My article "The Death of AI 'God-Making'" from three months ago has come true

![]() 07/05 2024

07/05 2024

![]() 531

531

AI startups in North America are accelerating their liquidation.

Compared to the booming fundraising of large model companies in the first half of 2023, the fundraising of large model companies seems to have stalled this year. In the first half of 2023, large model companies raised significant amounts of funding: - OpenAI raised $10 billion; - Anthropic raised $750 million in two consecutive rounds within half a year; - Inflection raised $1.3 billion; - Adept AI raised $350 million.

In the first half of 2024, the Inflection team joined Microsoft, and the Adept AI team joined Amazon. Both of them, once backed by DeepMind and Linkedin co-founders, and starting points for the two authors of the Transformer paper, have effectively sold themselves this year.

Coincidentally, Stability AI and Humane AI, which were at the forefront last year, are also rumored to be up for sale. Harvey, a legal AI startup that was once a darling of capital, has seen its funding and valuation shrink this year compared to expectations. (Originally planned to raise $600 million at a valuation of $2 billion, the most likely scenario now is to raise $100 million at a valuation of $1.5 billion.)

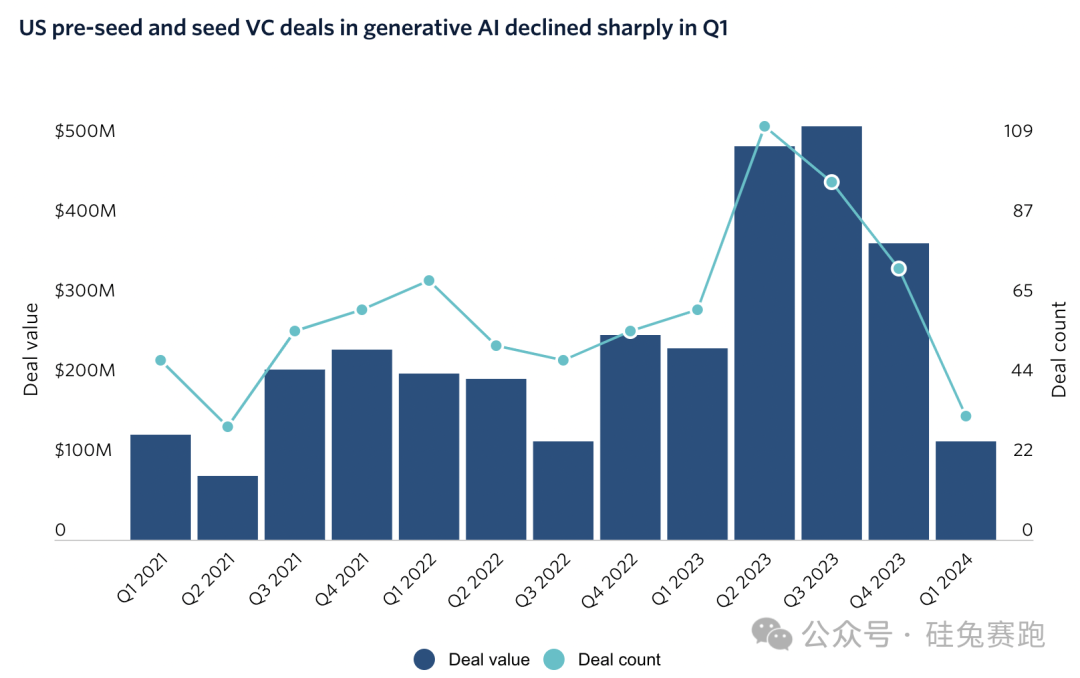

Head companies are on edge, and new startups are trembling. Pitchbook data shows that the number and amount of generative AI venture capital investments in the US Pre-seed and Seed stages have declined significantly in Q1 2024. Compared to Q3 2023, investment amounts have decreased by 76%, and compared to the same period last year, they have decreased by 49%.

Data Source: Pitchbook

Meanwhile, AI startups are consolidating through mergers and acquisitions at an unprecedented speed. Hyperplane, a startup founded in 2022 that develops vertical models for the banking industry, was acquired by Nubank, a leading Brazilian challenger bank, just seven months after its seed round of funding.

Hugging Face's Co-founder and CEO believes that "in general, there will be more and more mergers and acquisitions among AI companies, as many companies have made significant bets with high risks, and many companies are running out of money."

In just half a year, the AI market sentiment has changed dramatically. Such changes in market sentiment were predicted in an article published by Silicon Hare in March 2024:

● "The Matthew Effect in AI startups is becoming stronger, and the rate of replacement will accelerate." - UpHonest Capital

● "Considering the current hype, AI startups are overvalued, and only a few may survive in the future." - Khosla Ventures

● "Most AI applications are still in the proof-of-concept stage, and large-scale applications have not yet arrived." - Entrepreneurs

● AGI does indeed demonstrate unlimited potential, but in reality, AI's true applications and benefits may not have been realized yet. - Silicon Hare Editorial

In this rapid cycle of hot and cold, how should entrepreneurs consider their positioning? How can investors participate in AI investment and construction? Perhaps we can revisit the article "The End of AI 'God-Making' Movement, Killing, and Rebirth" from three months ago, and perhaps there will be new inspirations. (The following content was published on March 12, 2024, enjoy it, and feel free to leave your comments and discuss with us.)

▼

"Focusing on AI technology iterations makes me anxious, but focusing on the business doesn't. Some problems existed ten years ago and still exist today. I'm now clear that I won't compete in the model race, but only think about how to make the product self-sustainable."

A Silicon Valley entrepreneur involved in the AI startup wave told Silicon Hare.

"Our AI product (ChatDesigner) went live in four months, and I started thinking about how to make it self-sustainable in the fifth month. This was unimaginable ten years ago, when growth was all that mattered. Now, growth achieved through burning money ends when the money runs out. Without the next round of funding, AI is the same."

Despite the brutal and intense situation, the world still fell into an unprecedented AI "gold rush" in 2023, with different wealth creation myths unfolding in turn.

GitHub's former CEO invested $100 million in a competitor of his former employer. More than a year ago, AI programming assistant Magic just completed a $23 million Series A round of funding. In February this year, the company stood out from over a hundred competitors, raising five times more in Series B funding and attracting the attention of AI Grant (founded by GitHub's former CEO Nat Friedman and Daniel Gross).

In the fiercely competitive AI programming field, where leading players like GitHub Copilot, Google, Amazon, and numerous startups are vying for dominance, AI Grant's significant investment has shocked the industry.

New terms like "ChatGPT Wrapper," "Copilot," "AI Agent," and "AGI" have become wealth codes, and it seems that any association with them can get on the unicorn express.

Venture capital data is reflecting this trend. In 2023, US venture capital investments reached $170.6 billion, a decrease of $71.6 billion compared to 2022. However, investments in AI bucked the trend, accounting for more than a third of the annual investment amount, totaling $62.6 billion, a figure that far exceeds AI investments in recent years.

However, the speed of deification and the speed of falling from grace are almost the same.

AI voice company ElevenLabs joined the unicorn ranks in just over a year, becoming one of the hottest AI applications this year.

Last year at this time, Jasper AI, which was hotly discussed and valued at over $1 billion after just over a year of establishment, has experienced layoffs, the founder retreating behind the scenes, and a valuation downgrade, losing its luster.

Image Source: Medium

Similar stories are unfolding successively on the hotbed of Silicon Valley startups.

"The Matthew Effect in AI startups is becoming stronger, and the rate of replacement will accelerate." Silicon Valley VC UpHonest Capital told Silicon Hare.

Over the past year, AI-related technological iterations, commercial applications, and capital investments have reached unprecedented heights. Investment firm Coatue believes that the time required for AI to penetrate 50% of users will be halved compared to the mobile internet era (3 years).

After experiencing tremendous changes in a short period, what new thinking have Silicon Valley entrepreneurs and investors had? What AI startup status quo is condensed behind the financing figures? What opportunities and pitfalls are there in AI startups? As VCs, how should they participate in this AI gold rush?

Silicon Hare has exchanged views with over 20 individuals from the venture capital and artificial intelligence fields, trying to summarize the experiences and lessons behind the AI gold rush currently playing out in North America.

01

The "Hammer-Making" Movement of "Breaking Bank"

In August 2023, Llion Jones, the last author of the paper "Attention is all you need" that laid the technical foundation for ChatGPT and who remained at Google, announced his departure and the establishment of a new AI model company with a valuation of $200 million, a price that is more than ten times higher than most AI startups.

It has been six years since the "Google Eight" proposed the Transformer architecture.

Transformer is the source of this wave of generative AI technological breakthroughs. Simply put, compared to previous serial processing of information one by one, Transformer can "see" all information at once when processing information and then utilize the attention mechanism to combine words with different distances.

By removing the sequential structure, the Transformer model can achieve a parallel structure, which allows it to utilize massive computing power and data for training.

OpenAI discovered that when the amount of data, parameter scale, and computing power reach a certain scale, the model exhibits "emergent" abilities (abilities that do not exist in small-scale models but exist in large-scale models). From GPT-3, 3.5 to GPT-4, OpenAI's training data, model parameter scale, and computing power continue to increase, and the model's anthropomorphic degree becomes higher and higher. But this also means that the cost of model training increases exponentially.

"Making hammers" is the hottest and most lucrative trend in this wave.

Most AI venture capital investments in 2023 were absorbed by cornerstone models. The most noteworthy story is that OpenAI and Anthropic, two cornerstone model startups, raised a total of $17 billion, accounting for nearly one-third of total AI investments.

Image Source: Web3Cafe

Now it seems that this money-throwing approach will continue in cornerstone models. This is inherently a product of "violent aesthetics." Large models represented by the Transformer architecture work best when the amount and quality of data are high, which means a large number of GPUs are needed to support data computation.

According to the technical summary disclosed by GPT-3, at least 1024 GPUs are required to support its training, costing approximately $5 million. However, GPT-4's parameter scale is likely to be more than ten times that of GPT-3. Rumors suggest that OpenAI used approximately 25,000 GPUs for training, and the hardware cost alone could exceed $100 million.

At this stage, cornerstone models based on the Transformer architecture are far from reaching their upper limit, and the Scaling law has not been broken. Experiments to continuously expand model parameter scale, training data, and computing power will continue.

An engineer from one of the top seven tech companies in the world told Silicon Hare, "To linearly improve model capabilities, the capital investment required needs to grow exponentially."

OpenAI plans to raise $100 billion in funding, and another large model company, Anthropic, plans to raise $5 billion over the next four years.

In the future, spending $1 billion to train cornerstone models is not impossible.

In the face of the ability of cornerstone model companies to break the bank, the "bank-breaking" ability of VCs seems insignificant. Therefore, VCs do not participate much in cornerstone models, after all, not many VC funds have a scale of $1 billion, and this is clearly a game for giants.

Microsoft Azure Cloud's weekly revenue exceeds $2 billion, so investing $10 billion in OpenAI only consumes about six weeks of revenue for this tech giant.

Compared to VCs who have to wait for project exits to see returns, Azure's integration of OpenAI services has increased its revenue by 6% in the second quarter of 2023 alone, adding $5 billion to $6 billion in revenue.

This economic calculation is quite cost-effective for the giants.

From a capital and business perspective, perhaps only cloud vendors and tech giants are long-term partners for cornerstone model companies.

In addition to OpenAI, Microsoft recently announced a strategic partnership and $16 million investment in Mistral; Amazon and Google jointly supported Anthropic; Oracle and Salesforce jointly supported the enterprise-level large model Cohere; NVIDIA is the most aggressive among all corporate strategic investors, investing in 11 cornerstone model companies in 2023 (accounting for 40% of total AI investments), covering multiple large language models, video, and 3D generative cornerstone models.

Image Source: UC Today

On the other hand, cornerstone model companies are also differentiating into different patterns.

Currently, the North American cornerstone model landscape has basically formed, with companies like OpenAI, Google, Anthropic, and X.ai leading the latest progress in closed-source models, while Meta, Mistral, and others are leading the advancement of the open-source ecosystem.

A researcher involved in large language model development at NVIDIA shared with Silicon Hare his understanding of enterprises' paths to deploy and apply large language models. First, top players will build their own large language models to have absolute dominance; second, enhance and develop based on currently known open-source models according to their business domains; third, utilize APIs and prompt engineering from general cornerstone models, thicken the frontend, and adapt specific business needs to the context of cornerstone models, allowing for faster and lower-cost development of applications in specific domains.

Silicon Valley VC UpHonest Capital observed from an early-stage investment perspective that the first path has a high threshold, and few new entrepreneurs are currently involved. The second and third paths are currently the common choices for entrepreneurs, and many entrepreneurs may choose to quickly test and error by calling cornerstone model APIs in the early stage, and then attempt to fine-tune based on open-source models after obtaining more capital, computing power, and talent resources to deepen their moat.

Harvey, which develops a large language model for the legal industry, took the third path. They first collaborated with OpenAI and completed an $80 million Series B round of funding in December 2023 to strengthen their self-developed model.

Another large model development company, Magic AI, focused on code generation based on the earlier LSTM architecture to break through the input character length limitation of Transformer.

Hippocratic, which attracted $50 million in investment from General Catalyst and A16Z, uses data and feedback provided by professional healthcare personnel for RLHF training, targeting patient service scenarios beyond diagnosis.

The development of these vertical industry/specific task scenarios LLM startups also confirms the common views of Eric Schmidt, the former CEO of Google, Matei Zaharia, the chief scientist of Databricks, and Maithra Raghu, the founder of AI startup Samaya AI - in the future AI ecosystem, general large models will be responsible for solving long-tail problems, and high-value business scenarios will be addressed by specialized AI systems.

02

The "Nail" Will Become Finer and Narrower

Although the two founders of AI Grant are confident that "there will be AI applications with annual revenue exceeding $10 billion in the next 12-18 months!"

Even generative AI content marketing tools valued at over $1 billion in one year are still searching for PMF.

"Most AI applications are still in the proof-of-concept stage, and large-scale applications have not yet arrived." Multiple entrepreneurs and practitioners told Silicon Hare.

But this does not affect entrepreneurial enthusiasm. Silicon Valley VC UpHonest Capital told Silicon Hare that they have contacted more dropout entrepreneurs and PhD academic research entrepreneurs in the past year than ever before. These entrepreneurs either see it as a "once-in-a-lifetime opportunity" or are inspired by the entrepreneurship of all eight authors of the Transformer paper and dive headfirst into the AI track. This has not happened since the AI boom in 2016. Meanwhile, the number of AI-related startup projects is unprecedented.

Taking Silicon Valley incubator YC as an example, nearly half of the projects incubated in 2023 were AI companies (about 231), and considering the transformation of many startups, the actual number may be even higher. "Many companies transformed into new AI directions within a month after our investment," said an investment partner from YC, who has never seen founders find/transform new directions so quickly since he started working at YC.

An obvious trend of transformation is the shift from broad to focused, from general tasks to specific tasks.

For example, Fintool, which was incubated by YC in the first half of the year, previously created an AI-driven legal research tool called Doctrine. Initially, Fintool aimed to develop an LLM (Large Language Model) for the finance sector, akin to "Bloomberg GPT." After six months, the team has now shifted their focus to creating a Copilot assistant for institutional investors (with human-in-the-loop involvement). This assistant helps investors summarize and analyze financial reports, thereby streamlining investment decision-making processes more efficiently.

Another AI-driven company, Hadrius, which focuses on SEC (U.S. Securities and Exchange Commission) compliance automation, has found that AI entrepreneurs should "focus on specific vertical scenarios" during sales. They initially emphasized the AI capabilities of their product, only to realize that this approach was ineffective because their clients were not typically tech enthusiasts. It turned out to be more beneficial to clearly explain how their product addresses clients’ pain points rather than just highlighting its AI features.

According to a survey by consulting firm PwC, 61% of CEOs expect AI to improve the quality of their products or services in 2024 and anticipate seeing returns on their AI investments.

This indicates that ROI (Return on Investment) will be a critical challenge for AI application products this year.

Similarly, technology VC firm Madrona believes that "the mindset of AI product users will shift from 'trying it out' to 'pursuing ROI'." CEOs who last year asked, "What is our GenAI strategy?" will face a completely different question this year: "What is our GenAI ROI?" As AI usage deepens, people will realize that the largest cost associated with applying AI may not be training the models, but the inference costs incurred with each model run. Consequently, application scenarios that are easier to calculate and generate ROI will be more appealing to users.

From the revenue growth trajectory of leading applications, we can preliminarily identify the types of application scenarios that are thriving.

For instance, GitHub's Copilot surpassed $100 million in Annual Recurring Revenue (ARR) in 2023. According to Microsoft's Q2 2024 financial report, Copilot has over 1.3 million paying developers and more than 50,000 enterprise users, contributing to a 40% annual revenue growth for GitHub. AI legal assistant Harvey has shown rapid growth, with its ARR increasing tenfold to $10 million in just over six months. ChatGPT's revenue in December 2023 was approximately $167 million, leading to an annualized revenue of around $2 billion. Revenue from Microsoft Copilot, powered by GPT-4, is even more promising, with analysts from The Futurum Group predicting it will generate between $2.39 billion and $9.2 billion in 2024.

Given this context, new entrepreneurs must carefully avoid direct competition with industry giants, who possess capital, talent, comprehensive AI infrastructure, and ample GPU resources.

Tianqiang, founder of generative AI company HuHu AI, which was an early investment by VC firm UpHonest, experienced the AI startup boom in 2016 and successfully sold his company to Amazon. He has chosen to venture into AI once again. He notes that during the AI wave sparked by AlexNet in 2012, big companies lacked talent and scalable AI architectures. From 2012 to 2016, the primary exit strategy for AI startups was to sell to these larger companies, which allowed the giants to fill in their gaps in AI infrastructure and teams through mergers and acquisitions.

Thus, "Ten years ago, big companies had nothing, so startups could do anything. Ten years later, big companies can do everything. In this scenario, startups need to focus on niche, vertical areas that big companies overlook or disdain."

Similarly, a partner at Silicon Valley VC firm a16z believes that 2024 will see more narrowly-focused AI solutions. While ChatGPT may be an excellent general-purpose AI assistant, it is unlikely to be suitable for every task. He predicts we will see AI platforms specifically designed for researchers, writing generation tools for journalists, rendering platforms for designers, and so on.

In the long term, the products people use daily will be tailored to their use cases, whether through proprietary underlying models or specialized workflows built around them. These companies will have the opportunity to "own" the data and workflows of the new technology era. They will achieve this by initially focusing on a narrow field and then expanding. For the initial product, the narrower the scope, the better.

UpHonest Capital believes that in the era of generative AI, it is better to focus on specific, vertical problem-solving rather than proposing broad directions. The accumulation of AI and business expertise by internet giants and SaaS companies allows them to integrate new technologies more quickly.

Therefore, entrepreneurs must find their unique differentiation and amplify it tenfold. They need a faster iteration speed, with foundational models continuously updated—each update potentially causing significant shifts. This requires an accelerated learning capability to keep pace with technological advancements.

03

Large Models are “Killing” SaaS

During a conversation with UpHonest Capital, a startup they invested in caught my attention. This YC-incubated company, which received an AI Grant, is dedicated to providing AI receptionist services for the home services industry, ensuring that no customer calls are missed and that service appointments are scheduled.

The American home services industry reportedly loses millions of dollars annually due to missed calls. The founder of Sameday, who previously served as the CMO of Ardent Servicing, one of the fastest-growing home services companies in the U.S., understands the pain points of the industry well. Sameday's AI product experienced rapid growth within six months of its launch, with its Annual Recurring Revenue (ARR) nearing one million dollars.

Discussing Sameday's investment philosophy, UpHonest's founder mentioned his interest in opportunities where traditional industries could leapfrog the SaaS (Software as a Service) phase and directly enter the era of generative AI.

Coincidentally, a16z is also optimistic about AI's potential to bridge gaps in traditional industries. Their healthcare investment partner remarked, "Just as emerging markets have moved directly from using cash to mobile payments (completely 'leapfrogging' credit cards), the healthcare industry will transition from fax machines directly to artificial intelligence (bypassing traditional vertical software)."

The U.S. healthcare industry is notably traditional. In 2023, discussions in the American healthcare sector centered around how AI and fax technology could enhance efficiency. Among the top 100 publicly listed software companies in the U.S., only one serves the healthcare industry, highlighting the sector's low level of digitization.

Now, some entrepreneurs are reporting to Silicon Valley insiders that they believe the healthcare industry could be the first in the U.S. to embrace AI legislation. They are waiting for clearer signals before diving into AI+healthcare startups.

The direction of AI projects in YC's 2024 Winter Incubator also reflects healthcare practitioners' expectations for AI. This year, there is a notable increase in AI+healthcare applications, with projects even fine-tuning AI receptionists for dentists, assistants for radiologists, home-visit nurses, and inpatient nurses.

Moreover, the impact of AI products "killing" SaaS extends beyond their penetration into traditional industries; they could potentially disrupt the current subscription-based model of SaaS from a business model perspective.

Most current AI applications still adhere to the SaaS business model, aiming to improve employee productivity with subscription fees based on the number of accounts used. Pricing is often referenced to the cost of employing staff.

Consulting firm PwC and Benchmark investors have proposed a new perspective: "Future AI products are likely to evolve into a pay-for-results model," encapsulated by the phrase "Sell work, not software."

For example, EvenUp, an AI assistant for personal injury lawyers, raised $50.5 million in its Series B funding round. It helps personal injury attorneys prepare claim documents for their clients, such as case summaries and medical expense (including lost wages) estimates.

If EvenUp adopted the SaaS sales mindset, its product might be a software tool for personal injury lawyers that uses AI to generate documents at some stage of the preparation process, charging a subscription fee. However, this approach would mean EvenUp expects clients to pay for improved efficiency (something difficult to measure and limited in scope).

Instead, EvenUp chose to sell a "Work Product," providing the entire set of claim documents. Thus, EvenUp's pricing is based on the cost for law firms to use an outsourced team to prepare such documents, as EvenUp can completely replace this human labor.

From this perspective, Benchmark investors believe that any work requiring an outsourced team could potentially be replaced by AI products, as such work generally involves tedious, repetitive, and basic tasks. However, everything about AI is still evolving crazily, and both entrepreneurs and investors have boundless imaginations about its potential. This boundless imagination is also why AI entrepreneurship inevitably falls into hype and bubbles.

Reflecting on AI investments in 2023, the founder of Khosla Ventures believes AI startup investments have overheated.

"Given the current hype, the valuations of AI startups are too high, and in the future, only a few might survive." A YC partner also noticed that many people fell into a "Checkbox" mentality last year. They felt compelled to start a business or lay out an AI strategy because others were doing it, which he believes easily leads to "Tarpit ideas"—ideas that seem promising but are actually pitfalls.

Last year's environment exacerbated the likelihood of falling into "Tarpit ideas" because everyone wanted to set up an AI strategy. Some AI Copilot concept products might easily attract users to try them out or even convert some to paying users, but these users might not actually understand what they need AI for.

"Many AI applications haven't found Product-Market Fit (PMF). They seem to have gained some traction, but when we look closely, is anyone really using them? What are the real use cases? The founders themselves are baffled."

While AGI (Artificial General Intelligence) indeed shows limitless potential, in reality, the true applications and benefits of AI might not yet be realized. For instance, Morgan Stanley's AI assistant has not been adopted by wealth managers because clients prefer to interact with real people.

Attempting to replace journalists with AI-written articles in the news business is challenging because such articles often turn out to be incorrect or useless.

OpenAI's COO Brad Lightcap had to step in to calm the frenzy, telling CNBC reporters that artificial intelligence cannot dramatically lower costs or resurrect companies that are in trouble.

In the stage of rapid development and unrestrained growth of AI applications, there are many questions that remain unclear and unanswered.

Super angel investor Elad Gil recently stated in his blog, "In most markets, the longer the time, the clearer things become. But in the field of generative AI, the opposite is true. The longer it takes, the less I feel I really understand."

YC CEO Garry Tan also admitted that it is currently difficult to definitively identify which directions will certainly become AI "Tarpit ideas."

However, one consensus among Silicon Valley investors is that consumer AI applications will break through by providing the best user experience around unique use cases, rather than relying solely on model performance, as one a16z partner has mentioned.

LLMs (Large Language Models) can be a source of differentiation and may offer a first-mover advantage, but traditional moats like network effects, high switching costs, scale, and brand will still be the keys to long-term success.

From 2020 to 2022, before the generative AI boom, we experienced the waves of the metaverse and cryptocurrencies, whose bubbles quickly burst. It is hard to say that the AI boom will not follow a similar fate.

Yet, after every burst bubble, there are always true believers who remain and quietly push the technology forward.

As OpenAI CEO Sam Altman has said, "AGI is coming, but its impact on the world may not be as significant as we imagine."

Nevertheless, we believe that regardless of how things evolve, the essence of finding real use cases and building sustainable business models will remain unchanged.