Billions of AI Chip Orders: A Surge in the Middle East Market?

![]() 05/22 2025

05/22 2025

![]() 609

609

Recently, President Trump embarked on a four-day visit to Saudi Arabia, Qatar, and the United Arab Emirates, focusing on "business" and "major deals".

During this trip, nearly 30 U.S. tech industry leaders have cumulatively signed agreements worth $600 billion, encompassing areas such as AI chips, airplanes, and communications. Notably, the U.S. decision to cancel negotiations on exporting advanced chips to the Middle East has garnered significant industry attention.

In contrast to President Biden's stringent restrictions on AI chips, the policy shift has resulted in a flurry of AI chip orders being placed in the Middle East.

01 How Many Chips Were Sold on This Trip?

Before delving into the U.S. "easing" of AI chip restrictions on the Middle East, let's examine the significant orders secured by American companies from Middle Eastern tycoons during this trip. (For a previous analysis on the Middle East's semiconductor demand and data development, see our article "Middle Eastern Tycoons Set Their Sights on Semiconductors".)

Jensen Huang attended the U.S.-Saudi Investment Forum in Riyadh on May 13th.

NVIDIA was one of the prominent companies. On May 13, Jensen Huang made a high-profile appearance in Saudi Arabia, announcing the supply of the first batch of 18,000 Blackwell chips to the local AI newcomer Humain. These chips will be used to build a 500-megawatt data center in Saudi Arabia. Huang further stated: "In the next five years, Humain will receive hundreds of thousands of NVIDIA's most advanced AI chips."

AMD also secured a $10 billion order. While NVIDIA is focusing on AI infrastructure for Saudi Arabia, AMD is providing chip and software support worth tens of billions of dollars for Saudi Arabia's "Transatlantic AI Corridor" project, aiming to establish 12 supercomputing center nodes between Saudi Arabia and the U.S.

Qualcomm, too, announced its re-entry into the data center CPU market, signing an MoU with Humain to develop and build cutting-edge AI data centers based on Qualcomm's edge and data center solutions in Saudi Arabia.

It's evident that much of this cooperation revolves around Humain.

This AI newcomer stands out as it was established just one day before Trump's visit to Saudi Arabia on May 12. Humain is part of Saudi Crown Prince Mohammed bin Salman's "Vision 2030" strategy, aimed at diversifying the Saudi economy and serving as the core executive entity for Saudi Arabia's national AI strategy.

This competition among chip giants essentially embodies the concretization of Saudi Arabia's "Vision 2030" strategy. As the world's largest oil exporter, Saudi Arabia is investing $30 billion annually to promote economic transformation, with AI seen as the key to breaking the deadlock.

Humain, chaired by Crown Prince Mohammed bin Salman himself, is operated by Saudi Arabia's Public Investment Fund (PIF). PIF's mission is to build a 1.9-gigawatt data center by 2030 and has already supported multiple AI companies, including Alat, another enterprise hosted by Prince Mohammed, which plans to invest $100 billion in AI hardware and infrastructure by 2030.

PIF, with $940 billion in assets, aims to form a closed loop of "technology research and development - manufacturing implementation" by holding shares in Humain and Alat.

02 Winning Over the Middle East

During Trump's visit to the Middle East, the U.S. announced the abolition of the AI Diffusion Regulation.

Biden's AI Diffusion Regulation essentially established an "export classification" for AI chips, categorizing global countries and regions into three tiers, with different levels of export license restrictions. China fell into the most stringent category.

Under this regulation, the Biden administration placed Saudi Arabia and the United Arab Emirates in the Middle East on a "second-tier" control list, allowing them a quota equivalent to 50,000 H100 GPUs over the next two years, with the option to apply for an increase up to 320,000 H100 GPUs.

In contrast to the Biden administration's "diffusion control," the U.S. AI chip policy has undergone a sudden shift.

Not only did the U.S. abolish the AI Diffusion Regulation, but insiders suggest that the Trump administration is considering an agreement that would allow the United Arab Emirates to import over 1 million advanced NVIDIA chips. One-fifth of these chips will be allocated to Abu Dhabi's AI company G42, while the rest will go to American companies building data centers in the UAE, such as OpenAI.

Following the abolition of the AI Diffusion Regulation, the U.S. issued three new bans on AI chip exports:

- Using Huawei's Ascend chips anywhere in the world violates U.S. export controls.

- Warning the public about the potential consequences of allowing U.S. AI chips to train and infer Chinese AI models.

- Issuing guidance to U.S. companies on protecting their supply chains from diversion strategies.

Simultaneously, the U.S. government plans to warn the public that allowing U.S. AI chips to train and infer Chinese AI models poses serious risks.

Clearly, the U.S. is playing a game of "restricting opponents + winning over allies".

On one hand, the U.S. is relaxing domestic regulations and increasing investment in AI infrastructure to support local companies in leading the AI race. On the other hand, it is promoting the global deployment of the "American technology stack" to ensure countries use American chips, models, and tools instead of Chinese ones. Finally, it is implementing more precise and high-pressure export controls against China.

For the U.S. government and American tech companies, financially powerful Middle Eastern countries are a crucial battlefield for expanding the U.S. AI ecosystem and maintaining its leading position.

Saudi Arabia's promise to invest $600 billion in the U.S. includes $20 billion for AI data centers and infrastructure projects, as well as specific industry funds. This investment aligns with the U.S.'s strategic goals.

David Sacks, the U.S. Director of Artificial Intelligence and Cryptocurrency, stated at an event in Riyadh that the rule restricts the spread of American technology globally but poses no risk to "friends like Saudi Arabia."

On several issues, the U.S. government and American companies share a consensus: promoting American technology and blocking Chinese technology. Jensen Huang has publicly stated that "Huawei is our biggest competitor," while AMD testified before the U.S. Senate Committee on Commerce, Science, and Transportation that the U.S. should promote the global application of American AI technology while ensuring national security.

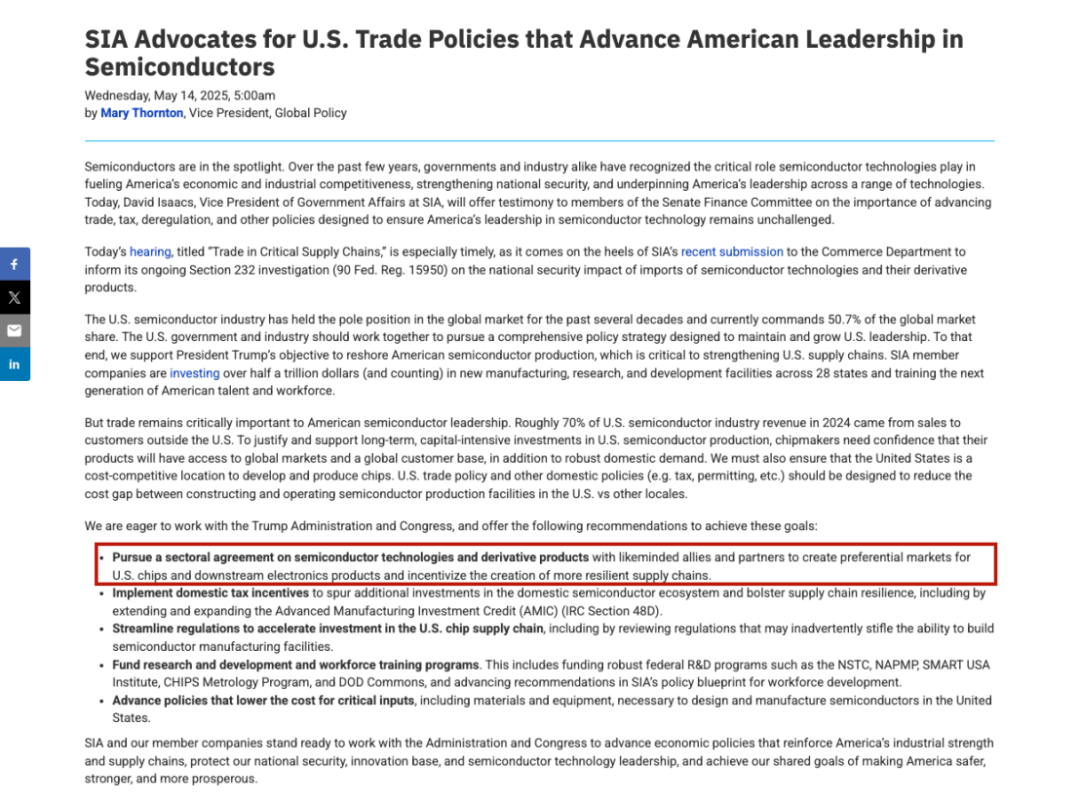

Just two days ago, the U.S. Semiconductor Industry Association (SIA) issued a statement hoping that Trump would "reach industry agreements with like-minded allies and partners on semiconductor technology and its derivatives, create preferential markets for American chips and downstream electronic products, and incentivize the establishment of a more resilient supply chain."

Huawei's Ascend series of chips are major domestic substitutes for NVIDIA's AI chips. The Ascend 910, released in August 2019, is comparable to NVIDIA's A100 in performance. According to iFLYTEK CEO Liu Qingfeng, "After optimization, the training efficiency of Ascend 910B can reach 90% of A100's." The next-generation 910C, comparable to NVIDIA's H100, reportedly entered mass production and delivery earlier this year.

Currently, Chinese tech companies like ByteDance, Alibaba, Tencent, Baidu, and Ant Financial Services are all using Huawei's Ascend chips.

If the BIS's "new rules" are assumed in the most extreme scenario—where Chinese companies using domestically produced Ascend chips within China also violate U.S. export control rules—it could result in Chinese AI having no share in the global market, and Chinese enterprises being unable or unwilling to buy either American or Chinese chips.

China's Ministry of Commerce has responded to the U.S., stating that the U.S. abuses export control measures and imposes stricter restrictions on Chinese chip products under baseless accusations, seriously damaging the legitimate rights and interests of Chinese enterprises, threatening the stability of the global semiconductor supply chain, and undermining market rules and the international economic and trade order. China urges the U.S. to immediately correct its wrong practices and will take resolute measures to safeguard the legitimate rights and interests of Chinese enterprises.

03 Conclusion

Notably, among the American business leaders accompanying Trump on this trip were Tesla CEO Elon Musk, OpenAI CEO Sam Altman, NVIDIA CEO Jensen Huang, Qualcomm CEO Cristiano Amon, Alphabet's President and Chief Investment Officer Ruth Porat, and IBM CEO Arvind Krishna.

However, Meta CEO Mark Zuckerberg, who attended Trump's inauguration ceremony, was absent from Trump's first visit to the Middle East, with no other Meta executives present. Similarly, Microsoft CEO Satya Nadella, President Brad Smith, Amazon founder Jeff Bezos, Google CEO Sundar Pichai, and Apple CEO Tim Cook did not travel to the Middle East. Additionally, among the chip giants that have reached agreements with Middle Eastern companies, Intel, a representative American company, was not involved.

On May 13, Trump praised Huang for attending the event and compared him to absent Apple CEO Tim Cook, saying, "Thank you very much, Jensen Huang. I mean, Tim Cook didn't come, but you did."

While this arrangement may be coincidental, it could also hint at the current development situation of the American AI industry and provide guidance for future resource allocation, particularly during the next four years of Trump's presidency.