Zhipu Initiates Price Increases, DeepSeek Expands Long-Text Capabilities: China's AI Industry Officially Bids Adieu to the 'Era of Freebies'

![]() 02/13 2026

02/13 2026

![]() 498

498

AI Capital Insights - Shi Tao

In the early morning hours of February 12, Beijing time, China's AI sector witnessed an early 'Spring Festival Blockbuster' surge.

First off, just a month after its market debut, Zhipu AI unexpectedly issued a 'price adjustment notice,' announcing price hikes for its core Coding models and select GLM-5 APIs, with increases starting at 30%. Almost simultaneously, DeepSeek made a bold move by dramatically expanding its context window from 128K to 1M (million-level) Tokens, aiming to undercut competitors' pricing advantages through technological superiority.

I strongly believe that these developments signify the end of an era in China's AI industry: the era characterized by reckless expansion, free services, and financing-driven growth is giving way to intense commercialization pressures and fierce competition over technological moats.

Zhipu's Price Hikes: The Secondary Market Rejects 'Passion Projects'

Zhipu AI's price increase has sent shockwaves through the industry. While major players are vying for consumer markets with generous incentives, Zhipu's audacious decision to raise prices amidst this trend reflects both confidence and the weight of financial expectations.

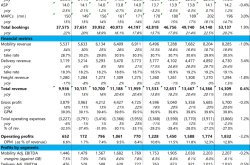

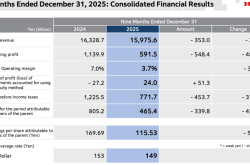

Financial pressures are the primary catalyst. As a newly listed company on the Hong Kong Stock Exchange, Zhipu AI's market value hovers around HK$150 billion. However, its 2025 financial report reveals a stark contrast between computing power investments and revenue. Unlike Silicon Valley venture capitalists, Hong Kong investors demand tangible profits, not just compelling narratives. Zhipu must demonstrate that its models have transitioned from 'novelty items' to 'essential productivity tools' worthy of premium pricing.

Screening 'big spenders' and ditching 'freeloaders.' Large models come with exorbitant inference costs. Zhipu's price hikes are primarily aimed at Coding and complex Agent scenarios, effectively segmenting its customer base. It no longer caters to casual users inquiring about the weather on web interfaces; instead, it targets B-side enterprises and high-net-worth developers willing to pay for advanced code generation and automated workflows.

DeepSeek's 'Dimensional Strike': Outmaneuvering Competitors with Technological Edge

If Zhipu is making 'commercial additions,' DeepSeek is executing 'technological subtractions.'

DeepSeek's expansion of the context window to 1M Tokens underscores a clear strategic intent: to nullify competitors' brand premiums through exceptionally high technical parameters.

What does 1M Tokens entail? It means you can feed an entire company's financial history or millions of lines of source code into the AI simultaneously without losing any nuances.

This feat is the tangible outcome of DeepSeek's earlier research papers, showcasing even more stringent cost control. Recall that the 2024 large model price war was initiated by DeepSeek, which was still flying under the radar at the time.

Now, as Zhipu is compelled to raise prices due to cost pressures, DeepSeek is offering more value at a lower cost. The 'technological cost reduction' strategy is suffocating many startups still operating in sheltered environments.

Industry Impact: The AI Arms Race Enters a 'Tiered Phase'

These developments reflect three profound shifts in China's AI industry chain:

Firstly, large models are no longer 'sprint races' but 'marathons with leverage.' Beyond the major players, Zhipu, DeepSeek, and MiniMax have established themselves as the first tier. They are not just competing on parameters but also on 'commercial closed-loop' (closed-loop commercialization). For second- and third-tier model vendors still reliant on financing, unlisted, and without a stable customer base, time and computing power resources are dwindling.

Secondly, a clear divergence is emerging between 'edge-side' and 'cloud-side' models. Zhipu's strategy is unequivocal: cloud models must be the strongest, most expensive, and most professional. Meanwhile, Alibaba's QianWen, Xiaomi, and other vendors are aggressively pursuing edge models for phones and PCs. In the future, AI will no longer be a monolithic market but will fragment into 'high-end productivity cloud services' and 'affordable embedded terminal services.'

Thirdly, the physical constraints of computing power costs are becoming increasingly evident. Don't be misled by claims of 'algorithmic optimization.' More robust models and higher inference volumes translate to higher electricity and computing card costs. Zhipu's price hikes essentially reflect the transfer of power and chip costs to end-users. AI Capital Insights predicts a wave of collective AI API price adjustments in 2026.

China's AI 'Coming-of-Age Ceremony'

'Large model companies cannot rely on PPT presentations indefinitely; they must learn to stand on their own two feet.'

Zhipu's price hikes represent a 'daring gamble,' attempting to shatter the outdated notion that internet services must be free. DeepSeek's million-length texts are a 'testament to technological prowess,' proving that Chinese companies now possess the capability to compete head-on with OpenAI and Google in foundational architectures.

Clearly, this Spring Festival, China's AI sector is foregoing fireworks but delivering the most exhilarating spectacle.