A $20 Billion Gamble on Tomorrow: NVIDIA and OpenAI’s Ecosystem Alliance Unpacked

![]() 02/13 2026

02/13 2026

![]() 539

539

When rumors surfaced of NVIDIA nearing a $20 billion investment in OpenAI, capital markets responded with a mix of optimism and skepticism, revealing subtle divisions in their interpretations.

Bloomberg reports that the deal is nearing completion, though terms remain fluid. Earlier, The Wall Street Journal highlighted internal debates at NVIDIA over OpenAI’s business model rigor and competitive vulnerabilities, underscoring the complexity of this high-stakes partnership.

Underlying Anxieties

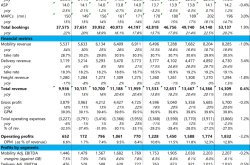

NVIDIA’s fiscal Q3 2026 results were stellar: $57 billion in revenue (up 62% YoY), with data center revenue hitting $51.2 billion (90% of total). Shipments of its Blackwell architecture chips soared past expectations. Yet, cracks are emerging beneath the surface.

Last September’s ambitious $100 billion AI collaboration plan was quietly scaled back, signaling a shift from “decade-long ambition” to “pragmatic recalibration.” This reflects broader anxieties in the computing power sector, despite NVIDIA’s fiscal 2025 dominance: $130.5 billion in annual revenue, $72.88 billion in net profit, and a gross margin above 73%.

Growth, however, is slowing. Q3 revenue growth dipped to 16% (from Q2’s 22%), data center growth decelerated to 66% (from 93%), and gross margins contracted slightly YoY. More concerning, clients like Microsoft and Google are accelerating in-house chip development. OpenAI, too, is reportedly exploring alternatives—AMD, Broadcom, and even whispers of self-built chips—posing a threat to NVIDIA’s dominance.

From a “$100 billion AI factory co-construction” to a “$20 billion equity stake,” NVIDIA’s strategic pivot is a calculated hedge against these risks.

Amid internal doubts, CEO Jensen Huang opted to secure OpenAI—a client demanding over 10 GW of annualized computing power (equivalent to $30–50 billion in GPU purchases)—at a lower cost. The investment aims to retain this “super-client” while forging a capital-level alliance to counter dual pressures from Google and other tech giants.

Positive Feedback Loop

The deal’s core logic is to extend NVIDIA’s “hardware + software + services” ecosystem. On the hardware front, the Blackwell architecture dominates AI training, with the upcoming Rubin architecture promising a 10x reduction in inference token costs. On the software side, NVIDIA’s CUDA ecosystem monopolizes over 90% of global AI developers, creating a virtuous cycle: “developer lock-in → hardware sales → ecosystem reinforcement.”

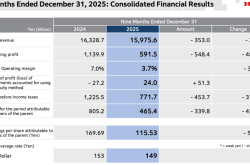

By injecting $20 billion, NVIDIA seeks to bind OpenAI to its ecosystem, ensuring next-gen models prioritize Rubin hardware while gaining technical feedback for model iterations. For OpenAI, the investment is a lifeline. Training trillion-parameter models like GPT-5 costs over $100 million per session, and the company reportedly lost $5 billion in 2025. This funding round values OpenAI at $830 billion post-investment—a staggering 700x price-to-sales ratio.

NVIDIA’s capital ensures stable computing power supply and enables chip-level customization, shortening model iteration cycles. Yet, beneath this win-win facade lie fractures.

OpenAI is dissatisfied with NVIDIA’s chip performance and seeks diversified suppliers to reduce reliance. More alarmingly, if OpenAI achieves breakthroughs in self-developed chips, NVIDIA’s investment could backfire—building a rival’s infrastructure.

This risk of ecological dependency explains NVIDIA’s internal hesitations: today’s “chokehold” weapon may become tomorrow’s “shackle.”

The “Dual Monopoly” and Industry Shifts

The $20 billion collaboration underscores the “Matthew effect” in AI—the rich get richer—and escalates the “computing power arms race.” Global AI infrastructure spending is projected to exceed $600 billion in 2026, with U.S. cloud providers investing over $180 billion. The industry is transitioning from “model competition” to “computing power clustering and cooperative ecosystems.”

No single firm can bear the costs of hardware R&D and model iteration alone, making cross-border cooperation inevitable.

The partnership creates three market opportunities:

- Supply chain surge: High-end PCBs, optical modules, and memory chips will see demand explode with Rubin mass production. Companies like InnoLight are already reporting significant growth.

- AI data center boom: NVIDIA-backed firms like CoreWeave will capitalize on surging computing demand to secure footholds in AI cloud services.

- Vertical industry solutions: Healthcare, finance, and autonomous driving will spawn practical applications (e.g., AI-assisted drug discovery, real-time risk monitoring), forming a “computing power → applications → computing power” cycle.

However, the “dual monopoly” of NVIDIA and OpenAI will raise industry barriers, squeezing smaller players. Competitors like Google-AMD and Meta-Intel may form counter-alliances, fragmenting standards and closing ecosystems.

Risks Ahead

Despite market enthusiasm, the deal faces three hurdles:

- Valuation risk: OpenAI generated just $1 billion in 2025 revenue but carries an $830 billion valuation. Failure to achieve profitability in 3–5 years could impair NVIDIA’s investment.

- Technological substitution: The AI chip landscape is fiercely competitive. AMD’s MI300 series is catching up, while Google’s TPU v5e and Amazon’s Trainium offer cost advantages. Huawei’s Ascend chips are rising in China via import substitution policies. Breakthroughs in specialized AI chips or photonic computing could disrupt NVIDIA’s GPU monopoly.

- Regulation and geopolitics: With over 80% GPU market share, NVIDIA’s stake in OpenAI could trigger U.S. FTC or EU antitrust scrutiny. U.S.-China AI tensions have already cost NVIDIA over 60% of its Chinese high-end market revenue. Further tightening of export controls or geopolitical friction could disrupt supply chains and affect performance.

A Reluctant Marriage

This $20 billion “AI marriage” is NVIDIA’s defensive offensive to巩固 (consolidate) its computing empire and OpenAI’s reluctant choice for survival. In an era where AI bubbles coexist with revolution, it is both a bet on tomorrow and a “dignity tax” to sustain high valuations.

Investors should recognize the technological acceleration and market opportunities while remaining vigilant against uncertainties. In tech, there are no permanent dominators—only survivors who adapt.