Waymo Secures $16 Billion in Record-Breaking Funding: Will Chinese L4 Autonomous Driving Companies Experience a Revaluation?

![]() 02/09 2026

02/09 2026

![]() 479

479

Source: Zhiche Technology

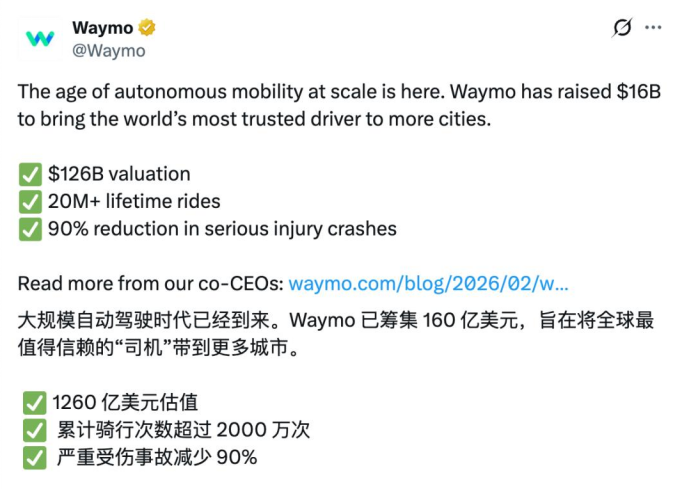

On February 2 (local time), Waymo, the autonomous driving subsidiary of Google's parent company Alphabet, announced the successful completion of a new funding round, raising a staggering $16 billion. This marks the largest single financing deal in the global autonomous driving sector to date.

Following this infusion of capital, Waymo's post-money valuation soared to $126 billion, cementing its status as the industry's highest-valued unicorn and signaling the official entry of the global L4 autonomous driving sector into a new era of scaled commercialization.

Billion-Dollar Funding Ignites Industry Enthusiasm

The funding round attracted a star-studded lineup of investors, co-led by Dragoneer Investment Group, DST Global, and Sequoia Capital, with participation from global heavyweights including Andreessen Horowitz, Mubadala Capital, Bessemer Venture Partners, Silver Lake, and Tiger Global. Alphabet, Waymo's controlling shareholder, not only participated in this round but also maintained its majority stake, providing stable strategic support for technological innovation and business expansion. This move is widely interpreted as Alphabet's strong confidence in the long-term value of the autonomous driving sector.

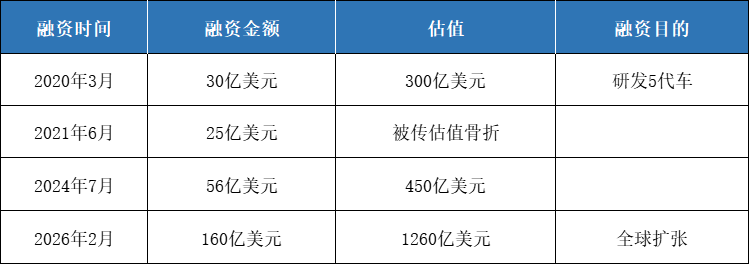

Reviewing Waymo's funding history, since its first public financing in 2020, it has completed four rounds totaling $27.1 billion. The previous round in October 2024 raised $5.6 billion at a valuation of approximately $45 billion. Over just 16 months, Waymo's valuation surged by 180%, reflecting robust capital market recognition of its technological maturity and commercialization potential.

As a global pioneer in autonomous driving, Waymo originated from Google's self-driving project launched in 2009 and became an independent Alphabet subsidiary in 2016. To date, it has accumulated over 125 million miles of fully autonomous driving. Its Waymo Driver system demonstrates industry-leading safety, with a 90% lower rate of serious injury or fatal accidents compared to human driving.

Beyond its core Robotaxi business, Waymo is actively exploring new business lines. According to The Information, the company has three main initiatives: (1) food delivery services using Robotaxi trunks for drop-offs at designated locations; (2) relaunching its Robotruck business focusing on long-haul freight; and (3) licensing autonomous driving technology to automakers, though this area has yet to see substantial progress. These diversified efforts will help Waymo expand revenue streams, reduce reliance on a single business, and further refine its commercial ecosystem.

Regarding the use of funds, Waymo's co-CEOs Tekedra Mawakana and Dmitri Dolgov stated in an official announcement that the capital will focus on three key areas: (1) expanding the Robotaxi fleet while optimizing vehicle hardware costs and operational efficiency; (2) accelerating global expansion, with plans to launch services in over 20 international cities including London and Tokyo (London service to debut in Q4 2026, marking its first European market entry); and (3) advancing autonomous driving technology to enhance complex road condition adaptation and dynamic target recognition capabilities, while improving end-to-end operational systems.

Supporting this valuation surge are Waymo's improving commercial operations. The company now operates stably across six major U.S. metro areas: Phoenix, San Francisco, Los Angeles, Austin, Atlanta, and Miami. In January, it received approval to launch autonomous services to and from San Francisco International Airport. Additionally, its partnership with Uber has broadened service accessibility, marking its transition from concept validation to scaled operations.

Waymo's billion-dollar funding not only fuels its own growth but also significantly impacts the global autonomous driving industry. After a period of capital caution, this record financing reignites sector enthusiasm, reflecting renewed investor confidence in autonomous driving commercialization. It will also accelerate industry resource consolidation around leading firms, compelling smaller players to focus on niche markets for differentiated competition.

Revaluation Moment for Chinese Players

The autonomous driving industry now features two distinct camps: U.S. technological depth versus Chinese implementation efficiency. Waymo leads the L4 race with its technological edge and capital strength, while Chinese frontrunners like Baidu's Apollo Go, Pony.ai, and WeRide leverage policy support and scenario advantages to excel in commercialization efficiency and cost control, creating a clear differentiated competition landscape. With Waymo's valuation doubling, revaluing Chinese L4 autonomous driving players may become an industry focal point.

Baidu's Apollo Go focuses on the core Robotaxi sector, operating in 22 global cities including Beijing, Shanghai, Shenzhen, Wuhan, Hong Kong, Dubai, and Abu Dhabi, with over 240 million cumulative autonomous miles. As of November 2025, it handles over 250,000 weekly orders—all fully driverless—surpassing 17 million total orders. These metrics rank it among global leaders, making it the Chinese Robotaxi company closest to Waymo's commercialization stage, with its value proposition rising alongside industry development.

WeRide distinguishes itself as the "first dual-listed company" in the sector—being the first global Robotaxi IPO and the first general-purpose autonomous driving IPO. Unlike single-segment players, WeRide's AI driving technology covers all scenarios, deployed across Robotaxi, Robobus, autonomous delivery vehicles, and street sweepers. In 2025, it began mass-producing L2 driver-assistance solutions, becoming China's most diversified autonomous driving enabler. As of October 31, 2025, its fleet exceeded 1,600 vehicles, including nearly 750 dedicated Robotaxi units. By mid-January 2026, its global Robotaxi fleet officially entered the "thousand-vehicle era," continuously improving its scaled operation capabilities.

Pony.ai, which went public in Hong Kong alongside WeRide, has built a three-pronged business matrix covering Robotaxi, Robotruck, and technology licensing. By late January 2026, its Robotaxi fleet had officially surpassed 1,159 vehicles, with projections to exceed 3,000 units in 2026. Public data shows its next-gen Robotaxi achieved per-vehicle profitability in Guangzhou, marking a critical commercialization milestone and demonstrating strong growth resilience.

With Waymo's valuation now tripling, the question arises: Should Chinese L4 autonomous driving players also be revalued amid global industry restructuring?

New Phase of Intensified Competition

2026 marks a pivotal year for scaled L4 autonomous driving technology breakthroughs, with sector competition reaching fever pitch.

Expanding application scenarios are driving industry growth. From Robotaxi to freight trunk transportation, autonomous logistics vehicles, shuttles, and mining vehicles, L4 use cases are becoming clearer, with increasingly concrete commercialization paths.

Capital activity remains robust. Public data shows L4 autonomous driving financing exceeded 30 billion yuan ($4.2 billion) in 2025. The player ecosystem continues expanding, with companies like Hello, Neolix, and Idriverplus accelerating deployments, Pony.ai's successful Hong Kong listing, and continued investments from Didi, Stena Driving, and Carl Force. Meituan also reshuffled its autonomous vehicle leadership in January 2026 to adjust strategic layouts and seize market opportunities.

Technological evolution is entering a new upgrade cycle. Waymo's disclosed technical roadmap shows core technologies like dual-system architectures, end-to-end algorithms, large model empowerment, and full-chain data loops have been validated and deployed, providing critical references for industry upgrades.

However, even as a global sector pioneer, Waymo faces challenges in its rapid expansion. The company increasingly faces safety scrutiny following incidents where its Robotaxis violated traffic rules near schools and was involved in a minor collision with a child. This has sparked public safety debates, prompting joint investigations by the U.S. National Highway Traffic Safety Administration (NHTSA) and National Transportation Safety Board (NTSB), with regulatory pressures mounting.

While Waymo's per-vehicle costs have dropped significantly from early levels, they remain high at $150,000, limiting adaptability to emerging markets. Additionally, with moderate growth in U.S. mobility demand, its global expansion must navigate regional regulatory compliance and cost pressures.

Despite strong operational data, Waymo's fleet size remains constrained at approximately 2,500 Robotaxi vehicles. This limited scale represents a bottleneck for scaled operations.

Waymo emphasized in its statement: "We're no longer validating autonomous driving concepts—we're scaling commercial realities." This billion-dollar funding marks a critical transition from R&D to scaled profitability in the autonomous driving industry. With capital deployment and technological optimization, Waymo is poised to solidify its global leadership and expand services to more cities. Global sector competition will shift from technological prowess to comprehensive contests of "technological maturity + commercialization efficiency + regulatory compliance."

For the industry, Waymo's exploration provides a blueprint for leading firms' scaled expansion while driving ecosystem upgrades across the supply chain, accelerating autonomous driving's integration into daily life.

For Chinese players, Waymo's valuation surge and scaled exploration present both opportunities and challenges—validating L4 commercialization prospects while compelling Chinese firms to accelerate technological iteration and cost optimization, focusing on niche scenarios for differentiated advantages.

Global autonomous driving players are simultaneously entering a new revaluation cycle alongside Waymo, as a comprehensive competition encompassing technology, capital, and commercialization has just begun.

- End -

Disclaimer:

Works marked "Source: XXX (non-Zhiche Technology)" in this publication are reprinted from other media for information-sharing purposes only. This platform does not necessarily endorse their views or verify their authenticity. All copyrights belong to the original authors. For any infringements, please contact us for removal.