Guoxing Aerospace Valued at Over RMB 6.5 Billion, Races to Become Hong Kong's 'First Commercial Aerospace Stock'

![]() 02/19 2025

02/19 2025

![]() 717

717

Preface:

In the recent past of 2024, with [commercial aerospace] featured prominently in the government work report, the commercial aerospace industry has embarked on a fast track of rapid development, attracting more enterprises into the capital market.

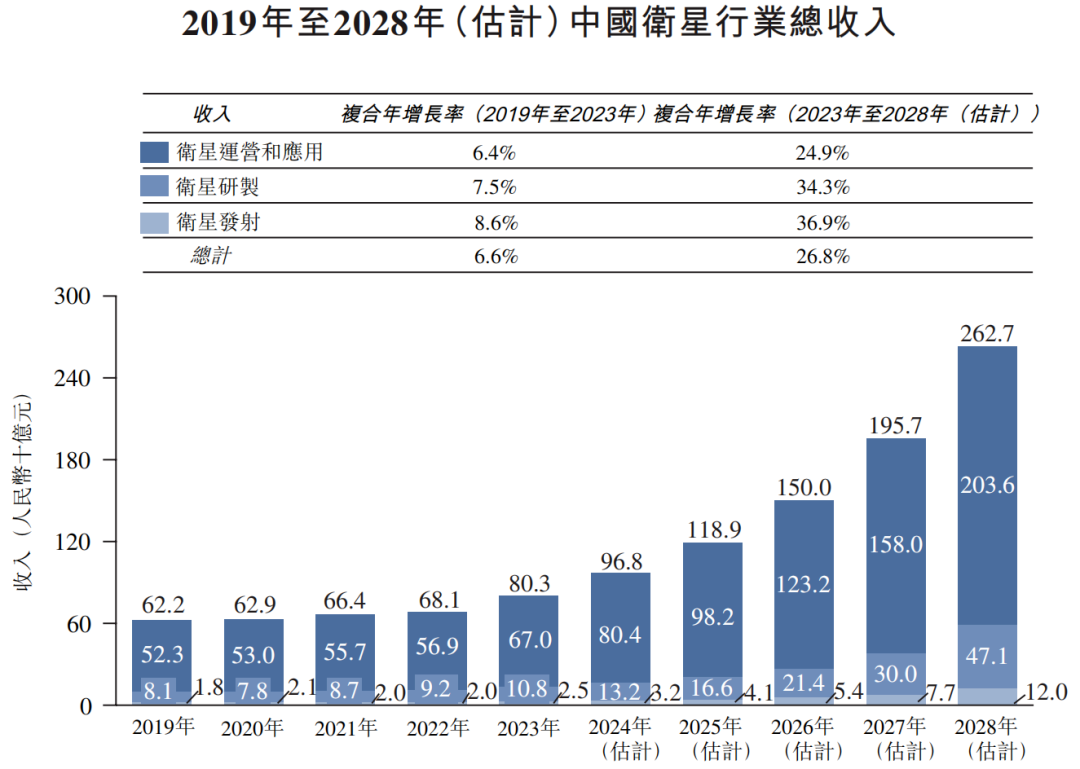

Data indicates that China's commercial aerospace industry's total output value has surged from approximately RMB 0.8 trillion in 2019 to RMB 1.9 trillion in 2023, marking an average annual compound growth rate of 24.1%.

It is projected that by 2028, the industry's total output value will reach approximately RMB 6.0 trillion, with an average annual compound growth rate of 25.9% from 2023 to 2028.

Author | Fang Wensan

Image Source | Network

Guoxing Aerospace Races to Become Hong Kong's 'First Commercial Aerospace Stock'

Recently, Chengdu Guoxing Aerospace Technology Co., Ltd. submitted IPO application documents to the main board of the Stock Exchange of Hong Kong Limited, aiming to become the first listed company in Hong Kong with commercial aerospace as its core business.

Guoxing Aerospace's core business revolves around [AI+satellite] technology, focusing on satellite research and development in commercial aerospace and artificial intelligence. It is the first commercial aerospace enterprise in China to research and successfully launch AI satellites.

Chengdu Guoxing Aerospace Technology Co., Ltd., a mainland company specializing in commercial satellite research and development, has officially submitted listing application documents to the main board of the Stock Exchange of Hong Kong Limited, with Guotai Junan International as its exclusive sponsor.

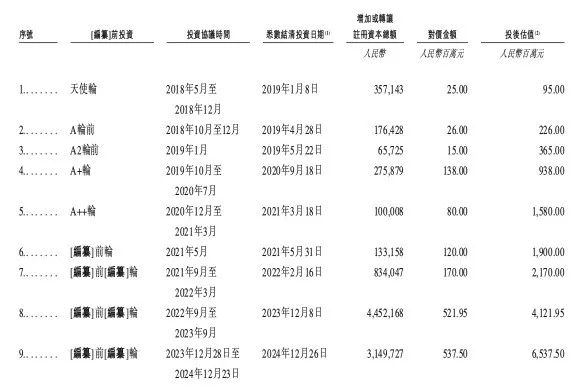

According to the prospectus, Guoxing Aerospace completed its latest round of financing in December 2024, raising RMB 537.5 million, with a subsequent valuation reaching RMB 6.5375 billion.

Guoxing Aerospace is dedicated to building commercial satellite constellations and establishing an integrated AI infrastructure linking space and earth, aiming to provide global users with widespread, low-cost, and accessible commercial satellite solutions and space-based intelligent computing services.

Since its inception, Guoxing Aerospace has witnessed rapid growth, amassing over RMB 1 billion in cumulative funding and achieving a valuation exceeding RMB 6 billion within seven years.

In 2018, Guoxing Aerospace received tens of millions of yuan in angel round investment from Shenzhen Capital Group; in 2019, it secured nearly RMB 100 million in Series A financing led by Vanke; and in 2020, it completed Series A+ financing of RMB 150 million.

In 2021, led by Everbright Health, it completed Series B financing; and in 2023, it received Series C financing of over RMB 500 million led by Hongtai Fund. According to the prospectus, Beijing Xingrong Aerospace holds a 23.51% stake, Beijing New Era Aerospace holds a 10.07% stake, and other investors collectively hold a 66.42% stake.

Midway Through the Three-Stage Development Plan

According to the prospectus, Guoxing Aerospace and its partners have jointly developed 6 traditional remote sensing satellites and 1 AI application satellite. Additionally, the company has independently developed 6 AI payloads, 4 AI application satellites, and 4 AI intelligent computing satellites.

Guoxing Aerospace has also secured research and development orders for 20 AI intelligent computing satellites, with launch service agreements signed for 12 of these satellites, expected to be launched in 2025.

To achieve its goals, Guoxing Aerospace has outlined a detailed development blueprint divided into three main stages:

The first stage, from the company's establishment to 2022, focused on accumulating extensive satellite remote sensing data.

The second stage, spanning from 2023 to 2027, involves accelerating the transition from AI application satellites to AI computing satellites.

The third stage commences in 2028, where Guoxing Aerospace aims to complete and operate a globally integrated AI infrastructure linking space and earth, offering commercialized satellite solutions and space-based intelligent computing services based on this infrastructure.

Currently, Guoxing Aerospace is in the second stage of its development plan.

At this stage, the company is advancing the iteration and market promotion of the Lingjing Engine, an AI application satellite-based technology that automates spatial dimension enhancement of remote sensing data. In November 2022, the company officially launched the Lingjing Engine, transforming traditional two-dimensional satellite remote sensing data into advanced three-dimensional solutions, significantly enhancing the depth and breadth of satellite solutions.

Simultaneously, the company is accelerating its transition from AI application satellites to AI intelligent computing satellites. As of the latest practicable date, the company has successfully completed 13 space missions.

Notably, in September 2024, Guoxing Aerospace successfully launched the world's first AI large model scientific satellite and completed the verification of AI large model technology for satellite in-orbit operation, marking the substantial entry of the [Star Calculation Plan] into the construction phase. This plan aims to establish a space-based computing power network comprising 2,800 AI intelligent computing satellites, with relevant satellite orbits and spectra already approved and announced by the International Telecommunication Union.

Guoxing Aerospace's Operating Revenue Primarily Derived from Two Major Business Areas

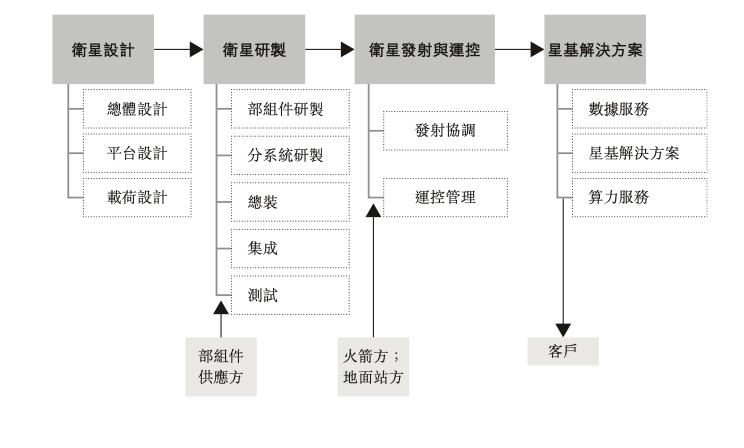

As of the end of 2023, there were fewer than 20 private commercial aerospace companies in China managing the complete satellite industry value chain, encompassing satellite research and development, satellite launch, satellite operation, and application.

In terms of 2023 revenue, Guoxing Aerospace ranks second among private commercial aerospace enterprises in China that manage the complete satellite industry value chain. According to Guoxing Aerospace's 2023 financial data, its revenue ranks eighth among private commercial aerospace enterprises in China, with a market share of 1.9%.

As of the latest practicable date, Guoxing Aerospace has successfully launched 9 AI satellites, ranking first in cumulative launch numbers among all private commercial aerospace enterprises in China.

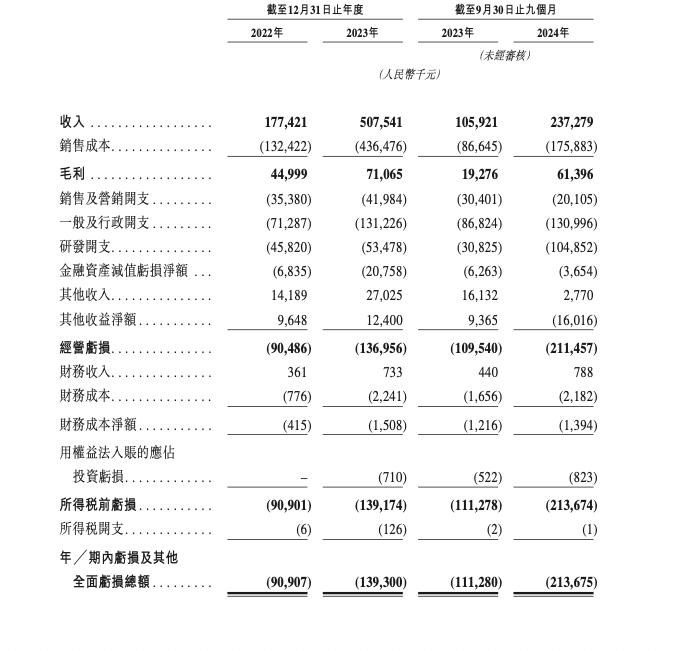

In 2022, 2023, and the first three quarters of 2024, Guoxing Aerospace's operating revenues amounted to RMB 177 million, RMB 508 million, and RMB 237 million, respectively. During the same period, the proportion of R&D expenditure to total revenue was 25.8%, 10.5%, and 44.2%, respectively.

In terms of revenue growth rate, Guoxing Aerospace leads the satellite industry in China.

One revenue stream is derived from satellite and related services, encompassing the research, development, and sales of customized satellites, as well as the provision of satellite operation and control management services. Building on this foundation, Guoxing Aerospace has further developed a second business line—satellite-based solutions, which contribute more than half of the company's operating revenue.

In 2022, 2023, and the first three quarters of 2024, revenue from satellite-based solutions accounted for 58%, 90.7%, and 81.5% of total operating revenue, respectively. With its product and service capabilities, Guoxing Aerospace has achieved substantial economic benefits in the commercial satellite industry, witnessing rapid growth in its satellite-based solutions business.

In 2022, this business's revenue surged from RMB 103 million to RMB 460 million in 2023, and achieved a revenue of RMB 82 million in the first three quarters of 2023, with an expected growth to RMB 193 million in the same period of 2024. The satellite-based solutions business is not only the primary driver of Guoxing Aerospace's growth but also its main source of revenue, significantly boosting the company's total revenue, which surpassed RMB 500 million in 2023.

Conclusion:

Guoxing Aerospace faces stiff competition within the industry. Domestic rivals such as the Beidou System and China Aerospace Science and Industry Corporation are closely monitoring its moves, while internationally, SpaceX's Starlink project has successfully launched 5,000 satellites.

Furthermore, the battle for spectrum and orbital resources in the commercial aerospace sector looms large, with international competition intensifying. This competitive pressure places Guoxing Aerospace at a disadvantage in the market, and its ambition to build a global computing power network faces significant challenges.

While Guoxing Aerospace has made certain achievements in the field of AI satellites, it remains unclear whether these accomplishments can be translated into actual profits. Looking ahead, with the further maturation of technology, the expansion of the customer base, large-scale production, and the reduction of satellite launch costs, Guoxing Aerospace's profit outlook is expected to improve. However, there are still many uncertainties regarding the realization of these expectations.