Marvell: Can ASIC Ignite a Counterattack Against Broadcom's "Trillion" Market Cap?

![]() 01/03 2025

01/03 2025

![]() 696

696

Amid the ongoing transformation in AI computing power, custom ASIC chips have garnered significant market attention. Key players in the ASIC market, such as Broadcom and Marvell, have seen substantial increases in their stock prices recently.

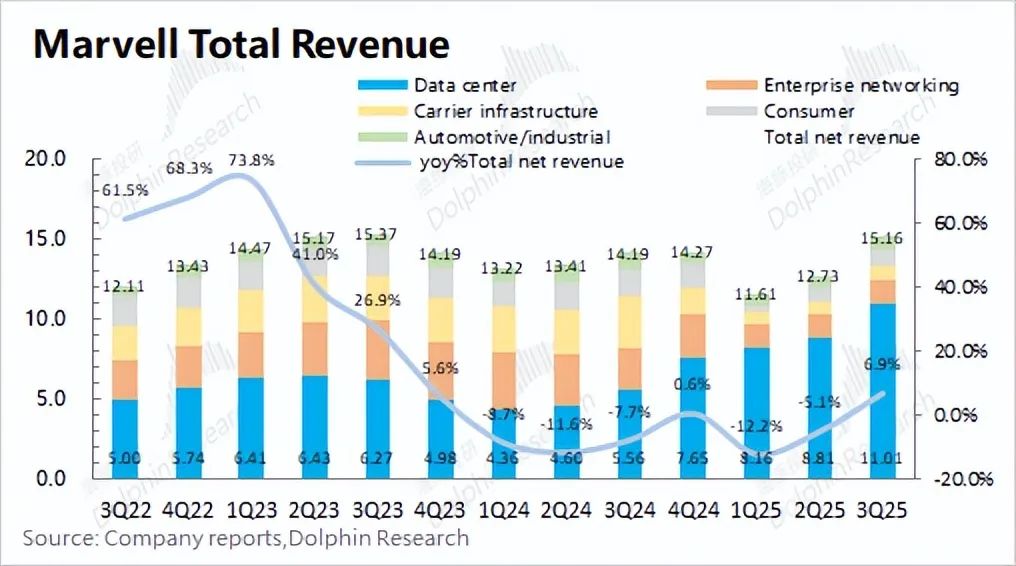

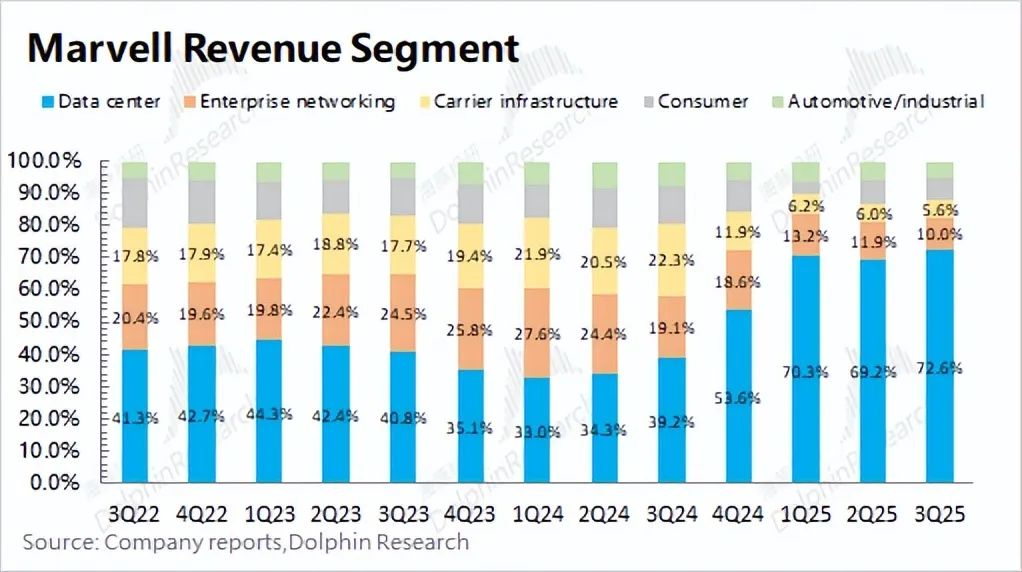

Currently, Marvell's data center business, fueled by AI demand, has emerged as the company's primary revenue source, accounting for nearly 70% of its total revenue. Its traditional businesses include enterprise networking, carrier infrastructure, automotive, and consumer products.

Despite the rapid growth in data center revenue (nearly doubling), Marvell's overall revenue has shown modest growth recently, mainly due to declines in traditional businesses such as enterprise networking and carrier infrastructure (with double-digit declines in other segments). The continuous rise in its stock price, despite poor performance in these traditional businesses, can be attributed to the market's focus on the growth potential of the data center business (with year-on-year growth exceeding 80% for the past three quarters).

This article by Dolphin Insights will focus on Marvell's business operations, with an emphasis on its data center and AI businesses. The next article will delve into the company's financial performance and valuation.

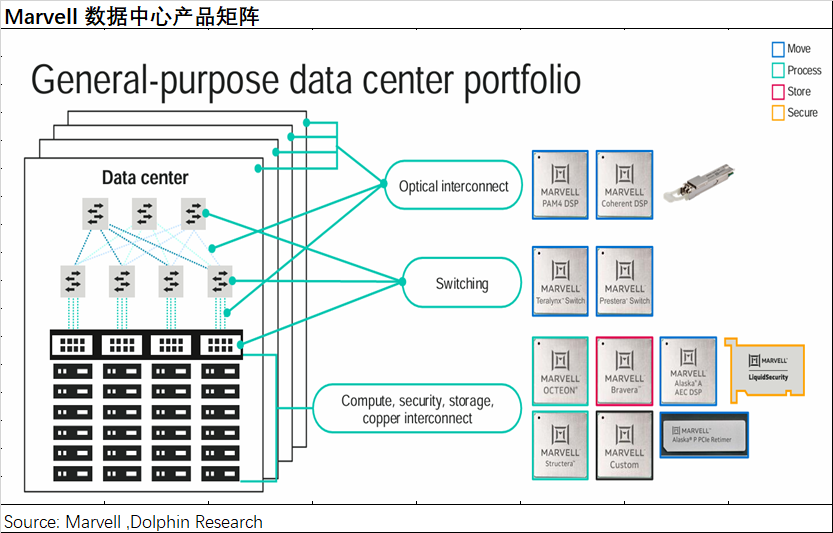

Marvell's data center business encompasses ASIC, optoelectronic products, Ethernet switch chips, and storage products. It can be divided into two main parts: ASIC and other businesses:

1) ASIC Business: Provides new growth for the company's data center business. Dolphin Insights expects Marvell's ASIC revenue to reach $500-600 million in FY2025 (calendar year 2024), with most of this being pure incremental revenue for the year.

Benefiting from the mass production of ASIC products by Amazon and Google, Marvell has established itself as a top player in ASIC design, currently holding a single-digit market share. With increasing demand from major cloud service providers, the company expects to further expand its customer base and scale. Marvell anticipates a 45% CAGR for the overall ASIC market from 2023 to 2028 and expects its medium to long-term market share to exceed 20%, resulting in an ASIC revenue CAGR exceeding 45% over the next five years.

2) Other Businesses: Before the surge in ASIC sales, Marvell's data center business primarily consisted of optoelectronic products and switch chips.

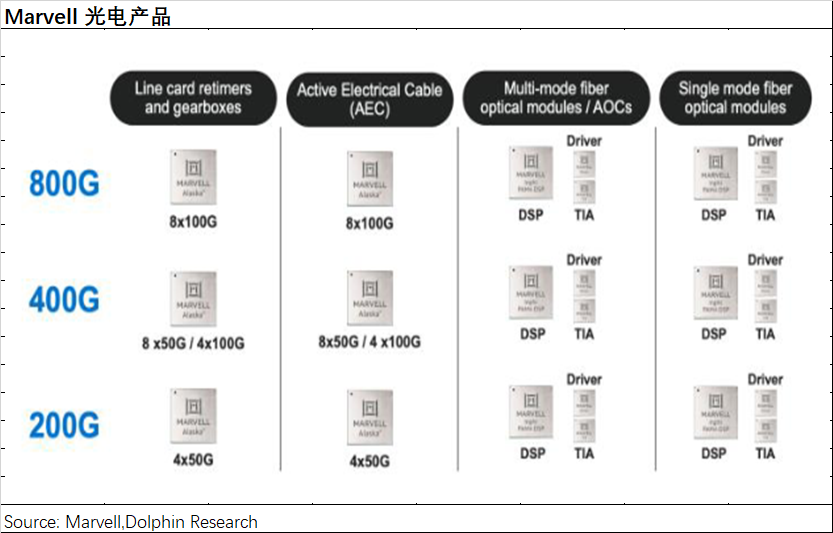

① Optoelectronic Products: Marvell's core product is the DSP chip for optical modules, leading the market. Driven by demand from AI and other applications, the market's demand for higher transmission rates has increased. Marvell currently holds over 60% of the global DSP market. The company expects a 27% CAGR for the overall optoelectronic product market from 2023 to 2028, contributing to significant revenue growth for Marvell.

② Ethernet Switch Chips: Marvell's switch chips are also among the top tier, slightly trailing Broadcom by about one year. The high-end switch chip market is relatively stable, with Marvell continuing to play a catching-up role. The company anticipates a 15% CAGR for the overall switch chip market from 2023 to 2028, and Marvell will benefit from this industry growth.

③ Storage Products: Marvell initially gained prominence through its storage products but has since seen its storage business shrink to about 10% of total revenue due to the decline of hard drives. The company now focuses on enterprise-grade SSD controller chips in a relatively stable industry. Marvell expects a 7% CAGR for the relevant storage market from 2023 to 2028.

Since initiating a strategic shift in 2016, Marvell has successfully realigned its business, with 70% of its total revenue in 2024 coming from the data center business. With growing AI demand and strong ties with major customers, Marvell's future performance will continue to benefit from the growth of its ASIC and data center businesses.

This article primarily focuses on Marvell's business operations and the qualitative aspects of its stock price increase. Part of this increase is attributed to the company's successful business transformation (with data center revenue accounting for 70% of total revenue), and part is due to the high-growth expectations for the ASIC sector in which Marvell operates. Dolphin Insights' next article will provide a quantitative analysis, including earnings forecasts, performance calculations, and valuation assessments for Marvell.

Here's a detailed analysis:

I. Marvell's AI Technology Origins

Marvell began as a storage technology company and later expanded its capabilities, similar to Broadcom, through acquisitions. From 2000 to 2016, Marvell entered the wireless communications and mobile processor markets through mergers and acquisitions but did not achieve significant success, keeping its stock price below $20 for over a decade.

With Marvell struggling to find its direction, the company changed its CEO in 2016 and set semiconductor solutions for data centers as its primary focus. It then divested its mobile communications and some consumer businesses while acquiring Cavium, Aquantia, Avera, Inphi, and Innovium, building its capabilities in custom ASIC and network interconnectivity for the data center market. Essentially, Marvell's AI and ASIC capabilities stem primarily from acquisitions.

Following these acquisitions, Marvell's stock price increased. Building on this foundation, the company capitalized on the current data center and AI industry boom, pushing its stock price above $100, reflecting market confidence in Marvell's future growth in the AI sector.

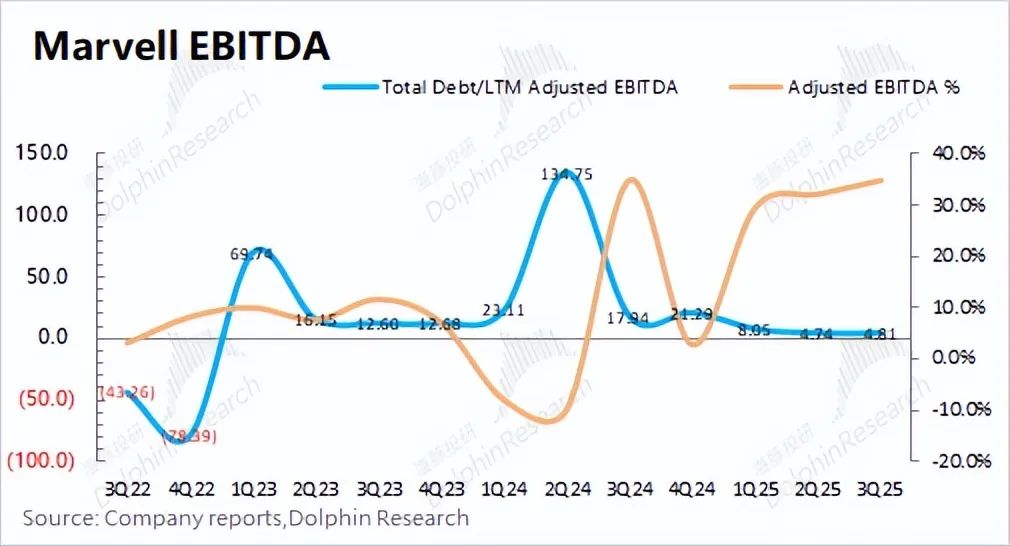

Since Marvell primarily expands through acquisitions, its debt-carrying capacity is a crucial indicator of sustainable development. A series of acquisitions temporarily increased the company's "Total Debt/LTM Adjusted EBITDA" ratio. However, as the company integrates its businesses and improves operational performance, its debt-carrying capacity has also increased.

In recent quarters, Marvell's "Total Debt/LTM Adjusted EBITDA" ratio has fallen to around 4.8x, but it still lags behind Broadcom's 3.1x. Considering the Adjusted EBITDA% of both companies, Broadcom's 64.7% is significantly better than Marvell's 34.7%, indicating that Broadcom could reduce its ratio to pre-acquisition levels faster. Marvell is unlikely to initiate large-scale acquisitions in the short term and will instead focus on enhancing its operational capabilities.

II. Marvell's Data Center Business

Marvell's current focus is on its data center business, which is also the market's primary concern regarding the company. Driven by AI and other demands, data center revenue now accounts for over 70% of total revenue, directly impacting the company's performance. This article will delve into Marvell's data center business.

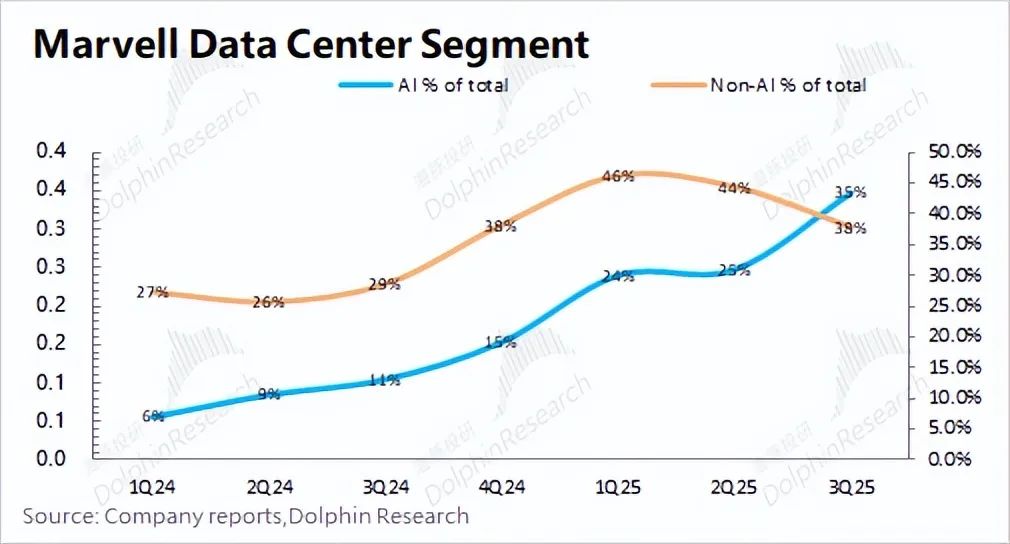

Through a series of acquisitions, Marvell gained capabilities in ASIC, optical module DSP chips, Ethernet switch chips, and storage controller chips. Within the data center business, it can be further divided into AI and non-AI businesses, with AI business revenue primarily aligning with market demand for AI servers.

Observing Marvell's stock price changes, it doubled from $50 in December 2023 to over $100. During this period, the AI business's contribution to total revenue increased from 5% to over 30%. Thus, the growth of the AI business has been the primary driver of Marvell's stock price increase.

Before the surge in ASIC sales, communication interconnect products and storage businesses were the most significant components of the data center business, encompassing optical products like DSPs for optical modules, Ethernet switch chips, and storage controller chips. Acquisitions of Inphi and Innovium further enriched Marvell's data center product portfolio.

2.1 Optical Module DSPs

In data centers, optical modules facilitate data transmission between servers and between servers and storage, utilizing both optical and electrical chips. Marvell's primary products are electrical chips, specifically DSPs (digital signal processing chips), TIAs (transimpedance amplifiers), and drivers.

Among Marvell's electrical chip products, DSPs are particularly crucial: 1) DSPs have a relatively high technical barrier, with Marvell and Broadcom dominating the market with a combined share of nearly 90%; 2) DSPs consume the most power among optical module chips, accounting for nearly half the power consumption in 400G optical modules; 3) DSPs directly impact the communication rate of optical modules.

Marvell's DSP technology primarily stems from Inphi. Post-acquisition, Marvell was the first to introduce a single-channel 200Gbps technology product for 1.6T optical modules, further catering to AI computing needs. Currently, Marvell's optoelectronic chip revenue is partially attributed to AI and partially to non-AI revenues.

Dolphin Insights believes that the overall increase in server demand will drive growth in both AI and non-AI revenues, with AI-related optoelectronic product revenue growing at a faster rate. For optoelectronic products in the data center business, Marvell anticipates a 27% CAGR for the optoelectronic market over the next five years.

2.2 Ethernet Switch Chips

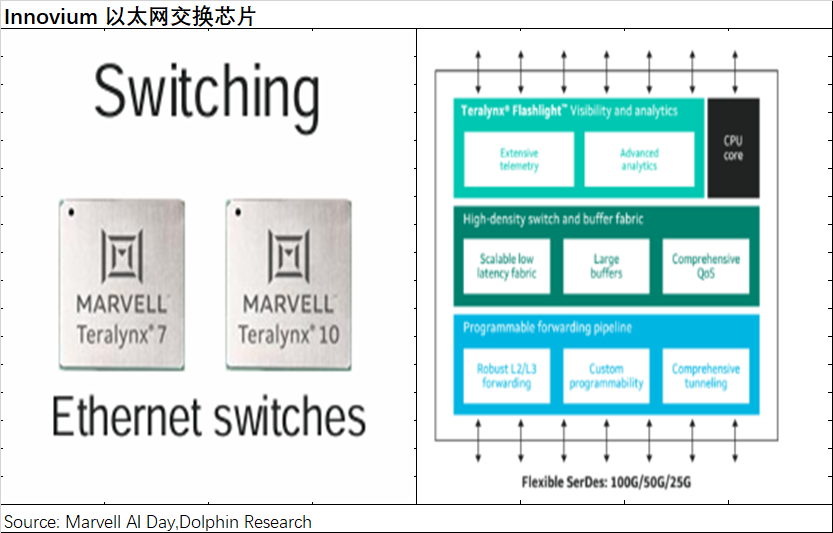

Ethernet switch chips are crucial components of switches, primarily responsible for packet preprocessing and forwarding. As data centers demand higher data processing capabilities, mainstream port speeds are gradually increasing from 200G/400G to 800G.

Marvell's current technological capabilities stem from the acquisition of Innovium. Post-acquisition, Marvell's switch chip products cover the entire high-to-low-end market. The original Prestera series targets the low-to-mid-end market, primarily used in enterprise networks and edge markets, while Innovium's Teralynx series targets the high-to-mid-end market, primarily for data centers and AI scenarios.

Currently, Marvell's Ethernet switch chips, while slightly inferior to Broadcom's, remain in the top tier. Both companies' high-end products offer 51.2Tbps bandwidth and up to 800G port speeds, with similar performance but a roughly one-year lag in Marvell's production and R&D capabilities compared to Broadcom.

Driven by AI and cloud service demands, Marvell anticipates a 15% CAGR for the overall switch chip market over the next five years. Although Marvell is still playing catch-up, it is poised to benefit from industry growth.

2.3 Storage Products

Although initially known for its hard drive controller chips, Marvell's storage business now accounts for less than 20% of its revenue due to years of development and acquisitions. The company's current storage products focus on the enterprise SSD market, where it maintains a relatively advantageous position.

Marvell's current storage product is Bravera. While the company has a lower market share in consumer-grade hard drive controller chips, it enjoys relative stability in the enterprise market. Driven by demand from data centers and other sectors, Marvell's storage business is expected to benefit. Marvell anticipates a 7% CAGR for the storage market in which it operates over the next five years.

III. New Power for Data Centers - ASIC

In terms of AI computing power, major cloud service providers previously relied primarily on GPU solutions. However, with its high performance and low power consumption in specific application scenarios, ASIC is expected to meet the customized needs of large cloud service providers, thereby expanding the demand for ASIC in the computing power market.

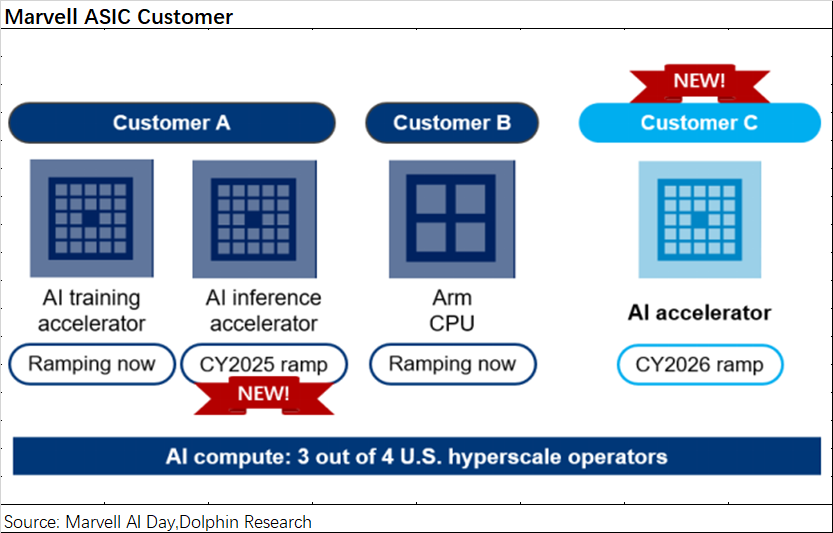

The company's ASIC revenue is expected to grow significantly starting from 2024 (i.e., fiscal year 2025). Based on company communications and industry chain information, it is speculated that Marvell's current ASIC revenue mainly comes from Amazon's Trainium 2 and Google's Axion Arm CPU processors. Additionally, the company's Inferential ASIC project with Amazon is also expected to commence mass production in 2025 (i.e., fiscal year 2026). The company's collaboration with Microsoft on the Microsoft Maia project is anticipated to yield results in 2026 (i.e., fiscal year 2027).

Following the emergence of ChatGPT, the demand for AI computing power has continuously increased in the market. Amidst this shortage, NVIDIA has emerged as the dominant player. However, large cloud service providers are reluctant to be long-term reliant on NVIDIA's products, prompting them to initiate in-house chip development. Apart from collaborating with Google on ARM CPU development, the company's current major customer for computing power is Amazon.

Comparing AI ASIC products with NVIDIA GPUs, Google's latest TPU v6e currently boasts the most advanced computing capability among ASIC chips from the four major manufacturers, approaching the level of NVIDIA's H100 and roughly trailing NVIDIA GPUs by two years.

Furthermore, Marvell's collaboration with Amazon on Trainium 2 places its computing capability roughly between A100 and H100, representing the primary growth driver for the company's ASIC revenue in 2024.

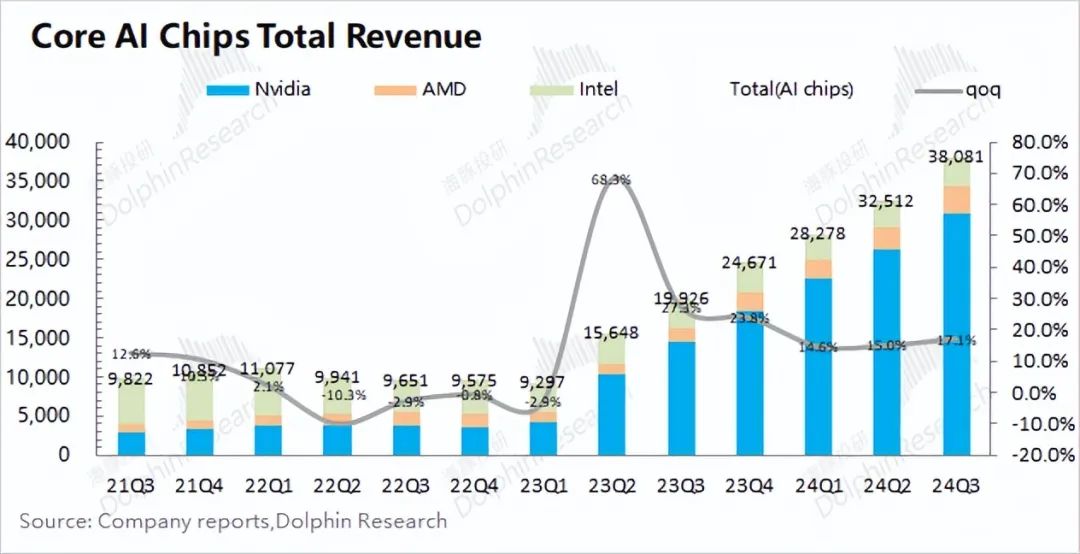

Despite the achievements of some manufacturers in mass-producing AI ASICs, their share of the overall AI chip market remains modest. When considering the combined annual revenue of NVIDIA, AMD, and Intel from data centers, which exceeds $100 billion, the ASIC market size in 2024 stood at less than $15 billion, accounting for less than 10% of the entire AI chip market.

Drawing on industry chain insights, Dolphin Insights asserts that Broadcom continues to lead the ASIC market. Thanks to increased shipments of Google's TPU, Broadcom's ASIC revenue surpassed $8 billion in 2024, securing the largest share of the ASIC market. Marvell, on the other hand, recorded ASIC revenues of approximately $500 million to $600 million in 2024, accounting for less than 10% of the market. Additionally, SMIC and GUC have carved out their share of the remaining market through collaborations with Intel, Microsoft, and others.

Although Marvell's current market share trails that of SMIC, Dolphin Insights believes that Marvell has the potential to outpace SMIC in the future. Leveraging its established technological prowess, Broadcom and Marvell engage in both front-end logic design and back-end physical design, while SMIC primarily focuses on back-end physical design. This strategic difference results in higher gross margins for Broadcom and Marvell compared to SMIC and other competitors.

Currently, SMIC's primary clients include Intel and Amazon. However, Marvell recently signed a five-year collaboration agreement with Amazon, potentially deepening their partnership. Marvell's Inferential ASIC project with Amazon is scheduled for mass production in 2025 (fiscal year 2026), with the company aiming to secure over 20% market share in the AI ASIC market in the long run.

Considering the company's aspirations and industry trends, Dolphin Insights contends that the ASIC business holds the greatest potential for growth within Marvell. Marvell's management anticipates a compound annual growth rate of 45% for the ASIC market over the next five years. Given the company's objective of further increasing its market share, Marvell's ASIC revenue growth rate is expected to exceed the industry's projected 45% growth.

This Dolphin Insights article primarily focuses on the business aspects of the company, outlining the status of its core data center products. The subsequent article will delve into earnings projections, performance metrics, and valuation analysis for Marvell.