2026 Cost Battle Commences: The 'Life-or-Death' Struggle Amidst Soaring Raw Material Prices and Policy Withdrawal

![]() 02/09 2026

02/09 2026

![]() 326

326

The haze of price wars in the automotive sector has yet to dissipate, but the clarion call for cost battles has already resounded loudly at the dawn of 2026. Since 2025, there has been a broad-based increase in the prices of core raw materials for power batteries and lightweight metal materials for vehicle bodies. Automotive-grade memory chips have witnessed a short-lived surge due to capacity constraints within the artificial intelligence sector. Against the backdrop of halved purchase tax incentives for new energy vehicles and adjustments to 'trade-in' subsidy policies, China's automotive industry is now grappling with the dual challenges of escalating costs and demand pressures.

Data from the National Bureau of Statistics reveals that the sales profit margin of China's automotive manufacturing industry stood at a mere 4.1% in 2025, marking a historic low for industry profits. Concurrently, cost pressures from the upstream supply chain are cascading down to the downstream vehicle manufacturing sector with unprecedented speed and intensity, eroding automakers' profit margins. At the same time, fierce competition among over 100 active brands in China's electric vehicle market has constrained automakers' pricing power, subjecting them to both market and cost constraints. This cost battle not only tests automakers' cost control and supply chain management capabilities but also progressively narrows the survival space for small and medium-sized automakers, while further accentuating the core advantages of leading companies amidst industry transformations.

▍Dual Pressures from Rising Raw Material Prices and Chip Competition

The cost pressures confronting automakers in 2026 primarily emanate from collective price hikes in the upstream raw material market. The soaring prices of core metal materials such as lithium, copper, aluminum, and tin have plunged the automotive manufacturing industry, which heavily relies on stable raw material costs, into a state of 'material agony.' Electric vehicles (EVs), which utilize significantly more of these metal materials than traditional fuel vehicles, have been the hardest hit in this raw material price surge.

As a core raw material for power batteries, the price trajectory of battery-grade lithium carbonate has been particularly remarkable. It surged from 75,700 yuan per ton at the beginning of 2025 to 182,200 yuan on January 26, 2026, marking an increase of over 150%. The price hike intensified further since the fourth quarter of 2025, with a 35% increase in just 23 days. Despite subsequent minor corrections, prices remain at record highs.

The price escalations for copper and aluminum have significantly elevated the costs of automotive lightweighting. Domestic electrolytic copper prices breached the 100,000 yuan per ton threshold at the end of 2025, repeatedly reaching all-time highs. On January 29, 2026, LME copper prices extended their gains to 10.1%, setting another record. Analysts have even revised their 2026 LME spot copper price forecast upwards by 14%. Aluminum prices, which fluctuated between $2,500 and $2,700 per ton in 2025, had their 2026 first-half target price raised to $3,150 per ton by Goldman Sachs.

The price increase for tin metal is equally noteworthy. In early 2026, the price of Shanghai tin 2602 reached approximately 440,000 yuan per ton, nearly doubling from 250,000 yuan per ton in February 2025. With EVs using 2-3 times more tin per vehicle than traditional cars, coupled with surging demand for tin from AI servers and the photovoltaic industry, the tin price hike has further intensified material cost pressures for electric vehicles.

UBS research data offers a clear reference for the changes in vehicle manufacturing costs due to raw material price hikes. A typical mid-size intelligent electric vehicle requires about 200 kg of aluminum and 80 kg of copper. In just the past three months, aluminum and copper have increased manufacturing costs per vehicle by 600 yuan and 1,200 yuan, respectively. New energy vehicles utilize 99.3 kg of copper per vehicle, more than four times the 22 kg used in fuel vehicles. The average aluminum usage per vehicle also reaches 219 kg. Magnesium alloys, constrained by cost and process limitations, cannot replace aluminum in the short term. This leaves electric vehicles bearing far higher cost pressures than fuel vehicles amidst the general raw material price hike.

Rising raw material prices not only directly impact vehicle manufacturing but also exert downward pressure on the profit margins of power battery manufacturers. Citibank has thus added leading battery companies such as CATL and Eve Energy to its 30-day downward catalyst watch. As batteries are the core component of electric vehicles, their cost increases will ultimately be further passed down to the vehicle manufacturing sector, forming a vicious cycle of cost hikes.

If rising raw material prices represent traditional cost pressures for automakers, then the surge in automotive-grade memory chip prices has emerged as a new challenge in the 2026 cost battle. This chip competition, triggered by the AI sector, has left the automotive industry in a passive position of 'competing with AI for memory.'

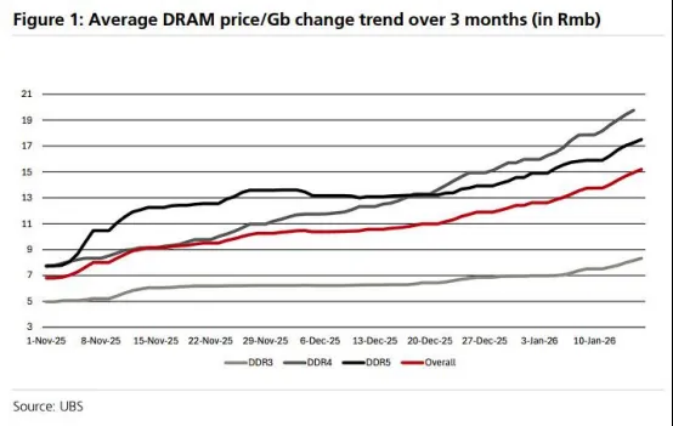

Report data indicates that DRAM prices in automotive applications have surged 180% in three months. Wells Fargo points out that DDR5 spot prices are more than eight times higher than the 2024 average, while DDR4 prices are 16 times higher. Automotive-grade DRAM, already priced higher than consumer-grade products due to stringent standards for temperature resistance, shock resistance, and high reliability, faces even greater pressure as the automotive industry accounts for less than 10% of the global DRAM market, with some data showing this proportion as low as 3%. This weak bargaining power makes it difficult for automakers to resist chip price hikes.

More critically, the world's top three memory manufacturers—Samsung, SK Hynix, and Micron—have reallocated over 80% of their advanced process capacity to high-margin HBM and premium DDR5 products, actively reducing consumer-grade production lines like DDR4. Explosive demand for AI servers has filled wafer fabs and packaging and testing plants to capacity, leaving the automotive industry as the weaker party in capacity allocation. TrendForce even predicts that the supply satisfaction rate for automotive storage chips may fall below 50% in the first quarter of 2026.

Calculations reveal that the DRAM cost for a moderately intelligent electric vehicle has climbed from about 700 yuan before the price hike to 2,000 yuan, increasing per-vehicle costs by 1,300 yuan alone. William Li of NIO bluntly stated that the biggest cost pressure for automakers this year comes not from traditional raw materials but from memory needed for core components like the Shenji chip and NVIDIA chips. Lei Jun of Xiaomi disclosed that memory prices are rising quarterly, with a 40% to 50% increase last quarter, and memory costs for vehicles alone may rise by several thousand yuan in 2026.

▍Policy Withdrawal and Market Challenges: Automakers' Dilemma

Sharp cost fluctuations could potentially be mitigated through moderate price increases during periods of robust demand. However, the Chinese automotive market in 2026 finds itself at the crossroads of weakening policy support and low consumer confidence. Starting January 1, the long-standing purchase tax exemption policy for new energy vehicles has been phased out, replaced by a halved tax rate (effective 5%) with a 15,000 yuan tax reduction cap. For a 200,000 yuan new energy vehicle, consumers now face an additional tax burden of about 8,850 yuan.

Simultaneously, the 'trade-in' subsidy mechanism has undergone significant overhauls. Instead of universal fixed subsidies, returns are now based on 8% to 12% of the new vehicle's price, with maximum caps of 15,000 yuan and 20,000 yuan, respectively. This change, while seemingly extending support, represents a structural shift—low-priced models see significantly reduced benefits, raising the purchase threshold for the sub-150,000 yuan market. This price segment has been the fastest-growing mainstay group driven by policy incentives in recent years. As core consumer groups hold onto their cash due to rising costs, market demand has stagnated. The China Passenger Car Association predicts 1.8 million passenger vehicle sales in January 2026, a sequential decline of over 20%. Morgan Stanley even forecasts an overall decline of 30% to 35% in the first quarter.

Against this backdrop, automakers find themselves in a classic 'prisoner's dilemma.' Raising prices to cover costs risks swift loss of orders in the fiercely competitive market of over a hundred brands. Maintaining prices means incurring losses of several thousand yuan per vehicle sold. UBS points out that the overall sales profit margin of China's automotive industry stood at just 4.1% in 2025, a near-five-year low, with some companies' vehicle business profit margins as low as 1.8%. On such thin profit margins, cost increases exceeding 4,000 yuan can easily wipe out all profits.

Therefore, most automakers opt to 'hold the line'—maintaining terminal prices through financial schemes (e.g., 7-year zero-interest loans), limited-time subsidies, and trade-in bonuses while passing pressure upstream. Leading companies like BYD and SAIC Maxus had already demanded 10% price cuts from suppliers starting in 2026 by late 2025, attempting to digest costs through supply chain collaboration. However, this approach carries significant risks: component companies, themselves operating on thin margins, may compromise quality or exit partnerships if forced to cut processing fees or extend payment terms, ultimately damaging vehicle reliability and brand reputation.

The haze of price wars has yet to clear, but the guns of cost battles are already firing intensely. Structural raw material price hikes, global chip supply tensions, and systematic policy withdrawals form an 'impossible trinity'—automakers cannot simultaneously balance costs, prices, and profits. Facing this systemic crisis, small and medium-sized automakers lacking scale, technological barriers, and financial reserves will bear the brunt. They cannot control costs through vertical integration (self-developing batteries, semiconductors), drive cost reductions through technological innovation, or rely on ecosystem support like tech companies.

Conversely, leading companies are seizing the opportunity to accelerate consolidation: deepening strategic ties with upstream resource providers to secure long-term supply while accelerating overseas expansion to partially offload domestic price wars and cost pressures to global markets. UBS clearly states in its latest report that despite short-term profit pressures, companies with 'supply chain resilience + global presence + technological moats' will emerge victorious in this elimination round.

Layout 丨 Yang Shuo Image Sources: Qianku.com, UBS Reports, Major Automakers