Baidu: DeepSeek as the "Soul Ferryman"? Survival Hinges on Self-Reliance

![]() 05/26 2025

05/26 2025

![]() 587

587

Baidu's first-quarter results, released after the Hong Kong stock market closed on May 21, 2025, surpassed expectations across the board. Put simply, DeepSeek was a game-changer!

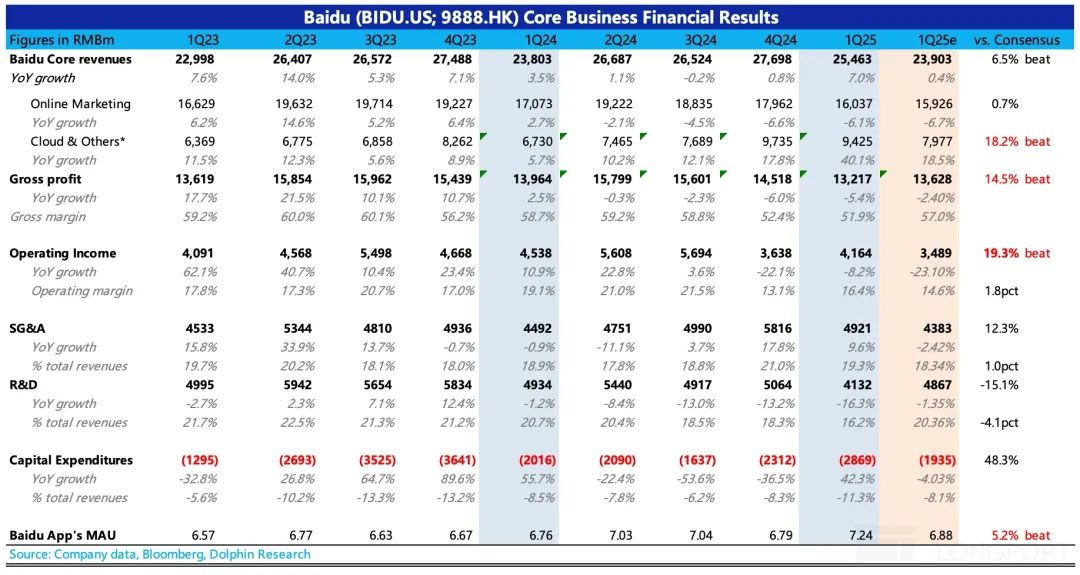

Key highlights (focusing solely on Baidu Core):

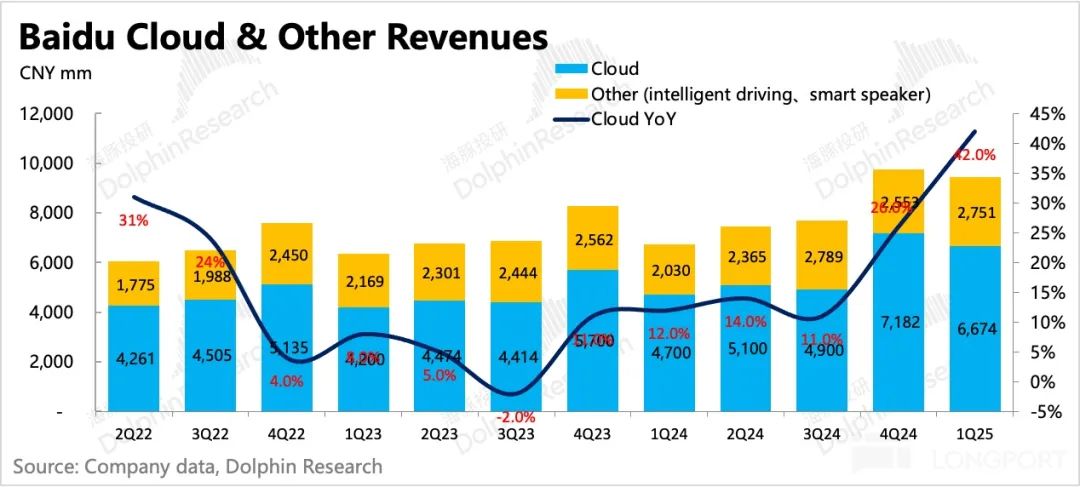

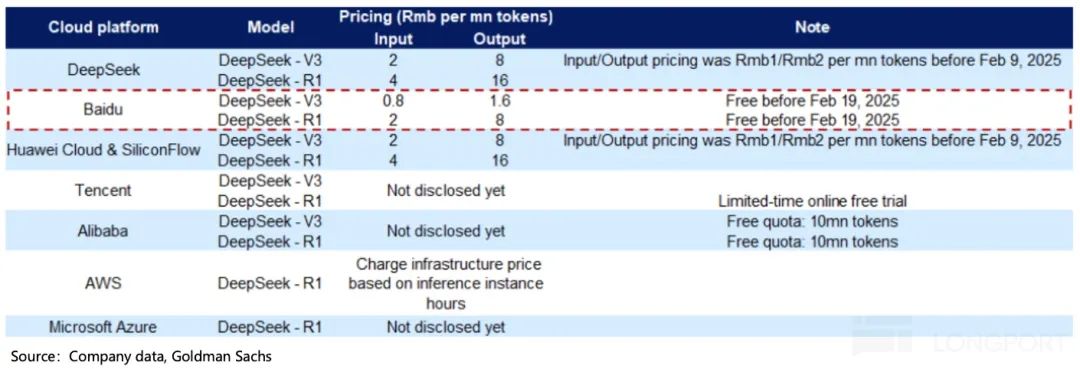

1. DeepSeek Drives Wisdom Cloud Growth with Network-wide Lowest Prices: Baidu was the first platform to fully capitalize on the DeepSeek dividend. Following its popularity, Baidu swiftly integrated it and launched a major promotion, offering the lowest priced computing power across the network. This directly boosted Wisdom Cloud growth from 28% in the previous quarter to 42% this quarter.

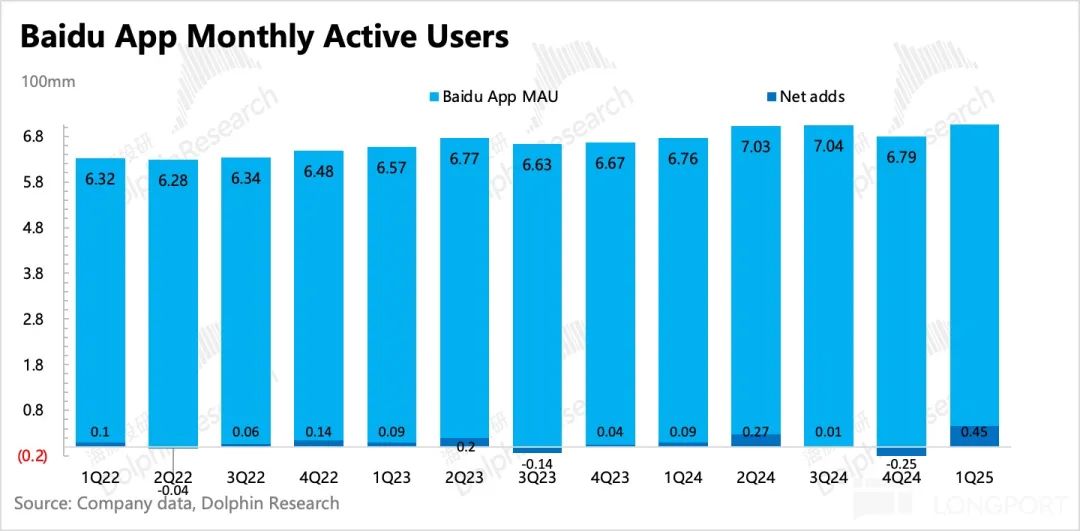

2. User Growth Experiences a Long-Awaited Surge: Besides the cloud, mobile Baidu's traffic also benefited from DeepSeek. In mid-February, the full-featured version of DeepSeek was integrated into Baidu Search, revitalizing existing user activity. Mobile Baidu's MAU surged by 45 million MoM, reaching a record high of 724 million.

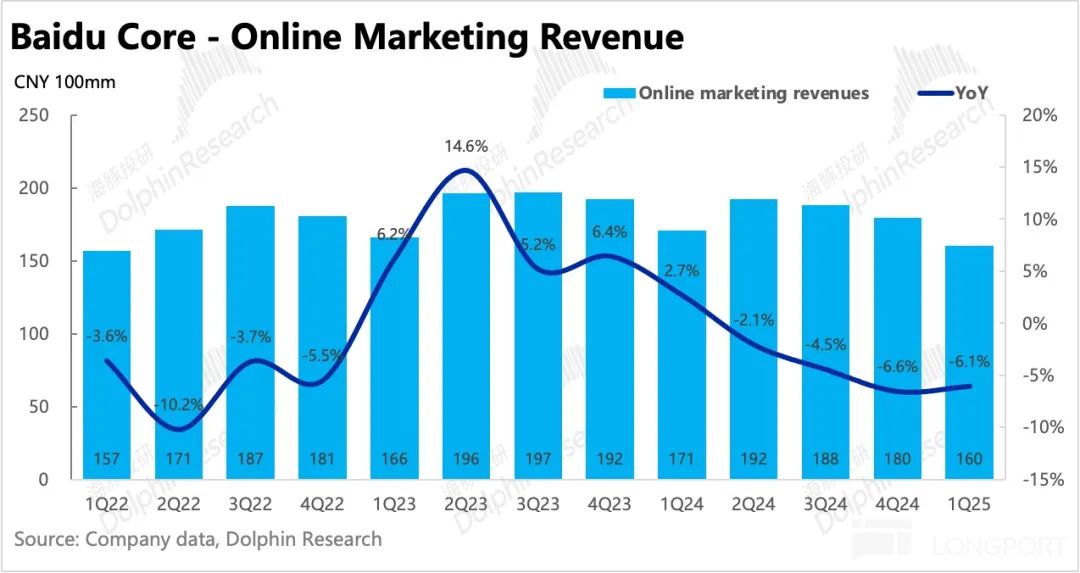

3. Advertising Performance Lags, AI Search Monetization Holds Promise: As anticipated, advertising faced pressure, declining by 6% YoY. Though it met company guidance, given the less severe macro environment in Q1, some institutions had slightly higher expectations. This resulted in disappointing advertising revenue from an expectations gap perspective. This further indicates that Q1's new traffic primarily focused on AI search, with traditional advertising unable to directly benefit. Baidu plans to gradually implement AI search monetization in Q2, making it crucial to monitor management's execution plan and phased goals.

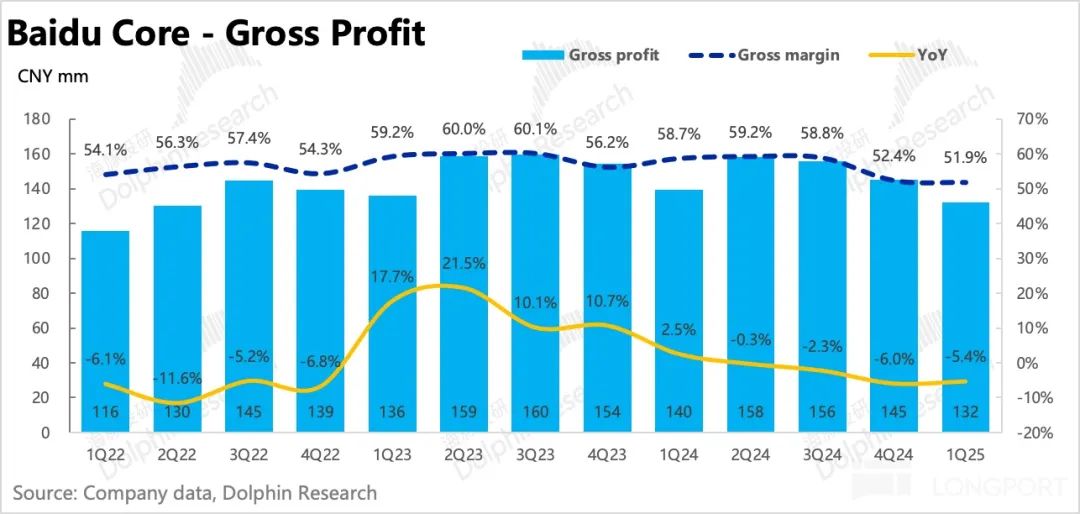

4. Innovative Business Economic Model Improves: From a gross margin perspective, it declined by 7% YoY in Q1, primarily due to changes in the business structure's proportion. However, a rough breakdown reveals that other businesses' gross margins continued to improve. Judging by significant improvement time points, this may be linked to Luobo Express's switch to RT6 and accelerated cloud business growth.

5. AI Enhances Internal Efficiency: While Baidu may not have garnered significant external AI dividends, internal efficiency improvements have been ongoing for nearly a year. In Q1, R&D expenses continued to decline, reflecting AI's role in boosting internal operating efficiency. This aligns with other high R&D investment internet platforms.

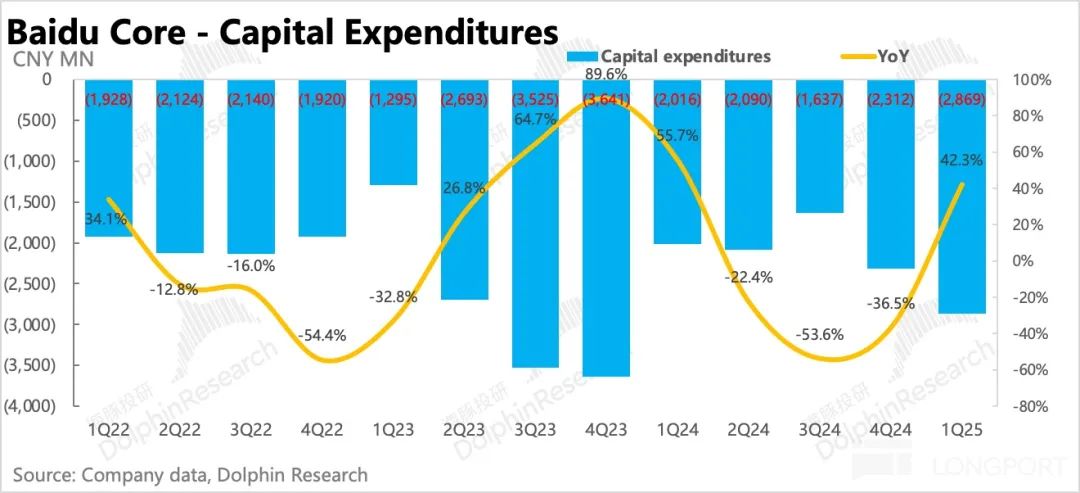

6. Capital Expenditure Resumes Expansion: Expanding now is a positive move. Baidu's capital expenditure has traditionally lagged behind other internet giants, even contracting last year due to profit and cash flow concerns. However, in Q1, possibly due to preemptive buying under chip purchase restrictions, capital expenditure resumed growth of 40%.

7. Buybacks Increase: Is Baidu Finally Generous? In Q1, free cash flow was negative due to increased AI-related operating expenses and short-term loan repayments, with net cash on the balance sheet (after deducting loans) of RMB 133.7 billion (USD 18.6 billion). Baidu Core repurchased USD 445 million in net cash in Q1, a MoM increase, bringing the 2023 repurchase plan's cumulative repurchases (USD 5 billion over 3 years) to USD 2.1 billion. Unless the company initially didn't intend to fully execute the plan, the repurchase pace is slow. However, Q1's quiet period was long. Assuming normal repurchases exceed USD 500 million per quarter for the rest of the year, the annual repurchase amount will approach USD 2 billion, doubling last year's. Based on the current market value of USD 30.7 billion, the return rate is 6.5%. In a period of low main business growth, this return rate is noteworthy, provided it's executed as expected.

8. Detailed Financial Report Data Overview

Dolphin Insights Viewpoint

In Q1, with advertising hopes dim, everything hinged on the cloud business. Fortunately, AI cloud, aided by DeepSeek and promotional offers, met expectations. From a valuation standpoint, Baidu is worth USD 29 billion. Excluding nearly USD 19 billion in net cash, the actual valuation is USD 10 billion, corresponding to the company's 2025 after-tax net profit of RMB 18 billion, with an actual PE of just four times. While Chinese concept stocks are often undervalued, Baidu's valuation is startling. Is it a value trap or an opportunity? Based on the current scenario, Dolphin Insights believes it's still a value trap until Luobo Express and Intelligent Cloud show tangible results.

Firstly, there's advertising, which Baidu avoids discussing. As a leaner camel, it's still a cash flow business, no matter how despised. The company aims to accelerate AI search monetization, but according to conference calls and subsequent communications, it's in an early stage, requiring gradual progress. This means Q1's poor advertising performance won't see marginal recovery in Q2 and may even accelerate its decline in Q2 and Q3.

Regarding Luobo Express's business logic, Dolphin Insights has long stated that the L4 model is too heavy. Navigating one street versus the entire city differs vastly, and rapid city- and nation-wide replication is another matter. Even if successful, it will be a long-term, asset-heavy, and long-term investment business. Its short-term valuation contribution may be more story-driven than fundamentals-driven.

Under these circumstances, the cloud business's "significant" expectations exceedance may garner some "encouragement" from funds. However, based solely on Q1 results, it's still challenging to convince us to completely alter our perception of Baidu's medium- and long-term growth as reflected by its intrinsic competitiveness.

In such a scenario, repurchases are the only thing supporting the bottom line: Baidu repurchased USD 450 million in Q1. Assuming an annual repurchase of USD 2 billion (with USD 2.9 billion remaining in the company's quota by year-end, making it one of Dolphin Insights's few focused Chinese concept companies unlikely to exhaust its quota), the current stock price corresponds to a 7% repurchase return. As a pure value stock with no growth, it's average compared to Vipshop and JD.com. Overall, to witness a clearer business inflection point, we must continue observing, and Dolphin Insights remains cautious.

Detailed Financial Report Interpretation

Baidu is a rare internet company that breaks down its performance into:

1. Baidu Core: Encompasses traditional advertising (search/information flow advertising) and innovative businesses (Intelligent Cloud/DuerOS Xiaodu Speaker/Apollo, etc.).

2. iQIYI Business: Includes membership, advertising, copyright sublicensing, and others.

These businesses are clearly separated, with iQIYI being a separately listed company with detailed data. Dolphin Insights will also break down these businesses in detail. Since there are about 1% (between RMB 200 million and RMB 400 million) of offset items between the two major businesses, Dolphin Insights' detailed Baidu Core data may slightly differ from actual reported numbers, but this doesn't affect trend judgment.

I. Will AI Search Monetization Be a "Breakthrough" or "Drinking Poison to Quench Thirst"?

In Q1, Baidu Core's advertising declined by 6.1% YoY. Though it met guidance, the Q1 macro environment wasn't as bad as anticipated. Compared to top institutions' slightly more positive expectations, it was still disappointing.

Regarding ecological scenario erosion, mobile Baidu's traffic significantly rebounded in Q1 with DeepSeek's help, with a net inflow of 45 million users. However, the new traffic's stickiness primarily focuses on the AI search page, preventing traditional search advertising from directly benefiting from the traffic rebound.

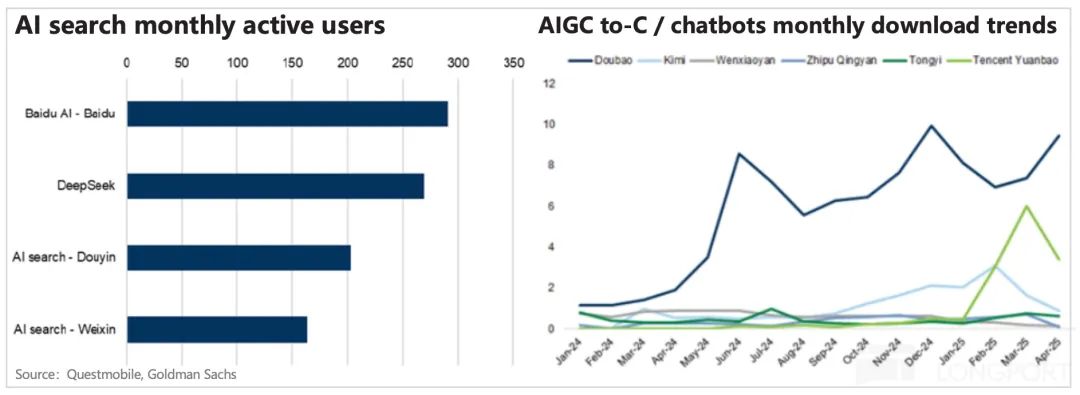

Looking solely at AI chatbot terminal traffic, the gap between ERNIE Bot and its competitors widened. Among peers, DeepSeek and Yuanbao surged in February and March, but in April, only Doubao stood alone and invincible. Besides Doubao, which has inherent advantages, a huge user base, and entertainment scenario advantages, other independent platforms struggle to maintain expansion and rely on original scenarios like Baidu Search and WeChat.

In Q2, Baidu will launch AI search monetization. How it's gradually implemented and the company's phased goals are crucial for guiding subsequent growth expectations and require attention.

II. Wisdom Cloud's Rapid Growth Relies on DeepSeek's Network-wide Lowest Prices?

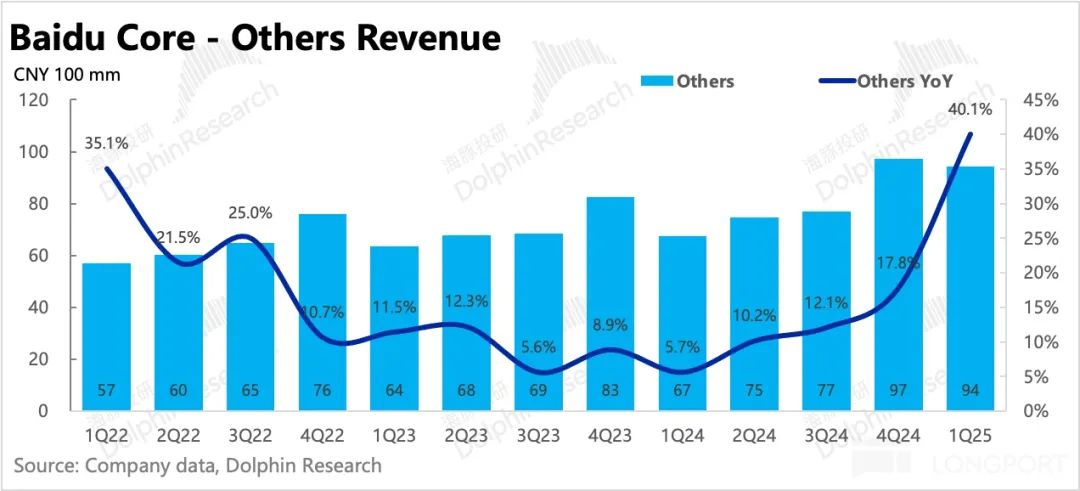

Among Baidu Core's other businesses (non-advertising), nearly 70% of revenue stems from Wisdom Cloud, with the remaining 30% primarily from autonomous driving technology solutions, smart speakers, etc. In Q4, other business revenue was RMB 9.4 billion, increasing by 40% YoY, with significant acceleration compared to the previous quarter. Wisdom Cloud's growth rate soared to 42% under DeepSeek, far exceeding the market's expected 25% growth rate.

When DeepSeek gained popularity in February, Baidu not only integrated it across all platforms at the first opportunity but also launched a highly advantageous pricing plan – free for half a month, followed by network-wide lowest prices. In mid-March, Baidu released ERNIE Bot 4.5, the first large model with multimodal capabilities, and the inference model X1. It not only led in technical benchmarks but also had more "attractive" prices compared to DeepSeek.

The accelerated growth of Baidu AI Cloud shows that current enterprise-side AI demand is high, and as a "shovel seller," Baidu Cloud can enjoy a growth dividend period.

Among other businesses besides Wisdom Cloud, namely Xiaodu, Smart Transportation, Autonomous Driving, etc., Q1 primarily benefited from YY's consolidation (estimated revenue of RMB 500 million), with a 35% YoY increase.

Among innovative businesses, the intelligent driving business stood out:

In Q1, Luobo Express received 1.4 million orders, increasing by 75% YoY, significantly accelerating compared to Q4's 36%, mainly due to progress under the expected UE economic model optimization, including deploying more vehicles and expanding into new regions. In April, Luobo Express was approved for open-road testing in Hong Kong.

Additionally, Luobo Express expanded abroad to Dubai and Abu Dhabi in the Middle East. In May, Luobo Express will commence road validation testing in Dubai.

III. AI Enhances Internal Efficiency, and Innovative Business Economic Model Improves

Changes in the business structure reduced the group's gross margin to 52% YoY. Although the proportion of other lower gross margin businesses increased by 2 percentage points compared to the previous quarter, the gross margin remained flat MoM, indicating that innovative businesses' UE models, particularly the intelligent driving business, continued to improve.

From the AI servers and chips capital expenditure perspective, Baidu's capital expenditure officially resumed expansion in Q1, with expansion signs already present in the previous quarter due to a quarter-on-quarter increase. While preemptive buying driven by chip purchase restrictions can't be ruled out, DeepSeek's revolutionary new R&D path significantly reduced enterprises' trial and error costs, obviously stimulating demand. This also prompted upstream "shovel sellers" to increase investment and expand supply.

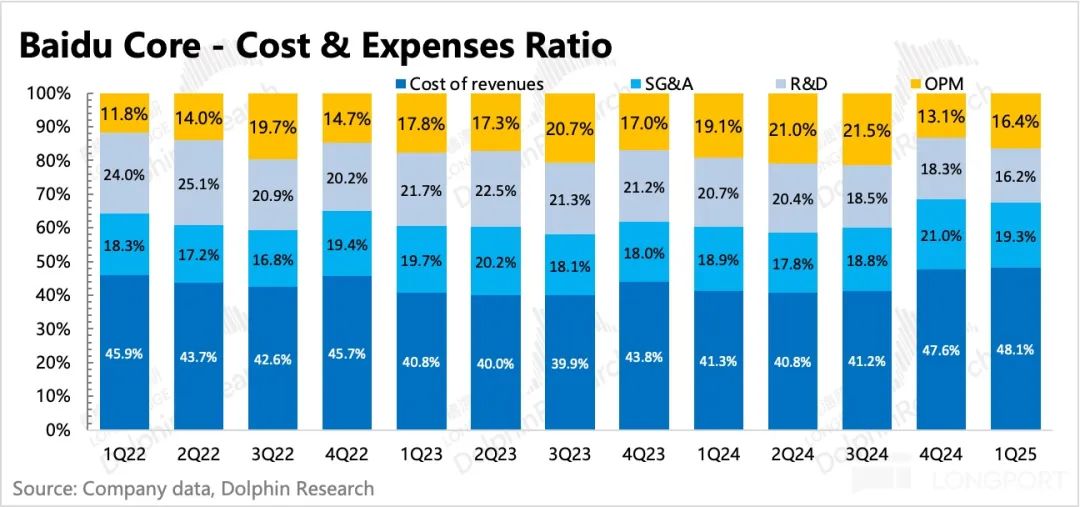

With regard to operating expenses, AI's influence on enhancing internal efficiency persists, particularly for core R&D personnel. During the first quarter, R&D expenses declined at an accelerated rate of 16%, while stock-based compensation (SBC) expenses for all employees dropped by 36% year-on-year. Apart from a market value reduction of approximately 15% to 20%, the remainder can be attributed to personnel optimization measures.

In conclusion, Baidu Core's operating profit for the first quarter amounted to RMB 4.2 billion, with a profit margin of 16%. This represents a year-on-year decrease of 3 percentage points, generally aligning with expectations. Modifications in the business structure will have a lasting impact on the group's overall cash conversion efficiency. As long as the period of advertising pressure persists, profit performance will continue to trail revenue growth. The turning point may only be observed in the commercialization of AI search. However, it is also a potential risk that users may harbor resentment and greater dissatisfaction.

For value investors who prioritize daily cash flow and group ROE over segment valuation, this ongoing decline in profitability is quite disconcerting. Unless there is a significant increase in share buybacks, the investment appeal of Baidu is waning for these investors.

- END -

// Repost Authorization

This article is originally created by Dolphin Investment Research. Kindly obtain authorization prior to republication.

// Disclaimer and General Disclosure Note

This report is solely for general comprehensive data usage, intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated entities. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or unique needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any individual making investment decisions by utilizing or referencing the content or information in this report does so at their own risk. Dolphin Investment Research shall not bear any direct or indirect responsibility or liability for any losses that may arise from the use of the data contained in this report. The information and data presented in this report are based on publicly available materials and are for reference purposes only. Dolphin Investment Research endeavors to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report should not be construed or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. It does not constitute advice, inquiry, or recommendation concerning relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials would violate applicable laws or regulations or subject Dolphin Investment Research and/or its subsidiaries or affiliated companies to any registration or licensing requirements in such jurisdictions.

This report reflects solely the personal views, opinions, and analytical methods of the relevant creative personnel and does not represent the position of Dolphin Investment Research and/or its affiliated entities.

This report is produced by Dolphin Investment Research, and its copyright is solely owned by Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no organization or individual may (i) produce, copy, replicate, reprint, forward, or create any form of reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.