Meitu Navigates the AI Landscape: Avoiding the Kimi Pitfalls

![]() 05/29 2025

05/29 2025

![]() 648

648

Yet, stability remains an elusive discussion.

Author | Jingxing Editor | Wen Changlong

The market buzz generated by Alibaba's investment in Meitu through convertible bonds is waning.

On the evening of May 20, Meitu announced its strategic collaboration with Alibaba, entailing the issuance of convertible bonds worth approximately US$250 million.

Concurrently, Alibaba and Meitu will collaborate on e-commerce platforms, AI technology, cloud computing, and other domains. Alibaba will prioritize promoting Meitu's AI design tools on its e-commerce platforms and aid in developing AI image and video technologies. In return, Meitu has pledged to procure services from Alibaba Cloud for no less than 560 million yuan over the next three years.

Upon the news' release, Meitu became a market sensation. Many investors were confident that access to Taobao's ecosystem would bolster Meitu's e-commerce potential, enhancing its paid user base and subsequent service R&D. That day, Meitu's share price surged nearly 19%, but it declined for three consecutive trading days, accumulating a drop of over 10%.

Coincidentally, a year prior, Alibaba disclosed in its financial report an US$800 million investment to acquire a 36% stake in Dark Side of the Moon, alongside a commitment to purchase US$600 million worth of Alibaba Cloud services. As of last April, Dark Side of the Moon's core product, Kimi, surpassed Baidu's ERNIE Bot in web traffic, becoming China's largest AI product.

For Alibaba, investing in mid-sized AI enterprises directly fuels growth in its cloud services. In a letter to shareholders, Wu Yongming noted that Alibaba aims to meet the computing demands spurred by large model proliferation, driving positive growth in cloud computing.

However, Kimi, recipient of substantial funding, misjudged market trends. Dark Side of the Moon's founder, Yang Zhilin, believed that AI products were highly homogeneous, necessitating substantial C-end investment to secure market share. According to Intelligence Emergence, Kimi's user acquisition cost on Bilibili peaked at 30 yuan per user, rendering competition with similar products unsustainable. With the emergence of Deepseek and dominant large models from Tencent's Yuanbao, Alibaba's Tongyi, and ByteDance's Doubao, Kimi faltered, abandoning its money-burning strategy.

Alibaba's investment in Meitu mirrors its Kimi deal, exchanging investment for procurement contracts. However, Alibaba's approach to Meitu is more cautious, opting for convertible bonds over direct equity. This structure allows flexibility: if Meitu thrives, Alibaba can convert bonds to shares; if not, it can withdraw its investment.

Regardless, Meitu now finds itself in Kimi's former position—receiving funds from Alibaba also places it at a pivotal juncture. To proceed, Meitu must be clearer than Kimi: amidst a fiercely competitive AI landscape, it must avoid repeating Kimi's mistakes.

01 Deepening Meitu's Moat

In terms of product moat, Meitu clearly outstrips Kimi.

Following aggressive traffic acquisition, Kimi's user base surged. Questmobile data shows that as of November 2024, Kimi's intelligent assistant, launched less than a year prior, had 22.82 million monthly active users, ranking second after ByteDance's Doubao.

Subsequently, with Deepseek's industry impact and Tencent's Yuanbao and Alibaba's Tongyi entering the market, Kimi's market share dwindled. AI product ranking data from April this year indicates that Kimi had 24.99 million monthly active users, while Doubao surpassed 100 million, Deepseek approached 100 million, and Tencent's Yuanbao had over 40 million.

In contrast, Meitu's 2024 financial report reveals that as of December 31, 2024, it had approximately 266 million global monthly active users, up 6.7% year-on-year. Of these, 95 million were from regions outside mainland China, a 21.7% increase, accounting for 35.6% of total monthly active users.

This user base disparity significantly influences the growth strategies of Kimi's Yang Zhilin and Meitu's CEO Wu Xinhong.

Kimi viewed marketing and customer acquisition as core competitive scenarios. At last year's Beijing AI Conference, Yang Zhilin suggested that future AI reasoning costs might significantly undercut customer acquisition costs, fostering a novel business model.

Previously, Wu Xinhong told NetEase Tech, "In imaging, China is fiercely competitive. Fortunately, Meitu's 230 million active users allow us to acquire customers almost cost-free. We can internally validate ideas with minimal resources."

Similarly, in an Intelligence Emergence interview, Wu Xinhong bluntly stated, "I believe large models' user and revenue growth, or cost reduction and efficiency gains, practically reflect product capabilities, which is more impactful than mere rhetoric."

Thanks to its enduring MeituXiuXiu product, Meitu thrives on membership subscriptions and advertising fees. In H1 2022, membership revenue surpassed advertising for the first time, becoming Meitu's primary revenue source.

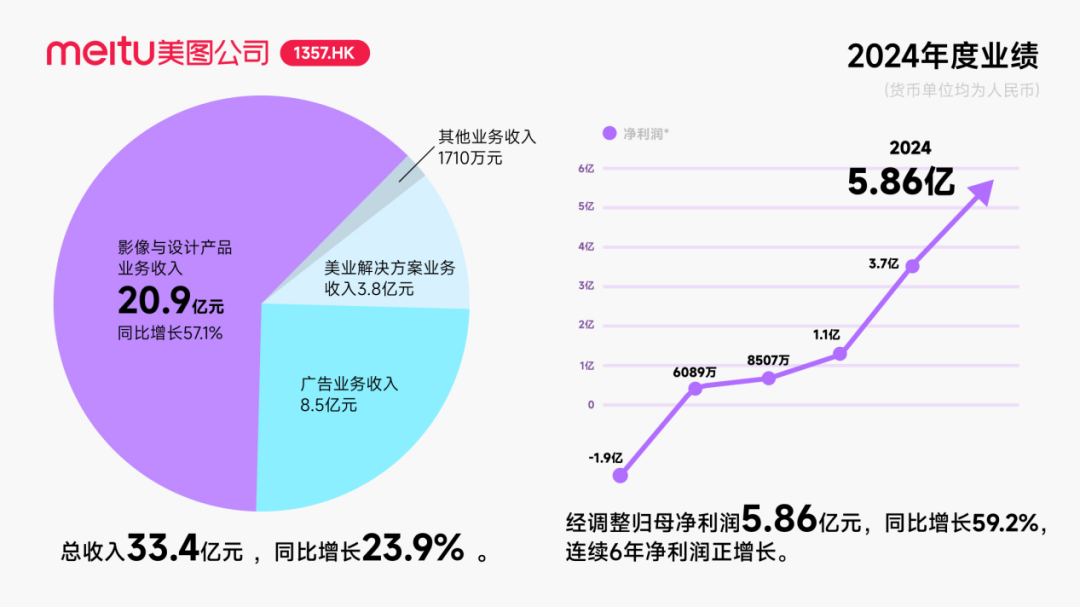

The 2024 financial report shows that Meitu's total revenue was 3.34 billion yuan, with imaging and design product revenue (including MeituXiuXiu, Meiyan Camera, Wink, Meitu Design Studio, etc.) at 2.09 billion yuan and advertising revenue at 850 million yuan. Notably, Meitu had 12.61 million paid users, with a subscription penetration rate of 4.7%.

In contrast, Kimi long relied on API call fees and introduced the "Fuel Kimi" feature, allowing users to fund via crowdfunding for peak-hour access. Since then, Kimi focused on external products, collaborating with Xiaohongshu and Caixin on AI assistant functions and recently expanding into AI healthcare.

Unlike Kimi, Meitu faces no immediate survival crisis. As of 2024's end, Meitu had 1.3 billion yuan in cash and cash equivalents. Additionally, it added over 300,000 paid users monthly this year, with a 5.1% paid penetration rate. Access to Alibaba's e-commerce system is expected to attract more merchants to Meitu Design Studio for product posters and other content, further boosting its subscription penetration rate.

Beyond its stable C-end tool app user base, Meitu's long-standing portraiture data accumulation offers significant brand recognition and technical reserves for AI image product transformations.

Compared to Kimi's struggle, Meitu's AI commercialization path appears more strategic. Wu Xinhong noted that MeituXiuXiu will serve as Meitu's functional entry point, actively seeking industry-ready products. Meitu Design Studio, serving merchants, emerged from the need for product poster creation on MeituXiuXiu. The AI transformation's paid penetration rate increase indicates Meitu's AI strategy's commercial viability.

02 Meitu Cannot Evade the Kimi Dilemma

However, the challenges faced by Kimi are inevitable for Meitu.

Kimi's decline stemmed from losing its brand niche. In 2024, Kimi was renowned for processing 2 million words of long text instantaneously. Dark Side of the Moon highlighted that while expertise once took 10,000 hours, Kimi approached junior expert levels in any new field in just 10 minutes.

However, with Deepseek's advent, industry focus shifted from long text processing to deep reasoning. Leveraging strengths in mathematics and coding, Deepseek surpassed Kimi, becoming the focal point, eagerly integrated into major companies' AI products.

Meitu confronts a similar dilemma.

In visual AI, Meitu enjoys over a decade of first-mover advantage in portrait image processing. Its official website shows a shift towards poster materials, virtual try-ons, and e-commerce scenarios.

However, major companies are swiftly catching up. ByteDance's Jimeng, Xinghui, UNO, and PicPic cover image generation and editing. For instance, UNO enables virtual clothing changes in e-commerce scenarios, claiming results on par with GPT-4.

Furthermore, Alibaba, Tencent, and Kuaishou vigorously promote their e-commerce efforts. Alibaba's Huiwa feature covers clothing changes, commercial photography, and design, targeting AI e-commerce marketing. Kuaishou's Poify is positioned for e-commerce, adding studio-quality backgrounds to product images.

An AI design practitioner told "Market Image" that top AI products iterate rapidly, with practitioners showing little loyalty. Switching to products with leading model performance is common.

Simultaneously, major companies vie for entry points. ByteDance's Doubao is tied to Douyin; Tencent's Hunyuan to WeChat and QQ Browser; Alibaba's Tongyi to DingTalk and Quark. These companies leverage group resources to support AI ventures, leveraging super apps' massive user bases for product launches. Meitu can only respond with a few tool products.

This underscores an insurmountable size disparity.

At this year's financial report meeting, Tencent President Martin Lau revealed that Tencent's 2025 capital expenditure may reach 100 billion yuan, primarily for computing power to meet reasoning demands. In February, Alibaba Group CEO Wu Yongming announced a three-year investment of over 380 billion yuan in cloud and AI hardware infrastructure, surpassing the past decade's total.

In contrast, Meitu's R&D investment last year was just 910 million yuan, a 40% increase due to growing AI training demands. Last year, Tencent's R&D investment was 70.7 billion yuan. Facing major companies' funding influx, Meitu cannot prolong battles and must allocate funds judiciously.

In past interviews, Wu Xinhong repeatedly mentioned Adobe, particularly admiring its professional tool positioning. Today, Meitu is becoming increasingly "specialized," with Meitu Design Studio focusing on e-commerce material generation, Kaipai on oral video creation, and Wink on beauty video editing.

Kimi's overtaking by Deepseek illustrates that, like live e-commerce, the large model market exhibits a significant super-head effect. Once top products' performance is validated, they can swiftly "dominate" the market. Amidst an AI landscape filled with strong competitors, Meitu must become more specialized and refined, fortifying its moat before the next "Deepseek moment."