The "First AI Chip Stock" Losing Money for 7 Years Catapults Its CEO to the Top of Jiangxi's Richest List

![]() 12/26 2024

12/26 2024

![]() 627

627

Since 2024, Cambrian's stock price has surged nearly 400%, and founder Chen Tianshi's net worth has soared accordingly, reaching 80 billion yuan, effectively catapulting him to the pinnacle of Jiangxi's wealthiest individuals. However, sustained losses cannot uphold a market capitalization nearing 300 billion yuan. Cambrian must swiftly identify pathways to profitability.

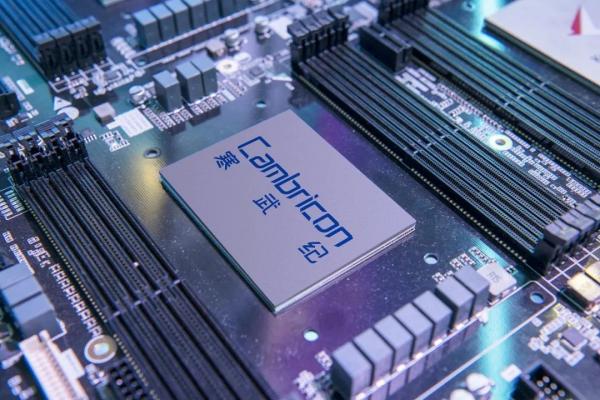

With esteemed titles such as "the First AI Chip Stock" and "China's NVIDIA," publicly traded Cambrian has undeniably been the capital market's shining star in 2024. By December 23, its share price had peaked at 700 yuan per share, making it the second-highest-priced A-share listed company after Kweichow Moutai, with a market capitalization that once exceeded 290 billion yuan.

As the stock price soared, founder Dr. Chen Tianshi's net worth skyrocketed as well. With 120 million shares, his net worth peaked at 84 billion yuan. As of December 25's close, Bloomberg's Billionaires Index indicated Chen Tianshi's net worth stood at $10.9 billion (approximately 79.55 billion yuan).

However, despite the surging stock price and Chen Tianshi's growing wealth, Cambrian's operating performance is a tale of chaos. From the public release of financial data in 2017 through the first three quarters of 2024, Cambrian has been mired in losses, amassing over 5.7 billion yuan in cumulative deficits.

On one hand, the stock price continues to set new highs; on the other, the company's operating performance shows persistent losses with no signs of profitability. This divergence has made Cambrian highly contentious and subject to intense scrutiny.

Creating Jiangxi's Richest Person

Before Chen Tianshi ascended to the top of Jiangxi's richest list, this title had been held by Wang Wenjing, founder of UFIDA Network; Huang Zelan and her husband from Zhangyuan Tungsten; Peng Xiaofeng from LDK Solar; Lin Yinsun from Zhengbang Technology; and Li Yihai from Jimin Trust.

However, unlike all previous Jiangxi billionaires, Chen Tianshi has been deeply entrenched in the chip and artificial intelligence realms. Since the early 21st century, when the Chinese government prioritized chip industry development and introduced supportive policies, the earliest Chinese CPU research and development project, Loongson, supported by the Chinese Academy of Sciences' Knowledge Innovation Program, was formally established in 2001. Dr. Hu Weiwu, an alumnus of the University of Science and Technology of China, led the project.

In 2002, Chen Yunji, one of Cambrian's founders, enrolled in consecutive master's and doctoral programs at the Institute of Computing Technology, Chinese Academy of Sciences, after graduating from the University of Science and Technology of China. Coincidentally, his mentor was Dr. Hu Weiwu. Due to a shortage of personnel in the Loongson project at the time, the 19-year-old Chen Yunji joined the R&D team. That year, the first domestically developed general-purpose CPU, Loongson 1, was successfully launched. In 2005 and 2008, the project team successively unveiled Loongson 2 and Loongson 3.

Chen Tianshi, Chen Yunji's younger brother by two years, followed in his footsteps by enrolling in the gifted youth class of mathematics and applied mathematics at the University of Science and Technology of China. After earning his bachelor's degree, he also pursued consecutive master's and doctoral studies at the Institute of Computing Technology, Chinese Academy of Sciences, earning a Ph.D. Since the brothers frequently collaborated, Chen Tianshi quickly gained Dr. Hu Weiwu's appreciation and joined the Loongson project team upon completing his Ph.D. in 2010.

Upon joining the project team, Chen Tianshi and Chen Yunji immediately clicked and decided to jointly explore cross-research in AI and chip design. Their presentation on the vision for AI chips within the Institute of Computing Technology, Chinese Academy of Sciences, was well-received by senior management.

Soon thereafter, in 2012, Chen Tianshi and Chen Yunji, alongside the Institute of Computing Technology and Professor Olivier Temam from the French National Institute for Research in Computer Science and Control, launched an AI chip project that later became Cambrian's technological foundation. Later, the duo presented the processor architecture DianNao at the international academic conference ASPLOS and the first multi-core deep learning processor architecture DaDianNao at the MICRO conference the same year. They subsequently released PuDianNao, ShiDianNao, and Cambricon ISA, the world's first AI processor instruction set.

In 2016, after securing tens of millions of yuan in funding from the Chinese Academy of Sciences' pilot program and meeting Le Jinxin, an investor from Suzhou Yuanhe Capital, the brothers established Beijing Sino-Micro Electronics Technology Co., Ltd., with Chen Tianshi as CEO and Chen Yunji as Chief Scientist.

In its inaugural year, Cambrian unveiled the world's first terminal AI-dedicated processor IP, Cambrian 1A. Upon release, the product was favored by Huawei HiSilicon, integrated into the Kirin 970 chip, and applied to Huawei's Mate 10, launched in 2017.

In 2017, Cambrian introduced the second-generation terminal AI-dedicated processor IPs, Cambrian 1H16 and Cambrian 1H8. In 2018, it launched the third-generation terminal AI processor IP, Cambrian 1M, and the first-generation cloud-based intelligent processor MLU100. Since then, Cambrian has been the first Chinese and one of the few global companies to simultaneously offer both terminal and cloud processor products. Cambrian has subsequently introduced MLU270, MLU290, and MLU370 products.

In 2020, Cambrian entered the capital market. On its listing day, the stock price surpassed the 200 yuan mark, and the total market capitalization exceeded 100 billion yuan.

From 2024 to present, Cambrian's stock price has surged over 390%, making it a legitimate "speculative stock." With the stock price spike, Chen Tianshi's net worth has also soared, reaching $10.9 billion to date. According to the Bloomberg Billionaires Index, Chen Tianshi's net worth has increased by $8.6 billion since 2024, making him the fourth-wealthiest individual in China in terms of annual wealth growth.

Those ahead of Chen Tianshi in wealth growth include renowned figures like Lei Jun and Pony Ma, whose wealth increased by $14 billion and $9 billion, respectively, as well as He Xiangjian from Midea Group, whose wealth grew by $9 billion.

7 Years, 5 Billion Yuan in Losses

From the first financial report disclosure in 2017 through the third quarter of 2024, Cambrian has consistently incurred losses.

According to "Digital Intelligence Research Institute," from 2017 to 2023, Cambrian sustained losses of 381 million yuan, 41 million yuan, 1.179 billion yuan, 435 million yuan, 825 million yuan, 1.166 billion yuan, and 848 million yuan, respectively, amounting to nearly 5 billion yuan in cumulative losses over seven years. Including the 724 million yuan net loss attributable to the parent company's shareholders in the first three quarters of 2024, Cambrian's total losses exceed 5.7 billion yuan.

In contrast to its persistent losses, Cambrian's revenue has stagnated in recent years. From 2017 to 2023, Cambrian generated revenues of 7.843 million yuan, 117 million yuan, 444 million yuan, 459 million yuan, 721 million yuan, 729 million yuan, and 709 million yuan, respectively. From 2021 to 2023, Cambrian's revenue did not grow but instead showed signs of decline.

Due to long-term losses and slowing growth, Cambrian's operating cash flow situation is also grim. Financial report data reveals that from 2017 to 2023, Cambrian's net operating cash flow was -24 million yuan, -55 million yuan, -202 million yuan, -132 million yuan, -873 million yuan, -1.33 billion yuan, and -596 million yuan, respectively.

Although Cambrian's net cash flow loss narrowed significantly in 2023, the situation in 2024 is not optimistic. The financial report for the first three quarters of 2024 shows that Cambrian's net operating cash flow was -1.81 billion yuan, almost matching the combined loss of 2023 and 2022.

Furthermore, as of the third quarter's end, Cambrian's cash and cash equivalents balance dwindled to 958 million yuan, a nearly 3 billion yuan decrease from the year's beginning.

Regarding Cambrian's disappointing performance, industry insiders told "Digital Intelligence Research Institute" that "the AI trend and inclusion in the Shanghai Stock Exchange 50 Index have temporarily alleviated Cambrian's crisis. However, in the long run, it will ultimately be reflected in its performance. NVIDIA serves as a prime example of this."

According to "Digital Intelligence Research Institute," NVIDIA generated revenue of $35 billion in the third fiscal quarter of 2024, a 94% year-on-year increase, with a net profit of $19.3 billion, a 109% year-on-year rise. In the first three fiscal quarters of 2024, NVIDIA achieved a net profit of $50.8 billion and is projected to surpass the $70 billion mark for the full year.

NVIDIA's stock price has increased by over 180% since 2024, at least partially supported by its robust performance. Cambrian, dubbed "China's NVIDIA," appears to struggle to justify its current market capitalization based on its current financial standing. Since its inception, Cambrian has relied on financing to sustain operations, raising a total of 7 billion yuan through six funding rounds prior to the IPO and IPO fundraising. Little remains now.

In other words, if Cambrian fails to achieve profitability soon, its current state cannot uphold a market capitalization nearing 300 billion yuan. When the bubble bursts, Chen Tianshi may swiftly fall from the pinnacle of Jiangxi's richest individuals.