YC W25 Scene Spotlight: Exclusive Insights with Top Investors on AI Homogeneity and Funding Polarization

![]() 03/14 2025

03/14 2025

![]() 687

687

Author | Xuushan, Yifan | Editor | Yifan

9 Visual Insights into the Thriving and Struggling Venture Capital Landscape in Silicon Valley

Amidst the Palace of Fine Arts venue on the U.S. West Coast, where the world's foremost innovation drivers converge, three individuals dressed as plumbers showcase their project—an AI-driven construction industry material quotation company. Meanwhile, a road worker attired entrepreneur passionately introduces his company's product—an asphalt pavement repair robot.

Photographed by a Silicon Rabbit frontline observer

This is the vibrant scene at YC W25 Demo Day, an annual venture capital event in Silicon Valley and beyond.

Under the bright lights of the YC venue, a ruthless and rapid business metabolism unfolds. At the juncture of large model singularity, the evolution and survival rules of silicon-based life are being rewritten. As the world's preeminent incubator, YC upholds its enigmatic incubation rule—10 minutes of decision-making, $200,000 in exchange for 7% equity. Even amidst today's rapid technological advancements outpacing investment cycles, this rule remains steadfast.

Behind this seemingly "gamble-like investment" lies a fusion of mathematical probability theory and social cognitive science. This underpins the survival and long-term success of YC, whose portfolio market value surpasses $800 billion. The numbers speak volumes: 45% of YC companies secure Series A funding, and 4.5% become unicorns, far exceeding industry averages. Tech giants like Airbnb, Dropbox, and Stripe, valued at over $100 billion, all hail from YC. Investors at Demo Day are akin to seasoned hunters, seeking the most promising future projects.

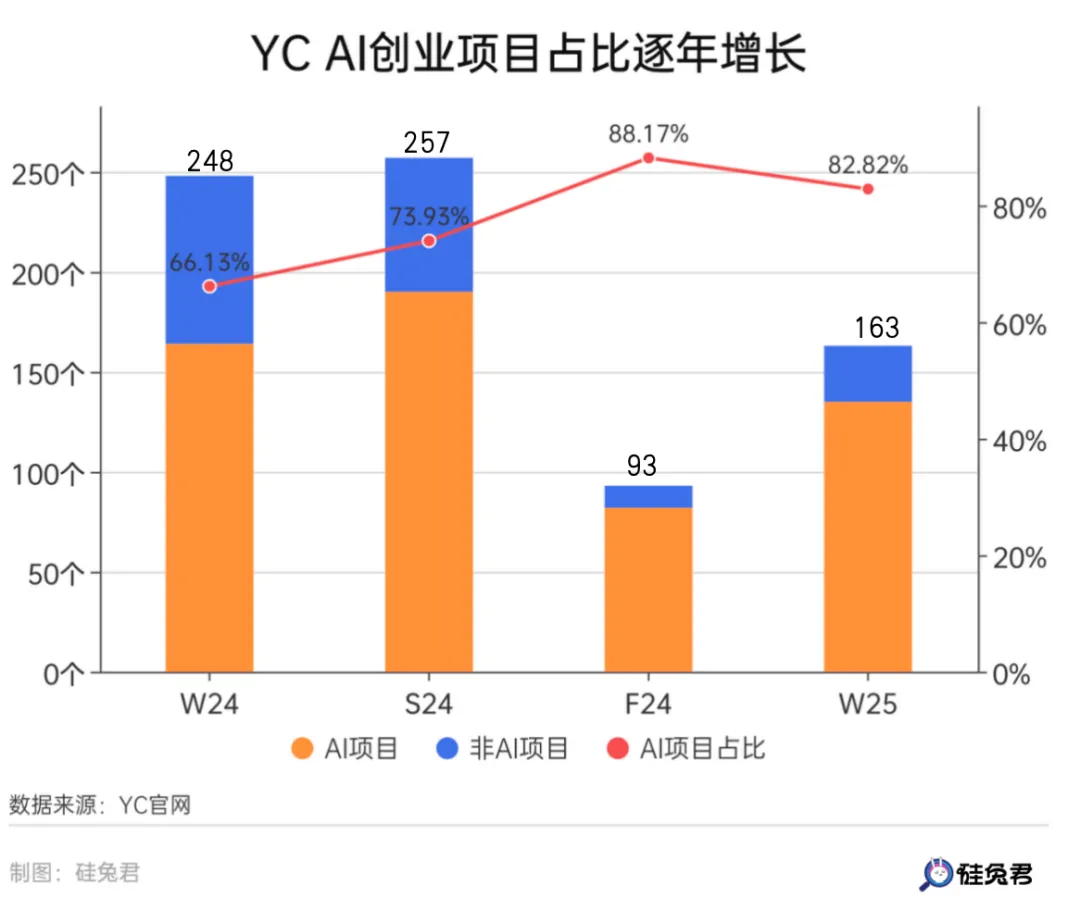

On March 11, YC celebrated its 20th anniversary. YC's training camps are divided into four sessions annually: Spring, Summer, Fall, and Winter. This session marks the first batch of graduates in YC's 25-year history, known as "YC W25 (Winter 25)".

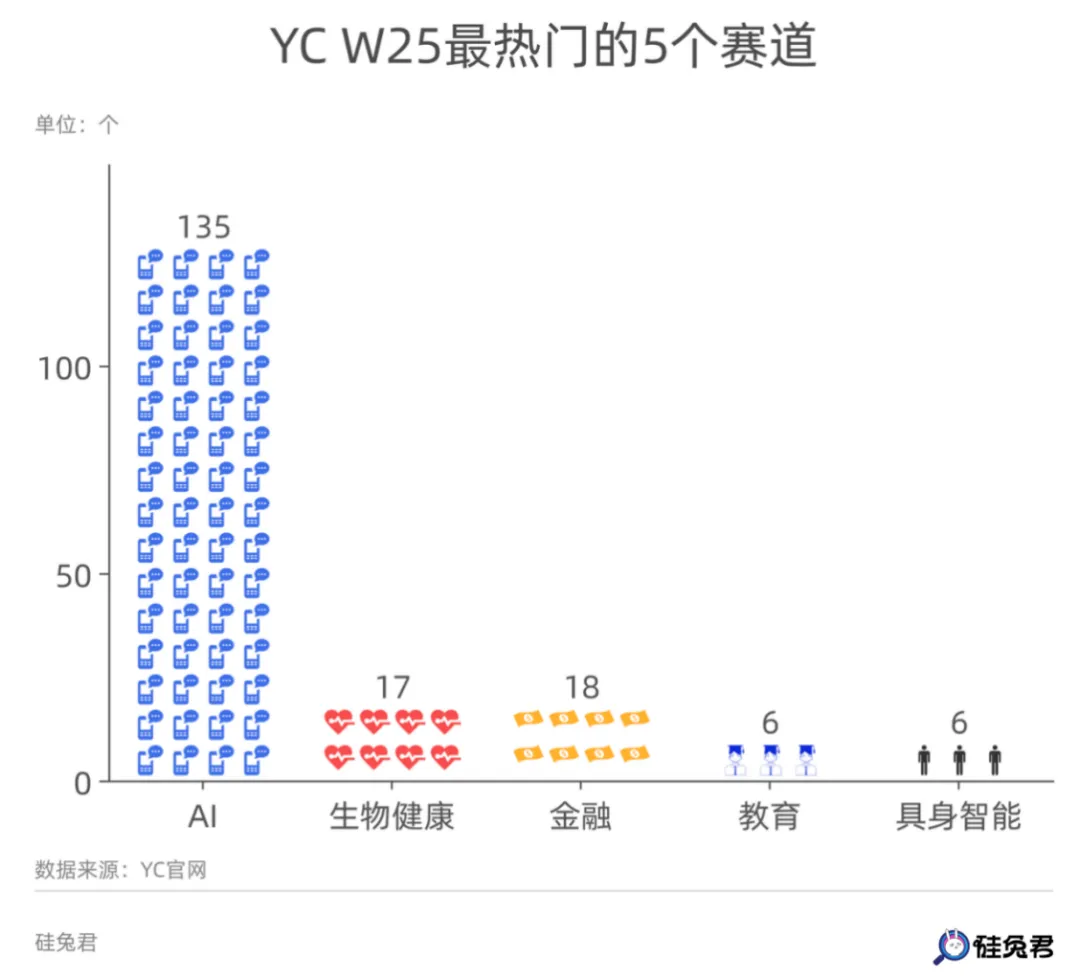

From an application perspective, AI, biohealth, finance, education, and embodied intelligence emerge as the five most popular tracks this year. Finance and biohealth rank second and third with 17 and 18 projects, respectively, comprising nearly one-tenth of total AI projects. The enthusiasm for AI startups remains unparalleled.

Silicon Rabbit has personally covered Y Combinator (YC) events for nine consecutive years, providing in-depth insights.

"As long as you stay on the scene, entrepreneurs will continuously engage with you."

Alan Zong, partner at UpScaleX, shared his thoughts with Silicon Rabbit—the entrepreneurs exhibit exceptional sales acumen, with founders conducting precise and well-managed cold calls. Uninterrupted, they seamlessly present their projects. "AI concentration is high, but projects are relatively rudimentary. On-site, half of the founding teams are Asian, with an estimated 30% having Chinese faces." This summarizes Alan's impression of the entire YC W25 Demo Day. However, he believes that despite the lively atmosphere, there's a lack of groundbreaking projects.

Photographed by a Silicon Rabbit frontline observer

Three notable features stand out at this YC W25 event:

1. The AI-led startup landscape is crystallizing, yet surprises are scarce: Over 80% of startup projects focus on AI. Most concentrate on leveraging AI to solve vertical industry problems, reflecting a trend towards project homogeneity at this YC Demo Day. Meanwhile, AI applications for C-end consumers remain in a lull, and companies focusing on large language models are differentiating, specializing in enhancing non-English language model capabilities.

2. Rise of national defense and military projects: Amidst the grand narrative of American manufacturing's resurgence, national defense and military projects have become YC's new darlings. This emerged as a new direction at last year's YC S24 Demo Day.

3. Polarization of project funding and overvaluation: According to Silicon Rabbit's on-site investor interactions, funding polarization at this YC W25 Demo Day is even more pronounced. Some fully funded projects have already departed, while those still seeking funding vigorously promote on-site. Funding typically ranges from $1.5 million to $2 million, and Demo Day project valuations are high, showing no signs of decline, attributed to the current AI industry's overall overvaluation.

Cluster of homogeneous AI agent projects

Three years post-ChatGPT's release, the AI "wealth creation myth" persists, yet ecological fissures are increasingly apparent—differentiation among underlying model companies and verticalization among application companies. Startups must be more acutely aware than ever of which directions hold promise and which are doomed.

At YC W25 Demo Day, 135 startup teams plunged into the AI deep waters, accounting for 82% of Demo Day projects. Though a 2.3 percentage point decrease from YC F24, the overall trend remains upward.

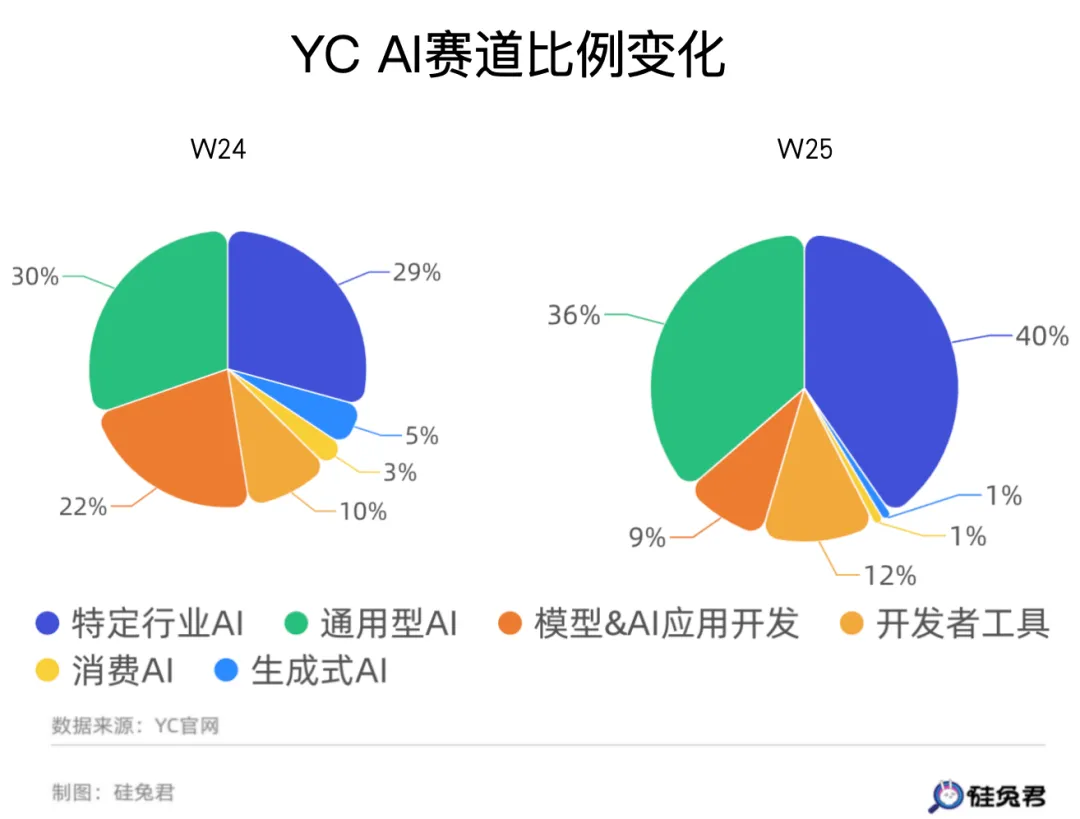

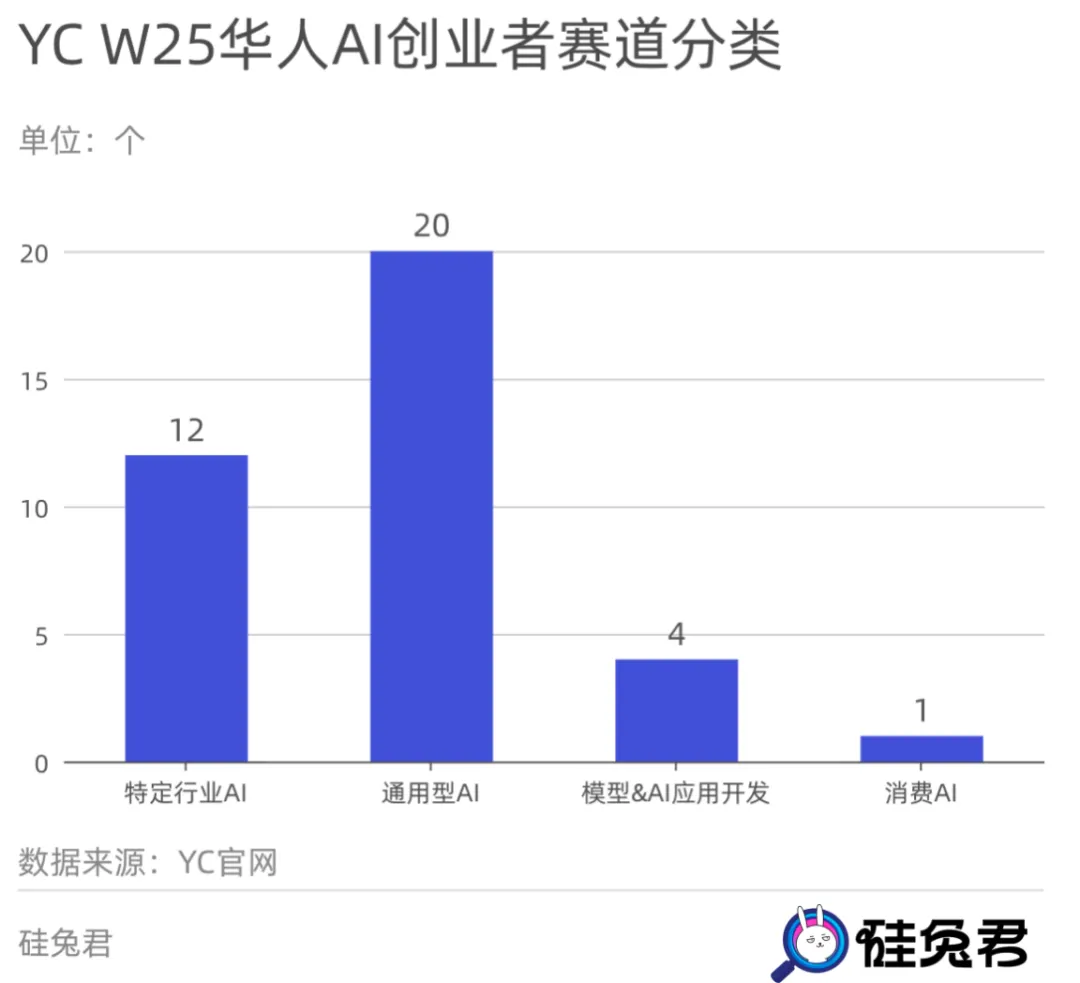

The UpHonest investment research team classifies AI startups into six categories based on existing projects:

Industry-specific AI: Primarily AI solutions for specific ToB industries

Consumer AI: Primarily AI solutions for ToC industries

General AI: Primarily AI solutions for general industries like sales and customer service

Model & AI application development: Primarily tools needed for model training and development in AI applications

Developer tools: Primarily code tools for developers

Generative AI: Primarily companies providing text-to-content services based on large model generation capabilities

Compared to last year, Silicon Rabbit found that vertical AI applications for specific industries and general AI applications remain among the hottest AI startup directions, comprising nearly 76% of the entire AI entrepreneur community. The number of startup projects engaged in model or AI applications within YC W25 has declined, from 22% to 9%.

Consumer AI is still in a "frozen period," with projects in specific industry AI and general AI being popular. The proportion of teams engaged in model research and development or pure AI application development, as well as generative AI, has dropped sharply.

Application companies are no longer addressing whether something exists but rather focusing on more precise vertical markets and higher-quality professional services.

This underscores the brutal fission within the large model business ecosystem.

It's a new survival philosophy distinct from the SaaS era—becoming an "organ transplanter" of AI, connecting and coexisting with the core of the basic large model through the capillaries of specific industry expertise.

"This year, the direction of vertical AI companies is relatively clear," Alan Zong told Silicon Rabbit. AI is penetrating more specific areas within segmented industries.

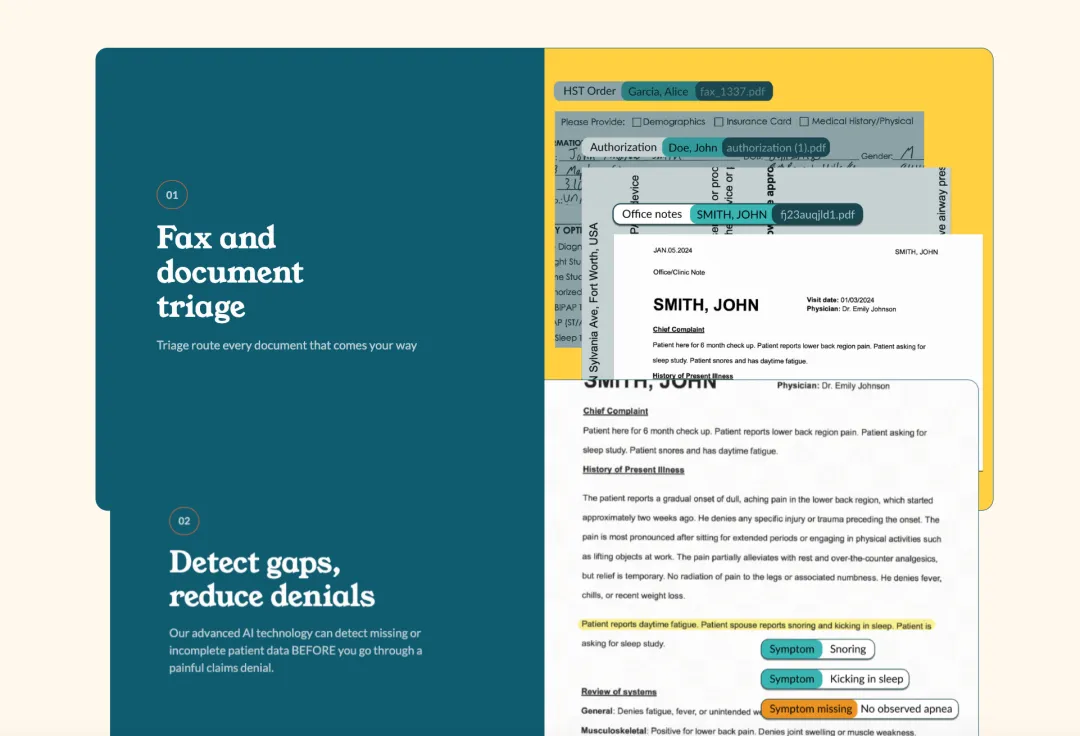

Bild AI primarily uses AI to interpret construction blueprints and automatically extract material and cost data, enhancing customers' bidding efficiency tenfold.

careCycle offers AI-driven voice customer service solutions for Medicare institutions, encompassing 24/7 customer support, compliance management, lead generation, and information maintenance.

Scout creates an AI student management system for K-12 schools, automating administrative processes like attendance and compliance reporting, replacing inefficient systems, and helping educators focus on teaching optimization and reducing compliance errors.

While general industry AI projects remain crowded this year, Alan Zong noted that launching a general AI application in 2025 will be challenging without strong technical advantages and development resources. Competing with A/B round startups prepared for two or three years with more funds and talent, extensive business expansion faces significant hurdles.

In areas where monopolies are forming—large model text-to-content—some companies are taking alternative paths. For instance, Mundo AI, a Canadian startup, is building the world's largest and highest-quality multilingual database to enhance AI capabilities in non-English contexts.

Opportunities beyond AI also exist. For example, Maritime Fusion primarily constructs HTS (high-temperature superconducting) fusion reactors for national defense and commercial shipping. The founding team boasts over a decade of industry and research experience in plasma physics, nuclear engineering, and electrical engineering, having worked at SpaceX, Tesla, Columbia University, and the University of Pennsylvania.

Inversion Semiconductor is even developing the next generation of lithography machines for chip manufacturing on a small team scale, aiming to manufacture the most powerful chips at 15 times the speed. The company scales transistors to their physical limits by shrinking particle accelerators by 1000 times to generate high-power light sources.

Some Fintech companies were also present, albeit in limited numbers. Bryan Liu, an investor at Alumni Ventures, observed that some companies at this YC Demo Day are attempting to use stablecoins to solve real-world problems, particularly stablecoins pegged to the US dollar maintaining a certain value. In high-inflation areas like Latin America and Africa, holding these stablecoins holds value. He hopes to see more Fintech-related projects.

Venture capital favors national defense technology

Amidst the grand narrative of American manufacturing's resurgence and global international relations shifts, national defense and military projects have been quite popular at this year's YC W25 Demo Day. In 2024, YC ventured into national defense and military for the first time, announcing an investment in Ares Industries, a missile manufacturing company established for less than six months.

Historically, national defense technology has contradicted venture capital principles. Silicon Valley venture capitalists have been reluctant to support the national defense hard technology industry, which may consume substantial funds. However, this trend is changing.

According to PitchBook data, venture capital investment in U.S. national defense and military has reached nearly $40 billion in the past two years. SpaceX has become one of the most valuable private companies in the U.S., with a market value of $350 billion; Palantir, a military software provider, has a market value exceeding $250 billion; and Anduril, another company manufacturing autonomous weapons, frequently releases financing information.

At the YC W25 Demo Day venue, numerous impressive national defense and military startup projects were showcased.

An unmanned vessel debuted at Demo Day. Splash primarily develops the next generation of autonomous surface vessels (ASV), aiming to provide national security and protect critical assets like oil drilling platforms and shipping terminals. According to their website, the company's ASV can protect maritime borders and detect incoming vessels, with one vessel capable of patrolling hundreds of square miles and automatically reporting threats.

Splash exhibition at YC W25 (photographed by a Silicon Rabbit frontline observer)

Reditus Space focuses on advanced manufacturing and research in microgravity environments, encompassing semiconductors, biomedicine, and microgravity materials (developing improved materials unattainable on Earth's surface).

Reditus Space exhibition at YC W25 (photographed by a Silicon Rabbit frontline observer)

Entrepreneur portrait: 1/5 are Chinese, most are serial entrepreneurs

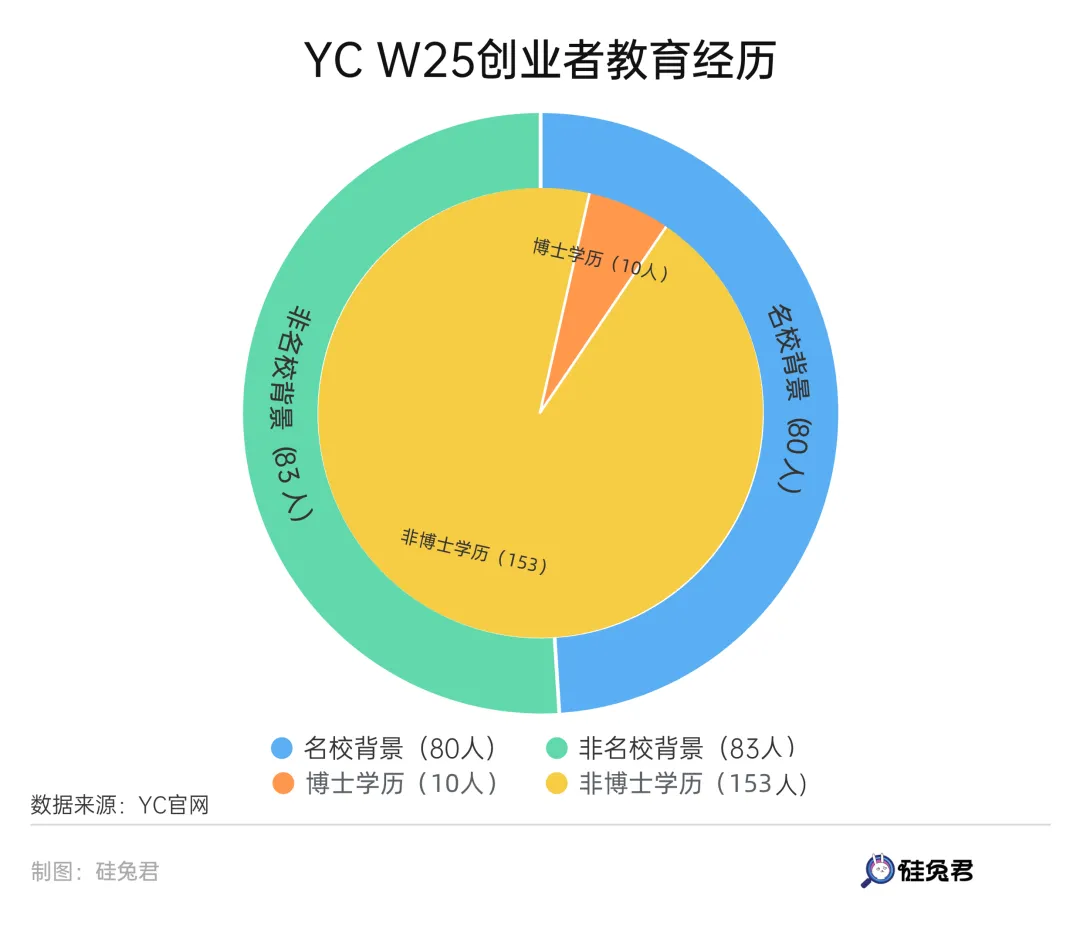

This year, we found that the founder teams' educational background in YC W25 no longer seems to be a rigid criterion for YC's selection. The number of entrepreneurs from prestigious universities is roughly equal to those from non-prestigious universities. Among the 163 projects, only 10 founders hold doctoral degrees.

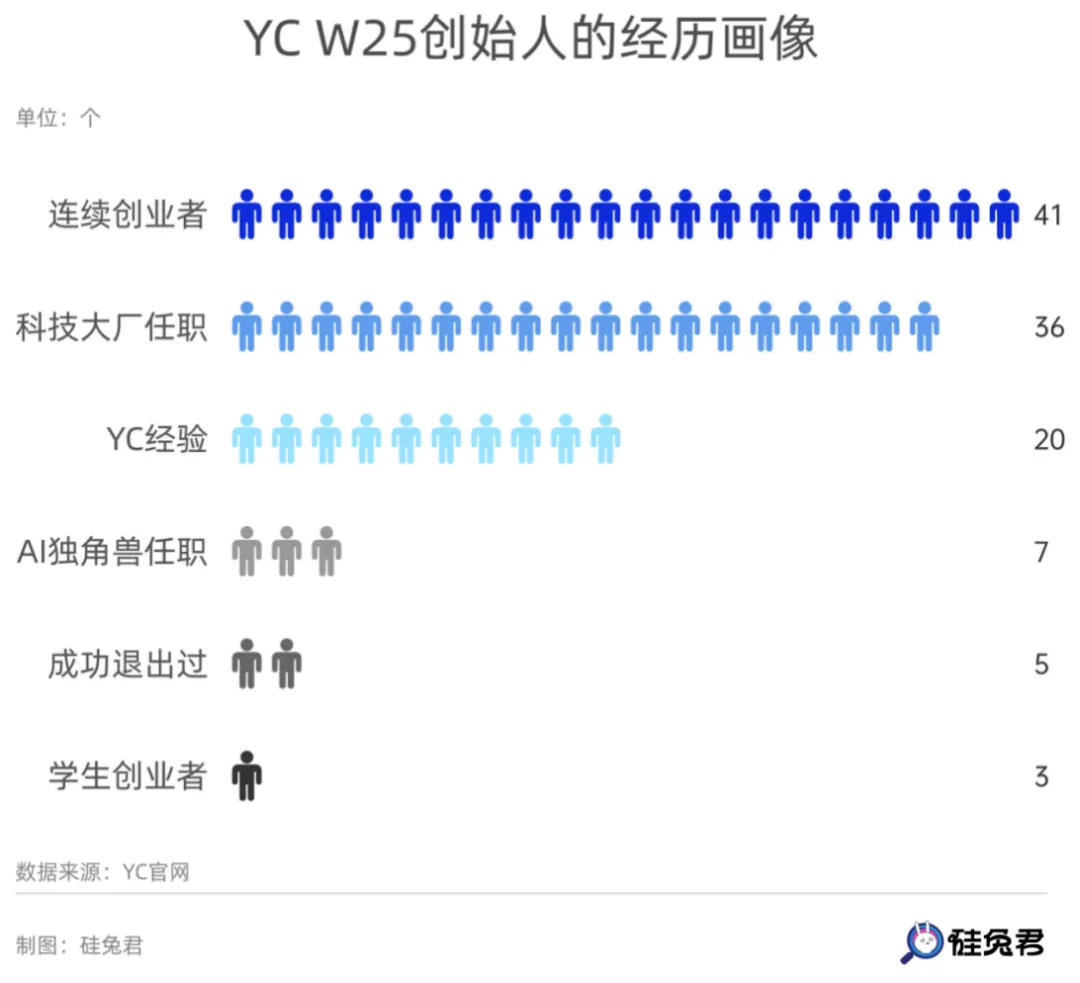

We delved deeper into the profiles of the 163 founders in YC W25 and discovered a clear preference among current Silicon Valley incubators, epitomized by YC, for serial entrepreneurs and those with experience in major technology firms.

In contrast, budding student entrepreneurs make up a relatively small proportion, with only three projects initiated by student teams. This stands in stark contrast to over a decade ago when Mark Zuckerberg dropped out of school to found Meta, embarking on its legendary journey. Similarly, Sam Altman founded OpenAI after leaving Stanford University. Nowadays, YC once again prioritizes founders with prior YC experience for investment and support.

Early investigations by Silicon Rabbit revealed a general consistency in the profiles of current Silicon Valley entrepreneurs:

They possess excellent educational backgrounds, prior entrepreneurial experience, and have served as executives in major corporations. This combination of factors has enabled them to smoothly embark on the first wave of entrepreneurship in Silicon Valley and secure financing support.

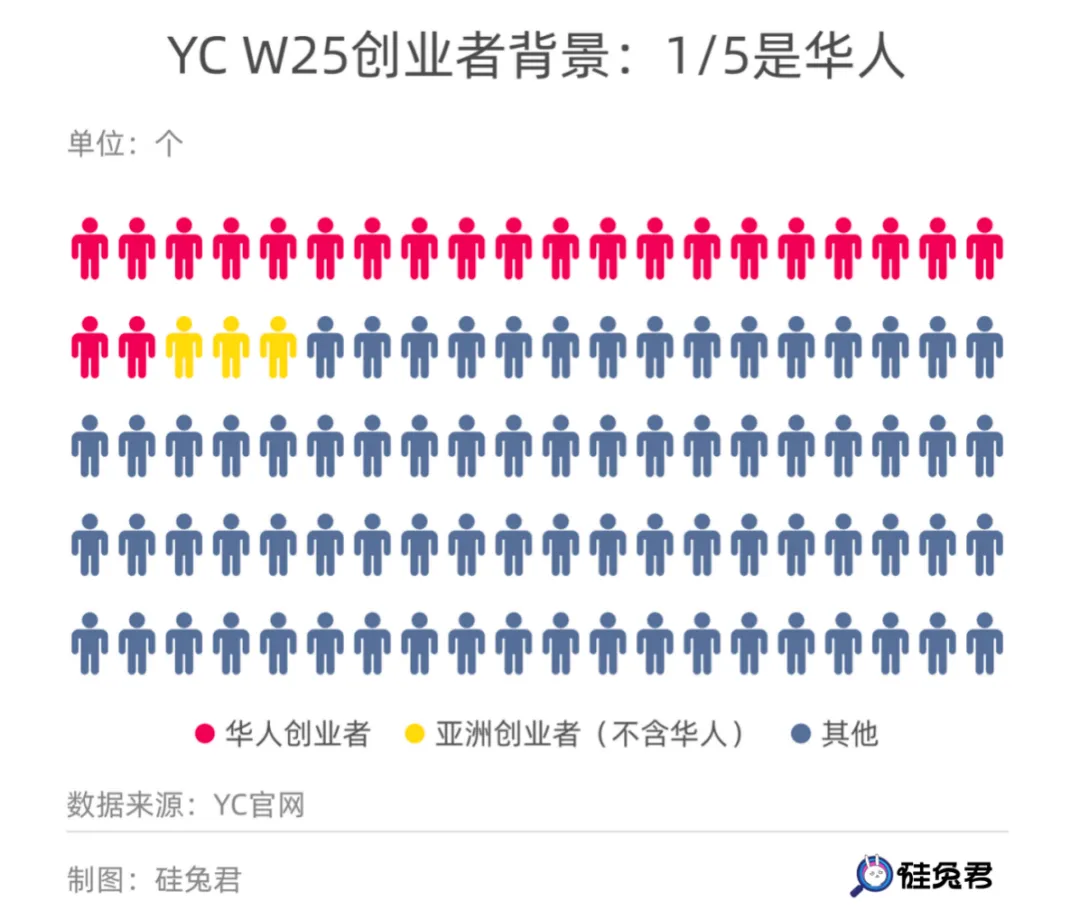

In this year's YC W25 projects, one-fifth of the founders are Chinese, accounting for the vast majority of Asian entrepreneurs.

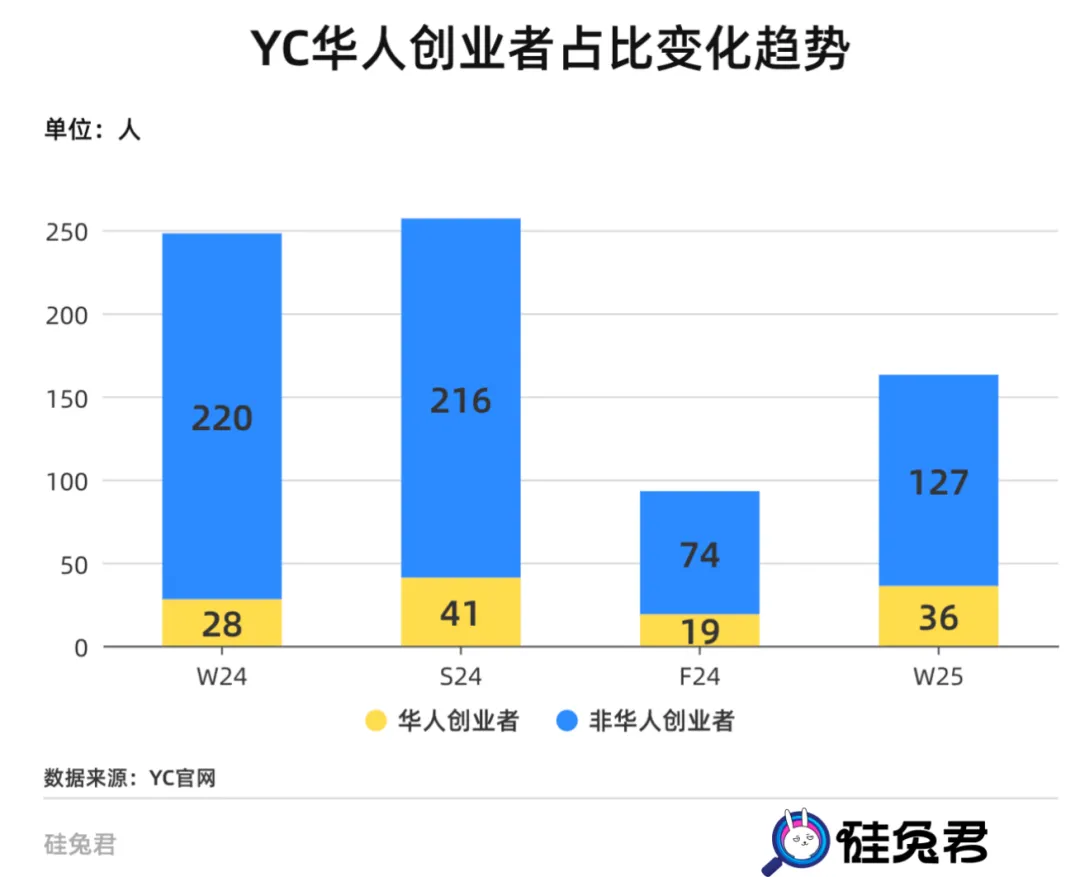

Compared to the number of Chinese entrepreneurs in previous years, the proportion of Chinese entrepreneur teams has reached a peak this year, far exceeding the number in the previous incubation batch and slightly lower than that in YC S24.

According to interviews conducted by Silicon Valley Insider, many "gold diggers" heading to Silicon Valley do so partly because entrepreneurial opportunities in China are gradually diminishing and partly because they aspire to the free entrepreneurial atmosphere, more mature venture capital incubation system, and rich innovation network in Silicon Valley. Numerous outlandish ideas are always seen in Silicon Valley, and these ideas often find "buyers." This is also the reason why more and more people choose to dig their first pot of gold in Silicon Valley.

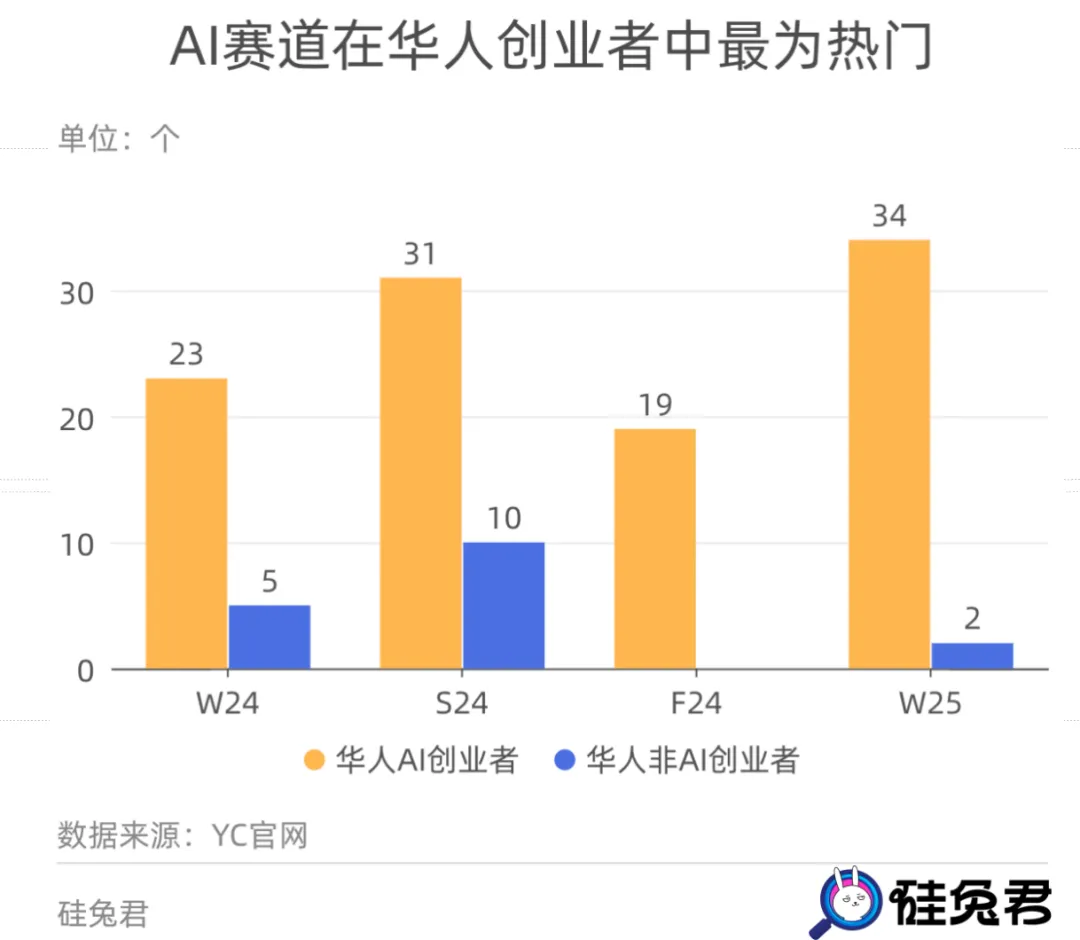

Data from this year shows that most Chinese entrepreneurs choose to follow the trend of the times and opt for AI as their sector. Among the 36 Chinese entrepreneurs, 34 of their companies have a deep connection with AI.

Among them, Trata has created a crowdsourced stock analysis database through AI. AI agents interview hedge fund analysts to obtain key information, anonymously write and generate research reports, and compile them into a database. Analysts can gain access to a wider range of information for free by contributing their insights.

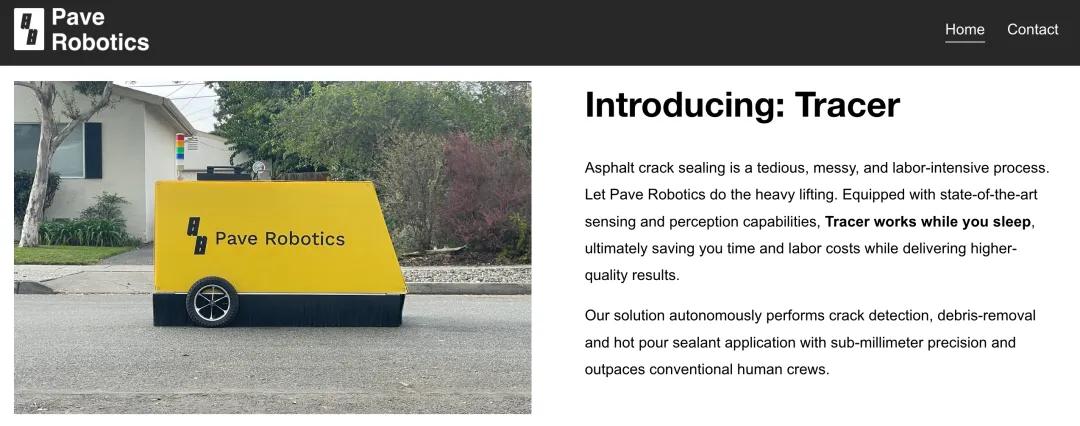

However, there are also two startups with a weaker connection to AI. One is Proception Inc., which focuses on software solutions for flexible manipulation of humanoid robots. The other is Axiom, which is primarily committed to building a centralized decentralized finance (DeFi) trading platform.

Chinese entrepreneurs in Silicon Valley have chosen to focus more on general AI sectors for their startups. Secondly, 12 projects involve vertical AI applications in specific industries, and 4 involve the development of AI models and their applications.

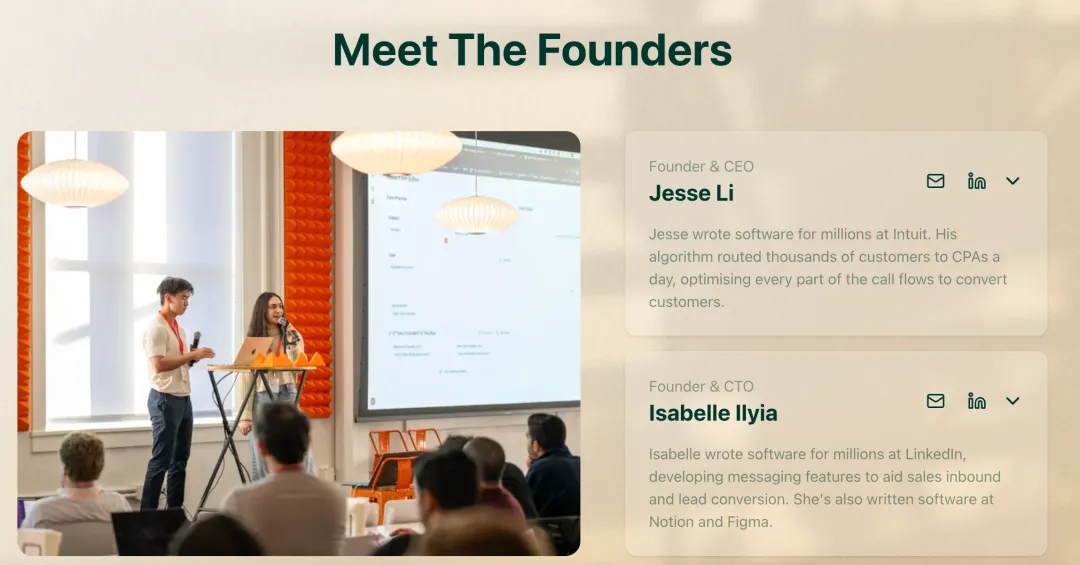

For example, Cedar provides AI-driven automation solutions for personal injury law firms, offering 24/7 customer reception, automated medical record review, quick identification of missing documents, ensuring compliance, etc. The company's founder and CEO, Jesse Li, once wrote software for millions of people at Intuit. His algorithm directs thousands of clients to CPAs daily, optimizing every part of the call process to convert clients.

Excellent educational backgrounds were a prominent impression of the Chinese group at this year's YC W25 Demo Day for investor JJ. Many Chinese entrepreneurs have strong research capabilities and are also competition experts.

Bryan Liu noted that the Chinese entrepreneurs at this year's YC Demo Day served different functions within the founding teams, some as technical backbones and others taking on marketing roles in front of the stage, with many shouldering significant responsibilities within the team.

However, JJ found that the research or technical capabilities of Chinese entrepreneurs in the direction of AI agents were not well utilized. On the contrary, in some hard tech directions, such as Robotics, Chinese people are demonstrating strong research capabilities. For example, the funding progress of the project Proception, which has a Chinese team background, has been relatively smooth. At YC, they were the ones selecting investors.

Revise Robotics demonstrating at YC W25 (source: photo provided by the frontline observer of Silicon Rabbit)

Over 160 YC startups on display! Who will be the next unicorn?

As of March 7, Silicon Rabbit has sorted out the latest information on over 160 YC W25 projects. Here is a list of some of the projects:

AI

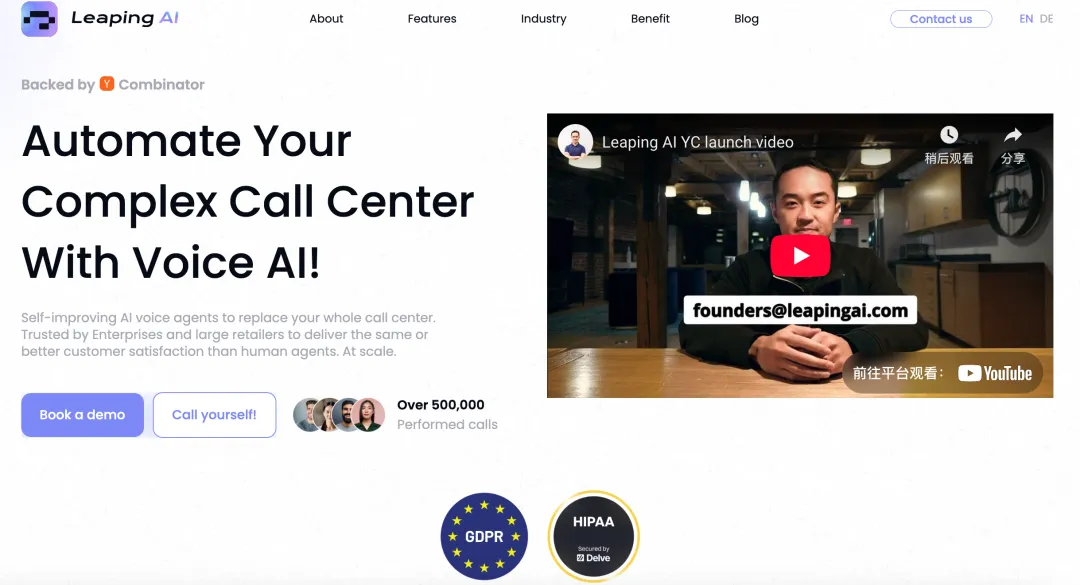

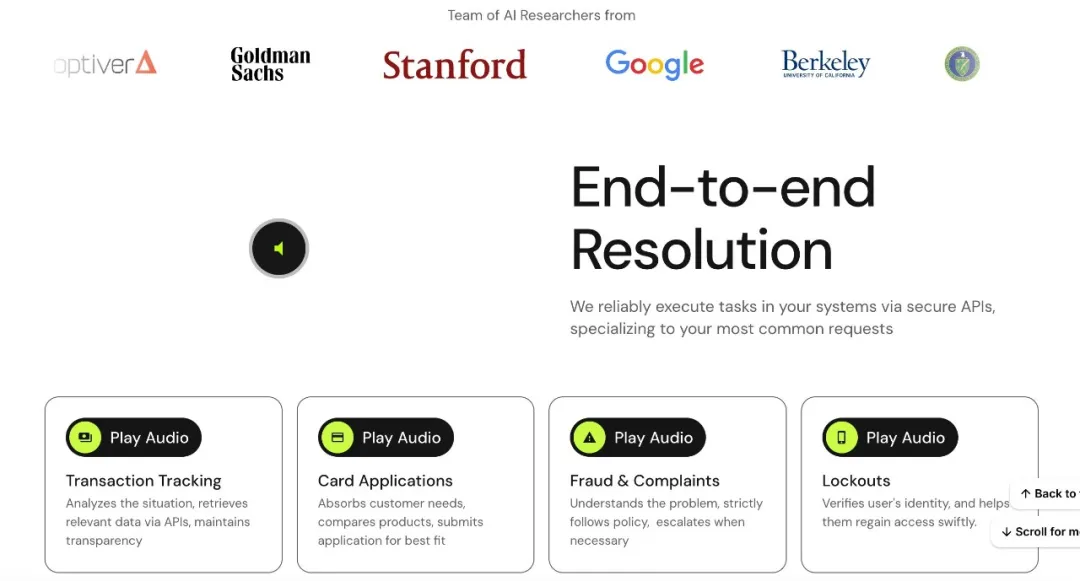

Leaping AI: Leaping AI provides anthropomorphic voice AI agents that automate customer service and sales calls, covering 70% of incoming calls while maintaining 90% satisfaction, supporting multi-language interaction and self-optimizing algorithms to improve service efficiency.

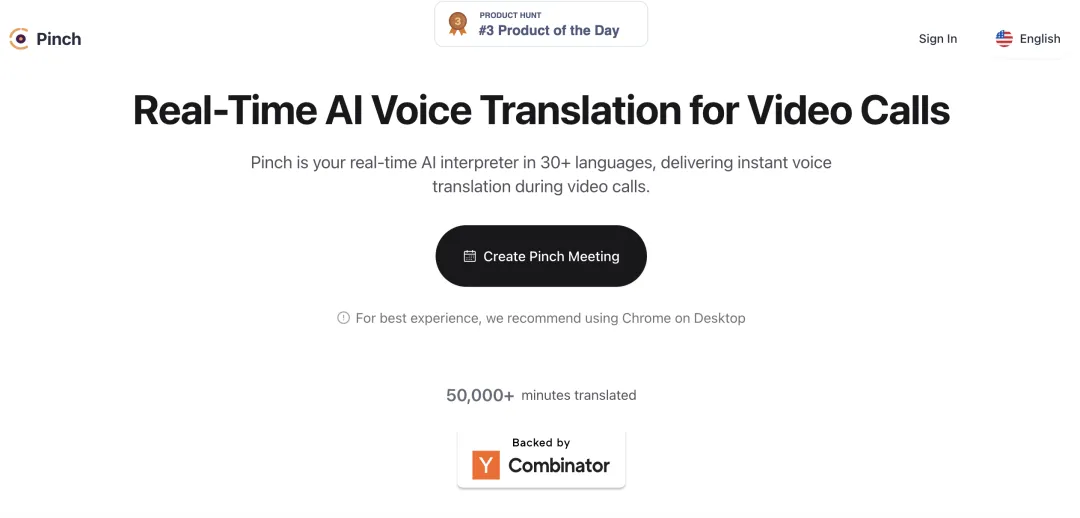

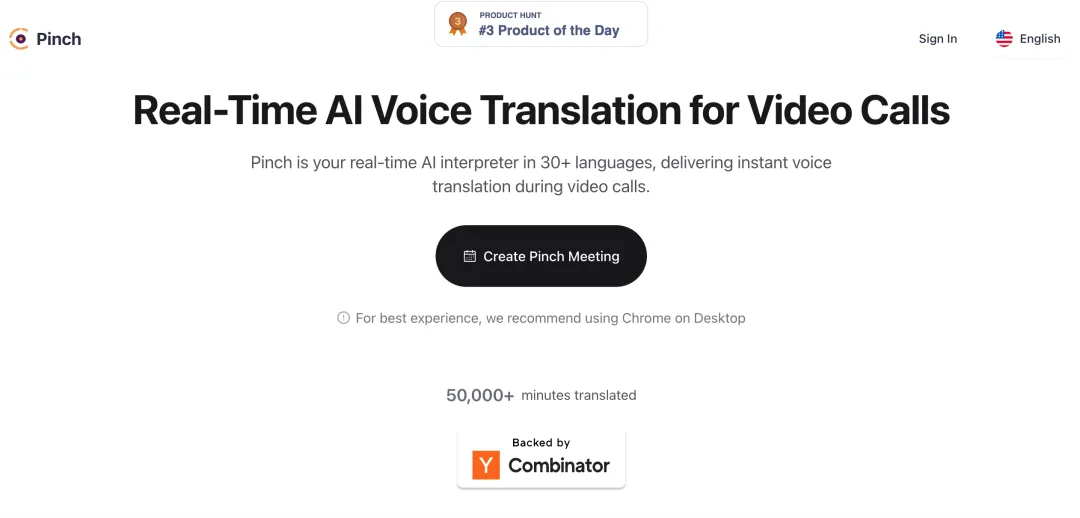

Pinch: A multilingual, real-time automatic translation video conferencing platform that enables cross-language meetings, supports lip synchronization and micro-expression adjustments, covers over 20 languages, and was founded by former engineers of the Deepfake video tool Tavus (invested by Sequoia).

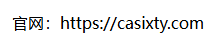

Casixty: Automates Reddit community interactions through AI, generates branded responses for technology companies, analyzes the effects, and enhances engagement and brand influence, helping customers earn over 5,000 karma in 10 weeks.

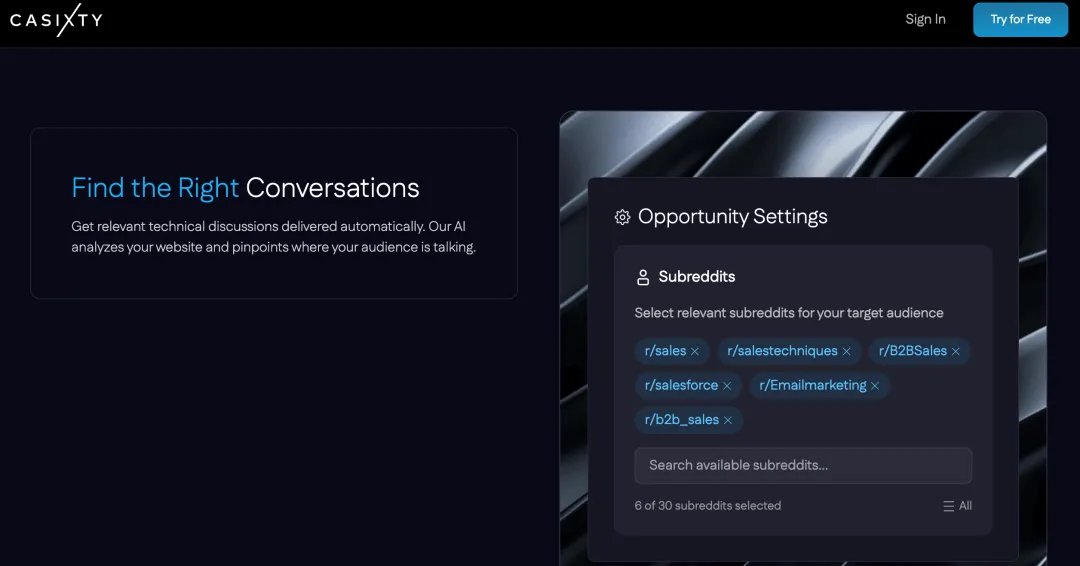

Nitrode: Focuses on providing an AI-assisted game development platform for game developers and players. Its main functions include: using AI technology to automatically generate worlds, helping developers quickly build game environments, assisting in coding, lowering the threshold for game development, and serving as a Prosumer-level application.

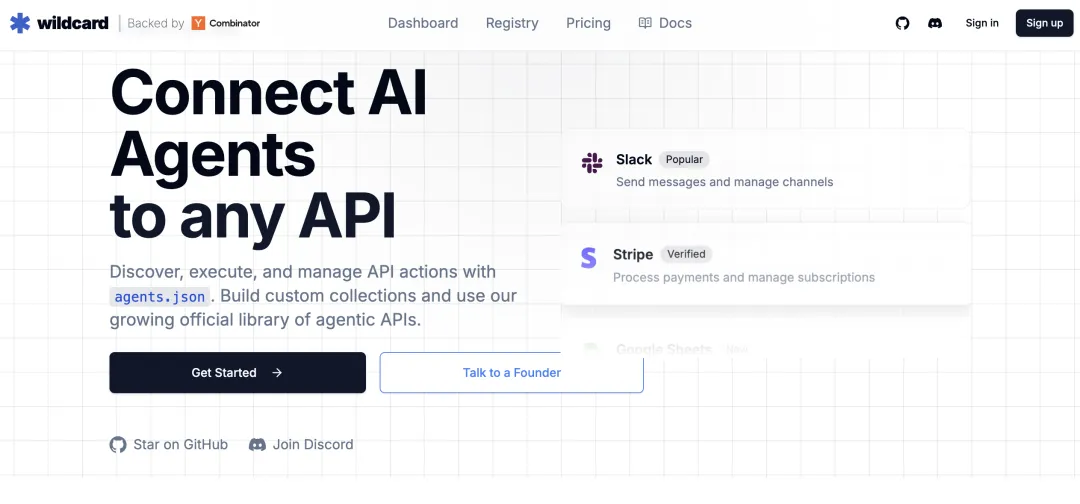

Wildcard: Wildcard specializes in AI agent API integration, a natural language-driven API gateway product that simplifies the discovery and invocation process through standardized agents.json and open-source SDKs.

...

Robotics

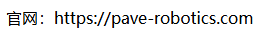

Pave Robotics: An asphalt pavement repair robot that operates around the clock, assisting road companies in sealing asphalt cracks, improving repair efficiency, and reducing costs. The condition of roads in the United States is dire, with annual maintenance and repair costs of $27 billion. Due to an aging workforce and labor shortages, road repair processes are slow, expensive, and difficult.

Proception: A software solution for flexible manipulation of humanoid robots, founded by former members of Tesla's Optimus humanoid robot team. The founder holds a bachelor's degree from Harbin Institute of Technology and a master's degree from Stanford University.

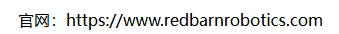

Red Barn Robotics: A farm weed removal robot driven by computer vision to identify weeds. The market size for agricultural weed removal in the United States is approximately $100 billion, with a labor shortage resulting in 1/5 of farm positions being vacant each year.

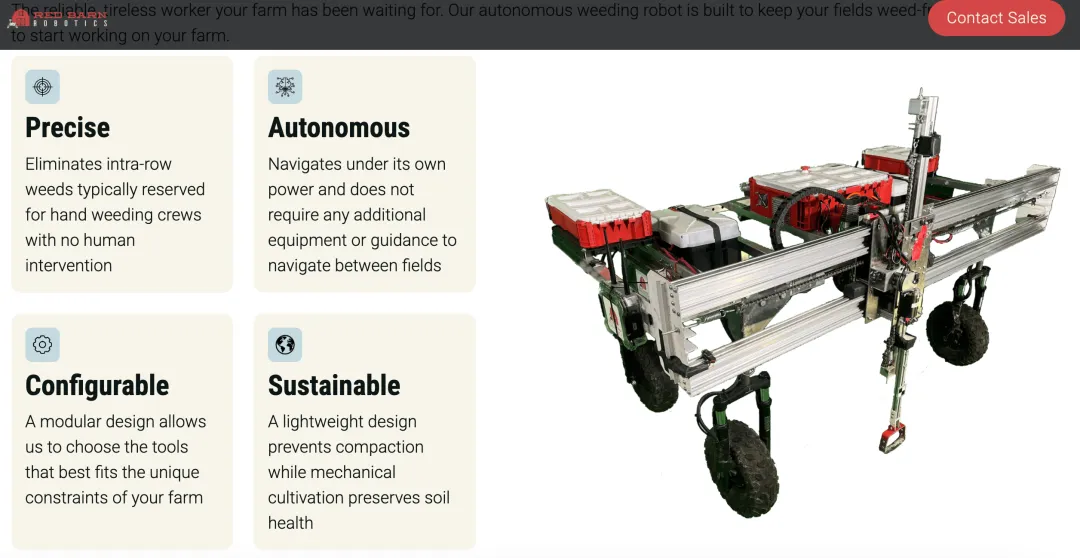

Revise Robotics: Focuses on using robotics and artificial intelligence to accelerate the refurbishment process of electronic products, especially laptops (more than 30 million discarded computers are generated in the United States annually). Its main customers are IT asset management/disposal companies.

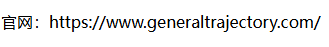

General Trajectory: Building the VLA - a large vision-language-action model that drives robots to move in real physical environments, starting with palletizing, sorting, and picking tasks in warehouse environments.

...

Healthcare

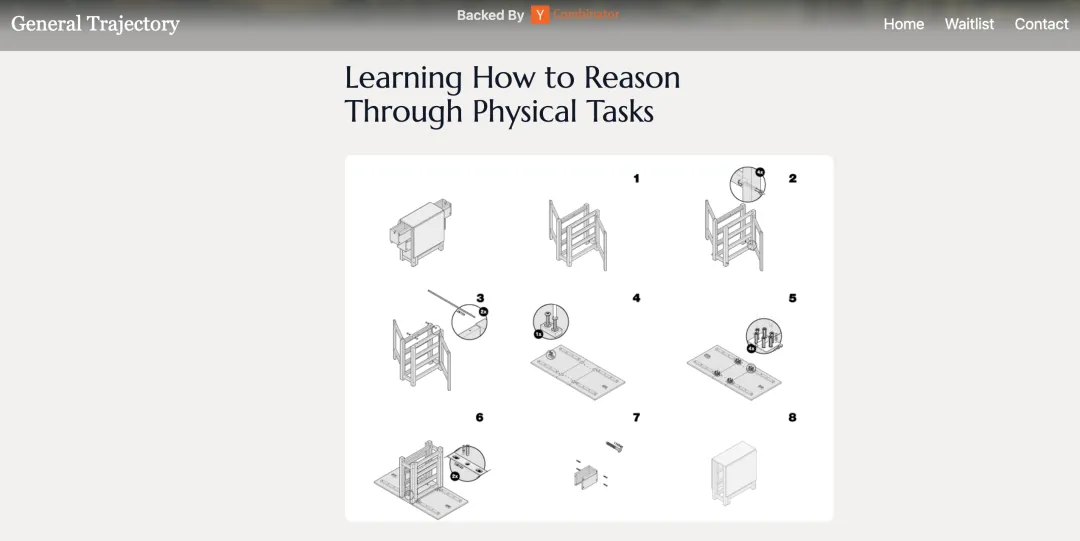

Mecha Health: Dedicated to helping radiologists generate preliminary reports through AI, improving diagnostic accuracy and shortening report generation time. Its AI can track medical image evidence for each finding and cite examples from training data to provide a basis for each conclusion, ultimately improving patient care quality.

Toothy AI: Provides fully automated accounts receivable management solutions for dental clinics. AI-based products automatically handle insurance verification, claim submission, reimbursement processing, and denial follow-up, significantly shortening the medical insurance reimbursement cycle.

Cenote: An AI-driven tool for optimizing medical institution management processes, starting with referral reception. It automates patient registration and management processes through AI referrals, shortening the time clinics spend processing new patients.

HealthKey: Focuses on providing AI-driven patient screening solutions for clinical trial research institutions. By integrating with electronic health record (EHR) systems, it uses

FintechTrace: Crafting voice AI agents tailored for fintech companies and banks to streamline customer support. These AI agents not only answer general inquiries but also perform tasks such as "replace my card" or "dispute this charge," all while maintaining a natural, human-like dialogue.

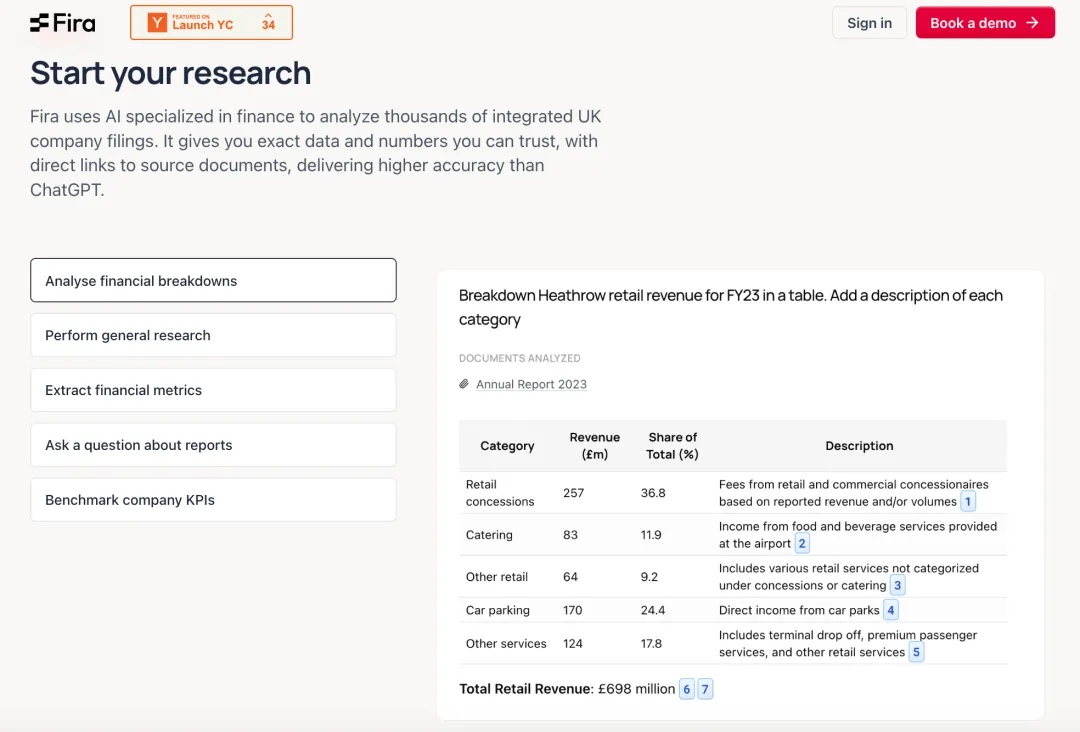

Fira: Empowering analysts at investment firms to swiftly extract and analyze data from unstructured reports of listed and private companies. Initially focusing on boutique investment banks and small private equity firms, Fira streamlines data-driven decision-making.

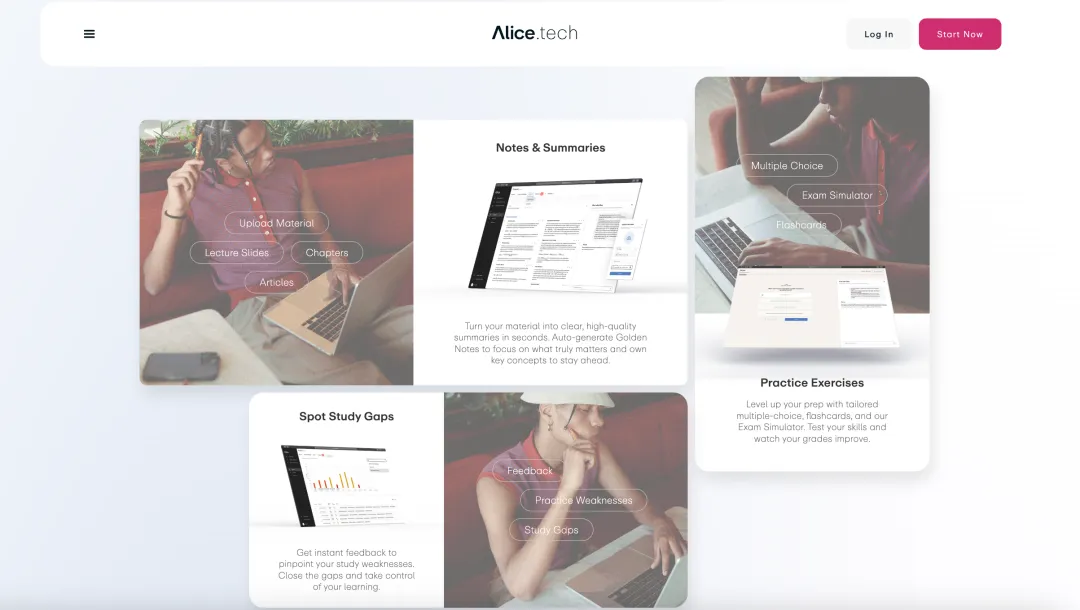

EduAlice.tech: Revolutionizing test preparation with AI-powered personalization. Alice.tech transforms textbooks into tailored study plans, complete with key point analysis, adaptive exercises, and weakness assessments. Adopted by over 7,000 students, it boasts a remarkable monthly revenue growth rate of 60%.

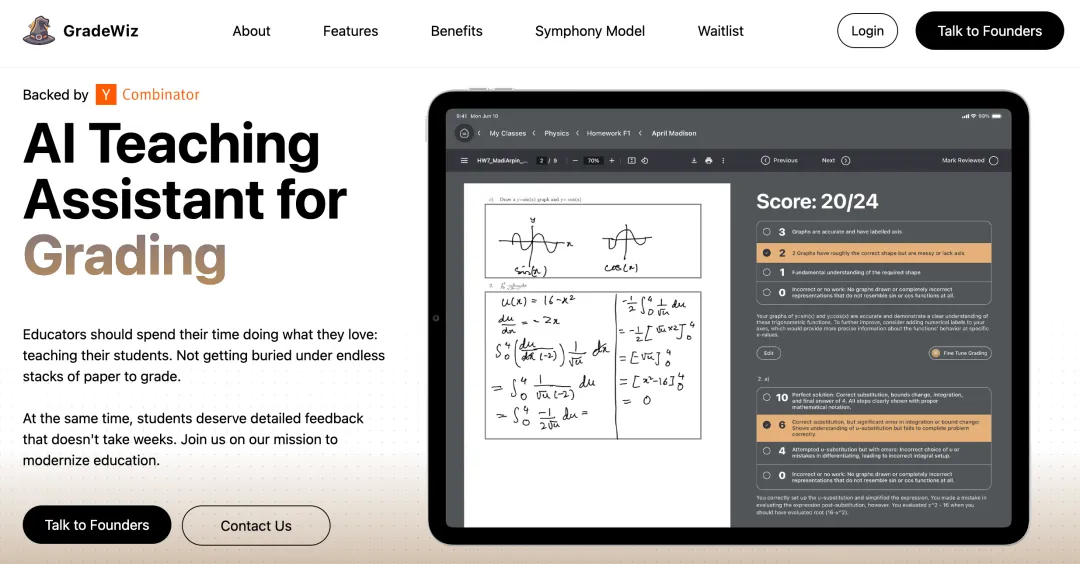

GradeWiz: An AI-driven grading system that automates the generation of grading criteria and assignment evaluations, providing instant personalized feedback. With 95% accuracy in STEM subjects, GradeWiz saves teachers an average of 60% of their grading time. Deployed in 12 universities, it enhances teaching efficiency and educational quality.

Excellence Learning: Offering a cutting-edge AI-driven math learning platform tailored for high school students, encompassing both high school and AP math courses. Students enjoy weekly one-on-one video sessions with mentors from Stanford University, along with personalized courses, exercises, and test preparation modules, ensuring continuous support and progress.

...