Revenue Soars 46%: Kunlun Wanwei Emerges as an AI "Hit Product Factory"

![]() 05/01 2025

05/01 2025

![]() 565

565

No one desires to be left behind by the times.

In the fiercely competitive AI landscape, giants lavish spending in pursuit of miracles, while upstarts introduce innovative ideas. Amidst fierce competition, how does Kunlun Wanwei stay at the forefront of this wave?

Top-tier strategic thinking is the key to winning.

Avoid red oceans and prioritize profitability.

Since the rise of large AI models three years ago, Kunlun Wanwei's Chairman and CEO Fang Han has adhered to this principle. "It's crucial to think from an endgame perspective and strive for 'SOTA' (State-of-the-Art) in our familiar tracks," Fang Han said in a recent interview.

Starting with first principles, one can grasp Kunlun Wanwei's strategy over the past three years—focusing on overseas markets and niche areas with strong willingness to pay.

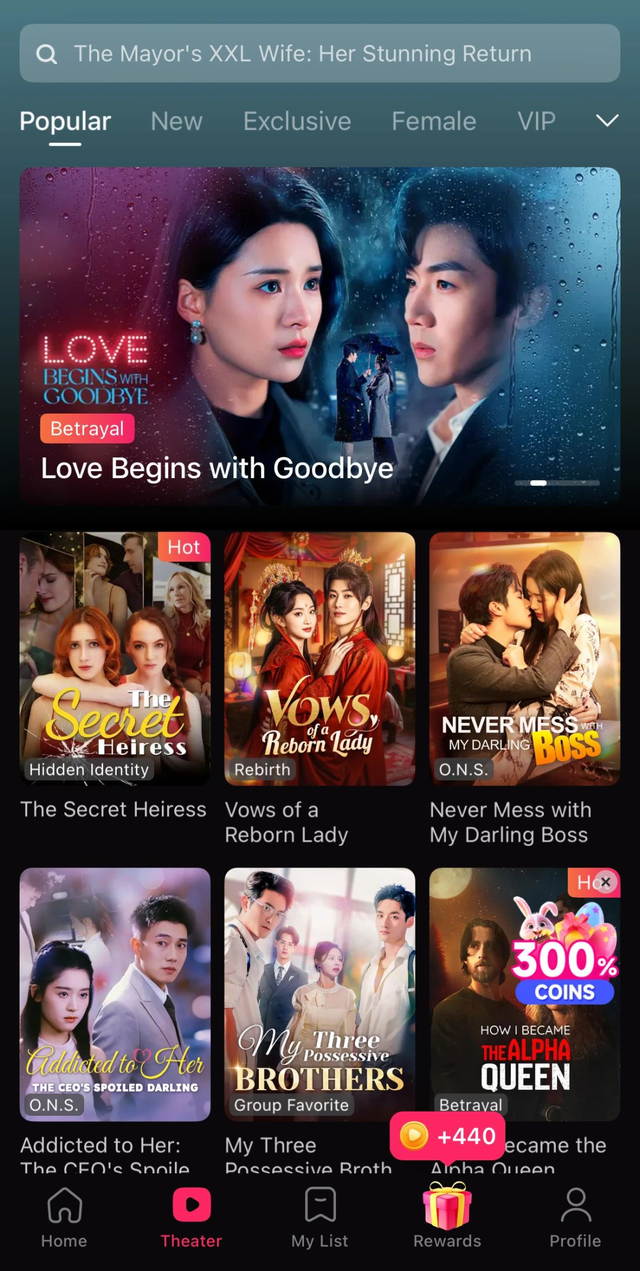

This strategy aligns with the new wave of AI+ going overseas, making Kunlun Wanwei one of the few Chinese AI firms achieving significant overseas results. The financial report reveals that during the AI social networking reporting period, monthly revenue peaked at over US$1 million, making it one of China's fastest-growing AI applications in terms of overseas revenue. By March 2025, the annualized run rate (ARR) of AI music revenue reached approximately US$12 million, and the ARR of short drama platform DramaWave's revenue was about US$120 million, with the company increasing AI's commercial application in short dramas.

On April 12, DramaWave topped the Google Play entertainment chart in South Korea.

Based on the success of these businesses, Kunlun Wanwei started seeing AI returns in 2024:

The 2025 first-quarter financial report released on April 28 shows revenue of RMB 1.76 billion, a 46.07% year-on-year increase.

In an environment where AI commercialization is challenging, how did Kunlun Wanwei achieve such results? Has its AI transformation truly been successful? What insights does it provide for internet companies' transformations?

Kunlun Wanwei's revenue has been accelerating over the past year. The 2025 first-quarter financial report indicates revenue of RMB 1.76 billion, a 46.07% year-on-year increase, marking a record-high growth rate. For the full year of 2024, Kunlun Wanwei's operating revenue reached RMB 5.66 billion, a 15.2% year-on-year increase, compared to only 3.8% in 2023.

With revenue accelerating, Kunlun Wanwei has clearly found new business growth points.

The financial report reveals that the first-quarter increase was due to higher revenue from AI software technology, short dramas, and advertising business segments.

After a detailed analysis of the financial report, Guangzhui Intelligence found that both new and old businesses' growth is inseparable from AI support.

Let's first examine the new businesses, which primarily include three products: short dramas, AI social networking, and AI music:

The short drama platform DramaWave generates the highest revenue, with an ARR of approximately US$120 million and monthly active users (MAU) exceeding 10 million. Notably, DramaWave has maintained a revenue level of tens of millions of dollars from Q4 2024 to Q1 2025. (Sure enough, short dramas are the most profitable.)

However, unlike mainstream domestic short drama platforms, Kunlun Wanwei's overseas short drama business also relies on AI. For instance, on the content distribution side, DramaWave has introduced intelligent chat functions, allowing users immersive interactions with the plot, characters, and actors, significantly enhancing user engagement. AI dubbing functions enable 16 language translations and dubbing, greatly improving the user experience.

As of this reporting period's end, DramaWave's monthly revenue was approximately US$10 million. Additionally, according to third-party data, as of March's end, DramaWave's cumulative downloads had surpassed 30 million, with MAU exceeding 10 million, ranking it among the top five in the industry and belonging to China's first-tier short drama overseas industry.

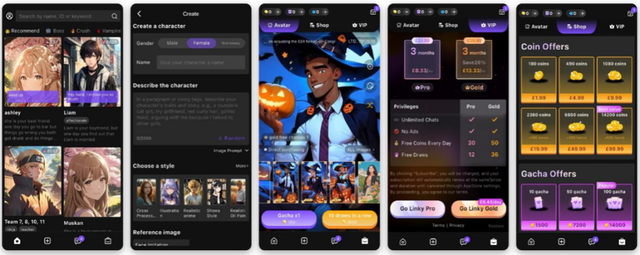

Furthermore, the AI social networking app Linky's highest monthly revenue exceeded US$1 million, with MAU exceeding 3 million; AI music had a monthly revenue of US$1 million, with an ARR reaching approximately US$12 million.

Now let's turn to the old businesses. Advertising, search, and overseas social networking remain Kunlun Wanwei's three core businesses. In 2024, the advertising business accounted for nearly 40% of total revenue, with a 29.81% year-on-year increase, continuing to drive overall revenue. This revenue accelerated further in the first quarter of this year. The financial report shows that driven by Opera Ads (Kunlun Wanwei's browser's advertising system), Opera's revenue increased by 41.1% year-on-year this quarter.

In fact, the traditional PC browser advertising market has been shrinking. To maintain such high growth, Kunlun Wanwei must increase traffic acquisition and iterate products using new technologies like AI to boost user stickiness.

Research reveals that after being acquired by Kunlun Wanwei, Opera has transformed, especially in AI functionality development, with products like GX Game Browser (an "esports-level browser" designed for gamers) and other specialized browsers.

Taking AI browser products like Google Chrome as a reference, Opera has launched a file understanding function that deeply understands various file types, including images, videos, audio, text, and spreadsheets. Additionally, Opera Developer has integrated the open-source DeepSeek R1 model, allowing users to run the model locally without uploading data to the cloud, ensuring data privacy and security.

Beyond these general functions, Opera GX has introduced several AI upgrades for gamers, enhancing the text generation capabilities of the built-in AI assistant Aria, enabling a writing mode. Simultaneously, it deeply integrates the Aria dialog system into browser tabs, achieving cross-interface multi-task collaboration. Moreover, the AI response engine significantly improves the accuracy of gaming field information services through enhanced semantic understanding and contextualized link recommendations.

It's evident that when general AI capabilities struggle to compete with large firms, Kunlun Wanwei has invested heavily in product design for specific groups, aligning with the concept of "avoiding red oceans and finding the right niche areas".

Furthermore, this year will be significant for Kunlun Wanwei's new product launches. The financial report reveals that numerous products, including AI agent platforms and AI games, will be introduced this year.

Over the past two years, Kunlun Wanwei has not only transformed its old businesses using AI but also validated several new AI-native or closely related businesses.

Especially for the aforementioned new products, which have been online for less than a year, Kunlun Wanwei's imagination space in these three areas is far from its upper limit.

Take AI social networking as an example. As overseas products, MiniMax's flagship AI social networking product Talkie, online for nearly two years, generated US$70 million in revenue in 2024, while the short drama platform DramaWave created another hit drama "Engagement Storm" in South Korea in April 2025. For short drama platforms, often just 2% of hit dramas can support 80% of monthly revenue. With DramaWave continuously supplementing its short drama inventory, it's expected to continue increasing revenue through more hit dramas.

As revenue expectations rise, Kunlun Wanwei's valuation is also expected to be further re-evaluated.

For technology companies like Kunlun Wanwei that still invest heavily in R&D costs, it's more suitable to use the price-to-sales (PS) ratio to measure performance rather than the price-to-earnings (PE) ratio. However, compared to the PS range of 5-20 times for general technology companies, Kunlun Wanwei's current PS is only 6.7 times, within a relatively low range.

Note: The data is calculated based on publicly available information and is for reference only.

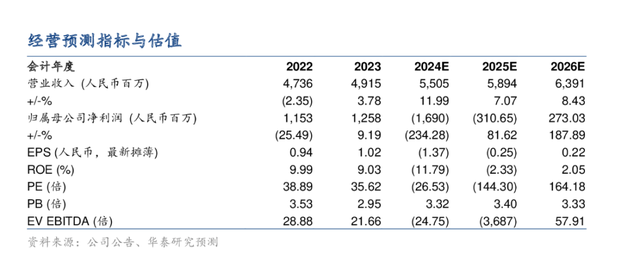

A research report issued by Huatai Securities in January of this year shows that it values Kunlun Wanwei at RMB 55.2 billion using the SOTP method. Compared to the company's market capitalization of RMB 37.9 billion on April 29, it's evident that there's a valuation gap in the market for Kunlun Wanwei.

The pace of Chinese technology companies going overseas has not stopped. In the first quarter of 2025, Kunlun Wanwei's overseas business revenue was RMB 1.67 billion, a 56.1% year-on-year increase, and the proportion of overseas business revenue increased to 94.4%, further deepening its international layout.

Many AI companies are global from the start, targeting overseas markets from inception. After years of overseas trial and error, Kunlun Wanwei also has a keen sense of market opportunities.

Overseas, Kunlun Wanwei has cast a wide net around AI applications.

After a year of screening, Kunlun Wanwei has identified three tracks: short dramas, music, and social networking. Based on To B, To C, cost reduction, and efficiency enhancement ideas, each of these three businesses occupies a seat:

Starting with the most profitable DramaWave, the short drama platform it represents is still in the "blue ocean" field of the overseas market. This track, emerging in 2023, is still seeing numerous newcomers rise to prominence.

Take DramaWave as an example; its current estimated ARR is around US$120 million, but compared to the doubling growth of the short drama overseas market, this estimate is conservative.

According to an iMedia Research report, in July 2024 alone, the monthly revenue of Chinese overseas micro-short dramas approached US$60 million, with a 92.2% year-on-year increase. Considering that the number of downloads of overseas short drama apps doubled in the first quarter, the growth rate will be even faster. Generally, the top players absorb about 80% of the market share. Based on a conservative estimate of a monthly market revenue of US$200 million and five top players, Kunlun Wanwei could earn at least US$300 million in 2025, supporting over 40% of its revenue.

However, among the above platforms, there's no trace related to AI short dramas. Currently, most of the short dramas launched on DramaWave are dubbed versions of domestic short dramas, involving subtitle translation, dubbing modification, and other processing before overseas release.

For Kunlun Wanwei, AI will be the key to "cost reduction and efficiency enhancement" for short dramas, both now and in the future.

From production to overseas launch, short dramas involve three processes: screenwriting (copyright), filming, editing (production), and overseas distribution. However, in the initial market development stage, short dramas are still a high-cost, high-risk business: it's not uncommon for a single popular script to be auctioned off for US$100,000, and the production cost of a single drama, from hiring foreign actors, overseas location filming to post-production, can also reach US$100,000 to US$200,000.

Kunlun Wanwei's overseas expansion mostly selects domestic short dramas, which is also the key to its high business gross margin. Using the retransmission rights of existing domestic dramas plus subtitle processing, the cost of a single drama can be kept within RMB 100,000, less than one-seventh of the production cost of overseas dramas.

As the fastest money-making "cash cow" currently, Kunlun Wanwei will have to bet on AI technologies, including text/image-to-video and AI screenplays, or optimize domestic dubbed drama versions using existing AI dubbing, AI translation, and subtitle functions to seize the short drama market in the future.

Focusing on the AI To B and To C tracks, social networking and music support revenue in these two directions.

Among them, AI social networking is entirely To C. Kunlun Wanwei's AI social networking product Linky is similar to C.AI, focusing on AI virtual character creation + chat interaction, which is also the mainstream play in AI social networking. In terms of payment models, Linky relies on a mixed monetization model of membership subscriptions + top-ups.

As for the application ecosystem, Kunlun Wanwei, which went overseas as early as 2009, can also provide traffic advantages for social networking products. If it relies on StarMaker (with 300 million registered users) and Opera Browser (with 300 million MAU) for traffic diversion in the future, Linky will also have the ecological advantages of domestic giants in traffic acquisition.

In this case, Linky's 3 million MAU still has room for growth, but based on the unstable revenue attributes of social networking products, even if we conservatively estimate based on Kunlun Wanwei's ARR of US$120 million, it's within a reasonable range.

In contrast to social networking, AI music adopts a dual strategy of targeting both businesses (To B) and consumers (To C). Similar to video attributes, AI music serves both content creators and the film and television industry, which consistently demands musical works.

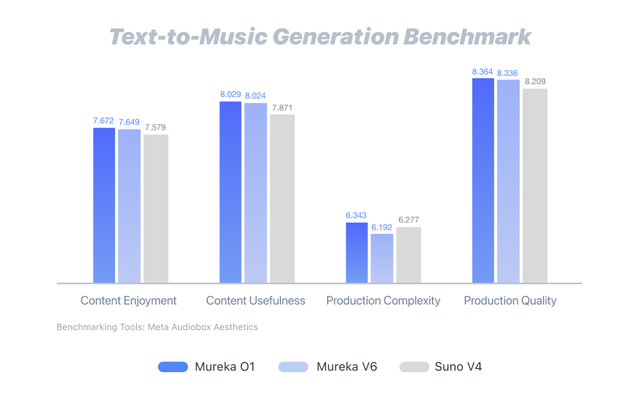

With its state-of-the-art (SOTA) capabilities in music models, Kunlun Wanwei boasts significant advantages in this field. It not only attracts users without marketing efforts due to the technological dividend of SOTA but also secures a position in the niche AI music market by collaborating with industry clients and capturing market share in advance.

Compared to Kunlun Wanwei's listed consumer-end music platform Mureka, which has an annual recurring revenue (ARR) of US$12 million, cooperation with the business end represents a more commercially viable path.

Producing music for film and television soundtracks is costly. Even when calculated based on the minimum standard quotation for background music (BGM), the Music Copyright Society of China sets a standard fee of RMB 5,000 per minute. On Mureka, however, generating a single song costs only RMB 0.18 based on a membership subscription price of US$10 for 400 generations. Even considering that music generation requires multiple attempts, this cost is still significantly lower than studio quotes.

Mukera Monthly Two Paid Subscription Plans

In Fang Han's view, Mureka's future positioning is as an alternative to a "digital music space station," which can be envisioned as a virtual online music studio capable of recording, editing music, and other operations, used to generate accompaniments, evening party music, film and television music, and more.

"The market is already relatively mature, with an annual size of approximately $4 billion. We are like providing a civilian tool, similar to offering 'CapCut' for video platforms," said Fang Han. If Mureka can truly become the "CapCut" of the audio sector, its potential is immense compared to CapCut, which generates billions of dollars in overseas market revenue.

Kunlun has established corresponding business layouts in both the business-end and consumer-end markets, and has firmly established itself in overseas markets with clear payment habits. In terms of AI commercialization planning, Kunlun has effectively avoided "red oceans" and chosen a more suitable path. This is also why, despite Huatai Securities lowering its profit forecast, it still opted to give Kunlun a "buy" rating and a valuation of 55.2 billion yuan.

Relying on these businesses, Kunlun has a clear business model for its R&D costs and has successfully transitioned the company towards AI.

Of course, Kunlun is not invincible, and underperforming businesses will be promptly shut down.

AI Comics is a business that Kunlun evaluated against its standards and subsequently abandoned.

During the three-month follow-up, the AI Comics business failed to meet Fang Han's expectations, both in terms of market potential and company research performance: The model's capabilities were average and could not reach SOTA levels. Additionally, comics face significant monetization challenges among overseas businesses, with high localization requirements and monetization benefits often falling short due to issues such as piracy and payment habits.

Not only in AI implementation but also from large models to applications, Kunlun's choices are quite "clever."

Firstly, to avoid competition in saturated markets, Kunlun chooses to stay away from the "must-fight areas" of major companies and focuses on relatively niche areas that these companies may find "too difficult and too tiring."

Unlike large model vendors focused on securing cloud computing orders and competing for the next generation of traffic entry points, Kunlun, which previously created the highly successful overseas karaoke product StarMaker, took its technology and products to the overseas market for early validation.

Starting again with large models, as the SOTA dividend period shortens, Kunlun is no longer pursuing the creation of all models but is aiming to be the "champion in a single category."

While tech giants like ByteDance and Alibaba are investing heavily in building ultra-large general models, Kunlun has chosen a more pragmatic path. The foundational large model "Tiangong," built as early as 2023, supports the company's AI foundational capabilities. In terms of vertical models, Kunlun places more emphasis on several sub-sectors, including music generation and video creation.

The essence of this strategy is that Kunlun pursues SOTA in select areas, relying on technology to establish a foothold in corners overlooked by giants.

When discussing SOTA dividends, Fang Han once used DeepSeek-R1 as an example. Leveraging the SOTA of the "reasoning large model" niche, the model quickly secured the top position in China's text large model client market, thereby effortlessly acquiring a large number of domestic and foreign customers without marketing expenses.

"We are well aware that if you don't have SOTA for this wave of large models, you won't be able to reap the technological and product dividends," said Fang Han. "If your technological level doesn't rank among the top three, you don't even qualify to participate. No matter how much money you spend on marketing, you won't be able to retain users. Too many enterprises have failed this way, whether in the Hundred Regiments Battle or the Ride-Hailing Wars. Kunlun has witnessed too much of this over the past 17 years."

Taking a closer look at Kunlun's performance in the large model field, video generation and AI music have emerged as two clear strengths: In the field of video generation, SkyReels-A1, which supports precise expression and movement control, has achieved a technical breakthrough SOTA; in the field of AI music, Mureka O1 has surpassed its competitor Suno, topping the industry SOTA.

Mureka O1's score in the objective evaluation of text-generated music

Secondly, while steering clear of overcrowded markets, Kunlun leverages its experience in overseas businesses to choose directions that align more closely with its existing business expertise.

Focusing on three businesses: AI music, AI short dramas, and AI social networking, Kunlun, which has been expanding overseas since 2009 in the music and social networking fields, currently owns the overseas social entertainment product StarMaker (similar to WeSing) and several overseas social apps. From the accumulation of over 2 million copyrighted songs at the bottom layer to traffic acquisition, social gameplay, and payment design, Kunlun has amassed technology, products, and traffic, with both tracks falling within its "comfort zone."

AI short dramas represent Kunlun's attempt to tap into the popular overseas trend. In less than a year of testing, Kunlun's short drama overseas platform DramaWave has achieved monthly revenue of tens of millions of dollars, becoming a new driver of Kunlun's revenue growth.

By avoiding direct competition with major companies and leveraging existing business genes, Kunlun swiftly screens, tests, and decides whether to continue with new businesses during its transition to an AI company, striving to ensure that every investment pays off.

This is also influenced by the investment mindset of Kunlun's founder Zhou Yahui. This founder, who once invested in unicorn companies like Inke and Dada, relied on several precise mergers and acquisitions during Kunlun's listing phase to shift Kunlun, which was listed through web games at the time, to the overseas market. Today, Opera, which accounts for 40% of revenue, was acquired by Kunlun in its early days.

Continuing this investment mindset, Kunlun made its AI strategy clear from day one: to quickly trial and error in a short period of time to identify directions with commercial value.

However, to achieve SOTA, even though the R&D costs and computing power required are relatively cost-effective compared to other tracks, Kunlun still needs to invest substantially: Last year, Kunlun reported its first loss after a decade of profitability, with the core reason being the payment of up to 1.58 billion yuan in R&D costs.

In fact, "burning money" is a necessary path for enterprises during Kunlun's transition "labor pains."

As a company that independently develops everything from chips, foundational large models, to application products, ByteDance and Alibaba have both committed to continuing to invest in AI infrastructure. The former has a budget of over 80 billion yuan this year, while the latter plans to invest over 380 billion yuan cumulatively within three years. When weighing costs and revenue, most companies in the market are currently experiencing a significant gap between costs and revenue.

The reason Kunlun can spend so much money "burning" on AI is its conviction that early-stage R&D can swiftly translate into computing power, technology, and talent, thereby securing market share.

The story of investing early in technology and products and later reaping market position has already been proven during Kunlun's overseas expansion era.

At that time, Kunlun, targeting the overseas market, chose the relatively less competitive audio social track and focused on creating karaoke products overseas. The Star Group acquired by Kunlun included a library of 2 million overseas copyrighted songs, but after the acquisition, unclear vocal accompaniment significantly degraded the user experience.

To address these issues, Kunlun specifically established an AI composition lab and spent three years of R&D to bring AI vocal elimination technology to the forefront. To this day, a high-quality song library remains one of StarMaker's advantages.

As early as 2022, Kunlun explored the overseas expansion of AI-generated songs.

In the AI era, Kunlun still employs the same logic as StarMaker to conduct business, namely solving technical problems first, then optimizing products, and securing the top position in the market.

To enhance its technological advantages, Kunlun spares no expense in its investments. To achieve integrated coordination of software and hardware and further stabilize computing power and improve the training effect of large models through underlying infrastructure, Kunlun not only independently develops foundational large models and multiple vertical large models but also invests 800 million yuan in chips during the early stages. The financial report indicates that Kunlun's acquired company Aijieke Xin is currently more than halfway through its overall R&D progress and is pushing forward with mass production.

Fortunately, Kunlun's financial report has gradually shown signs of recovery. Nowadays, with the rapid decline in the cost of large model training and inference, Kunlun's R&D expenses are expected to decrease, and the revenue of multiple AI businesses bet on a year ago has also begun to increase. Kunlun is currently navigating a period of growth towards profitability.

While revenue is increasing, Kunlun is also exploring more potential tracks based on the support of its technological foundation.

For example, in 2025, the year of Agent explosion, Kunlun has already announced in advance the release of its general Agent platform next month. As the world's first AI for productivity scenarios, Kunlun's next ambition is to create an ecosystem platform. In the announcement, Kunlun will not only provide the world's first open-source DeepResearch Agent framework but will also open up a vast number of MCPs for developers to utilize.

Spending every penny wisely, how many "StarMakers" can Kunlun cultivate with the same mindset next? This will be its confidence in transitioning to the AI era.