Huawei Invests Heavily to Address Limitations of Pure HarmonyOS

![]() 02/09 2026

02/09 2026

![]() 561

561

Source | YuanSight

Nearly five years ago, Huawei's smartphone market share took a significant hit, reaching an all-time low. However, by 2025, the company had made a remarkable comeback, with its domestic market share soaring to 17%. All indicators suggest that, at least in the domestic market, Huawei has overcome previous supply chain constraints and is on a path to reclaim its former glory.

Recently, third-party data agency Omdia released figures showing a 1% year-on-year decline in China's mainland smartphone market in 2025, with total shipments reaching 282.3 million units. Among these, Huawei shipped 46.8 million units, securing the top spot with a 17% market share.

In a stagnating smartphone market, Huawei's resurgence can be attributed to its dual strategy of integrating software and hardware.

On one hand, in 2025, the mass production of Kirin series chips saw a sustained increase in capacity, boosting the localization rate of Huawei's core components and completely breaking free from supply chain constraints. Flagship models like the Mate 80 and Pura 80 formed a comprehensive product lineup. Concurrently, Huawei continued to implement its '1+8+N' all-scenario strategy, fostering user loyalty.

On the other hand, during the refinement phase of 'Pure HarmonyOS,' Huawei adopted strategies such as offering direct financial incentives to users and regularly adjusting product prices to manage inventory and enhance market share.

01

Pure HarmonyOS and Financial Incentive Strategies

In 2019, Huawei unveiled its long-anticipated HarmonyOS, aiming to independently create an ecosystem that integrates multiple smart devices, including smartphones, PCs, smart screens, and automobiles.

In the first quarter of 2024, HarmonyOS's market share in China reached 17.2%, officially surpassing iOS to become the country's second-largest operating system after Android.

That same year, Richard Yu, then Chairman of Huawei's Terminal BG, announced the official release of HarmonyOS NEXT, dubbed 'Pure HarmonyOS' by outsiders. This version underwent full-stack self-research, no longer supporting Android apps, and exclusively supported the HarmonyOS kernel and applications.

However, during the subsequent transition phase, Pure HarmonyOS encountered several challenges. For instance, in the first half of 2025, it faced delays in application ecosystem adaptation, system stability and functionality issues, subpar hardware and interaction experiences, and high costs for upgrades and rollbacks.

Take the initial HarmonyOS version of WeChat as an example; it lacked features like Moments cover settings and had issues with image text recognition, fingerprint payments, mini-programs, and official accounts. Even now, NetEase Cloud Music, China's largest internet music platform, has yet to release an official HarmonyOS app, forcing users to run the software through Zhuoyitong.

Under these circumstances, some users opted to run Android apps via Zhuoyitong or retain alternative devices, while others attempted to revert to previous software versions.

Nevertheless, with the introduction of HarmonyOS 6.0 and enhanced chip performance, Huawei has deeply optimized multiple dimensions, including performance, communication, cross-device collaboration, security and privacy, interaction experience, AI capabilities, and the developer ecosystem. System fluidity, battery life, and experiences in high-frequency scenarios and older models are all improving.

Media statistics show that in January 2026, the number of newly installed native HarmonyOS devices increased by 7.56 million, surpassing 42 million in total, with over 15,000 native applications.

Additionally, Huawei revived its strategy of financial incentives, boosting user loyalty to HarmonyOS.

Starting last year, Huawei introduced the 'HarmonyOS Gifts' benefits package. Purchasing designated models like the Mate, Pura, and nova series, or upgrading to specific HarmonyOS versions as an existing user, granted access to video memberships, shopping coupons, service discounts, and transportation card incentives.

Furthermore, Huawei launched the 'HarmonyOS Ecosystem Daily Refresh' sign-in red packet program. New models and older models upgrading to HarmonyOS could participate, with a maximum of 1,000 yuan in cash available for 60 consecutive days of sign-ins.

Source: Screenshot of the HarmonyOS Daily Refresh red packet interface

While increasing investment in and comprehensively upgrading the HarmonyOS operating system, Huawei has pledged to continuously support innovation in the HarmonyOS operating system and AI ecosystem.

In September 2025, at HUAWEI CONNECT 2025, Huawei officially launched the 'Tiangong Plan,' committing 1 billion yuan in funds and resources to fully support HarmonyOS AI ecosystem innovation.

IDC data shows that by the fourth quarter of 2025, HarmonyOS Next had captured 12% of China's smartphone operating system market share.

02

The Strategy of Price Reductions

With supply chain optimization and an increased localization rate of core components, Huawei has gained some flexibility for price adjustments.

In the latter half of last year, Huawei announced price reductions for the Mate 80 series, with the standard version's starting price dropping by 800 yuan and the Pro version by 500 yuan.

Leveraging the pre-Chinese New Year phone upgrade rush, Huawei launched targeted promotional activities. On January 29, Richard Yu announced the upcoming Chinese New Year limited-time offers, running from that day until February 28. Designated models in the Pura 80 series saw discounts of up to 1,500 yuan, the Mate 70 series up to 1,800 yuan, and the Mate X6 series up to 2,000 yuan. Participating products included the Huawei Mate 80 series, Pura 80 series, Mate 70 series, Mate X6 series, Pura X series, nova 15 series, Mate XTs, as well as Huawei watches, earphones, tablets, PCs, smart screens, and routers.

A month ago, Huawei's foldable phone, the Pura X, initiated price reductions, with the standard version dropping by 600 yuan and the premium version by 800 yuan.

Earlier last year and mid-year, Huawei launched various price reduction promotions. Judging by the timing of these promotions, the objectives were either to lower consumption barriers, capture the festive gift-giving and year-end bonus consumption markets, or to accelerate inventory turnover of older products in preparation for new releases.

This phased, gradient pricing strategy can balance profit and market share while minimizing the impact on Huawei's premium positioning and maintaining brand image.

Beyond its localization efforts, the continued implementation of the 'national subsidies' policy in 2025 enables Huawei to achieve greater price reductions while bearing less profit loss.

IDC analysis states that, facing industry-wide cost pressures and rising competitor prices, Huawei maintained pricing stability for the Mate 80 series and nova 15 series, effectively enhancing product attractiveness and competitiveness. With continued supply chain improvements and steady capacity increases, Huawei's market coverage and supply capabilities across multiple price segments will be further consolidated.

According to IDC data, in the second quarter of 2025 in China, Huawei secured an 18.1% market share with 12.5 million smartphone shipments, ranking first in Chinese market sales. This marked its return to the top annual spot in the Chinese market after five years since 2020.

03

Room for Adjustment

Even so, Huawei and other brands continue to face challenges in the subsequent smartphone market.

Omdia data shows that in the fourth quarter of 2025, driven by year-end promotions and the continuation of national subsidy policies, the overall market decline slowed.

Additionally, as one of Huawei's main competitors in China, Apple has also begun to increase the frequency of its price reductions.

Data reveals that in the first half of 2025, the iPhone 16 series saw a 5.2% year-on-year increase in shipments, with its market share rebounding to 15.5%, thanks to significant price reductions combined with '618' promotions and national subsidies. In the latter half of the year, driven by the 'more features, same price' strategy of the iPhone 17 series, Apple's shipments surged, with its market share rising to 21.2%, and the fourth quarter alone accounting for 34.6% of shipments.

With a continuously growing market share, Apple has reaped substantial profits.

In the first fiscal quarter of 2026, iPhone revenue increased by 23% year-on-year to $85.27 billion. During this period, Apple's revenue in Greater China soared by 38% year-on-year to $25.526 billion, making it one of the most outstanding performers among the world's five largest markets.

Omida commented that Apple achieved robust shipment growth through product differentiation and upgrade strategies, supporting overall sales and optimizing its product mix. Besides the redesigned iPhone 17 Pro series, which received an enthusiastic response from consumers, the iPhone 17 saw comprehensive upgrades in storage and display specifications while maintaining the same entry-level price as its predecessor. Its contribution to the product mix exceeded that of previous base models.

However, it should be noted that the price adjustment space for Huawei and Apple continues to be squeezed.

According to a report by market research firm Counterpoint Research, affected by rising memory chip prices and supply constraints, global smartphone SoC (system-on-chip) shipments are expected to decline by 7% year-on-year in 2026.

IDC also anticipates that, facing the prospect of significantly rising memory prices, cost pressures on phone manufacturers will intensify further, potentially leading to a more noticeable decline in China's smartphone market shipments in 2026.

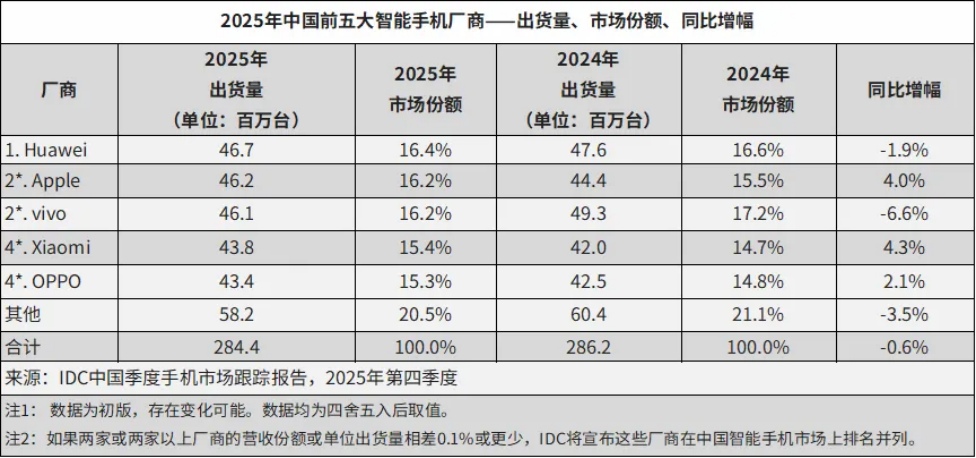

Market Performance of China's Top Five Smartphone Vendors in 2025 | Source: IDC

Against this backdrop, some brands have begun to hit the brakes.

According to Jiemian News, Xiaomi, OPPO, Vivo, and Transsion have all lowered their 2026 shipment expectations. Xiaomi and OPPO reduced their targets by over 20%, Vivo by nearly 15%, and Transsion to below 70 million units. However, the downward adjustments by major manufacturers primarily focus on mid-to-low-end and overseas products.

In comparison, thanks to recent supply chain management, domestic substitutions, and ecological synergies, Huawei is relatively less affected by rising upstream raw material prices like memory chips. Meanwhile, high-end models have stronger resilience against cost increases; to maintain top-tier configurations and brand positioning, manufacturers can absorb some pressure through internal cost control.

In contrast, mid-to-low-end models are most severely impacted, as price hikes will significantly dampen price-sensitive users' purchase intentions, even leading them to abandon upgrades altogether.

Of course, in the long run, software and ecological shortcomings of HarmonyOS, as well as chip performance and supply capabilities, remain areas where Huawei needs to improve. Amid demand being prematurely exhausted by 'national subsidies' and the need to further boost market share, Huawei must strike a balance between maintaining product competitiveness through pricing and implementing dynamic price adjustments.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.