AI Storage: HBM Grabs NVIDIA's Vital Point

![]() 06/19 2024

06/19 2024

![]() 461

461

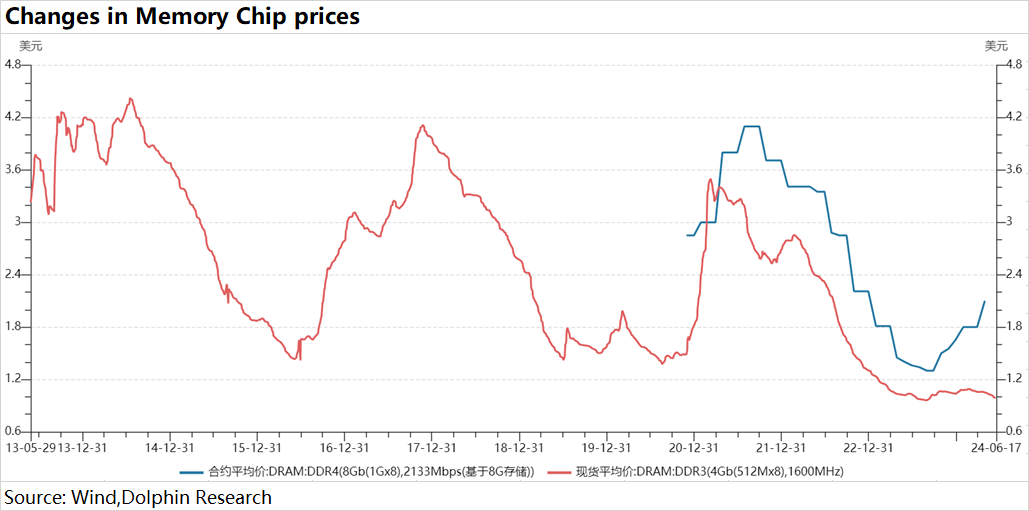

After nearly two years of decline, the storage industry has once again seen a rise in prices. Storage itself is cyclical, and changes in supply and demand directly affect the price trend of storage chips. However, this round is different, as driven by new applications such as AIGC, the storage industry is expected to usher in a resonance of "cycle + growth." Looking at the past price changes of DDR3 and DDR4, it can be seen that there is a clear cyclicality, approximately 3-4 years as a cycle. As storage prices declined in this round, major manufacturers began to reduce capital expenditures and adjust production capacity structures in the second half of 2022. The change in supply and demand patterns led to storage prices hitting a bottom in 2023. Coupled with the emergence of new applications such as AI, the storage industry has once again embarked on an upward cycle.

The upward cycle of the storage industry in this round: Resonance of "Cycle + Growth" ① Traditional Cycle: Mobile phones and PCs contribute nearly half of the revenue in the storage industry. As the two downstream areas bottom out and recover, they bring a cyclical rebound to the storage industry; ② AI New Growth: AI applications such as ChatGPT have stimulated the growth of demand for AI servers, and storage upgrades are also an important part of it. Terminal innovations in AI PCs and AI phones have also brought new storage demand. The traditional cycle only brings expectations of bottoming out and recovery to the market, while AI can bring higher prospects. Currently, the demand for HBM storage by AI servers has already generated significant revenue and performance. Through disassembly and calculations, Dolphin expects that AI servers are expected to bring more than $10 billion in HBM demand space to the storage industry, injecting growth prospects into the storage market. Additionally, AI PCs and AI phones are also expected to accelerate the iterative upgrades of storage products. Currently, the storage industry is still dominated by Samsung, Hynix, and Micron. Especially in the DRAM market, the three manufacturers combined occupy 95% of the market share. The increase in HBM demand has brought an expansion of market space to the three manufacturers, but there are still differences in market share. Hynix, with its pioneering breakthrough in HBM3, currently holds a leading share advantage. Although NVIDIA is leading the current AI wave, it is also being grasped by HBM at its vital point. Currently, HBM is constrained by insufficient production capacity, with supply exceeding demand in the market, and prices are expected to continue to rise. With the frequent increases in storage product prices, the performance of the three storage manufacturers is expected to continue to improve. Among them, the manufacturers that successfully expand production capacity first will enjoy stronger alpha. Dolphin will conduct valuation calculations on individual stocks in the next article and analyze how much elasticity the additional $10 billion will bring to specific companies.

Detailed Analysis Below

I. Storage Chips: Resonance of "Cycle + Growth"

Storage chips, also known as semiconductor storage, include DRAM, Flash, SRAM, PROM, etc. Among them, DRAM and NAND Flash are the most main storage types, accounting for about 99% of the overall market share. ① DRAM: Used for temporary storage of data and instructions, it is the mainstream solution for current mobile phones, computers, servers, etc.; ② Flash (flash memory): Used in various electronic product hard drives (SSD, USB drives, SD cards, etc.), responsible for permanent data storage. Although both DRAM and NAND Flash are currently mainstream products in the storage market, DRAM has a higher market size and concentration than NAND.

With the recent growth of new AI applications, the importance of DRAM has further increased. 1.1 DRAM products can be classified into DDR, LPDDR, GDDR, and HBM based on product types. The first three categories are mainly used in traditional cyclical areas, while HBM is mainly driven by the AI market. Among them, DDR is mainly used in consumer electronics, servers, and PC areas; LPDDR (low-power) is mainly used in mobile devices, mobile phones, and automotive areas; GDDR is mainly used in GPUs for image processing, etc.; HBM is for high-performance computing areas such as AI servers.

adv