Echelon Intelligence: Defying the Odds for Remarkable Growth!

![]() 03/07 2025

03/07 2025

![]() 719

719

Recently, Echelon Intelligence's share price has repeatedly scaled new heights, surging over 240% since its 2022 IPO. This impressive performance is largely attributed to the capital market's bullish outlook on the company's future growth prospects.

[The Turning Point in Business Operations is Unmistakable]

Echelon Intelligence stands as a leading provider of intelligent networking hardware products and solutions in China, with its business portfolio encompassing industry terminals, ICT infrastructure, and the industrial internet. In the first half of 2024, these segments contributed 62%, 17.8%, and 3.8% to the company's revenue, respectively.

Specifically, the industry terminal business revolves around multi-industry IoT intelligent terminals launched on mainstream platforms such as Intel and AMD. The product line includes PCs, OPS (Open Pluggable Specification) computer modules, cloud terminals, and commercial display terminals.

Among these, OPS and cloud terminal products enjoy a substantial market share, with key customers such as Sangfor and Ruijie Networks (leading cloud desktop providers) and Honghe Technology (a pioneer in smart tablet interaction).

The ICT infrastructure business primarily includes network equipment, network security, edge terminals, and servers. The industrial internet segment, on the other hand, comprises industrial motherboards and core boards, embedded industrial computers, industrial computers, robots, and machine vision controllers.

According to financial report previews for 2024, Echelon Intelligence's net profit attributable to shareholders is projected to range between 105 million and 135 million yuan, marking a year-on-year increase of 220% to 311.4%. This significant recovery in profitability is driven by two key factors.

Firstly, downstream demand has rebounded, stabilizing and revitalizing the company's core business. Notably, in the industry terminal and ICT fields, Echelon Intelligence offers both customer-oriented standard products/solutions and customized services. Additionally, it has launched a comprehensive range of industrial product families under the "Echelon Industrial" brand, providing customers with its own brand of industrial control products and solutions.

Secondly, the new intelligent computing business has achieved remarkable success, emerging as a new growth engine for the company. This segment has significantly contributed to the overall net profit attributable to shareholders, driving a gradual recovery in profitability.

At the beginning of 2024, Echelon Intelligence established a subsidiary, Tengyunzhisuan, focused on providing end-to-end full lifecycle services for intelligent computing centers, with a particular emphasis on AI computing power. In the first half of the year, Tengyunzhisuan contributed 48 million yuan in net profit to its parent company, accounting for 85% of the profit for the same period.

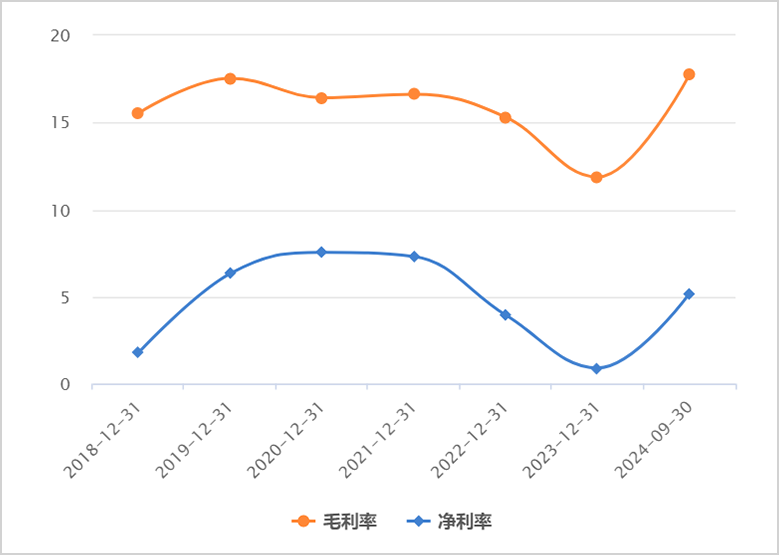

Benefiting from these two factors, Echelon Intelligence's profitability has seen a notable recovery. As of the end of the first three quarters of 2024, the company's sales gross margin stood at 17.76%, an increase of 6.14 percentage points from the same period in 2023, hitting a new high since financial disclosure data became available. Concurrently, the latest net profit margin has risen to 5.18%, also a new high since 2021.

▲Echelon Intelligence's Operating Profit Margin Over the Years, Source: Eastmoney Choice

In summary, amidst intensifying industry competition, Echelon Intelligence has defied the odds, witnessing significant improvements in revenue and net profit attributable to shareholders, alongside a bottoming-out and recovery in profitability. The overall turning point in its business operations is undeniable.

[Potential for Explosive Growth in Core Business]

Looking ahead, the potential for explosive growth in Echelon Intelligence's core business cannot be overlooked. This is primarily due to the continuous enhancement of its core competitiveness and the favorable growth opportunities arising from industry changes.

Initially, Echelon Intelligence's business was predominantly based on the ODM model, where it served as the original design manufacturer, overseeing product design, development, and production, while the brand focused on marketing and distribution channels. During this period, the company accumulated extensive precision manufacturing experience through large-scale production, fostering robust supply chain management capabilities.

Subsequently, the company pivoted its focus to the industrial internet, edge computing terminals, and AI acceleration devices, launching its own brand and adopting a dual-wheel drive strategy combining ODM and OBM (Original Brand Manufacturer).

This approach enables Echelon Intelligence to not only address the diverse needs of downstream customers amidst industry shifts but also explore new growth avenues and bolster its core competitiveness within the industry through its autonomous brand model.

Currently, with the rapid advancement of AI technology, AI PCs are emerging as a prominent trend. Since 2024, over 20 AI PC products based on Qualcomm chips have been introduced. Internationally, industry giants such as Dell and HP are also making strides to jointly cultivate an AI ecosystem.

Domestically, Lenovo, as the leading PC shipper and one of the earliest vendors to deploy AI PCs, has released more than 20 AI PC products. Additionally, Huawei launched its first AI PC product, the MateBook X Pro, in April 2024, pioneering the integration of the Pangu large model on a PC.

According to IDC's optimistic forecast, the penetration rate of AI PCs in the Chinese market is expected to reach 55%, 75%, 80%, and 85% from 2024 to 2027, respectively. With AI's support, the upcoming PC replacement wave is anticipated to accelerate significantly.

It's worth noting that AI PCs are just one vital branch of AI terminals. Other devices, including AI servers, AI edge computing terminals, and AI industrial computers, among numerous other hardware devices, will also experience a resurgence in demand, supporting the growth of Echelon Intelligence's main business areas.

In particular, OpenHarmony is poised to become a highlight of the company's growth. As early as January 2024, Echelon Intelligence showcased a series of OpenHarmony-related products at the Developer Conference, encompassing the IPC-510-FD2K industrial computer, E088 edge gateway, OPSS088/S0D2, R68D, tablet, and other products tailored for diverse application scenarios such as industry, internet, home, and personal use.

Furthermore, AIGC (Artificial Intelligence Generated Content), as a significant branch of AI, is rapidly gaining traction, fueling demand for infrastructure like computing power and communications. According to IDC's forecast, the global data generation volume will soar from 16ZB in 2016 to 163ZB by 2025.

This explosive growth in data volume places higher demands on computing power equipment, presenting new growth opportunities for Echelon Intelligence's ICT infrastructure business.

[From Data Centers to Robots]

Beyond its core businesses such as industry terminals and ICT infrastructure, Echelon Intelligence has ventured into computing power through its subsidiary Tengyunzhisuan, unlocking new avenues for growth.

On one hand, as a server supplier to multiple CSP (Cloud Service Provider) giants, Echelon Intelligence is poised to offer them comprehensive computing power optimization services.

In the realm of AI servers, Echelon Intelligence independently launched the SYS-60415WG, powered by the Intel W790 chipset and equipped with the Sapphire Rapids series processor, delivering exceptional overall performance. Additionally, leveraging Tengyunzhisuan, it has developed the AI supercomputing series server SYS-8043, suitable for deep learning training, inference, and other application scenarios.

It's foreseeable that the AI server market will remain highly attractive in the future. Firstly, domestic internet giants have significantly accelerated their capital expenditures in the AI sector. For instance, Alibaba recently announced that its investment in cloud and AI over the next three years will surpass the total of the past decade, with a focus on AI infrastructure, fundamental model platforms, and the AI transformation of existing businesses.

Secondly, the United States' frequent restrictions on China in the AI field have created a hidden growth trajectory for ICT infrastructure, led by AI servers, under the "domestic substitution" theme.

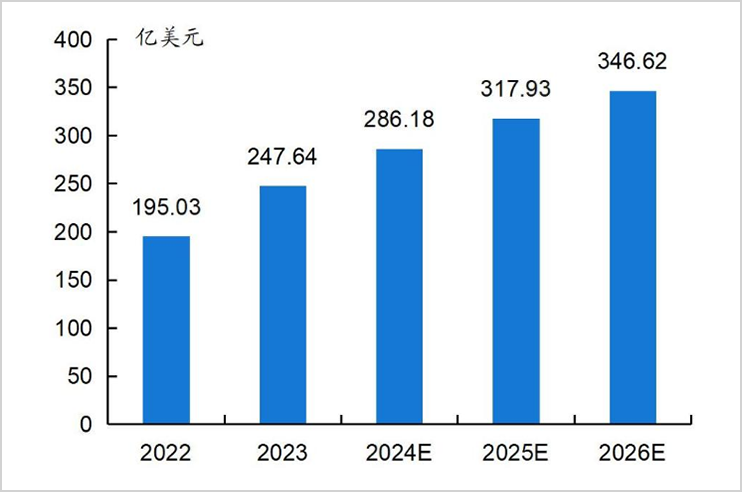

According to IDC data, the global AI server market size was 24.76 billion dollars in 2023 and is projected to grow to 34.66 billion dollars by 2026, with the penetration rate of AI servers also on a steady rise. Amidst the AI wave, Echelon Intelligence's AI series servers are set to benefit from this prevailing trend.

▲Global AI Server Market Size, Source: IDC

Beyond hardware, Tengyunzhisuan offers end-to-end full-process services for intelligent computing centers, encompassing AI computing power planning and design, large model development, computing power equipment supply, computing power and data center leasing, and computing power equipment maintenance and operation. Its clientele primarily comprises internet giants and operators.

The computing power service market where Tengyunzhisuan operates is also experiencing a period of industry dividend growth and is anticipated to sustain high growth rates. According to IDC statistics, the overall market size of China's intelligent computing services reached 14.6 billion yuan in the first half of 2024, marking a year-on-year growth rate of 79.6%.

On the other hand, in the realms of robotics and edge computing, Echelon Intelligence has forged a deep partnership with NVIDIA, positioning itself to benefit from the accelerated development of related industries.

In the field of humanoid robots, Echelon Intelligence has successfully developed the PAS-6102 controller based on the NVIDIA Jetson Orin platform, achieving impressive motion planning and trajectory control. For industrial robotic arms and mobile AMR robots, the company has also introduced the PAS-6200 series products, also leveraging the NVIDIA Jetson Orin.

Furthermore, in December 2024, the company unveiled the generative AI super edge terminal E608, built on the NVIDIA Jetson Orin Nano platform, providing edge-side inference capabilities for robots, multimodal intelligent products, and the deployment of industry-wide large models.

It's crucial to note that NVIDIA Jetson is an AI platform specifically designed for robots and edge computing. With its impressive technical prowess, it has become the "brain" of numerous robots and edge computing devices.

Worth mentioning is that at the 2024 GTC conference, NVIDIA officially announced Project GR00T, a general-purpose foundation model for humanoid robots, capable of better understanding human language and mimicking human movements. Its crucial hardware and platform support include Jetson.

Currently, Echelon Intelligence's robot control solutions have been adopted by multiple robot equipment vendors. In the long run, robots have the potential to become a major industry on par with smartphones and automobiles, offering boundless business growth prospects.

In summary, from data centers to robots, Tengyunzhisuan stands out as a relatively rare full-scenario product service provider within the industry, poised to fully capitalize on the burgeoning demand for computing power. Coupled with the growth potential of its original core businesses, such as industry terminals and ICT infrastructure, Echelon Intelligence's future growth trajectory is promising.

Disclaimer

This article contains information related to listed companies, based on the author's personal analysis and judgments drawn from information publicly disclosed by the listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions presented in this article do not constitute investment or other business advice. Market Value Observation shall not be held liable for any actions taken as a result of adopting this article.

——END——