Two years ago, XPENG wanted to phase out hybrid models, but two years later, it has turned to embrace extended-range technology.

![]() 11/07 2025

11/07 2025

![]() 493

493

Lead

Introduction

"Getting slapped in the face isn't scary; what matters is surviving and thriving even better."

During the conference call after the release of the second-quarter financial report, He Xiaopeng stated that monthly sales of 40,000 units would become the norm for XPENG.

And in October just passed, this new force in car manufacturing did not go back on its word, delivering a total of 42,013 new vehicles, marking a 76% year-on-year increase and a 1% month-on-month rise, setting another all-time high.

As an onlooker, the greatest impression is clearly centered on the fact that "after consecutively launching a series of pure electric models, the market has given XPENG relatively positive feedback, and it should have no problem maintaining the so-called bottom line."

However, the pain points are also glaringly obvious.

As of now, even without the specific sales composition for XPENG in October, it is foreseeable that the MONA M03, targeting the A-class sedan market, will likely account for nearly half of the sales. The remaining portion will be contributed by models such as the G6, G7, G9, including the P7+, the all-new P7, and the X9.

When it comes to the average price per model, XPENG has virtually no advantage compared to its competitors in the same camp, such as Xiaomi, NIO, Li Auto, and Harmony Intelligent Mobility.

Moreover, it's important to note that whenever competition intensifies in the Chinese auto market, the mainstream mass-market segment inevitably becomes the most fiercely contested, with intense internal competition and Fight and kill (which means fierce fighting or competition). Despite breaking through the 40,000-unit threshold, XPENG has not essentially escaped the tough quagmire and remains at risk of being challenged and besieged at any time.

Precisely against this backdrop, the most urgent task this year is to find new breakthroughs, gaining incremental growth at the consumer end while helping the brand ascend to higher grounds.

Betting on extended-range technology is XPENG's answer.

In fact, similar signals were already released as early as last year's Technology Day. Last night, the moment for a phased reveal finally arrived.

Regarding the technology itself, according to He Xiaopeng, the current traditional extended-range models on sale have limited pure electric range, only able to meet urban commuting needs, and frequent charging is time-consuming and laborious.

In contrast, XPENG, with its deep accumulation and leading technological innovation in the three electric domains (battery, motor, and electronic control), has successfully defined and achieved "Super Extended-Range," pushing the pure electric range to the extreme.

As the inaugural carrier, the X9 Super Extended-Range version not only boasts a 452-kilometer pure electric range, meeting the demand for a one-week commute with just a single charge, but also becomes the world's longest-range large seven-seater model with a combined range of 1,602 kilometers.

Of course, as the brand's first Super Extended-Range product, no effort has been spared in terms of configuration.

It is reported that the X9 Super Extended-Range version is the industry's only product to feature a "63.3 kWh large battery + 60L large fuel tank," supporting 800V 5C ultra-fast charging rates, allowing for a 313-kilometer charge in just 10 minutes, with battery cycle times exceeding 2,000.

In terms of luxury and comfort configurations, it also excels, not only equipped with high-tech features such as a dome star track ambient light, AI aviation reading light, and AR-HUD, but the entire vehicle also adopts 100% soft covering and Ayous solid wood materials.

Two SKUs, MAX and Ultra, will be launched, equipped with one and three self-developed Turing AI chips respectively, with pre-sale prices set at 350,000 yuan and 370,000 yuan.

As for its mission, it is quite straightforward: to gain a larger share of the luxury MPV segment through extended-range technology. After all, the performance of the X9 pure electric version can only be described as mediocre. Walking on two legs, hoping to achieve a "1+1>1.5" effect, would be ideal.

At the same time, the reason why XPENG chose the X9 as its inaugural carrier is also very simple.

Using the current flagship model of the family to help establish a sufficiently high-end initial industry impression for the "Super Extended-Range" system and fully guide potential customers to view it as a configuration rather than a powertrain form.

Next, according to the MIIT's new vehicle catalog, the Super Extended-Range versions of the G6 and P7+ are highly likely to roll out one by one soon. For the protagonist of today's article, a battle of "both volume and ascension" has clearly begun to unfold.

If pure electric models have set the bottom line for XPENG, then extended-range technology will determine its upper limit. Leveraging the magic of the "fuel tank" is crucial, as it pertains to whether this new force in car manufacturing can smoothly enter the widely recognized final round.

From an onlooker's perspective, I would also like to discuss a concern of mine on this occasion.

There was a time when the meteoric rise of Li Auto and Seres largely proved that extended-range technology is far from being the outdated technology that some ignorant people claim it to be; instead, it resembles a coveted prize that helps automakers achieve both fame and fortune.

However, entering this year, as more and more brands blindly follow suit, everyone has been surprised to find that the actual situation seems somewhat amiss.

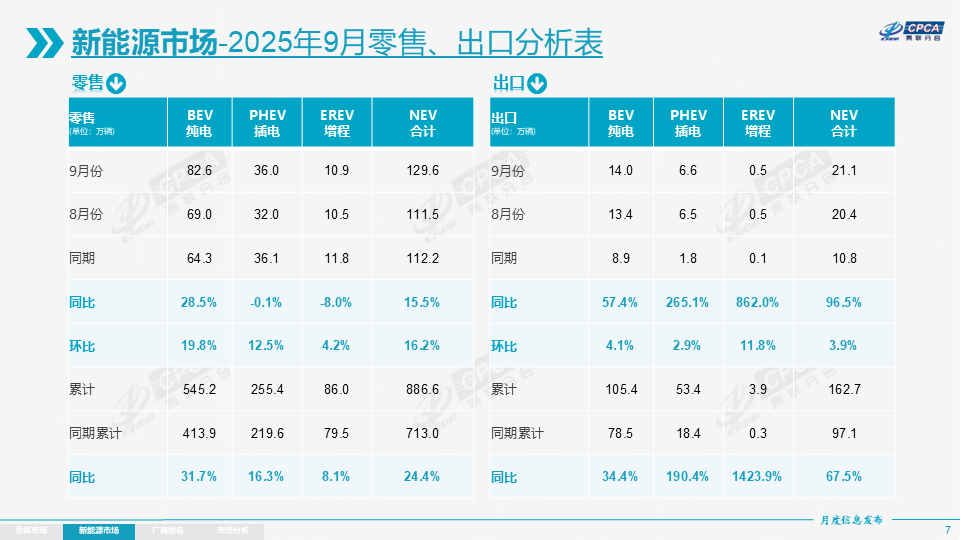

Taking the retail data of new energy vehicles in September released by the China Passenger Car Association as an example, extended-range models sold a total of 109,000 units, representing an 8% year-on-year decline. The cumulative growth rate from January to September was also the weakest compared to pure electric and plug-in hybrid models.

Looking further at the sales structure of new energy vehicles in September, pure electric models accounted for 63% (YoY +4.7%), plug-in hybrids for 28% (YoY -3.9%), and extended-range models for 9% (YoY -0.9%).

From January to September, the cumulative sales structure of new energy vehicles showed pure electric models at 62% (YoY +3.8%), plug-in hybrids at 29% (YoY -3.0%), and extended-range models at 9% (YoY -0.8%).

The aforementioned results indicate that while this pie is indeed delicious, its size is not large enough to feed so many hungry wolves. The timing of XPENG's entry into the market has actually passed the widely recognized best window of opportunity.

Next year, judging from the continuously emerging list of heavyweight new models, whether it's Li Auto, Seres, or the other "Jie" models under Harmony Intelligent Mobility, as well as the ambitious Xiaomi, not to mention the unnamed domestic and joint venture giants, they are bound to stir up the extended-range market even more fiercely. Fortunately, the bigger the waves, the more valuable the fish.

The extended-range segment will ultimately be a game for the strong.

In such an environment, how much reward and dividend XPENG can reap and how high it can elevate the company's upper limit is undoubtedly filled with unknowns and challenges.

Additionally, looking at any automaker in the industry that operates on dual powertrains, internal conflict and cannibalization are inevitable. For XPENG, it should also strive to alleviate the dilemma of "extended-range eating into its own pure electric sales." Only by doing so can it ascend to monthly sales of 50,000, 60,000, or even higher.

While flipping through my photo album, I by chance (which means by chance) came across a photo taken on November 6th, two years ago. He Xiaopeng stood center stage, vigorously promoting pure electric vehicles, with a PPT behind him prominently displaying "Phasing Out Hybrids = Ultra-Fast Charging + High Range + Proprietary Charging."

Yet, two years later today, XPENG has turned to embrace extended-range technology. Although slightly ironic, the same principle applies: "Getting slapped in the face isn't scary; what matters is surviving and thriving even better." In the Chinese auto market, one must learn to assess the situation.

As He Xiaopeng said in an exclusive interview, "Many things are not about right or wrong; they're just choices."

He then specially shared, "Since 2019, I've been continuously pushing within the company to develop extended-range technology, but I always encountered various resistances. Finally, on the fifth attempt, I persuaded everyone."

When asked if it's too late to enter the market now,

He Xiaopeng judged, "There's still a significant share of gasoline vehicles, and the first stop for gasoline vehicle users transitioning to new energy will likely be extended-range models. Our products will selectively adopt a dual powertrain strategy of pure electric and extended-range."

Anyway, after an hour of communication, one can deeply sense the determination and confidence of this helmsman. New extended-range, new journey, has begun.

Now that we've reached this point, and the article is gradually nearing its end, what I ultimately want to share is about last Thursday afternoon's Technology Day.

The aspect I care about the most is not whether the XPENG IRON hides any secrets, not how many orders the XTENG Aerocraft has received, and not how many Robotaxis can be mass-produced next year.

To some extent, they are temporarily just pawns that prop up the capital valuation of this new force in car manufacturing, helping it seek greater visibility.

In comparison, I've always believed that the success or failure of the second-generation VLA is crucial.

According to the official introduction, this new intelligent driving system innovatively eliminates the "language translation" link (which means step or process), achieving for the first time the direct end-to-end generation from visual signals to action commands, completely overturning the industry's traditional "V-L-A" architecture and attempting to explore a new physical model paradigm.

It is further learned that by the end of this year, XPENG will invite pioneer users for co-creation experiences of the second-generation VLA, with a full rollout scheduled for all Ultra models in the first quarter of next year.

At that time, the quality of the functional experience and whether it can Undisputed (which means without dispute) rank in the first tier will directly determine its subsequent position in the industry.

As we all know, "intelligent driving" has always been a key label firmly attached to XPENG and its golden signboard for selling cars.

However, in the past two years, with the entry of "oligarchs" like Huawei and the efforts of many leading suppliers, XPENG's first-mover advantage has gradually diminished.

The protagonist of today's article is facing fierce attacks from both front and rear. Once it fails to capture consumers' minds in this dimension, the blow to the enterprise will be devastating.

Therefore, the second-generation VLA cannot afford to fail. And from He Xiaopeng's words and actions at the Technology Day, one can clearly sense that "the old era is over, and a new war with AI as its backdrop has begun."

For better or worse, XPENG must continue to strive.

Editor-in-Chief: Cui Liwen Editor: He Zengrong