AI Revival on the Stock Market Stage: Will Chinese Stocks Fade Again Soon?

![]() 12/18 2024

12/18 2024

![]() 678

678

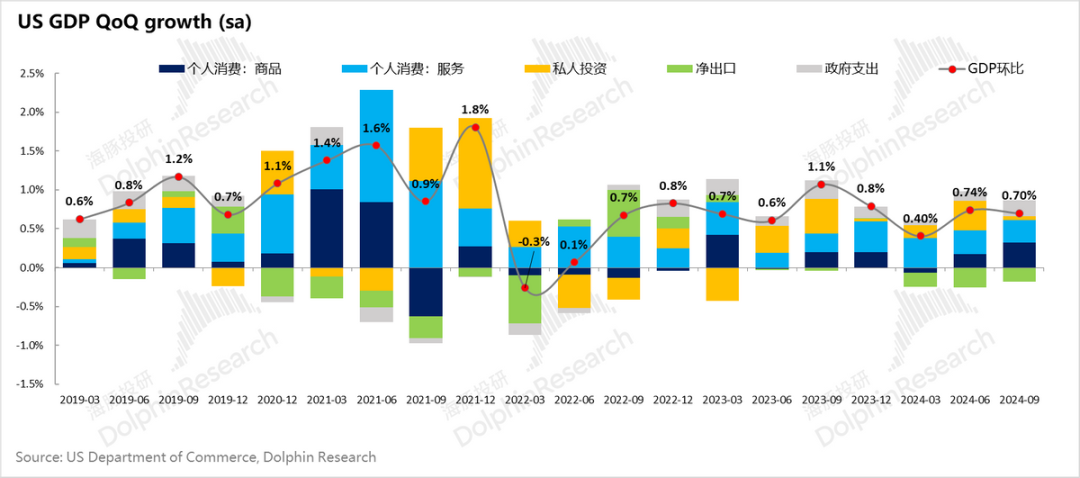

2024 is a pivotal year where technological advancements will significantly propel stock prices upward. However, besides technological advancements, the consistent performance of the United States, as the cornerstone of global economic growth, remains a fundamental prerequisite. Recent macroeconomic data, coupled with noteworthy AI technology events at the micro-stock level, resonate in unison, suggesting that the AI economy, combined with impeccable deleveraging at the macro level, concludes 2024 on a high note.

I. Deleveraging: A Perfect Execution?

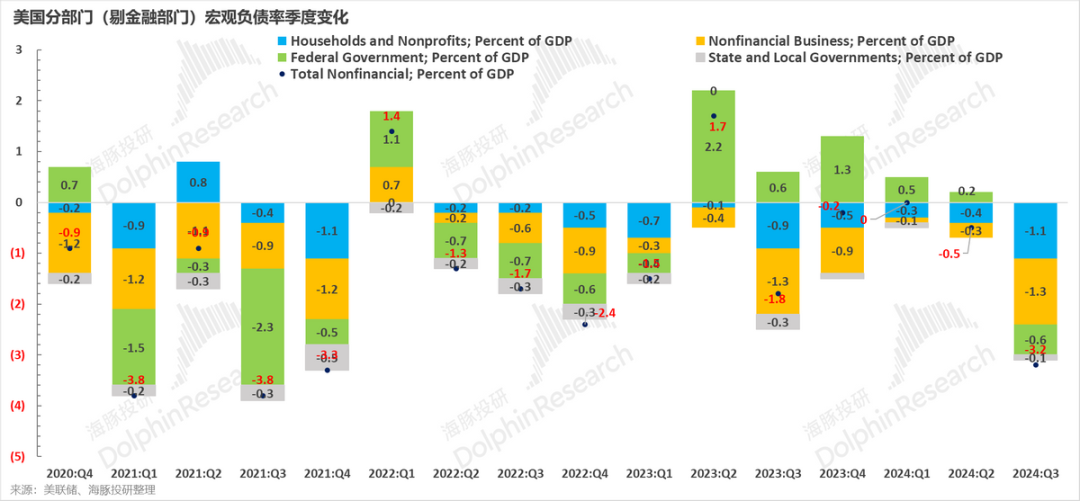

The recently released third-quarter U.S. macro leverage ratio and U.S. residents' balance sheets, along with previous third-quarter GDP data, provide a clearer picture of how the U.S. achieved "impeccable deleveraging" post-pandemic.

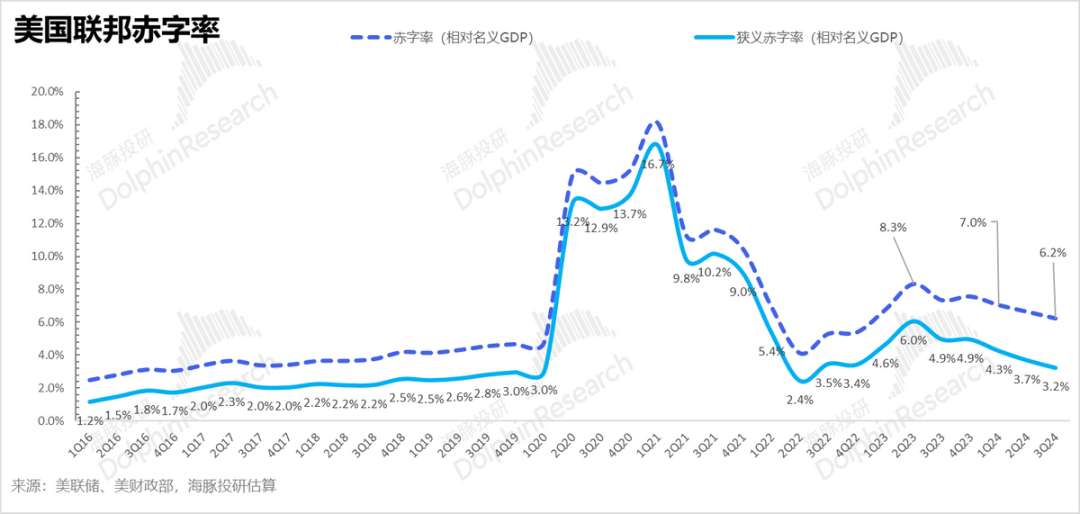

First, regarding the macro leverage ratio, as fiscal revenue increased, the U.S. federal fiscal deficit ratio steadily declined, leading all major U.S. economic sectors to finally enter a deleveraging state in the third quarter.

Despite the decrease in the macro leverage ratio, GDP growth did not slow down in the third quarter, with a 2.8% annualized quarter-on-quarter growth rate. Residents' consumption of goods and services remained the core driver of economic growth.

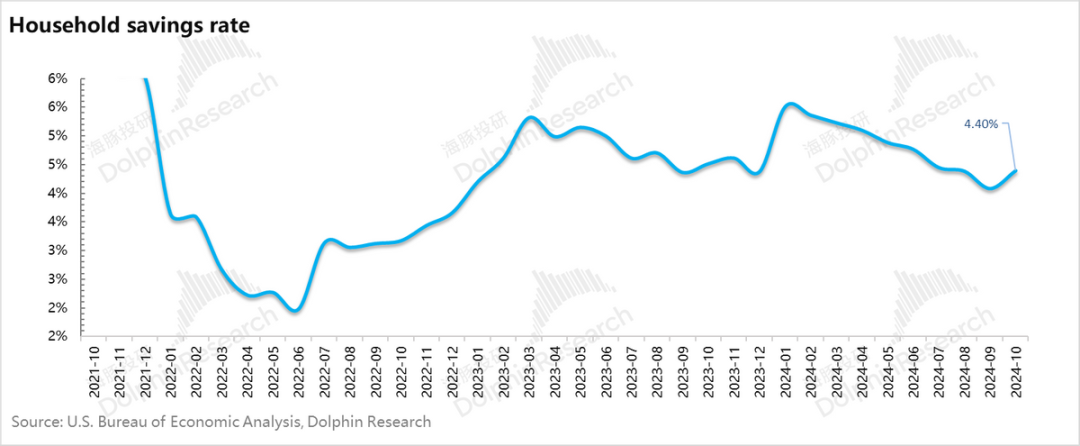

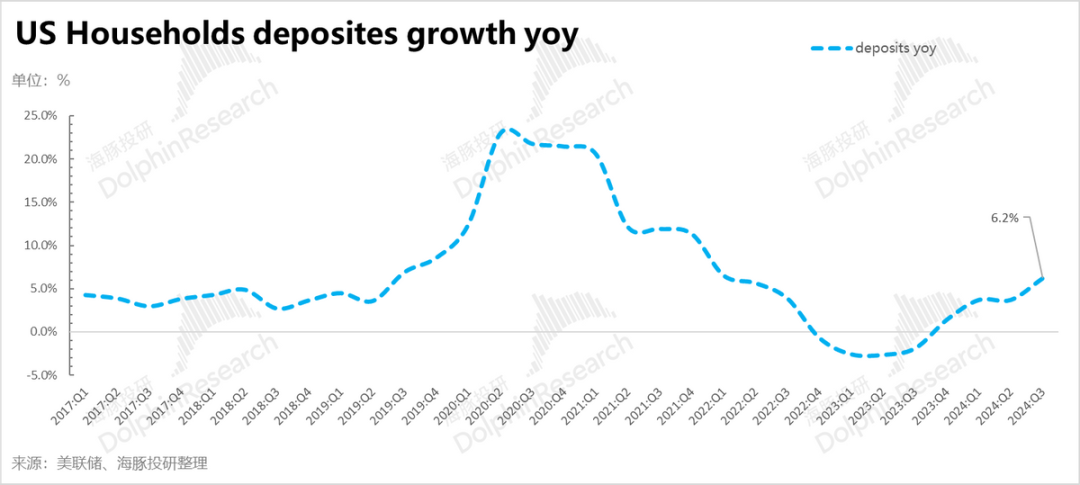

However, an intriguing aspect of residents' balance sheets is that, despite the savings rate of the residential sector (the share of income allocated to savings, which can be deposits or financial management) continuing to decline in the third quarter, residents' deposits on the balance sheet increased rather than decreased (both year-on-year and quarter-on-quarter). Additionally, residents' holdings of equity assets continued to grow due to the simultaneous rise in stocks and bonds.

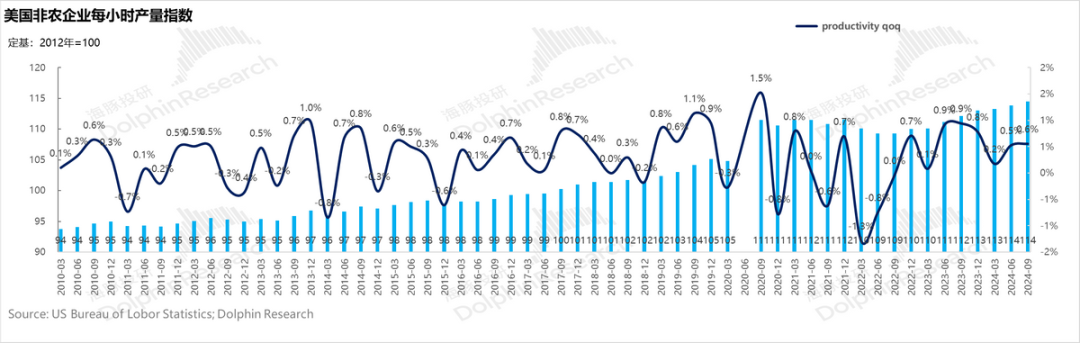

In other words, after residents invested more of their earnings from the current quarter into consumption, their deposits and assets increased. The more they spent, the more they saved and invested to earn money. A direct explanation for this is that, as the economy enters a benign inflationary environment, the profitability of existing assets becomes stronger (the ROI of existing assets increases). The ultimate reason behind this may be the accelerated online penetration post-pandemic and the structural improvement in production efficiency brought about by AI technology, as suggested by many. This data reveals a clear issue: deleveraging is only effective when the economy is robust, and asset inflation is an effective means of deleveraging. When the economy is weak, deleveraging can lead to even higher leverage.

II. Gradual Inflation Easing

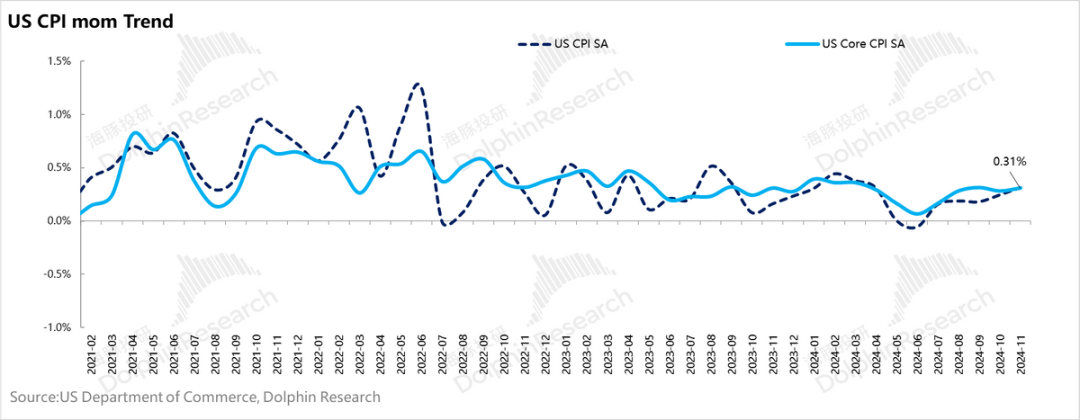

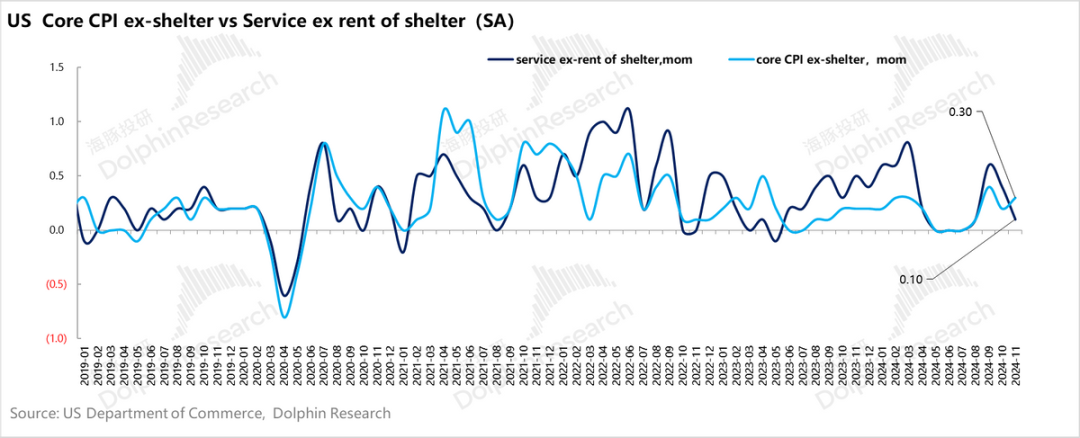

Examining the latest U.S. inflation progress during the economic soft landing, both the U.S. CPI and core CPI grew at a month-on-month rate of 0.31% in November, and a month-on-month growth rate of 0.25%+ points to a 3% annualized year-on-year rate. The November figures further fueled market expectations that the steady-state CPI year-on-year rate will hover around 3% in the long term.

However, a notable difference in November was that the slight increase in core inflation was not driven by service or residential inflation. In particular, prices in insurance, healthcare, transportation, and other service categories remained stable.

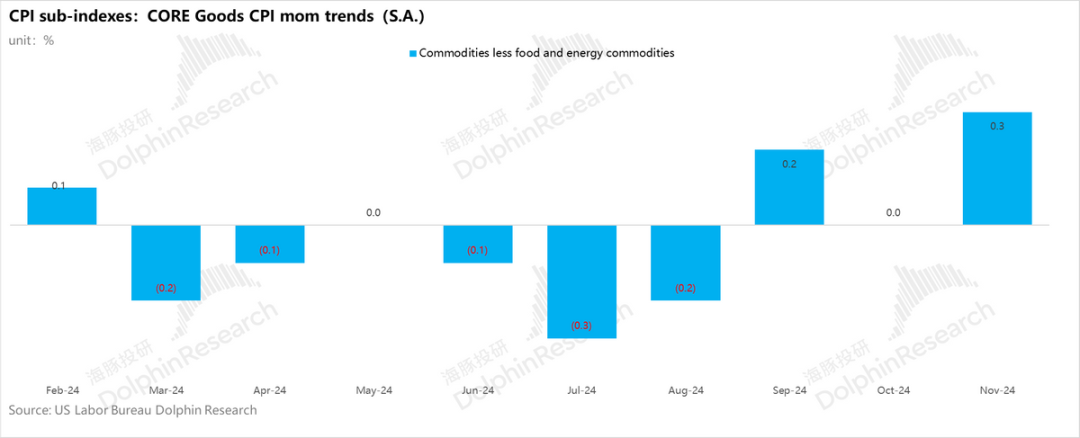

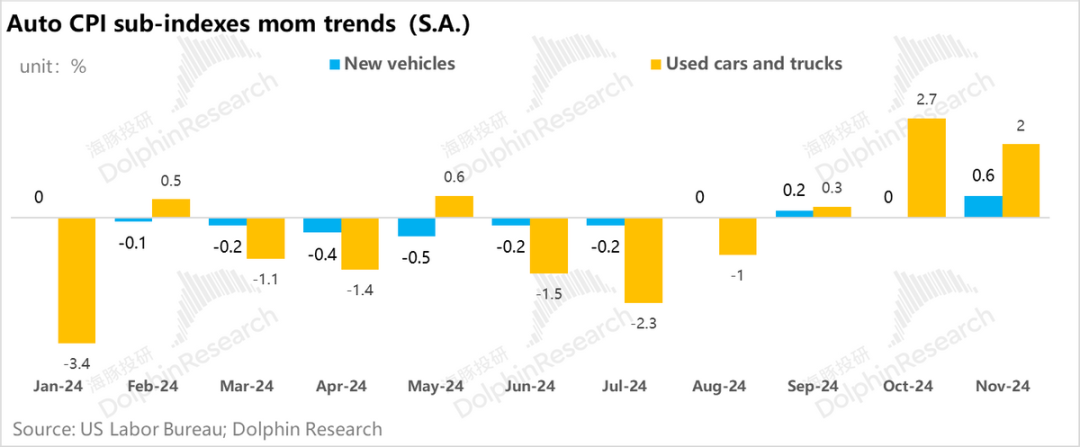

The main contributor to marginal growth in November was goods, which had been in continuous deflation for six months: key automobiles (including new and used cars, accounting for 5.4% of the total weight of prices) were the main categories with rising prices. Prices of other categories such as tobacco and clothing also began to rise slowly.

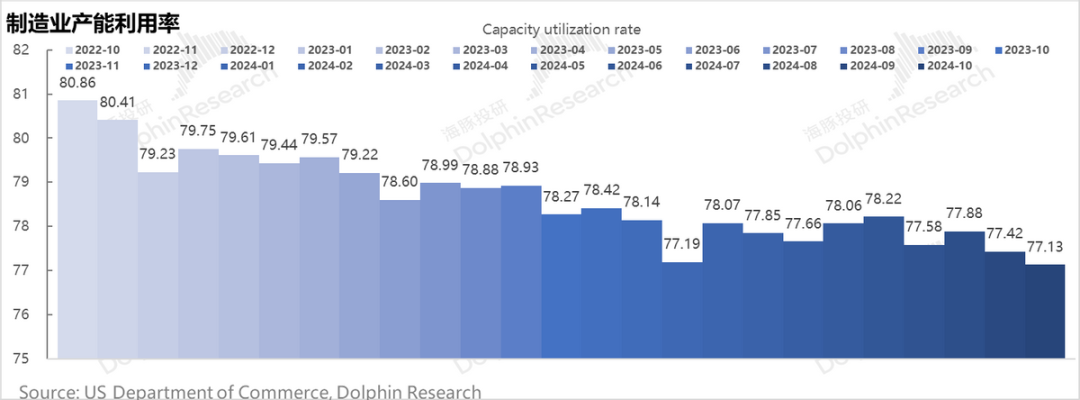

However, regarding goods, judging from the continuously declining capacity utilization rate in the U.S., especially in the automotive industry (which has been declining for nine consecutive months), this increase is unlikely to be sustained and is more likely due to short-term inventory depletion.

Disregarding the disturbance of goods price fluctuations and focusing solely on "stubborn" service inflation, besides residential costs, which are still increasing at a monthly rate of around 0.3%, the other two main contributors are healthcare and categories with high labor input and difficult to replace with technology.

Overall, the rise in prices in November appears to be more of an internal industrial rotation within the economy. The digestion of commodity inventories has concluded, but as manufacturing capacity utilization remains low, it is difficult to ascertain that commodity consumption has truly rebounded. While service consumption has slowed down, the pace of slowdown is still gradual.

Although the latest CPI does not constitute a true rebound, it certainly has not caused the market to question the expectation that the era of low inflation in the U.S. at 2% is gone for good and that the steady-state CPI post-pandemic will hover around 2.5-3%.

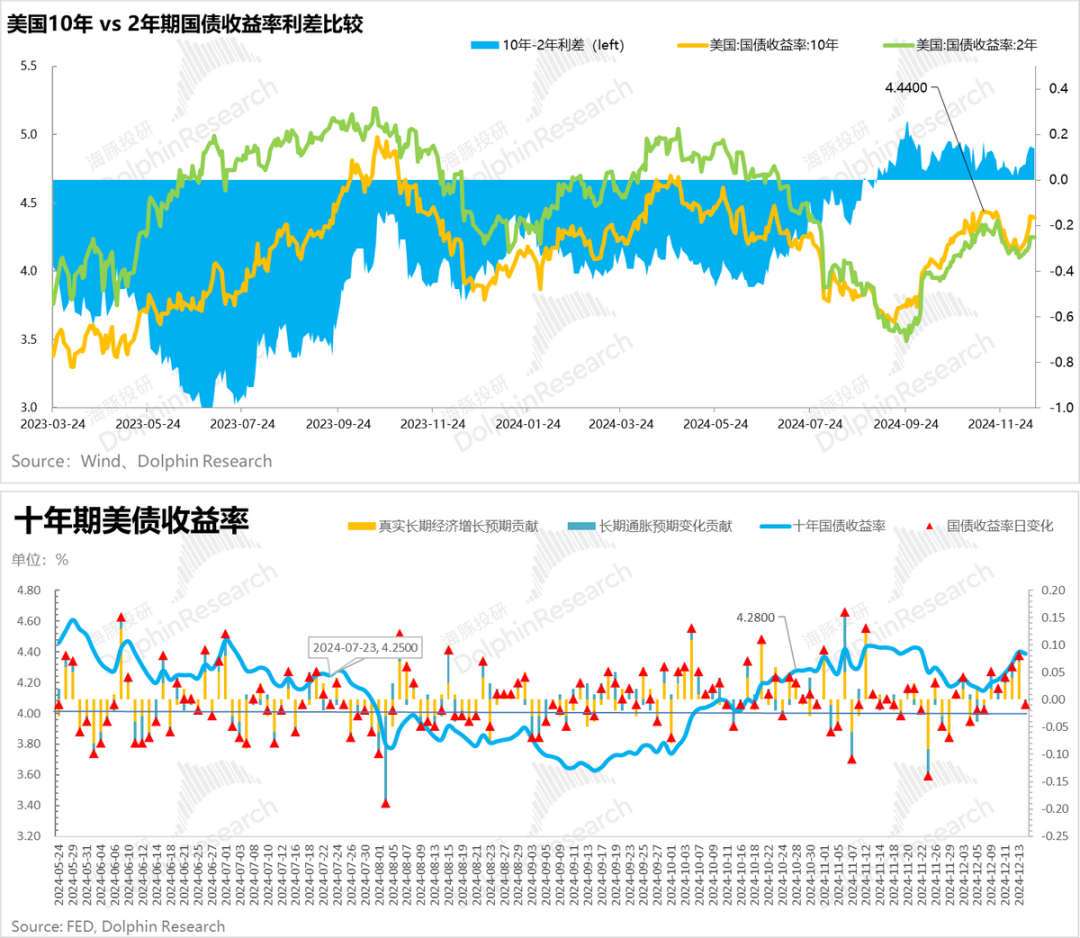

Such inflation data will not affect the Federal Reserve's pace of interest rate cuts in the short term but will raise long-term economic growth expectations. As a result, the yield on 10-year U.S. Treasury bonds has accelerated, and the term spread has narrowed again.

III. U.S. Stocks Rotate, While Chinese Stocks Correct?

Amidst the robust overall economic growth momentum, significant company performance or product launches in the U.S. stock market can serve as catalysts for market growth. Recently, major U.S. AI companies have released new versions of their large models and new technologies, and Broadcom declared the "ASIC Era" during the earnings season. This has led market funds to return to the Nasdaq after speculating on the Dow Jones and small-cap indices under the Trump administration, suggesting that U.S. stocks are merely rotating.

The current macroeconomic environment facing Chinese assets makes the market believe that policy is the only solution. Although China's retail sales data in November initially appeared poor, after adjusting for differences in promotional timings, the actual performance showed a slight recovery (for a detailed interpretation, see "November Retail Sales Review: 'Double Eleven' Becomes 'Double Ten' as the Culprit").

However, by category, it is evident that categories with better sales performance, such as automobiles and home appliances, are major subsidized items for trade-ins. This underscores that current consumption necessitates subsidies to be stimulated. Although retail sales have slightly rebounded, prices remained low in November, and the market hopes that policies will continue to exceed expectations.

However, the tone set by the recently concluded Central Economic Work Conference was relatively rational, with no significant surprises. The content expressed at the conference, such as after the September 26 Politburo meeting, "boosting social confidence and significantly recovering the economy," implies that the scale and intensity of announced policies are already quite commendable.

The conference emphasized "stabilizing growth, the real estate market, and the stock market"; the focus of fiscal expenditure is on "two priorities" (implementing major national strategies and strengthening security capabilities in key areas) and "two innovations" (large-scale equipment upgrades and trade-ins of consumer goods).

Stabilizing housing prices, stock prices, and commodity prices is essentially about combating deflation. The "two priorities" indicate that during the process of stimulating domestic demand and combating deflation, industrial upgrading must continue. However, compared to spreading out projects, more emphasis will be placed on "improving investment efficiency" for industrial upgrading projects in the future. The overall tone remains rational, with long-term industrial upgrading remaining unchanged but also striving to balance the contraction of domestic demand in the current economic adjustment.

From late September to the present, the intense policy period has essentially concluded. The remaining time will depend on whether macroeconomic data can truly recover. This process is likely to be accompanied by the realization of profits by funds that have gambled on policy, and Chinese assets may face a correction in the short term.

However, after New Year's Day, approaching the Spring Festival, this extra-long holiday period may also include local consumption vouchers (for both goods and services). To a certain extent, under the policy logic of combating deflation, the vicious spiral of expected collapse in consumer goods has passed. After the correction, good consumer goods can still be considered for future opportunities.

IV. Portfolio Rebalancing and Returns

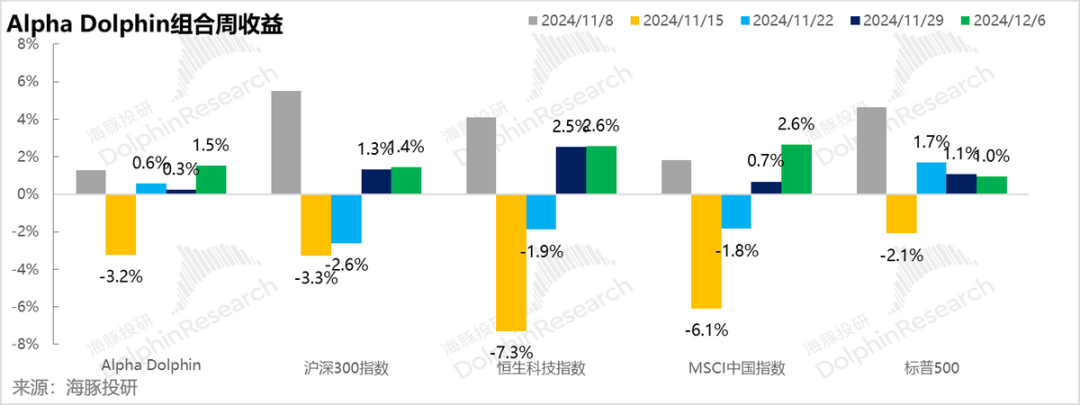

There was no portfolio rebalancing last week. The Alpha Dolphin portfolio's return fluctuated by 0.2% last week, slightly underperforming the MSCI China Index (+0.4%), Hang Seng Tech Index (0.3%), but outperforming the CSI 300 Index (-1%) and S&P 500 Index (-0.6%).

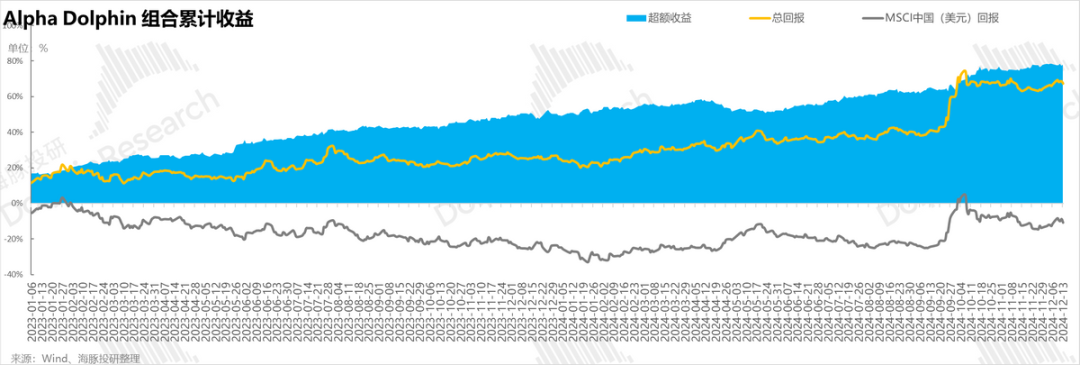

From the start of the portfolio's testing (March 25, 2022) to last weekend, the portfolio's absolute return was 68%, with an excess return of 78% compared to the MSCI China Index. From a net asset value perspective, Dolphin's initial virtual assets of $100 million exceeded $169 million as of last weekend.

V. Individual Stock Profit and Loss Contributions

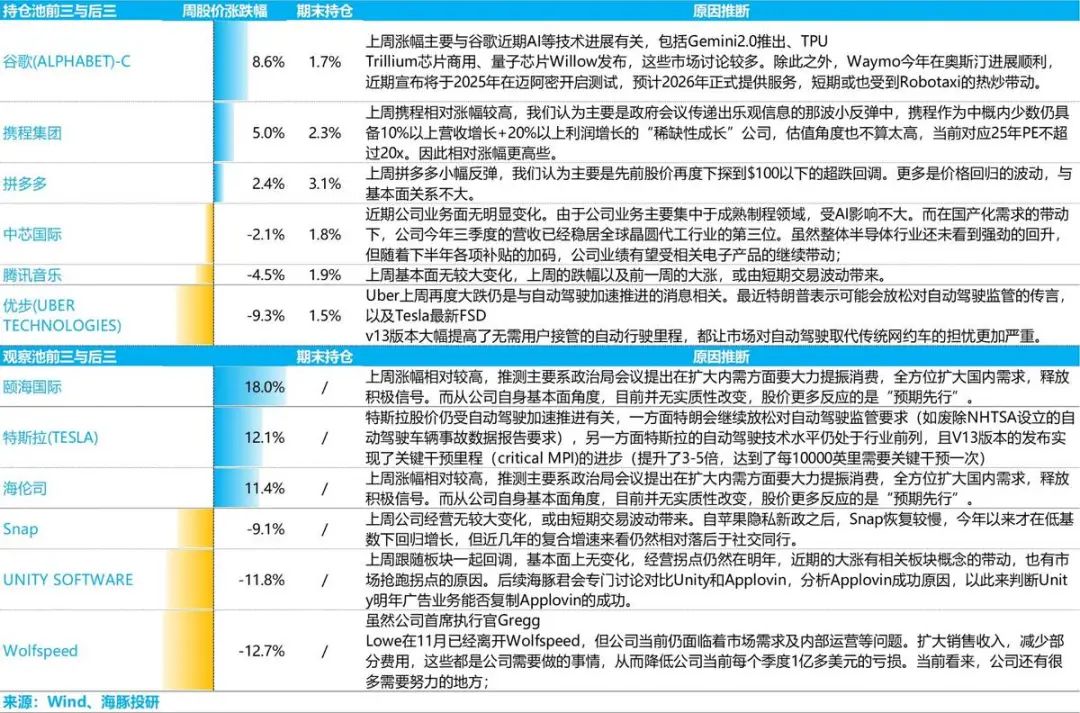

Last week, both the stocks with significant gains and losses were time-driven and related to AI. For example, Google's movements were influenced by Gemini 2.0 and quantum chips, while Uber was rattled by Tesla's FSD. The two small-cap consumer stocks in the observation portfolio were purely speculative based on the content of the Central Economic Work Conference.

For a detailed analysis of the reasons for the larger price fluctuations of the individual stocks covered and tracked by Dolphin last week, please refer to the following chart:

VI. Asset Portfolio Distribution

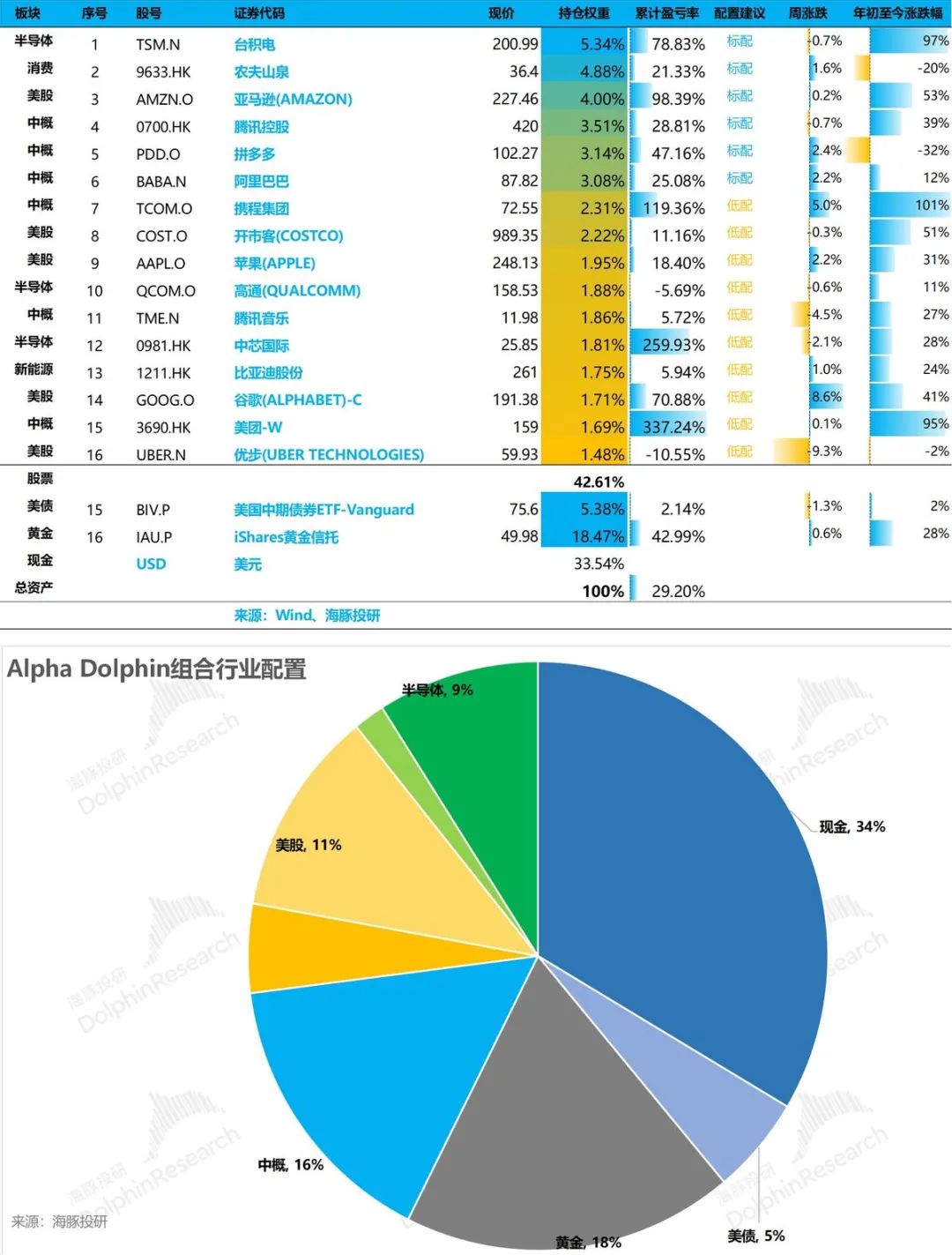

The Alpha Dolphin virtual portfolio holds a total of 14 stocks and equity ETFs, with 3 standard allocations and 8 equity assets under-allocated. The rest is distributed among gold, U.S. Treasuries, and U.S. dollar cash. As of last weekend, the Alpha Dolphin asset allocation and equity asset holdings weights were as follows:

VII. Key Events This Week:

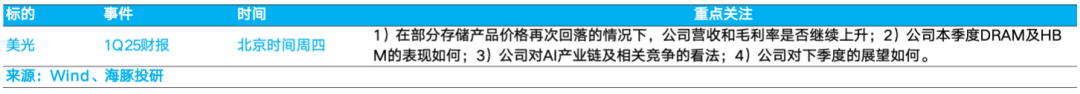

This week marks the end of the third-quarter U.S. earnings season, but Micron's latest quarterly earnings report (for the month of November) is about to be released again. It will be intriguing to observe if the storage market is recovering and how HBM is progressing.

- END -