Intel: Asset Sales and Layoffs with New CEO, Can It Turn Around?

![]() 04/28 2025

04/28 2025

![]() 463

463

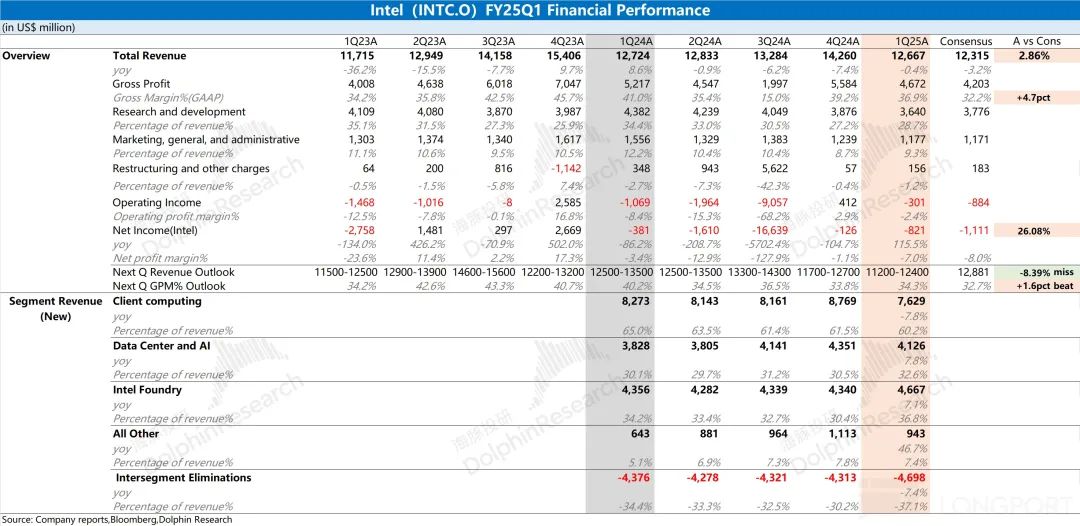

Intel released its first-quarter 2025 earnings report (ending March 2025) after the U.S. market closed on April 25, 2025, Beijing time. The key points are as follows:

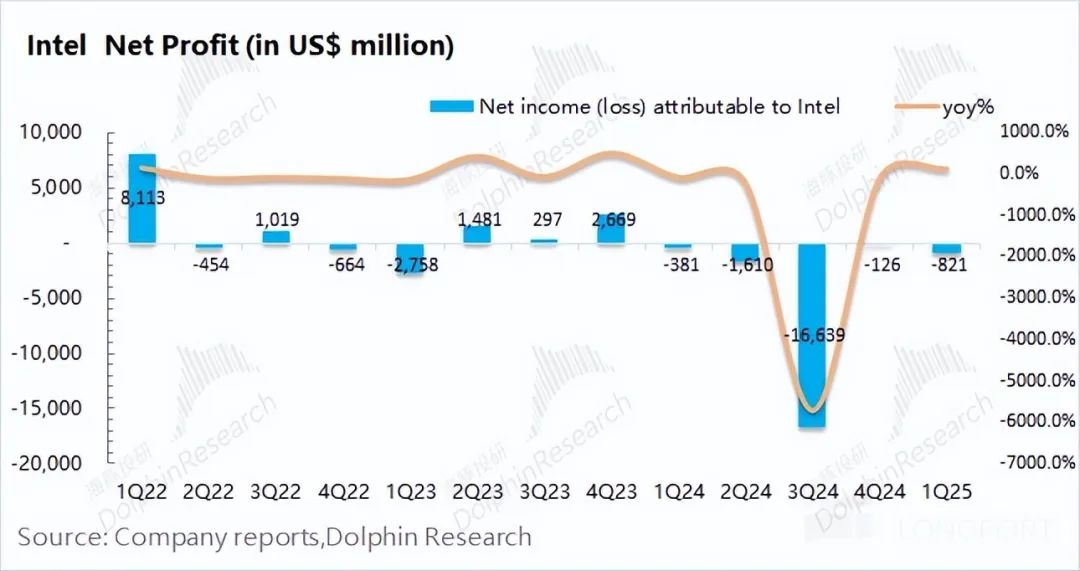

1. Core Data: Revenue Remains Flat, Gross Margin Declines Again. Intel achieved revenue of $12.67 billion in the first quarter of 2025, basically flat year-on-year and close to the upper end of guidance ($11.7-$12.7 billion). Client computing revenue declined this quarter, but growth in data center and AI businesses and other businesses largely offset this decline. Intel reported a net loss of $820 million in the first quarter of 2025, with losses expanding primarily due to declining gross margins and increased non-recurring losses.

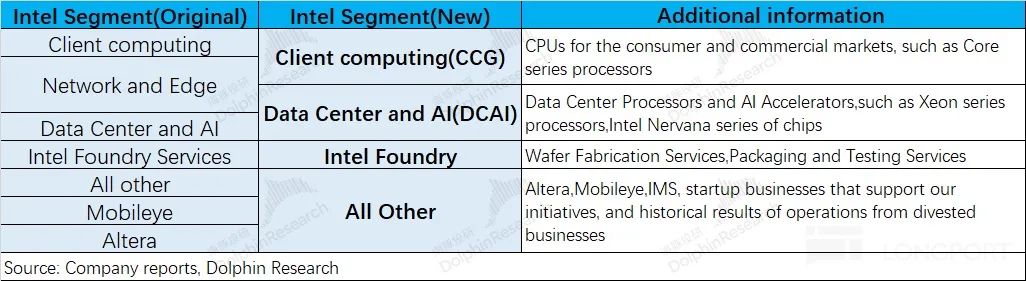

2. Business Segments: Client Computing Loses Share, AI and Foundry Show Potential. The company made another adjustment to its business segments this quarter, reclassifying its Intel products business into client computing and data center and AI businesses.

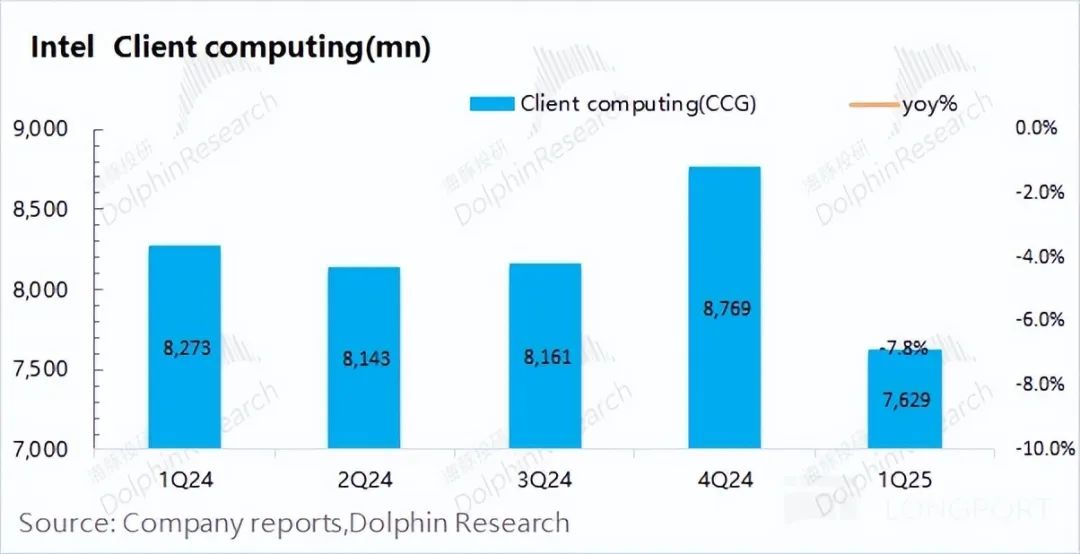

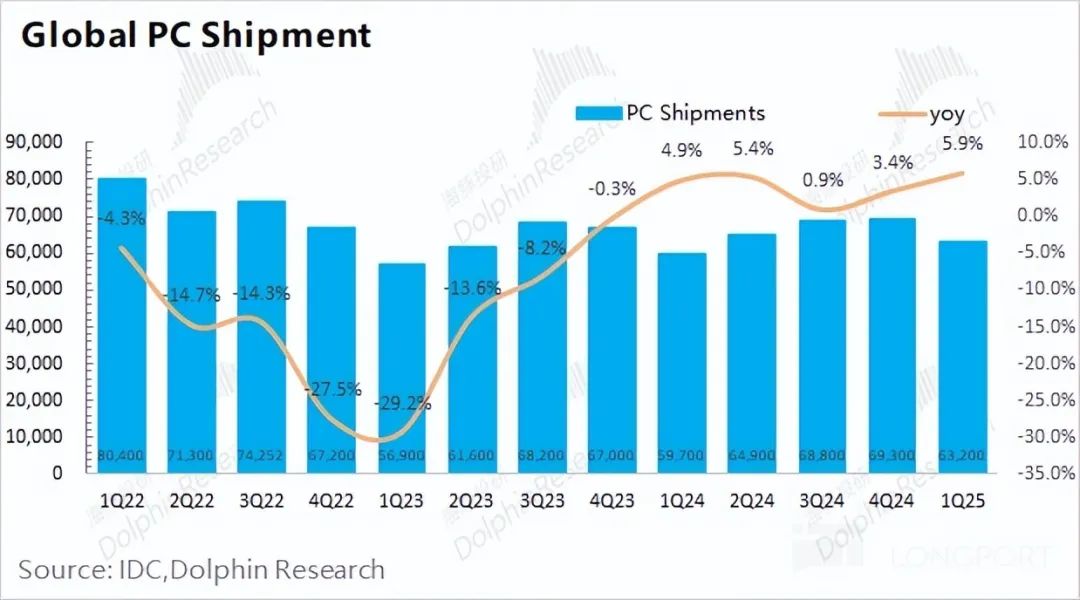

1) Client Computing: Client computing revenue was $7.63 billion this quarter, down 7.8% year-on-year. PC industry shipments increased by 5.9% year-on-year during the same period, while Intel's related revenue declined by 7.8%, indicating that Intel continues to lose market share;

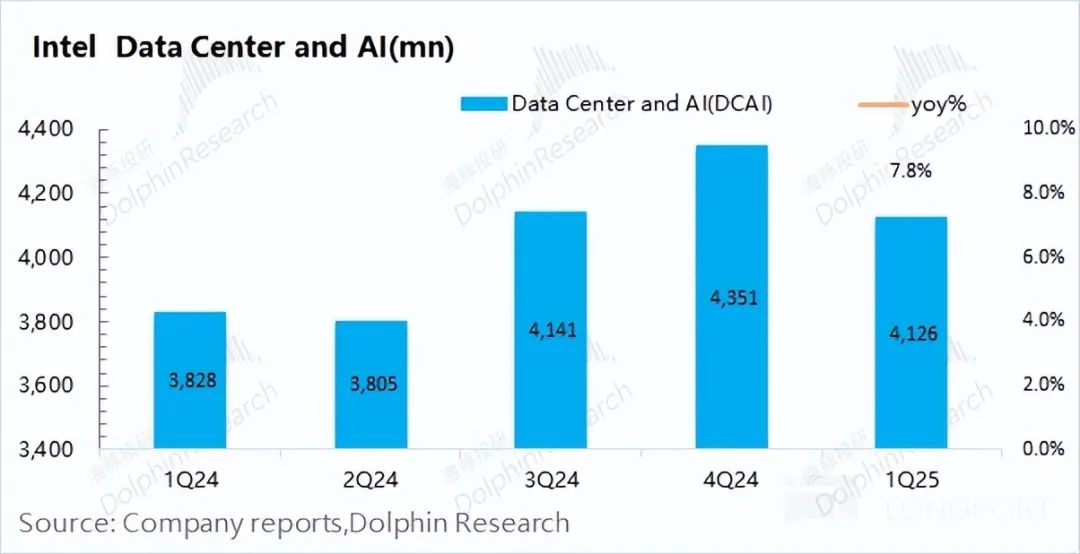

2) Data Center and AI: Revenue from the data center and AI business was $4.13 billion this quarter, up 7.8% year-on-year, primarily driven by sales of Xeon servers and advanced stockpiling by some customers in anticipation of potential tariffs;

The company's traditional server and Altera businesses declined this quarter and did not benefit from the growth of the AI supply chain.

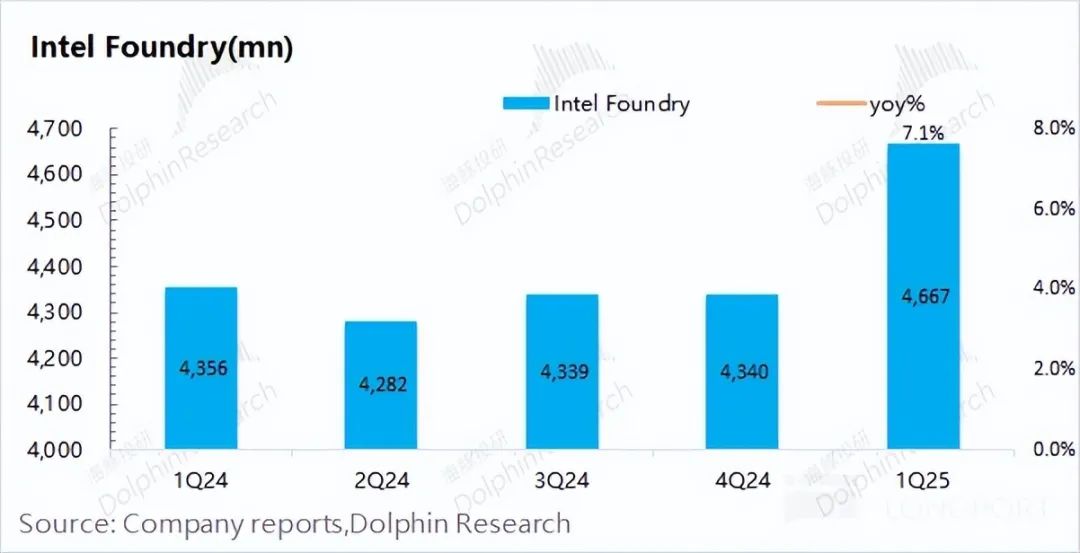

3) Intel Foundry Services: Revenue from Intel's foundry services was $4.67 billion this quarter. However, due to approximately $4.7 billion in internal offsets, the company's current wafer foundry business is still primarily internally digested, with minimal external foundry work;

3. Intel Guidance: Expected revenue for the second quarter of 2025 is $11.2-$12.4 billion (market expectation: $12.88 billion) and GAAP gross margin is 34.3% (market expectation: 32.7%). Both guidance figures declined year-on-year.

Intel's Overall Outlook: The company is currently focused on internal reforms, and its financial performance has not yet improved.

Intel's earnings report this time was decent, with revenue close to the upper end of guidance and gross margin performance better than expected. However, the company's financial performance has not actually improved. Considering the company's guidance for the next quarter, the company expects revenue and gross margins to continue declining in the next quarter, with no signs of improvement in the short term.

After changing CEOs, the company again adjusted its financial reporting segments this quarter, with Network and Edge businesses no longer disclosed separately. Intel's proprietary products business is now directly divided into client computing and data center and AI. Specifically: 1) Client computing remains sluggish, with related revenue still declining despite steady growth in PC industry shipments, primarily due to market share lost to competitors (AMD); 2) Data center and AI business grew, primarily driven by demand for Xeon and advanced stockpiling by customers in anticipation of potential tariffs, but has not yet penetrated core AI segments such as GPUs; 3) Intel's foundry services continue to focus on internal services, with minimal external foundry work.

After the new CEO Pat Gelsinger took office, he clarified that the company will focus on core x86 businesses, data center and AI, and the development and production of 18A processes, which is also in line with the company's new business classification. Judging from the performance of various businesses, there are currently no signs of improvement. The company's current focus is mainly on internal reforms and adjustments, including reclassifying businesses, continuing layoffs and cost reductions. By the end of the first quarter, the company's total number of employees had decreased by 28,000 year-on-year, and operating expenses had also decreased by $1.3 billion year-on-year.

In addition, the company recently announced the sale of a 51% stake in Altera to Silver Lake Capital at a valuation of $8.75 billion, with the transaction expected to close in the second half of 2025, followed by plans for an IPO of Altera. The company acquired Altera for $14.45 billion in 2015, and the current sale at a loss further demonstrates the company's commitment to focusing on core businesses.

Overall, the company's current three core businesses (client computing, data center and AI, and foundry services) show no signs of improvement. After changing CEOs, the company is currently focused on internal reforms, reclassifying businesses, layoffs and cost control, and asset sales, allowing the company to focus more on client computing, data center and AI, and foundry services in the future. Client computing is aimed at consolidating traditional strengths, while data center and AI and foundry services can provide growth potential for the company in the future.

However, Intel still faces three major challenges (fierce competition from AMD in traditional areas, the data center and AI business failing to penetrate core segments such as GPUs, and minimal external foundry work), which will continue to put pressure on the company's revenue and gross margins. Judging from the company's financial report structure, if the overall gross margin cannot return to above 45%, the company's operating performance will still face losses. If the company achieves breakthroughs in these three challenges through a series of adjustments and reforms, it will restore market confidence.

Here is a detailed analysis

I. Core Data: Revenue Remains Flat, Gross Margin Declines Again

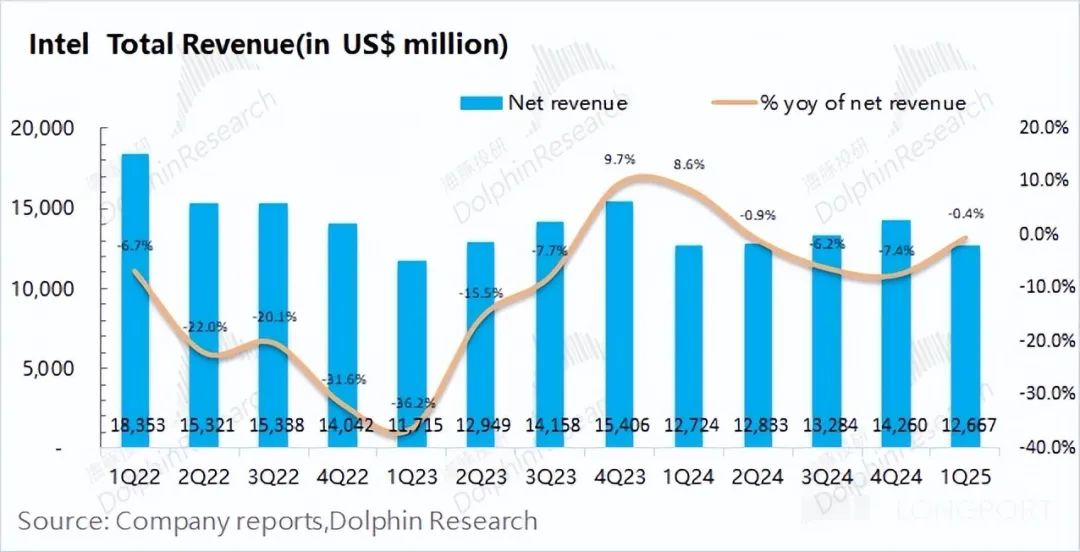

1.1 Revenue: Intel achieved revenue of $12.67 billion in the first quarter of 2025, a decrease of 0.4% year-on-year and close to the upper end of company guidance ($11.7-$12.7 billion). Growth in the company's data center and AI business and other businesses offset declines in client computing this quarter.

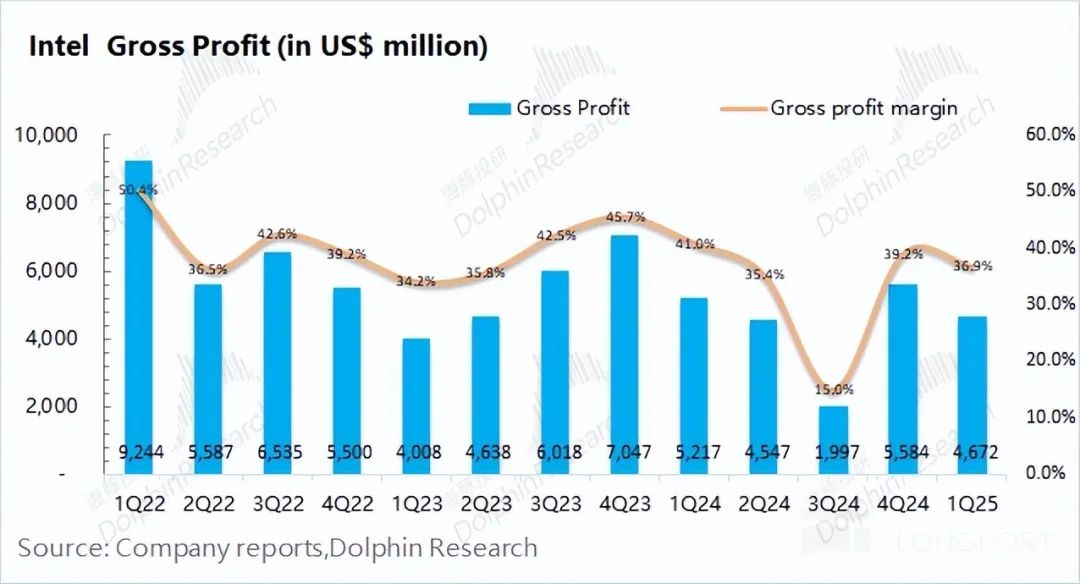

1.2 Gross Profit and Gross Margin: Intel achieved a gross profit of $4.67 billion in the first quarter of 2025, a decline of 10.4% year-on-year.

With revenue remaining basically flat, this was primarily due to the decline in gross margins.

Specifically, the company's gross margin was 36.9% this quarter, a year-on-year decline of 4.1 percentage points but better than market expectations (32.2%). The decline in gross margin this quarter was primarily due to seasonal factors and the decline in client computing gross margins.

The previous "flash crash" in gross margins to 15% was primarily due to the impact of one-time impairment charges (approximately $3.1 billion). Excluding this impact, the actual operating gross margin for the previous quarter was 38.4%.

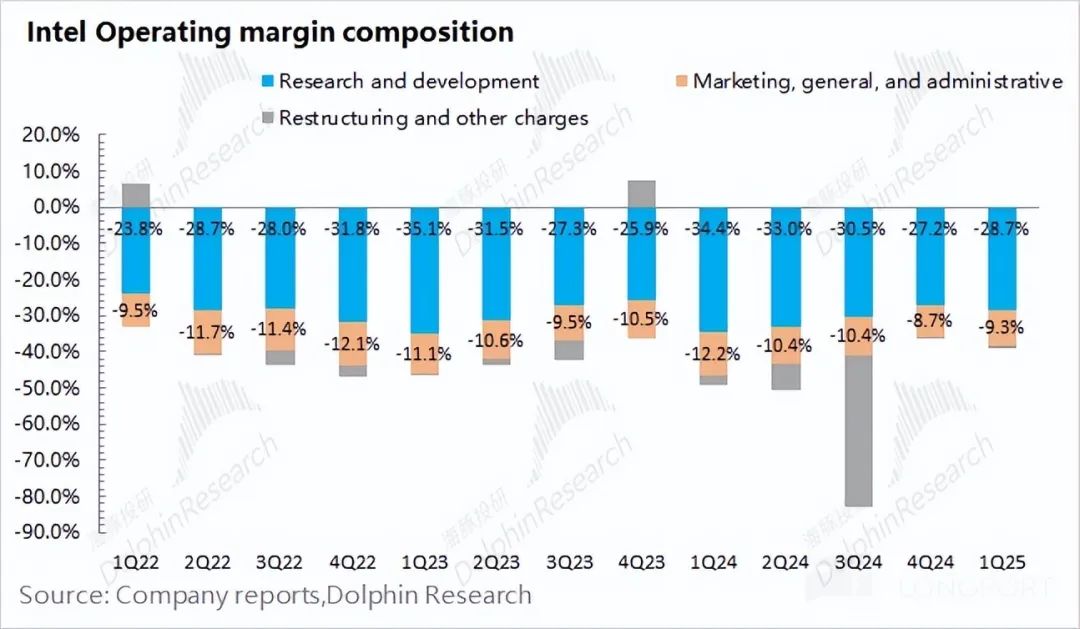

1.3 Operating Expenses: Intel's operating expenses were $4.973 billion in the first quarter of 2025, a decline of 20.9% year-on-year. With no growth in revenue, the company continued to cut core operating expenses (R&D + sales and marketing management), and the company again implemented layoffs and cost reductions this quarter (the number of employees decreased from 109,000 at the end of the previous quarter to the current 103,000).

From a core perspective:

1) R&D Expenses: R&D expenses were $3.64 billion this quarter, a decline of 16.9% year-on-year, with an R&D expense ratio of 28.7%. Amid poor operating performance, the company has cut R&D expenditures for four consecutive quarters, making departmental and personnel adjustments, but it is still the largest item in the company's operating expenses;

2) Sales, Marketing, and Administrative Expenses: Sales and marketing expenses were $1.18 billion this quarter, a decrease of 16.9% year-on-year; the sales and marketing expense ratio decreased to 9.3%; the decline in sales and marketing expenses was also significant, primarily due to the company's layoffs and other actions;

3) Restructuring and Other Expenses: The company's restructuring and other expenses were $160 million this quarter.

1.4 Net Profit: Intel reported a net loss of $820 million in the first quarter of 2025, with losses expanding again, primarily due to the decline in gross margins and an increase in other non-recurring losses.

Excluding non-operating impacts, the company's operating profit for this quarter was -$300 million, declining year-on-year and quarter-on-quarter. Affected by the decline in gross margins, even though the company has started layoffs and cost reductions, its operating profit still declined.

II. Segment Data: Client Computing Loses Share, AI and Foundry Show Potential

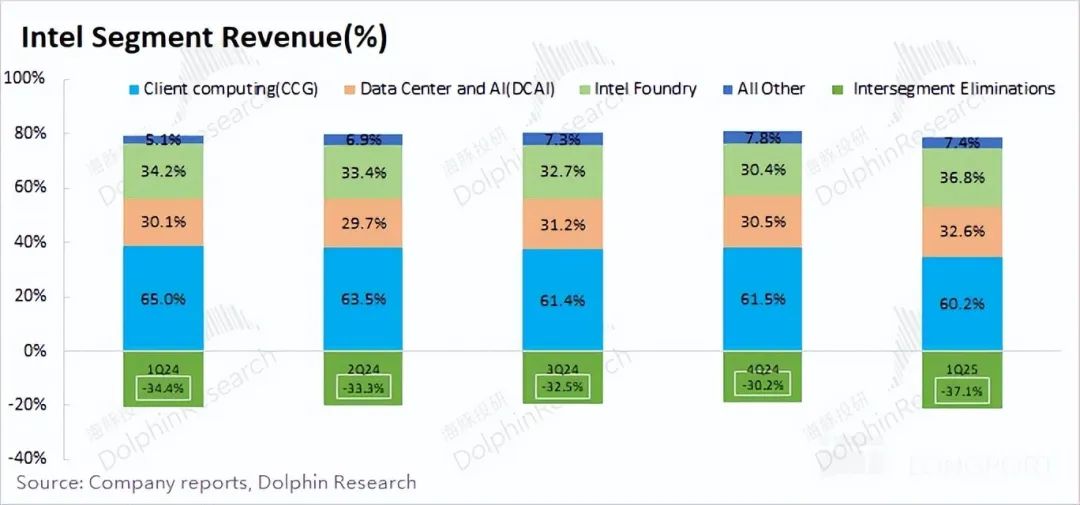

After changing CEOs, Intel again adjusted its business disclosure segments this quarter. Intel classified its proprietary products business into client computing and data center and AI segments, with the remaining segments being foundry services and all other businesses.

Network and Edge businesses are no longer disclosed separately starting this quarter, and businesses such as Altera and Mobileye are unified under all other businesses.

After the company's business adjustments, it can be seen that client computing and data center businesses are the company's largest sources of revenue. Considering the company's foundry services and internal offsets, the company still primarily focuses on self-production and self-sales, with relatively few external foundry services.

2.1 Client Computing

Intel's client computing revenue was $7.629 billion in the first quarter of 2025, a decline of 7.8% year-on-year. The decline in client computing revenue was primarily due to industry competition and declining market share.

This quarter's business segments were adjusted, with a portion of the original Network and Edge revenue counted into client computing, resulting in data inconsistencies with past financial reports.

Combined with IDC industry data, although the first quarter is traditionally a slow season for the PC industry, global shipments were 63.2 million units this quarter, an increase of 5.9% year-on-year, indicating some recovery in the industry.

However, despite a 5.9% year-on-year increase in PC industry shipments, Intel's client computing (PC) revenue declined by 7.8% year-on-year. While the PC industry as a whole maintained a recovery pace, the company's related revenue continued to decline, indicating that the company is still losing market share.

According to CPU-Z statistics, as of April 1, 2025, Intel still held a 56.3% share of the CPU market but saw a year-on-year decline of 10%. Although the PC CPU market remains the company's traditional strength, AMD's continued pursuit has led to a continuous decline in market share.

2.2 Data Center and AI

Intel's data center and AI revenue was $4.126 billion in the first quarter of 2025, an increase of 7.8% year-on-year, driven by sales of Xeon servers and advanced stockpiling by some customers in anticipation of potential tariffs.

After stripping Altera from the data center and AI business, the company merged a portion of Network and Edge revenue into the data center and AI business this quarter.

In addition, after previously spinning off the Altera segment from its data center and AI businesses, the company recently plans to ship the products. On April 14, 2025, Intel announced that it would sell a 51% stake in Altera to Silver Lake Capital for $8.75 billion (acquired in 2015 for $14.45 billion). The transaction is expected to be completed in the second half of 2025, followed by plans for an IPO of Altera.

The sale of Altera is due, on the one hand, to the continued downturn in this business and, on the other hand, to allow the company to recoup funds to support the development of other core businesses, such as process technology research and development and data center business expansion.

The client business is the company's traditional area of strength and its fundamental base. The data center and AI businesses provide growth potential for the company. For the data center market, the capital expenditures of the four major cloud vendors will be key to market demand. Although the disclosed capital expenditures of Google for this quarter are solid at $17.2 billion, an increase of 43% year-on-year, it cannot be ignored that Google mentioned at the GCP Next conference the risk of cooling demand from some customers.

As current market demand is still primarily concentrated in the GPU and ASIC fields, and the company's products are still mainly CPUs in servers, it has relatively benefited less in the current AI market performance.

2.3 Intel's Foundry Business

Intel's Foundry Business revenue reached $4.67 billion in the first quarter of 2025, an increase of 7.1% year-on-year. Combined with the company's total internal offsets of $4.7 billion for this quarter, it can be seen that the company's current foundry business is mainly internally oriented, with very little external foundry work.

Although the company's external foundry business has been difficult to improve, after changing its CEO, the company further clarified its focus on the research and production of the 18A process. Especially under the general policy of the return of the U.S. manufacturing industry, the company will continue to adhere to Intel's foundry strategy. As the company's external foundry business has not made significant progress, the market has largely ignored this part of the business. If the 18A process and foundry business exceed expectations, it is expected to help improve the company's operating performance.

- END -

// Reprint Authorization

This article is an original article by Dolphin Investment Research. If you wish to reprint it, please obtain authorization first.

// Disclaimer and General Disclosure

This report is for general comprehensive data use only and is intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referencing the content or information mentioned in this report does so at their own risk. Dolphin Investment Research shall not be liable for any direct or indirect responsibility or loss that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report may not be construed or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They do not constitute advice, inquiries, or recommendations regarding the relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or result in Dolphin Investment Research and/or its subsidiaries or affiliates being required to comply with any registration or licensing requirements in such jurisdictions.

This report reflects only the personal views, opinions, and analysis methods of the relevant authors and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and the copyright belongs solely to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no institution or individual may (i) produce, copy, replicate, reprint, forward, or create any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.