Racing to Spend $200 Billion on Armaments! Amazon Pushes AI to New Heights

![]() 02/09 2026

02/09 2026

![]() 447

447

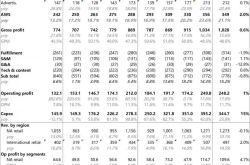

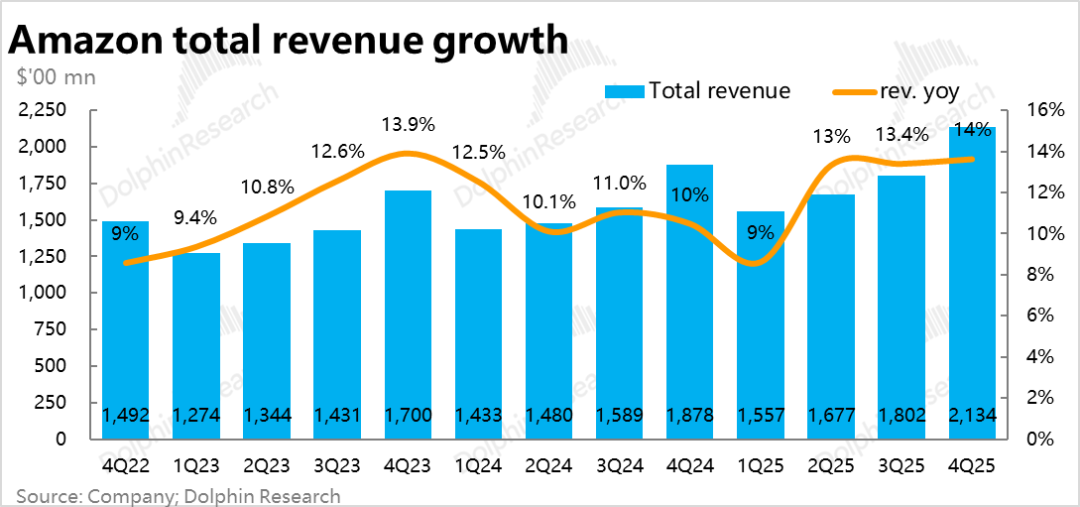

Amazon released its Q4 2025 earnings report after the U.S. stock market closed on the morning of February 6th, Beijing time. Overall, the quarterly performance was solid, with minor flaws, but both total revenue and operating profit slightly surpassed expectations. Core AWS growth also accelerated significantly as anticipated, yet the market's reaction was familiar—despite a strong quarter, the stock still plunged. Here are the details:

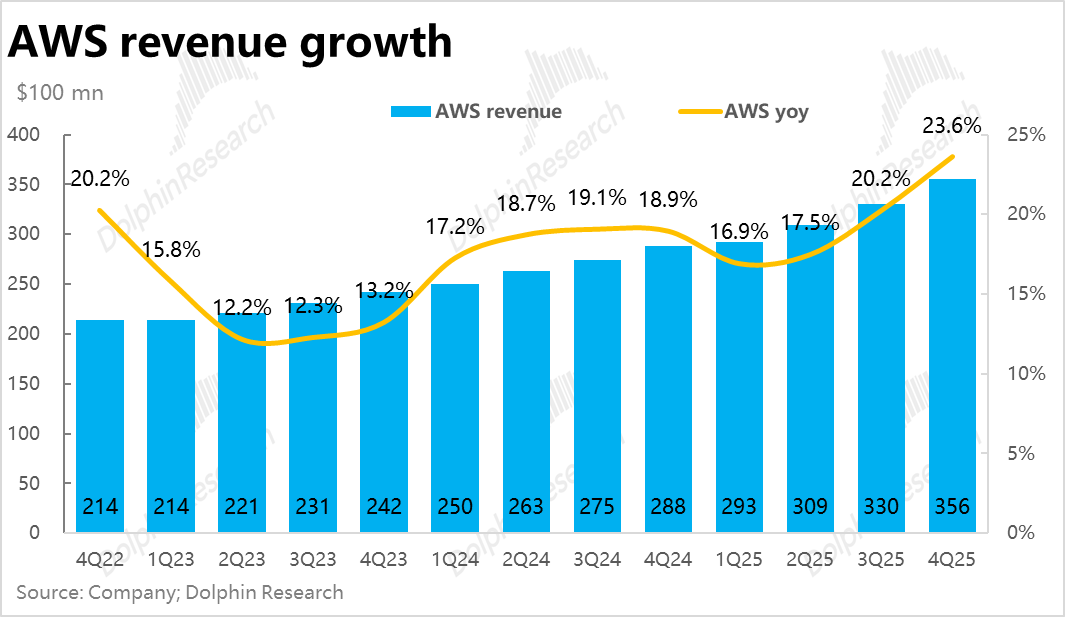

1. AWS Accelerates as Expected: AWS revenue grew 23.6% YoY this quarter (similar growth under constant currency), accelerating by 3.4 percentage points from last quarter and by a cumulative 6.7 percentage points since the start of the year, delivering the long-awaited AWS reacceleration.

However, with the market fully anticipating AWS's acceleration, the actual growth rate of nearly 23% (compared to Bloomberg's consensus of 21%) only slightly exceeded expectations.

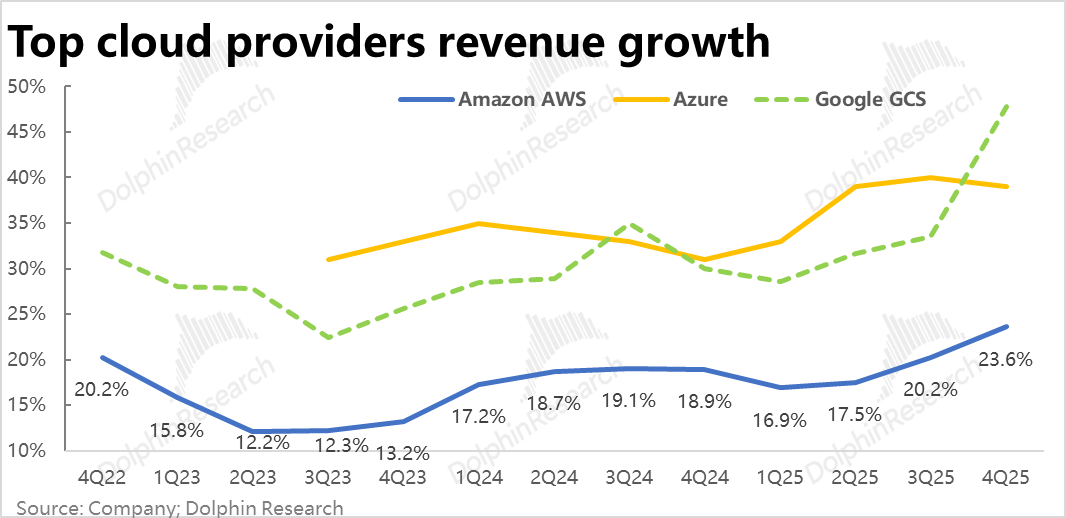

In cross-comparison, as cloud services are the most direct reflection of AI capabilities, Azure's deceleration & AWS's acceleration indicate that Amazon's AI capabilities are indeed narrowing the gap with peers.

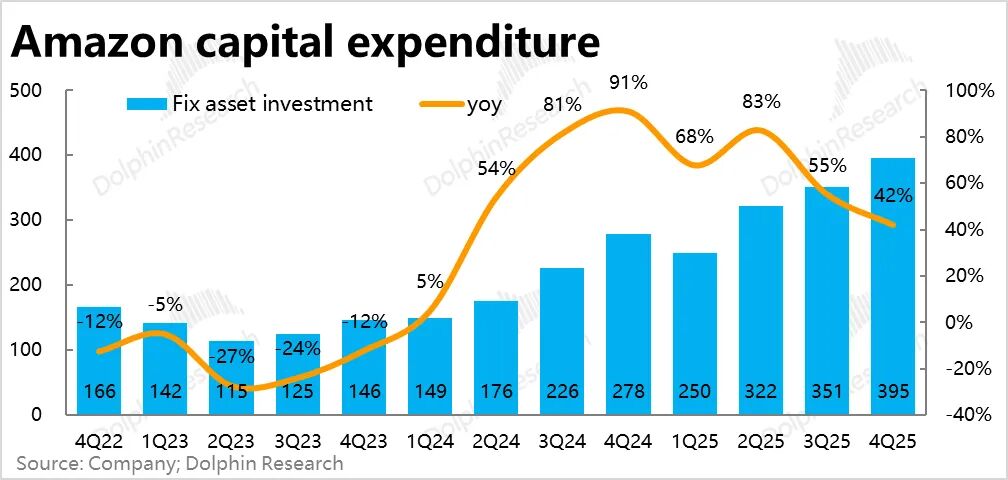

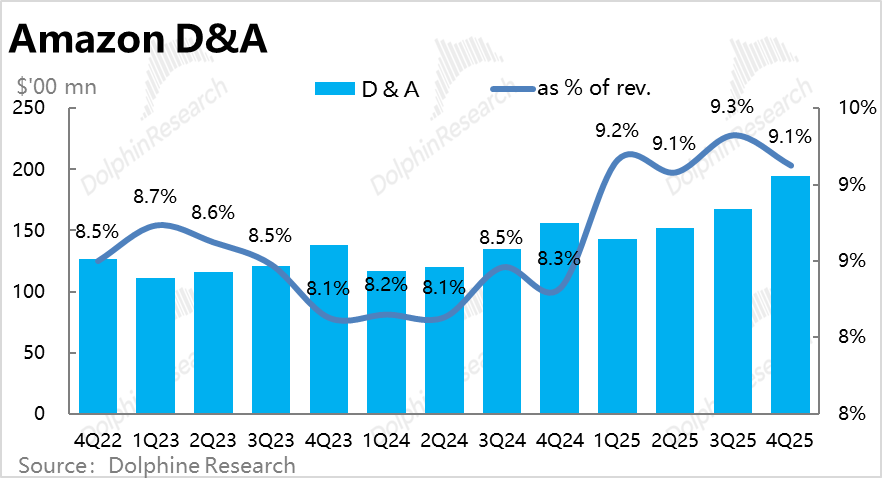

2. $200 Billion Capex Bombshell: This quarter's spending reached $39.5 billion, up over $4 billion from last quarter. However, D&A as a percentage of revenue also declined by 0.2 percentage points sequentially, contributing to the company's solid profit margins this quarter.

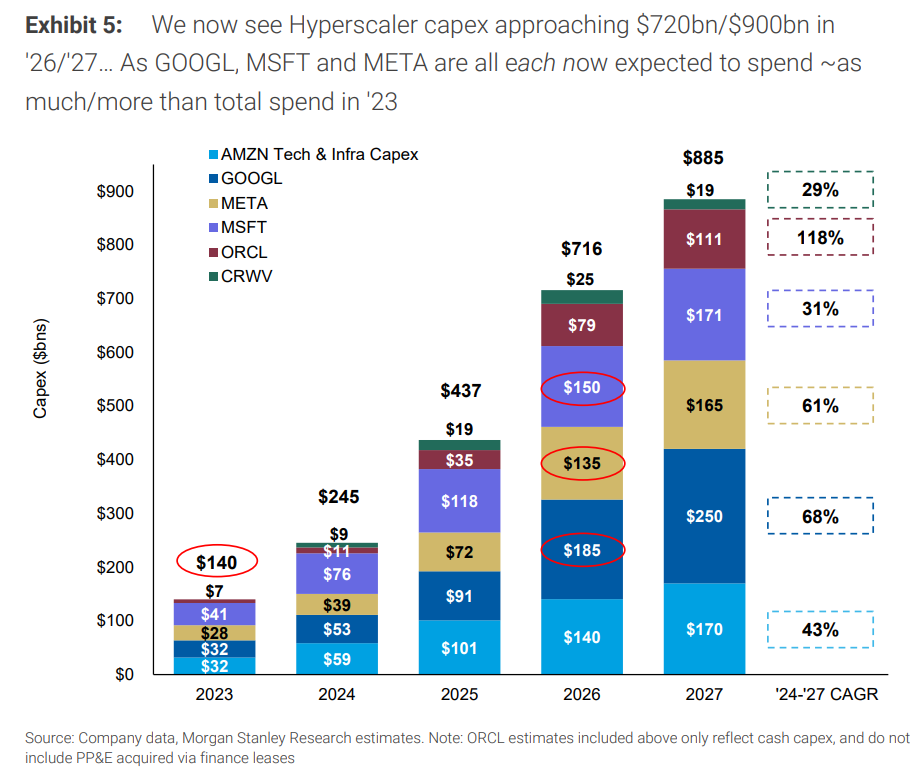

The major market concern is the company's guidance that total Capex for FY2026 will reach $200 billion, growing over 50% from an already high base in 2025 and far exceeding all other cloud giants' Capex budgets (estimated at $150-180 billion).

At this scale, depreciation's share of revenue will likely rise another 2-3 percentage points next year, exerting even greater pressure on profit margins. With the market now shifting from 'loving' to 'hating' high Capex, this is not good news.

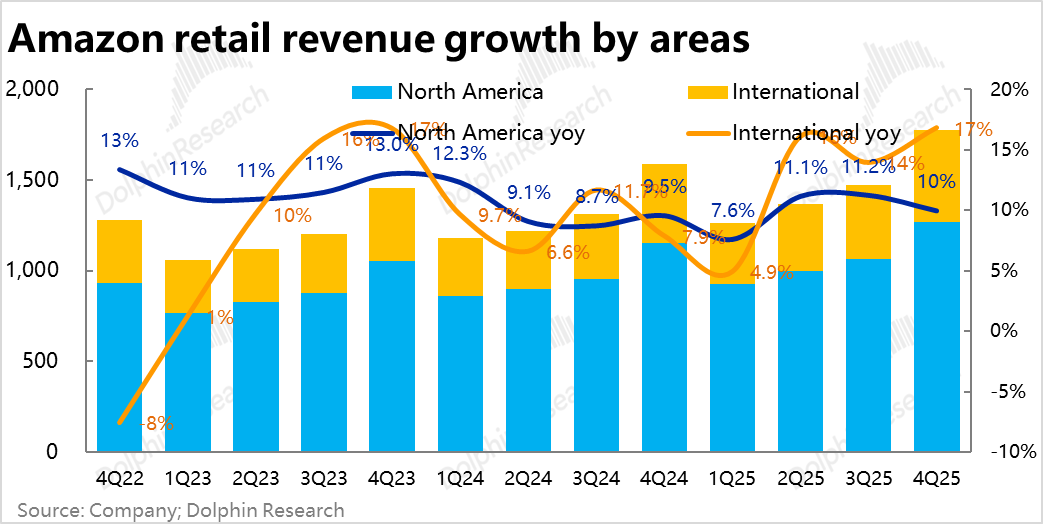

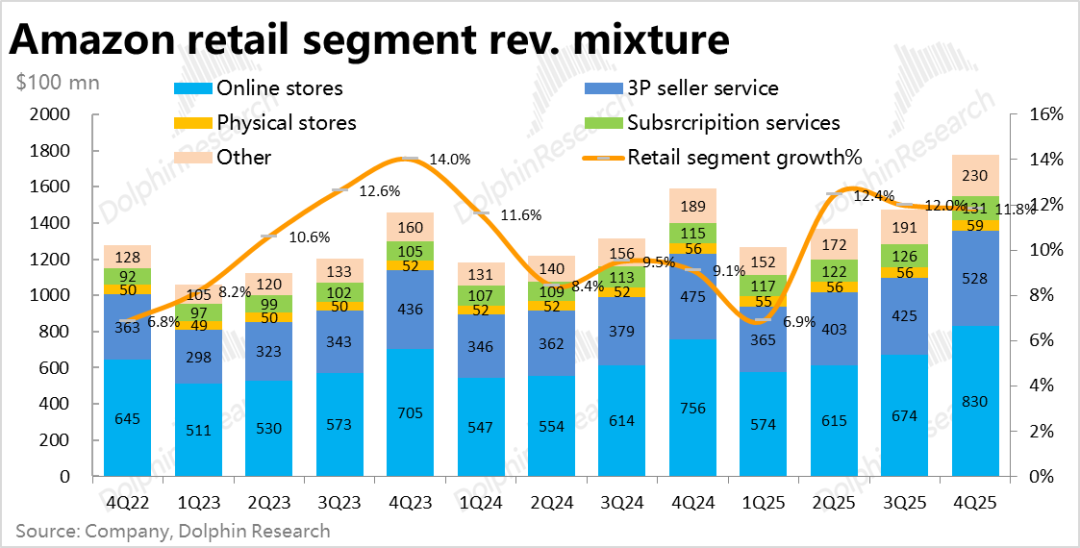

3. Steady Retail Growth: The less-focused general retail segment performed relatively steadily. Total revenue grew 11.8% YoY this quarter, slightly decelerating from last quarter.

Regionally, North American retail revenue grew 10%, slowing by 1.3 percentage points sequentially. Considering no significant deterioration in U.S. doorless retail growth overall, AI appears to be exerting some mild competitive pressure on Amazon's e-commerce.

International retail revenue grew 17% nominally this quarter due to favorable exchange rates, but actual growth under constant currency was 11%, accelerating only by 1 percentage point sequentially—largely stable.

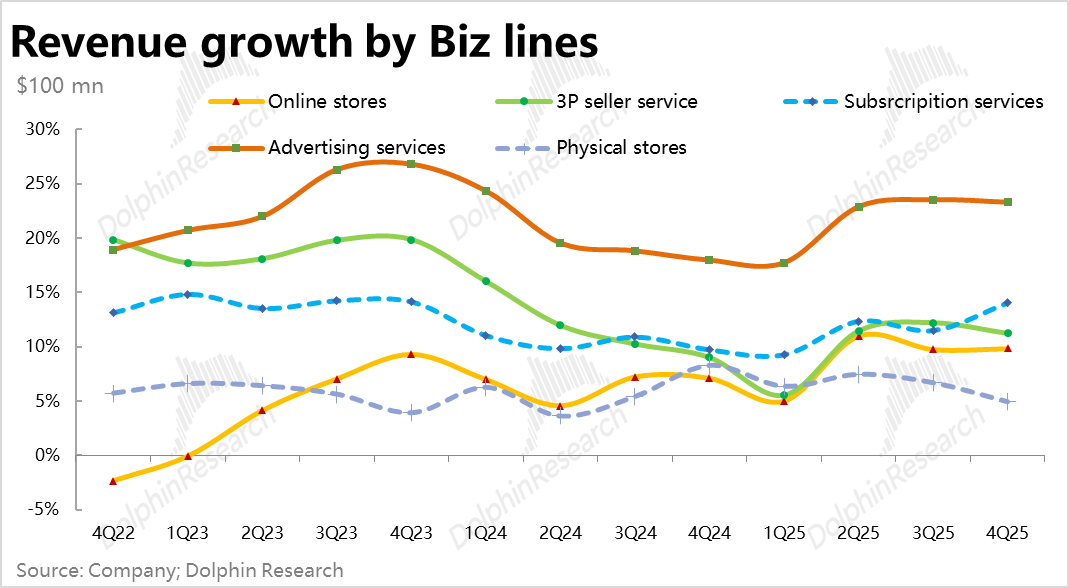

4. Advertising Continues Strong Growth: Among general retail's sub-segments, advertising and subscription services were the standout performers this quarter.

Advertising revenue grew 23.3%, the highest among general retail segments. Combined with previous reports, the ramp-up of advertising on other Amazon multimedia content like Prime Video appears to be the main driver.

Subscription revenue growth accelerated significantly to 14% from 11.5% last quarter, likely driven by the popularity of Thursday Night Football (which may have also boosted multimedia advertising).

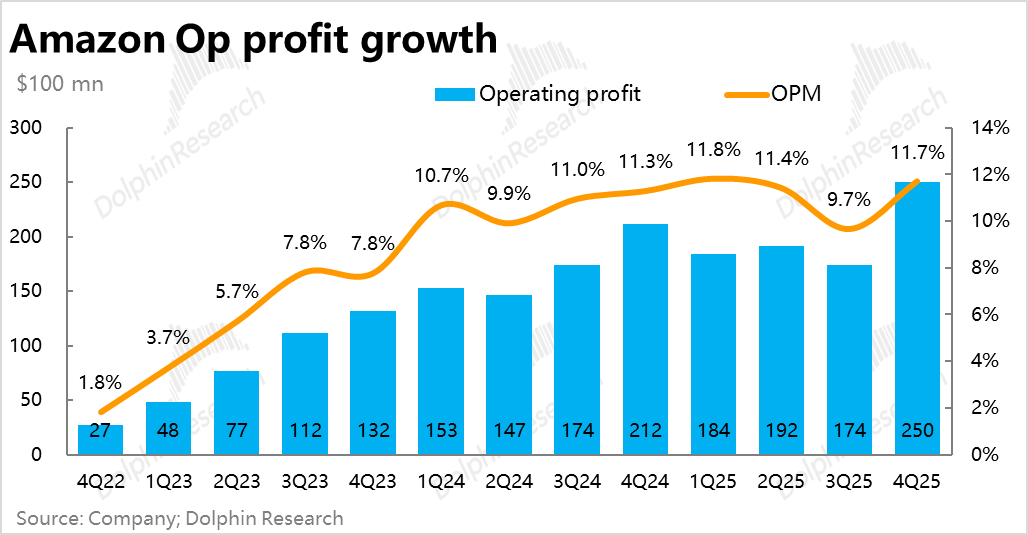

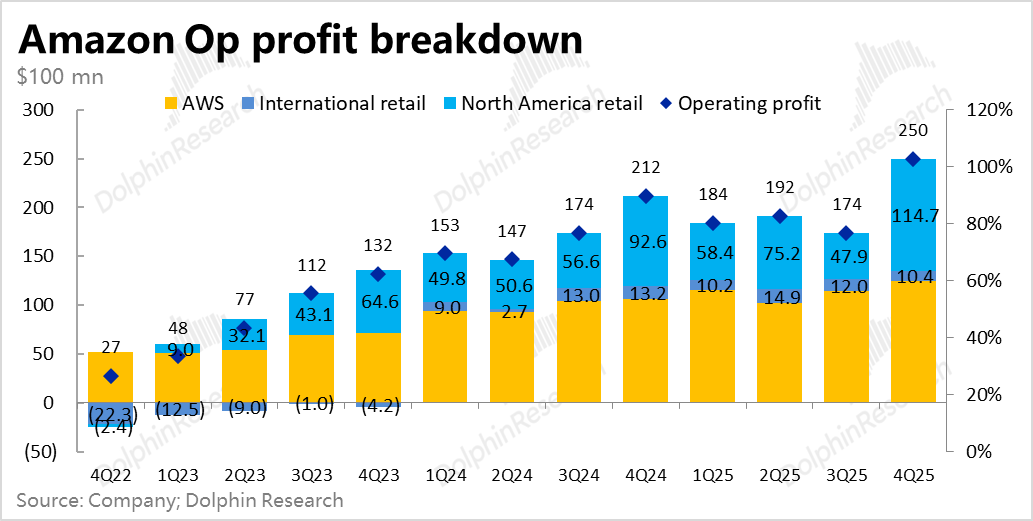

5. Profits Rise Across the Board, Solid Performance: Profit performance was also strong this quarter, with total operating profit reaching $25 billion, up nearly 18% YoY, slightly beating market expectations. Overall operating margin was 11.7%, expanding 0.4 percentage points YoY despite high Capex.

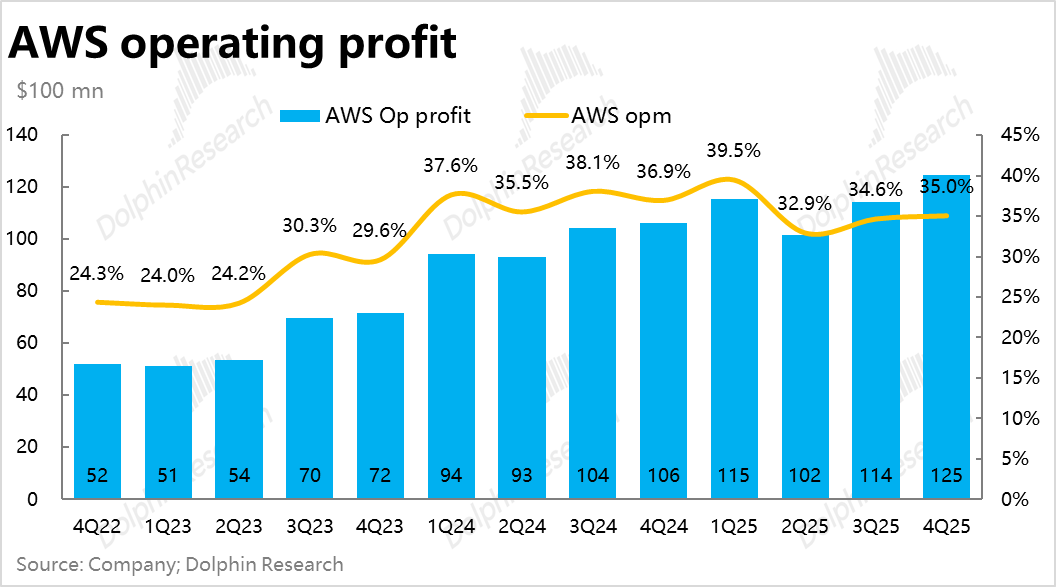

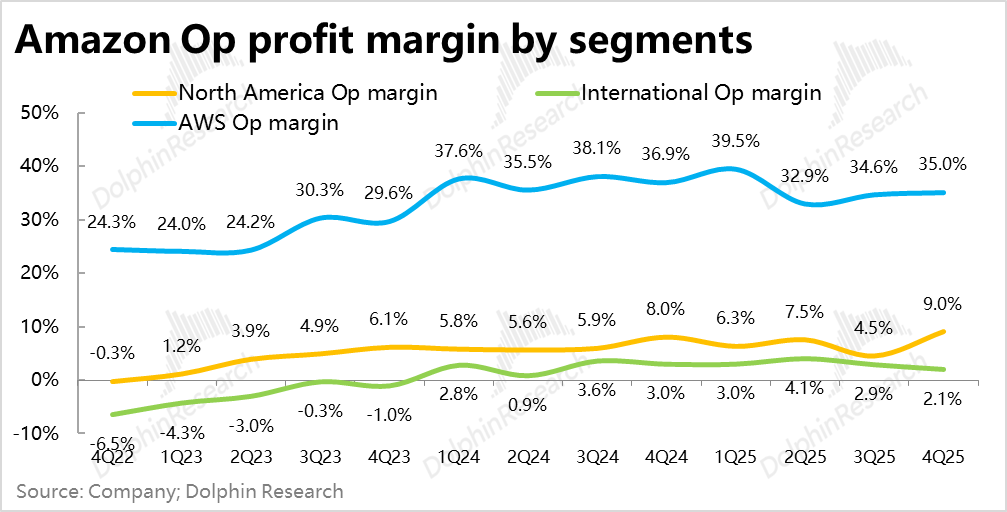

By segment, AWS's operating margin increased to 35% this quarter, up 0.4 percentage points sequentially. As mentioned earlier, the decline in D&A as a percentage of revenue was likely a contributing factor.

North America's operating margin reached 9% this quarter, up 1 percentage point YoY. Despite significant recent logistics investments (achieving same-day delivery in 2,300 U.S. towns), margins continued to rise driven by high-margin advertising and subscription revenue.

International retail's operating profit was $1.04 billion this quarter, with an operating margin of 2.1%, down 0.9 percentage points YoY. While appearing significantly below expectations, the company attributed this to one-time special expenses, with actual margins also improving YoY (see earnings call for details).

6. Cash Flow Tightens: The company's total operating cash inflow in 2025 was approximately $139.5 billion, projected to grow 15% to about $160 billion in 2026. Against a $200 billion Capex budget, this would be insufficient. External financing will be necessary (the company has less than $90 billion in liquid cash on hand, with net cash after debt deductions being extremely limited). In this quarter alone, the company raised nearly $15 billion through bond issuances, with more financing likely needed.

Dolphin Research View:

1. Solid Quarterly Performance, Capex and Guidance Are the Issues

Overall, Amazon's quarterly performance was clearly solid. Total revenue accelerated, and actual profit margins for the group and all segments continued to improve despite high Capex, slightly beating expectations.

Most critically, AWS growth accelerated by nearly 4 percentage points as expected. While the market had fully anticipated this, the actual performance still slightly exceeded expectations. Traditional general retail, while not dazzling, at least grew steadily with margins continuing to rise. Thus, on a standalone basis, this quarter's performance had few flaws.

Therefore, the core issue lies in the massive Capex guidance. The market has moved past the phase of rewarding 'higher Capex is better' and now increasingly cares—when uncertain how much incremental revenue and profit AI can generate, sustained high investments continuously burden the balance sheet/business model, diluting ROI and profit margins, actually degrading the originally excellent asset-light business model.

Additionally, guidance suggests next quarter's operating profit will be $16.5-21.5 billion, below market expectations of about $22 billion even at the upper end. The midpoint implies an OPM of 10.8%, down a full percentage point YoY, suggesting massive Capex will drag on profits.

Meanwhile, the guidance midpoint implies YoY revenue growth of 13.1%, roughly in line with this quarter, indicating steady revenue momentum. More critically, AWS revenue guidance requires close attention during the earnings call disclosures.

2. AI Competitiveness Is Indeed Improving

Beyond quarterly results, the market's fundamental concern is how Amazon's competitiveness in the AI era is evolving, with AWS growth being the intuitive reflection (direct manifestation). This explains Amazon's previously weak performance among the Mag7. Recent developments and this quarter's results show signs of improvement.

In summary, the root cause of previous weakness was Amazon's relatively weak capabilities in developing top-tier AI foundation models. Unlike Google, which has long-term AI technology accumulation, or Microsoft, which—despite its own weaknesses—early on 'tied up' with powerful external partner OpenAI.

However, Amazon is now taking a series of measures to narrow this gap, including:

1) Partnership with Anthropic: First, similar to Microsoft & OpenAI's partnership, Amazon and Anthropic (currently the second-strongest independent AI lab) have formed multi-faceted collaborations.

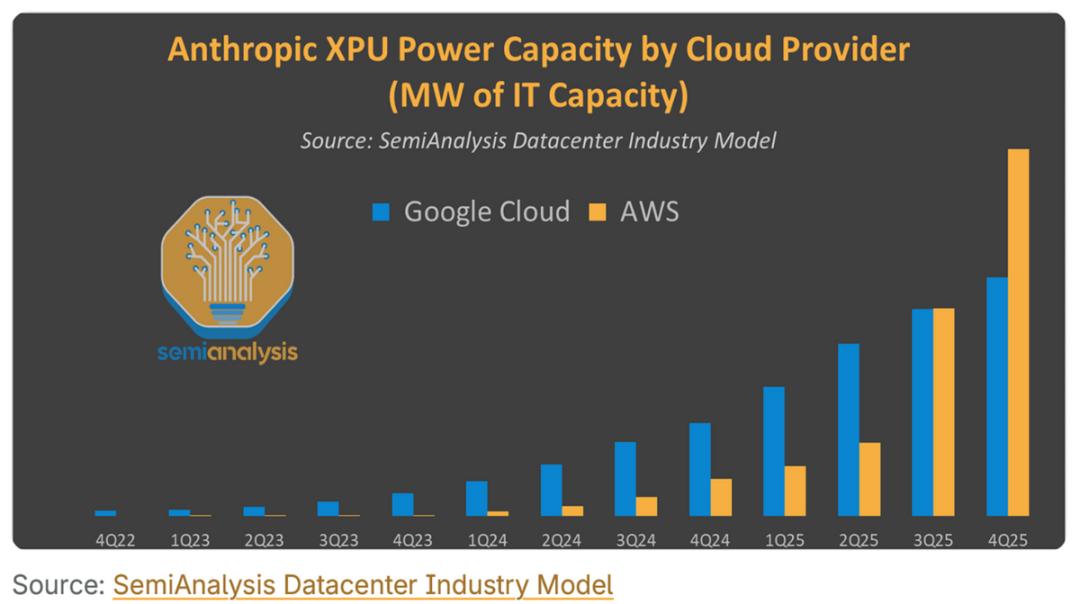

These include: a. Anthropic extensively using Trainium and Inferentia chips for model training and daily inference. Amazon's Project Rainier, built for Anthropic, is expected to reach 2.2GW in total capacity, potentially generating about $14 billion in annualized revenue for AWS at full production;

b. AWS having priority rights to sell Anthropic models (e.g., Claude Opus/Sonnet) to its customers, with customization and fine-tuning capabilities.

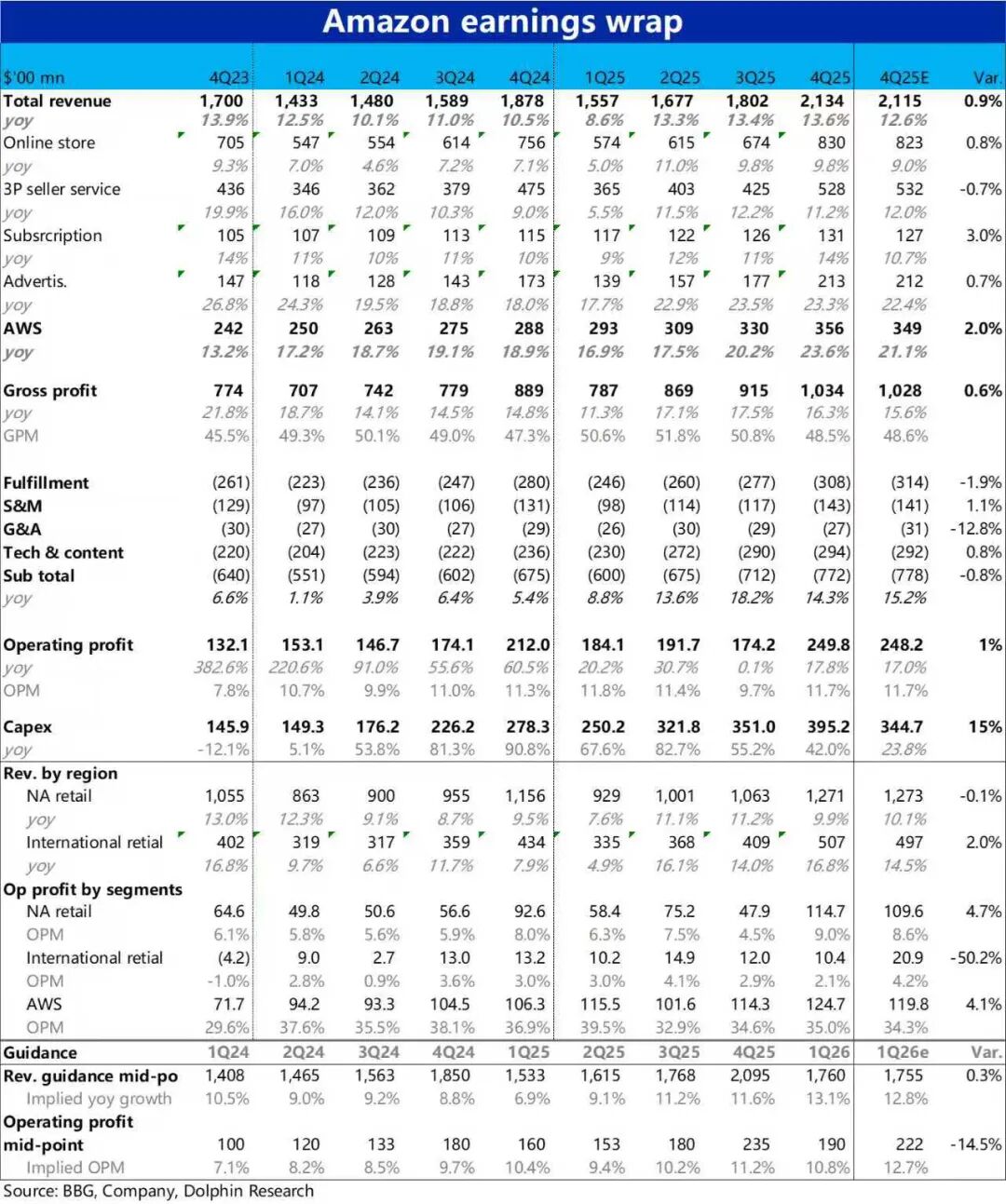

The reason Anthropic's collaboration has not yet significantly boosted AWS growth—apart from Anthropic's smaller scale and lower compute requirements compared to OAI—is, according to Semi Analysis, that Anthropic previously relied more on GCP, only shifting heavily to AWS in Q3-Q4 2025.

Thus, the growth impact on AWS will become more pronounced later. According to one foreign bank's estimates, Anthropic's revenue contribution to AWS will rise significantly from just 0.5% in 2025 to over 3% by 2027.

b. Investment in OpenAI: With Microsoft & OAI's exclusive partnership ending, Amazon and OAI have had 'frequent' interactions, attempting to make OAI another technical partner beyond Anthropic. On one hand, OAI previously announced a $38 billion, 7-year contract with AWS (likely a trial).

Recently, in OAI's new $100 billion funding round, rumors suggest Amazon intends to contribute a 'major portion' ($50 billion) to deepen the partnership. In exchange, OAI reportedly must arrange for its technicians to directly participate in developing Amazon's own AI products (e.g., Alexa). This clearly reflects Amazon's intent to rapidly strengthen its AI capabilities through external partnerships.

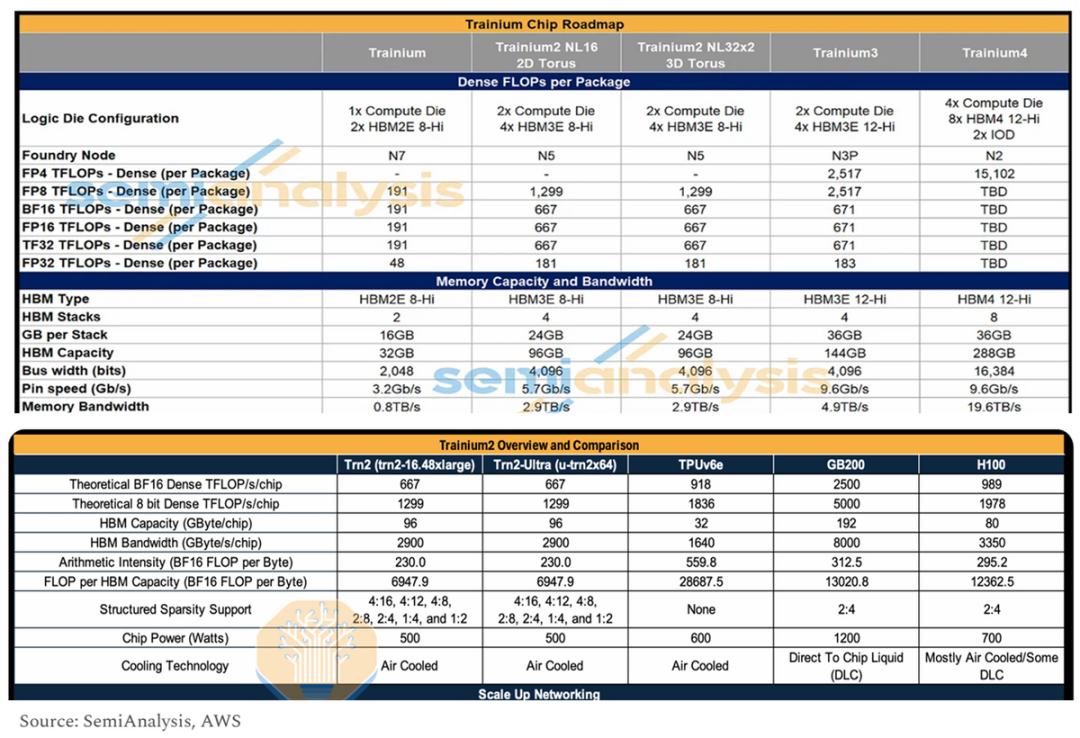

c. In-house Chip Development: Beyond software, Amazon recently launched its third-generation Trainium chip, doubling compute performance from the previous version and reaching about 127% of H100's capability.

The company also announced plans for a fourth-generation Trainium (expected to begin delivery in 2027), projected to triple FP8 compute and quadruple memory bandwidth compared to Gen3. If achieved, this would surpass NVIDIA GB200's performance (see table below for specifics).

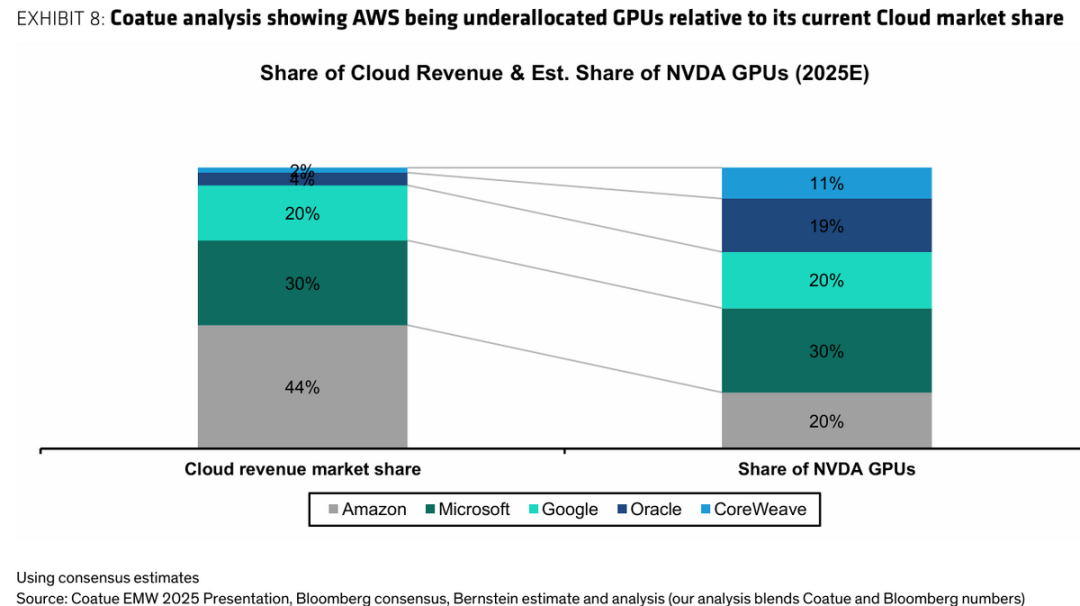

The greatest significance of in-house chips for Amazon is the potential to accelerate resolution of difficulties in obtaining cutting-edge NVIDIA chips, which have continuously constrained compute capacity expansion. A previous Coatue estimate showed that AWS—the largest cloud provider (44% market share)—only obtained about 20% of NVIDIA's chip supply, the largest deficit among top cloud providers.

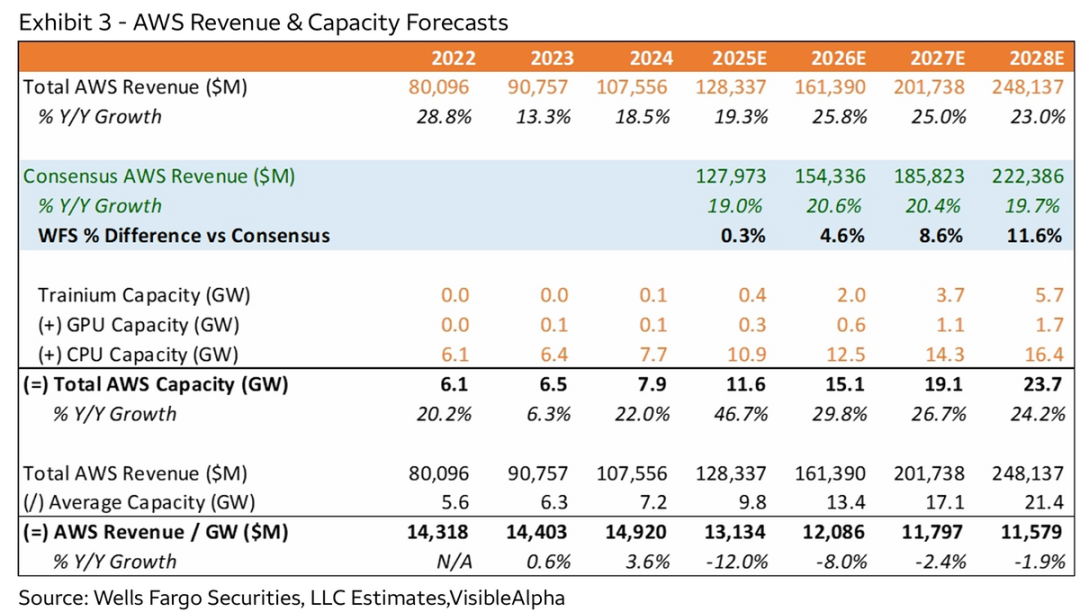

The market currently widely expects that over half of AWS's new compute capacity (e.g., Project Rainier) will be driven by in-house chips. According to one foreign bank's projection, the rough mix will be: in-house chips : NVIDIA GPUs : CPUs = 3 : 1 : 1. If so, resolving chip acquisition bottlenecks would finally allow AWS's compute capacity to scale up rapidly.

3. AWS Growth Prospects Look Bright, But at What Cost?

With software capabilities strengthened through the above partnerships and in-house chips largely addressing GPU acquisition disadvantages, the market is highly optimistic about AWS's growth prospects.

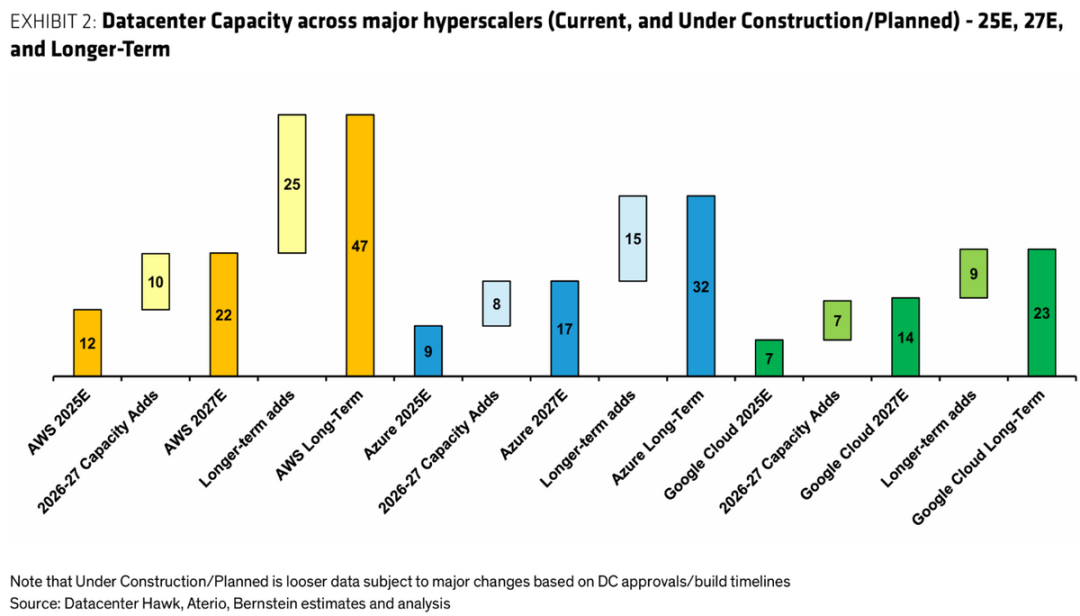

According to company disclosures, AWS will be the cloud provider adding the most new compute capacity over the next two years. Based on guidance to double compute capacity by 2027, AWS is expected to add about 10 GW of new capacity over the next two years, while Azure and GCP will add about 7-8 GW each.

With compute capacity scaling up rapidly, sell-side consensus currently expects AWS's annualized revenue under full load to exceed $200 billion by the end of 2027 (from about $129 billion in 2025). Thus, revenue growth expectations for AWS in 2026-2027 are generally at least 25%+.

In other words, the market broadly expects sustained strong growth for AWS. However, as the cloud provider adding the most new capacity, the company's disclosed Capex scale is also the industry's highest by far, raising concerns about whether sufficient demand exists to match this massive investment and whether further investments will become increasingly 'unprofitable.'

A more detailed value analysis has been published in the Changqiao App's [Dynamic - In-Depth (Research)] section under an article with the same title.

Here's the detailed analysis:

I. AWS: Accelerates as Expected, Is the AI Capability Gap Narrowing?

The single most 'make-or-break' metric—AWS revenue grew 23.6% YoY this quarter to $35.6 billion (similar growth under constant currency), accelerating by 3.4 percentage points sequentially and by a cumulative 6.7 percentage points since the start of the year. This delivered the long-awaited AWS reacceleration.

However, with the market fully anticipating AWS's acceleration (Bloomberg consensus at 21% vs. actual buy-side expectations near 23%), the performance—while undoubtedly strong—did not constitute a major upside surprise.

Combined with pre-earnings reports, AWS's recent acceleration mainly stems from alleviated compute supply bottlenecks (driven by Capex increases and in-house chip shipments) and contributions from partnerships with major clients like Anthropic and OpenAI.

When compared horizontally with the other two major cloud service providers, Azure is slowing down & AWS is accelerating. Previously, Amazon's gap in AI capabilities and business with its peers was indeed narrowing.

Meanwhile, AWS's operating profit margin for the quarter increased to 35% instead of decreasing, up 0.4 percentage points (pct) quarter-over-quarter (QoQ), with the year-over-year (YoY) decline also continuing to narrow, significantly better than the Bloomberg consensus of 34.3%. It seems that it has not been particularly affected by the increase in Capex and the drag of generally lower gross margins in AI businesses compared to traditional businesses.

As a result, revenue growth accelerated as expected, and the deterioration in profit margins was not as severe as feared. Looking solely at this quarter, AWS's performance was actually quite good.

II. Capex Surges to $200 Billion, Is Profit Pressure Still Looming?

In terms of Capex, spending this quarter was $39.5 billion, roughly flat compared to the previous quarter (a slight decrease of $100 million). Although still at a high level, it did not increase further QoQ. Correspondingly, diluted by revenue growth this quarter, the proportion of D&A decreased by 0.2 pct compared to the previous quarter. Dolphin Research believes that this may be one of the reasons why AWS's profit margin was still decent this quarter.

While Capex continued to rise this quarter, the issue is that the company's guidance indicates that total Capex for 2026 will reach $200 billion! This is a 43% increase from the already high quarterly figure of $35 billion. It also far exceeds the current Capex budgets of all other cloud giants (estimated to be between $150 billion and $180 billion).

Based on this guidance, the proportion of depreciation to revenue is likely to increase by another 2-3 pct, putting more obvious pressure on profit margins. At a time when the market is generally questioning the excessive investment by cloud companies and its impact on lowering their ROI, this is not good news.

III. Steady Growth in Pan-Retail, Multimedia Business Drives Growth

Equally important but currently less focused on, the overall performance of the pan-retail sector has been relatively stable. Total revenue for the quarter was $177.8 billion, up 11.8% YoY, with the growth rate slightly decreasing steadily compared to the previous quarter.

By region, retail revenue growth in North America was 10%, slowing down by 1.3 pct compared to the previous quarter. Considering that the overall growth of doorless retail in the United States has not significantly deteriorated recently, with YoY growth rates of 6%-9% from September to November and an overall growth rate of around 8% in the third quarter, it appears that stronger competition in the AI era seems to be having some impact on Amazon.

The nominal growth rate of retail business in international regions benefited from favorable exchange rates, reaching as high as 17% this quarter. However, the actual growth rate at constant exchange rates was 11%, only accelerating by 1 pct compared to the previous quarter, not as strong as it initially appeared.

Looking at segmentation (Note: This Chinese term means "detailed" or "segmented" business lines, but as it's not standard English, I'll interpret it in context) business lines, growth across all business lines has been relatively stable. More specifically, the following are noteworthy:

a. Revenue growth rates for self-operated retail, offline stores, and third-party merchant services have slightly decreased or remained largely flat QoQ.

b. Advertising revenue growth remains strong at 23.3%, the highest among the pan-retail business lines. Combined with previous reports, the increase in advertising on other Amazon multimedia content, such as Prime Video, should be the main driving force.

c. Correspondingly, subscription revenue growth increased from 11.5% in the previous quarter to 14% this quarter. Combined with company disclosures, the popular Thursday Night Football series and favorable exchange rates may be one of the main reasons for the accelerated growth.

IV. Impressive Profit Performance, Profit Margins Increase Across the Board

Combining all businesses, Amazon's total revenue for the quarter was $213.4 billion, up 13.6% YoY, slightly accelerating and slightly higher than market expectations. Excluding the impact of favorable exchange rates, the actual growth rate was roughly flat QoQ at 12%.

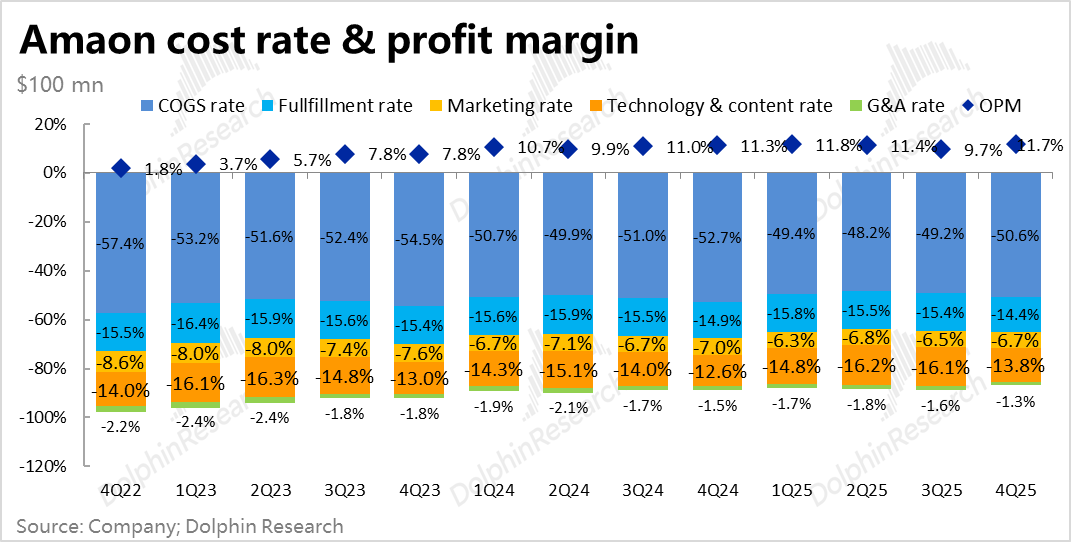

Profit performance was also good, with total operating profit of $25 billion, up nearly 18% YoY, slightly beating market expectations. The overall operating profit margin was 11.7%, still expanding YoY by 0.4 pct despite high Capex.

By segment:

a. As mentioned earlier, AWS's profit margin increased QoQ this quarter, performing well.

b. The operating profit margin in North America reached 9% this quarter, up 1 pct YoY. Although the company has recently increased its logistics investment (achieving same-day delivery in 2,300 U.S. towns and cities), driven by high-margin businesses such as advertising and subscription revenue, profit margins are still rising.

c. The operating profit in the international retail segment was $1.04 billion this quarter, significantly below expectations of $2.09 billion. The corresponding operating profit margin was 2.1%, down 0.9 pct YoY. However, the company explained that this was also due to the impact of special one-time expenses. If these were excluded, profit margins would still be expanding YoY. (For specific explanations, please refer to the earnings call.)

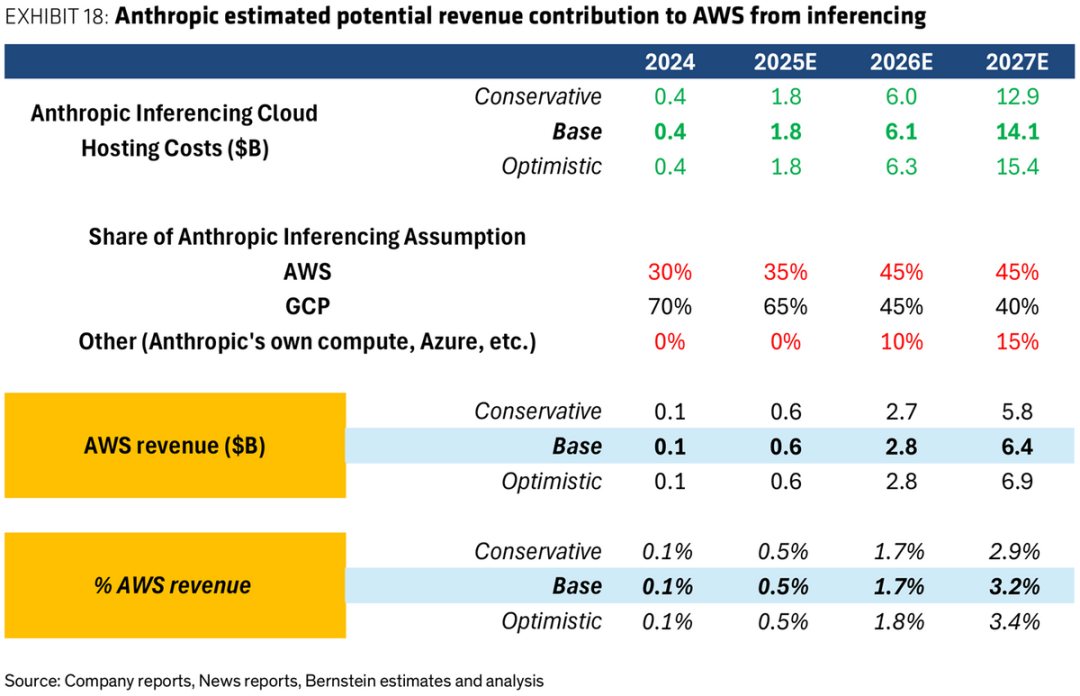

V. Gross Margin Still Expanding, R&D is the Only High-Growth Investment

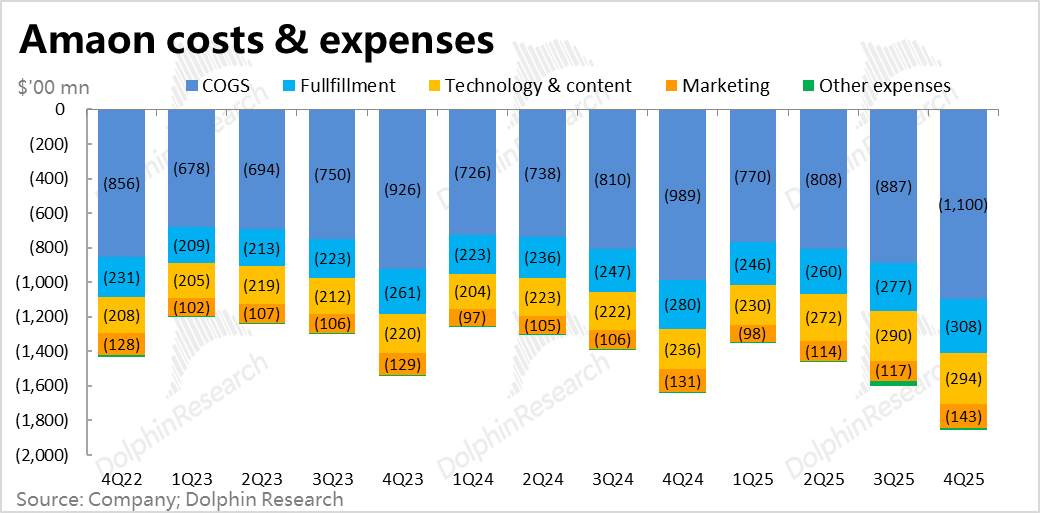

From the perspective of costs and expenses, the company's overall gross margin for the quarter was 48.5%, expanding by 1.2 pct YoY, with the increase slightly narrowing compared to the 1.8 pct increase in the previous quarter. However, it is evident that even with continuously rising capital expenditures, due to the increase in the proportion of high-margin businesses and optimization of operating efficiency, gross margins are still rising.

From the perspective of expenses, total operating expenses for the quarter were $77.2 billion, up 14% YoY, slightly lower than the expected 15%. Of course, compared to the growth rate of less than 10% that has persisted for more than two years, it has entered an investment phase.

Specifically, except for R&D expenses, fulfillment and marketing expenses only increased by around 10% YoY, while administrative expenses even decreased by 6% YoY. Only R&D & content expenses increased significantly by 25% YoY.

Since AWS's employee salaries, R&D costs, some equipment costs, and streaming content production costs are recorded in this expense item, it is evident that there has been significant investment in these businesses.

- END -

// Transfer Authorization

This article is an original work by Dolphin Research. If you wish to reprint it, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is for general comprehensive data purposes only, intended for general reading and data reference by users of Dolphin Research and its affiliated institutions. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report must bear their own risks. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or views mentioned in this report shall not be considered or construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor shall they constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for or proposed to be distributed to jurisdictions where the distribution, publication, provision, or use of such information, tools, and data contradicts applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliated companies are required to comply with any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. No institution or individual may, without the prior written consent of Dolphin Research, (i) make, copy, reproduce, duplicate, forward, or distribute in any form any copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all relevant rights.