NVIDIA Partners with Toyota, Navigating Competition with Chinese Auto Firms

![]() 01/13 2025

01/13 2025

![]() 520

520

Recently, Jen-Hsun Huang once again captured the spotlight at CES 2025 (Consumer Electronics Show), his familiar black leather jacket echoing Steve Jobs's iconic "jeans," symbolizing the pinnacle of current technology.

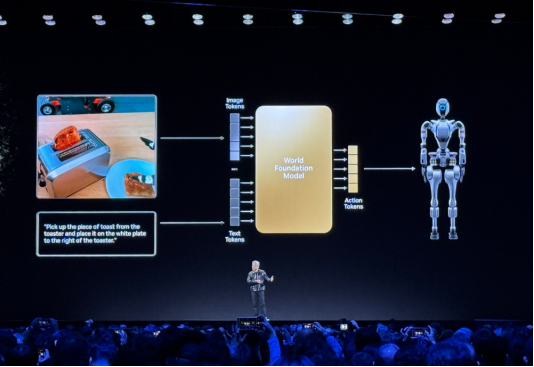

In his CES keynote, NVIDIA unveiled several groundbreaking products, including the RTX 50 series gaming graphics cards, the world foundation model Cosmos, and the AI supercomputer Project DIGITS. Additionally, NVIDIA announced a collaboration with Toyota to develop the next generation of autonomous vehicles and shared the latest advancements on their next-generation autonomous driving chip, Thor.

Historically, the automotive business was not a core focus for NVIDIA. However, the rapid rise of China's new energy vehicle industry and the relentless pursuit of Chinese auto companies have put pressure on NVIDIA, prompting CEO Jen-Hsun Huang to personally lead collaborations with automotive and intelligent driving giants.

Yet, all global tech companies are eyeing the lucrative intelligent driving market. Can NVIDIA maintain its desired "far ahead" position?

1. NVIDIA Intensifies Efforts in Intelligent Driving

Following NVIDIA's official partnership announcement with Toyota to "build cars," Jen-Hsun Huang revealed that the next-generation autonomous driving chip Thor has commenced mass production, with the Thor chip-based NVIDIA DRIVE AGX Hyperion autonomous driving platform set to launch in the first half of this year.

Huang also showcased NVIDIA's "automotive alliance," which includes domestic auto companies like BYD, Zeekr, Xiaomi, and Lixiang; foreign auto giants such as Mercedes-Benz and Tesla; autonomous driving technology firms like Aurora; and automotive suppliers like Continental.

Based on NVIDIA's total revenue of $22.1 billion in fiscal year 2024, the automotive business accounted for only about 5% of the total. Now, Huang's $5 billion revenue target for the next fiscal year signifies a significant leap forward for the company.

NVIDIA's foray into the automotive field began in 2015 with the launch of NVIDIA DRIVE, a computing platform for intelligent driving development. Since then, NVIDIA has updated the DRIVE platform annually or biannually and released a new automotive-grade SoC chip roughly every two years.

Currently, NVIDIA's Orin chip is one of the few that can stably handle the computing power required for L2+ and above levels, placing it at the forefront of intelligent driving technology.

Reports indicate that NVIDIA's next-generation Thor chip offers over 60 times the performance of the Orin chip. Huang emphasized that Thor is no longer limited to being a "small" autonomous driving chip but is "born for the central computing architecture of cars," making NVIDIA the only company capable of providing end-to-end computing solutions for automakers.

In essence, hundreds of partners across the automotive ecosystem can develop software on NVIDIA DRIVE and freely choose the "tools" they need.

At CES 2025, Huang highlighted NVIDIA's "three computers": the cloud-based NVIDIA DGX supercomputer, the NVIDIA Omniverse platform for simulation and validation, and the edge-side DRIVE AGX computing platform.

Taking NVIDIA Omniverse as an example, it is an API, SDK, and service platform that enables developers to integrate OpenUSD with RTX rendering technology into existing software tools to build AI systems.

Huang believes that having a "complete development tool chain" is one of the reasons why intelligent driving companies choose to partner with NVIDIA, allowing customers the flexibility to use one, two, or all three computers.

Coupled with the partnership with Toyota, the world's largest automotive group, and the imminent mass production of the new generation of Thor chips, NVIDIA's automotive business may indeed experience a qualitative leap next year.

2. Jen-Hsun Huang Aims to Maintain AI Leadership

However, NVIDIA has historically "marginalized" its automotive business. Despite its global "friend circle," the automotive business's share of overall revenue is not high. But starting this year, NVIDIA is taking "big steps forward," and Huang's intentions may extend beyond mere "revenue growth".

At CES 2025, Huang spoke extensively about artificial intelligence. He said, "Without AI agents, we will struggle to advance in the next 10 or 20 years. NVIDIA aims to become the utilities of our future world – water, electricity, and gas. Without NVIDIA, the world's buildings cannot be constructed."

Currently, artificial intelligence is a hot pursuit across all industries globally, so it's no surprise that NVIDIA is emphasizing AI. Over the past two years, amidst the generative AI trend, tech giants have launched their large model services, and NVIDIA's GPUs have become highly sought after, driving the company's revenue and net profit to continue growing, with NVIDIA's market value nearly tripling.

In fact, besides NVIDIA, Xpeng also recently announced its commitment to becoming a globally leading AI auto company, while Lixiang stated its goal of becoming a leading AI enterprise.

Why is the smart car business highly valued by tech companies on the path to an AI future, even attracting many consumer electronics companies to venture into this field? Last September, market news reported that Sharp would launch its own brand of electric vehicles relying on the Foxconn electric vehicle platform. Notably, Foxconn's "auto partner" is also NVIDIA.

On the surface, cars are just consumer goods, but in reality, the automotive industry encompasses a vast array of aspects, including intelligent driving research and development, automotive data processing, vehicle-road-cloud integration, etc. Each of these links involves powerful algorithmic support and a large amount of data accumulation, or even the use of AI to transform traditional automotive production lines.

For example, Li Xiang, Chairman of Lixiang Auto, said that cars are the means, while intelligence is the goal. The reason Lixiang develops its large model is not just to achieve intelligent driving but to position it as a "large language model." Ultimately, the large automotive model will evolve into a "visual-language-action model," which will be the ultimate form of AI products.

Horizon Robotics, an intelligent driving supplier, also stated that end-to-end is a means, not an end, and the goal is to allow AI to permeate the entire process from perception to decision-making. It can be said that cars are the first major scenario for intelligent AI robots to land and are pioneers in robot classification.

Against this backdrop, AI targeting the physical world is Huang's ultimate goal. At CES 2025, NVIDIA also released NVIDIA Cosmos, the first generative world foundation model, which can generate virtual world states based on text, image, or video prompts, aiming to accelerate the development of physical AI systems, especially autonomous vehicles and robots.

Huang aims to lead NVIDIA to stay ahead. Besides the graphics card business, NVIDIA's infrastructure has already penetrated multiple fields such as automobiles, robots, and industry. It is reported that NVIDIA's future autonomous driving and robotics business is estimated to reach a scale of $300 billion.

3. Facing the Challenge from Chinese Auto Companies

Building a comprehensive AI ecosystem is not only Huang's foresight of future evolution but also the "free ride" that most tech companies aspire to take. However, with everyone on the same track, competition is inevitable to determine the winner.

Currently, collecting data and continuously evolving along the path of autonomous driving has become another strategy for new energy auto companies trapped in price wars. For NVIDIA, this is also part of its diversification strategy.

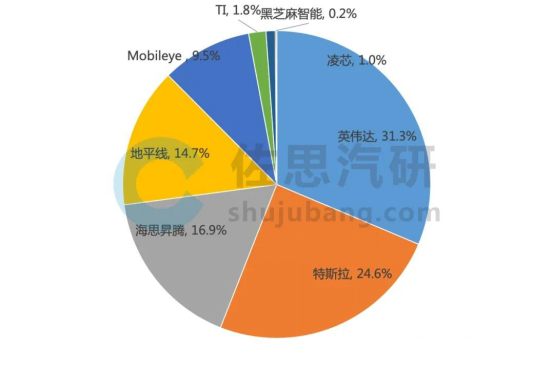

While NVIDIA's market share in the high-end intelligent driving field remains difficult to shake, it is not "far ahead of the pack." In the latest list of NVIDIA's "automotive alliance," Xpeng and NIO have quietly disappeared.

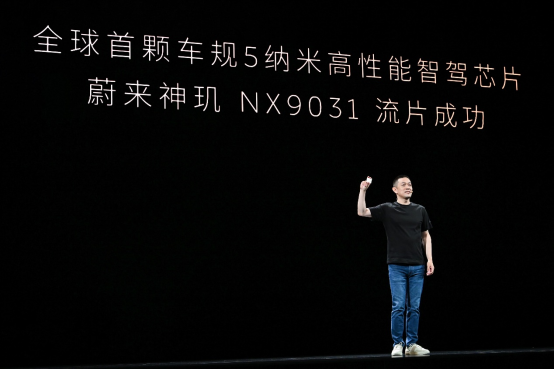

In fact, over the past two years, Xpeng and NIO have been focusing on developing their in-house intelligent driving chips. Last August, NIO announced the successful tape-out of its self-developed Shenji NX9031, claiming it to be the world's first automotive-grade 5-nanometer high-performance intelligent driving chip. Xpeng's self-developed intelligent driving chip also successfully completed tape-out in August last year, with AI computing power close to that of three mainstream intelligent driving chips.

Additionally, Lixiang, though slightly behind, reported the start of tape-out in October last year. Furthermore, based on Longying No.1, Geely's Xinqing Technology has been on the path of in-house development for many years.

The unwillingness of domestic auto companies and intelligent driving suppliers to be constrained by NVIDIA has become one of the main reasons for accelerating their in-house development of intelligent driving chips. Only by mastering core technologies can they avoid being "choked" by powerful suppliers at critical times, as technology empowerment could otherwise bring operational uncertainty.

Secondly, cost is also a consideration for auto companies. Li Bin, Chairman of NIO, once said that NIO purchased many NVIDIA chips in 2023, costing the company significantly. Considering the procurement costs, the company decided to shift to in-house chip development, estimating that NIO's Shenji NX9031 can recoup costs in about a year.

Finally, meeting customized needs and propelling intelligent auto companies towards becoming tech companies is also an ambitious blueprint for enterprises. After all, in-house intelligent driving chips are more compatible with their own algorithms, further enhancing the competitiveness and differentiation of smart cars.

In the long run, having intelligent driving data in the hands of auto companies will also aid in developing more AI hardware, such as robots frequently mentioned by tech companies, and even more intelligent terminal traffic entry points in the future.

In fact, the market share of domestic intelligent driving SoC manufacturers has been increasing in recent years, with leading manufacturers including Hisilicon Ascend and Horizon Robotics, which together account for over 30% of the market, double that of the same period last year.

However, although China's auto chips have made a breakthrough from 0 to 1, it is still a long way to go to challenge NVIDIA's leadership at this stage.

But for NVIDIA, there are now more and more intelligent driving solutions that can "compete" with it, and it is no longer without competitors.

Of course, whether it's giants like NVIDIA constantly pushing boundaries, Japanese giants catching up through "partnerships," or the Chinese contingent that has been silently working hard and making breakthroughs, it's a positive scenario for consumers. After all, competition breeds progress, and we'll have to wait and see who will ultimately transform the current landscape.