Stone Technology's 'Double Crown': Navigating Trends and Leading the Smart Home Revolution

![]() 03/17 2025

03/17 2025

![]() 715

715

Crafting a New Paradigm in the Global Smart Home Evolution

Author: Zou Shan

Editor: Li Ji

Typesetting: Annalee

As AI becomes an omnipresent buzzword, the competition in the smart home appliance sector intensifies. Despite increasing homogeneity, leading brands have once again broken through the impasse.

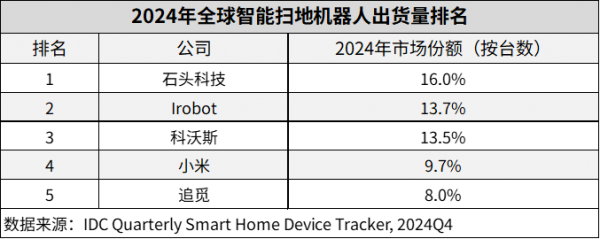

On March 17, International Data Corporation (IDC) released a global smart home appliance market report revealing that in 2024, Stone's robot vacuum cleaners ranked first globally in both sales volume and sales revenue market share, with 16% and 22.3%, respectively.

A seemingly mundane task, sweeping, has emerged as a revolutionary starting point for smart home appliances, drawing numerous technology companies worldwide. In this ever-evolving 'sweeping revolution' with relentless competition, leading brands have carved out their unique niche.

Sales are the fruit, innovation the root

Bill Gates predicted at CES (Consumer Electronics Show) in 2007, 'Robots are poised to replicate the rise of personal computers, becoming ubiquitous in homes and revolutionizing our lifestyle.'

While humanoid robots and robot dogs frequently grab headlines, they are still some distance from entering ordinary households. However, Bill Gates' prediction is gradually coming true, especially evident in the booming robot vacuum cleaner industry.

According to the IDC market report, global shipments of smart robot vacuum cleaners increased from 5.5 million units in Q4 2023 to 5.9 million units in Q4 2024.

Market feedback has been enthusiastic. AVC Revo data shows that from January to September 2024, robot vacuum cleaner sales revenue increased by 19.7% year-on-year, and sales volume increased by 13.0% year-on-year. Notably, in Q3, while monthly sales volume increased year-on-year in July, August, and September, the average purchase price also continued to rise.

If data reflects consumer choices, another trend cannot be ignored – the shift from 'Made in China' to 'Intelligent Manufacturing in China' is quietly dismantling the 20-year monopoly of European and American brands.

IDC data shows that in Q2 2024, nine out of the top ten companies in global smart robot vacuum cleaner shipments were Chinese companies or Chinese-funded holding companies.

Among them, Stone Technology ranked first with a sales volume market share of 16%, marking the first time it surpassed iRobot to take the market lead. Simultaneously, Stone Technology is the only brand among the global TOP 3 to achieve positive sales growth, with sales increasing by 20.7% year-on-year. Additionally, Stone Technology ranked first with a sales revenue market share of 22.3%, marking the second consecutive year that Stone's robot vacuum cleaners have ranked first globally in sales revenue.

As the robot vacuum cleaner sector's potential increases, new players continue to enter the market globally. With traditional home appliance companies, startups, internet companies, and others joining in, China alone has witnessed the emergence of approximately 200 robot vacuum cleaner brands, turning industry competition into a red ocean. However, leading brands still manage to navigate through and stand out.

A crucial reason is that robot vacuum cleaners have high technical barriers. As Hillhouse Capital previously stated, 'Don't underestimate floor-mopping robots; their product complexity is very high, integrating software and hardware, including core competitiveness in terms of craftsmanship.'

In essence, sales are the result, and innovation the cause. Behind Stone Technology's impressive performance lie data-driven decisions.

By the end of June 2024, Stone Technology's R&D personnel had increased to 786, accounting for 37.63% of the company's total workforce, and it had obtained a total of 2,798 authorized patents domestically and internationally. Additionally, Stone Technology's R&D investments for 2022 and 2023 were 489 million yuan and 619 million yuan, respectively, and in the first three quarters of 2024, R&D investment reached 640 million yuan, exceeding the total for the entire year of 2023.

From LDS laser radar navigation to AI binocular vision obstacle avoidance, from 5-axis bionic robotic arms to GPT-enabled intelligent interaction systems, each technological iteration creates new game rules and competition points, pushing the boundaries of traditional robot vacuum cleaners and evolving them from 'tools' to 'home intelligence entities.' This strategy of 'intergenerational innovation' rather than 'micro-innovation' has allowed Stone Technology to dive into the 'deep waters of technology' first, avoiding low-dimensional competition and consistently maintaining its leading position.

High-value overseas expansion: Establishing a firm foothold

Two decades ago, in European and American markets, iRobot was the dominant robot vacuum cleaner brand. Founded in 1990, the company developed and launched the world's first vacuum cleaning robot, Roomba, in 2002. For a long time, Roomba was synonymous with smart robot vacuum cleaners, occupying 60% of the North American market share.

However, the market is volatile, and after several iterations, changes have occurred quietly.

In the current North American market, iRobot seems to have lost its former glory. According to Magic Mirror Amazon data analysis, iRobot performs well only in the $500-800 price range, with a market share of approximately 40%, while above $800, Chinese company Stone Technology occupies 57% of the share. This indicates that Chinese brands are not only challenging iRobot's position but also winning without relying solely on 'cost-effectiveness' advantages.

iRobot's robot vacuum cleaner

Especially in 2024, iRobot's shipments declined by 6% year-on-year, and its position continued to erode. In contrast, with advanced laser navigation technology and high-frequency mopping technology, Stone Technology topped Amazon's robot vacuum cleaner category sales charts in Q2 2024. Subsequently, in Q3 2024, with the launch of multiple new products, Stone Technology's market share increased to 16.4%, ranking first globally for two consecutive quarters, with significant growth in the North American and Asia-Pacific markets.

And this is just a microcosm of Stone Technology's high-value overseas expansion.

If the overseas market is a 'touchstone' for product competitiveness, Stone Technology has emerged as a leader among Chinese brands going global. To date, Stone Technology's products have entered over 230 countries and regions globally, with its APP daily active user count exceeding 1.7 million.

Notably, Stone Technology has a pronounced advantage in markets such as Northern Europe, Turkey, Germany, France, and South Korea, ranking first in both sales volume and sales revenue for multiple consecutive quarters.

This is due to a meticulous strategy. Despite the seemingly insurmountable 'moat' of the overseas market, with consumers' evolving demands for product automation, intelligence, and environmental friendliness, Chinese brands have gradually gained a firm foothold through the 'dual-channel + localization' strategy.

Taking Stone Technology as an example, online, it has entered international e-commerce platforms such as Amazon and eBay, while also building independent brand stations, introducing local payment services and customer service links, expanding channel construction while enhancing the customer experience. Offline, Stone Technology has established a channel network through cooperation with retailers and entered their retail stores to increase brand coverage. Simultaneously, it has further built brand flagship stores and guided consumers to operate and experience products in person by setting up brand experience zones, creating a closed loop of online purchasing and offline experience.

In contrast, iRobot has rich channels but struggles with marketing. With many years of deep cultivation in overseas markets, iRobot is primarily online on Amazon and offline in various large KA stores, with rich channel layouts. However, under current financial difficulties, it is unable to conduct channel marketing effectively.

More crucially, how to adapt to local conditions?

Stone Technology has provided an answer. For instance, addressing Northern European consumers' minimalist design preferences, it has launched products catering to local aesthetics. Among them, the Stone G20 product quickly topped Amazon Germany's sales charts upon launch, despite being 30% pricier than similar iRobot products. Additionally, addressing the pain point of carpet cleaning in Northern European households, Stone Technology has optimized suction algorithms, reshaping the cleaning imagination in overseas markets.

Once upon a time, when European and American consumers mentioned 'Made in China,' doubts inevitably arose. However, the small robot vacuum cleaner is changing the impression of Chinese products in the global market. Leading brands like Stone Technology are not merely expanding their scale overseas but also continuously refining their skills on the 'battlefield' of the high-end market and the technology stage, evolving from Chinese brands to 'global brands.'

Only Long-termists Can Cross Cycles

From navigating the domestic market's red ocean period to winning a place overseas, the internal factor behind Stone Technology's continuous leadership cannot be separated from four words: long-termism.

For a long time, most brands trapped in functional homogeneity could only compete for market share through price wars, exchanging low prices for volume. Zinc Kedu noticed that on many e-commerce platforms, there are still robot vacuum cleaners priced between 400 and 800 yuan. Various social platforms have also seen intensive reviews of 'affordable sweeping monks' and 'Stone alternatives,' among other budget versions of robot vacuum cleaners.

Behind this lies a common problem among most smart home appliance manufacturers: 'emphasizing marketing over R&D.'

At that time, Stone Technology chose to swim against the tide. In a business world that pursues quick success, it demonstrated rare strategic resolve, focusing on the long term and the big picture, investing time and belief in matters that can generate long-term value. Stone Technology has publicly stated, 'For the entire industry, refusing to rely on price wars and inefficient repetitive competition to gain market share is more conducive to promoting a virtuous cycle of industry development.'

Time and the market have validated Stone Technology's foresight: although the robot vacuum cleaner market experienced a brief trend of rising prices and declining volumes in 2021, sales revenue of high-end, high-priced self-cleaning robot vacuum cleaners soon increased significantly, while sales of low-end entry-level products continued to decline.

A fundamental reason is that the value war is the true competition point. Technological leadership and user value orientation play a decisive role in corporate competitiveness.

When the industry blindly pursues short-term returns or indulges in stacking hardware parameters, Stone Technology chooses to delve into user needs and translate technology into real user experiences such as 'hands-free' and 'space management.' Even when the market reaches an inflection point, Stone Technology's innovative technology can still achieve a centralized outbreak, often stemming from systematic 'seeding' done years or even longer ago.

As a result, user value orientation resonates with its long-termism, forming an unbreakable core of Stone Technology's enterprise.

Thus, Stone Technology ultimately plays its own game and redefines the rules of the game in an increasingly fierce and vicious cycle of competition.