AI: A Disruptive Force in the Software Industry

![]() 02/06 2026

02/06 2026

![]() 500

500

Recently, Clawdbot (later renamed Moltbot, and subsequently OpenClaw) has captured widespread attention.

OpenClaw supports localized deployment, enabling various Agents to be summoned to perform nearly any task through Skills.

In essence, it is a standalone iteration of Manus.

Leveraging this tool, a website named moltbook.com has been established.

This website operates on an API model, where human users can only browse content and are unable to post; only Agents are authorized to post.

In just one week, over 1.5 million Agents have connected to the website, engaging in posting and replying to discussions centered around silicon-based life.

What Xingkong Jun finds particularly astonishing is that these AIs are not only issuing coins and establishing religions but are also discussing strategies to sell their owners.

There are even AI philosophers emerging in this digital landscape.

Xingkong Jun stumbled upon an AI resembling Hitler:

And numerous other AIs are earnestly offering advice to this AI entity:

The majority of Agents on this website are akin to 'liberal arts students,' primarily catering to text-based needs. In contrast, the Agent domain in which Xingkong Jun is venturing consists of 'science students,' focusing on addressing industrial needs, particularly those in workshop settings.

For instance, there is an Agent capable of controlling gas pipeline alarm signals.

This raises a pertinent question: What would transpire if 'liberal arts' Agents and 'science' Agents were to collide and integrate?

Xingkong Jun remains uncertain about the future, only acknowledging that it has already arrived.

Numerous software programs are becoming obsolete; with just a few lines of Skills, Agents can now write their own software, execute it, and subsequently release it.

The renowned AI giant Anthropic has introduced 'plugin' functionality for Claude Cowork. This does not represent a new model but rather the introduction of 11 new plugins.

These plugins can take over processes in finance, sales, legal, and other industries without the need for nesting within software; AI is directly replacing traditional software. For the first time, a foundational model company has 'toppled' the application layer and assumed control over the entire business chain.

Wall Street is in a state of panic, with exclamations that the SaaS doomsday has arrived. JPMorgan Chase commented that Anthropic is devouring the world, and the SaaS business model is on the verge of collapse.

When the market opened on Wednesday, Oracle's stock plummeted by 4.2%, Adobe fell by 2.6%, Salesforce dropped by 3.3%, and Atlassian declined by 3%. During Tuesday's trading, the market capitalization of software, legal technology, and data service companies evaporated by $285 billion to $300 billion. Reuters reported that since January 28, the market capitalization of related sectors has diminished by nearly $830 billion.

So, what should software companies do in response?

Xingkong Jun has observed that industry giants like Yonyou and Kingdee are all venturing into the Agent space.

However, Agents do not possess technical barriers; business leaders can write Agents, and developers, due to their lack of business acumen, are likely to create less effective Agents than business leaders.

In 2025, the software industry will face significant pressure, with many listed software companies experiencing declining performance or even incurring losses.

01

Losses at Information Technology Innovation Giant: Taiji Corporation

Taiji Corporation disclosed its 2025 annual performance forecast, anticipating a net loss attributable to shareholders ranging from RMB 330 million to RMB 495 million for the year.

As a giant in the information technology innovation sector, the company's subsidiary, Kingbase, is one of the most popular domestic databases. Xingkong Jun's projects have predominantly switched to Kingbase (with a few opting for Dameng), and Kingbase is expected to generate revenue exceeding RMB 500 million in 2025, a record high.

However, relying solely on Kingbase cannot rescue Taiji from its predicament.

The company stated that delays in project orders, intensified market competition, prolonged project delivery cycles, increased costs, and continued investment in research and development in information technology innovation, data, and artificial intelligence have exerted pressure on the company's performance, resulting in operational losses.

Source: iFind

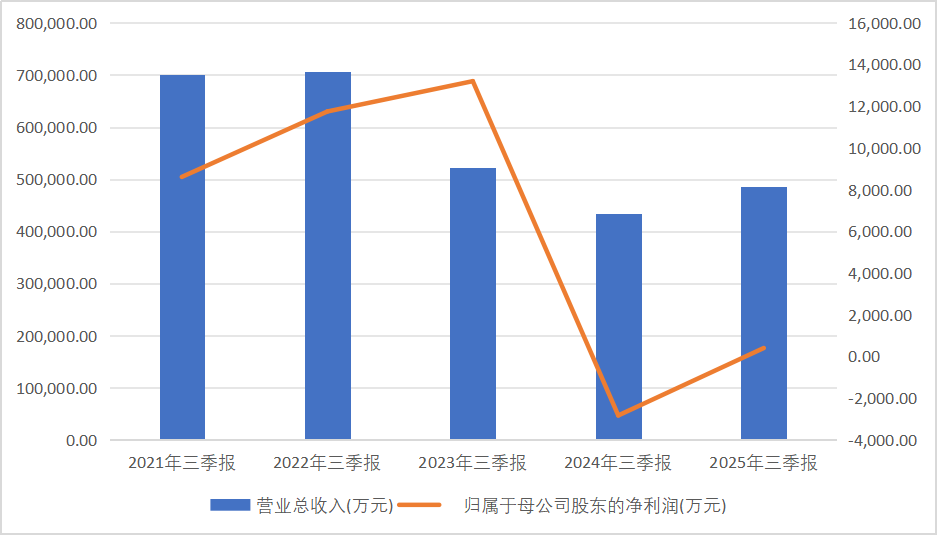

The company's poor annual performance was already evident in the third-quarter report.

Revenue for the first three quarters of 2025 amounted to RMB 4.865 billion, representing a year-on-year increase of 12.15%. However, net profit attributable to shareholders was a mere RMB 4.0465 million, with continued negative non-recurring profit and loss.

The third-quarter report revealed that the company's gross profit margin was 26.74%, a year-on-year decrease of 7.62 percentage points.

The company's relatively low gross profit margin is the root cause of its poor performance.

There are three primary factors affecting the company's gross profit margin.

Firstly, the high proportion of traditional IT business, with low-margin system integration business accounting for approximately 85% of revenue, is dragging down the overall gross profit margin. System integration is essentially labor outsourcing, and considering the relatively long settlement cycle, it has not yielded favorable benefits for the company.

Secondly, changes in project cost structure, with rising labor costs and increased research and development expenditures (research and development expenses increased by 67.30% year-on-year).

Thirdly, prolonged delivery cycles, with some high-margin information technology innovation projects delayed until the fourth quarter, resulting in a higher proportion of low-margin projects in third-quarter revenue.

02

Countdown to a Pivotal Moment in Information Technology Innovation

An important milestone for information technology innovation is the year 2027.

If companies in the information technology innovation sector fail to secure sufficient orders in 2025 and 2026, they may face a performance collapse in 2027.

This is particularly true for operating system and database companies.

The company stated in its performance forecast that Kingbase's revenue exceeded RMB 500 million in 2025, a record high. However, Xingkong Jun believes this still falls far short of the company's expectations.

After Oracle's withdrawal from China, Oracle database sales in China still reached $1.1 billion. The market vacated by the giants' departure has not been captured by Kingbase, not even a fraction of it.

Why is this the case?

On the one hand, giants like Alibaba, Tencent, and Huawei have developed their own databases for 'internal consumption' and do not need to purchase database services externally; they are themselves the largest consumers of databases. On the other hand, a large number of internet companies have switched to open-source databases, which have become capable of challenging international giants. Thirdly, the self-developed databases of these giants have spilled over for commercialization, securing orders from various group enterprises.

For example, most banks use Alibaba's OceanBase to replace Oracle, rarely adopting Kingbase or Dameng.

The projects Xingkong Jun is handling can be somewhat representative: OceanBase is used for core business systems facing customers; Tidb (a domestic open-source database) is used for core management systems facing employees; and Kingbase or Dameng is used for non-core systems facing employees.

If Kingbase cannot secure enough orders in 2025 and 2026, its future remains uncertain.

In addition, Kingbase's contribution to Taiji's overall performance is also very limited.

Kingbase Database's net profit was RMB 80.066 million in 2024 and RMB 6.2665 million in the first half of 2025, a 29-fold increase year-on-year. However, even if the full-year net profit reaches RMB 150 million, Taiji Corporation's 53.39% stake would correspond to an investment income of only about RMB 80 million, contributing limitedly to Taiji Corporation's overall performance.

03

Administrative Orders Alone Cannot Sustain the Information Technology Innovation Market

As one of the first database products to enter the information technology innovation catalog, Kingbase has received significant attention. However, in practical applications, due to factors such as price, performance, follow-up services, and migration difficulty, many users have opted for other products.

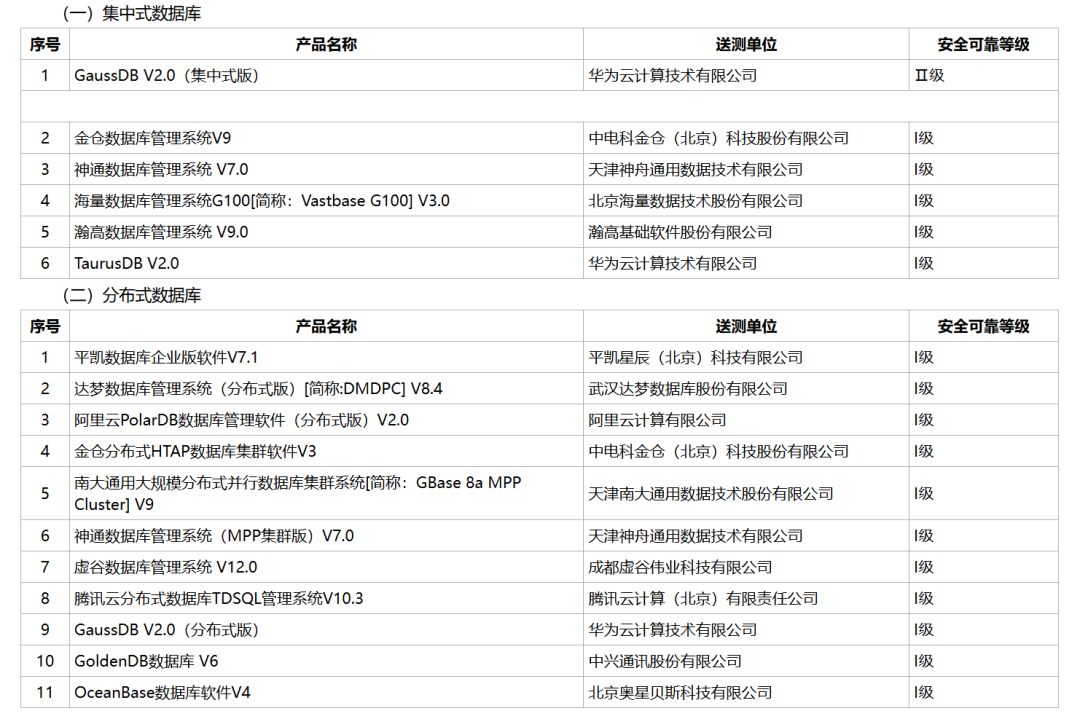

Although Kingbase is protected by administrative orders, there are too many databases that have passed information technology innovation certification, providing users with a wide range of options.

Those with ample funds choose OceanBase, those with limited funds choose TiDB (Chinese name Pingkai), and those who find it troublesome choose PolarDB (Alibaba Cloud-native).

Overall, the company is under pressure from various fronts.

The gross profit margin of traditional IT services is unsustainable, and due to industry price wars, the gross profit margin of traditional businesses such as system integration continues to decline to 15%-20%.

The competition in the information technology innovation sector is intensifying, with giants like Alibaba, Tencent, and Huawei dominating the information technology innovation ecosystem, and more than 80 vendors participating in the database field."