The Limits of Computing Power: Transformers' Indispensability in the Digital Era (with related stocks)

![]() 01/09 2025

01/09 2025

![]() 571

571

In the wake of the generative AI revolution, the concept that computing power is fundamentally electricity-dependent has gained prominence. As large AI models proliferate and industrial applications accelerate, the appetite for computing power skyrockets, fueled by electricity's unwavering support as a cornerstone energy source.

Beyond computing, global electricity demand is projected to surge by 2.7% annually under the International Energy Agency's (IEA) pledged goals scenario, anticipated to leap from just below 25 trillion kWh in 2021 to nearly 54 trillion kWh by 2050.

Amidst this soaring electricity demand, the expansion and fortification of power grids are imperative. Transformers, vital components in the grid system, have embarked on a period of robust industry growth, indispensable for sustaining power supply and addressing diverse power requirements.

01. Transformers: A "Seller's Market" Emerges

The rapid evolution of AI technology, particularly the widespread adoption of deep learning algorithms, is driving unprecedented demand for data center computing power. GPT-4, for instance, boasts a colossal number of parameters, reaching trillions, underpinned by immense computing resources. To satiate this voracious appetite for computing power, the number of servers in data centers has ballooned, transitioning from hundreds or thousands in early stages to hundreds of thousands in contemporary ultra-large data centers.

These server clusters operate relentlessly, executing intricate data storage, processing, and analysis tasks, leading to a spike in data center energy consumption. Statistics reveal that the average Power Usage Effectiveness (PUE) of global ultra-large data centers hovers between 1.5 and 2.0, implying that for every kWh of electricity consumed for computing, an additional 0.5 to 1.0 kWh is required for auxiliary systems such as cooling.

A prominent domestic internet company's large data center annually consumes hundreds of millions of kWh of electricity, equivalent to the total annual electricity usage of residents in a medium-sized city, underscoring the astonishing electricity demand.

In the intricate power architecture of data centers, transformers serve as pivotal "power hubs." They convert high-voltage electricity from the grid into medium- and low-voltage electricity suitable for various internal equipment. Core IT loads, including servers and storage devices, necessitate stable low-voltage DC power, and transformers ensure power quality aligns with these devices' operational requirements through precise voltage transformation and rectification.

Simultaneously, auxiliary facilities like air conditioning and lighting systems rely on transformers to supply AC power at the appropriate voltage level. Within the hierarchical structure of data centers, large-capacity main transformers in the park's main substation are responsible for stepping down city electricity to power the entire data center park. Transformers in building distribution rooms further refine the distribution, accurately delivering power to each computer room floor. Small transformers or power modules within the computer room are positioned close to servers, providing them with the ultimate "customized" power guarantee.

With the explosion of demand in emerging sectors like AI data centers, the transformer market faces unprecedented challenges. Hitachi Energy, the world's largest transformer manufacturer, has cautioned that the entire industry is overwhelmed. Historically, the transformer market has been oversupplied, with delivery cycles typically spanning 6 to 8 months. However, utilities seeking to procure critical power infrastructure may now face waits of three to four years if advance orders haven't been placed.

This situation stems from the transformers' complex manufacturing process, encompassing numerous delicate procedures and stringent requirements for technology, equipment, and manpower.

Furthermore, the supply of key raw materials is constrained by the upstream industries' expansion cycle, making rapid production capacity increases challenging in the short term. The industry has historically underinvested, leading to sluggish new capacity construction. Amid the sudden surge in demand, manufacturers struggle to keep pace, yet bridging the vast gap remains difficult in the near term.

According to Rystad Energy, a consulting firm, transformer prices have surged by 40% since 2019, and the tight supply situation is anticipated to persist at least until the end of 2026. This not only substantially increases data center construction costs but also delays some utility projects, compelling existing power grid infrastructure to "overserve," posing hidden risks to power supply stability.

02. Will Domestic Manufacturers Capitalize?

Since the 1980s, the global transformer market has become increasingly concentrated, with many transformer manufacturers evolving into large multinational corporations. Sustained transformer demand growth has maintained high capacity utilization and profit margins for these companies. However, expanding transformer production necessitates substantial capital investment and a lengthy return on investment period, often requiring several years to break even, deterring overseas transformer manufacturers from expanding capacity. In recent years, capital expenditures by major overseas transformer manufacturers have trended downward.

Concurrently, the global digitalization process accelerates, with emerging market countries catching up in digital infrastructure development. Southeast Asia, for instance, witnesses significant investments in data center construction by countries like Indonesia and Malaysia, aiming to establish regional digital hubs. Local transformer demand is poised for explosive growth. The African continent's digital economy also blossoms, with nations like Nigeria and Kenya actively promoting 4G and 5G network construction. The demand for transformers to support grid upgrades is immense, presenting new development opportunities for global transformer enterprises.

Amid the overseas transformer supply-demand mismatch, China's exports of power equipment, including transformers, have welcomed favorable opportunities. Currently, domestic manufacturers are primarily deployed in overseas countries along the Belt and Road Initiative and developed economies like Europe and the United States. In the future, domestic manufacturers are expected to further expand their overseas markets and scale up overseas operations by leveraging their advantages in cost-effective products, ample capacity, and swift response.

China's transformer export volume has demonstrated a robust growth trend, with oil-immersed transformers' export performance particularly notable. According to Customs data, China's dry-type transformer export value in 2023 was $2.36 billion, a year-on-year decrease of 14.8%, with exports dominated by small units (below 1kVA). In the same year, China's oil-immersed transformer export value reached $2.94 billion, a year-on-year increase of 78.0%. Among them, the export values of small (≤650kVA), medium (650kVA-10MVA), and large (>10MVA) oil-immersed transformers were $380 million, $770 million, and $1.79 billion, respectively, with year-on-year growth rates of 96.6%, 94.5%, and 68.4%, respectively. As the overseas transformer supply-demand mismatch persists, China's transformer export volume is anticipated to maintain a growth trajectory.

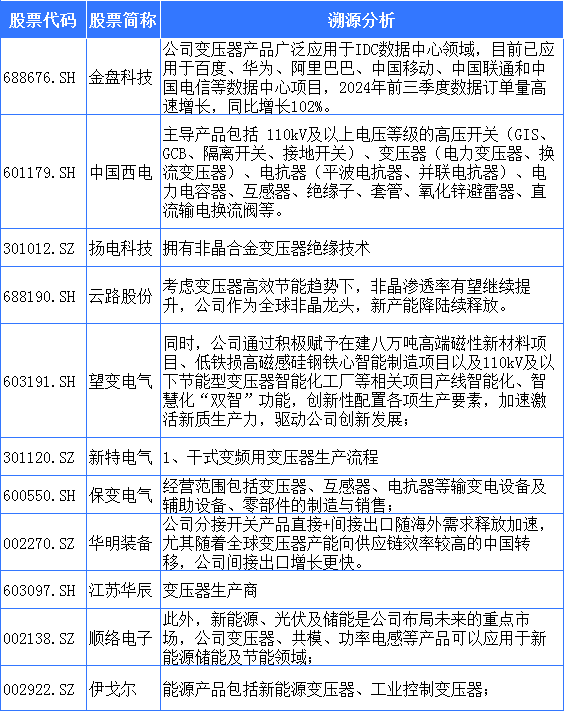

In the transformer industry, Jinpan Technology, a leading dry-type transformer enterprise, has established a strong presence in the US market for years, boasting advantages in channel layout and product certification. Huaming Equipment, a transformer tap changer pioneer, actively expands its overseas operations to compete for global market share. Siyuan Electric, a prominent private power equipment enterprise, offers a comprehensive product portfolio spanning primary and secondary equipment. In 2023, its overseas transformer orders surged significantly. Igor's robust demand for new energy products is supported by its overseas production bases, which strongly facilitate product exports.