Global Expansion of AI Applications: Wondershare and Others Target the Japanese Market

![]() 12/31 2024

12/31 2024

![]() 665

665

The AI era is swiftly engulfing the globe, propelling technological advancements across various sectors.

Since 2024, generative AI has firmly entrenched itself in large-scale applications, exploring novel scenarios and business models. As the popularity of large AI models soars, global AI applications are experiencing unprecedented growth, with industries such as media, finance, healthcare, education, entertainment, office work, and manufacturing poised for radical transformations.

Industry experts predict that by 2025, global AI applications will enter a phase of rapid development, transitioning from niche to mainstream. Valuates Reports anticipates that the global AI market will reach $1694.118 billion (approximately RMB 123 trillion) by 2025.

Amid this global shift towards AI, China aims to become a global AI innovation hub by 2030, with AI projected to generate over $600 billion in annual economic value. China ranks among the world's leaders in scientific contributions, demonstrated by its robust research capabilities and consistent lead in generative AI patent applications from 2014 to 2023.

Chinese companies are not only engaging in global AI technology competition but also driving AI applications worldwide. "Going global" has emerged as a pivotal strategy for AI enterprises, with many, including internet giants, leveraging large models for practical applications in areas like AI photo and video editing, text-based AI office and writing assistants, and companion AI.

Analysts emphasize that overseas markets, with their broader reach and stronger payment capabilities, are an attractive option for many AI developers. Unlike domestic markets, overseas consumers tend to be more willing and able to pay for innovative AI application products. A report indicates that approximately 70% of companies surveyed for 40 AI products adopt a subscription pricing model.

Among the AI application companies expanding globally, Wondershare (300624.SZ), an A-share listed AIGC software company, stands out with its overseas strategy. As a pioneer in digital creativity software, Wondershare has targeted the overseas market since its inception. After over 20 years of expansion, Wondershare now generates over 90% of its revenue from abroad, operating in over 200 countries and regions with a cumulative global user base exceeding 1.5 billion.

Wind data reveals that in the past two years, Wondershare's primary overseas revenue was RMB 1.05 billion and RMB 1.35 billion, respectively, ranking first in terms of primary regional revenue for two consecutive years.

Wondershare executives have stated that amidst the new wave of globalization, the company is actively embracing generative AI to empower enterprises with technology. They have created a comprehensive digital content export product solution encompassing audio and video large models for content production, AI+video/image creativity software for content creation, and AI+digital humans for overseas marketing.

The success of Chinese AI brands in globalizing and establishing their reputations lies in their foresight, early overseas deployment, and profound insights into AI technology. This enables them to serve the global market with high-quality products.

Wondershare, for instance, made forward-looking deployments in the AIGC field before the AI wave, forming an AI algorithm research team in 2020. With the rapid development of AI, Wondershare has launched AI creative products like Wondershare VidAir and Wondershare Virbo. Additionally, Wondershare's video creativity software Filmora, diagramming software EdrawMax, and document creativity software PDFelement have integrated AIGC functionality.

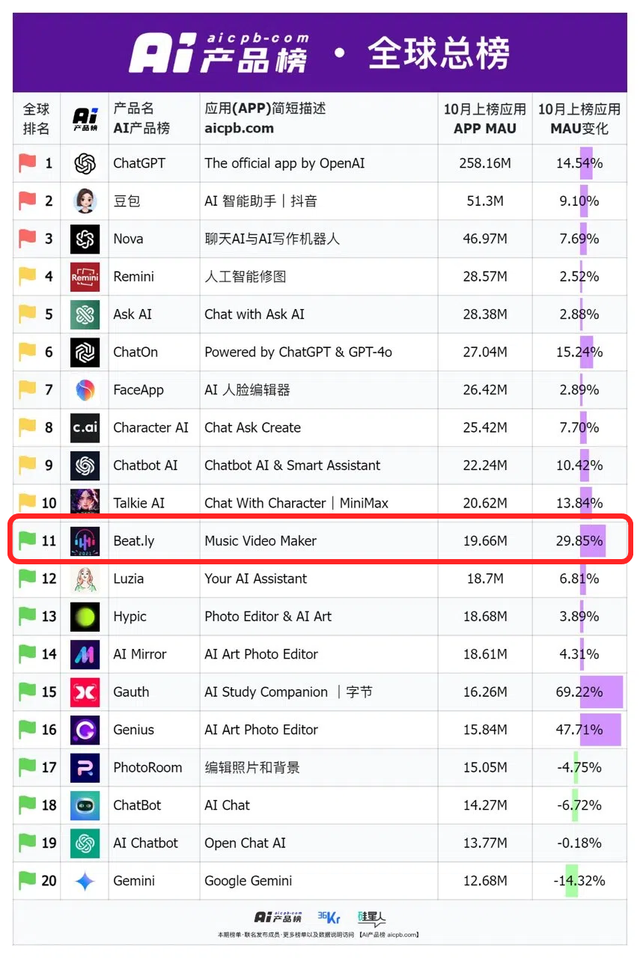

In terms of market performance, multiple Wondershare AI applications have excelled. In the October 2024 AI Product Rankings and sub-rankings by AI Product Ranking and Silicon Valley Insider, seven Wondershare products, including Beat.ly, Media.io, and Filmora, were included.

Notably, Beat.ly, an AI music video creation tool, ranked 11th globally and third domestically after Doubao and Talkie. The cloud-based AI creativity toolset, including Media.io, Filmora, and Virbo, ranked 13th, 27th, and 40th, respectively, on the overall overseas expansion ranking.

Currently, Wondershare continues to delve into user needs, introducing new products and features tailored to the global creator market. The latest version of Filmora V14, for example, introduces advanced features like multi-camera editing, planar tracking, and keyframe path curves, fully catering to professional video editing needs. It also integrates a series of AI capabilities, including a creative intelligent long-to-short editing feature for efficient short video creation and distribution.

Specifically, the intelligent long-to-short editing feature addresses the needs of video bloggers, educators, marketing teams, and others for video remixing and short video creation. Users simply upload the original long video, and the feature intelligently identifies and extracts highlight clips, matches them with corresponding dynamic subtitles, sound effects, and other elements, and supports functions like horizontal-to-vertical screen conversion, AI-powered audio, and copywriting generation, simplifying the video creation process.

Globally, while the North American market still dominates the AI market share, the Asia-Pacific region is experiencing rapid growth. Among these, the Japanese market, ranking third in the global economic system, has become an ideal destination for many AI enterprises due to its strong consumption potential and mature market structure.

This year, Wondershare has frequently participated in various online and offline exhibitions or events in Japan, such as the Advancing AI & HPC 2024 conference hosted by AMD and the International IT and Consumer Electronics Exhibition.

Recently, Wondershare's Filmora launched a series of events in Japan titled "A New Wonder to Share," encouraging everyone to capture precious moments through video. Its new theme video also made a striking appearance on Tokyo's iconic Shibuya screen and multiple subway line advertising screens.

Wondershare executives stated that the company has increased its presence in the Japanese market in recent years due to high demand for software products, especially creative software and tool-based applications. Additionally, Wondershare's products like Filmora and PDFelement enjoy popularity in Japan, and there is a high demand for AI, with the company's current AI application products effectively empowering local creators.

Indeed, it's not just Chinese companies like Wondershare. This year, more industry giants and investment institutions have announced investments in Japan's AI industry.

On April 15, OpenAI opened its first Asian office in Tokyo, Japan, providing GPT-4 in Japanese for Japanese enterprises.

On April 18, Oracle announced an $8 billion investment in Japan over the next decade in cloud computing and AI.

Before global leading AI companies entered the Japanese market, many AI applications had already increased their investments. For example, Notta, an AI transcription company with an annual recurring revenue (ARR) of ten million dollars, and Sparticle, an AI search company ranking among the top 20 search engines, are successful cases of deep market penetration in Japan.

Analysts believe that Japanese users are willing to pay for AI due to the country's acute labor shortage exacerbated by an aging population. In 2023, there were 260 corporate bankruptcies due to labor shortages, significantly surpassing previous highs. In this context, AI, as a tool to enhance production efficiency, has become highly sought after.

Amid the imminent explosion of global AI commercial applications, the value of AI vertical software companies is accelerating. AI enterprises that have already deployed overseas may gain a competitive edge.

Furthermore, as the global AI process accelerates, the demand for AIGC software is expected to continue growing. With its product advantages and brand influence in AI video creativity, AI drawing creativity, and other software fields, Wondershare is poised to further expand its overseas market share.

Goldman Sachs highlights that in the next round of AI investments, investors should focus not only on NVIDIA and other AI infrastructure companies but also select platforms aimed at building AI business applications.