Quarterly revenue exceeds ten million, robot leasing becomes a highly profitable industry

![]() 05/22 2025

05/22 2025

![]() 455

455

Author | Mao Xinru

Editor | Bai Xue

After the May Day holiday, some merchants engaged in robot leasing began to feel anxious.

Without the glow of the holiday, merchants with a sudden drop in customer resources directly called out that they "can't rent them out".

Of course, it cannot be ruled out that some merchants use this as a gimmick to attract traffic, but this leasing frenzy has indeed brought joy to some and sorrow to others.

On a social media platform, a merchant from Yunnan directly quoted prices in a post, with the Unitree G1 basic version costing 8,000 yuan per day and the dance version costing 12,000 yuan per day.

When we tentatively asked in the background, "It seems like your quotation is a bit on the high side, is there any advantage?"

The reply received was, "We're making changes now."

Within less than an hour, the quotation changed to 6,000 yuan per day for the basic version and 10,000 yuan per day for the dance version.

The sudden price drop is not only a result of competition among various companies on pricing, but also reflects the large profit margin behind robot leasing.

Unitree ignites the robot leasing market

In fact, robots performing on the Spring Festival Gala are not a new phenomenon, and similarly, earning money through leasing robots for performances is not a novelty that emerged this year.

During the 2016 Monkey Year Spring Festival Gala, UBTech brought 540 ALPHA 1S robots on stage to dance alongside singers, garnering a great deal of attention.

Although these robots are humanoid robots less than 40 centimeters tall, they can perform difficult movements such as raising their hands, folding, and twisting.

At that time, some people had already set their sights on the robot leasing performance industry.

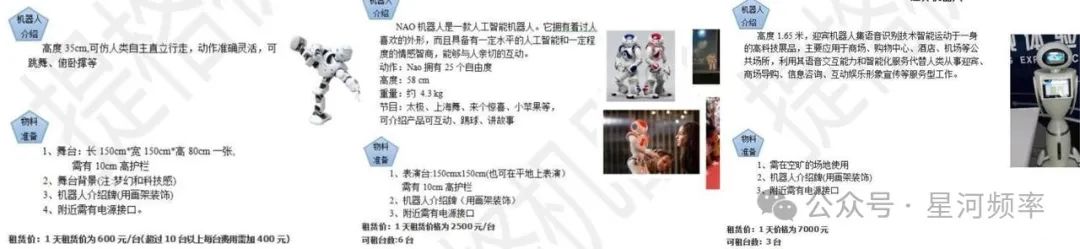

In the same year, a robot company called Tige in Shanghai launched a variety of robot leasing services.

Rental prices vary depending on the robot's functionality.

For example, the UBTech ALPHA 1S, which was also featured on the Spring Festival Gala, costs 600 yuan per day, the French humanoid intelligent robot NAO costs 2,500 yuan per day, and the rental price for a welcoming robot is even higher at 7,000 yuan per day.

However, due to the limited technological popularization and communication capabilities at that time, the robot leasing market was relatively small.

Not only was the coverage area small, but the commercial value demonstrated by leasing was not as apparent as it is now.

Fast forward to now, nine years later, with the rapid development of the internet and the emergence of high technology, people have more extensive channels to understand technology and more capabilities to access advanced technology.

Against this backdrop, a video of Unitree robots wearing colorful jackets and doing yangko dance garnered over 230 million views, successfully igniting social media.

This phenomenal spread not only made Unitree Technology a public focus but also thoroughly ignited the upsurge in the robot leasing market.

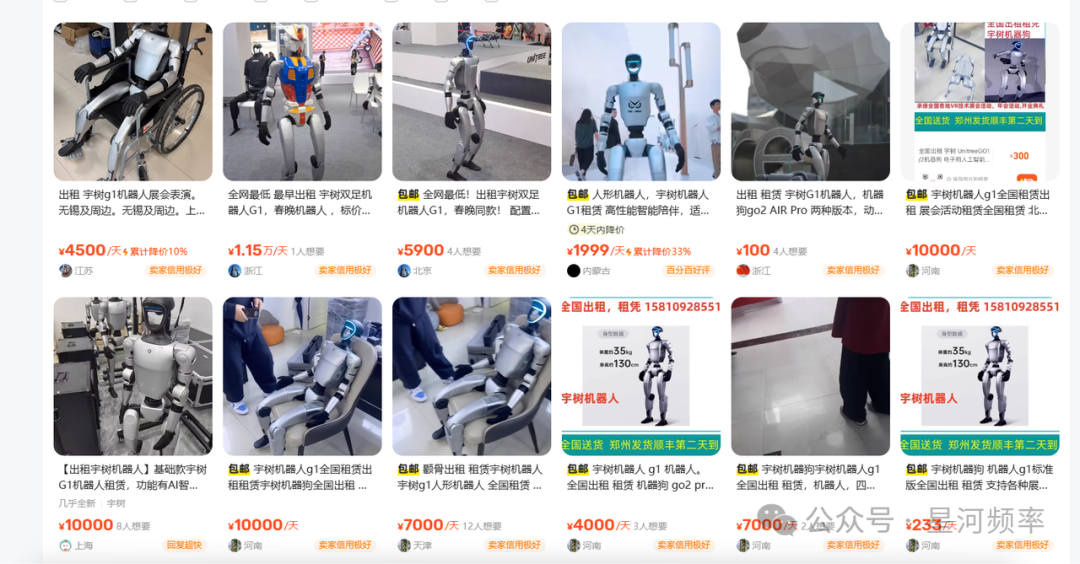

In just four months, nearly a thousand Unitree robot merchants emerged in the second-hand leasing market.

However, even before the Spring Festival Gala, some people had already earned money by leasing Unitree robots.

In August of last year, A Rong, who was engaged in the laser marking machine leasing business, first learned about Unitree Technology at the 14th Shenzhen International Industrial Automation and Robotics Exhibition.

At that time, Unitree's popularity was far from what it is now, and in common parlance, "nobody knew who was who".

The Unitree Go 2 robot dog on the exhibition stand caught A Rong's attention. Although the Unitree G1 was also standing next to the robot dog, the robot dog, with its ability to perform various tricks, was far more eye-catching than the robot.

At the exhibition, the price of the Unitree G1 was 66,000 yuan per unit, and the price of the robot dog Go 2 was 18,000 yuan per unit. Both robots and robot dogs were available in stock, and there was a discount of 20% for every unit purchased.

A Rong immediately bought 1 robot and 5 robot dogs, launching his robot leasing business.

From the outset, he targeted short video platforms as a customer acquisition channel, but at that time, market awareness of robots and robot dogs had not yet fully increased. Therefore, from September to December of last year, he received about 5 orders per month, with an average order value of 5,000 yuan, mainly from orders within Guangdong Province.

In the first four months, he barely managed to break even. With the popularity of Unitree robots on the Spring Festival Gala, his robot leasing business also saw a surge.

Daily income exceeding ten thousand yuan, robots become a highly profitable harvest machine

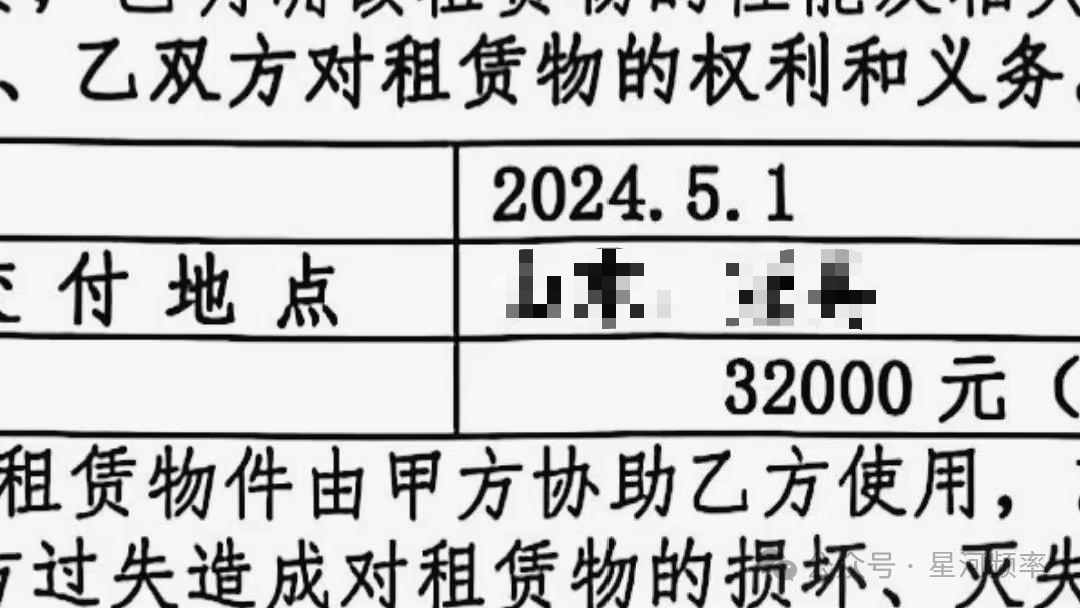

On the eve of May Day, A Rong shared a pre-order for May Day, which showed that the appearance fee for one robot on that day reached 32,000 yuan.

Although driven by the special consumption scenario of the May Day holiday, the daily salary of robots reached 32,000 yuan, it can also be seen from second-hand platforms that the usual leasing price of Unitree robots ranges from 3,000 yuan to 30,000 yuan, with differential pricing based on the robot's functionality.

A Rong himself admitted, "This is a highly profitable industry."

Now, after nine months in the leasing business, he owns 20 robots, including Unitree G1, U1, and U2 models, as well as 100 Go2 PRO robot dogs.

Currently, his team has 50 people, 20% of whom are technically proficient, and of course, he himself can program robots.

In February of this year, he achieved his highest monthly revenue to date, exceeding 2 million yuan. He estimates that from February to the present, his revenue has exceeded 5 million yuan.

A Rong revealed, "Earning five million in three months is only average in the industry. I know some people who can earn over 10 million in a quarter."

Through the operational strategy of "focused track + high-premium leasing", he has achieved an average of 50 orders per month and revenue of over a million yuan.

One of the keys to successful operation is choosing a focused product.

Because he values the market recognition and reputation that Unitree has already established, he chose to only lease Unitree robots.

Unitree has an absolute say in the current leasing market, not only because it started selling early, has relatively cheaper prices, and has a large amount of traffic, but also because it already has successful marketing cases and has been "exposed" enough times to the audience.

In terms of product selection, he also bought a wide range of robot dogs, basic versions, and versions that can be secondarily developed. Through the large holding volume, diverse product selection, and stable product reputation, his business remains consistent and stable.

The second key is clear cost control.

A Rong put all his costs into the robots, mainly including the purchase of robots and their routine maintenance.

He expanded his robot holdings in batches. The price of one Unitree G1 is 99,000 yuan, and he bought the Unitree U1 and U2 for 350,000 yuan each, while the Unitree Go2 PRO costs 18,600 yuan per unit.

There is a 20% discount for orders of 10 or more units. Based on the reference prices, his invested costs exceed 3 million yuan.

As for labor, about 80% of his team are operators who are mainly responsible for moving and supervising the robots when they go out on field assignments.

In addition, by dynamically adjusting market prices, the profit calculation formula for leasing robots and robot dogs becomes very simple and straightforward.

The profit from leasing one robot only needs to subtract 2,000 yuan for labor costs and the difference in travel reimbursement from the rental price for that day.

Taking an order with a rent of 32,000 yuan as an example, the order is in Guan County, Shandong Province, and the lessee bears the travel expenses of 1,000 yuan, including accommodation.

Traveling from Guangzhou to Guan County costs at least 800 yuan, and accommodation can be controlled within 200 yuan, so the gross profit can reach around 30,000 yuan.

When leasing a robot dog, because it is delivered to the renter via express and no operator accompanies it, the profit is directly equal to the rent.

A Rong only believes in the commercial value of robots.

He said that robot leasing will be a great industry for the next five years, but he will not expand his scale any further due to the limited size of the local market.

As the business scale expands, robot transportation will become a new issue.

It is still inconvenient to transport robots across provinces, as one must not only consider costs but also ensure that no accidents occur during transportation.

Therefore, robot leasing is still mostly locally operated. A Rong mainly operates in the Pearl River Delta region. If he chooses to set up bases nationwide, it will be another considerable expense.

At the same time, he also said that if there is no profit, he will immediately exit the market, and the final destination for robots and robot dogs will be the trash can and scrap iron.

It's like the classic line from "Westworld", "This brutal pleasure will end in brutality."

This is a shared economy with an end

In the current era of the sharing economy, robot leasing, as an extended form, has successfully harvested a wave of market dividends.

However, robots are ultimately different from products like power banks and bicycles. Robot leasing will be a shared economy with an end.

First, robot leasing is a short-term boom driven by novelty.

The explosion of the leasing market is essentially a capital game driven by the novelty of technology.

From a short-term perspective in the robot leasing market, it has already screened entrants. Currently, there are some netizens on the internet who have purchased a few robots to try their hand at the leasing market. Due to the lack of long-term and consistent orders, they are in a dilemma of not being able to rent them out.

Subsequently, there is also the dilemma of "possibly not recouping costs" and "robots that can't be rented out are useless at home".

On a social media platform, a merchant from Shenzhen encountered such a problem after the May Day holiday ended.

Owning one robot dog and one robot, he has limited customer resources, and the robot can only perform basic functions such as shaking hands, waving, squatting, and walking, making it less competitive in the market.

So now, he wants to choose to sell the robot at a low price.

At the same time, as more and more players enter the market, competition in price wars will also test the operational abilities, marketing abilities, technical proficiency, and resource holding capacity of leasing merchants. Players with insufficient comprehensive strength will also be eliminated early.

Facing the price war, A Rong feels that it is a normal thing, but he is not worried. Because he only talks business with customers who can accept his pricing.

After May Day, quotations during non-holiday periods vary greatly among companies.

A tenant in Zhejiang quoted 4,000 yuan per day for the basic version and 7,000 yuan per day for the dance version, while a tenant in Xi'an quoted 8,000 yuan per day for the basic version and 15,000 yuan per day for the dance version. A tenant in Beijing only offers the basic version, with a quotation of 6,666 yuan per day.

A Rong's quotation is 5,000 yuan per day for the basic version and 15,000 yuan per day for the dance version.

Thinking that thin profits can lead to higher sales and setting a lower price, or having confidence in the team's strength and setting a higher price, each merchant has their own pricing logic. However, those who can earn more, like A Rong, are not in the minority in the industry.

In the long run, this is essentially a prosperity under the attention economy.

Taking humanoid robots as an example, despite the rental fee of tens of thousands of yuan, they cannot be stopped from frequently appearing in first-tier cities down to third- and fourth-tier cities. Even the order schedules of many leasing companies are fully booked.

However, the scenarios in which robots appear are mostly commercial performances and cultural and entertainment performances, and sometimes they only need to stand there.

The core of this demand is not a rigid scenario demand but an "eyeball economy" for corporate marketing and event traffic.

When people are no longer fascinated by the monotonous performances of robots, the robot rental market will also experience a corresponding contraction.

Secondly, the current boom in the rental market precisely reflects that robots have not yet truly met user needs. Once technology breaks through the critical point of functionality, its mode of penetration will also undergo a fundamental transformation.

Currently, consumer-grade robots are focused on simple interactions and basic tasks, lacking autonomous decision-making capabilities and generalized execution abilities in complex scenarios. This functional limitation results in rental demand being concentrated only in short-term, low-frequency scenarios.

Taking Unitree as an example, a Unitree salesperson once stated: "Unitree's humanoid robots are currently not suitable for purchase for dance performances because their movements are very limited, only able to walk and wave. If a dance performance is to be realized, it requires a large number of company personnel to develop adaptations, which is very costly."

Although Unitree has made significant progress in hardware research and development, the degree of intelligence of its upper-level software is still insufficient in practical applications. Currently, Unitree is actively deploying software upgrades to further enhance the robot's generalization ability and multi-scenario execution capabilities.

In May of this year, Unitree partnered with Reborn, a company specializing in AI data and model infrastructure, to use its RoboVerse simulator to increase the reinforcement learning speed of Unitree robots by 30 times while developing a wider range of application scenarios.

Therefore, when robots possess the ability to "solve problems" rather than just "display technology", audiences are more likely to choose to purchase directly rather than rent.

In addition, the functionality and commercialization of robots have always been the focus of competition among various companies. For robots to truly enter thousands of households, they must follow a "consumer-grade" route. At that time, robots will break through their "tool attribute" and lean completely towards a "companion attribute".

The current price of consumer-grade robots has always been a bottleneck for popularization. However, companies like Unitree, UBTECH, and Tesla have all proposed further compressing manufacturing costs. When technology maturity, cost, and user acceptance resonate, robots will transition from "optional consumer goods" to "necessities".

The "limited path" of robot rentals is actually a necessary stage in industrial evolution. Rental is merely a transitional form before technology matures and will ultimately be replaced by sales, subscription, or service bundling models.

Perhaps we are currently in a somewhat absurd transitional period - humans are using the most cutting-edge technological products to portray the most primitive curiosity.

However, under this shared frenzy, everyone is a beneficiary of technological development.