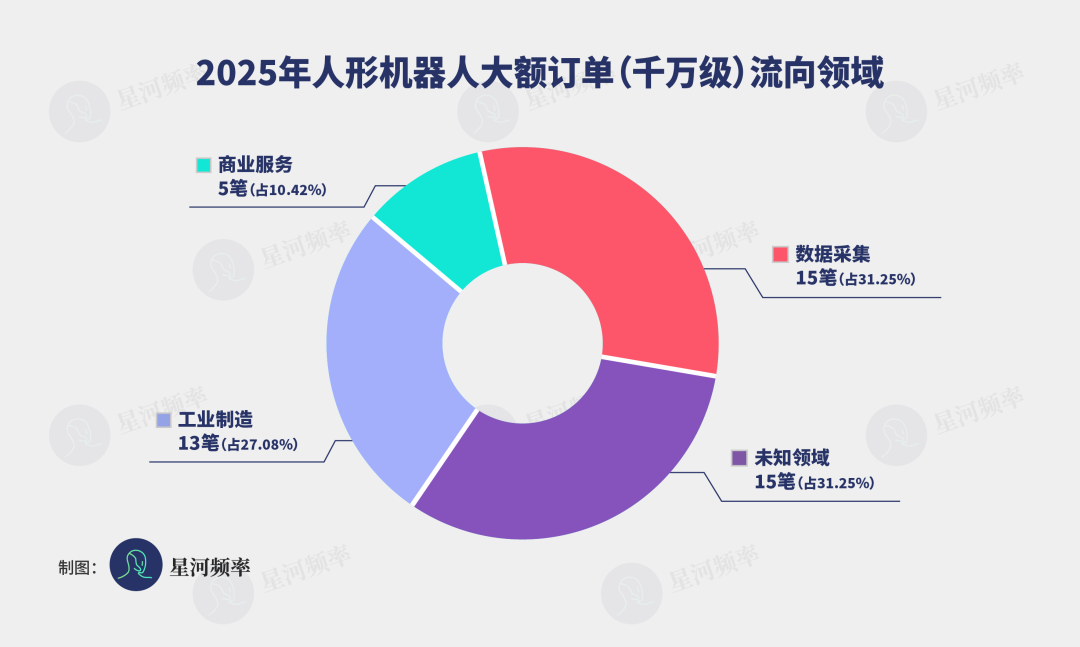

From the perspective of industry distribution for orders, data collection and industrial sectors are the most concentrated areas of demand for humanoid robots.

This reflects that the humanoid robot market in 2025 is still in a transitional phase of 'capability building + scenario validation.'

The most stable 'buyers' for humanoid robot companies are the G-side. The 15 data collection orders essentially represent the government and state-owned enterprises providing early survival space for the industry.

However, embodied intelligence relies heavily on real-world scenarios and high-quality data. Data collection projects also serve to build data infrastructure for the industry while providing financial support for the continuous operation and iteration of relevant companies.

An additional 13 orders flowed into the industrial sector, with 8 originating from automotive manufacturing-related enterprises, showing a high concentration of demand in this classic scenario with mature automation foundations and relatively clear implementation paths.

The commercial services sector received 5 orders, while 15 orders lacked specific application directions. This often implies that many order demands have not yet taken shape, remaining either in the stages of scientific research exploration or strategic trial water, or carrying certain capital narratives and compliance considerations, with their true implementation value still to be tested.

In terms of client attributes, among the 48 orders, only 33 disclosed their clients, with 16 being listed companies or enterprises in the process of going public (13 of which are already listed). Listed companies account for nearly 50% of the disclosed clients.

The reason listed companies have become the main purchasers lies, on the one hand, in their strong financial strength and ability to bear trial-and-error costs, possessing the strategic patience to explore unknown scenarios over the long term.

On the other hand, signing orders with leading embodied intelligence companies is also an important means for listed companies to manage their market value and shape a technological image.

However, behind the order boom, several realistic issues must be viewed calmly.

First, among the 33 large orders counted, a significant portion consists of framework agreements with vague terms, lacking specific deployment timelines, quantities, and acceptance criteria.

This also renders the actual implementation effectiveness and timeliness of some orders uncertain, to some extent showing signs of being a 'false fire.'

Among them, only some of UBTECH's orders are explicitly set for completion and delivery in 2025, while a small number of robot order deployment cycles are clearly defined as within 2-3 years.

Second, there is also the phenomenon of 'left hand trading with the right hand' in the industry, such as subsidiaries within a group purchasing products from the parent company or orders signed between affiliated enterprises with shareholdings. The independence and market nature of such transactions warrant consideration.

Overall, the humanoid robot order market in 2025 has made significant progress in terms of scale and diversity, featuring both centralized large-scale projects for heavy industrial scenarios and distributed small orders penetrating diverse scenarios.

However, at the same time, order quality, fulfillment pace, and true demand intensity still require further validation during subsequent delivery and mass production processes.

Mass Production Threshold: Who Has Truly Crossed the Scale Line?

The ability to achieve large-scale mass production and stable delivery is the core indicator for testing the true commercialization capabilities of humanoid robot companies.

Among the 14 humanoid robot companies involved in the 48 large orders counted, only 6 have publicly disclosed clear shipment or mass production volume data, accounting for less than half.

Here, a concept needs to be clarified:

'Shipments' typically refer to the number of robots already delivered to clients;

'Mass production volume,' on the other hand, focuses more on the production side, referring to the number of products that have completed manufacturing and rolled off the production line, which may include some inventory or products pending delivery.

The market often conflates the two, but distinguishing between them helps more accurately assess a company's actual delivery capabilities and production pace.

From the published data, Unitree Technology and Zhiyuan Robotics have taken a significant lead, with their delivery volumes surpassing the 5,000-unit mark.

Unitree Technology ranks first with over 5,500 units shipped and over 6,500 units rolled off the production line, followed closely by Zhiyuan Robotics with 5,168 units shipped.

Both companies have achieved rapid volume growth, but their underlying approaches differ.

Unitree Technology's core advantages lie in two areas: first, its deep control over the supply chain, and second, its early accumulation of mass production experience.

By independently developing key components such as motors, reducers, and encoders, Unitree has increased the self-developed rate of core components to over 90%, reducing costs while ensuring the stability and controllability of its production system.

However, in the current humanoid robot industry, self-developing core components is gradually becoming a consensus. The true gap still lies in mass production experience itself.

As early as 2023, its global sales of quadruped robots reached approximately 23,700 units, capturing nearly 70% of the market share.

Due to the technological similarities between quadruped robots and humanoid robots in motion control and core components, Unitree has been able to quickly transfer its mature production system, process experience, and production line capabilities to the humanoid robot sector, thereby accelerating mass production.

Unlike Unitree's endogenous expansion, Zhiyuan Robotics' mass production path relies more on external collaboration with mature manufacturing systems. It has rapidly bridged its industrial capability gaps by partnering with several listed manufacturing companies.

Currently, Zhiyuan has established collaborations or joint ventures with companies such as Universal Robots, Lens Technology, Bozhon Precision Industry Technology, LY International, and Ningbo Huaxiang, leveraging their experience in structural components, precision manufacturing, and automated production lines to accelerate the mass production of humanoid robot bodies and key components.

For example, Universal Robots is supplying lightweight structural components for Zhiyuan's humanoid robots in bulk. The joint venture they established, Puzhi Future, has launched a pilot production line for humanoid robot bodies, which commenced operations in July 2025 with an initial annual production capacity of 1,000 units, planned to increase to 3,000 units by October 2025.

Apart from these two companies, the mass production volumes of humanoid robots for the other companies that have disclosed data are concentrated within the 500-1,000 unit range in 2025, while companies that have not disclosed relevant data generally have shipments stay at (use 'remaining' or 'stuck') at the several-hundred-unit level.

Wang Chuang, a partner at Zhiyuan Robotics, once summarized the key thresholds for mass production of robots with four numbers: 1, 200, 1,000, and 5,000:

"1 unit" means the robot is feasible at the laboratory level;

"200 units" indicates the product can move out of the laboratory and operate stably on production lines;

"1,000 units" shows the robot has gained support from more application scenarios, and R&D personnel begin to withdraw from the front lines, with production line workers and quality systems taking over;

"5,000 units" means the manufacturer not only has the capability for mass delivery but also indicates that some application scenarios have become relatively mature.

This shows that most companies in the industry are still at the stage of moving out of the laboratory and seeking real-world application scenarios.

Compared with the disclosed total order volume exceeding 5.7 billion yuan in 2025, the current scale of mass production and shipments still appears somewhat thin.

The core reason for the limited pace of mass production is that humanoid robots are still unable to perform tasks effectively and cannot meet real order demands.

A significant portion of the aforementioned large orders are still in the pilot or validation phase. Even UBTECH, which has been conducting long-term tests of humanoid robots in automotive factories, has had its humanoid robot efficiency pointed out by Morgan Stanley research to be only about 30% of that of human workers.

Secondly, the humanoid robot body is still in a rapid iteration phase, with insufficient reliability and durability. Issues such as motor overheating and limited lifespan of components are prevalent, leading to frequent product adjustments.

This makes it difficult for companies to establish fixed standardized production lines. Currently, most assembly still relies on a "handmade workshop" model, with single-unit assembly taking several days, resulting in low efficiency and difficulty in ensuring consistency.

Furthermore, the industry lacks unified standards, making it difficult to scale up the supply chain. Unified joint interfaces and communication protocol standards have not yet been established, with each robot manufacturer developing its own set, preventing suppliers from diluting costs through mass production.

In terms of orders and mass production, the humanoid robot sector in 2025 can be summarized in eight words: "Orders lead, mass production catches up."

Market demand is evident through orders, but the industry as a whole is still constrained by key factors such as technological maturity, product reliability, supply chain support, and production systems, with the capability for large-scale delivery still in its early stages of development.

China focuses on mass production, while the U.S. delves into technology.

Although China's humanoid robot industry also faces challenges in mass production and delivery, it has clearly taken the lead over the U.S. market across the ocean in terms of absolute numbers.

Against the backdrop of Unitree Technology and Zhiyuan Robotics achieving mass production at the 5,000-unit level, Tesla, a leading humanoid robot company on the other side of the ocean, has frequently delayed its mass production plans.

In early 2025, Musk announced a target of producing 5,000 units that year, but just three months later, the target was lowered to 2,000 units. Ultimately, at the October earnings call, Tesla officially abandoned its 2025 mass production plan, postponing the start to the end of 2026.

According to reports, the main reason for the delay of Optimus is the insufficient maturity of the robot body. Key components such as the 22-degree-of-freedom dexterous hand cost over $6,000 each but have a lifespan of only six months; joint actuators in the arms and legs also fall short of expectations in terms of lifespan and stability.

In a factory environment, Optimus's average work efficiency is only 20%-30% of that of humans, raising questions about the cost-effectiveness of its large-scale application.

Another prominent U.S. company, Figure AI, claims to have an annual production capacity of 12,000 units but has remained silent on real order volumes and delivery schedules, without disclosing specific data.

Figure AI is silent, yet anxious. A noteworthy episode is that after UBTECH released its mass production video, Figure AI founder Brett Adcock accused the video of being "CG-synthesized" on Twitter. However, after UBTECH responded with a continuous live video, the question (which means "doubts" or "questions" in English, but kept as pinyin here to indicate the original Chinese term was used in the context) were dispelled.

This anxiety stems from the fact that Figure AI and UBTECH have highly overlapping application paths, with both considering automotive factories as their core deployment scenarios. They are in direct competition, which to some extent amplifies their sensitivity to mass production progress.

So, why are there such significant differences in the pace of mass production and orders between China and the U.S. in the humanoid robot sector?

The core driving force lies in China's significant advantages in the supply chain system. This advantage is specifically reflected in three aspects: comprehensiveness, efficiency, and low cost.

Currently, China has formed a complete industrial chain covering upstream core components (reducers, servo systems, sensors), midstream robot body manufacturing, and downstream application scenarios. A Morgan Stanley report shows that Chinese companies account for 63% of the global humanoid robot industrial chain.

A highly concentrated local supply chain enables Chinese companies to quickly conduct trial production, iteration, and modification. Currently, the localization supply rate of core components for Chinese humanoid robots generally exceeds 70%, significantly shortening the product development cycle from design to deployment.

Zhu Yuxiang, the strategic manager of SEED Robotics, once stated that in less than a year and a half, the company has formed flexible collaborative relationships with multiple upstream and downstream enterprises, achieving rapid verification and mass production switching for key components such as reducers, motors, skeletons, and joints. "Sometimes, connections can be made on-site at exhibitions, and samples can be produced immediately upon return," he said.

An industry insider who was once responsible for connecting with the humanoid robot supply chain also pointed out that the Greater Bay Area provides Shenzhen enterprises with a typical "2-hour supply chain circle," where mature suppliers for almost everything from high-precision sensors to reducers can be found within a hundred-kilometer radius.

The cost advantage is also significant. Morgan Stanley research shows that relying on the Chinese supply chain, the material cost of a single humanoid robot is approximately $46,000; if non-Chinese supply chains are used entirely, the cost rises to over $130,000.

In other words, if the Chinese supply chain is used, the cost of humanoid robots can be directly reduced by three times.

The completeness, collaborative efficiency, and cost advantages of the supply chain enable Chinese companies to tolerate higher frequency and lower-cost trial and error, accepting a development path of "delivering while iterating," shifting some risks to the delivery and operation phases, and continuously optimizing products in real-world applications.

In contrast, the U.S. humanoid robot supply chain is relatively fragmented, with high manufacturing costs and significant adjustment costs.

Both Musk and Figure AI's Brett Adcock have publicly stated that the U.S. market lacks a readily available, reusable component system, often requiring humanoid robots to design key components from scratch. In the Optimus project, Tesla had to involve multiple Chinese manufacturers in component R&D.

In this environment, U.S. companies are more inclined to fully refine their products during the R&D phase before initiating large-scale production, concentrating risks in the early R&D cycle and capital consumption rather than exposing them to the application side in advance.

Beyond the supply chain, deeper differences stem from policy orientation and capital expectations.

In China, humanoid robots have been included in the national "15th Five-Year Plan" and prioritized directions for future industrial innovation and development. In 2025, embodied intelligence was written into the government work report.

From the central to local levels, special support policies have been dense (which means "intensively" or "frequently" in English, but kept as pinyin to indicate the original Chinese term's intensity) introduced, and industrial funds have been established. State-owned assets across various regions are also heavily investing to support robot companies.

The Ministry of Industry and Information Technology proposed in the "Guidelines for the Innovative Development of Humanoid Robots" that by 2027, the annual production volume of domestic humanoid robot bodies should reach 1 million units.

UBTECH humanoid robot mass production video frame

Against this backdrop, "forming scale first, then improving efficiency" has clear policy rationality, with data collection projects and demonstration projects often led by the government or state-owned enterprises.

In contrast, U.S. industrial policies focus more on supporting frontier technology exploration through R&D subsidies and tax incentives, with relatively late direct promotion of large-scale manufacturing. It wasn't until the end of 2025 that news reports indicated the Trump administration began formulating a national robot strategy to strengthen domestic manufacturing.

At the capital level, the Chinese market is more "industrialization-oriented." Faced with inquiries from investors like Neil Shen about commercialization prospects, domestic companies must present verifiable order and delivery data to prove their viability.

U.S. capital is more tolerant of long-term technological uncertainties, such as granting Figure AI, which lacks large-scale orders and mass production data, a valuation as high as $39.5 billion. In contrast, the highest-valued Chinese humanoid robot company, Galaxy General, has a valuation of approximately $1 billion, nearly 40 times less.

This capital preference directly shapes the development pace of Chinese and U.S. companies:

U.S. companies continue to advance in technological depth but are more restrained in initiating mass production;

Chinese companies enter a deliverable state earlier, accelerating product finalization and scale expansion through government and industrial demand.

However, the gap in technological accumulation is somewhat rapidly narrowing. Over the past five years, China has registered 7,705 humanoid robot-related patents, far exceeding the 1,561 in the U.S.

Compared to overseas markets, China currently demonstrates more specific and tangible advantages—a mature supply chain, clear policy direction, and a market environment highly sensitive to "whether it can be deployed"—pushing humanoid robots into real-world combat earlier.

In 2025, humanoid robots are heating up on both the order and mass production fronts, injecting a strong dose of confidence into the industry. However, doubts linger.

Amidst the marketing hype, we must soberly recognize that between orders and large-scale, profitable delivery lies a long and repetitive process of engineering and commercial validation.

The true usability and economic viability of technology are the key factors determining the industry's final direction.