Who is the Most Profitable Enterprise in ByteDance's Computing Power Sector?

![]() 12/30 2024

12/30 2024

![]() 761

761

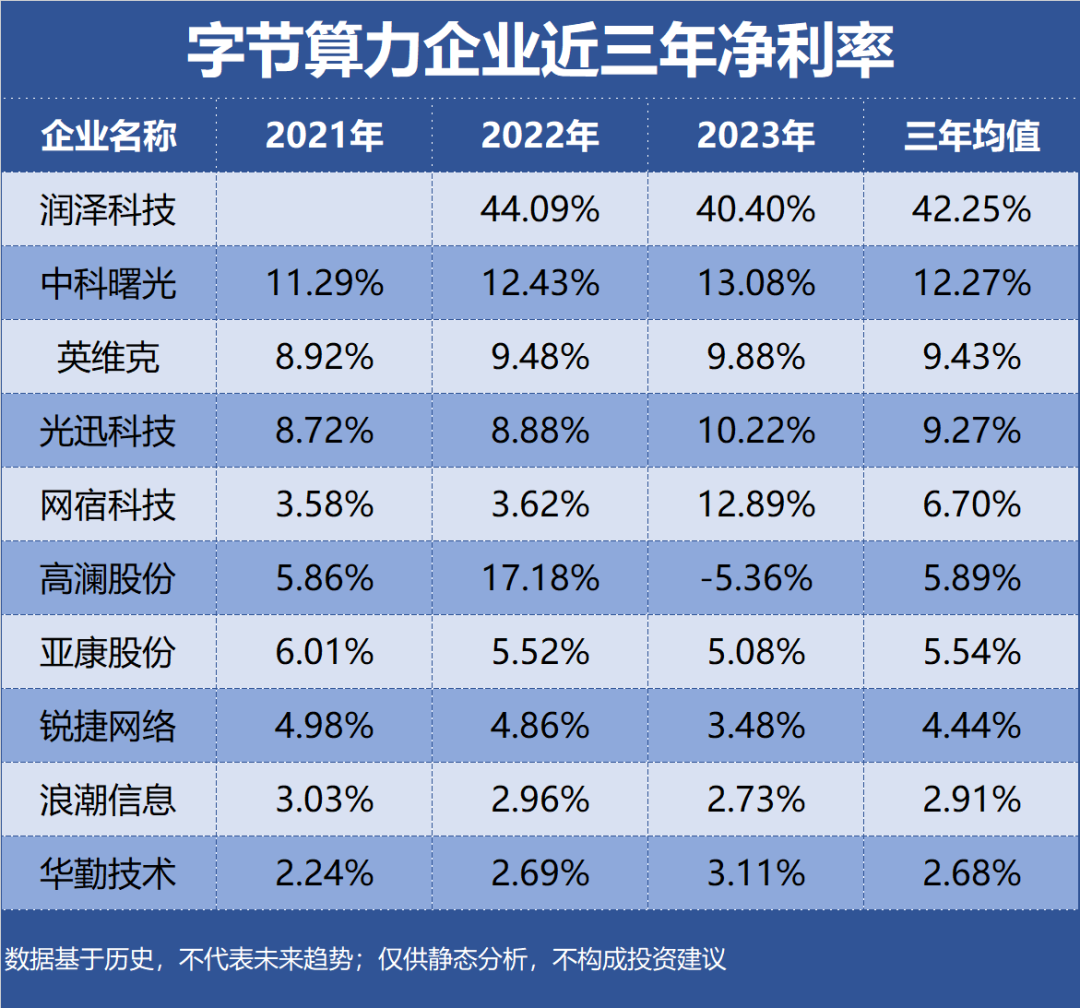

ByteDance has invested heavily not only in AI computing power hardware but also across multiple links of the computing power industry chain, encompassing AIDC (Artificial Intelligence Data Center), switches, optical modules, liquid cooling, and more, to establish an independent and controllable infrastructure. Profitability is typically reflected in the amount and level of corporate earnings over a given period. Analyzing profitability involves a deep dive into a company's profit rates. This article, part of the "Profitability" series within the Enterprise Value series, examines 13 ByteDance computing power enterprises, using return on equity, gross profit margin, net profit margin, and other metrics as evaluation criteria. Note that the data presented is historical and does not predict future trends; it serves for static analysis only and does not constitute investment advice.

Top 10 Profitable Enterprises in ByteDance's Computing Power Sector:

No. 10 Yakang

Industry Segment: IT Services

Profitability: Return on Equity 11.74%, Gross Profit Margin 13.66%, Net Profit Margin 5.54%

Performance Forecast: No performance forecast has been made by any institution this year.

Main Products: Integration and sales of computing power equipment, generating 63.93% of revenue with a gross profit margin of 6.22%.

Company Highlights: Yakang's comprehensive services for computing power infrastructure encompass technical operation and maintenance, after-sales maintenance, and delivery and implementation services, providing comprehensive support for data centers of customers like ByteDance.

No. 9 Goland

Industry Segment: Other Special Equipment

Profitability: Return on Equity 9.53%, Gross Profit Margin 23.67%, Net Profit Margin 5.89%

Performance Forecast: The highest ROE in the past three years was 24.08%, with the latest forecast averaging 2.21%.

Main Products: High-power-density device thermal management products, generating 53.09% of revenue with a gross profit margin of 17.11%.

Company Highlights: Goland subsidiary Goland Innovation provides 12U immersion liquid cooling modules to ByteDance.

No. 8 Wangsu Technology

Industry Segment: IT Services

Profitability: Return on Equity 3.53%, Gross Profit Margin 27.89%, Net Profit Margin 6.70%

Performance Forecast: ROE has risen continuously to 6.58% in the past three years, with the latest forecast averaging 6.56%.

Main Products: CDN and edge computing, generating 93.18% of revenue with a gross profit margin of 32.33%.

Company Highlights: Wangsu Technology's primary business includes providing MSP services, edge computing, security, computing cloud, and IDC+liquid cooling energy-saving solutions. ByteDance is a significant customer.

No. 7 Accelink Technologies

Industry Segment: Communication Network Equipment and Components

Profitability: Return on Equity 9.71%, Gross Profit Margin 23.48%, Net Profit Margin 9.27%

Performance Forecast: ROE has declined continuously to 8.00% in the past three years, with the latest forecast averaging 8.30%.

Main Products: Transmission equipment, generating 50.66% of revenue with a gross profit margin of 30.09%.

Company Highlights: Accelink Technologies is a leading global supplier of optoelectronic devices and subsystem solutions, with ByteDance among its major customers.

No. 6 Sugon

Industry Segment: Other Computer Equipment

Profitability: Return on Equity 10.02%, Gross Profit Margin 25.42%, Net Profit Margin 12.27%

Performance Forecast: ROE has risen continuously to 10.30% in the past three years, with the latest forecast averaging 10.58%.

Main Products: IT equipment, generating 89.74% of revenue with a gross profit margin of 24.72%.

Company Highlights: Sugon's liquid cooling products are utilized by multiple users in the financial, internet, and IDC industries, including China Construction Bank and ByteDance.

No. 5 Inspur Information

Industry Segment: Other Computer Equipment

Profitability: Return on Equity 12.12%, Gross Profit Margin 10.89%, Net Profit Margin 2.91%

Performance Forecast: ROE has fluctuated between 9% and 14% in the past three years, with the latest forecast averaging 11.24%.

Main Products: Servers and components, generating 99.57% of revenue with a gross profit margin of 7.65%.

Company Highlights: Inspur Information holds over 60% of the domestic market share in artificial intelligence computing, supporting domestic AI-related enterprises like Toutiao.

No. 4 Ruijie Networks

Industry Segment: Communication Network Equipment and Components

Profitability: Return on Equity 23.70%, Gross Profit Margin 38.68%, Net Profit Margin 4.44%

Performance Forecast: ROE has declined continuously to 9.44% in the past three years, with the latest forecast averaging 10.96%.

Main Products: Network equipment, generating 79.01% of revenue with a gross profit margin of 37.29%.

Company Highlights: Ruijie Networks is a leading supplier of data center switches for major internet companies, including ByteDance.

No. 3 Huaqin Technology

Industry Segment: Consumer Electronics Components and Assembly

Profitability: Return on Equity 20.81%, Gross Profit Margin 9.64%, Net Profit Margin 2.68%

Performance Forecast: ROE has fluctuated between 16% and 24% in the past three years, with the latest forecast averaging 12.82%.

Main Products: High-performance computing, generating 56.31% of revenue with a gross profit margin of 9.58%.

Company Highlights: Huaqin Technology has forged a deep partnership with ByteDance in data business, consistently serving as a core supplier with full-stack capabilities from boards and cards to modules to complete AI server systems.

No. 2 Invicta

Industry Segment: Other Special Equipment

Profitability: Return on Equity 14.13%, Gross Profit Margin 30.50%, Net Profit Margin 9.43%

Performance Forecast: ROE has risen continuously to 15.03% in the past three years, with the latest forecast averaging 18.67%.

Main Products: Data center temperature control and energy-saving products, generating 49.96% of revenue with a gross profit margin of 30.62%.

Company Highlights: Invicta provided hundreds of XFlex indirect evaporative cooling units for Qinhuai Data's Huailai New Media Big Data Industry Base project, with the first and second phases specifically customized for ByteDance.

No. 1 Runze Technology

Industry Segment: Communication Application Value-Added Services

Profitability: Return on Equity 30.67%, Gross Profit Margin 50.84%, Net Profit Margin 42.25%

Performance Forecast: The highest ROE in the past three years was 38.80%, with the latest forecast averaging 21.72%.

Main Products: AIDC business, generating 57.46% of revenue with a gross profit margin of 22.14%.

Company Highlights: Runze Technology's primary business includes IDC and AIDC services, with over 60% of its computing power supplied to ByteDance.

Top 10 Profitable Enterprises in ByteDance's Computing Power Sector, with their return on equity, gross profit margin, and net profit margin over the past three years: