A-share Humanoid Robot Stocks Skyrocket: What Institutions Are Driving This Surge?

![]() 01/13 2025

01/13 2025

![]() 513

513

This article is based on public information and is intended solely for informational purposes. It does not constitute investment advice.

Produced by: Corporate Research Lab's Listed Company Team

In the first week of 2025 following the New Year, A-shares experienced a sharp decline, followed by continued falls in the second week amidst hovering and oscillations.

However, amidst the market gloom, humanoid robot concept stocks surged unexpectedly, akin to Sun Wukong emerging from nowhere, skyrocketing in the secondary market. From the afternoon of January 7th to the morning of January 10th, this hot topic continued to gain momentum, becoming a prominent red spot in the otherwise greenish overall market. By the close of January 10th, the humanoid robot concept had risen by 9.77% for the week.

Largest External Catalyst

The most direct catalyst behind this week's surge in humanoid robot concept stocks was undoubtedly the 2025 CES Global Consumer Electronics Show, which took place in Las Vegas from January 7th to 10th, US local time.

At the conference, over 323 Fortune Global 500 companies from 166 countries and regions gathered to showcase cutting-edge innovations spanning artificial intelligence (AI), quantum computing, and advanced digital health solutions. Among these, AI emerged as the hottest core topic at CES 2025.

During on-site interviews, a reporter found that AI chips, new applications, and solutions powered by AI technology were ubiquitous at the CES exhibition.

In recent years, A-share speculation has often mirrored overseas hot topics, and the rise in humanoid robot concept stocks was no exception.

Due to the time difference, the 2025 CES exhibition had not yet commenced on January 7th, Beijing time. However, domestic hot money could not contain its excitement, and after the lunch break on January 7th, it propelled the A-share humanoid robot concept upwards. That day, the sector closed with a significant 3.54% gain, buoying the overall market to close with a lower shadow, and even turning the ChiNext Index red.

Soaring in Four Trading Days

On the evening of January 7th, the Central Government issued the "Opinions on Deepening the Reform and Development of Elderly Care Services," proposing to research and establish major national science and technology projects related to elderly care, with a focus on humanoid robots, brain-computer interfaces, and artificial intelligence technologies and products.

Following the news, on the opening of the A-share market on January 8th, the elderly care robot concept stock Maidi Technology (603990.SH) immediately hit the daily limit. It is reported that this company has collaborated with UBTech to develop healthcare robots and has jointly established a robotics company with UBTech.

On January 7th, US local time, NVIDIA Chairman Jen-Hsun Huang announced at the 2025 CES annual meeting that NVIDIA's next phase goal is embodied AI, and simultaneously unveiled the Cosmos World Foundation Model.

CITIC Securities believes that from Huang's introduction of the concept of embodied intelligence in 2023, to the formation of the GEAR team in 2024 dedicated to researching general embodied intelligence, to the clear announcement of the next phase strategic plan for embodied AI in 2025, NVIDIA's investment in robots, i.e., embodied intelligence, has progressively increased. On one hand, as a "shovel seller," the company will accelerate the progress of downstream robot bodies. On the other hand, the all-in approach of major companies is also expected to stimulate investment competition in robots within the tech industry, thereby igniting industry enthusiasm.

That morning, the overall market fell unilaterally, casting a gloomy atmosphere.

In the afternoon, fueled by the humanoid robot concept, the overall market index bottomed out and rebounded. The Shanghai Composite Index rebounded from a near 1.6% decline to briefly turn red, and the ChiNext Index significantly rebounded from a decline of over 3%. On that day, the humanoid robot concept swung from a decline of over 2.7% to a rise of over 4.7%, with a rebound range exceeding 7%. Related concept stocks such as reducers, actuators, PEEK, and machine vision all witnessed gains.

On January 8th, US local time, at the CES 2025 exhibition site, a staff member from the Chinese company Unitree Robotics stated, "All the prototypes we brought have been sold out."

Currently in overseas markets, the price of robot dogs starts at $2,000 (approximately RMB 14,600), and the price of robots starts at $16,000 (approximately RMB 117,300).

On the same day, Musk mentioned in an online interview that Tesla's humanoid robot Optimus will be the company's largest product ever. If all goes smoothly, 50,000 to 100,000 humanoid robots will be produced this year, and then increased tenfold in 2026.

Stimulated by these developments, the A-share humanoid robot concept continued its upward trajectory on January 9th, surging by 3.61% that day and driving up related AI concept stocks such as PCB.

On the morning of January 10th, humanoid robots continued their upward assault, with multiple stocks hitting the daily limit. Around 10:50, the sector peaked at a 5.38% gain before starting to decline. By the close of the day, the sector had risen by 0.94%, indicating a clear trend of peaking and then falling.

Nonetheless, four stocks still hit the daily limit that day, among which Maidi Technology achieved its third consecutive trading day of daily limits.

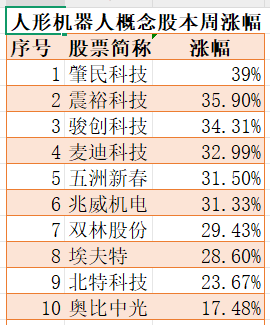

Six Stocks Rose by Over 30% for the Week

This week marked the second week of the new year. Data shows that while the CSI 300 Index fell by 1.13%, six humanoid robot concept stocks rose by over 30%. Among these, one each is listed on the Beijing Stock Exchange and the Science and Technology Innovation Board, with the rest mostly from the ChiNext and the Shanghai Stock Exchange Main Board.

Third-quarter reports reveal that among the humanoid robot concept stocks with significant gains this wave, public funds appeared multiple times among the top 10 shareholders.

Taking Zhaomin Technology (301000.SZ), which recorded the largest gain, as an example, at the end of the third quarter, its top 10 shareholders included not only one private equity fund from Qianhai and one pension fund but also three public funds: Penghua New Energy Automobile Theme Hybrid Fund, Penghua Carbon Neutral Theme Hybrid Fund, and Huabao Dynamic Portfolio Hybrid Fund.

However, Maidi Technology, which hit the daily limit for three consecutive days, did not have any public funds among its shareholders as of the end of the third quarter. This may be attributed to its poor performance, with a loss of RMB 0.88 per share in 2023 and a continued loss of RMB 0.546 per share in the third quarter of 2024, preventing it from entering the fund stock pool.

It is noteworthy that a significant number of foreign institutions appear among the shareholders of Zhenyu Technology (300953.SZ) and Wuzhou Xinchun (603667.SH). Among them, foreign institutions hold a substantial number of shares in Wuzhou Xinchun. As of August 16, 2024, Prime China International, Citibank USA, Goldman Sachs Asia, Morgan Stanley Hong Kong, and JPMorgan Chase all held more than 100,000 shares.

Almost simultaneously, at the end of the third quarter last year, 16 domestic public funds held a total of 22.14 million shares of Wuzhou Xinchun, with Fullgoal Tianrui Strong Mix Fund holding the most at 5.351 million shares.

Analysis of the Future Trend of Robot Concept Stocks

Regarding the future trajectory of robot concept stocks, various institutions have recently voiced their opinions.

GGII predicts that the global humanoid robot market size was $1.017 billion in 2024 and will reach $15.1 billion by 2030, with a compound annual growth rate exceeding 56% from 2024 to 2030. Global humanoid robot sales will grow from 11,900 units to 605,700 units.

Hua'an Securities believes that 2025 will mark the first year of mass production for humanoid robots, with Tesla's Optimus expected to enter the stage of small-batch mass production, deploying thousands of humanoid robots to operate within internal factories, with external sales anticipated in 2026. Leading domestic and foreign robot companies such as Figure, 1X, Unitree, Zhiyuan, Kepler, and UBTech have successively commenced mass production of humanoid robots.

CITIC Securities stated that with the acceleration of robot projects, attention should focus on the core links of the Tesla robot industry chain. It is recommended to concentrate on: 1) Assemblies; 2) Reducers; 3) Lead screws; 4) Dexterous hands. Additionally, attention should be paid to players in other crucial links.

Guohai Securities pointed out that in 2024, following technological accumulation and policy stimulus in the domestic humanoid robot industry, the transmission effect of compound influencing factors began to emerge. In 2025, manufacturers will successively enter the robot body manufacturing field, and major companies will continue to deploy large AI models. The entire industry will accelerate the construction of the humanoid robot industry chain and commercialization. However, it should be noted that after experiencing a short-term violent rebound, some stocks in the robot concept have rebounded to near their previous highs. Subsequently, they may face the dual challenge of short-term profit-taking and early trapped positions. Whether there is still sufficient capital willing to enter and take over remains the focus of subsequent attention.