From Topstar to Efort: Which A-share Company is Most Likely to Breakthrough in the Humanoid Robot Sector?

![]() 01/21 2025

01/21 2025

![]() 545

545

This article is based on public information and is intended solely for informational purposes, not constituting investment advice.

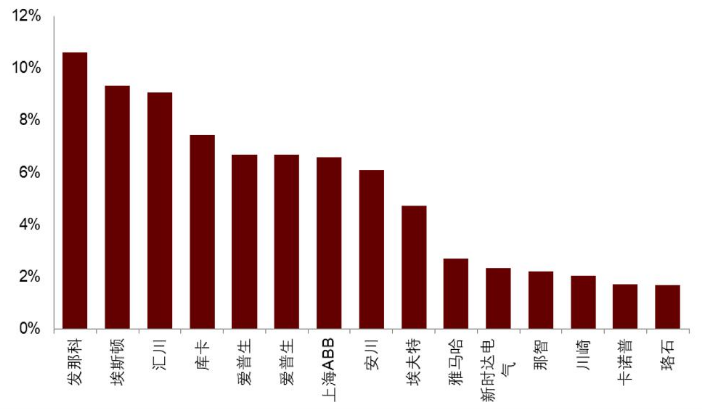

In 2020, the new energy vehicle and photovoltaic industries witnessed explosive growth, fostering remarkable investment opportunities. Stocks that appreciated tenfold were not uncommon during that period. Starting in 2023, the artificial intelligence industry accelerated its ascension, giving birth to super bull stocks such as Hygon, InnoLight, and Eoptolink. In 2025, the market's focus shifted to the next industrial investment frontier, with humanoid robots emerging as the center of attention. From policy guidance to the execution of corporate production capacity plans, the likelihood of 2025 becoming the inaugural year for the humanoid robot boom is increasing. Consequently, numerous humanoid robot companies have seen their share prices soar significantly since September 2024, with Topstar being one of the star performers. So, what are the fundamental qualities of Topstar? And can it distinguish itself in the humanoid robot sector in the future?

01 First Loss After Listing, Deteriorating Profitability

Headquartered in Dongguan, Topstar was founded in 2007. In its early stages, its business centered on injection molding machine auxiliary equipment, providing three-in-one machines, mold temperature controllers, water chillers, etc., to injection molding enterprises. These products featured low barriers to entry. From 2015, the company began diversifying into industrial robots and developed a six-axis industrial robot body the following year. In 2021, Topstar acquired Dongguan Efumi, entering the field of five-axis CNC machine tools. Currently, Topstar's business is primarily divided into four segments: injection molding equipment and accessories, industrial robots and automation, CNC machine tools, and smart energy and environmental management. In 2023, the revenues of these segments were 430 million yuan, 969 million yuan, 349 million yuan, and 4.553 billion yuan, respectively, accounting for 9.46%, 21.27%, 7.67%, and 59% of total revenue. From the perspective of business development over the past few years, the injection molding and CNC machine tool segments have accounted for a relatively small proportion. Industrial robots, after experiencing explosive growth since 2020, have fallen into decline, whereas the smart energy and environmental management business (providing customers with production workshop environment and energy management systems) has become the company's largest revenue source. However, due to severe overcapacity among customers in the lithium battery and photovoltaic industries, this business declined by more than 50% year-on-year in 2024, incurring losses exceeding 200 million yuan. In the first three quarters of 2024, Topstar's revenue was 2.235 billion yuan, a sharp year-on-year decrease of 31%, and its net profit attributable to shareholders was 9 million yuan, a significant year-on-year drop of 93%. According to the latest performance forecast, the company is expected to incur a loss of 180 million yuan to 250 million yuan for the full year, marking its first loss since listing. Regarding profitability, as of the end of the third quarter of 2024, Topstar's gross margin was 20.3%, a notable decline of 16.48% from the 36.78% recorded in its listing year of 2017. This decline can be attributed to changes in the company's business structure, with the low-margin smart energy and environmental management segment accounting for an increasing proportion. Additionally, businesses such as industrial robots have been impacted by intense market competition, leading to a significant drop in gross margins. Compared to peers, Topstar's gross margin is not unfavorable, higher than that of Robot and Efort but lower than Estun's 29.7%.

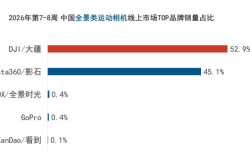

Figure: Gross Margin Trends of Four Major Robot Companies, Source: Wind

From 2021 to 2023 and the first three quarters of 2024, Topstar's net profit margin was below 3.5%, in stark contrast to the double-digit performance seen before 2021. It is evident that Topstar's main business lacks significant highlights, and both its performance and profitability are deteriorating, which is at odds with its current PE valuation of over 100 times. However, the capital market grants a high valuation premium primarily due to the potential of the humanoid robot business.

02 Control Platform Technology is the Key

The humanoid robot industry has yet to achieve mass production, and related enterprises are still in the money-burning stage, so it is normal not to see profits. Currently, the capital market places greater emphasis on which company possesses stronger technical capabilities and can master and address current industry technical challenges, as this will increase their chances of standing out in the future. Humanoid robots differ from industrial robots in that the former needs to simulate human learning and movement and possess the ability to interact in complex scenarios, whereas the latter's actions are relatively standardized and programmed, with lower technical barriers. Currently, the mass production of humanoid robots faces at least three major technical challenges: Firstly, there are still technical difficulties with the robot body hardware, such as flexible hands and joints. Although the application of neodymium-iron-boron permanent magnet materials enables motors to perform better with smaller volumes and weights, and the use of lightweight materials like PEEK effectively reduces the weight of robots and enhances their flexibility, reducers still have deficiencies in meeting the needs of humanoid robots for high-precision positioning and fast response. Secondly, the realization of brain-like functions such as autonomous learning, planning, and decision-making is relatively difficult. The rapid development of AI large models will significantly aid in the learning and decision-making of humanoid robots, but currently, there is no universal algorithm model in the industry, and algorithms need to be developed and calibrated separately for each fine motion task, resulting in poor compatibility and interoperability between components. Thirdly, the cerebellum-like functions of motion control and coordination represent the biggest technical bottleneck currently encountered by humanoid robots. The "cerebellum" comprises a system of algorithms and hardware devices, including sensor modules, dynamic models, and controllers, but the main issues lie in insufficient data, the difficulty of scenario coverage, the high cost of data acquisition, the difficulty of feature extraction, and the low universality of data. Topstar has been in the industrial robot field for 10 years and has accumulated some underlying technologies in core areas such as controllers, servo drives, and vision systems. It is one of the few domestic robot enterprises that can achieve full coverage from "upstream core components + midstream industrial robot bodies + downstream automation system integration applications." However, Topstar's market share is not high, far lower than that of domestic brands such as Estun and Efort.

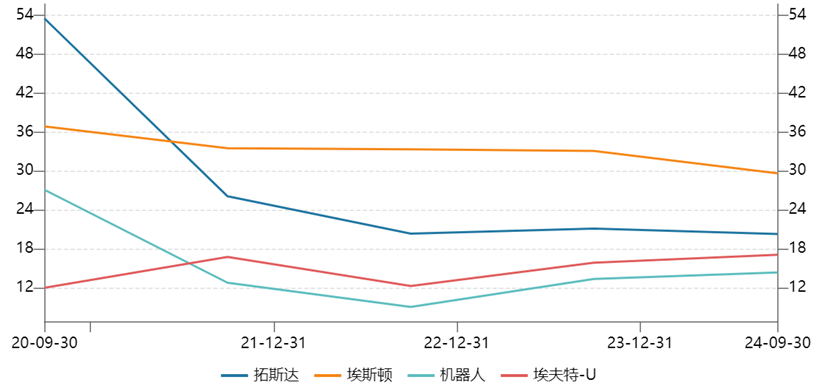

Figure: China's Industrial Robot Market Landscape in Q1 2024, Source: CICC

Topstar's biggest highlight is its new-generation X5 robot control platform that integrates "sensing-computing-control." This control platform serves as the link between the "cerebellum and spine" of humanoid robots, shortening the robot's motion control cycle to 1-2 milliseconds, providing better guarantees for the robot's higher-precision motion control and perception. The underlying system of this X5 control platform is supported by Huawei's openEuler operating system. It is worth noting that Huawei's openEuler was previously Huawei's self-developed server operating system EulerOS, which was officially open-sourced and shared in 2019. According to IDC's report, in 2023, openEuler's market share in China's server operating system market reached 36.8%, ranking first in the market. Moreover, this control platform is compatible and adaptable to common standard models throughout the industrial robot industry, meeting the needs of more than 90% of models in the industrial field. It is evident that Topstar has made tangible breakthroughs in solving the technical bottleneck of the "cerebellum" of humanoid robots. Additionally, the company has newly established "Matrix Intelligent Control (Dongguan)" and will further develop the general robot "sensing-computing-control" control platform in the future. Therefore, whether the technology of the X5 robot control platform can further address industry technical pain points is crucial for Topstar's ability to secure a position in the humanoid robot sector.

03 Who is Most Likely to Breakthrough?

The humanoid robot industry chain is extensive and holds immense future potential, integrating cutting-edge fields such as artificial intelligence, high-end manufacturing, and new materials. An increasing number of players are entering this field, roughly divided into the following categories: Firstly, robot body manufacturers that initially entered the humanoid robot sector can be classified as new forces native to the industry, such as UBTech, Zhiyuan Robotics, and Unitree. Secondly, companies that have cross-borderly deployed from other types of robots, including Topstar and Efort in the industrial robot sector, Pudu and Dreame in the service robot sector, as well as Estonian Coolbro, Thinkerbot, and Elephant Robotics in the collaborative robot sector. Thirdly, AI/Internet giants, including Huawei, Baidu, and iFLYTEK, primarily through internal research and development of cutting-edge technologies, external strategic investments, and large model ecosystem cooperation. For example, UBTech's Walker S is integrated with Baidu's ERNIE Bot large model, and Leju Robotics is integrated with Huawei's Pangu large model, launching the "Kuafu" humanoid robot in June 2024. Fourthly, new energy vehicle companies, including Tesla, XPeng, and Xiaomi. Additionally, there are innovative companies with backgrounds in university research or large corporations, such as Zhongqing Robotics (founded by Zhao Tongyang, the former head of XPeng Robotics), Yinhe General (Tsinghua-affiliated), and Qianxun Intelligence. In my opinion, the manufacturers with the best chance of winning in the domestic market should be a combination of industrial robot manufacturers and Huawei (industrial and humanoid robot hardware technologies are interconnected, and the latter excels in software capabilities), followed by competitive new forces in the humanoid robot sector. Huawei's layout in humanoid robots is not a whim but the result of seven years of research and development in AI+robot technology, obtaining patents related to robot arms, safety protection methods, human-computer dialogue, model updates, obstacle avoidance systems, etc. Of course, Huawei's strongest points lie in its technological accumulation in areas such as cloud computing platforms, the Pangu large model, the openEuler open-source operating system, and the Bisheng editor. Therefore, Huawei's entry may to some extent influence the direction and division of labor within the industrial chain. Lu Hanchen, director of the Research Institute of the High-tech Robotics Industry, once predicted that for domestic robot enterprises, those that collaborate with Huawei may achieve faster growth, while those that go it alone will inevitably face certain competitive pressures. This is also the core factor behind the soaring stock prices of industrial robots led by Topstar and Efort after they signed cooperation agreements with Huawei. The market is betting that these enterprises have a higher probability of securing a position in the future. Of course, whether through cross-border cooperation or going it alone, the high popularity of the humanoid robot sector in the coming years will provide numerous opportunities for enterprises. As stated in the "Guiding Opinions on the Innovative Development of Humanoid Robots" issued by the Ministry of Industry and Information Technology in October 2023: Humanoid robots are expected to become a game-changing product following computers, smartphones, and new energy vehicles, profoundly transforming human production and lifestyle and reshaping the global industrial development landscape. By 2027, they will become an important new engine of economic growth. In summary, the industrial investment opportunities in humanoid robots should be taken seriously in 2025, while also being vigilant against the high valuation risks associated with sector investments.