Facing Challenges and Opportunities, Is Tesla Shifting Focus Away from Cars?

![]() 02/06 2026

02/06 2026

![]() 326

326

Introduction | Lead

Currently, Tesla is encountering challenges and pressures in the automotive sector. Recently, Tesla (TSLA) officially released its financial results for the fourth quarter and full year of 2025, revealing a decline in electric vehicle deliveries that led to an overall downturn in performance. Regarding how to break through in 2026, CEO Elon Musk has set his sights on AI, increasing investment in AI-related fields. Can AI help Tesla regain its former glory? Additionally, Musk's team recently inspected several Chinese photovoltaic companies. What exactly is he planning?

This article is produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Full text: 2,780 characters

Reading time: 4 minutes

Tesla's automotive business is facing challenges.

In 2025, Tesla delivered 1.636 million vehicles globally, a year-on-year decrease of approximately 8.6%. In the fourth quarter alone, vehicle deliveries fell by 16% year-on-year. This marks the second consecutive year of declining deliveries for Tesla, resulting in unsatisfactory financial results for 2025. Tesla's total revenue last year was $94.827 billion, a 3% year-on-year decrease—the first revenue decline in recent years. Net profit attributable to ordinary shareholders was $3.794 billion, a significant 46% year-on-year drop. Faced with weak performance, Tesla also announced its future development direction during the earnings call, aiming to boost investor and shareholder confidence.

△ Tesla's performance in 2025 was unsatisfactory

Streamlining the Vehicle Product Matrix

Facing a downturn, Tesla is making a series of adjustments.

At the earnings call, Musk stated that Tesla will halt production of the Model S and Model X in the next quarter. With the discontinuation of the Model S and Model X, Tesla's investments will focus more on core forward-looking technologies. One key indicator for evaluating an automaker is sales volume, and the most crucial way to boost sales is to introduce a sufficient number of competitive models to the market. From Tesla's plans, it appears that the company may no longer prioritize boosting sales volume in the short term.

In fact, there were already signs of the discontinuation of the Model S and Model X. In 2025, global sales of these two models were only around 30,000 units. In April 2025, these models were already removed from sale and order on Tesla's Chinese website. For Tesla, maintaining production and sales of these two models would continue to drain profits. To boost sales, Tesla would need to comprehensively update these models to ensure they remain competitive in their respective market segments. However, globally, brands like BBA, Porsche, and Ferrari already offer competing models to the Model S and Model X. Achieving a dominant position in this niche market is undoubtedly challenging for Tesla.

△ The Model S and Model X models are set to be discontinued

Looking at new models, Tesla is expected to launch the next-generation Roadster sports car in April this year. The Cybercab, Tesla Semi, and Megapack 3 are all scheduled to enter mass production in 2026. In the short term, these models are unlikely to provide solid support for Tesla's sales volume, leaving the company to rely heavily on the refreshed Model Y launched last year. Unless Tesla's Full Self-Driving (FSD) technology achieves further breakthroughs, the Cybercab, positioned as a Robotaxi model, could quickly scale up. However, this possibility currently seems limited.

△ Models including the next-generation Roadster are unlikely to significantly boost Tesla's sales volume

Who is Tesla's New Favorite?

With the streamlining of Tesla's product matrix, core technologies such as humanoid robots and autonomous driving will become new focal points for the company. In 2026, Tesla plans to invest $20 billion in these two areas.

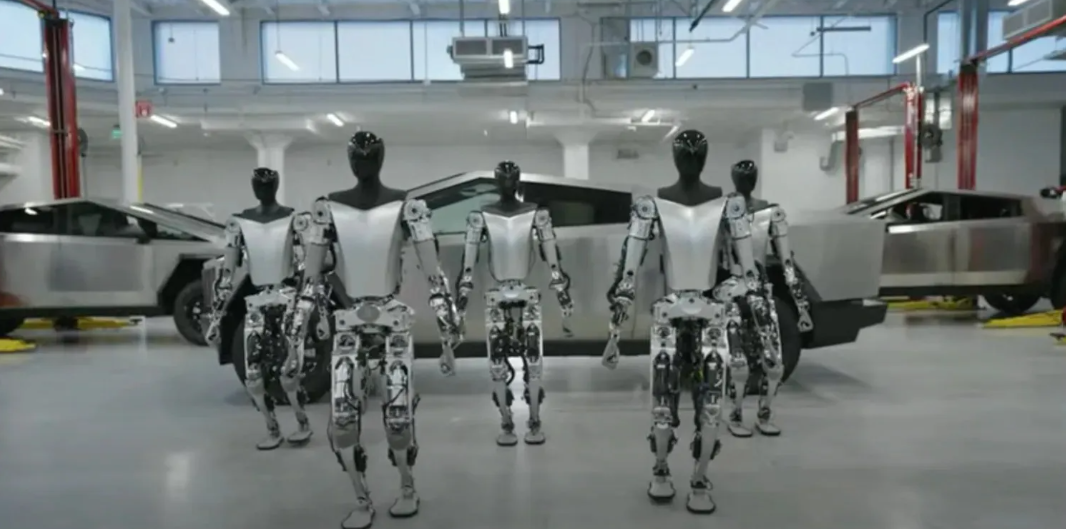

First, the Optimus humanoid robot will become a top priority for Tesla in the next phase. In the third quarter of 2026, Tesla's third-generation Optimus will be unveiled, marking the beginning of large-scale production. To achieve this, the California Fremont factory and production lines originally used for the Model S and Model X will be repurposed for Optimus humanoid robot production. According to Musk's vision, Optimus will be an intelligent robot capable of performing various tasks, from factory work to childcare, and Tesla aims to become a company producing millions of robots annually.

△ The third-generation Optimus will usher in a new era of large-scale production

Second, in the field of autonomous driving, Tesla has shifted all its focus to the Robotaxi sector. In the first half of this year, Tesla's Robotaxi pilot program will expand from Austin, Texas, to seven other cities across the United States. Notably, in the Austin-based Robotaxi fleet, a few vehicles have already operated without human safety supervisors, indicating growing confidence in Tesla's FSD technology.

△ Tesla has accelerated Robotaxi testing and operations in the United States

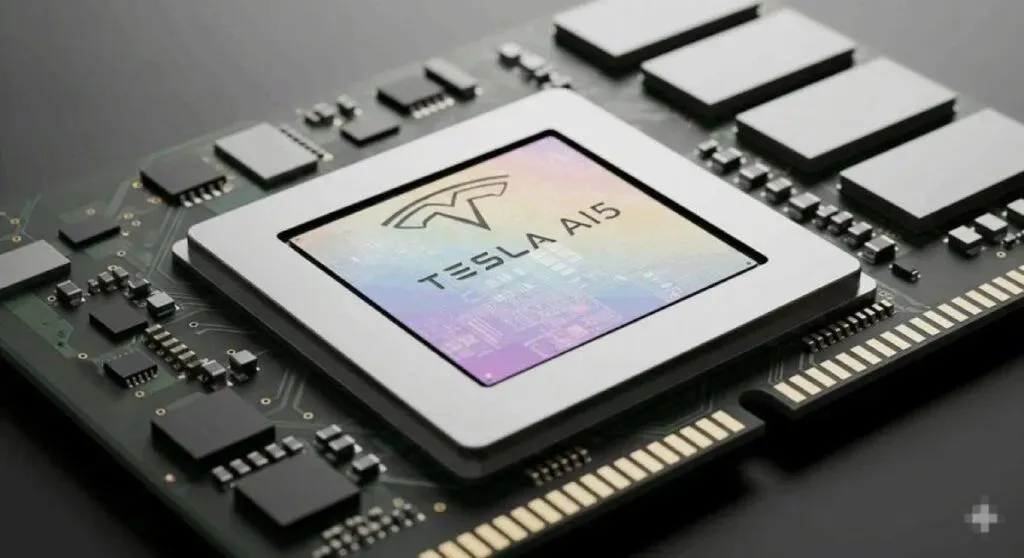

Additionally, Musk stated during the earnings call that Tesla will build and operate a massive chip factory, "Terafab," in the United States to produce semiconductors. As automotive intelligence advances, the demand for chips in the automotive industry will rise rapidly. Tesla already possesses chip design capabilities, and to eliminate potential chip production bottlenecks in three to four years, establishing full in-house control over the "design → manufacturing → packaging → finished product" process will be a crucial step for Tesla.

△ Tesla will build and operate a massive chip factory, "Terafab," in the United States

Furthermore, Musk's team inspected several Chinese photovoltaic companies, including TCL Zhonghuan, Jinko Solar, and Jingsheng Mechanical and Electrical, from late January to early February 2026. The focus was on evaluating Heterojunction (HJT) and perovskite technologies to support Tesla's space photovoltaic initiatives. In the future, Musk may even consider shifting his focus away from automobiles to other industries.

Is the AI Layout Reliable?

Tesla is not the only company accelerating its AI layout (AI layout means AI layout). In the domestic automotive market, two new-force automakers, XPENG and Li Auto, are also somewhat emulating Tesla, hoping to secure their futures through comprehensive AI layout (AI layout).

Li Auto's CEO, Li Xiang, emphasized at an online company-wide meeting that Li Auto's L4 autonomous driving will definitely be achieved by 2028 and that the company must develop humanoid robots and unveil them as soon as possible. In Li Xiang's view, there are no more than three companies globally simultaneously developing "foundation models + chips + embodied AI + OS," and 2026 will be the last opportunity for leading AI companies to enter the field. Similarly, XPENG's AI strategy will enter a phase of full acceleration from 2024 to 2026, transitioning from a "smart electric vehicle company" to a technology company focused on "physical AI + embodied intelligence." The three pillars supporting this strategy are: a physical AI large model, Turing AI chips, and a cross-morphology embodied intelligence product line consisting of automobiles, Robotaxis, robots, and flying cars.

△ XPENG and Li Auto are also making comprehensive AI layout s (AI layout means AI layout)

However, can AI be a lifesaver for Tesla, Li Auto, and XPENG?

Take Tesla's focus on autonomous driving as an example. Achieving true L4-level high-automation driving is undoubtedly challenging. Even if end-to-end large models completely replace previous rule-based algorithms, significant uncertainty remains regarding whether all corner cases can be overcome. Any severe accidents involving autonomous driving technology could prompt regulatory authorities to halt testing and deployment, as seen when General Motors suspended Cruise's Robotaxi operations.

For Li Auto to achieve L4 autonomy by 2028, fundamental or revolutionary advancements in algorithms over the next two years would be necessary. Otherwise, following the previous path, selling L4-level vehicles seems unlikely. As for humanoid robots replacing humans in service roles, that goal is even more distant. While replacing repetitive mechanical tasks on assembly lines is foreseeable, achieving full replacement of human labor would require solving more problems than anticipated.

△ The deployment of L4 autonomous driving faces numerous challenges

For these three companies, developing AI requires substantial financial investment. Tesla may be able to raise funds through the developed U.S. securities market, but Li Xiang and He Xiaopeng lack Musk's storytelling prowess and influence. From a performance perspective, Li Auto's full-year deliveries in 2025 declined by approximately 19% year-on-year, making it the only negative-growth company among leading new-force automakers. As for XPENG, excluding technology transfer fees from Volkswagen, it is likely still operating at a loss. In this context, these companies rely on their automotive businesses to sustain operations. If they hastily shift their focus to AI and reduce investment in new models, they may lose sight of their core objectives. Boosting automotive sales and ensuring survival may be far more urgent for these companies than transitioning to AI at this stage.

Commentary

New-force automakers face significant challenges in sustaining innovation. When traditional automakers begin introducing similar products, the survival space for new-force automakers is continually squeezed. Tesla's all-in commitment to AI could reflect Musk's unique vision, recognizing AI as the future of global development and aiming to once again lead the technological trend. Alternatively, it may be a desperate move by Tesla in the face of joint efforts by multinational automakers to encircle and suppress it. The path ahead is full of uncertainties, representing a new and formidable battle for Musk and Tesla.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)