AI Fuels the Recovery of the Storage Market

![]() 03/18 2025

03/18 2025

![]() 726

726

The storage market encountered fresh headwinds in the second half of 2024, but by March 2025, subtle signs of change were emerging.

01

NAND Manufacturers Initiate Collective Price Hike

Recently, prominent global storage chip manufacturer SanDisk notified customers of a price increase, effective April 1, across all channels and consumer products by more than 10%. The company further hinted at potential additional hikes in subsequent quarters. Following suit, NAND manufacturers such as Micron, Samsung, and SK Hynix also announced price increases for April.

Supply disruptions, including a power outage at Micron's Singapore NAND factory, have compounded the situation. Phison, a NAND Flash controller chip manufacturer, revealed delivery delays from Micron, who subsequently announced an average price increase of approximately 11% for new orders. Samsung and SK Hynix had already initiated production cuts, leading to a supply reduction of over 10% in the first quarter of 2025 compared to the second half of 2024. Industry insiders noted that Samsung's March deliveries were only 20%-25% of original orders, hinting at price hikes evident in their actions. It is anticipated that Samsung and SK Hynix NAND prices will increase by approximately 10% or more.

Biwin Storage observed that the rising prices of NAND-based storage products are generally beneficial to the industry chain. Institutions are optimistic about storage prices throughout 2025, viewing the price increase transmission to end-users positively.

In fact, multiple brands have recently seen upward trends in storage product prices. A TF Securities report on March 5 revealed that in the first week of March, SK Hynix DDR5 prices continued to climb, with some eMMC product prices increasing by 8%-10%, DDR4 8GB 3200 prices up 4.55% month-on-month, and SSD 256GB PCIe3.0 prices up 2.61% month-on-month.

At this juncture, some may wonder: Is the storage market poised for recovery? What will drive its growth in the coming period?

Many eyes are now turning to AI, placing hopes on it for the overall recovery of the storage market.

02

Storage Prices: Fluctuations are the Norm

Long-time observers of the storage market understand that compared to other semiconductor sub-sectors, the storage chip market exhibits more significant and elastic cyclical fluctuations.

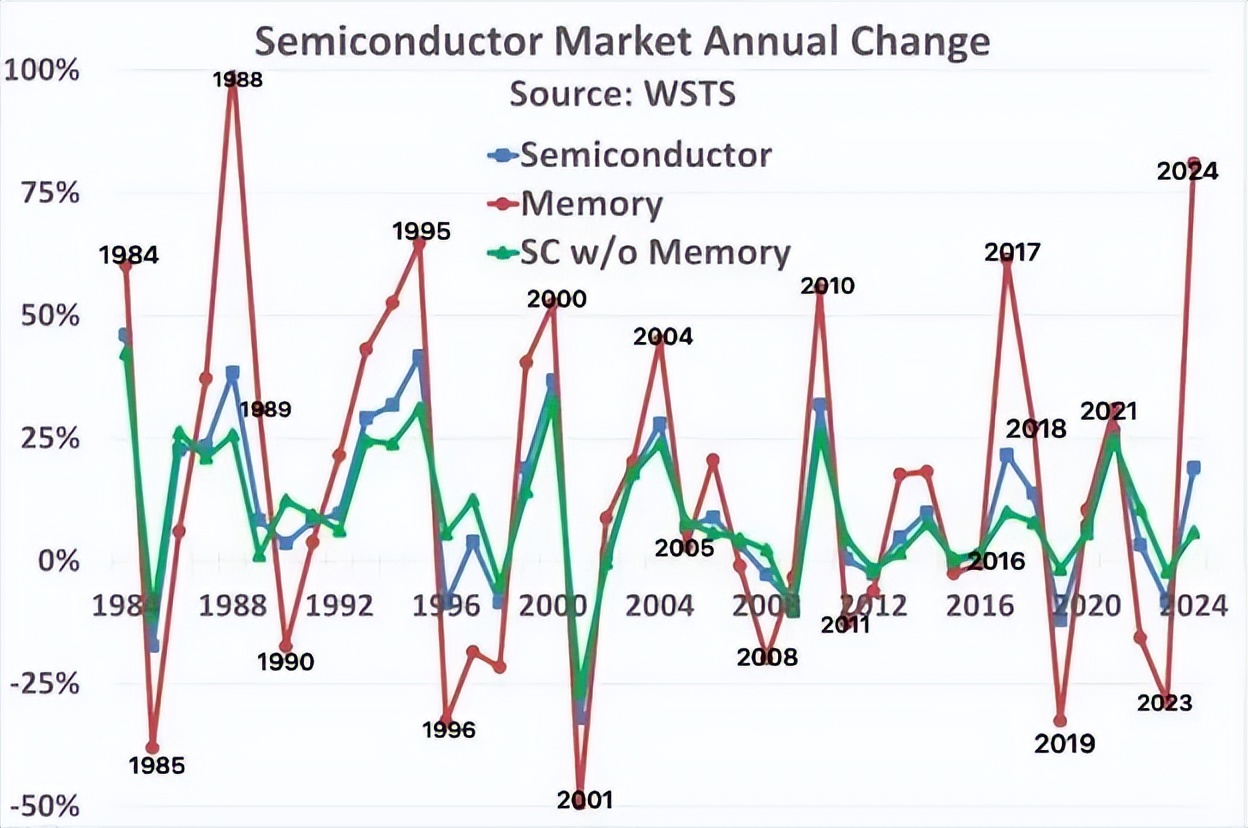

The chart below, based on WSTS data, illustrates the cyclical fluctuations in the storage market over the past 40 years. It compares the total semiconductor volume, the memory market, and the semiconductor market excluding memory. Notably, the memory market displays extreme volatility, with growth rates as high as 102% and declines of 49%. In contrast, the market excluding memory remains relatively stable, fluctuating between growth of 42% and a decline of 26%.

Over the past 40 years, a clear pattern emerges in the memory market: When the annual growth rate surpasses 50%, a significant slowdown or decline often follows the next year. Before 2024, such high growth occurred six times, leading to market declines in four of those instances—1988, 1995, 2000, and 2010. In the other two cases, 2004 and 2017, although growth continued the following year, it significantly slowed, with the market declining two years after the peak.

The fundamental supply and demand relationship drives these fluctuations. When supply falls short of demand, memory prices rise, boosting production; when supply exceeds demand, prices and production decline.

Driven by robust AI server demand, global DRAM and NAND Flash sales revenue hit a record high of $167 billion in 2024. After this peak, will the market climb higher or decline again?

Considering the pattern in the chart, it's plausible to speculate that the memory market might experience another significant decline in 2025 or 2026.

The current downturn in the storage market is primarily influenced by two factors: excess market supply and persistent sluggish demand for consumer electronics like smartphones and PCs, exacerbating the imbalance between supply and demand, putting downward pressure on prices.

However, despite the cool market atmosphere, it's not entirely bleak. Demand in certain sub-sectors, such as AI, is injecting momentum into overall market development.

Institutions note that factors including technological innovation, countercyclical investment strategies, shifts in the global storage chip market landscape, AI-driven storage chip demand, and capital market support are collectively propelling the rise of domestic storage chips. These factors are expected to drive the storage market's improvement in the second half of 2025, with storage prices entering an upward range.

03

AI: The Core Driver for Storage Recovery

In the AI era, the importance of computing power is evident. However, another critical factor, whose influence rivals that of computing power, is storage capacity.

For data storage, AI's development relies on massive amounts of data, placing stringent demands on data processing and requiring larger memories to store more data.

In terms of data access speed, during training and inference, read speed directly impacts overall performance. High-speed storage systems mitigate I/O bottlenecks, enhancing data processing efficiency.

For data management, large-scale datasets require robust storage capabilities, including backup, recovery, and version control.

While readers are aware of the significant investment in GPUs, these GPUs necessitate high-performance storage to efficiently provide data and maintain high utilization throughout the process. Insufficient storage performance can leave GPUs idle for extended periods during training.

Discussions on AI and storage abound in the industry. Readers' primary concerns revolve around two points: How much storage demand does AI generate? Can this demand withstand the storage market's headwinds?

AI's storage demand manifests in several ways:

In SSDs, Gartner's Director-level Analyst and Head of Technology Products, Shrish Pant, predicts that due to growing AI server demand, SSD bit shipments will increase in the second half of 2025. Long-term, AI demand will continue to drive demand for larger capacity and higher performance SSDs.

In DRAM, AI storage products like High-Bandwidth Memory (HBM) and the new generation of DDR5 memory chips are emerging as market favorites, with HBM being the star of 2025.

Yongxing Securities stated that benefiting from supply-side price increases, inventory normalization, and AI-driven demand for HBM, SRAM, and DDR5, the industry chain is expected to bottom out and rebound.

Analysts from the China Chamber of Commerce Industry Research Institute predict that China's semiconductor memory market will reach 458 billion yuan in 2025. They also noted that after inventory destocking, storage chip sales improved significantly in 2024. In 2025, AI is expected to become the core driver for the storage chip market's upward cycle.

The combined demand from AI servers, AI mobile phones, and AIPC is anticipated to resonate, accelerating demand growth marginally. NAND demand from AI servers has surged, with institutions estimating that global enterprise-class SSD bit demand will increase by at least 30% in 2025.

04

Storage Companies Focus on HBM

TechInsights predicts that HBM shipments will increase by 70% year-on-year in 2025, as data centers and AI processors increasingly rely on this memory for low-latency data processing.

At the beginning of 2025, global storage giants Samsung, SK Hynix, and Micron all indicated plans to expand HBM production. These companies account for nearly 90% of the global storage chip market share. According to TrendForce statistics, SK Hynix held a 53% market share in 2023, leading the HBM market, while Samsung and Micron accounted for 38% and 10%, respectively.

Notably, SK Hynix's financial report revealed a 102% revenue growth in the past year due to its HBM product line, setting a new record.

TechInsights forecasts that driven by surging AI applications, memory market capital expenditures (capex) in 2025 are increasingly directed towards DRAM, especially HBM. As manufacturers expand capacity to meet growing demand, DRAM capex is expected to increase by nearly 20% year-on-year.

Samsung and Micron are intensifying their deployments, with Micron aiming to capture over 20% of the HBM market in 2025. The rapid rise in HBM demand is likely to reshape the DRAM market, with many manufacturers prioritizing AI-related chip production over traditional DRAM products.

Recently, major DRAM manufacturers, including Micron, Samsung, and SK Hynix, announced plans to cease DDR3 and DDR4 memory production by the end of 2025.

05

Domestic Storage Companies Take Early Action

Since the beginning of the year, among the 28 stocks in the storage sector, only one has declined, with an average individual stock increase of 18%. Leading stocks such as Demingli, Allwinner Technology, GigaDevice Semiconductor, GigaDevice Innovation, and Jetech have spearheaded the sector.

On February 24, amidst a technology sector adjustment, storage chips stood out, with the Wind Memory Index closing up 2.3%, hitting an all-time high. Index component stocks like Demingli, GigaDevice Innovation, Purane Microelectronics, and Beijing Actions Semiconductor all reached new stage highs.

Demingli set a new all-time high stock price on February 24, closing at 147.15 yuan, up 10%, and up 68% year-to-date. Leading stock GigaDevice Innovation closed up 3.6% at 143 yuan, narrowly missing the 100 billion yuan market value mark by only 5 billion yuan.

Amid the AI wave, computing power demand has surged, benefiting domestic storage vendors.

GigaDevice Innovation: Emphasizing Opportunities in Edge AI Applications

GigaDevice Innovation is a dual leader in domestic storage chips and MCU chips. Its general NOR Flash products are widely used in consumer electronics and smart wearable devices.

For AIPC, increasing BIOS program code volume drives demand for larger NOR Flash capacity. In wearable devices, the growing penetration of AI glasses and headphones also boosts NOR Flash demand. GigaDevice Innovation's NOR Flash products are poised to benefit from edge AI application trends.

Addressing edge AI's high bandwidth demands, GigaDevice Innovation has developed a compact storage solution based on a 3D stacking architecture, utilizing hybrid bonding technology for tight SoC and DRAM integration. This design reduces size and increases data transfer rates to 32-256GB/s, approaching HBM2e standards. Critically, compared to traditional HBM technology, GigaDevice Innovation's solution significantly reduces power consumption to one-third to one-fourth.

Biwin Storage: High-End Storage Becomes AI's New Favorite, Forward-Looking Layout of HBM+DDR5

According to Biwin Storage's recently disclosed investor relations activity record, the company excelled in the smart wearable field in 2024, with storage product revenue reaching approximately 800 million yuan, marking significant year-on-year growth.

Relying on its strong technical prowess, Biwin Storage provided ROM+RAM memory for Meta's latest AI smart glasses, Ray-Ban Meta, and entered the supply chains of renowned domestic smart glasses manufacturers like Rokid, Thunderbird Innovation, and ZMI. Biwin has launched multiple high-performance storage products in AI mobile phones, AIPC, and smart wearable devices, covering advanced solutions like UFS3.1, LPDDR5/5X, and ePOP, supporting smart devices' efficient operation.

Furthermore, with large AI models spurring massive computing power demand, Biwin Storage has introduced enterprise-class SSDs, CXL 2.0 DRAM, and RDIMM products suitable for server applications, promoting them in the market. Simultaneously, Biwin Storage is closely grasping the significant opportunities presented by AI development and server upgrades for HBM and DDR5.

Beijing Actions Semiconductor: Laying Out 3D Stacking Technology to Adapt to AI Storage Demands

Recently, on the investor relations platform, Beijing Actions Semiconductor disclosed its active engagement and strategic layout in 3D DRAM-related technologies. As technological advancements continue to unfold, particularly in the realms of chip and storage technology, 3D DRAM, a high-performance storage solution, is progressively revealing its pivotal role in future markets.

Longsys: Capitalizing on New Opportunities in AI Applications

Longsys recently announced on the investor relations platform that it successfully secured server storage orders from several prominent enterprises in 2024, marking a substantial growth in its enterprise storage business. AI technology is poised to exert a lasting and profound influence on the storage sector.

Longsys' newly launched storage products, including LPCAMM2, CAMM2, and CXL2.0, underscore its technological foresight in AI applications. These storage solutions are anticipated to open up new avenues for growth by meeting the heightened demands of AI-related devices such as AI servers, AI smartphones, and AI computers.

Purane Microelectronics: NOR Flash Technology Powers AI Glasses

The race for AI glasses is intensifying. With the storage technology requirements for Doubao AI glasses and Xiaomi AI glasses upgraded to 128M, Purane Microelectronics has emerged as a focal point of discussion. Purane Microelectronics recently revealed on the investor relations platform that its NOR Flash product line encompasses dual processes and multiple manufacturing methodologies, offering notable advantages like low power consumption and compact size. This makes it a key supplier for AI glasses and other intelligent devices. As the global AI glasses market enters a period of explosive growth, with shipments anticipated to surpass 12.8 million pairs in 2025 and reach 1.4 billion pairs by 2035, the demand for storage chips is also surging.

06

Can AI Demand Withstand the Challenges in the Storage Market?

Since 2025, major AI events, epitomized by DeepSeek, have further heightened global investors' interest in the industry. The accelerated deployment of AI edge-side applications, fueled by large-scale model training, positions AI as the likely core catalyst for the upward cycle of storage chips in 2025.

Currently, from the perspective of the overall storage market, demand for traditional storage solutions (smartphones and PCs) is gradually recovering. Memory giant Samsung noted during a performance briefing that with the completion of inventory adjustments for related products, traditional storage demand is anticipated to show signs of recovery in the second quarter of 2025. Samsung predicts that DRAM shipments will decline by a single-digit percentage sequentially in the first quarter of 2025, and NAND shipments will decline by a double-digit percentage sequentially. However, for the full year, DRAM shipments are expected to grow by a double-digit percentage year-on-year.

Regarding NOR Flash and MCU, GigaDevice Innovation stated on an interactive platform, "Competition in NOR Flash and MCU will remain intense in 2025, and the industry has yet to clear out excess capacity. Additionally, in an environment of modest recovery, new demand is insufficient to fully absorb the industry's total capacity. Therefore, we believe prices will most likely continue to consolidate at current lows, with limited scope for further decline."

Thus, from the standpoint of the overall storage market, while AI has fueled the growth in demand for products such as DDR5, HBM, and enterprise-level SSDs, the weakness in the consumer market has significantly impacted the storage market and may not be sufficient to drive positive growth across the entire industry. Nonetheless, with the recovery of traditional storage demand in the latter half of the year, the entire storage market is still anticipated to regain momentum.