Cross-border E-commerce Rewritten by AI: Easier Than Domestic Trade

![]() 01/05 2026

01/05 2026

![]() 345

345

Article | Intelligent Relativity Theory

The maturity of cross-border e-commerce is continuously improving.

From a physical infrastructure perspective, the establishment of overseas warehouses and cross-border logistics networks has made the circulation of goods increasingly convenient. The improvement of supporting services such as payments and customs has also made transaction processes smoother.

However, the core challenges inherent in “cross-border”—information asymmetry, multilingual barriers, and the complexity of cross-market operations—remain like an invisible wall, blocking millions of domestic traders from entering the global market.

This situation may change with the deep integration of AI.

Recently, 1688 introduced the cross-border AI agent “Aoxia” (overseas brand name AlphaShop), focusing on the entire cross-border e-commerce process and integrating five core capabilities: product selection decision-making, factory sourcing, material generation, intelligent inquiry, and issue consultation.

From a technical standpoint, this product has surpassed ChatGPT 5.2 on the EcomBench e-commerce vertical leaderboard, becoming the world’s top AI for e-commerce product selection.

With the increasing penetration and implementation of AI, the threshold for cross-border e-commerce is getting lower, and cross-border business is becoming simpler.

Cross-border E-commerce: The “Golden Track” for AI Implementation

What determines the practical value of AI?

At least in commercial scenarios, it is almost directly proportional to the degree of information asymmetry. The harder and more complex it is to obtain information, the more evident AI’s value becomes.

This is why AI is generally believed to be more valuable in B2B contexts—there are too many information blind spots waiting to be addressed.

Cross-border e-commerce is precisely a “disaster zone” for information gaps.

For merchants, entering a new cross-border market often means starting from scratch: not knowing local consumer preferences, unclear which domestic manufacturers’ products can best match, being in the dark about platform rules, compliance requirements, and material display characteristics, along with various complex issues like logistics and tariffs to resolve.

Under these information barriers, the value of AI products like Aoxia is infinitely amplified—they can integrate publicly available data from global sources and specific data from 1688 and Alibaba platforms, quickly build market awareness, and directly assist in operations, enabling merchants to go from knowing nothing to having a clear understanding.

Moreover, from a market size perspective, cross-border e-commerce is far from a niche sector.

Industry data shows that while there are over ten million domestic e-commerce sellers in China, only 1.3 to 1.5 million are active in cross-border e-commerce, less than one-tenth of domestic sellers. This implies a potential go overseas (going global) group of nearly nine million, coupled with the efficiency improvement needs of existing cross-border merchants, forming a vast and essential market.

Furthermore, the cross-border e-commerce industry has a “low barrier to entry, high ceiling” characteristic. There are small merchants operating like family businesses and top-tier enterprises with annual GMVs in the billions. A significant number of practitioners operate below the “competency line.” AI’s inherent “ability leveling” attribute precisely meets the core demands of most merchants, whether they are beginners or experienced players looking to improve efficiency, finding corresponding value points.

This natural fit makes cross-border e-commerce the “golden track” for AI implementation.

Unlike general-purpose AI, cross-border AI does not need to be omniscient but focuses on specific pain points like product selection, operations, and supply chains, where each optimization directly translates into commercial results. As Yilong, the head of 1688’s cross-border business, said, “We don’t make toy-like products; we aim to create ‘toothbrush-like tools’ that merchants can’t live without every day.”

AI: Making Foreign Trade E-commerce Operations Nearly as Simple as Domestic Trade

Taking a step further, since AI’s value lies in eliminating information asymmetry, combined with upgrades in infrastructure and policies, for merchants, cross-border e-commerce + AI can be considered roughly equivalent to domestic e-commerce in terms of difficulty.

This is evident in the various AI capabilities provided by Aoxia. Its core value to the industry and cross-border merchants lies in systematically lowering the operational threshold of cross-border e-commerce through “ability equity,” making foreign trade operations nearly as straightforward as domestic ones.

This equity manifests in two key dimensions.

First is information equity.

In the past, core capabilities like global market insights and precise product selection logic were only possessed by large trading companies or top buyers. Leveraging professional teams and long-term accumulation, they could predict overseas market trends half a year in advance, while small and medium-sized merchants could only rely on following trends and trial-and-error.

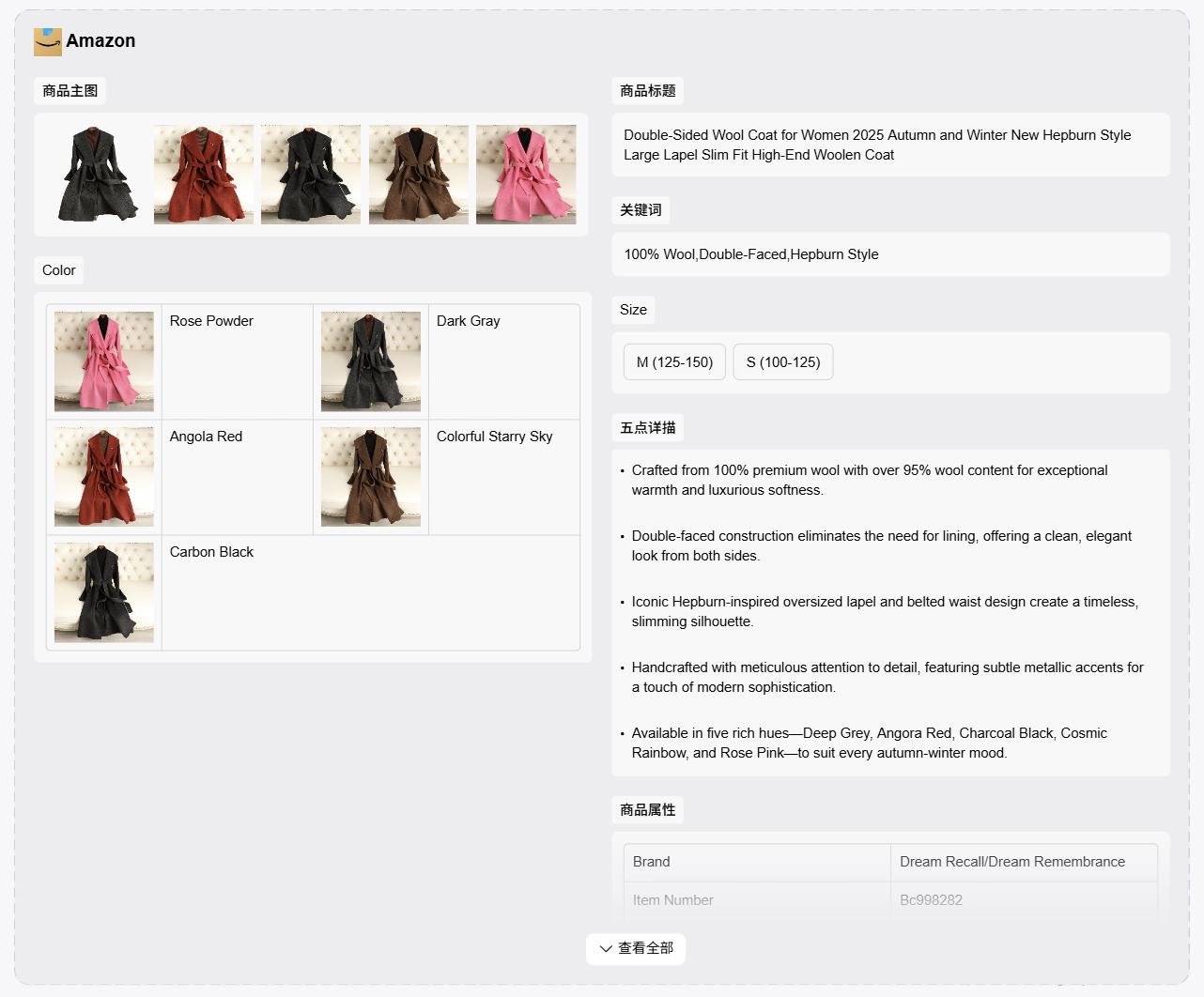

Now, Aoxia productizes this complex product selection logic by integrating billion-scale product data from downstream platforms like Amazon and TikTok, as well as factory supply data from 1688. Users only need to upload a product image or input a link to initiate the entire process from market research to platform listing with one click: AI automatically analyzes global market and category supply and demand data, recommends blue ocean categories; precisely matches source factories on 1688 with cross-border service capabilities, presenting key indicators like fulfillment rates and customization qualifications; and batches dock (connects) merchants for negotiation and price comparison through intelligent inquiry functions.

Whether it’s determining “which blue ocean subcategories of yoga pants are there in the US market” or analyzing “which styles of trench coats sell well in the UK,” AI can generate professional reports within minutes, whereas a mature traditional buyer would take significantly longer to complete the same tasks.

This equalization of information acquisition capabilities enables small and medium-sized merchants and even factories to possess market insights on par with large enterprises.

Second is operational equity.

The complexity of cross-border operations once deterred countless domestic traders. Multilingual translation, cross-platform material adaptation, compliance qualification inquiries, and international logistics connections each required professional expertise.

Aoxia automates these complex processes through AI technology. Inputting a 1688 product link generates titles, main images, and size charts adapted for multiple platforms like Amazon, Korean, and Japanese with one click, enabling one-click listing; it supports the generation of various e-commerce images like selling point and scenario images, addressing the issue of rough factory materials.

The intelligent consultation module can answer practical questions like “how to ship a piano to Brazil” or “what certifications are required for a product in the US.” This operational capability supplementation enables factories focused solely on production to directly participate in global competition without relying on professional foreign trade teams.

The value of “equity” is ultimately intuitive (intuitively) validated by various internal test data from Aoxia.

Some merchants using Aoxia have seen their daily orders increase from 40-80 to 300-400, a 4-5x growth in order volume and approximately a 3x increase in conversion rates; product selection accuracy reached 40%, far exceeding the industry expert average of 7%.

Looking back, the reason China’s domestic market can accommodate tens of millions of sellers lies in its unified market: a common language, consistent rules, transparent information, and a single operational logic covering the entire country. In contrast, the marginal costs of cross-border e-commerce were once high—a set of materials could only cover one country, and entering a new market required rebuilding the operational system from scratch.

Now, with the improvement of physical infrastructure like logistics and AI’s extreme compression of operational costs, the marginal costs of cross-border trade are approaching zero. As information gaps are eliminated and operational complexity is reduced, the essential differences between foreign and domestic trade are disappearing. In the future, “cross-border” may no longer be a label that needs to be emphasized deliberately (deliberately); merchants choosing overseas markets will do so as naturally as selecting a provincial market within China, with e-commerce’s core reverting to “what to sell” and “who to sell to” rather than “how to cross borders.”

Only Platform Economics Can Proactively Use AI to Bridge Gaps

In the vertical field of cross-border e-commerce, platform players need to step in—this is not just their opportunity but their responsibility. Only platform players have both the capability and willingness to engage in such “heavy investment, deep vertical” endeavors.

Technologically, the long-term perspective inherent in platform economics makes them most likely to resist the temptation of “large model showmanship” and avoid pursuing short-term general-purpose AGI. Instead, they invest the immense resources close to those of foundational large models into highly vertical e-commerce scenarios.

For example, 1688 Aoxia is powered by Tongyi Qianwen’s first-tier base model, utilizing oversized (extra-large-scale) models for specialized training—a rarity in vertical models.

To support this training, 1688 deployed a GPU cluster at the thousand-card level, with investment costs reaching hundreds of millions of yuan. They also assembled a professional data annotation team to meticulously process Segmented product categories (subcategory) data like “Chinese cleavers vs. Western cleavers.”

This scale of investment is beyond the reach of ordinary vertical AI companies, which either lack sufficient computational resources or access to massive amounts of high-quality data.

Data is precisely 1688’s core barrier (barrier).

Unlike general-purpose AI relying on publicly available data, Aoxia’s training data includes Alibaba ecosystem’s unique “private transaction data”—supply information from millions of factories on 1688, historical transaction records, fulfillment performance, and terminal pricing data from platforms like Taobao and AliExpress. After deep cleaning and annotation, this data effectively reduces model “hallucinations” and improves decision accuracy. More importantly, 1688 has connect through (connected) supply and demand-side data, understanding both factories’ production capabilities and customization qualifications and overseas sellers’ procurement preferences and operating histories. This bidirectional understanding enables AI’s matching efficiency to far surpass that of mere information retrieval tools.

Commercially, 1688 has explicitly stated that Aoxia’s future pricing will adopt a “cost-based pricing method,” nearly at a break-even point or even not profit-oriented as its core goal.

Behind this pricing strategy lies the consistent ecological thinking of platform enterprises: by setting extremely low barriers to meet the needs of a vast user base, they accumulate more authentic behavioral data to feed model iterations, forming a flywheel effect of “more users → fuller data → more accurate models → higher value.” Ultimately, as more Chinese manufacturing enterprises go global through Aoxia, 1688’s value as a supply chain foundation will naturally grow synchronously.

This “ecosystem-first, profit-later” model stands in stark contrast to pure model companies that earn money through API calls, and only platform economics have the confidence and capability to realize it.

E-commerce “Global Expansion” Becomes a Reality

As AI gradually eliminates the differences between cross-border and domestic trade, an inevitable trend is emerging: China’s robust domestic e-commerce capabilities and countless domestic and foreign trade merchants will leverage AI to go global, achieving true e-commerce “global expansion.”

In the past, China’s e-commerce “involution” was well-known—intense price wars and traffic battles in the domestic market continuously compressed merchant profit margins.

However, the global market offers entirely new growth spaces: the Middle East’s e-commerce penetration rate is still rising, Southeast Asia’s market is growing rapidly, and emerging markets in Africa and Latin America hold vast untapped potential. Information gaps in these markets remain significant, and Chinese merchants, armed with AI, possess the ability to break through these barriers.

Thus, Chinese merchants’ core advantages will be amplified on a global scale. China’s manufacturing boasts a complete industrial system capable of providing cost-effective and diverse products; Chinese e-commerce practitioners have accumulated mature operational experiences and flexible adaptability. Previously, these advantages were constrained by cross-border barriers and could not be fully utilized. Now, AI has dismantled these barriers, enabling Chinese merchants to rapidly replicate their domestic success globally.

As tens of millions of domestic merchants flood into the cross-border market, they will not bring disorderly competition but the global popularization of China’s e-commerce model—just as Chinese sellers now account for over 70% of market share on platforms like Amazon and Russian e-commerce sites, their advantages will further expand in more emerging markets.

The significance of this “global expansion” far exceeds the profit growth of individual merchants.

It means Chinese manufacturing will reach every corner of the globe through AI, from mainstream markets in Europe and America to edge (peripheral) markets like Iraq and Madagascar, vastly enriching local product supplies; it signifies that China’s e-commerce operational models and supply chain efficiencies will become the new global standards for cross-border trade; and it implies that “Made in China” will truly upgrade to “Intelligent Manufacturing in China + Global Distribution,” achieving efficient global allocation through AI as digital infrastructure.

Conclusion

AI is eliminating the barriers and complexities represented by the “cross-border” label.

In the foreseeable future, “cross-border” will no longer be a challenge that needs to be emphasized deliberately (deliberately) but a market dimension that merchants can freely choose. The emergence of Aoxia has refocused the competitive landscape of cross-border e-commerce on the product itself, enabling the commercial principle of “who manufactures better wins the market” to take effect globally.

The future is here, and AI is making global trade fairer and more efficient. Chinese merchants stand at the forefront of this transformation.

*All images in this article are sourced from the internet