"DJI Godfather" Li Zexiang joins the ranks of autonomous driving companies going public

![]() 11/12 2024

11/12 2024

![]() 462

462

The autonomous driving industry is fiercely competitive in Hong Kong stocks, with the latest player aiming for an IPO:

CIDI Intelligence.

A notoriously low-profile autonomous driving company in recent years, its business covers autonomous mining, vehicle-road coordination, and rail transit perception solutions.

Although CIDI Intelligence keeps a low profile, its spiritual leader is renowned in the industry: Professor Li Zexiang, the company's founder and chairman, and mentor of DJI's founder Wang Tao.

Li Zexiang himself supported DJI from its inception, providing funding and talent, and even served as its chairman, earning him the nickname "DJI Godfather." After propelling DJI to the top of the global drone market, he gradually withdrew and founded CIDI Intelligence.

Today, according to the prospectus, Li Zexiang holds 43.63% of CIDI Intelligence's shares through various channels, serving as its core leader.

So, what kind of company is CIDI Intelligence, founded by Li Zexiang, an academic giant and serial entrepreneur?

Let's look at the prospectus.

01 What kind of company is CIDI Intelligence?

The most intriguing aspect of this company is its founding team.

CIDI Intelligence Founder Li Zexiang

The prospectus states that CIDI Intelligence was founded in 2017. Its core founder and current leader, Li Zexiang, as mentioned earlier, is an academic giant who propelled DJI to the top of the drone market.

Public information shows that Li Zexiang studied at Central South Institute of Mining and Metallurgy (also the alma mater of Wang Chuanfu) and obtained a publicly funded study abroad opportunity in 1979, earning a Ph.D. in Engineering from the University of California, Berkeley in 1989.

In the early 1990s, Li Zexiang joined the Hong Kong University of Science and Technology as a professor in the Department of Electronic and Computer Engineering. During this time, he also incubated Googol Tech, a leading enterprise in motion control at that time.

In 2005, Li Zexiang met DJI founder Wang Tao and provided guidance. In 2006, Wang Tao founded DJI with Li Zexiang's strong support, from funding to personnel, serving as DJI's chairman later on.

In addition to DJI, Li Zexiang also supported academic entrepreneurship projects such as CloudMinds, a star startup in the robotics industry.

For most of the time, Li Zexiang is known more as a mentor and guide for academic entrepreneurs.

CIDI Intelligence Vice Chairman Ma Wei

The other co-founder and vice chairman, Ma Wei, is responsible for R&D. A contemporary of Li Zexiang and a highly educated academic figure, he graduated from Xidian University and earned a Ph.D. from the University of Surrey, UK, in 1994.

The youngest member of the founding team is CEO Hu Sibo, responsible for CIDI Intelligence's algorithm and simulation R&D, and management.

In terms of funding, the prospectus shows that CIDI Intelligence has completed eight rounds of funding since its inception, raising a total of nearly 1.5 billion yuan, with a post-investment valuation of approximately 9 billion yuan in the last round.

In terms of business, CIDI Intelligence has a broad range of offerings.

Its primary business is autonomous driving, focusing on special scenarios such as mining and logistics.

CIDI Intelligence Mining Truck

The mining autonomous driving project, named "MetaMine," is a full-stack autonomous mining truck solution aiming to achieve unmanned and intelligent operations for key processes in mining scenarios, including drilling, blasting, excavation, and transportation.

The entire product line includes autonomous mining trucks, fleet management systems, and mining central dispatch platforms.

For the logistics scenario, CIDI Intelligence's autonomous logistics vehicle solutions are primarily targeted at closed and semi-closed environments such as factories and logistics parks, providing unmanned heavy-duty logistics operations.

Its logistics vehicles have similar basic functions to mining trucks, enabling cargo handling and mixed operations with pedestrians and other vehicles for autonomous vehicles.",In the prospectus, CIDI Intelligence claims multiple domestic "only" and "first" achievements in its autonomous driving business, including being the only autonomous driving company in China to implement solutions in closed scenarios, urban scenarios, and intercity roads; operating the world's largest mixed-fleet mining operation (including 56 autonomous mining trucks and 500 manned trucks); and deploying China's first fully unmanned electric mining fleet.",As well as ranking first in China's autonomous mining market based on revenue for the six months ended June 30 of this year.

CIDI Intelligence Business Composition

Another significant revenue contributor is the V2X vehicle-road coordination solution, encompassing perception technology, sensor fusion algorithms, V2X communication functions, and traffic optimization algorithms.

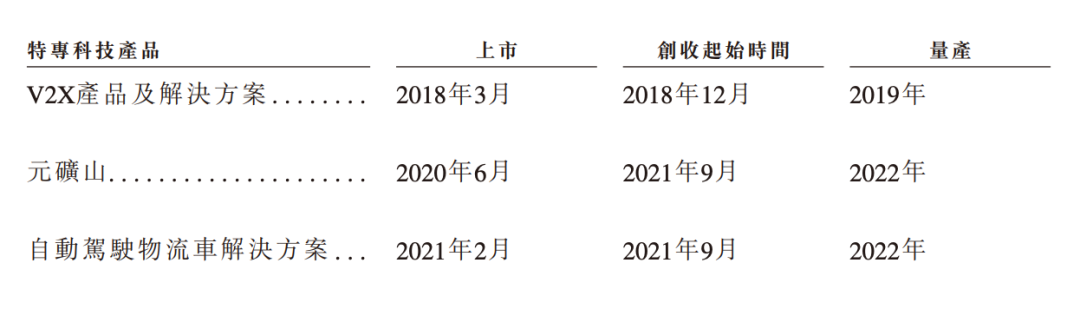

In fact, as an autonomous driving company, its vehicle-road coordination products have been on the market and generating revenue since 2018, about three years earlier than its autonomous driving solutions.

CIDI Intelligence Major Product Line Start Dates

The prospectus shows that CIDI Intelligence was one of the first autonomous driving companies in China to launch commercial V2X products. Its star project was the world's largest-scale active bus priority system based on V2X technology, deployed in Changsha in 2020.

Finally, there are high-performance perception solutions, primarily including the Train Autonomous Perception System (TAPS) and the Commercial Vehicle Intelligent Safety Management Solution.",TAPS applies autonomous driving perception technology from autonomous trucks to provide speed measurement, positioning, and obstacle detection for rail transit using sensors such as LiDAR and cameras.",The Commercial Vehicle Intelligent Safety Management Solution utilizes high-performance interconnected devices and data analysis platforms to reduce driving risks.",However, these two businesses currently contribute relatively little to revenue, hovering around 15% throughout the year.",02 Financial Fundamentals: Revenue Growth but Also a Need for Funds

What kind of shape can a startup founded by an entrepreneurial godfather take?

The prospectus shows that its revenue was 77.39 million yuan in 2021, 31.06 million yuan in 2022, and 133 million yuan in 2023. In the first half of this year, it was 285 million yuan, a year-on-year increase of 473%.

Overall, the scale is not large, but there was a leapfrog growth in the first half of this year, mainly driven by the autonomous driving business.

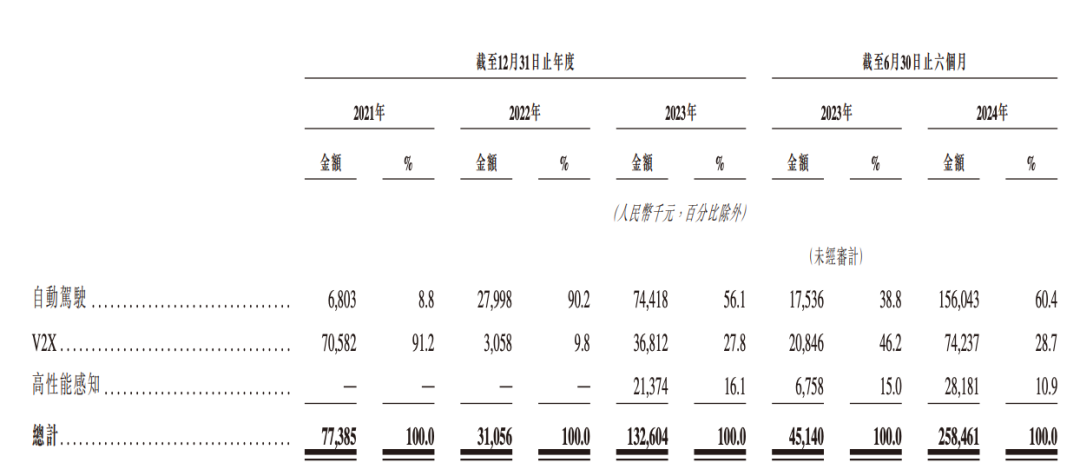

Revenue Distribution of CIDI Intelligence's Businesses

Data shows that in the first half of this year, its autonomous driving business revenue was 156 million yuan, a year-on-year increase of over 800%, accounting for 60.4% of total revenue.

In addition, its V2X business is also a major revenue source, with revenues of 70.58 million yuan in 2021, 3.06 million yuan in 2022, and 36.81 million yuan in 2023. In the first half of this year, this business generated 74.24 million yuan in revenue.

The revenue share dropped from 91.2% in 2021 to 28.7% in the first half of this year.

However, it should be noted that the revenue source of this business is highly unstable.

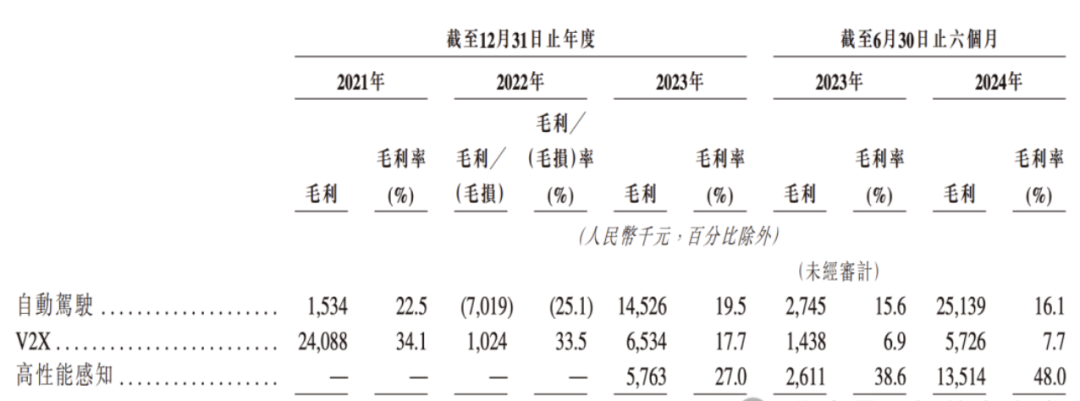

Gross Margin of Each Business

In terms of gross margin, the company recorded 25.622 million yuan in 2021, -5.595 million yuan in 2022, and 26.823 million yuan in 2023, with gross margins of 33.1%, -19.3%, and 20.2%, respectively.

In the first half of this year, its gross margin was 44.38 million yuan, or 17.2%.

The instability in gross margin may be partially attributed to the unstable revenue composition, and the overall gross margins of each business are generally declining.

Especially for the autonomous driving business, it dropped from 22.5% in 2021 to 16.1% in the first half of this year; the V2X business also fell from 34.1% in 2021 to 7.7% in the first half of this year.

On the expenditure side, R&D, which accounts for the largest proportion, shows an overall downward trend for CIDI Intelligence. From 2021 to 2023, its R&D expenditures decreased from 111 million yuan to 90.4 million yuan. In the first half of this year, this expenditure was 35.34 million yuan.",During the same period, R&D expenditures as a percentage of revenue fell from 144% to 13.7%.

In terms of net losses, adjusted net losses for CIDI Intelligence were 114 million yuan in 2021, 159 million yuan in 2022, and 138 million yuan in 2023, with 59.45 million yuan in the first half of this year. As of the first half of this year, CIDI Intelligence had cash and cash equivalents of 332 million yuan on its books.",Considering the background of significantly tightening R&D expenditures, the need for IPO financing has become urgent under these circumstances.",The good news is that although fundraising in the primary market has become challenging, the IPO window is relatively favorable. This explains why many autonomous driving companies are rushing to seek IPOs during this period.",03 The Best Time for Autonomous Driving IPOs is Now

An autonomous driving practitioner said, "The best time to go public was three years ago, and the second-best time is now."

This is true. On the one hand, public awareness of autonomous driving is increasing due to the popularity of services like Luobo Kuaipao, large funding rounds for Waymo, and Tesla's release of Robotaxi models. On the other hand, capital market liquidity has also increased following interest rate cuts in the U.S. stock market.",After enduring a difficult period, autonomous driving companies are eager to seize this "wave." The reasons behind this may be diverse, such as the expiration of gambling agreements with investors, making an IPO a redemption opportunity for the founding team; or the dwindling funding opportunities in the primary market, coupled with the opening of the Hong Kong stock market to startups (i.e., Hong Kong Stock Exchange Listing Rule 18C), creating an opportune moment for IPOs.",That's why we're seeing players across the autonomous driving industry striving for IPOs recently, including industry leaders like Horizon Robotics, WeRide, Pony.ai, and other star companies, as well as second-tier players desperately seeking a way out.

Of course, CIDI Intelligence is neither the first nor the last.

-END-