China’s Second-Largest Autonomous Mining Truck Manufacturer Eyes Hong Kong IPO, Having Sold 259 Units for RMB 291 Million

![]() 02/06 2026

02/06 2026

![]() 496

496

Another autonomous driving enterprise is gearing up for a Hong Kong stock market debut.

Recently, Boreal Smart, a company specializing in autonomous mining trucks, formally submitted its prospectus to the Hong Kong Stock Exchange.

Unlike Robotaxi services, which continue to undergo extensive testing on urban roads, autonomous mining trucks have emerged as a leading segment within the autonomous driving sector, distinguished by their commercial maturity and rapid growth.

Industry data underscores this trend through revenue expansion.

In 2024, E-Control Intelligent Driving’s revenue skyrocketed from RMB 271 million to RMB 986 million, reflecting a year-on-year increase of approximately 264%. During the same period, CiDi Inc.’s revenue climbed from RMB 133 million to RMB 410 million, up roughly 208%.

Boreal Smart is no exception. The company reported revenue of RMB 69.565 million in 2023, which surged to RMB 171 million in 2024, marking a 145.8% year-on-year increase. By the first three quarters of 2025 alone, revenue had further soared to RMB 315 million.

Based on 2024 shipment volumes, Boreal Smart has secured its position as China’s second-largest provider of autonomous mining transport solutions.

Next, let’s delve deeper with Silicon-Based Insights.

/ 01 /

Autonomous Mining Trucks Hit Commercialization Milestone, Doubling Per Capita Revenue in 2024

Compared to Robotaxi services, autonomous mining trucks represent one of the most commercially advanced and scalable applications in today’s autonomous driving landscape.

The rationale is straightforward. Mine transportation operates within a closed, low-speed, rule-bound, and highly repetitive environment: operational zones are relatively fixed, avoiding complex interactions with public traffic, while clearly defined routes simplify high-precision mapping and centralized scheduling—ideal for autonomous driving systems.

More critically, mines face pressing economic demands for autonomous solutions.

Traditional mine transportation confronts three persistent challenges: safety risks, labor shortages, and high operational costs.

Transportation accounts for a disproportionate share of mining accidents, with rollovers and collapses occurring frequently. Despite employing only about 1% of the national workforce, the mining sector accounts for roughly 8% of workplace injuries, creating immense safety pressures.

Meanwhile, harsh mine conditions and demanding workloads have driven younger workers away. A single mining truck typically requires 24-hour continuous operation, manned by 2–3 driver shifts. Annual driver salaries average around RMB 200,000, exceeding RMB 300,000 in remote regions, keeping labor costs elevated.

Against this backdrop, autonomous mining trucks have become indispensable for reducing costs, boosting efficiency, and enhancing safety.

Data indicates the autonomous mining truck market reached RMB 1.9 billion in scale, with projections to expand to RMB 38.1 billion by 2030, representing a compound annual growth rate of 64.2%.

Company performance aligns with this trajectory. From 2023–2024, E-Control Intelligent Driving’s revenue grew from RMB 271 million to RMB 986 million (264% YoY), while CiDi Inc.’s revenue increased from RMB 133 million to RMB 410 million (208% YoY), both confirming the segment’s rapid commercialization.

Boreal Smart followed suit. Its revenue rose from RMB 69.565 million in 2023 to RMB 171 million in 2024 (145.8% YoY), surging to RMB 315 million in just the first three quarters of 2025.

Based on 2024 shipment volumes, Boreal Smart ranks as China’s second-largest autonomous mining transport solution provider, holding a ~13.9% market share and firmly establishing itself among industry leaders.

/ 02 /

259 Autonomous Mining Trucks Drive RMB 291 Million in Revenue

Boreal Smart’s revenue primarily stems from three segments: Smart Vehicles, Smart Mining, and Smart Transport.

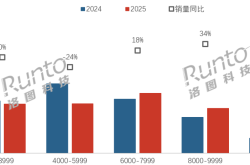

Smart Vehicles constitute the company’s core and most mature business. In 2024, this segment generated RMB 149 million in revenue, accounting for 87.2% of total revenue. By the first nine months of 2025, Smart Vehicles revenue reached RMB 291 million.

This business can be distilled to “vehicle sales.” Delivery data shows 109 units shipped in 2023, increasing to 160 in 2024. By the first nine months of 2025, deliveries had reached 259 units.

The company’s flagship offerings are its proprietary “Boreal eTruck” series of fully electric autonomous mining trucks, currently including the eTruck 105 and eTruck 145 models.

The eTruck 105 caters to mainstream mining transport scenarios, priced at approximately RMB 1.2–1.7 million per unit. The eTruck 145, with a 100-ton payload capacity, ranks as the world’s highest-capacity fully electric autonomous mining truck, priced at RMB 2.1–2.6 million per unit.

All models integrate the company’s self-developed iDrive autonomous driving system, with deep integration of VCU, intelligent electric drive systems, battery swap modules, and supporting devices, forming a complete vehicle solution from perception to decision-making and execution.

Boreal Smart employs flexible delivery models. The company sells vehicles directly to mine owners or partners with leasing firms and mining service providers through “system + vehicle” collaborations, serving clients including mine owners, operators, and OEMs.

Beyond Smart Vehicles, Smart Mining forms the company’s second critical business line.

In traditional mines, even with autonomous mining trucks, manual coordination remains necessary across loading, transport, unloading, and charging/battery swapping, limiting overall efficiency.

Smart Mining essentially unifies these fragmented processes into a seamless system through standardized technology and scheduling, advancing toward end-to-end automation.

Specifically, Boreal Smart provides a comprehensive “Full-Stack Smart Mining” solution, encompassing an integrated mining management platform, remote and autonomous control systems for excavation equipment, and intelligent charging/battery swap systems. The company handles hardware-software integration, system deployment, and ongoing maintenance.

Clients can flexibly combine these modules under a unified architecture to build customized intelligent mining systems based on mine type, production scale, and operational rhythm.

In addition to these segments, Boreal Smart operates a Smart Transport business resembling an Uber-like model—essentially outsourced transport capacity.

Mine owners avoid heavy upfront capital investments in mining trucks. Instead, Boreal Smart deploys its autonomous truck fleet directly to mines, managing scheduling, charging/battery swapping, and transport operations while charging clients based on transport volume or service periods.

This model mirrors E-Control Intelligent Driving’s TaaS (Truck-as-a-Service), where the company purchases trucks, handles deployment, operations, and maintenance, with clients paying per transport volume.

The core value lies in enabling clients to achieve safety and efficiency gains from autonomous transport without upfront capital commitments, significantly lowering initial investment barriers and operational risks.

/ 03 /

Autonomous Mining Trucks Scale, But Profitability Remains a Challenge

Despite rapid revenue growth, the company remains unprofitable.

In 2023, 2024, and the first nine months of 2025, Boreal Smart reported adjusted net losses of RMB 32.28 million, RMB 60.42 million, and RMB 53.3 million, respectively.

Low gross margins represent a primary driver of these losses.

In 2024, the company’s gross margin stood at 15.1%. The prospectus attributes this to the Smart Vehicles segment’s heavy reliance on hardware components, with new models, technologies, and supply chains requiring time for production ramp-up and cost optimization, temporarily suppressing margins.

From a cost perspective, autonomous mining trucks comprise two major components: vehicle chassis and autonomous driving suites.

The mining truck chassis represents the largest cost item. According to CIC data, the average price of a conventional mining truck reached approximately RMB 1.5 million in 2024, classifying it as heavy-asset equipment.

Additional costs arise from autonomous driving systems, particularly sensors—especially LiDAR and millimeter-wave radar—which dominate component expenses.

Low margins are not unique to Boreal Smart.

E-Control Intelligent Driving, which also pursued a listing, reported a mere 7.6% gross margin in 2024. The fundamental issue stems from autonomous mining trucks remaining a “hardware-heavy, delivery-intensive, and maintenance-dependent” business, with scale economies yet to fully materialize.

While unit manufacturing costs and some core component prices may decline with increased shipments, short-term improvements will likely prove gradual rather than transformative.

Notably, differing business model choices among companies are creating performance divergences.

Unlike Boreal Smart’s “vehicle sales + system” focus, E-Control Intelligent Driving initially adopted an ATaaS (Autonomous Truck as a Service) model—purchasing trucks itself while handling deployment, operations, and maintenance, with clients paying per transport volume. This approach required heavy upfront capital but accelerated scenario validation.

To improve profitability, E-Control has shifted toward a lighter ATaaS variant in recent years, where clients purchase vehicles while E-Control provides autonomous hardware, software, and technical support.

By 2024, over 40% of its active fleet operated under this model, helping raise the company’s gross margin from -29.5% to 7.6% over three years.

Overall, autonomous mining trucks have achieved initial deployment and scaling, but their ability to sustain technological advantages and expand commercial boundaries remains subject to market validation.

By Lin Bai