Seres A+H Listing: China's Luxury New Energy Vehicles Embrace Their 'Home Turf Moment'

![]() 11/07 2025

11/07 2025

![]() 597

597

Written by / Liujin

Source / Jiedian Finance

On November 5, Seres (stock code: 9927.HK) listed in Hong Kong, becoming the first luxury new energy vehicle (NEV) manufacturer to achieve a dual 'A+H' share listing. Transitioning from A-shares to H-shares and from 'Made in China' to 'Globally Intelligent Manufacturing,' Seres has emerged as a prime example of China's automotive industry ascension as the global NEV competition enters its final stage.

As a milestone marking the value explosion of China's high-end NEV sector, Jiedian Finance delves deeper: What key decisions enabled Seres, the first luxury NEV firm with A+H shares, to set multiple industry records and become the most talked-about disruptor?

Seres' Hong Kong IPO shattered several 'largest' records, propelling China's luxury NEV narrative into the 'Seres Era.'

It represents the largest-ever IPO for a Chinese automaker and the biggest global automotive IPO this year. The market responded with overwhelming confidence: Hong Kong's public offering saw over 133 times subscription, with institutional funding exceeding HKD 170 billion. This capital feast accelerated Seres' globalization drive.

The most striking highlight of Seres' IPO was the 'All-Star League' of 22 cornerstone investors, collectively subscribing approximately USD 826.5 million—nearly half of the total funds raised.

First, the 'national team' not only led the investment but also provided end-to-end support. Chongqing Industrial Mother Fund, a key cornerstone investor, has a longstanding partnership with Seres beyond this IPO. During Seres' critical Capacity ramp up (production ramp-up) phase for the AITO M9, the fund financed the construction of its 'super factory.' This full-cycle support—from industrial empowerment to capital backing—exemplifies a new paradigm of state-owned capital investment: not mere financial participation but strategic ecosystem co-building.

Second, international capital formed alliances to build a global financial network. Giants like Schroders and Mirae Asset joined hands with domestic mainstream players such as GF Fund Management and China Post Wealth Management, creating cross-market financial forces that paved the way for Seres' international strategy.

Additionally, the industrial 'friend circle' expanded collectively. From upstream core suppliers like Sanhua Intelligent Controls and Xingyu Co., Ltd. to downstream channel partners like Zhongsheng Group and Meidong Auto, leading enterprises across the supply chain invested together, forming a rare synergistic closed loop (closed loop) and constructing a complete ecological moat from manufacturing to market.

No wonder many retail investors joked that Seres' Hong Kong listing resembled less a traditional IPO and more a 'Seres Global Promotion Event' co-staged by capital and industry. Beyond capital mobilization, it reflected a profound market consensus on Seres' long-term value—a vivid testament to 'the triumph of long-termism.'

Market consensus on long-term value requires a clear strategic path, which Seres has delivered with precision. The Hong Kong listing provides not just capital but an international springboard.

Jiedian Finance learned that Seres will allocate the raised funds along a clear roadmap: 70% for R&D to strengthen technological moats; 20% for overseas channels and charging networks to solidify market presence; and 10% for working capital to ensure operational flexibility.

Seres' technological success stems from long-term vision.

As early as 2016, when most automakers hesitated over tech routes, Seres proactively adopted a 'pure electric + extended-range' dual strategy and sustained heavy R&D investment. Over the years, it has spent nearly RMB 30 billion on R&D, with RMB 5.06 billion allocated in the first three quarters of 2025 alone—a 15.82% YoY increase. R&D personnel now account for 36% of its workforce, surpassing many tech firms.

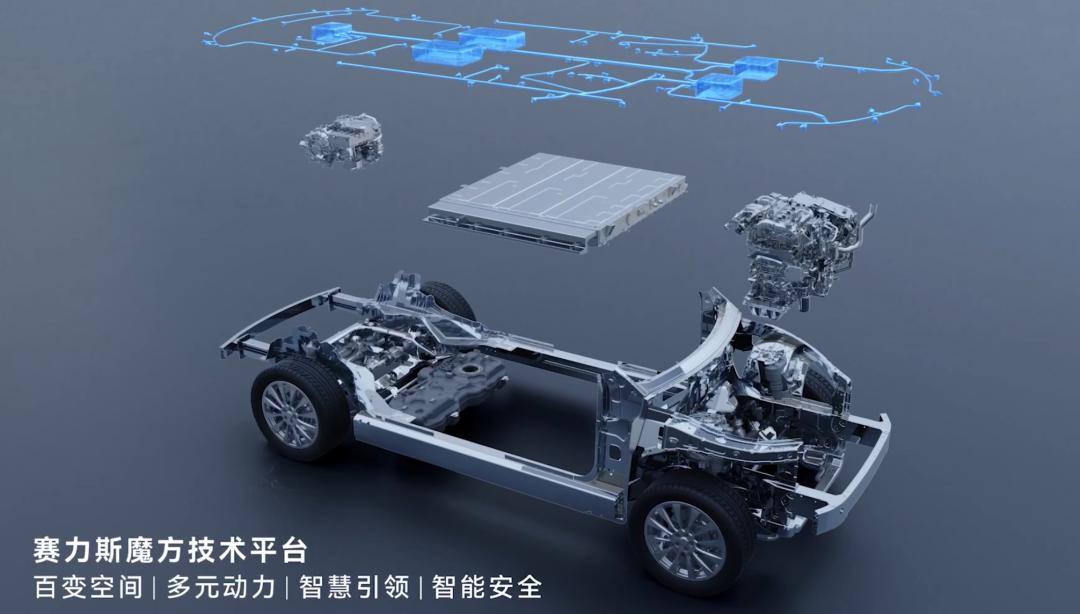

Today, Seres' technologies—including Super Extended-Range, Magic Cube Tech Platform, Super Factory, and Intelligent Safety—form the core competitiveness of its AITO brand. For instance, the Magic Cube Platform, a self-developed super-intelligent vehicle platform, pioneers compatibility with extended-range, pure electric, and hybrid powertrains, drastically shortening new vehicle R&D cycles.

Moreover, Seres has built differentiated competitiveness in core three-electric systems (battery, motor, electric control) and intelligent driving, injecting strong momentum for brand ascension. The AITO's electromagnetic battery, for example, features a five-layer protection structure and chassis anti-collision beams to prevent bottom damage, coupled with ultra-fast charging (10%-80% in 10.5 minutes). Seres also expands its tech 'friend circle' by embracing AI trends—forming strategic alliances with tech giants like ByteDance (beyond Huawei) to advance embodied intelligence.

Judging by fund allocation, Seres' Hong Kong listing marks a pivotal move in its globalization strategy, directly aligning its valuation system with international standards.

Retail-wise, Seres plans to establish 100 brand experience centers in Europe and the Middle East by 2026, while collaborating with Huawei to build ultra-fast charging networks covering 80% of major overseas highway routes—a 'channels-first, infrastructure-follows' approach to solidify market presence. The prospectus reveals plans to accelerate expansion in the Middle East, Europe, Australia, and Central/South America through diversified methods like self-construction, reverse joint ventures, strategic partnerships, and M&As.

The goal is clear: localize high-end models overseas, develop region-specific international products, and ultimately penetrate the global premium auto market.

Industry analysts note Seres' timing leverages the vast potential gap in global NEV markets—Europe at ~19.8% penetration, North America at 9.0%, Middle East/North Africa at 8.7%, and South America at a mere 2.8%. This positions Seres to swiftly establish China's luxury auto brand presence overseas, reshaping perceptions of Chinese brands as merely cost-effective and achieving value reinvention in premium markets.

Backed by solid R&D investment, rich industrial expertise, and a clear market layout, Seres has constructed a robust 'capability foundation.' Its influence is driving a radical revaluation of China's automotive industry.

A veteran involved in multiple automotive M&As told Jiedian Finance that Seres' Hong Kong listing holds landmark significance—it signifies China's transition from a 'guest challenger' to a 'home-field definier' in luxury NEVs.

While the industry debates luxury market dynamics, the AITO series has become a phenomenon. Cumulative deliveries surpassed 800,000 units, setting a new record for China's NEV luxury brand delivery speed. The AITO M9 delivered over 250,000 units in 21 months, dominating the 500,000+ RMB segment; the AITO M8 exceeded 100,000 deliveries in just five months, leading the 400,000 RMB market. By October 2025, Seres' cumulative sales reached 356,000 units, with monthly sales exceeding 50,000 for the first time in October—highlighting its leadership in China's premium NEV market.

Behind this 'home-field' status lies a self-sufficient supply chain. As a 'chain leader,' Seres optimized its supplier network, integrating 300 Tier-1 suppliers into 100, including 20 world-class partners. Core suppliers like CATL, Yanfeng, and Wencan operate in 'factory-within-factory' modes at Seres' Super Factory, with 13 key suppliers establishing bases in Chongqing. This localized synchronous production and supply model forms the backbone of industrial cluster competitiveness.

Seres Super Factory

Take CATL as an example: its first Chongqing plant adopts a 'factory-within-factory' model to supply batteries for AITO models nearby. This collaboration enhances vehicle performance, accelerates production, and shortens delivery cycles.

Seres also established a stringent supplier management system with 'penetrating oversight'—managing not just direct parties but upstream suppliers to ensure full transparency. This stable supply chain enables 'launch-to-volume' high-quality deliveries and a profitable model, forging a sustainable luxury business paradigm.

In the first three quarters of 2025, Seres reported RMB 110.534 billion in revenue and RMB 5.312 billion in net profit attributable to shareholders—a 31.56% YoY increase. Barring surprises, it will rank first in net profit among new energy vehicle makers in 2025.

From challenger to definier, from sales breakthrough to profit leadership, Seres is setting a new benchmark for China's luxury NEVs with a solid industrial foundation and sustainable business model.

Epilogue

Looking back, Seres completed China's most inspiring manufacturing 'triple jump' in 39 years—from a spring to 800,000 AITO vehicles.

First Jump: Parts to Vehicles. Founded in 1986 as an auto parts factory, Seres transitioned to vehicle manufacturing in 2003 after 17 years of expertise.

Second Jump: Fuel to New Energy. Facing industry transformation, Seres pivoted to NEVs in 2016 and went public on the A-share market, achieving a critical 'manufacturing to intelligent manufacturing' shift.

Third Jump: Traditional to Top-Tier. The AITO series not only secured Seres' foothold in the premium market but also broke foreign brands' long-standing monopoly on luxury vehicles. Once confined to mid-low-end markets, Seres proved Chinese brands could compete in high-end segments through technological prowess.

Seres' 'triple jump' encapsulates China's manufacturing journey from OEM to innovation, from follower to leader. Today, the core arena of global high-end NEV competition is China—where we are not just participants but definers of home-field rules.