Hello's $2.1 Billion Acquisition of Yong'anxing, as Ant Group Exits with $297 Million

![]() 03/18 2025

03/18 2025

![]() 647

647

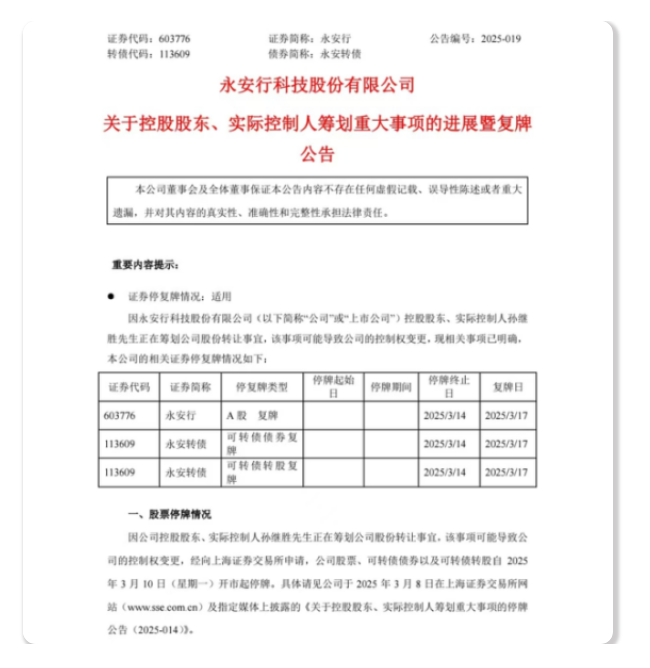

On March 16, market announcements revealed that Hello Inc.'s co-founder and CEO Yang Lei had officially taken control of Yong'anxing, while Ant Group seized the opportunity to exit with a cash-out of $297 million.

Overview Yong'anxing, once the leading player in the shared bike industry and known as the "first shared bike stock," has faced challenges in recent years. In 2023, the company reported a net loss of $180 million, with revenues declining annually and share prices plummeting. Against this backdrop, Yang Lei, through Hello Inc.'s Shanghai Hamao Company, invested approximately $2.1 billion to acquire control of Yong'anxing.

Why Did Ant Exit?

Ant Group, previously Yong'anxing's largest shareholder with a 36.3% stake, has shifted its strategic focus over the years.

The group now favors a "light asset + technology" approach and has lost interest in money-intensive heavy asset projects like shared bikes.

Consequently, through its subsidiary Shanghai Yunxin, Ant transferred some shares to Yang Lei, realizing a $297 million cash-out and achieving strategic realignment.

Why Did Yang Lei Take Over?

Hello Inc., under Yang Lei's leadership, has long harbored ambitions for a public listing, but its previous IPO attempt on the US stock market was not successful.

This acquisition of Yong'anxing may be driven by the value of its A-share listing platform, with the aim of enhancing Hello's market competitiveness through resource integration.

Some analysts believe that a backdoor listing could be faster and more aligned with Hello's short-term strategic needs compared to an IPO.

Image generated by AI

Can Yong'anxing Turn Things Around?

Yong'anxing's docked bike model has struggled in industry competition, with its market share eroded by dockless bike brands like Meituan and Qingju.

Following the acquisition, Yang Lei has pledged to promote business synergy and integrate the resources of Hello and Yong'anxing to their mutual advantage.

In the future, Hello may leverage Yong'anxing's listing platform to further expand its business empire and enhance its market influence.

However, skeptics question how Hello, which is also incurring losses, can revive Yong'anxing. Will it replace all of Yong'anxing's docked bikes with Hello's model?

In summary, Hello's $2.1 billion acquisition of Yong'anxing and Ant Group's exit with a $297 million cash-out reflect the strategic adjustments of both parties.

How Hello integrates Yong'anxing's resources remains to be seen, and whether this move will prove to be a masterstroke or a white knight scenario is worth anticipating.