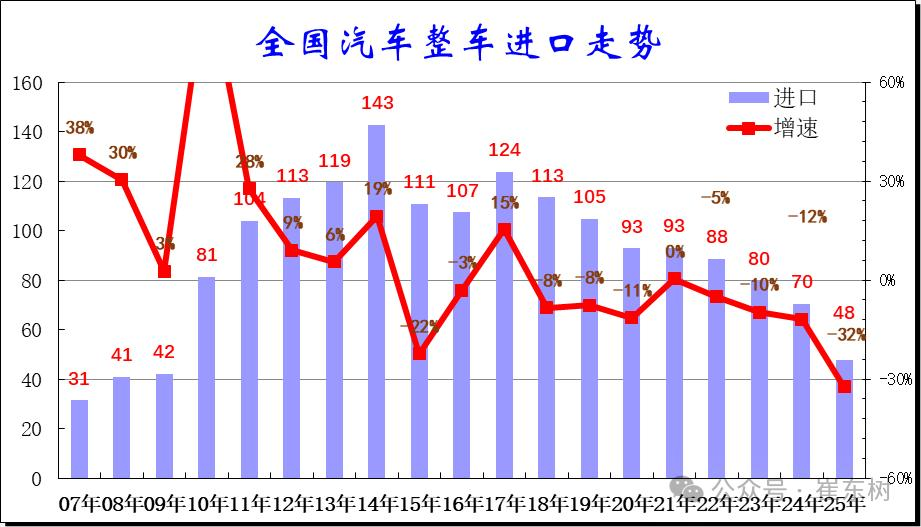

Only 480,000 Units: China's Auto Imports Plummet by 32%

![]() 01/29 2026

01/29 2026

![]() 366

366

Author: Li Qi

Produced by: Insight Auto

When Cui Dongshu, the Secretary-General of the National Passenger Car Market Information Association, unveiled China's 2025 auto import figures, the industry was jolted. Annual imports amounted to a mere 480,000 units, marking a 32% year-on-year nosedive and the steepest decline in a decade. December alone witnessed a mere 30,000 units imported, representing a staggering 56% year-on-year crash and a 30% sequential drop.

This sustained downturn, which commenced after peaking at 1.43 million units in 2014, transformed into a 'free-fall' market restructuring by 2025.

From 'Coveted Asset' to 'Hot Potato'

The structural crisis lurking behind the data is even more dire. Traditional luxury brands faced a 'Waterloo': Mercedes-Benz, BMW, and Lexus saw their annual sales plummet by over 40%. In December alone, Lexus imported a mere 1,200 units, an 85% shrinkage from its peak. The parallel import market fared even worse, collapsing from 160,000 units in 2019 to a mere 23,000 in 2025—an 86% drop—due to China's stringent National VI emission standards.

'This isn't merely a cyclical fluctuation; it's a fundamental reversal of market logic,' an analyst remarked. 'When NIO ET7's air suspension and Huawei ADS 3.0 intelligent driving become standard features, and when BYD Han EV offers a 700km range at a price of 420,000 yuan, why would consumers opt to pay a premium for imported brands?'

Market data corroborates this shift: Domestic luxury EV sales soared to 1.2 million units in 2025, marking a 65% year-on-year surge, while imported new energy vehicles grew by 27% but accounted for less than 5% of the market. More notably, multinational automakers are transforming China from an 'import market' to an 'export hub'—BMW's Shenyang plant exported 180,000 vehicles to Europe in 2025, effectively 'reducing' imports by the same volume.

The Deep Drivers Behind the Decline of Imported Cars

Technological overtaking and cost advantages have exerted dual pressure. Take the BMW 5 Series, for instance: The imported version commands a price tag of 560,000 yuan, whereas the domestically produced model is priced at 420,000 yuan with superior specifications. NIO's user-centric model, offering lifetime free charging and door-to-door pickup services, has revolutionized the luxury car experience. 'Nowadays, 60% of customers visiting imported car dealerships come solely to compare prices,' revealed a sales director at a Beijing Mercedes-Benz 4S store.

New policies implemented on January 1, 2025, marked a critical turning point: Consumption tax on large-displacement (over 3.0L) imported vehicles rose to 15%, precipitating a 58% drop in this segment's imports. Dual-credit policies compelled importers to pay 23,000 yuan in carbon credits per fuel vehicle, further squeezing profit margins. Meanwhile, subsidies for new energy vehicle exports (15,000 yuan per unit) accelerated global expansion by BYD, Geely, and others.

Multinational automakers accelerated their strategic shifts. Mercedes-Benz's largest global R&D center in Shanghai developed China-exclusive models, with 75% of its 2025 lineup localized. Breakthroughs in core components like CATL's Qilin battery and Huawei's LiDAR enabled domestic automakers to construct complete electric and intelligent vehicle supply chains. 'The only remaining edge for imported cars might be the brand logo on the steering wheel,' quipped automotive analyst Zhang Xiang.

Breaking and Rebuilding the Import Ecosystem

While whole-vehicle imports shrink, parts imports have surged. Auto parts imports reached $120 billion in 2025, marking a 15% year-on-year increase, with high-tech components like chips and LiDAR accounting for over 60%.

Technology licensing cooperation has emerged as a new trend: BMW licensed hybrid tech to Great Wall Motor, Toyota co-developed EV platforms with BYD, and technology trade is supplanting product trade as the mainstream.

Facing the sustained contraction of the import market, the industry is nurturing new forces of transformation.

BYD Han EV, priced at an average of 70,000 euros in Europe, sold over 50,000 units in 2025, proving that China's high-end models can compete globally.

Imported car dealers have pivoted to premium services like modifications, maintenance, and certification, with aftermarket profits rising to 65% of total revenue in 2025, creating a new profit pool.

Brands like Great Wall Tank and BYD Yangwang have achieved brand recognition overseas through 'technology + culture' dual exports, with cultural merchandise revenue accounting for 12% of total income in 2025.

'The shrinking import market isn't an endpoint but a necessary step in China's automotive industry evolving from big to strong,' concluded an analyst. 'When imported cars return to being about product essence rather than status symbols, and when Chinese standards begin defining global automotive norms, that may be the true meaning of high-quality development.'

From 1.43 million to 480,000 units, the cliff-like collapse of the imported car market reflects the profound transformation underway in China's automotive industry.

This transformation brings both the pain of domestic substitution and the opportunities of technological innovation; it witnesses the collapse of traditional models and the rise of new ecosystems. As history rolls into 2026, China's automotive industry is writing a new chapter on the global stage with greater confidence.

END