Nvidia: Unwavering, Still the Premier Stock in the Universe!

![]() 05/29 2025

05/29 2025

![]() 746

746

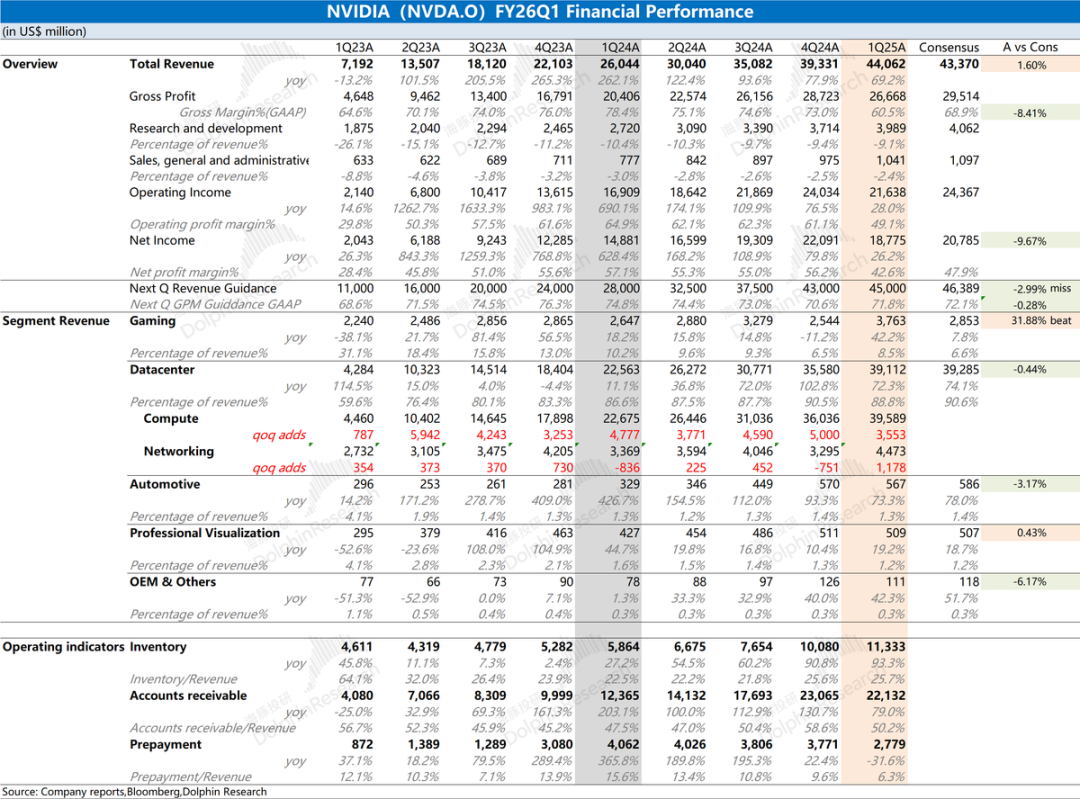

Nvidia (NVDA.O) released its fiscal Q1 2026 financial report (ending April 2025) on the morning of May 29th, Beijing time, following the U.S. market close. The highlights are as follows:

1. Core Financial Metrics: Revenue stood at $44.06 billion, meeting expectations ($43.37 billion), with a quarterly increase of $4.7 billion, fueled by the data center and gaming segments. Gross margin was 60.5%, lower than anticipated (68.9%), primarily due to a $4.5 billion provision for H20 chip inventory impairment. Excluding this impact, the company's gross margin for the quarter would have been approximately 71%.

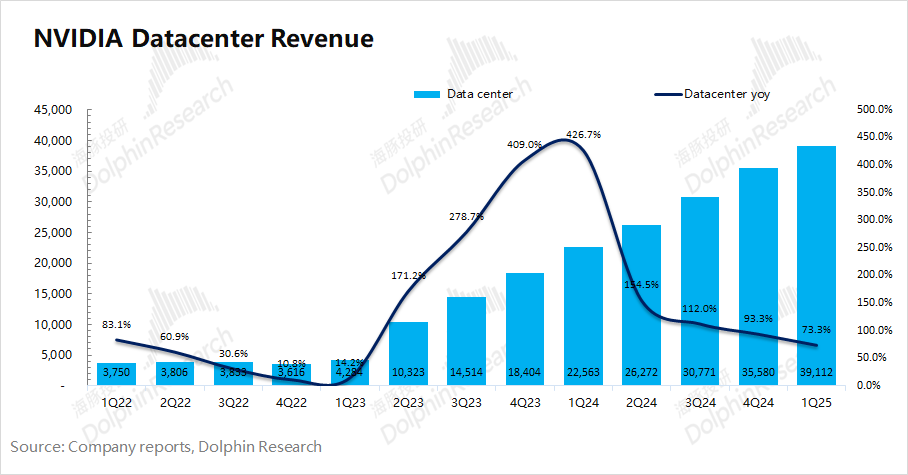

2. Data Center: Revenue amounted to $39.11 billion, marking a 72% year-over-year increase. The H20 incident impacted only the last two weeks of this quarter, with minimal overall impact. The revenue impact will mainly manifest in the next two quarters.

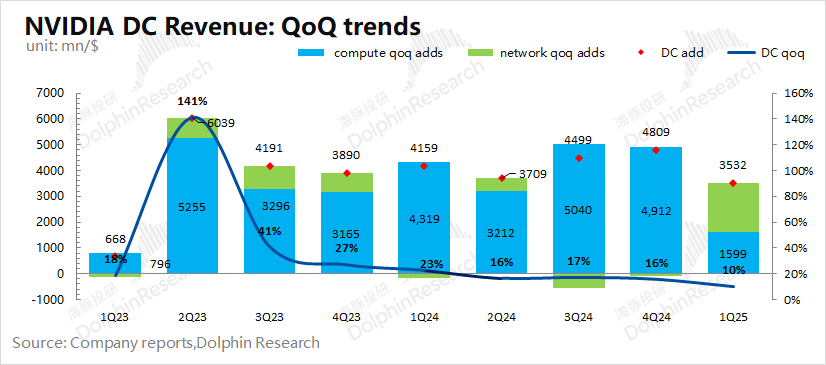

Breakdown: Computational revenue for the quarter was $39.6 billion, while networking revenue was $4.5 billion. Quarter-over-quarter growth in computational revenue slowed this quarter as some downstream customers anticipate the upcoming mass production of GB300 products, adjusting their capital expenditure timings accordingly.

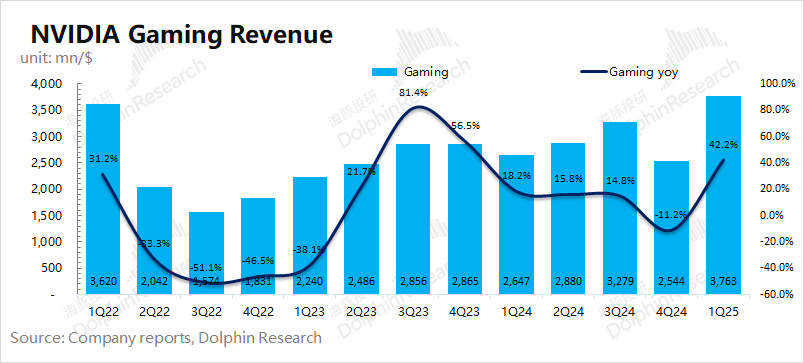

3. Gaming Business: Revenue was $3.76 billion, a 42% year-over-year increase, the most notable segment this quarter. Driven by the RTX50 series products, Nvidia's market share in discrete graphics cards has further increased, contrasting AMD's decline in gaming revenue.

4. Profitability: Core operating profit for the quarter was $21.6 billion, a 28% year-over-year increase. The core operating profit margin declined to 49.1%, mainly due to the $4.5 billion in related expenses for H20 inventory impairment.

5. Guidance: The company expects revenue of $45 billion in the next quarter, a $1 billion increase quarter-over-quarter; the gross margin (GAAP) for the next quarter is projected at 71.8%, a 11.3 percentage point increase quarter-over-quarter. The return of the gross margin to around 72% indicates that the company has largely completed the H20 inventory write-down this quarter.

Dolphin's Overview: Overall performance was solid, with confident guidance.

The company's revenue this quarter was largely in line with expectations, while the gross margin significantly declined due to the H20 ban, with nearly $4.5 billion in related expenses provisioned this quarter. Excluding this factor, the company's gross margin would have recovered to around 71%.

In terms of specific businesses, the gaming segment was a pleasant surprise with a 42% year-over-year increase, driven by shipments of RTX50 series graphics cards. The data center business remains a key focus, with the H20 incident's revenue impact mainly expected in the second and third quarters, having a minor impact this quarter (estimated at only 1-2 weeks). The slowdown in computational revenue quarter-over-quarter growth (from $5 billion to $3.5 billion) is attributed to H20 export restrictions in Q1 resulting in a $2.5 billion revenue loss and customers awaiting the mass production of GB300 products.

Compared to this quarter's financial data, the company's next quarter guidance offers more market confidence. Nvidia expects $45 billion in revenue, which seems like a modest $1 billion increase quarter-over-quarter but already accounts for the impact of nearly $8 billion in lost H20 revenue. Without the H20 incident, the company anticipates a $9 billion quarter-over-quarter revenue increase, which is impressive. Previously, Nvidia's highest quarterly revenue growth was only $5 billion, highlighting the strong downstream demand for Blackwell products.

Short-term, the U.S. H20 ban will affect Nvidia's performance. However, the company may later introduce customized products for the Chinese market to offset this loss. Gross margin expectations suggest that H20-related expenses, such as inventory write-downs, have been largely provisioned, allowing the company to operate more smoothly in the future. Despite an $8 billion revenue hit from the H20 ban, the company's $1 billion quarter-over-quarter increase next quarter further demonstrates robust Blackwell demand.

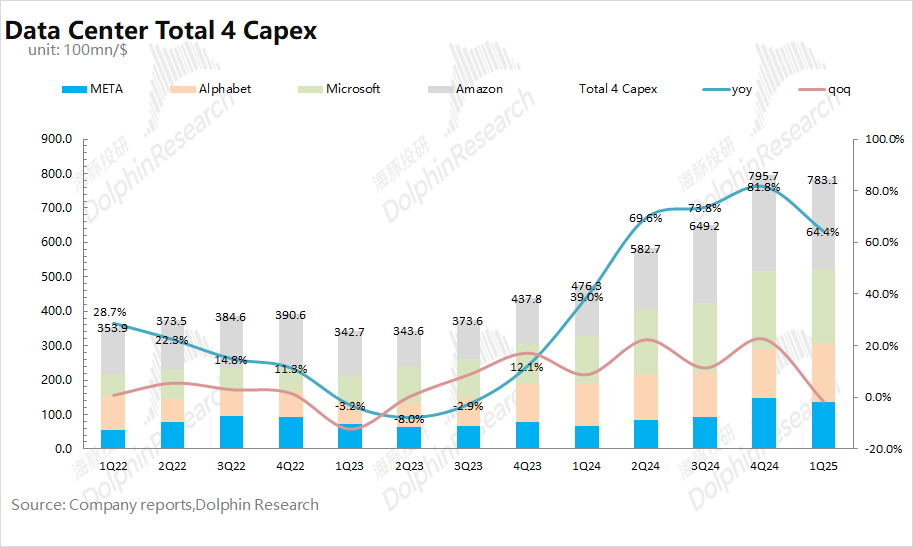

Considering the capital expenditure projections of the four major cloud vendors, Dolphin expects their combined capital expenditures to reach $346 billion in 2025, a 38% year-over-year increase. Since Nvidia's fiscal year 2026 first-half performance was atypical, valuation calculations primarily refer to (the second-half performance multiplied by 2). Nvidia's current market capitalization is $3.3 trillion, roughly corresponding to a PE of 26 times Dolphin's expected net profit for the second half of fiscal year 2026 multiplied by 2 (assuming a +55% year-over-year revenue increase in the second half, a -0.5 percentage point year-over-year gross margin decrease, and a 14.3% tax rate).

Before the Rubin architecture arrives, given that Blackwell still has a volume explosion cycle of over a year, using the annualized revenue for the second half of 2026 is a relatively conservative estimation. A PE of 22-26X is not expensive for Nvidia currently, and the company is expected to break free from the first-half trading range and open up a new upward trajectory.

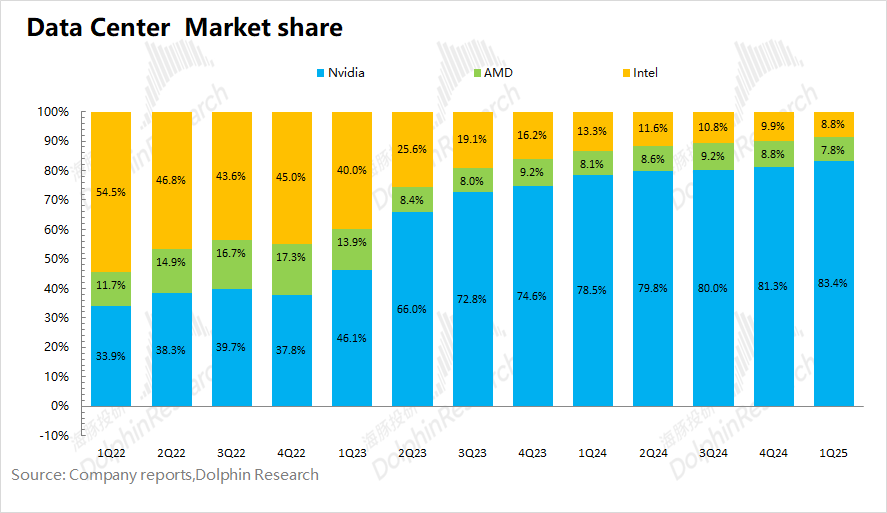

As Blackwell shipments increase, the H20 impact will gradually diminish. If customized products for the Chinese market are later introduced, they are expected to further compensate for this loss. Next quarter's guidance further underscores strong Blackwell demand in the market. Comparing the growth of the company's data center business with the capital expenditures of the world's four major cloud vendors reveals that Nvidia's share in the core data center chip market continues to rise, and the company is poised to reap more benefits from this round of expanded capital expenditures by giants.

For insights into the disruptions to Nvidia's business and guidance caused by the H20 export ban, as well as the real ramp-up speed of Blackwell shipments implied by the guidance excluding this impact, please refer to the short review "This time, Nvidia's outlook for the second half of the year and its judgment on the Chinese market are equally important..." in the Changqiao App. For details, visit the Changqiao App's "Dynamics - Investment Research" or scan the QR code below to join the Dolphin communication community.

Below is a detailed analysis:

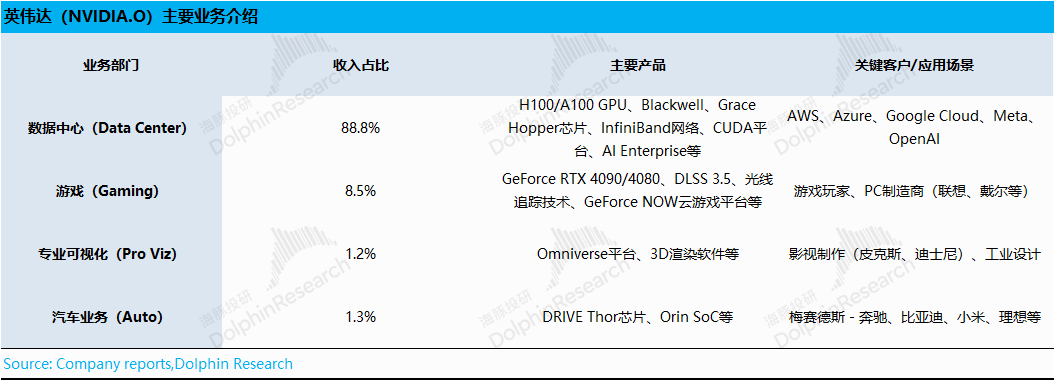

I. Nvidia's Business Scenario

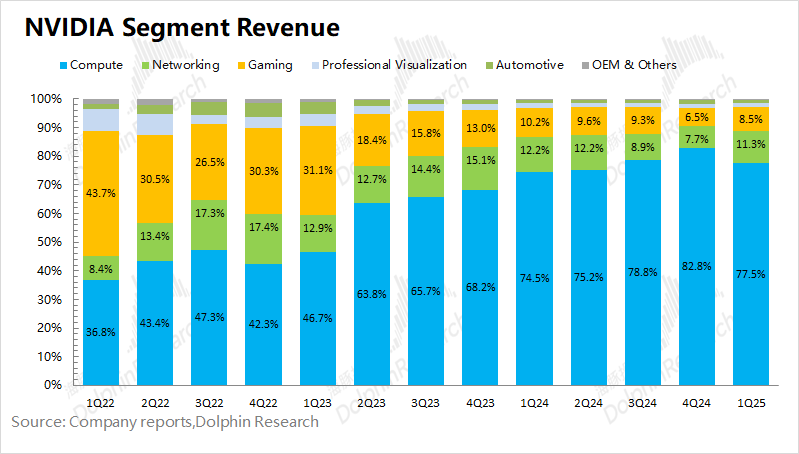

With the continuous growth of its data center business, it has now become Nvidia's largest revenue source, accounting for nearly 90% of total revenue. The gaming business, once the company's primary revenue driver, has been compressed to around 10%.

Specific Businesses:

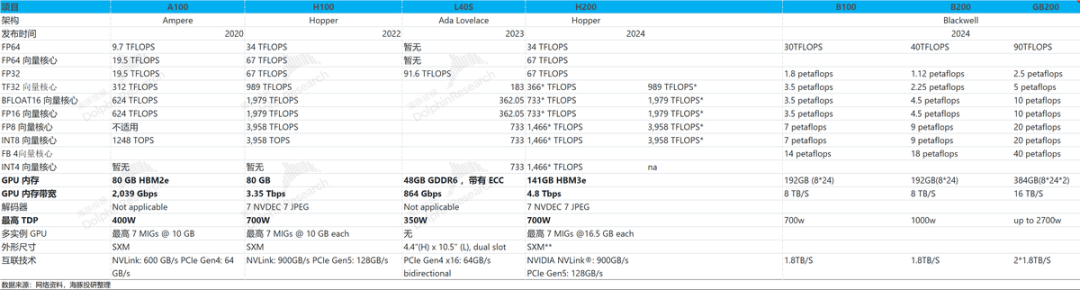

1) Data Center Business: Currently the main focus, with key products including H100, A100, Blackwell, and other computing chips. Core customers include cloud service giants such as Amazon, Microsoft, and Google.

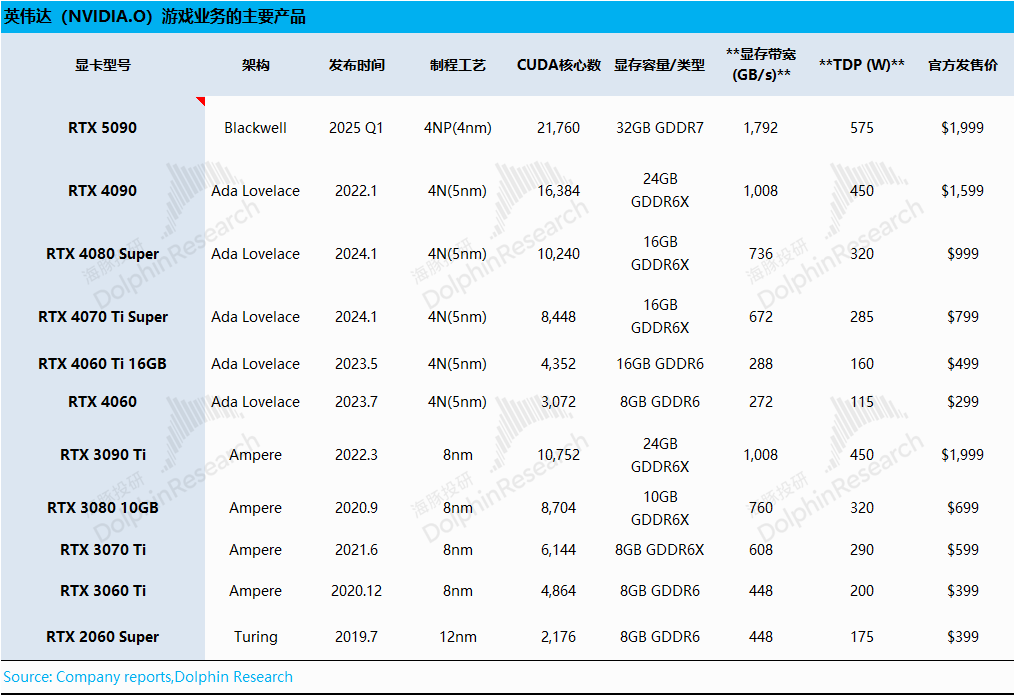

2) Gaming Business: Nvidia still leads the discrete graphics card market with its RTX40 and RTX50 series, primarily targeting gamers and PC manufacturers.

3) Professional Visualization and Automotive Businesses: These segments currently account for a relatively small proportion, both around 1-2%. The professional visualization business serves clients like Pixar and Disney, while the automotive business focuses on Orin and Thor chips, with customers such as BYD, Xiaomi, and Li Auto.

II. Core Performance Indicators: H20 Provision Impact Largely Over

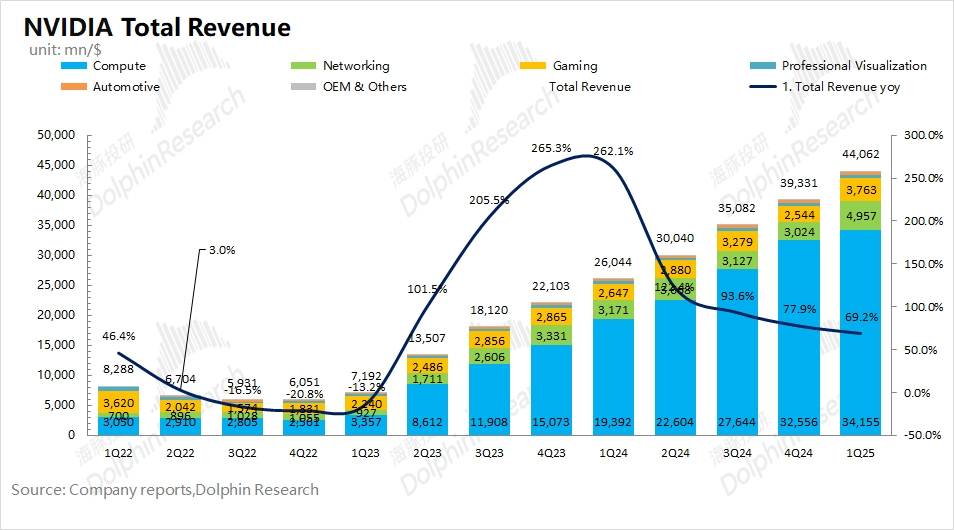

2.1 Operating Revenue: In fiscal year 2026 Q1, Nvidia achieved revenue of $44.06 billion, a 69.2% year-over-year increase. Growth was primarily driven by the data center and gaming segments, with the gaming segment outperforming expectations due to RTX50 series products. Cloud vendors anticipate the launch of GB300 products, and this quarter's performance was generally in line with market expectations.

Looking ahead to the next quarter, the company has provided revenue guidance of $45 billion, not as ambitious as the previous quarters' expected $4-5 billion quarter-over-quarter increase. This is due to the H20 ban's primary impact being felt in the following two quarters, which will affect revenue by around $8 billion next quarter. Excluding the H20 impact, the company anticipates a $9 billion quarter-over-quarter revenue increase next quarter, fueled by Blackwell and RTX50 series shipments.

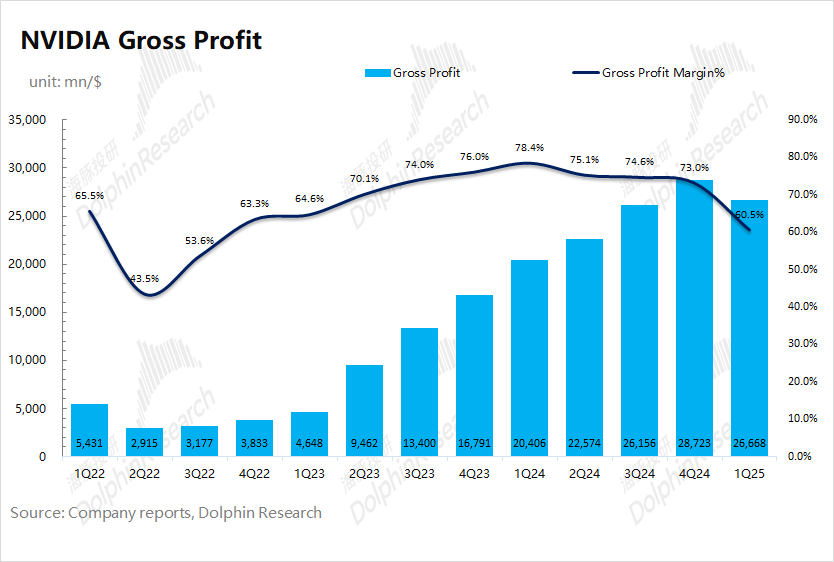

2.2 Gross Margin (GAAP): In fiscal year 2026 Q1, Nvidia achieved a gross margin (GAAP) of 60.5%, significantly lower than market expectations (68.9%). This quarter's gross margin "flash crash" was mainly due to the April H20 ban, with nearly $4.5 billion in related expenses, such as inventory write-downs, provisioned this quarter.

Since H20 products are primarily designed for the Chinese market, after the ban, the significant performance gap between H20 and Blackwell meant other regions would not purchase H20 products, necessitating inventory write-downs.

Excluding the H20 incident, adding back the $4.5 billion inventory write-down, the company's gross margin for this quarter would have recovered to around 71%, maintaining above 70%. The quarter-over-quarter gross margin decline (73% -> 71%) was also influenced by factors like the ramp-up of Blackwell products.

For the next quarter, the company expects a gross margin (GAAP) of 71.8%, returning to around 72%. This guidance indicates that the company has largely completed the H20 incident inventory write-down this quarter, with minimal impact on subsequent gross margins. With increasing Blackwell series shipments, the company's gross margin is expected to continue rebounding.

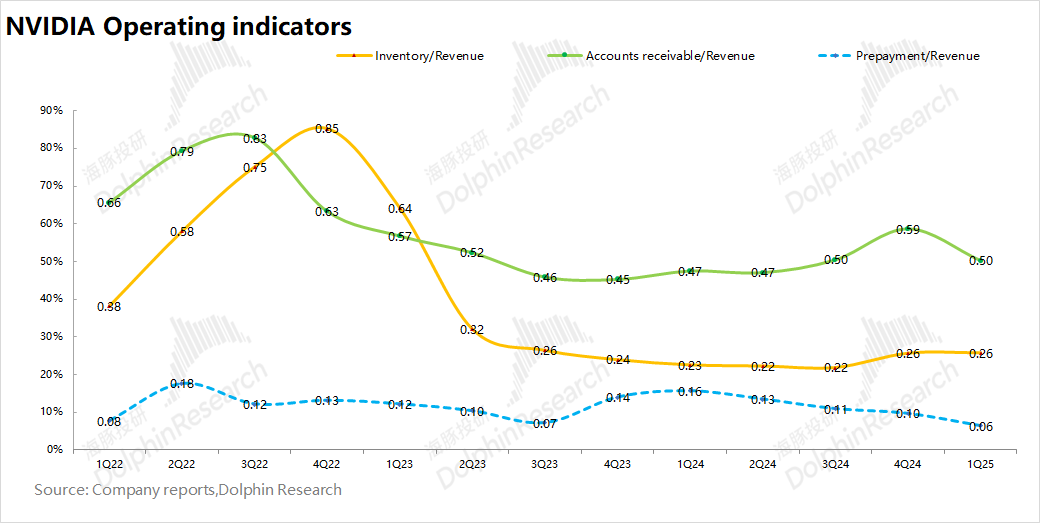

2.3 Operating Indicators

1) Inventory/Revenue: The ratio for this quarter was 0.26, flat quarter-over-quarter. Inventory increased to $11.3 billion this quarter, primarily due to stockpiling related to Blackwell products. With revenue still maintaining a high growth rate of nearly 70%, the company's inventory ratio remains relatively low.

2) Accounts Receivable/Revenue: The ratio for this quarter was 0.5, declining again. Affected by the company's high revenue growth, the proportion of accounts receivable for this quarter fell once more.

III. Core Business Progress: Market Share Continuously Rising

Driven by demand in AI and other areas, Nvidia's data center business (Compute+Networking) revenue share has approached 90%, while the gaming business share has been compressed to below 10%.

3.1 Data Center Business: In fiscal year 2026 Q1, Nvidia's data center business achieved revenue of $39.11 billion, a 73.3% year-over-year increase. The data center business remains the company's top priority, with this quarter's growth primarily driven by Blackwell products used for training and inference of large language models, recommendation engines, and generative AI applications.

Breakdown: Computational revenue in the data center business was $34.1 billion, a 76.1% year-over-year increase; networking revenue was $4.96 billion, a 56.3% year-over-year increase.

Since the market primarily focuses on the data center's growth potential, attention is paid to quarter-over-quarter increases. This quarter's computational revenue growth slowed to $1.6 billion, while networking revenue growth increased to $1.93 billion. This suggests that current downstream customers anticipate the upcoming mass production of GB300 products, thereby slowing down their computational purchases.

The H20 ban will have a short-term impact on the company's performance. As H20 is a China-specific product, other regions are unlikely to absorb this inventory. The company made a $4.5 billion inventory write-down this quarter and expects a nearly $8 billion revenue impact next quarter. However, considering the company's ability to still provide $45 billion revenue guidance for the quarter, even affected by the H20 incident, the company remains confident in Blackwell series sales. Without the H20 ban, the company anticipates a nearly $9 billion quarter-over-quarter revenue increase next quarter, which is impressive.

Furthermore, the cumulative capital expenditures of the four leading cloud providers in the first quarter of 2025 amounted to $78.3 billion, marking a 64.4% year-over-year surge. Coupled with the company's data center business experiencing a 73.3% year-over-year growth rate, Nvidia's share in the capital expenditure budgets of these giants continues to escalate. Cloud service providers serve as the primary demand driver for the company's data center products, hence their capital expenditure decisions directly impact Nvidia's performance. Following discussions with the management teams of these four companies, Dolphin anticipates their combined capital expenditures to reach $346 billion in 2025, a 38% year-over-year increase, thus underpinning the growth trajectory of Nvidia's data center business.

As NVIDIA, AMD, and Intel maintain their prominent positions in the core chip market for data centers, a comparison of their relevant businesses highlights that NVIDIA's market share continues to expand, fueled by its cutting-edge computing power products. Cloud service providers prefer NVIDIA's offerings when procuring core chips.

On the whole, Dolphin believes that the H20 incident will only temporarily affect NVIDIA, and the company retains the opportunity to recoup market losses by tailoring products specifically for the Chinese market in the subsequent stages. Additionally, the sustained increase in capital expenditures by major cloud providers offers further reassurance for the company's performance growth.

3.2 Gaming Business: In the first quarter of fiscal year 2026, NVIDIA's gaming business generated revenue of $3.76 billion, reflecting a 42.2% year-over-year growth, primarily attributed to shipments of the RTX 50 series products.

In comparison to AMD's performance, Dolphin contends that NVIDIA significantly gained market share this quarter. AMD's gaming business declined by 29.8% year-over-year, totaling $650 million. With the launch of its RTX 50 series, NVIDIA has secured a larger portion of the discrete graphics card market.

IV. Key Financial Indicators: Operating Expenses Remain Stable

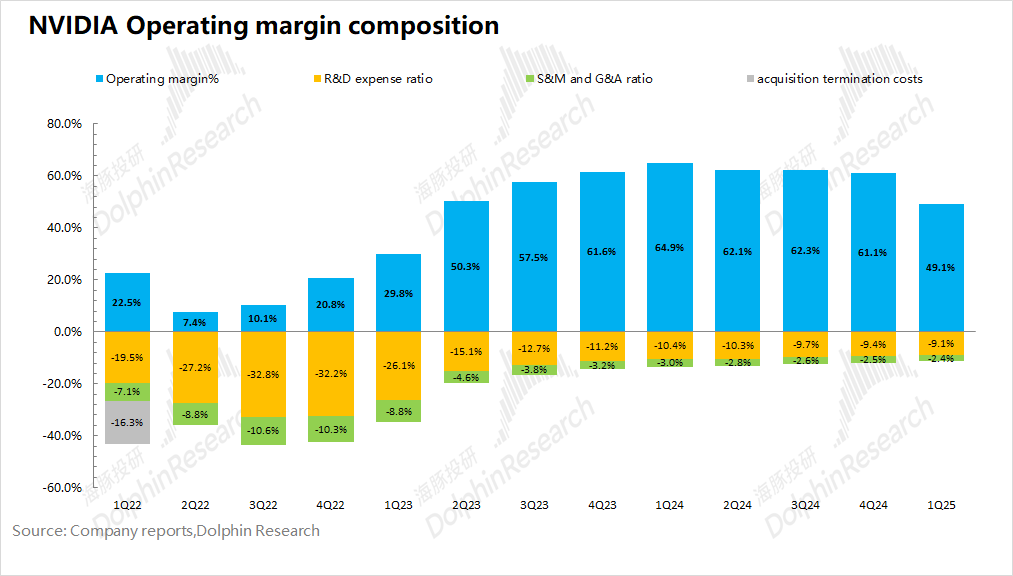

4.1 Core Operating Margin

NVIDIA's core operating margin for the first quarter of fiscal year 2026 stood at 49.1%, experiencing a notable decline. This was due to the write-down of H20 inventory, causing a "flash crash" in gross margin.

Breaking down the components of the operating margin, the specific changes are as follows:

"Operating Margin = Gross Margin - R&D Expense Ratio - Selling, General, and Administrative Expenses Ratio"

1) Gross Margin: This quarter's gross margin was 60.5%, a significant decrease attributed to the write-down of H20 inventory. Excluding this impact, the gross margin would have hovered around 71%, albeit still down sequentially due to the ramp-up of Blackwell products;

2) R&D Expense Ratio: This quarter's R&D expense ratio was 9.1%. The company's R&D investments continue to rise, increasing by $270 million sequentially, and under the influence of high revenue growth, the R&D expense ratio continued to decline;

3) Selling, General, and Administrative Expenses Ratio: This quarter's ratio was 2.4%, also diluted by the high revenue growth.

The company anticipates operating expenses for the next quarter to continue rising to $5.7 billion. Based on revenue guidance, the operating expense ratio for the next quarter is projected to be 12.7%, still in a relatively healthy range.

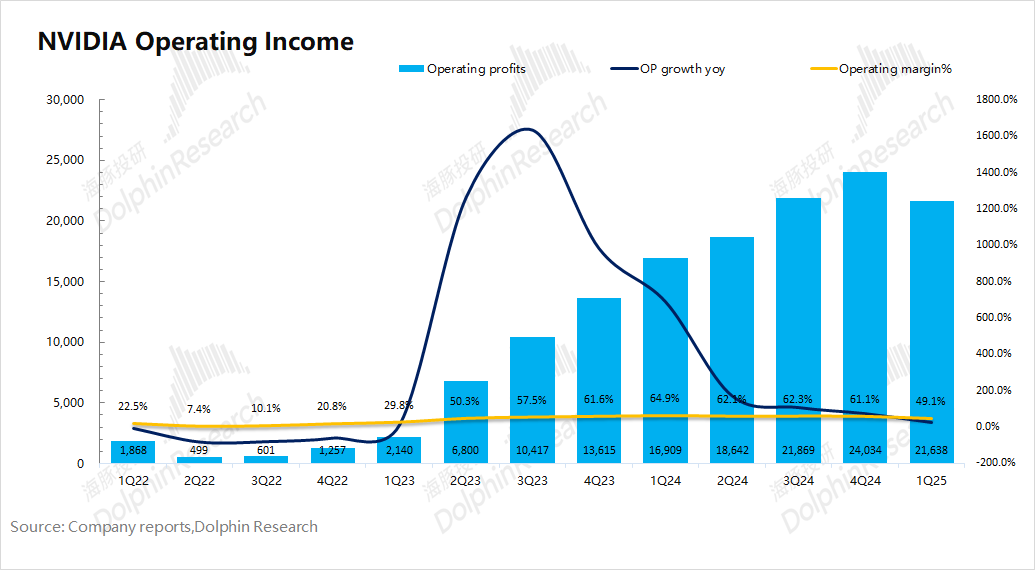

4.2 Core Operating Profit

NVIDIA's net profit for the first quarter of fiscal year 2026 was $18.78 billion, representing a 26.2% year-over-year increase. The net profit margin for this quarter was 42.6%.

Given that net profit is also influenced by non-operating items, Dolphin places greater emphasis on the company's core operating profit (gross profit - R&D expenses - selling, general, and administrative expenses). Nvidia's core operating profit for this quarter was $21.64 billion, marking a 28% year-over-year increase. The core operating margin decreased to 49.1%, primarily due to the write-down of H20 inventory, which totaled approximately $4.5 billion.

- END -

// Reprint Authorization This article is an original work of Dolphin Research. Please obtain authorization for reprinting.

// Disclaimer and General Disclosure Notice This report serves as a general reference for data, intended for general browsing and data reference by users of Dolphin Research and its affiliated institutions. It does not account for the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any individual making investment decisions using or referencing the content or information in this report bears the associated risks. Dolphin Research shall not be held liable for any direct or indirect responsibilities or losses arising from the use of the data contained in this report. The information and data in this report are based on publicly available information and are provided for reference only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data. The information or opinions expressed in this report must not be construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions regarding relevant securities or related financial instruments. The information, tools, and data in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or subject Dolphin Research and/or its subsidiaries or affiliated companies to any registration or licensing requirements in such jurisdictions. This report solely reflects the personal views, opinions, and analysis methods of the relevant authors and does not represent the position of Dolphin Research and/or its affiliated institutions. This report is produced by Dolphin Research, and the copyright belongs exclusively to Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual may (i) produce, copy, replicate, reprint, forward, or create any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.