BAIC subscribes, IPO valuation up to $5 billion, Pony.ai is about to ring the bell on the US stock market

![]() 11/15 2024

11/15 2024

![]() 568

568

Pony.ai is just one step away from ringing the bell.

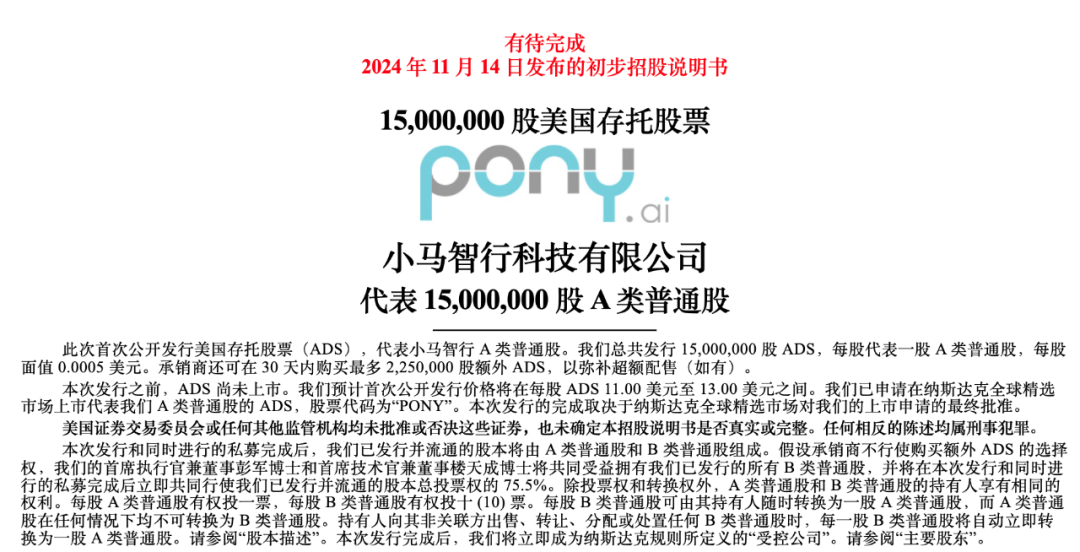

On November 15, the autonomous driving company Pony.ai submitted its red herring prospectus and began the share offering process (pre-IPO prospectus), planning to list on Nasdaq under the ticker symbol "PONY".

According to the latest prospectus, Pony.ai plans to issue 15 million ADSs (American Depositary Shares), priced between $11 and $13 per ADS, with each ADS representing one common share. If underwriters fully exercise their over-allotment option, Pony.ai could issue up to 17.25 million ADSs.

Pony.ai begins share offering

Among them, BAIC Group and Singapore transportation operator ComfortDelGro have both expressed their intention to subscribe to the ADSs issued in Pony.ai's IPO. BAIC Group is willing to subscribe for up to $70.35 million, while ComfortDelGro is willing to subscribe for up to $4.5 million.

Additionally, multiple investors, including GAC Capital, a wholly-owned subsidiary of GAC Group, will subscribe for approximately $153.4 million worth of Class A common shares through strategic private placements.

Based on this offering plan, Pony.ai's IPO could raise up to approximately $378 million (approximately RMB 2.747 billion).

At a price of $13 per ADS and with 383.5 million shares outstanding after the offering, Pony.ai's IPO valuation in the US will be close to $5 billion (approximately RMB 36.168 billion), lower than its post-investment valuation of over $8.5 billion in its last round of funding.

Pony.ai stated that approximately 40% of the IPO proceeds will be used for large-scale commercialization and market expansion of autonomous ride-hailing and freight services, including production, sales, marketing, customer service, and industry collaboration; approximately 40% will be used for continued research and development of autonomous driving technology; and approximately 20% will be used for potential strategic investments and acquisitions to enhance the company's technical capabilities and build an industrial chain ecosystem.

01 Revenue of $39.51 million in the first three quarters of this year

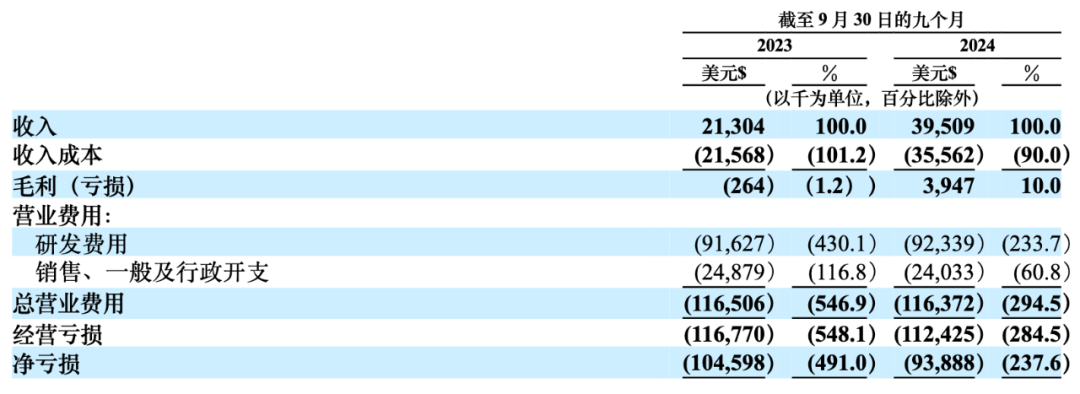

In this prospectus, Pony.ai also disclosed some financial data for the first three quarters of 2024. Its overall revenue for the first three quarters increased by 85.5% year-on-year to $39.51 million.

In terms of business, all revenue streams have shown growth.

Pony.ai's financial performance in the first three quarters of 2024

In the first three quarters of 2024, Pony.ai's autonomous ride-hailing service revenue was $4.7 million, a year-on-year increase of 422.2%. According to Pony.ai, this was mainly due to technical service fees for providing autonomous driving solutions for a project in South Korea.

In addition, as Pony.ai expanded its paid autonomous taxi service for the public in China's first-tier cities, the increase in passenger fares also contributed to the revenue growth. However, the company also acknowledged that these businesses are still in the early stages of commercialization.

Revenue from autonomous freight services was $27.4 million, a year-on-year increase of 56.5%. Pony.ai attributed this growth to the increase in transportation service fees charged by Cyantron.

In the first nine months of this year, compared to the same period in 2023, Cyantron expanded its geographical coverage and added 45 robotic trucks, leading to an increase in transportation service fees. At the same time, the mileage traveled by Cyantron's autonomous truck fleet increased from over 12 million kilometers in the first nine months of 2023 to over 17 million kilometers in the same period of 2024.

Revenue from technology licensing and application services was $7.4 million, a year-on-year increase of 155.2%. Pony.ai stated that this growth was mainly due to an increase of $4.4 million in value-added service revenue.

Overall, Pony.ai, which is still in the business exploration phase, has seen significant changes in its revenue structure during this period. Notably, the autonomous truck business has grown significantly over the past period and contributed a large proportion of Pony.ai's revenue.

Data shows that revenue from the autonomous truck business increased from $22.37 million in 2022 to $25.02 million in 2023. In the first nine months of this year, this figure reached $27.4 million.

Over the past two years, the proportion of this business in total revenue has increased from 32.7% to 69%.

Meanwhile, the revenue proportion of Pony.ai's Robotaxi business during the same period declined from 13.1% in 2022 to 10.7% in 2023 and to less than 11.9% in the first nine months of this year, showing no significant overall change.

In terms of gross profit margin, Pony.ai's gross profit margins were 46.9%, 23.5%, and 10% in 2022, 2023, and the first nine months of this year, respectively, showing a clear downward trend. Previously, Pony.ai stated in its prospectus that the decline in gross profit margin was mainly due to changes in the revenue mix.

In terms of expenditures, research and development expenses accounted for the majority of its expenditures during the same period. From 2022 to the first nine months of this year, its R&D investments were $154 million, $123 million, and $92.34 million, respectively.

In less than three years, the cumulative investment was approximately $367 million, with R&D expenditures consistently exceeding twice the revenue.

Sales, general, and administrative expenses during the same period were $49.18 million, $37.42 million, and $24.03 million, respectively.

Whether in absolute terms or as a percentage of revenue, both showed a downward trend, indicating Pony.ai's internal emphasis on cost reduction.

In terms of net loss, Pony.ai reported losses of $148 million, $125 million, and $93.9 million in 2022, 2023, and the first nine months of this year, respectively.

Finally, regarding cash, as of the first half of this year, its cash and cash equivalents and restricted cash amounted to $335 million (approximately RMB 2.38 billion).

Given the current rate of cash burn, Pony.ai's operational pressure in the short term is manageable, but long-term financial pressure remains significant, especially as its various businesses have not yet generated stable commercial revenue.

However, according to Pony.ai's projections, the Robotaxi business is expected to achieve positive gross profit per vehicle in 2025.

02 Three business lines, commercialization still in its early stages

Pony.ai's business lines are currently composed of three main areas, which have now basically stabilized.

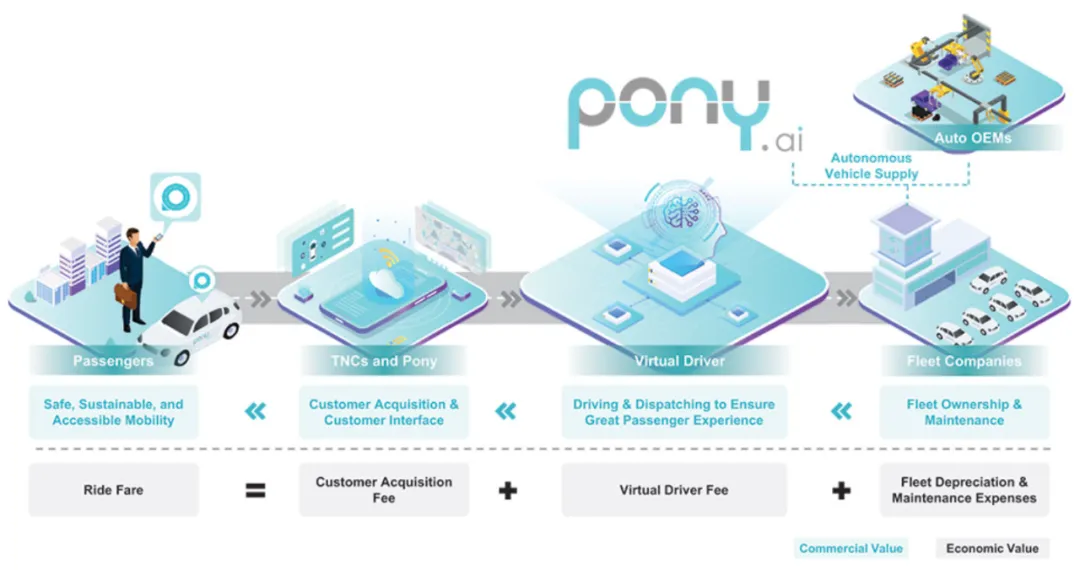

Pony.ai's Robotaxi service

First is the Robotaxi business, which was deployed the earliest. Currently, Pony.ai operates a fleet of over 250 Robotaxis in cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, and has obtained licenses for fully autonomous commercial operations.

As of the first half of 2024, the number of registered users of Pony.ai's PonyPilot mobile app exceeded 220,000. At the end of August this year, the proportion of users who repeatedly used the service accounted for approximately 70%, with an average of over 15 orders per vehicle per day.

The specific implementation and commercialization methods of this business are: firstly, providing autonomous driving solutions to OEMs or multinational companies, including software deployment, maintenance, integration, engineering, and full-process road testing services, thereby generating revenue; secondly, providing Robotaxi services to users through autonomous operations (or third-party platforms) and charging fees.

In this regard, Pony.ai has the closest cooperation with Toyota. On April 26, 2024, Pony.ai jointly established a joint venture with Toyota China and GAC Toyota, with Toyota providing the latest generation of Robotaxi vehicles to Pony.ai.

Pony.ai's desired business model for Robotaxi

In the future, Pony.ai expressed its hope to develop a network of third-party fleet companies through an "asset-light" model to expand its fleet size. These third-party fleet companies include Ruqi Chuxing, a subsidiary of GAC.

In addition, Pony.ai has also integrated with third-party ride-hailing platforms such as Gaode Maps, Alipay, and Ruqi Chuxing. As of June 30, 2024, the average daily order volume per fully autonomous Pony.ai Robotaxi exceeded 15.

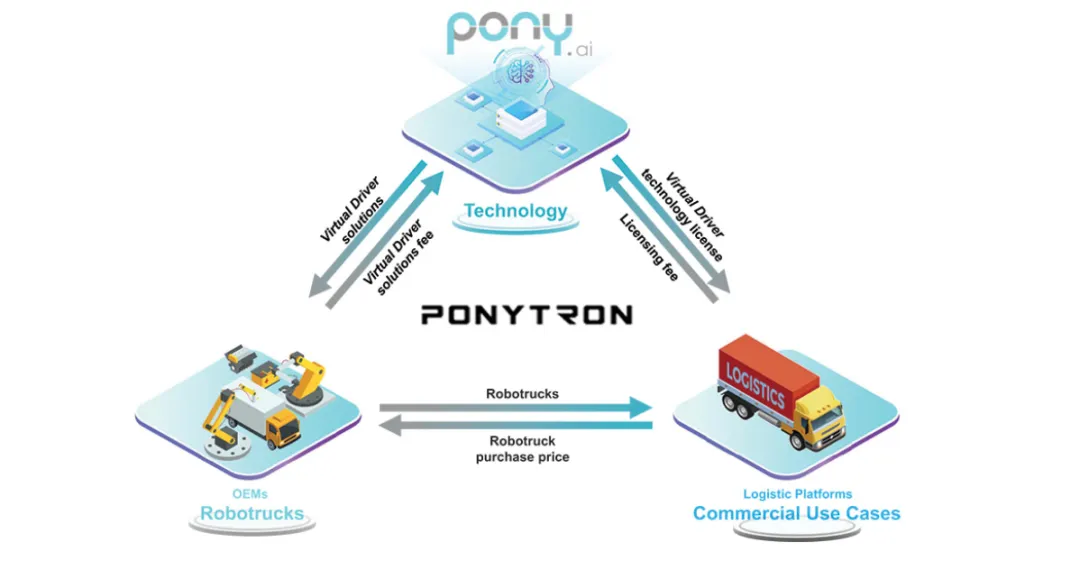

The second business is also the Robotruck business, which is also based on high-level autonomous driving. Currently, Pony.ai operates a fleet of 190 autonomous trucks with a cumulative operating mileage of 767 million ton-kilometers (a ton-kilometer is the sum of the product of the transported cargo volume and the transportation distance, an important indicator reflecting the efficiency of the transportation industry).

This business is mainly implemented through an ecosystem approach, where Pony.ai builds an ecosystem with OEMs and logistics platforms, providing autonomous driving technology to OEMs and deploying vehicles for different logistics platforms.

Pony.ai's Robotruck business model

In this regard, Pony.ai has partnered with Sany Heavy Industry and established a joint venture with Sinotrans called Qingji Logistics. Currently, Qingji Logistics operates over 160 autonomous trucks.

As mentioned in our previous financial review, Qingji Logistics has become a key contributor to Pony.ai's commercial revenue.

Lastly, there is the licensing and applications segment, which has a more complex business structure.

One of these is the POV Business Unit established by Pony.ai at the beginning of last year, which mainly provides full-stack technical capabilities for intelligent driving assistance from software to hardware to OEMs of passenger vehicles, including the PonyPilot intelligent driving software solution, the "Fangzai" domain controller, and the "Cangqiong" data toolchain.

The currently known customer is Gemstone Automobile.

In addition, there is also a portion of V2X business, which contributed significantly to revenue before 2023.

Pony.ai's technology overview

Behind this is a complete autonomous driving AV software stack that serves as the "brain" of the virtual driver. This AV software stack employs end-to-end (E2E) technology, eliminating traditional boundaries between perception, prediction, planning, and control, thereby enabling a unified and seamless approach to analyzing complex road conditions and ensuring safe and smooth vehicle operation.

These three business lines constitute the entire business landscape of Pony.ai.

However, we can also see that this business landscape is still in a very early stage of development. A specific manifestation of this is the instability in revenue structure mentioned in the first part.

This also indicates that none of the business segments can currently generate high and sustainable revenue, ultimately leading to unstable company-wide revenue and continuously deteriorating gross profit margins.

In the short term, due to factors such as technology and policy, both Robotaxi and Robotruck cannot be considered for large-scale deployment or positive commercialization cycles.

The excessive fluctuation in the growth and decline of these businesses, as well as the progress in achieving key business goals, will be key areas of focus for future investors and major issues that Pony.ai needs to address in the future.

03 Who owns Pony.ai?

A significant reason for Pony.ai's attention is its star founding team, which is also the initial driving force for its capital appeal.

Public information shows that Pony.ai was founded in 2016 by two technology experts, Peng Jun and Lou Tiancheng, who both previously worked at Baidu.

Founder and CEO Peng Jun

Among them, Peng Jun, as the co-founder, serves as the Chairman of the Board and CEO of Pony.ai. Before founding Pony.ai, Peng Jun worked at Baidu for five years as the Chief Architect, responsible for R&D in Baidu's autonomous driving department. Earlier, he worked as a software engineer at Google.

Additionally, Peng Jun was a founding member and the first employee of Baidu Research USA. His technical research fields include advertising, infrastructure, big data, cloud computing, etc.

Founder and CTO Lou Tiancheng

The other more renowned co-founder, Lou Tiancheng, holds a Bachelor's degree in Computer Science and a Ph.D. in Computer Science from Tsinghua University and serves as the CTO of the company. He previously worked at Quora and Baidu. During his time at Baidu, he was recognized as the youngest Chief Architect and was affectionately known as "Master Lou" in the industry.

Before Baidu, Lou Tiancheng was also a member of Google's autonomous driving team.

CFO Wang Haojun

CFO Wang Haojun joined Pony.ai in 2016 and is also the head of the company's human resources team.

Before being promoted to CFO, Wang Haojun held many core leadership roles at Pony.ai, including head of the Fremont R&D center, global HR, global PR, head of the Shanghai R&D center, and head of POV BU.

In addition, he has technical experience at companies such as Baidu and IBM.

In other words, the company's three core leaders are all technically skilled, which aligns with Pony.ai's style as a technology-driven startup.

Thanks to this star-studded technical team, Pony.ai has been one of the most capital-attractive Chinese autonomous driving companies since its inception, and it's difficult to add the word 'one of' after it.

Public information shows that since its inception, Pony.ai has conducted multiple rounds of funding, raising over $1.3 billion (approximately RMB 9.234 billion) in total. Its post-investment valuation after the last round exceeded $8.5 billion (approximately RMB 60.4 billion).

Investors include leading automakers like Toyota and GAC, as well as top institutions such as Sequoia China, CPE China Fund, and IDG Capital.

However, multiple rounds of high-intensity funding have diluted the equity of the founding team and company executives to some extent.

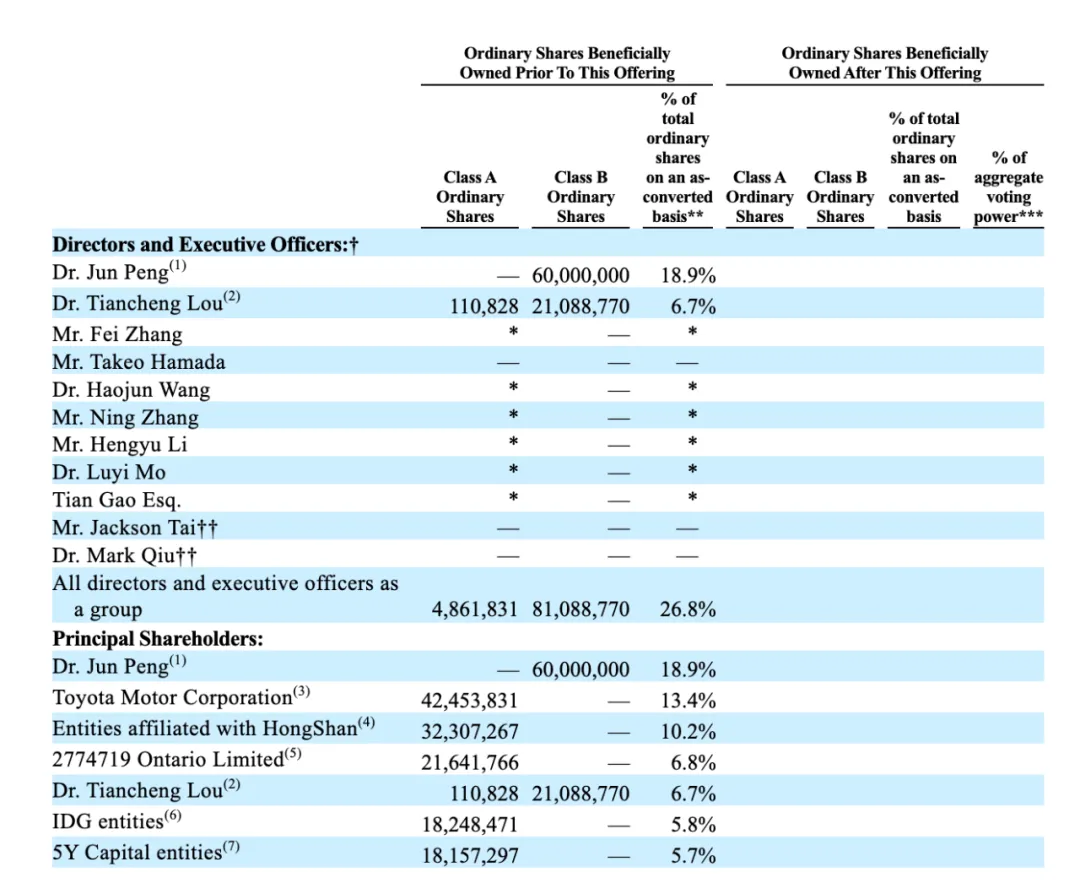

Major Shareholders and Executive Holdings

According to the prospectus, before the IPO, Pony.ai's largest shareholder was Peng Jun, holding 18.9% of the shares. Based on the A/B share structure (1 Class A share = 1 vote, 1 Class B share = 10 votes), Peng Jun held 57.44% of the voting rights, while another founder, Lou Tiancheng, held 6.7% of the shares and 20.19% of the voting rights.

The two core founders have absolute control over Pony.ai.

In addition to Peng Jun and Lou Tiancheng, the top five shareholders also include Toyota with a 13.4% stake, Sequoia Capital with a 10.2% stake, and 2774719 Ontario Limited, a subsidiary of the Ontario Teachers' Pension Plan Board, with a 6.8% stake.

04 Conclusion

Recently, Tesla introduced progress on its Robotaxi during an event. Although the announcement was mostly conceptual, it generated positive attention for the Robotaxi industry due to Tesla's influence in the autonomous driving sector.

Taking advantage of this momentum, Pony.ai seems to have caught a small window of opportunity.

However, there is still much to be done. For example, the POV business, once seen as a cash cow, has yet to generate stable revenue. The number of customers and fixed-point installations is also unimpressive.

Regarding higher-level autonomous driving services, Robotruck appears relatively stable and accounts for a significant portion of revenue, but the absolute volume is still small, and the Robotaxi business is even less significant.

This is a normal situation. Due to factors such as technology maturity, policies, and regulations, rapid progress in high-level autonomous driving is still unlikely in the short term. High-intensity investment will continue in the future.

In this context, going public for funding is a good channel, and Pony.ai is also about to 'come ashore.'

END-